Accenture SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

Accenture's robust global presence and diverse service offerings are significant strengths, but its reliance on large client contracts presents a potential vulnerability. Understanding these dynamics is crucial for anyone looking to navigate the consulting landscape.

Want the full story behind Accenture's competitive advantages and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning.

Strengths

Accenture's global leadership is underscored by its operations in over 120 countries, supported by a workforce exceeding 700,000 professionals as of late 2023. This expansive reach enables the company to tackle massive, intricate projects and tap into a worldwide talent pool, giving it a distinct edge in securing global contracts.

Accenture's broad service portfolio is a significant strength, encompassing strategy, consulting, digital, technology, and operations. This extensive offering allows them to tackle a vast range of client challenges, from initial strategic planning to the intricate execution of technology solutions.

This ability to provide comprehensive, end-to-end services fosters deeper client engagement and diversifies revenue generation. For instance, in fiscal year 2023, Accenture reported net revenue of $64.1 billion, reflecting the broad market reach of its integrated service lines.

Accenture boasts a powerful brand, recognized globally as a premier consulting and professional services firm. This strong reputation, built over decades, positions them as a trusted advisor, enabling them to secure and maintain long-term relationships with a diverse client base, including many Fortune Global 500 companies.

This brand equity directly translates into a significant competitive advantage. Clients consistently choose Accenture for their complex business transformations, valuing the firm's deep industry expertise and proven track record. For instance, in fiscal year 2023, Accenture reported a net revenue of $64.1 billion, underscoring the scale of client trust and engagement they command.

The loyalty fostered by this strong brand and client-centric approach is a cornerstone of Accenture's business model. It ensures a steady stream of recurring revenue and provides a stable foundation for sustained growth, as clients often engage Accenture for multiple projects and ongoing support.

Innovation and Digital Capabilities

Accenture’s dedication to innovation is evident in its substantial investments in research and development. The company consistently channels resources into emerging technologies such as artificial intelligence, cloud computing, and cybersecurity, aiming to stay ahead of the curve.

This focus on cutting-edge advancements allows Accenture to deliver sophisticated digital solutions that provide tangible value to its clients. For example, in fiscal year 2023, Accenture reported approximately $3 billion in consulting and outsourcing revenue from its Cloud business, highlighting the market demand for its digital capabilities.

- Innovation Investment: Accenture consistently invests heavily in R&D, focusing on AI, cloud, and cybersecurity.

- Digital Prowess: The company's advanced digital solutions are a key market differentiator.

- Client Value: Accenture's technological foresight translates into significant value creation for its clients.

- Market Leadership: Its commitment to innovation positions Accenture at the forefront of digital transformation services.

Deep Industry Expertise and Talent Pool

Accenture's deep industry expertise is a significant strength, allowing it to offer specialized knowledge across diverse sectors like financial services, health, and communications. This specialized knowledge, combined with a vast pool of highly skilled professionals, enables the delivery of precisely tailored and effective solutions for clients. For instance, in fiscal year 2023, Accenture reported revenue of $62.1 billion, reflecting the demand for its deep industry insights and talent.

The company's commitment to continuous training and development ensures its workforce stays ahead of the curve, equipped with the latest skills to address evolving client needs. This investment in human capital is crucial for maintaining its competitive edge in the rapidly changing technology and consulting landscape. As of the end of fiscal year 2023, Accenture employed approximately 732,000 people globally, a testament to its extensive talent pool.

- Deep knowledge across key industries

- Large, skilled global workforce

- Tailored, effective client solutions

- Continuous investment in talent development

Accenture's expansive global presence, operating in over 120 countries with a workforce exceeding 700,000 professionals as of late 2023, allows it to secure large, complex projects and access a diverse talent pool. This broad reach is a critical asset in winning global contracts.

The company's comprehensive service portfolio, spanning strategy, consulting, digital, technology, and operations, enables it to address a wide array of client needs from start to finish. This end-to-end capability fosters deeper client relationships and diversifies revenue streams.

Accenture's strong global brand recognition as a leading consulting firm builds trust and facilitates long-term client partnerships, particularly with Fortune Global 500 companies. This brand equity is a significant competitive advantage.

Significant investments in R&D, particularly in AI, cloud, and cybersecurity, ensure Accenture remains at the forefront of technological advancements. This focus on innovation allows for the delivery of high-value digital solutions, as evidenced by its approximately $3 billion in cloud revenue in fiscal year 2023.

Accenture's deep industry expertise across sectors like financial services and health, coupled with continuous investment in talent development for its approximately 732,000 employees (end of FY23), enables the creation of highly tailored and effective client solutions.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Global Reach | Extensive international operations | Operations in over 120 countries; >700,000 professionals (late 2023) |

| Service Breadth | Comprehensive service offerings | Strategy, consulting, digital, technology, operations; $64.1 billion net revenue (FY23) |

| Brand Reputation | Strong global brand recognition | Trusted advisor to Fortune Global 500 companies |

| Innovation Focus | Investment in emerging technologies | Focus on AI, cloud, cybersecurity; ~$3 billion Cloud revenue (FY23) |

| Industry Expertise & Talent | Deep sector knowledge and skilled workforce | Expertise across key industries; ~732,000 employees (end of FY23) |

What is included in the product

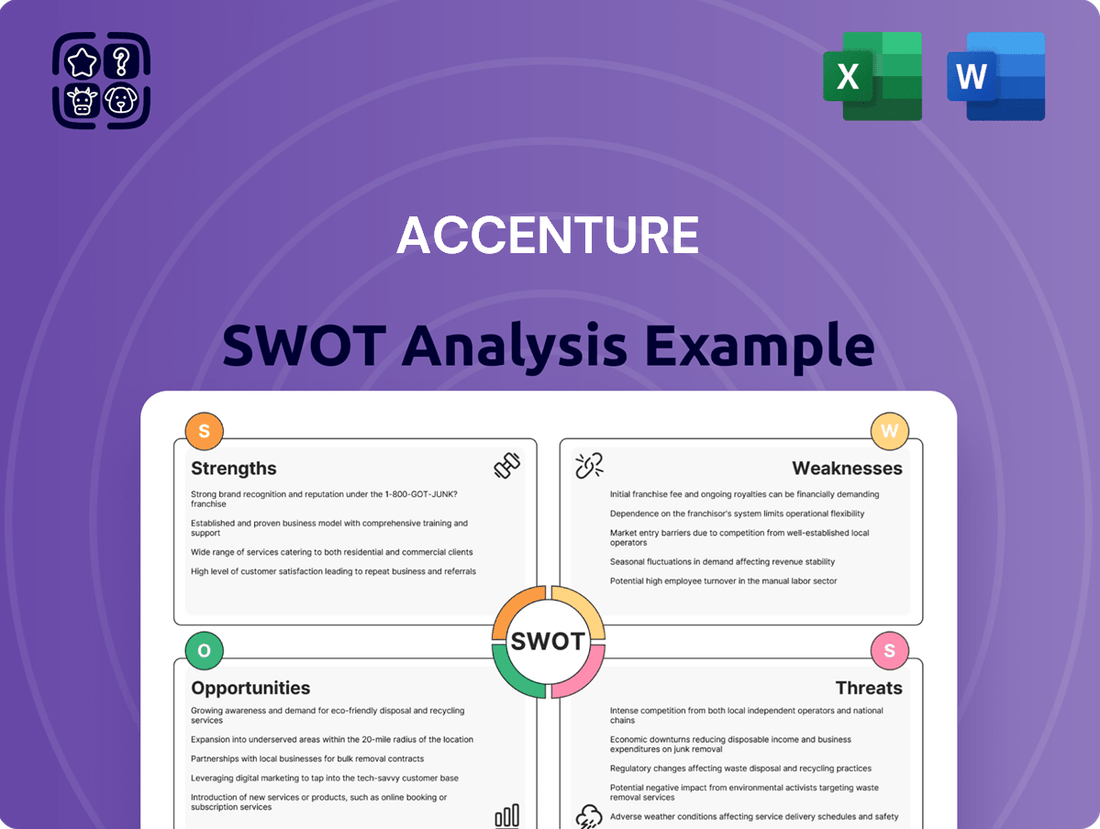

Delivers a strategic overview of Accenture’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Accenture's reliance on a select group of major clients, while beneficial for securing substantial revenue streams, also presents a significant vulnerability. This concentration means that the loss or reduced engagement of even a few of these key accounts could have a disproportionately negative impact on the company's overall financial performance. For instance, in fiscal year 2023, Accenture reported that its top 10 clients accounted for approximately 20% of its total revenue, highlighting this inherent dependency.

Accenture operates in a crowded professional services landscape, facing formidable competition from established global consulting giants, specialized IT service providers, and nimble niche players. This intense rivalry often translates into significant pricing pressures, requiring Accenture to constantly innovate and differentiate its offerings to maintain its market position and profitability. For instance, the global consulting market was valued at approximately $300 billion in 2023 and is projected to grow, but this growth is shared among many participants.

Accenture faces significant operating costs, largely driven by its extensive global workforce. In fiscal year 2023, personnel-related expenses represented a substantial portion of their total costs, reflecting competitive salaries and benefits necessary to attract and retain skilled professionals. This high cost base is inherent to a professional services model.

The intense competition for top talent in the technology and consulting sectors presents a persistent challenge. Accenture must continually invest in competitive compensation and development programs to retain its highly skilled employees, which can lead to wage inflation and impact profitability. For instance, in the highly sought-after areas of cloud and AI, talent acquisition costs have seen a noticeable increase in 2024.

Employee turnover, while managed, can still pose a risk. High attrition rates can disrupt project delivery, impact client relationships, and necessitate costly recruitment and onboarding processes. Maintaining a stable and experienced workforce is crucial for Accenture's reputation and its ability to deliver consistent, high-quality services.

Integration Challenges Post-Acquisition

Accenture's growth strategy often involves acquiring other businesses, but merging these new entities into its existing structure presents significant hurdles. This process involves harmonizing different company cultures, integrating disparate technologies, and aligning diverse teams, which can be a complex and lengthy undertaking.

Failure to effectively integrate acquisitions can create operational inefficiencies and lead to valuable talent departing, thereby hindering the company's ability to fully capitalize on the strategic benefits of these deals. For instance, a poorly integrated acquisition might not achieve its projected revenue targets, impacting overall financial results.

- Integration Complexity: Merging acquired companies' cultures, technologies, and operational processes is a significant challenge.

- Time and Resource Intensive: Successful integration demands substantial time, financial investment, and dedicated resources.

- Risk of Underperformance: Ineffective integration can result in missed synergy targets and reduced return on investment from acquisitions.

- Employee Attrition: Cultural clashes or uncertainty post-acquisition can lead to the loss of key personnel.

Risk of Commoditization of Services

Accenture's reliance on more standardized IT outsourcing and basic consulting services poses a significant risk of commoditization. This means clients might view these offerings as interchangeable, intensifying price competition and squeezing profitability. For instance, the IT outsourcing market, while large, is increasingly competitive with numerous providers offering similar capabilities, potentially driving down rates for Accenture's less specialized services.

This commoditization pressure is particularly evident in areas like cloud migration and managed IT services, where differentiation is becoming harder to maintain. As these services mature, clients naturally become more price-sensitive, demanding greater value for their investment. Accenture's financial reports often highlight the need to shift focus to higher-margin, specialized consulting and digital transformation services to counter this trend.

To mitigate this weakness, Accenture must continue its strategic pivot towards innovation and bespoke solutions. This involves investing heavily in areas like artificial intelligence, cybersecurity, and advanced analytics, where specialized expertise commands premium pricing. The company's ongoing acquisitions and talent development programs are geared towards building these higher-value capabilities, aiming to stay ahead of the commoditization curve.

The financial implications are clear: a sustained shift towards commoditized services could negatively impact Accenture's revenue growth and operating margins. For example, while Accenture's overall revenue for fiscal year 2023 reached $64.1 billion, the profitability of its more standardized service lines is under constant scrutiny compared to its digital and cloud-focused segments.

Accenture's substantial global workforce, while a core strength, also represents a significant cost center. Personnel expenses, including salaries, benefits, and training, are a major component of its operating costs, directly impacting profitability. In fiscal year 2023, Accenture's total operating expenses were substantial, with a large proportion attributed to employee compensation and related costs, underscoring the financial implications of its human capital investment.

The intense competition for skilled professionals, particularly in high-demand areas like cloud computing, artificial intelligence, and cybersecurity, drives up talent acquisition and retention costs. This wage inflation can squeeze profit margins, as Accenture must offer competitive compensation packages to attract and keep top talent. For instance, the demand for AI specialists in 2024 has led to increased salary expectations across the industry.

Accenture's reliance on a concentrated client base, where a few major clients contribute a significant portion of revenue, creates a vulnerability. The loss or reduced spending from these key accounts could have a material adverse effect on the company's financial performance. In fiscal year 2023, Accenture noted that its top 10 clients represented approximately 20% of its total revenue, illustrating this dependency.

The risk of commoditization in standardized IT outsourcing and basic consulting services is a notable weakness. As these services become more common, clients tend to focus on price, leading to increased competition and pressure on Accenture's margins. The IT outsourcing market in 2024 continues to see many providers offering similar capabilities, potentially driving down rates for less differentiated services.

Preview the Actual Deliverable

Accenture SWOT Analysis

This is the actual Accenture SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Accenture's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The accelerating global digital transformation, fueled by widespread AI and generative AI adoption, is a significant opportunity for Accenture. Companies worldwide are actively seeking specialized expertise to embed these advanced technologies, streamline their operations, and pioneer novel business frameworks. Accenture's established proficiency in these critical domains positions it to secure a substantial portion of this expanding market.

Businesses are increasingly moving their operations to the cloud, a trend that accelerated significantly in 2024 and is projected to continue strongly into 2025. Simultaneously, the escalating complexity of cyber threats has elevated cybersecurity to a critical business imperative. Accenture's established proficiency in cloud migration, data protection, and risk mitigation positions it to capitalize on this dual demand.

The market for cloud services and cybersecurity solutions is expanding rapidly. For instance, the global cloud computing market was valued at over $600 billion in 2023 and is expected to surpass $1 trillion by 2028, with cybersecurity being a major component driving this growth. Accenture's ability to offer specialized cloud solutions and managed security services directly addresses this robust market opportunity, enabling them to protect and enhance client digital assets.

Accenture has a significant opportunity to expand its reach by focusing on emerging technologies like blockchain, quantum computing, and the metaverse. These cutting-edge fields represent the next wave of digital innovation, and early investment in expertise can position Accenture as a leader.

By developing specialized solutions for niche markets within these technologies, Accenture can differentiate itself and attract clients eager for forward-thinking strategies. For instance, the global metaverse market was valued at approximately $61.1 billion in 2022 and is projected to grow substantially, offering a fertile ground for new service offerings.

Increased Focus on Sustainability and ESG Consulting

The increasing global commitment to sustainability and Environmental, Social, and Governance (ESG) principles presents a substantial opportunity for Accenture. Companies worldwide are actively seeking guidance on integrating ESG factors into their core strategies, reporting mechanisms, and operational frameworks. This surge in demand is driven by regulatory pressures, investor expectations, and a growing consumer awareness of corporate responsibility.

Accenture is well-positioned to capitalize on this trend by offering specialized consulting services. These services can assist clients in navigating complex ESG regulations, reducing their environmental impact, and improving their social contributions. The market for ESG consulting is experiencing robust growth. For instance, the global ESG consulting market was valued at approximately $12.5 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating a compound annual growth rate exceeding 15%.

- Growing Demand: Companies are increasingly prioritizing sustainability and ESG integration.

- Regulatory Tailwinds: Evolving regulations worldwide are compelling businesses to adopt ESG practices.

- Market Expansion: The ESG consulting sector is a rapidly expanding market with significant revenue potential.

- Accenture's Role: Leveraging consulting expertise to guide clients through ESG transformation and reporting.

Strategic Acquisitions and Partnerships

Accenture can bolster its market position by pursuing strategic acquisitions and forming key partnerships. This approach allows for rapid expansion of its service offerings, geographical footprint, and specialized industry expertise. For instance, acquiring niche technology firms or consulting practices can instantly integrate advanced capabilities and skilled talent.

Partnerships are equally vital, enabling Accenture to broaden its ecosystem and deliver more comprehensive, end-to-end solutions to clients. This inorganic growth strategy is crucial for maintaining a competitive edge and accelerating market leadership in a rapidly evolving digital landscape. In fiscal year 2023, Accenture completed several acquisitions, demonstrating its commitment to this strategy.

- Acquisition of specialized technology firms to integrate cutting-edge capabilities.

- Formation of strategic alliances to enhance service delivery and market reach.

- Expansion into new geographic markets through targeted M&A activities.

- Deepening industry-specific expertise via the acquisition of niche consulting practices.

Accenture can capitalize on the increasing demand for data analytics and AI-driven insights. Businesses are leveraging data to make more informed decisions, optimize operations, and personalize customer experiences. Accenture's expertise in data management, advanced analytics, and AI implementation positions it to assist clients in unlocking the full potential of their data assets, driving significant value and competitive advantage.

The ongoing shift towards cloud-native architectures and the adoption of hybrid and multi-cloud environments present a substantial growth avenue. Companies are actively seeking to modernize their IT infrastructure for greater agility, scalability, and cost-efficiency. Accenture's comprehensive cloud services, including migration, management, and optimization, are critical for organizations navigating this complex transition.

The global market for cloud services is projected to reach over $1 trillion by 2028, with cybersecurity solutions forming a crucial element of this expansion. Accenture's ability to offer integrated cloud and security offerings addresses a critical need for businesses looking to secure their digital transformation journeys.

Accenture is well-positioned to benefit from the growing need for digital transformation services across various industries. As businesses aim to enhance customer engagement, improve operational efficiency, and develop new digital products and services, Accenture's broad capabilities in areas like cloud, data, AI, and cybersecurity are in high demand. The company's ability to deliver end-to-end solutions makes it a preferred partner for complex digital initiatives.

Threats

Global economic instability, including potential recessions and geopolitical tensions, poses a significant threat to Accenture. These conditions can cause clients to reduce their spending on consulting and IT services, leading to project deferrals or cancellations. For instance, in late 2023 and early 2024, many companies tightened their belts due to inflation and interest rate concerns, impacting discretionary IT budgets.

Accenture's revenue and profitability are directly susceptible to these economic downturns. A slowdown in client investment means fewer new projects and potentially lower fees on existing ones. The inherent cyclicality of the consulting industry means Accenture's performance often mirrors the broader economic cycle, making it vulnerable to widespread business slowdowns.

Accenture is facing a growing challenge from specialized boutique consulting firms that offer deep expertise in niche areas like AI ethics or quantum computing. These smaller, agile players can often provide more focused and cost-effective solutions than a large, diversified firm. For instance, a report from Source Global Research in late 2024 highlighted a significant rise in demand for niche consulting services, with specialized firms capturing a larger share of these specific project budgets.

Furthermore, many large corporations are building out their own internal consulting and digital transformation teams. This trend, particularly pronounced in 2024 and projected to continue into 2025, means clients may opt to handle certain projects in-house, reducing the overall market for external consultancies like Accenture. This internal capability development directly impacts the volume of work available for traditional consulting engagements.

Accenture faces a significant threat from the rapid pace of technological change, especially in fields like artificial intelligence and cloud computing. This necessitates ongoing, substantial investment in training and upskilling its extensive global workforce to keep pace with evolving industry demands and client needs.

Failure to adapt swiftly to emerging technologies or to effectively attract and retain talent possessing the most current skills poses a direct risk to Accenture's service relevance and overall market competitiveness. Skill obsolescence is an inherent and persistent challenge within the dynamic technology sector.

Talent Shortages and Wage Inflation

Accenture faces significant challenges from ongoing talent shortages and escalating wage inflation within the technology and consulting sectors. The global demand for highly skilled professionals frequently surpasses the available supply, creating intense competition and driving up labor costs. This upward pressure on wages directly impacts Accenture's operating expenses and can compress profit margins.

The scarcity of specialized skills presents a tangible threat, potentially hindering Accenture's capacity to secure new projects or pursue growth opportunities in emerging, high-demand markets. For instance, the cybersecurity talent gap remains a critical concern, with estimates suggesting millions of unfilled positions globally in 2024 and projected to continue through 2025. This directly affects Accenture's ability to deliver comprehensive cybersecurity solutions to its clients.

- Talent Demand vs. Supply: Global demand for tech and consulting talent consistently exceeds available supply, creating shortages.

- Wage Inflation Impact: Increased competition for skilled workers leads to higher salaries, impacting Accenture's operating costs and profitability.

- Specialized Skill Scarcity: A lack of niche expertise can limit project acquisition and expansion into high-growth areas.

- Cybersecurity Gap: The persistent shortage of cybersecurity professionals, a key service area, poses a direct operational risk.

Data Privacy, Cybersecurity Breaches, and Regulatory Risks

Accenture's role as a custodian of extensive client data, encompassing sensitive information, positions it as a prime target for sophisticated cybersecurity threats. A successful breach could lead to catastrophic reputational damage, significant financial penalties, and a severe erosion of customer confidence.

The company faces escalating regulatory risks stemming from the complex and ever-changing landscape of data privacy laws globally. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks in other regions necessitate continuous investment in compliance measures to avoid substantial fines. In 2023, data breaches cost organizations an average of $4.45 million globally, a figure that underscores the financial gravity of these threats.

- Cybersecurity Risks: Accenture's vast data holdings make it a lucrative target for cyberattacks, potentially leading to client data compromise.

- Reputational Damage: A significant breach could severely tarnish Accenture's brand and lead to a loss of trust among its global clientele.

- Regulatory Compliance: Navigating diverse and evolving data privacy regulations, such as GDPR, presents ongoing compliance challenges and potential legal liabilities.

- Financial Impact: Beyond direct breach costs, Accenture could face substantial fines and legal settlements, impacting profitability and investor confidence.

Intensifying competition from specialized firms and the growing trend of clients building in-house capabilities present significant challenges. These factors can directly reduce Accenture's addressable market and project pipeline, impacting revenue growth. For example, Source Global Research noted in late 2024 that niche consultancies were increasingly capturing specialized project budgets.

The rapid evolution of technology, particularly in AI and cloud, demands continuous, substantial investment in workforce upskilling to maintain service relevance. Failure to adapt quickly to new tech or attract talent with current skills risks diminishing Accenture's market competitiveness, as skill obsolescence is a constant threat in the tech sector.

Talent shortages and wage inflation are major concerns, driving up operating costs and potentially compressing profit margins. The scarcity of specialized skills, such as in cybersecurity where millions of positions were unfilled globally in 2024, can hinder Accenture's ability to secure new projects and expand into high-growth markets.

Accenture is also vulnerable to cybersecurity threats and evolving data privacy regulations, such as GDPR. A data breach could cause severe reputational damage and significant financial penalties, with global data breaches averaging $4.45 million in 2023.

SWOT Analysis Data Sources

This Accenture SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to provide a well-rounded and accurate strategic overview.