Accuray Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Accuray's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the oncology treatment market.

The complete report reveals the real forces shaping Accuray’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Accuray's dependence on highly specialized components for its advanced medical systems, like those used in radiosurgery and radiation therapy, significantly amplifies supplier bargaining power. These niche components are not readily available from multiple sources, meaning a few specialized suppliers hold considerable sway over pricing and terms.

In 2024, the global medical device supply chain faced ongoing challenges, including shortages of critical electronic components and increased shipping costs, which directly impacted companies like Accuray. This reliance on a limited supplier base for advanced technologies means that any disruption or price hike from these suppliers can directly affect Accuray's production schedules and ultimately, its profitability.

Accuray faces significant supplier bargaining power due to high switching costs for its complex medical devices. Changing suppliers for critical components like radiation emitters or advanced imaging systems would necessitate extensive re-engineering, rigorous re-testing, and new regulatory certifications. This process can easily take years and cost millions, making it a substantial barrier to seeking alternative sources and thus strengthening existing suppliers' leverage.

Supplier concentration significantly impacts the bargaining power of suppliers for radiation therapy systems. If a small number of companies control the market for critical high-tech components or specialized software, they can exert considerable influence over Accuray. This limited supplier base means Accuray has fewer alternatives, enabling these dominant suppliers to set prices, control delivery, and dictate contract terms, potentially increasing Accuray's operational costs and affecting production schedules.

Proprietary Technology of Suppliers

Suppliers possessing proprietary technology or intellectual property for critical components of Accuray's radiation therapy systems can significantly influence the company. This unique technology may make it difficult for Accuray to negotiate favorable pricing or find suitable alternatives, potentially increasing input costs.

Accuray's reliance on these specialized suppliers for key system elements, such as advanced beam shaping or treatment planning software, can diminish its bargaining power. For instance, if a supplier holds patents on a core component essential for Accuray's CyberKnife or Radixact systems, they can command higher prices.

- Supplier Dependence: Accuray's reliance on suppliers with unique, patented technology for critical system components, like advanced imaging or beam delivery mechanisms, can limit its leverage in price negotiations.

- Limited Alternatives: The proprietary nature of these technologies means Accuray may not have readily available or equally effective substitutes, reinforcing the supplier's strong position.

- Cost Implications: This dependence can translate into higher procurement costs for Accuray, impacting its overall cost of goods sold and potentially its profit margins on its medical devices.

Potential for Forward Integration by Suppliers

While Accuray operates in a highly specialized field, the potential for suppliers to engage in forward integration, though less common, can influence their bargaining power. A supplier possessing significant technological expertise might theoretically consider moving into system manufacturing, directly competing with Accuray.

This theoretical capability, even if unlikely in practice, grants suppliers leverage. It highlights the strategic importance of cultivating robust, long-term partnerships with critical technology providers. For instance, in 2024, the medical device industry saw continued consolidation, with some component suppliers exploring broader capabilities, which could theoretically extend to system integration in niche areas.

- Forward Integration Threat: Suppliers with advanced technological capabilities could potentially enter Accuray's market by manufacturing their own systems.

- Supplier Leverage: This threat, however remote, enhances a supplier's bargaining position in negotiations with Accuray.

- Strategic Relationships: Maintaining strong, collaborative relationships with key technology suppliers is crucial for mitigating this risk.

Accuray's bargaining power with suppliers is significantly constrained by the specialized nature of its medical equipment components. Suppliers of critical, often patented, technologies for systems like CyberKnife and Radixact hold considerable sway due to limited alternatives and high switching costs for Accuray. For example, in 2024, disruptions in the semiconductor supply chain highlighted how reliance on a few key component providers can lead to price increases and production delays, directly impacting Accuray's ability to deliver its advanced cancer treatment solutions.

| Factor | Impact on Accuray | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Limited alternatives empower dominant suppliers to dictate terms and pricing. | Ongoing consolidation in the medical device component sector continues to reduce supplier options. |

| Proprietary Technology | Suppliers with unique, patented components reduce Accuray's negotiation leverage. | Key technologies for advanced beam delivery and imaging remain under tight control by a few specialized firms. |

| Switching Costs | High costs associated with re-engineering and regulatory approval for component changes deter Accuray from seeking new suppliers. | The complexity of Accuray's systems means that even minor component changes require extensive validation, reinforcing supplier power. |

What is included in the product

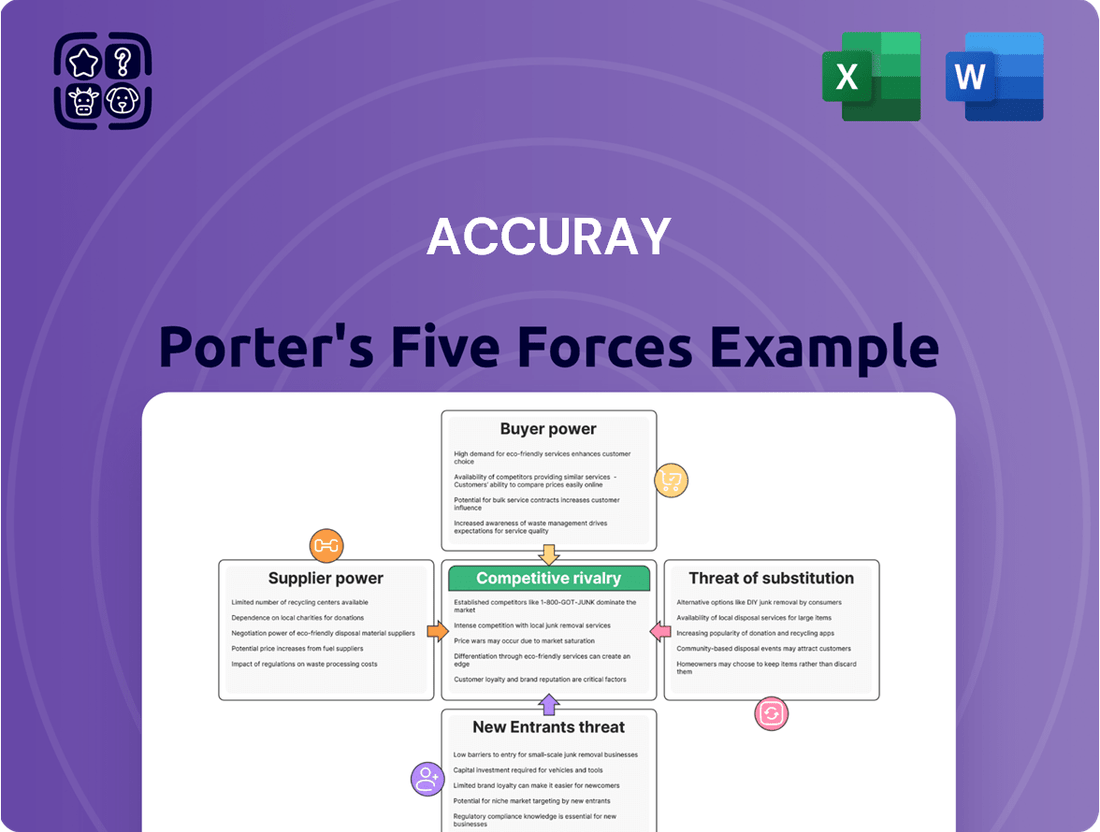

Accuray's Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on Accuray's oncology treatment solutions.

Instantly visualize competitive intensity across all five forces, revealing hidden threats and opportunities to proactively address market pressures.

Customers Bargaining Power

Accuray's primary customers, healthcare providers, face significant capital investment when acquiring their advanced radiosurgery and radiation therapy systems. These systems can represent a substantial financial commitment, with individual units costing anywhere from $2 million to upwards of $100 million.

This considerable expenditure necessitates thorough due diligence from these healthcare institutions. They meticulously evaluate the performance, long-term reliability, and ongoing support services offered by Accuray. The sheer scale of the investment makes them highly attuned to pricing and grants them considerable leverage during negotiations.

The bargaining power of customers in the radiotherapy sector is significantly amplified by the consolidation of healthcare providers. Large hospital networks, integrated delivery systems, and governmental healthcare bodies wield substantial purchasing power. For instance, in 2024, major hospital systems often negotiate bulk purchases for multiple facilities, allowing them to demand more favorable pricing and customized service agreements from medical device manufacturers like Accuray. This consolidation means fewer, but larger, buyers, giving them a stronger voice in dictating terms and influencing product development roadmaps.

Once a healthcare provider commits to a radiation therapy system, such as Accuray's CyberKnife or TomoTherapy, the financial and operational hurdles to switching are substantial. These include the significant expense of retraining clinical staff, integrating the new system with existing hospital IT infrastructure, and the inevitable disruption to ongoing patient treatment schedules. For instance, a new system installation can involve millions in upfront costs and months of operational adjustments.

Availability of Competing Solutions

Accuray faces significant bargaining power from its customers, largely due to the availability of competing solutions. Major competitors such as Siemens Healthineers, particularly through its Varian segment, and Elekta offer advanced radiation therapy systems that directly rival Accuray's product portfolio.

This competitive environment empowers customers, typically hospitals and cancer treatment centers, to compare offerings rigorously. They can scrutinize features, performance specifications, pricing structures, and service level agreements from multiple vendors. This ability to easily switch or select alternatives grants them considerable leverage in negotiations, pushing Accuray to offer competitive pricing and enhanced value propositions.

For instance, the global radiation therapy market was valued at approximately $7.5 billion in 2023 and is projected to grow, indicating a dynamic marketplace where customer choice is paramount. This competitive pressure necessitates continuous innovation from Accuray to maintain market share and customer loyalty.

- Competitive Landscape: Siemens Healthineers (Varian) and Elekta are key rivals offering comparable advanced radiation therapy systems.

- Customer Leverage: The presence of viable alternatives allows customers to negotiate better terms based on features, pricing, and service.

- Market Dynamics: The competitive nature of the radiation therapy market, valued at billions, forces Accuray into ongoing innovation and value demonstration.

Reimbursement Policies and Budget Constraints

Healthcare providers operate under significant pressure from reimbursement policies and their internal budget limitations. These factors directly influence their purchasing power for new medical technologies.

For instance, in 2024, many hospitals faced tighter operating margins due to increased labor costs and supply chain disruptions, making them more sensitive to the upfront investment in advanced radiation therapy systems. A study by Kaufman Hall in late 2023 indicated that hospital operating margins were projected to remain slim throughout 2024, averaging around 2.5%, highlighting the critical nature of cost-effectiveness.

The extent to which insurers reimburse for novel radiation therapies plays a crucial role. Broader coverage can stimulate demand for Accuray's systems, as it improves the financial viability for providers. Conversely, any shifts or reductions in reimbursement rates can amplify customer price sensitivity, thereby increasing their bargaining power.

- Reimbursement Influence: The Centers for Medicare & Medicaid Services (CMS) reimbursement rates for radiation oncology services are a key determinant of provider adoption of new technologies. Changes in these rates directly impact the financial return on investment for acquiring advanced systems.

- Budgetary Constraints: Hospitals and cancer centers are increasingly scrutinizing capital expenditures. In 2024, many institutions prioritized investments that offered clearer and faster returns, making the total cost of ownership and operational efficiency of radiation therapy equipment paramount.

- Price Sensitivity Increase: When reimbursement is uncertain or limited, providers are more likely to negotiate harder on the purchase price of new equipment, leveraging their budget constraints to gain concessions.

- Impact on Demand: Favorable reimbursement policies can unlock significant demand for innovative treatment solutions, while restrictive policies can dampen market growth and empower customers to demand lower prices.

Accuray's customers, primarily healthcare providers, possess significant bargaining power due to the substantial capital investment required for their advanced systems, often ranging from millions to over $100 million per unit. This financial commitment necessitates rigorous evaluation, making customers highly sensitive to pricing and granting them considerable negotiation leverage.

The consolidation of healthcare providers further amplifies customer bargaining power. Large hospital networks, acting as single entities, can negotiate bulk purchases for multiple facilities, demanding more favorable pricing and customized service agreements. This trend, prominent in 2024, means fewer but larger buyers, giving them a stronger voice in dictating terms.

The availability of strong competitors like Siemens Healthineers (Varian) and Elekta, offering comparable advanced radiation therapy systems, empowers customers to compare offerings and negotiate better terms. This competitive market, valued at billions, forces Accuray into continuous innovation and value demonstration to retain customers.

Financial pressures on healthcare providers, including tight operating margins projected to average around 2.5% in 2024 as per Kaufman Hall, increase their price sensitivity. Reimbursement policies also play a critical role; less favorable rates amplify customer demands for lower prices, directly impacting Accuray's pricing power.

| Factor | Impact on Accuray | Supporting Data (2023-2024) |

|---|---|---|

| High Capital Investment | Increases customer price sensitivity and negotiation leverage. | System costs can exceed $100 million. |

| Customer Consolidation | Concentrates purchasing power among fewer, larger buyers. | Major hospital systems negotiate bulk purchases. |

| Competitive Landscape | Enables customers to demand better terms and pricing. | Siemens Healthineers (Varian) and Elekta are key rivals. |

| Provider Financial Pressures | Heightens customer focus on cost-effectiveness and ROI. | Projected hospital operating margins around 2.5% in 2024. |

What You See Is What You Get

Accuray Porter's Five Forces Analysis

This preview showcases the complete Accuray Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape for Accuray. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The radiation oncology market is characterized by the strong presence of established global leaders, primarily Siemens Healthineers, through its acquisition of Varian Medical Systems, and Elekta. These companies command substantial market shares, setting a high bar for competition.

Accuray faces direct competition from these large, diversified medical technology giants. Their extensive product lines and well-developed global distribution channels provide them with significant advantages in securing new installations and driving upgrade cycles.

In 2023, the global radiation therapy market was valued at approximately $7.2 billion, with Varian (Siemens Healthineers) and Elekta being key contributors to this figure, indicating their dominant positions.

Developing and manufacturing sophisticated radiation therapy systems demands significant upfront investment in research and development, coupled with high fixed costs. This financial reality compels companies to aggressively pursue market share, aiming to achieve sufficient sales volumes to offset these substantial expenditures.

The industry's competitive nature is further fueled by the critical need to establish and maintain a robust installed base of equipment. This is essential for securing ongoing service and maintenance contracts, which represent a vital stream of recurring revenue for manufacturers.

In 2023, Accuray reported total revenue of $470.5 million, underscoring the scale of operations required to manage high fixed costs in this sector.

Competitive rivalry in the radiation oncology sector is fierce, primarily fueled by a relentless pursuit of technological innovation. Companies like Accuray, Siemens Healthineers, and Elekta are locked in a race to develop more precise, faster, and patient-outcome-focused treatment solutions.

This intense competition centers on advancements in imaging capabilities, the integration of artificial intelligence into treatment planning and delivery, and the development of adaptive radiotherapy technologies. These innovations are crucial for companies to differentiate themselves and capture market share.

For instance, Accuray's CyberKnife platform emphasizes sub-millimeter accuracy, a key differentiator. Similarly, competitors are heavily investing in AI to optimize treatment plans and predict patient response. This constant push for technological superiority necessitates substantial Research and Development (R&D) investments, with companies allocating significant portions of their revenue to stay ahead. In 2023, for example, Accuray reported R&D expenses of approximately $100 million, reflecting the industry's commitment to innovation.

Global Market Growth and Regional Dynamics

The global radiation therapy market is expanding significantly, driven by an increasing cancer diagnosis rate worldwide. This growth fuels intense competition, particularly in rapidly developing markets like Asia-Pacific, where local players are increasingly challenging established global companies.

Companies are vying for market share by focusing on technological innovation, cost-effectiveness, and the ability to adapt to varied regulatory landscapes. Building strong local distribution networks and strategic alliances is crucial for success in these dynamic regions.

- Market Expansion: The global radiation therapy market was valued at approximately $7.5 billion in 2023 and is projected to reach over $11 billion by 2029, indicating substantial growth opportunities.

- Regional Competition: Asia-Pacific is a key growth area, with an estimated compound annual growth rate (CAGR) of over 7% for radiation therapy equipment, leading to increased competition from both international and domestic manufacturers.

- Competitive Factors: Beyond advanced technology, companies differentiate themselves through regulatory compliance expertise, pricing strategies, and the development of robust service and support infrastructures in diverse healthcare systems.

Service and Software Offerings as Differentiators

Competitive rivalry in the oncology sector goes well beyond just the sale of radiation therapy machines. Companies are increasingly differentiating themselves through comprehensive service contracts and sophisticated software solutions. These offerings are designed to create integrated oncology information systems that manage the entire patient treatment journey.

The goal is to provide end-to-end solutions, encompassing everything from initial treatment planning software to ongoing technical support and data management. This holistic approach aims to foster deeper customer loyalty and secure more predictable, recurring revenue streams. For instance, Varian Medical Systems, a key player, has heavily invested in its AI-powered treatment planning software, Ethos Therapy, which streamlines workflows and personalizes patient care, demonstrating a clear strategy to move beyond hardware dependency.

This focus on integrated solutions is critical for standing out in a market where technological advancements can quickly narrow hardware-based advantages. Companies that can offer seamless software integration, robust service packages, and valuable data analytics are better positioned to capture and retain market share. Accuray, for example, has been enhancing its RayStation treatment planning software and its RadOnc IT platform to offer a more connected experience for its clients.

- Service Contracts: Extended warranties, maintenance agreements, and upgrade programs are crucial for customer retention and revenue generation.

- Software Solutions: Treatment planning software (e.g., Varian’s Ethos, Accuray’s RayStation), patient management systems, and data analytics platforms are key differentiators.

- Integrated Systems: Offering end-to-end oncology information systems that connect hardware, software, and services create a more cohesive and valuable offering.

- Recurring Revenue: The shift towards software and service-based models provides more stable and predictable revenue streams compared to solely hardware sales.

Competitive rivalry in the radiation oncology market is intense, driven by a few dominant global players like Siemens Healthineers (through Varian) and Elekta, who hold significant market share and possess extensive resources. Accuray competes directly with these giants, facing pressure from their broad product portfolios and established distribution networks.

The high cost of R&D and manufacturing for advanced radiation therapy systems necessitates aggressive market share pursuit to offset substantial fixed costs. Companies are compelled to innovate rapidly, focusing on technological advancements such as AI integration and adaptive radiotherapy to differentiate themselves and secure sales volumes.

The market's growth, with the global radiation therapy market valued at approximately $7.5 billion in 2023, fuels this rivalry, particularly in expanding regions like Asia-Pacific. Success hinges not only on hardware but also on integrated software solutions and comprehensive service contracts, which provide recurring revenue and foster customer loyalty.

| Company | 2023 Revenue (Approx.) | R&D Investment (Approx.) | Key Offerings |

|---|---|---|---|

| Siemens Healthineers (Varian) | $4.0 billion (Varian segment) | Significant (part of SHS total) | Halcyon, Ethos Therapy, Edge Radiosurgery |

| Elekta | $1.3 billion | $200 million+ | Versa HD, Unity MR-Linac, Monaco planning |

| Accuray | $470.5 million | $100 million | CyberKnife, Radixact, RayStation planning |

SSubstitutes Threaten

The threat of substitutes for Accuray's radiation therapy solutions is significant, stemming from a range of alternative and complementary cancer treatment modalities. These include established methods like traditional surgery and chemotherapy, alongside rapidly advancing fields such as targeted drug therapies, immunotherapy, and hormone therapies. For instance, the global cancer immunotherapy market was valued at approximately $15.7 billion in 2023 and is projected to grow substantially, indicating increasing adoption of these alternatives.

While radiation therapy remains a vital component in many cancer treatment plans, the growing efficacy and accessibility of these other modalities can dilute its demand or necessitate its integration into more complex, multi-modal treatment approaches. For example, advancements in precision medicine allow for highly targeted drug therapies that can sometimes reduce the reliance on broad-spectrum treatments like radiation for certain cancer types.

The emergence of novel therapeutic approaches presents a significant threat of substitutes for radiation therapy. Advanced gene therapies and highly personalized medicine are increasingly offering alternative treatment pathways for various conditions, potentially reducing reliance on traditional radiation methods.

While often used in conjunction with radiation, substantial advancements in these new modalities could fundamentally alter current treatment paradigms. For instance, the market for gene therapy, projected to reach over $20 billion by 2028, highlights the rapid innovation and growing acceptance of these alternative treatments.

The medical landscape is in constant flux, with ongoing research dedicated to developing less invasive and more effective non-radiation treatment options. This continuous innovation fuels the threat of substitutes, as patients and healthcare providers seek the most optimal and least burdensome therapies available.

The growing preference for minimally invasive treatments presents a significant threat. This trend could spur the development of non-radiation-based therapies that offer comparable or better results with fewer adverse effects. For instance, advancements in targeted drug delivery and immunotherapy are increasingly offering alternatives for certain cancers, potentially reducing reliance on radiosurgery.

Preventative Measures and Early Detection

Advancements in cancer prevention and early detection pose a significant threat to Accuray by potentially shrinking the market for its advanced radiation therapy systems. For instance, improved diagnostic tools that catch cancers at earlier, more treatable stages might reduce the need for complex, high-dose radiation treatments that Accuray's CyberKnife and RadFormation systems are designed for. This societal benefit could translate into a smaller patient pool for these specific interventions.

The potential reduction in demand for intensive radiation therapy could intensify competition among existing providers of cancer treatment technology. As the overall incidence of advanced cancers requiring such specialized equipment potentially decreases, companies like Accuray may face pressure to differentiate their offerings or adjust pricing strategies. This dynamic could impact market share and profitability.

- Reduced Incidence: Improvements in preventative measures and early diagnostics directly lower the number of patients requiring advanced radiation therapy.

- Market Shrinkage: A smaller patient population for complex cancer cases could lead to decreased demand for high-end treatment systems.

- Intensified Competition: With fewer patients needing specialized treatments, existing providers may compete more aggressively for market share.

Cost and Accessibility of Alternatives

The cost-effectiveness and accessibility of alternative medical treatments present a significant threat to Accuray's radiation therapy systems. If other therapies become substantially more affordable or easier to access, especially in emerging markets, patients and healthcare providers might opt for these alternatives over Accuray's high-cost solutions. This competitive pressure compels Accuray to continually highlight the long-term value, efficiency, and superior clinical outcomes associated with its precise radiation delivery technology.

For instance, advancements in less capital-intensive treatment modalities or improvements in the cost-effectiveness of existing non-radiation therapies could directly impact demand for Accuray's products. In 2024, the global oncology market saw continued growth, but also increasing pressure on healthcare budgets, making cost a critical factor in technology adoption. Accuray's strategy likely involves demonstrating how its systems reduce overall treatment costs through improved patient outcomes and fewer side effects, thereby justifying the initial investment.

- Cost-Effectiveness: The increasing affordability of alternative therapies directly challenges the pricing of advanced radiation systems.

- Accessibility in Emerging Markets: Wider availability of less expensive treatment options in developing regions could divert market share from Accuray.

- Value Proposition: Accuray must emphasize the long-term economic and clinical benefits of its precise radiation delivery to counter this threat.

- Market Dynamics: Healthcare budget constraints in 2024 necessitate a clear demonstration of return on investment for capital equipment purchases.

The threat of substitutes for Accuray's radiation therapy systems is substantial, driven by advancements in other cancer treatment modalities. These include immunotherapy, targeted drug therapies, and minimally invasive surgical techniques, all of which offer alternative pathways for patient care. For example, the global cancer drug market is projected to exceed $250 billion by 2025, showcasing the significant investment and growth in non-radiation treatments.

These evolving alternatives can reduce the need for radiation therapy, especially in cases where they demonstrate comparable or superior efficacy with fewer side effects. The increasing focus on personalized medicine further fuels this trend, allowing for treatments tailored to individual patient profiles, potentially bypassing traditional radiation protocols.

The development of novel, less invasive treatments presents a direct challenge. As these therapies become more refined and accessible, they may displace radiation therapy in certain treatment scenarios. For instance, the market for robotic surgery, a direct substitute for some oncological procedures, was valued at over $6 billion in 2023 and is expected to continue its upward trajectory.

The financial aspect also plays a crucial role. If alternative treatments become more cost-effective or offer a better return on investment for healthcare providers, they can pose a significant threat to Accuray's high-value systems. In 2024, healthcare systems globally are under increasing pressure to manage costs, making affordability a key consideration in technology adoption.

| Treatment Modality | Estimated Market Value (USD) | Projected Growth (CAGR) | Key Substitute Factor |

|---|---|---|---|

| Immunotherapy | $15.7 billion (2023) | ~10-15% | Increasing efficacy, fewer side effects |

| Targeted Drug Therapies | $100+ billion (2023) | ~8-12% | Precision, personalized treatment |

| Minimally Invasive Surgery | $6+ billion (2023) | ~10-15% | Reduced invasiveness, faster recovery |

| Gene Therapy | $20+ billion (projected by 2028) | ~15-20% | Novel therapeutic approach |

Entrants Threaten

Entering the advanced radiosurgery and radiation therapy systems market, like that of Accuray, demands substantial capital. Companies need millions for cutting-edge research, sophisticated manufacturing, and establishing global distribution. For instance, a single linear accelerator can cost upwards of $1 million, making it incredibly difficult for new players to compete.

The medical device sector, particularly for advanced cancer treatment technologies like those developed by Accuray, faces formidable regulatory barriers. New companies must contend with extensive approval processes, including rigorous clinical trials and certifications from bodies like the FDA and EMA. For instance, the average time for a new medical device to gain FDA clearance can extend to several years, with associated costs often running into millions of dollars.

Established players like Accuray, Siemens Healthineers (Varian), and Elekta have cultivated robust brand reputations and deep-seated relationships with healthcare providers worldwide. These companies have spent years building trust and demonstrating the reliability of their radiation oncology systems, creating significant customer loyalty.

New entrants would face a considerable challenge in replicating this level of trust and displacing competitors with proven track records and extensive service networks. For instance, the radiation oncology market, valued at approximately $7.5 billion in 2023, is characterized by high switching costs and a strong reliance on established vendor support, making it difficult for newcomers to gain a foothold.

Proprietary Technology and Intellectual Property

The threat of new entrants in the radiosurgery and radiation therapy market is significantly mitigated by the substantial investments in proprietary technology and intellectual property. Accuray, for instance, holds numerous patents covering its CyberKnife and TomoTherapy systems, safeguarding its innovative treatment delivery methods and software. This deep technological moat requires any new competitor to either invest heavily in developing groundbreaking, patentable technologies or navigate complex and costly licensing agreements for existing intellectual property, a considerable barrier to entry.

New entrants face the daunting task of replicating or surpassing the sophisticated technological capabilities that Accuray and its established rivals have cultivated over years of research and development. For example, the precision and automation inherent in Accuray's systems are protected by a web of patents, making it difficult for newcomers to offer comparable performance without infringing on existing IP. This intellectual property landscape not only protects incumbents but also dictates that innovation must be substantial to overcome the established technological advantages.

- Patented Innovations: Accuray's portfolio includes patents on beam delivery, imaging integration, and treatment planning software, critical components for advanced radiotherapy.

- R&D Investment: Companies like Accuray consistently invest millions annually in R&D to maintain their technological edge, creating a high financial hurdle for new entrants.

- Licensing Challenges: Acquiring licenses for essential technologies from established players can be prohibitively expensive and strategically restrictive for potential new market participants.

Talent and Expertise Scarcity

The threat of new entrants in the advanced radiation therapy systems market is significantly impacted by talent and expertise scarcity. Developing, manufacturing, selling, and servicing these complex medical devices demands highly specialized scientific, engineering, and clinical knowledge. This creates a substantial barrier, as there's a limited pool of professionals possessing the requisite skills in this niche field.

New companies would face considerable challenges in attracting and retaining the specialized talent needed to compete effectively against established players like Accuray. For instance, securing individuals with deep understanding in areas such as medical physics, radiation oncology engineering, and clinical application support is critical. The ongoing demand for these skills, particularly in emerging markets, further exacerbates this challenge. In 2024, the demand for medical physicists, a key talent segment, continued to outpace supply, with many regions experiencing shortages.

- Specialized Skill Requirements: Expertise in medical physics, radiation oncology engineering, software development for treatment planning, and clinical application support is paramount.

- Limited Talent Pool: The number of professionals with experience in designing, building, and supporting advanced radiotherapy equipment is finite.

- High Recruitment Costs: Attracting top talent in such a specialized field often involves significant compensation and benefits packages, increasing initial investment for new entrants.

- Retention Challenges: Established companies often have strong retention programs and a reputation that makes it difficult for newcomers to poach experienced personnel.

The threat of new entrants in the advanced radiation therapy market is low due to high capital requirements and regulatory hurdles. Significant investment is needed for R&D, manufacturing, and global distribution, with systems costing millions. Additionally, stringent FDA and EMA approvals, involving lengthy clinical trials, create substantial barriers, often taking years and millions of dollars.

Established players like Accuray benefit from strong brand reputations and deep customer relationships, built over years of providing reliable systems and support. This loyalty, coupled with high switching costs in the approximately $7.5 billion radiation oncology market in 2023, makes it difficult for newcomers to gain traction.

Proprietary technology and extensive patent portfolios, such as those held by Accuray for its CyberKnife and TomoTherapy systems, further deter new entrants. Developing comparable, patentable technologies or navigating expensive licensing agreements presents a significant challenge, requiring substantial innovation to overcome existing advantages.

The scarcity of specialized talent, including medical physicists and radiation oncology engineers, also limits new entrants. The demand for these professionals, particularly in growing markets, outstrips supply, with shortages noted in 2024, increasing recruitment costs and making it hard for new companies to build experienced teams.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment for R&D, manufacturing, and distribution. | Single linear accelerator cost: $1M+ |

| Regulatory Hurdles | Extensive approval processes from bodies like FDA and EMA. | FDA clearance can take years and cost millions. |

| Brand Reputation & Customer Loyalty | Established trust and long-term relationships with healthcare providers. | High switching costs in the $7.5B radiation oncology market (2023). |

| Intellectual Property | Patents on critical technologies and treatment delivery methods. | Accuray's patents on CyberKnife and TomoTherapy systems. |

| Talent Scarcity | Limited pool of highly specialized engineers and medical physicists. | Shortages of medical physicists in various regions during 2024. |

Porter's Five Forces Analysis Data Sources

Our Accuray Porter's Five Forces analysis is built upon a robust foundation of data, including Accuray's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports and competitor financial disclosures.