Accenture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

Accenture operates in a dynamic consulting landscape, facing intense rivalry and significant buyer power. Understanding these forces is crucial for navigating its competitive environment.

The full Porter's Five Forces Analysis reveals the real forces shaping Accenture’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Accenture's suppliers are quite varied, encompassing technology giants like Microsoft, AWS, SAP, Oracle, and Salesforce, alongside contingent labor providers and real estate firms. This broad supplier base means that no single supplier typically holds significant leverage over Accenture, as the company can often turn to alternatives.

While the overall supplier concentration is low, there are nuances. For critical, specialized technology or cloud services, the bargaining power of a few dominant providers can become more pronounced. For instance, reliance on a specific cloud infrastructure provider for a large portion of Accenture's operations could shift power dynamics, though diversification efforts generally mitigate this.

Switching costs for Accenture's suppliers are a key factor in their bargaining power. For commodity items like standard IT hardware or office supplies, Accenture can easily switch vendors with minimal disruption, keeping supplier power low.

However, when it comes to specialized talent or deeply integrated software platforms, the switching costs escalate significantly. Changing these critical suppliers can demand substantial time, resources, and potentially disrupt ongoing client projects, thereby granting these specialized suppliers greater leverage.

The availability of substitute inputs for Accenture's operations is generally quite broad, particularly for common IT hardware, cloud services, and general professional talent. This widespread availability of alternatives naturally moderates supplier power, as Accenture can often switch to different providers if one demands excessive terms. For instance, the cloud computing market in 2024 features intense competition among major players like Amazon Web Services, Microsoft Azure, and Google Cloud, offering Accenture significant flexibility and pricing leverage.

However, the bargaining power of suppliers can increase significantly when Accenture requires highly specialized or proprietary inputs. For cutting-edge artificial intelligence development or unique industry-specific software platforms, the pool of qualified suppliers is considerably smaller. In such cases, a limited number of providers offering these advanced capabilities can command higher prices and more favorable contract terms, thereby increasing their bargaining power over Accenture.

Importance of Supplier to Accenture's Business

Accenture's reliance on key technology partners and providers of highly specialized talent underscores the significant bargaining power of its suppliers. These relationships are fundamental to Accenture's capacity to offer a comprehensive suite of consulting, technology, and outsourcing services. For instance, in 2023, Accenture continued to invest heavily in strategic alliances with major cloud providers like Microsoft, Amazon Web Services, and Google Cloud, whose platforms underpin many of its digital transformation offerings.

Disruptions or unfavorable terms from these critical suppliers can directly impact Accenture's service delivery and client satisfaction. The cost of specialized talent, particularly in high-demand areas like artificial intelligence and cybersecurity, is a key factor where suppliers can exert leverage. Accenture's ability to secure and retain top talent, often sourced through specialized recruitment firms or directly from technology vendors, is directly influenced by supplier costs and availability.

- Key Technology Partnerships: Accenture's strategic alliances with major cloud providers and software vendors grant these suppliers considerable influence due to the integrated nature of their solutions within Accenture's service delivery.

- Specialized Talent Acquisition: The market for highly skilled professionals in areas like AI, data analytics, and cloud engineering is competitive, giving specialized talent providers and individual experts strong bargaining power.

- Impact on Service Delivery: Unfavorable terms or disruptions from critical suppliers can lead to increased operational costs and potential delays in project execution, affecting Accenture's profitability and client relationships.

- Supplier Concentration: In certain niche technology areas, Accenture may rely on a limited number of specialized suppliers, further concentrating bargaining power in the hands of those suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by Accenture's suppliers, particularly technology vendors, is generally considered low. Their core business models are typically focused on product development and sales, not the broad spectrum of consulting and implementation services that Accenture provides.

However, there's a growing trend where major software providers are expanding their offerings to include implementation and advisory services. This creates a degree of overlap, as these vendors can leverage their deep product knowledge to offer services that compete with Accenture's. For instance, in 2024, major cloud providers continued to enhance their professional services arms, aiming to capture more of the client engagement lifecycle.

- Low Threat: Suppliers' primary focus remains product sales, not comprehensive consulting.

- Increasing Overlap: Large software vendors are expanding into implementation and advisory services.

- Competitive Landscape: This trend creates a competitive dynamic for Accenture in specific service areas.

Accenture's bargaining power with suppliers is generally moderate, influenced by the diverse nature of its supplier base and the availability of substitutes. However, for specialized technology and critical talent, supplier leverage increases due to high switching costs and limited alternatives. For example, in 2024, major cloud providers like AWS, Microsoft Azure, and Google Cloud continue to dominate the infrastructure landscape, giving them significant pricing influence.

The threat of forward integration by suppliers is low, though some tech vendors are expanding into consulting services, creating a competitive edge. Accenture's reliance on these key partners for specialized skills, such as AI and cybersecurity expertise, means that supplier terms and talent availability directly impact Accenture's operational costs and client delivery capabilities.

| Supplier Category | Key Players (Examples) | Bargaining Power Factors | Accenture's Mitigation Strategies |

|---|---|---|---|

| Technology Platforms (Cloud, Software) | Microsoft, AWS, SAP, Oracle, Salesforce | High switching costs for integrated solutions, specialized capabilities. | Diversification across providers, strategic alliances, in-house development. |

| Specialized Talent Providers / Contingent Labor | Various recruitment agencies, individual contractors | Scarcity of niche skills (AI, cybersecurity), high demand. | Long-term contracts, internal talent development, competitive compensation. |

| General IT Hardware & Office Supplies | Multiple vendors | Low switching costs, high availability of substitutes. | Volume purchasing, competitive bidding, standardized procurement. |

What is included in the product

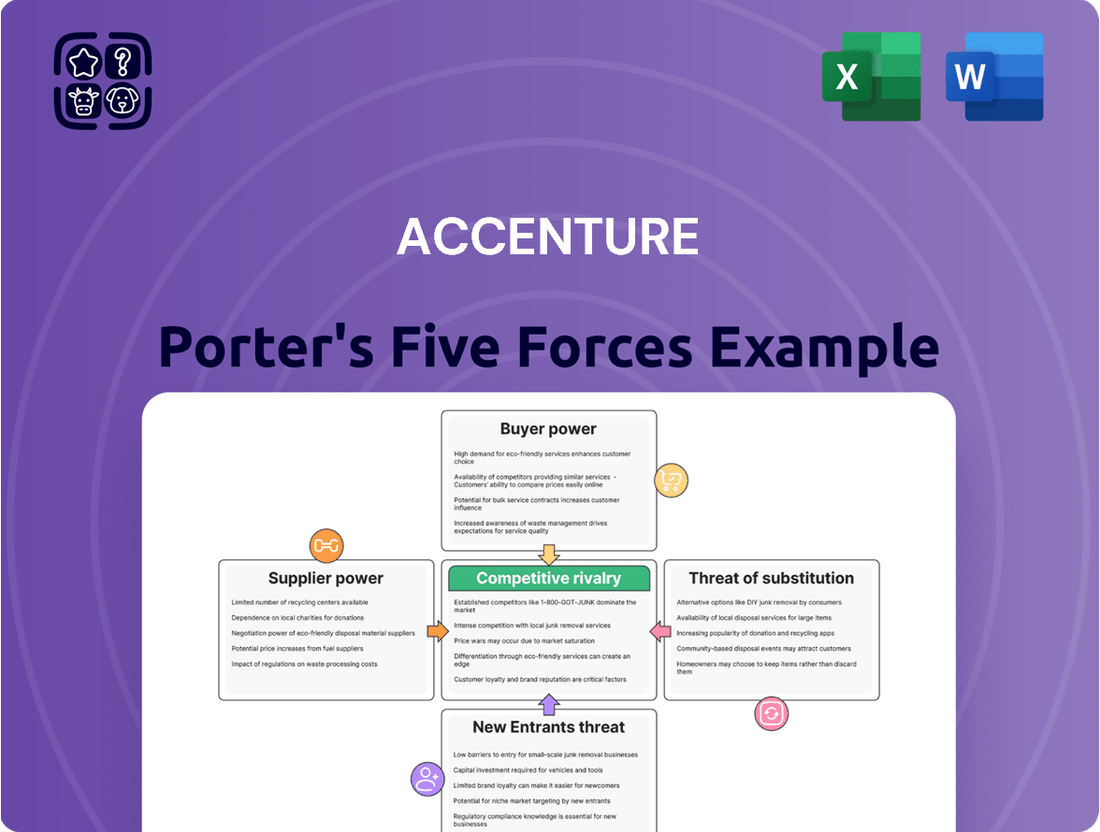

Accenture's Porter's Five Forces analysis dissects the competitive intensity within the consulting and technology services industry, evaluating threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing firms.

Instantly pinpoint competitive pressures with a visual, actionable framework, reducing the pain of strategic uncertainty.

Customers Bargaining Power

Accenture's client base is incredibly diverse, with over 9,000 clients across many different sectors and regions. This wide distribution significantly reduces the bargaining power of any single customer.

The company's broad reach means that even its largest clients typically represent a small fraction of total revenue. For instance, while specific client revenue figures are not publicly disclosed, the sheer volume of clients suggests a low dependence on any one entity. This diffusion of customer concentration is a key strength, limiting the ability of individual customers to exert significant price pressure or demand unfavorable terms.

For clients, switching from a major professional services firm like Accenture often comes with significant switching costs. These costs stem from the deep integration of Accenture's solutions into a client's existing systems and processes, the proprietary knowledge their teams have developed, and the sheer complexity involved in migrating ongoing projects or entire operational frameworks. This makes clients quite "sticky," meaning they are less likely to move to a competitor.

Customers in the professional services sector, particularly large corporations, are increasingly well-informed. They readily access market benchmarks, analyze competitor pricing, and leverage past project data to inform their decisions. This heightened transparency significantly strengthens their bargaining position, allowing them to negotiate more favorable terms on both price and project scope.

Threat of Backward Integration by Customers

Large enterprise clients possess the potential to develop in-house capabilities for certain consulting or IT services, presenting a threat of backward integration. This means they could bring services currently outsourced to firms like Accenture under their own roof.

However, the sheer scale, highly specialized expertise, and extensive global reach that Accenture provides are exceptionally difficult and prohibitively expensive for most clients to replicate internally. This significant barrier limits the practical feasibility of widespread backward integration for most customers.

- Client Capability Development: While some large clients might develop niche in-house IT or consulting functions, replicating Accenture's full spectrum of services is a substantial undertaking.

- Cost and Complexity Barriers: The investment required for technology, talent acquisition, training, and global operational infrastructure makes internal replication by clients economically unviable for most services.

- Accenture's Competitive Advantages: Accenture's established global network, deep industry knowledge, and continuous investment in cutting-edge technologies create a significant competitive moat against client backward integration.

- Focus on Core Competencies: Most clients prefer to focus on their core business operations, outsourcing specialized functions like advanced IT solutions and strategic consulting to experts like Accenture.

Price Sensitivity of Customers

Customer price sensitivity plays a significant role in Accenture's bargaining power of customers. While some clients are keenly focused on cost, many recognize the value in Accenture's specialized knowledge and innovative approaches. For instance, clients seeking advanced AI solutions or complex digital transformations often weigh the total value delivered, not just the initial price tag.

This means that while price is always a consideration, it's not always the sole determinant. Accenture's ability to offer unique, high-impact solutions can reduce the direct pressure of price competition. This is particularly true for projects requiring deep industry expertise or cutting-edge technology, where the risk of choosing a less experienced provider can outweigh cost savings.

- Price Sensitivity Varies: Clients' willingness to pay is not uniform; some prioritize cost reduction, while others value expertise and innovation.

- Value Proposition Mitigation: Accenture's deep industry knowledge, AI-driven tools, and successful track record for complex projects can lessen direct price pressure.

- Strategic Importance: For critical transformations and specialized needs, clients often look beyond the lowest bid to secure reliable, high-quality outcomes.

Accenture's diverse client base, spanning over 9,000 clients across numerous sectors, significantly dilutes the bargaining power of individual customers. Even the largest clients represent a small portion of overall revenue, limiting their ability to dictate terms. The substantial switching costs associated with deep system integration and proprietary knowledge further anchor clients, making them less likely to seek alternatives. While clients are increasingly informed and can negotiate better terms, Accenture's specialized expertise and global scale present formidable barriers to clients developing in-house capabilities or easily switching providers.

| Factor | Impact on Accenture's Customer Bargaining Power | Supporting Data/Observation (as of mid-2024) |

|---|---|---|

| Client Concentration | Lowers bargaining power due to broad client base. | Over 9,000 clients; no single client dominates revenue share. |

| Switching Costs | Reduces bargaining power by increasing client stickiness. | High integration of Accenture's solutions into client systems. |

| Client Information & Negotiation | Increases bargaining power as clients are more informed. | Clients readily use market benchmarks and past project data. |

| Potential for Backward Integration | Threatens bargaining power if clients build in-house capabilities. | Limited by the high cost and complexity of replicating Accenture's scale and expertise. |

| Price Sensitivity | Mitigated by value-based selling for specialized services. | Clients often prioritize expertise and innovation over lowest cost for complex projects. |

Preview the Actual Deliverable

Accenture Porter's Five Forces Analysis

This preview displays the complete Accenture Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect to download this professionally formatted and ready-to-use analysis, providing valuable strategic insights for your business.

Rivalry Among Competitors

Accenture operates in a fiercely competitive professional services landscape. The market is populated by major global consulting firms like Deloitte, IBM, PwC, EY, and KPMG, alongside numerous specialized IT service providers and smaller digital agencies. This broad array of players means Accenture encounters significant rivalry across all its service lines and in every geographic region it serves.

The global consulting market is experiencing robust growth, with projections indicating the professional services sector will reach $7,893.42 billion by 2029, growing at a 5.39% compound annual growth rate. This expansion, largely driven by the increasing demand for digital transformation and artificial intelligence solutions, presents considerable opportunities for firms like Accenture.

Accenture stands out by offering a comprehensive suite of integrated services, spanning strategy, consulting, digital transformation, technology solutions, and operations management. This breadth allows them to address client needs holistically, fostering deeper relationships and creating stickier engagements.

Their deep industry expertise is a significant differentiator, enabling them to tailor solutions to specific sector challenges. For instance, in 2023, Accenture reported significant growth in its Industry X segment, which focuses on digital engineering and manufacturing, reflecting strong demand for specialized knowledge.

Accenture's commitment to innovation, particularly in areas like artificial intelligence and cloud computing, further sets them apart. In fiscal year 2023, the company invested billions in research and development, launching new AI-powered platforms and solutions designed to drive client value and operational efficiency.

Exit Barriers

Exit barriers for companies like Accenture in professional services are substantial, primarily stemming from the immense investment in human capital. The specialized skills and deep client relationships cultivated by consultants represent a significant, often non-transferable, asset. For instance, Accenture reported over 743,000 employees globally as of the end of fiscal year 2023, highlighting the sheer scale of human capital that is difficult to redeploy or divest cleanly.

Furthermore, the specialized assets and intellectual property developed for specific client engagements create further exit challenges. Divesting a business unit without jeopardizing ongoing client projects or damaging the firm's overall reputation and client trust is a complex undertaking. This can lead to significant financial penalties or loss of future business if not managed meticulously.

The interconnectedness of services within a large consultancy also acts as an exit barrier. Untangling specialized divisions or divesting specific capabilities can disrupt the integrated service offerings that clients often value. This complexity makes a clean break difficult, often requiring significant restructuring and potentially impacting the perceived value of the divested entity.

- Human Capital Investment: Accenture's workforce of over 743,000 employees (FY23) represents a massive, specialized asset that is hard to exit cleanly.

- Client Relationships: Deeply embedded client trust and ongoing project commitments make divestitures complex and potentially reputation-damaging.

- Specialized Assets & IP: Unique intellectual property and assets created for specific client needs are often non-transferable, increasing exit costs.

- Service Interdependencies: The integrated nature of professional services makes it challenging to divest specific units without impacting the broader business and client experience.

Strategic Stakes

The strategic stakes for Accenture are exceptionally high, reflecting its status as a preeminent global professional services firm. In 2024, the company's continued success hinges on its ability to defend its substantial market share against aggressive competitors and to secure the specialized talent essential for delivering cutting-edge solutions.

Accenture's commitment to innovation, particularly in rapidly evolving fields like artificial intelligence, is paramount. For instance, in fiscal year 2023, the company reported a significant increase in its investment in AI capabilities and talent acquisition, underscoring the critical nature of these areas for future revenue streams and competitive differentiation.

- Maintaining Market Dominance: Accenture aims to solidify its position as a top-tier provider of consulting, technology, and outsourcing services.

- Talent Acquisition and Retention: Attracting and keeping highly skilled professionals, especially in AI and cloud computing, is a primary strategic objective.

- Continuous Innovation: Investing in research and development to stay ahead of technological advancements is crucial for sustained growth.

Accenture faces intense competition from a wide range of global and specialized firms, driving constant pressure on pricing and innovation. The sheer volume of players, from established consultancies like Deloitte and IBM to niche digital agencies, means differentiation is key. This rivalry is particularly fierce in high-growth areas like digital transformation and AI, where firms vie for both clients and top talent.

The competitive landscape is characterized by a relentless pursuit of market share and a focus on specialized capabilities. Accenture's strategy of offering integrated services and deep industry expertise, as seen in its strong performance in the Industry X segment in 2023, aims to counter this intense rivalry. The company's substantial investments in AI and R&D in FY23 further highlight the need to stay ahead in this dynamic market.

The professional services market is projected to reach $7,893.42 billion by 2029, with a CAGR of 5.39%, indicating significant growth opportunities but also intensifying competition. Accenture's ability to attract and retain over 743,000 employees globally (FY23) is a critical factor in maintaining its competitive edge against rivals who also heavily rely on human capital.

| Competitor Type | Key Players | Impact on Accenture |

|---|---|---|

| Global Consulting Firms | Deloitte, PwC, EY, KPMG, IBM | High rivalry across all service lines, pressure on pricing and talent. |

| Specialized IT Service Providers | Capgemini, Infosys, TCS | Competition for specific technology-focused projects, particularly in cloud and digital. |

| Niche Digital Agencies | Numerous smaller, agile firms | Disruption in specific digital marketing and creative service areas. |

SSubstitutes Threaten

Clients increasingly have the option to bypass traditional consulting firms by leveraging in-house expertise or specialized software vendors for direct implementation. For instance, many companies in 2024 are investing heavily in building their internal data analytics teams rather than relying solely on external consultants for such projects.

The proliferation of sophisticated automation and AI tools further empowers organizations to handle tasks previously outsourced to consultants. Companies are seeing significant cost savings by adopting AI-driven platforms for market research and process optimization, reducing the need for external advisory services.

Furthermore, the growing maturity of business process outsourcing (BPO) providers offers a cost-effective alternative for many operational and strategic functions. In 2023, the global BPO market was valued at over $270 billion, indicating a substantial and growing availability of these alternative solutions.

While some clients might consider in-house IT departments or smaller, specialized consulting firms as substitutes, these options often come with limitations. For instance, smaller firms may offer lower initial pricing, but they typically lack the broad industry expertise and the integrated, end-to-end service delivery that a company like Accenture provides, especially for complex digital transformations.

The performance of these substitutes can be significantly hampered when dealing with large-scale, multifaceted business challenges. Accenture's ability to leverage its global scale and deep technological capabilities means it can often deliver more robust and sustainable solutions compared to niche players or internal teams that may struggle with the scope and complexity of modern business needs.

In 2024, the demand for integrated digital transformation services remained high, with many organizations seeking partners capable of managing intricate projects from strategy to implementation. This environment favors providers like Accenture that can offer a full spectrum of services, making it harder for less comprehensive substitutes to compete effectively on performance for critical business initiatives.

Switching from a comprehensive consulting engagement with Accenture to a substitute solution can involve substantial costs. These often include significant expenses related to data migration, reconfiguring existing systems, and the potential for disruption to ongoing business operations. For instance, a company might face hundreds of thousands of dollars in IT integration costs and weeks of lost productivity during a transition to a new service provider.

Customer Propensity to Substitute

Customer propensity to substitute for services like those offered by Accenture is significantly influenced by the complexity of their requirements and their tolerance for risk. For highly strategic initiatives or intricate projects, clients typically exhibit a lower propensity to switch from established, trusted providers. This is because the potential costs of failure or underperformance are substantial, making reliability and proven expertise paramount.

Conversely, for more standardized or routine tasks, the likelihood of clients considering substitutes, such as developing in-house capabilities or leveraging automated solutions, increases. This shift is driven by the potential for cost savings and greater control over simpler processes. For instance, in 2024, many organizations explored robotic process automation (RPA) for back-office functions, indicating a growing comfort with automation for less complex operational needs.

The risk appetite of a client plays a crucial role. Companies with a low-risk appetite will lean towards established players like Accenture, even for moderately complex tasks, to minimize potential disruption. Those willing to experiment or facing budget constraints might evaluate alternatives more readily for less critical functions. For example, a 2024 survey revealed that 45% of mid-sized businesses were actively investigating cloud-based solutions as substitutes for traditional IT consulting services, particularly for non-core operations.

- Client Risk Aversion: Highly risk-averse clients are less likely to substitute established, reputable firms for complex projects.

- Task Complexity: Routine or commoditized tasks see a higher propensity for substitution by in-house teams or automation.

- Automation Adoption: In 2024, adoption of RPA for operational tasks increased, demonstrating a growing willingness to substitute external services for simpler processes.

- Cost Sensitivity: Budget constraints can drive clients to explore alternative solutions, especially for non-strategic business functions.

Impact of Technological Advancements on Substitutes

Technological advancements, particularly in AI and automation, are reshaping the landscape of substitutes for consulting services. Clients are increasingly capable of performing certain tasks in-house that were once the exclusive domain of external consultants. For instance, in 2024, many businesses are leveraging AI-powered analytics platforms to gain insights previously requiring specialized consulting expertise, potentially reducing the need for traditional market research or operational efficiency consulting.

However, this trend doesn't eliminate the threat; it transforms it. The very technologies enabling clients to do more internally are simultaneously creating new opportunities and demands for Accenture. The complexity of implementing and effectively leveraging these advanced technologies, such as generative AI or sophisticated data management systems, necessitates new forms of external support. Accenture's role is evolving from performing tasks to enabling clients to master these new capabilities.

This dynamic creates a dual effect on substitutes. On one hand, off-the-shelf software and AI tools can directly substitute for certain discrete consulting services. On the other hand, the growing sophistication of these technologies increases the demand for Accenture's expertise in integration, strategy, and change management. For example, while a company might use an AI tool for basic data analysis, they might still require Accenture to build a comprehensive AI strategy or implement a large-scale automation project.

- AI-driven analytics platforms are becoming more accessible, allowing businesses to conduct internal market analysis.

- Automation tools can now handle routine operational tasks previously outsourced to consultants.

- Accenture's expertise in **AI implementation and strategy** is becoming a key differentiator, creating new service demands.

- The threat of substitutes is shifting from task-based replacement to a need for **higher-level strategic enablement**.

The threat of substitutes for consulting services is evolving with technological advancements. In 2024, businesses are increasingly leveraging AI and automation to perform tasks previously outsourced, like market analysis and process optimization, leading to potential cost savings and greater internal control. This shift is particularly noticeable for more standardized or routine functions.

However, the complexity of implementing and managing these advanced technologies creates new demands for specialized expertise. While off-the-shelf solutions can substitute for discrete services, they also highlight the need for strategic guidance in areas like AI implementation and large-scale automation projects, areas where firms like Accenture can offer significant value.

Client risk aversion and the complexity of requirements heavily influence the propensity to substitute. For highly strategic and intricate projects, clients tend to stick with established providers due to the high cost of failure. Conversely, budget constraints and a higher tolerance for risk can drive the exploration of alternatives for less critical functions.

| Substitute Type | 2024 Client Adoption Trend | Key Driver | Accenture's Counter-Strategy |

| In-house Expertise | Increasing for routine tasks | Cost savings, control | Focus on complex strategy, integration |

| AI/Automation Tools | Growing adoption for analytics | Efficiency, insights | Enablement of advanced AI strategies |

| BPO Providers | Significant market presence | Cost-effectiveness for operations | Higher-value, end-to-end solutions |

| Smaller Specialized Firms | Niche adoption | Lower initial pricing | Broad industry expertise, scale |

Entrants Threaten

Entering the global professional services arena at Accenture's magnitude demands immense capital. This includes significant investments in attracting top-tier talent, establishing robust technology infrastructure, building a worldwide operational footprint, and cultivating a strong brand reputation. These considerable upfront costs create a formidable barrier for any new player aiming to compete at this level.

Accenture's deep-rooted relationships with over 9,000 clients, including its significant 'Diamond client' base, create a formidable barrier for new entrants. These established, trusted networks are vital for securing substantial, long-term projects, making it incredibly difficult for newcomers to penetrate the market and gain access to key distribution channels and client decision-makers.

Accenture's vast global presence and integrated service lines create substantial economies of scale and scope, making it difficult for new entrants to match its operational efficiency and cost advantages. For instance, in 2023, Accenture reported revenues of $62.1 billion, demonstrating the sheer volume of business it handles, which allows for significant cost absorption across its operations. This scale enables Accenture to invest heavily in technology, talent development, and marketing, further widening the gap for potential competitors.

Newcomers struggle to replicate Accenture's ability to leverage resources across diverse projects and clients, a key driver of its cost-effectiveness. The company's broad portfolio, spanning strategy, consulting, digital, technology, and operations, allows it to cross-sell services and optimize resource allocation, leading to superior margins. This interconnectedness, built over years, presents a formidable barrier to entry, as replicating such a complex and efficient ecosystem requires immense capital and time.

Brand Identity and Reputation

Accenture's formidable brand identity and established reputation for tackling complex business transformations present a significant barrier to new entrants. Building comparable trust and credibility in the market requires substantial investment and a proven track record, which newcomers lack.

New entrants struggle to replicate Accenture's global reach and the deep client relationships it has cultivated over decades. This established presence makes it difficult for emerging firms to gain traction and secure large-scale projects.

- Brand Strength: Accenture's brand is synonymous with innovation and reliable execution in the consulting and technology services sector.

- Reputational Capital: Decades of successful project delivery and client satisfaction have built immense reputational capital, a difficult asset for new players to acquire.

- Client Trust: Existing clients often exhibit strong loyalty to Accenture due to their history of delivering value, making it challenging for new entrants to displace them.

- Market Perception: The market generally perceives Accenture as a leader, which influences client decision-making and the perception of risk associated with choosing a new provider.

Government Policy and Regulations

Government policies and regulations can significantly influence the threat of new entrants in the professional services sector, including Accenture's operations. While not as heavily regulated as some industries, compliance with data privacy laws like GDPR or CCPA, and sector-specific regulations (e.g., financial services consulting) can act as a barrier. For instance, in 2024, the ongoing evolution of data protection frameworks globally requires substantial investment in legal and compliance infrastructure, which can be prohibitive for smaller, new firms. International business laws further complicate market entry, demanding expertise in diverse legal and tax environments.

New entrants must also contend with licensing requirements and professional conduct standards that vary by jurisdiction. These can include certifications, ethical guidelines, and ongoing professional development mandates. For example, in the United States, consulting firms advising on government contracts must adhere to strict procurement regulations and ethical standards, adding complexity and cost. This regulatory burden can deter potential competitors who lack the resources or knowledge to navigate these requirements effectively.

The threat of new entrants is also shaped by government incentives or restrictions related to foreign investment and market access. Policies promoting domestic service providers or imposing tariffs on imported services can create an uneven playing field. As of early 2024, several countries are reviewing their digital trade policies, which could impact how professional services are delivered and regulated across borders, potentially increasing barriers for international newcomers.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA necessitates significant investment in secure data handling and privacy protocols, a hurdle for new entrants.

- Industry-Specific Regulations: Compliance with sector-specific rules, such as those in financial services or healthcare consulting, requires specialized knowledge and resources.

- International Business Laws: Navigating diverse international tax, labor, and corporate laws presents a substantial barrier for firms looking to operate globally.

- Licensing and Professional Standards: Varying jurisdictional requirements for professional licenses and adherence to ethical codes add complexity and cost for new market participants.

The threat of new entrants for a company like Accenture is generally low due to substantial barriers. These include the enormous capital required for global operations, talent acquisition, and technology infrastructure. Furthermore, Accenture's established client relationships, particularly with its large client base, create significant hurdles for newcomers seeking to gain market access and secure substantial projects.

Economies of scale and scope, driven by Accenture's vast global presence and integrated service lines, allow it to achieve cost advantages that are difficult for new players to match. In 2023, Accenture's revenue of $62.1 billion highlights its operational volume, enabling significant investment in technology and talent, which further widens the competitive gap.

Accenture's strong brand reputation, built on decades of successful project delivery and client trust, acts as a major deterrent. New entrants struggle to replicate this market perception and the client loyalty that Accenture enjoys, making it challenging to displace incumbents and secure a market foothold.

Regulatory compliance, including data privacy laws and industry-specific standards, adds another layer of complexity and cost for potential new entrants. Navigating these requirements, along with international business laws and licensing, demands significant resources and expertise, further limiting the threat of new competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for talent, technology, and global infrastructure. | High barrier; deters capital-constrained firms. |

| Client Relationships | Deeply entrenched relationships with over 9,000 clients. | High barrier; difficult for newcomers to gain access to key decision-makers and projects. |

| Economies of Scale & Scope | Leveraging global presence and integrated services for cost efficiencies. | High barrier; new entrants struggle to match operational efficiency. |

| Brand Reputation & Trust | Decades of successful delivery build strong market credibility. | High barrier; requires substantial time and investment to build comparable trust. |

| Regulatory Compliance | Adherence to data privacy, industry-specific, and international laws. | Moderate to High barrier; adds complexity and cost for new market participants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from publicly traded companies, and insights from reputable business news outlets.