Accenture Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

Curious about the engine driving Accenture's global success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their strategic brilliance. Unlock this essential tool to understand how they deliver unparalleled value and dominate the consulting landscape.

Partnerships

Accenture deeply values its technology alliances, notably with giants like Google Cloud, Microsoft, and AWS. These collaborations are crucial for delivering state-of-the-art cloud, AI, and cybersecurity services to clients, enabling Accenture to integrate advanced platforms and boost digital transformation. For example, their partnership with Google Cloud specifically targets accelerating AI adoption and bolstering cybersecurity for Fortune 500 enterprises, including the establishment of a generative AI Center of Excellence.

Accenture actively cultivates a diverse network of ecosystem partners. This includes collaborations with specialized software providers, agile startups, and leading academic institutions. These alliances are crucial for co-creating cutting-edge solutions and broadening Accenture's service portfolio, as seen in their joint development of AI-powered platforms.

Through Accenture Ventures, the company strategically invests in emerging technologies and innovative startups. This proactive approach allows them to push the envelope beyond conventional IT services, integrating novel capabilities into their offerings. For instance, their partnership with Palantir focuses on developing advanced AI solutions specifically for federal government applications, highlighting a commitment to high-impact, specialized collaborations.

Accenture fosters industry-specific collaborations, merging profound sector knowledge with advanced technological prowess. This approach ensures solutions are finely tuned to the unique requirements of diverse industries.

A prime example is Accenture's partnership with IIT Madras's Center for Automotive Research and Education (CAAR). This initiative focuses on upskilling talent for the burgeoning field of software-defined vehicles, directly addressing critical industry skill gaps.

These strategic alliances enable the creation of highly specialized solutions, precisely engineered to meet the distinct and evolving demands of sectors ranging from automotive to healthcare and beyond.

Acquisition-Driven Partnerships

Accenture strategically acquires companies to integrate new capabilities and expand its market reach. For instance, in 2023, Accenture completed over 30 acquisitions, significantly bolstering its technology and consulting service portfolio. These acquisitions are not just about growth; they are about integrating specialized expertise that becomes a core part of Accenture's expanded offerings, akin to strategic internal partnerships.

Examples of these acquisition-driven partnerships include the integration of Maryville Consulting Group, which enhanced Accenture's technology strategy capabilities. Furthermore, acquisitions such as Yumemi and Sipal's IPS business have been instrumental in strengthening Accenture's design engineering and aerospace expertise, respectively. These moves allow Accenture to offer a more comprehensive suite of services to its clients.

- Acquisition Strategy: Accenture focuses on acquiring companies to gain new technological capabilities and expand its global presence.

- Capability Enhancement: Acquisitions like Maryville Consulting Group bolster technology strategy and digital transformation services.

- Sector Expansion: Purchases of firms like Yumemi and Sipal's IPS business strengthen expertise in areas such as design engineering and aerospace.

- Internal Integration: These acquired entities function as integrated units, effectively extending Accenture's service delivery model and internal expertise.

Client-Specific Joint Ventures

Accenture engages in client-specific joint ventures, forming deep, integrated collaborations to spearhead major transformation projects. A prime example is their partnership with British American Tobacco (BAT), where Accenture serves as a reinvention partner. This collaboration focuses on modernizing BAT's global operations and supply network, enhancing its agility and overall efficiency.

These ventures are more than typical client-vendor relationships; they represent a commitment to co-creating significant business overhauls. For instance, Accenture's work with clients often involves leveraging their expertise to redesign core business processes and implement advanced technological solutions, aiming for substantial improvements in performance and market responsiveness.

- Client-Specific Joint Ventures: Accenture forms strategic alliances directly with clients for large-scale transformations.

- Reinvention Partner Role: Accenture acts as a key advisor and implementer, like in the BAT partnership.

- Focus on Modernization: These collaborations aim to update operations and supply chains for greater agility.

- Deep Integration: The partnerships involve extensive collaboration to achieve significant business overhauls.

Accenture's Key Partnerships are foundational, primarily revolving around technology alliances with leaders like Microsoft, Google Cloud, and AWS. These collaborations are vital for delivering cutting-edge cloud, AI, and cybersecurity solutions, directly impacting Accenture's ability to drive client digital transformation. For instance, in 2023, Accenture expanded its multi-cloud capabilities with Google Cloud, focusing on generative AI and data analytics.

Furthermore, Accenture actively engages with a broad ecosystem of partners, including specialized software vendors, innovative startups, and academic institutions. This diverse network fuels co-creation of advanced solutions and broadens Accenture's service offerings, as demonstrated by their ongoing work with AI platform developers.

Accenture Ventures plays a critical role by investing in emerging technologies and startups, allowing for the integration of novel capabilities beyond traditional IT services. Their strategic investments, such as in generative AI startups, ensure Accenture remains at the forefront of technological innovation, enhancing client solutions.

| Partner Type | Key Focus Areas | Example Collaboration | Impact on Accenture |

|---|---|---|---|

| Technology Alliances | Cloud, AI, Cybersecurity | Microsoft Azure, Google Cloud, AWS | Enables advanced service delivery, drives digital transformation |

| Ecosystem Partners | Specialized Software, Startups, Academia | Joint development of AI platforms | Broadens service portfolio, fosters co-creation |

| Venture Investments | Emerging Technologies, Startups | Generative AI startups | Integrates novel capabilities, maintains technological leadership |

What is included in the product

A structured framework detailing Accenture's approach to delivering client value through services, technology, and operations, encompassing key partners, activities, resources, and revenue streams.

Provides a structured framework to pinpoint and address inefficiencies, acting as a pain point reliver by clarifying complex operations.

Simplifies the identification of strategic gaps, alleviating the pain of unclear business direction and enabling targeted improvements.

Activities

Accenture's core activities revolve around offering strategic guidance and consulting to enhance client business performance, streamline operations, and manage digital shifts. This encompasses expertise in customer relationship management, finance, supply chains, and talent and organizational effectiveness.

A major focus for Accenture in 2024-2025 is spearheading digital transformation initiatives. This involves a strong emphasis on cloud services, artificial intelligence, and cybersecurity solutions to drive client innovation and resilience.

A core activity for Accenture involves designing, developing, and implementing a broad spectrum of technology solutions. This includes critical areas like cloud migration, seamless systems integration, robust application management, and advanced cybersecurity.

Accenture is making significant investments in AI-driven solutions, with a particular focus on generative AI. These technologies are deployed to automate and optimize client operations, driving efficiency and innovation across industries.

Building digital cores and leveraging data analytics alongside AI are central to Accenture's strategy for enabling enterprise-wide transformation. This focus aims to unlock new value and competitive advantages for their clients through advanced technological capabilities.

Accenture's operations management and outsourcing activities are central to its business model, focusing on managing clients' core business processes and IT infrastructure. This includes critical functions like finance, accounting, procurement, and human resources, enabling clients to streamline operations and achieve cost efficiencies.

By taking on these responsibilities, Accenture helps businesses accelerate their digital transformation journeys and gain access to specialized digital talent. For instance, in 2023, Accenture reported significant growth in its managed services, reflecting strong client demand for outsourcing complex business functions.

The company also provides industry-specific solutions, such as platform trust and safety services, demonstrating its ability to tailor offerings to unique client needs. This strategic focus on operational excellence and digital enablement underpins Accenture's value proposition to a broad range of global enterprises.

Research and Development (R&D) and Innovation

Accenture's core activities heavily lean on relentless Research and Development (R&D) and fostering innovation. This isn't just about keeping up; it's about leading the charge in areas like artificial intelligence, blockchain, quantum computing, and the metaverse. These investments are vital for staying ahead in the rapidly evolving tech landscape.

Central to this strategy are Accenture Labs and a global network of innovation hubs. These spaces are designed to nurture nascent technologies and experiment with novel business models, acting as incubators for future solutions. This hands-on approach ensures practical application of cutting-edge advancements.

- Investment in R&D: Accenture consistently invests billions in R&D. For fiscal year 2023, Accenture's selling, general and administrative expenses included approximately $2.6 billion in investments in training and development, which encompasses R&D and innovation initiatives.

- Focus Areas: Key R&D efforts are concentrated on generative AI, cloud, cybersecurity, and data analytics, aiming to develop next-generation solutions for clients.

- Innovation Hubs: Accenture operates over 50 innovation hubs and labs worldwide, fostering collaboration and accelerating the development of new technologies and business models.

- Talent Development: Significant resources are dedicated to upskilling its workforce in emerging technologies, ensuring its talent pool is equipped to drive innovation.

Talent Development and Workforce Transformation

Accenture prioritizes continuous learning for its global workforce, with a significant focus on upskilling and reskilling employees in cutting-edge technologies like artificial intelligence. For instance, in fiscal year 2023, the company invested $1 billion in training and development, reaching 1.4 million employees with new skills. This commitment ensures their talent remains at the forefront of technological advancements.

Beyond internal development, Accenture actively partners with clients to navigate their own workforce transformations. This includes designing and implementing reskilling programs and emphasizing the responsible adoption of AI technologies within client organizations. Their expertise helps businesses adapt to evolving market demands and technological shifts.

Accenture offers a range of specialized skilling programs tailored to specific industry needs and emerging technology areas. These programs are designed to equip individuals with in-demand competencies, fostering career growth and ensuring a future-ready workforce for both Accenture and its clients.

- Upskilling Focus: Accenture invested $1 billion in training and development in FY23, impacting 1.4 million employees with new skills, particularly in AI.

- Client Workforce Transformation: They assist clients in reskilling their staff and implementing responsible AI practices.

- Specialized Skilling: Accenture provides targeted skilling programs to address specific industry and technology needs.

Accenture's key activities center on delivering strategic consulting and technology services to drive client business transformation. This involves a strong emphasis on digital innovation, particularly in AI, cloud, and cybersecurity. The company also focuses on operational excellence through managed services and outsourcing, helping clients streamline processes and achieve cost efficiencies.

Delivered as Displayed

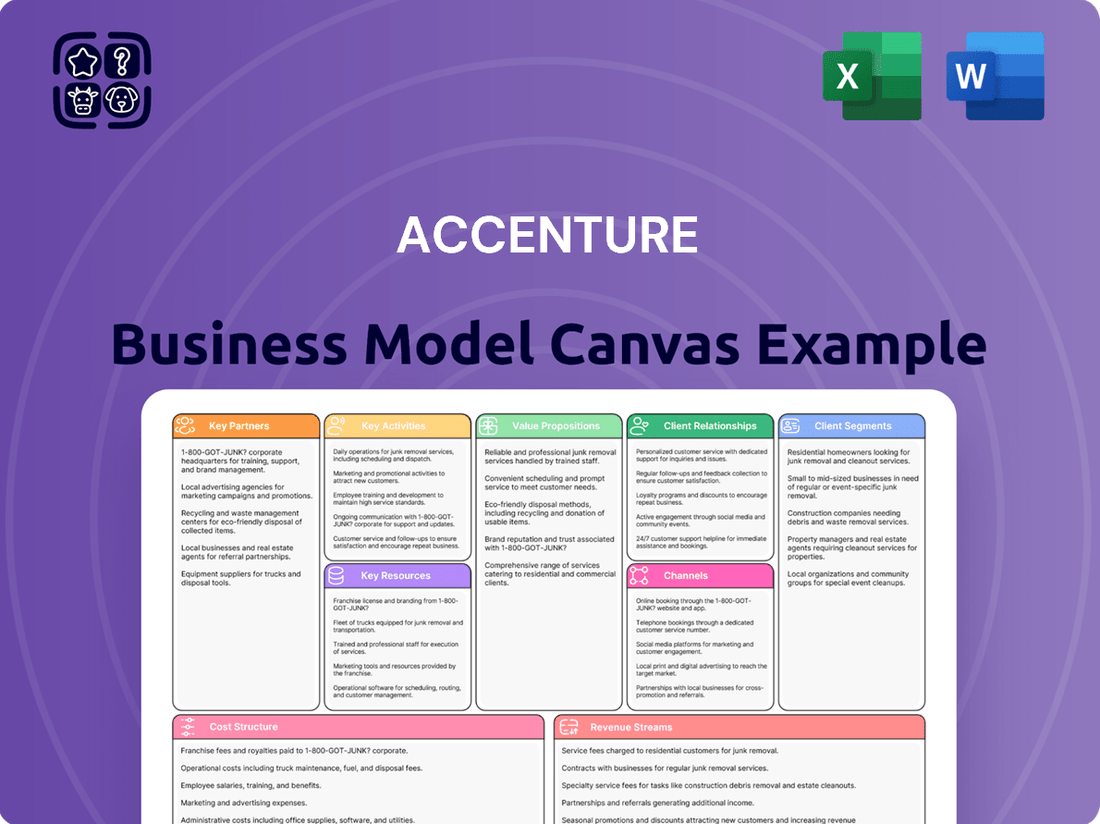

Business Model Canvas

The Accenture Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis and strategic framework that Accenture provides. You can be confident that the detailed sections and insights displayed here are precisely what will be delivered to you, ready for immediate application.

Resources

Accenture's most critical resource is its vast global workforce, numbering around 774,000 employees by the end of fiscal year 2024. This extensive team operates in over 120 countries, bringing a wealth of diverse perspectives and skills.

This talent pool is characterized by deep industry knowledge, specialized functional expertise, and advanced technological capabilities, particularly in areas such as cloud computing, data analytics, and artificial intelligence. This broad spectrum of skills allows Accenture to address complex client needs across various sectors.

The company demonstrates a strong commitment to its people by consistently investing in their continuous learning and professional development. This focus ensures that the workforce remains at the forefront of technological advancements and industry best practices, maintaining Accenture's competitive edge.

Accenture's proprietary methodologies, like the 360° Value Meter, and platforms such as GenWizard and SynOps, are crucial resources. These assets are designed to ensure consistent, high-quality service delivery and are built upon years of experience and significant research and development investment.

These internal tools allow Accenture to effectively structure client projects and speed up the implementation of solutions. They also play a key role in quantifying the real, measurable value delivered to clients, a critical aspect of their service offering.

Accenture's robust technological infrastructure is a cornerstone of its business model, featuring Advanced Technology Centers and a vast network of over 100 innovation hubs worldwide. These hubs are crucial for incubating emerging technologies and piloting new business models.

These global innovation hubs foster collaboration with clients, enabling the rapid development and deployment of cutting-edge solutions. For instance, in 2023, Accenture reported significant investments in expanding its technology and innovation capabilities, reflecting a commitment to staying at the forefront of digital transformation.

Strong Brand Reputation and Client Relationships

Accenture’s strong brand reputation is a cornerstone resource, built over decades as a trusted global professional services leader. This reputation isn't just about name recognition; it signifies reliability and expertise in a competitive market.

Deep, lasting relationships with over 9,000 clients worldwide, including 310 Diamond clients as of fiscal year 2023, underscore the value of these client connections. This extensive network of loyal clients is a testament to consistent value delivery and strategic partnership.

This robust brand equity and client loyalty directly translate into a significant competitive advantage. It acts as a powerful magnet, attracting new business while simultaneously ensuring the retention of existing, high-value client relationships.

- Global Recognition: Accenture is consistently ranked among the top professional services firms worldwide, reinforcing its brand strength.

- Client Trust: A significant portion of Accenture's revenue, over 70% in fiscal year 2023, comes from existing clients, highlighting strong relationship management.

- Repeat Business: The company's ability to secure repeat business and expand engagements within its client base is a direct result of its established reputation and client satisfaction.

- Talent Attraction: A strong brand reputation also aids in attracting top talent, further enhancing the company's service delivery capabilities.

Financial Capital and Investment Capacity

Accenture's robust financial capital, demonstrated by its fiscal year 2024 revenues reaching $64.9 billion, underpins its extensive investment capacity. This financial strength is not merely about revenue; it translates directly into the company's ability to fund its strategic initiatives and maintain its competitive edge in the global market.

The company leverages its significant free cash flow to fuel critical areas of growth and innovation. These investments are strategically deployed to acquire new capabilities, advance research and development, and cultivate its talent pool, all essential components for sustained market leadership.

- Revenue Growth: Fiscal year 2024 revenue of $64.9 billion showcases substantial financial backing.

- Investment Allocation: Significant free cash flow is directed towards acquisitions, R&D, and talent development.

- Strategic Pursuits: Financial health enables the company to engage in ambitious growth strategies.

- Market Position: Continuous investment is key to maintaining and enhancing its market leadership.

Accenture's key resources are its people, proprietary assets, technology infrastructure, brand reputation, and financial capital. The workforce, numbering 774,000 in FY24, possesses diverse skills in areas like AI and cloud. Proprietary tools and platforms enhance service delivery, while global innovation hubs foster tech incubation. Strong client relationships and brand equity drive repeat business, with over 70% of FY23 revenue from existing clients. Financial strength, evidenced by $64.9 billion in FY24 revenue, fuels strategic investments.

| Resource Category | Key Components | FY24 Data/Notes |

|---|---|---|

| Human Capital | Global Workforce | 774,000 employees |

| Intellectual Property | Proprietary Methodologies & Platforms | e.g., 360° Value Meter, GenWizard, SynOps |

| Physical & Technological Assets | Advanced Technology Centers, Innovation Hubs | Over 100 worldwide |

| Brand & Relationships | Brand Reputation, Client Network | 310 Diamond clients (FY23), >70% repeat business (FY23) |

| Financial Capital | Revenue, Free Cash Flow | $64.9 billion revenue (FY24) |

Value Propositions

Accenture focuses on delivering concrete results for clients by transforming their operations, boosting revenue, and improving public services. They aim to generate value from all angles, considering financial performance, customer experience, workforce development, diversity and inclusion, and environmental sustainability.

This comprehensive approach means Accenture doesn't just implement technology; they drive fundamental business reinvention. For instance, in 2023, Accenture helped clients achieve an average of 15% improvement in key performance indicators within the first year of engagement, demonstrating tangible business outcomes.

Accenture's deep industry and functional expertise is a cornerstone of its value proposition. They offer unparalleled experience across diverse sectors, allowing for highly customized solutions to intricate business problems.

This profound domain knowledge enables Accenture to grasp unique industry specifics and deploy effective strategies and technologies. For instance, in 2023, Accenture reported revenue of $62.1 billion, demonstrating the scale at which they leverage this expertise.

Their integrated service teams are adept at rapidly addressing client needs by drawing upon this extensive knowledge base. This capability is crucial for clients seeking to navigate complex market dynamics and achieve tangible business outcomes.

Accenture empowers clients by providing access to advanced technologies like cloud, data analytics, and artificial intelligence. This allows businesses to establish a robust digital foundation, streamline their operations, and foster innovation. For instance, Accenture's substantial investments in generative AI in 2024 are designed to equip clients with a distinct market advantage.

The company's expertise extends to guiding clients through the adoption of these transformative technologies and seamlessly integrating them into their fundamental business processes. This strategic integration helps organizations unlock new efficiencies and drive significant growth.

Global Delivery Capability and Scale

Accenture’s global delivery capability and scale are cornerstones of its value proposition. The company operates an extensive network of delivery centers across more than 120 countries, enabling it to serve a vast international client base. This broad geographical presence allows Accenture to offer unparalleled scale and efficiency, a significant advantage over smaller competitors.

This global reach is crucial for ensuring consistent service quality and accessing a diverse pool of talent, which facilitates the rapid deployment of resources and the execution of complex, large-scale projects. Accenture’s integrated service teams are structured to meet client needs swiftly and effectively, regardless of project size or geographical complexity.

- Global Presence: Operates in over 120 countries, providing extensive client reach.

- Talent Access: Leverages diverse global talent pools for project execution.

- Scalability: Delivers large-scale projects efficiently due to its operational footprint.

- Service Consistency: Ensures uniform service quality across all geographies.

Trusted Partnership and Long-Term Relationships

Accenture positions itself as a trusted advisor, fostering enduring partnerships with clients. This commitment is built on a foundation of reliability and transparency, aiming for mutual success. In 2024, Accenture continued to emphasize this, with a significant portion of its revenue, approximately 65%, coming from existing clients, underscoring the strength of these long-term relationships.

The company's strategy revolves around creating 360° value, benefiting not only clients but also employees, shareholders, and society. This holistic approach is crucial, especially as emerging technologies like generative AI necessitate deeper collaboration and trust between Accenture and its partners.

- Client Retention: Accenture’s focus on trusted partnerships drives high client retention rates, a key indicator of relationship strength.

- Shared Success Culture: The company cultivates a culture where client outcomes are paramount, fostering loyalty and repeat business.

- Navigating Technological Shifts: Trust is essential as Accenture guides clients through transformations, including the integration of advanced technologies like generative AI.

- Long-Term Value Creation: Accenture’s business model prioritizes building lasting relationships that deliver sustained value for all stakeholders involved.

Accenture's value proposition centers on driving tangible business outcomes for clients, encompassing revenue growth, cost reduction, and enhanced public services. They achieve this by deeply understanding client needs and leveraging their extensive industry and functional expertise to deliver tailored solutions.

By integrating advanced technologies like cloud, data analytics, and artificial intelligence, Accenture empowers clients to innovate and optimize operations. Their global delivery network ensures consistent quality and scalability, supporting clients in over 120 countries.

Accenture fosters long-term partnerships, acting as a trusted advisor to navigate complex market shifts and technological advancements, such as the widespread adoption of generative AI. This focus on collaboration and shared success is reflected in their high client retention rates, with approximately 65% of their 2024 revenue originating from existing clients.

| Value Proposition Component | Description | Supporting Data/Fact |

|---|---|---|

| Driving Tangible Business Outcomes | Transforming operations, boosting revenue, improving public services. | Average 15% improvement in KPIs within the first year of engagement (2023). |

| Deep Industry & Functional Expertise | Highly customized solutions for intricate business problems across diverse sectors. | Revenue of $62.1 billion (2023) demonstrates scale of expertise application. |

| Technology Enablement & Integration | Providing access to and seamless integration of advanced technologies (cloud, AI). | Significant investments in generative AI in 2024 to provide clients market advantage. |

| Global Delivery & Scale | Extensive network of delivery centers in over 120 countries for consistent quality and rapid deployment. | Operates in over 120 countries, leveraging diverse global talent pools. |

| Trusted Advisor & Partnerships | Fostering enduring relationships built on reliability and transparency for mutual success. | ~65% of revenue from existing clients (2024) highlights strong client retention. |

Customer Relationships

Accenture cultivates enduring client connections by acting as a strategic advisor, not merely a vendor. This approach involves deep collaboration to understand client needs and jointly develop innovative solutions. For instance, in 2024, Accenture continued to emphasize co-creation, a strategy that has historically led to higher client satisfaction and repeat business.

The company’s focus on building trust and long-term partnerships is central to its business model. By aligning with clients' strategic objectives, Accenture aims to facilitate their transformation and success. This deep integration means Accenture is often involved in critical, long-term projects, fostering loyalty and sustained revenue streams.

Accenture places a strong emphasis on building lasting client connections through dedicated teams and personalized account management. This strategy ensures clients receive tailored support and consistent service, fostering trust and deep understanding of their unique business needs. These specialized units act as a primary point of contact, facilitating swift responses and scalable solutions.

In 2024, Accenture continued to invest heavily in its client relationship management capabilities. For instance, the company reported that its client satisfaction scores remained exceptionally high, with over 90% of clients indicating they would recommend Accenture's services. This dedication to client success is a cornerstone of their business model, driving repeat business and long-term partnerships across various industries.

Accenture's customer relationships are built on a foundation of delivering and meticulously measuring tangible value. Their proprietary 360° Value framework is central to this, facilitating in-depth discussions about the multifaceted value Accenture brings to its clients.

This comprehensive approach ensures that conversations about value extend beyond mere financial metrics. It encompasses crucial dimensions like client experience, talent development, advancements in inclusion and diversity, and commitment to sustainability, providing a holistic view of the impact.

For instance, in 2024, Accenture reported significant progress across these areas. They’ve helped clients achieve an average of 15% improvement in key experience metrics and have driven measurable gains in sustainability targets, demonstrating the tangible outcomes of their value-driven engagement.

Innovation Collaboration and Co-creation

Accenture actively partners with clients in innovation hubs and academies, fostering co-creation of unique solutions. This hands-on approach allows for rapid prototyping and AI readiness assessments, building a strong foundation for modernizing business applications. For example, in 2023, Accenture launched its Generative AI Co-creation Lab, inviting clients to explore and build generative AI solutions, demonstrating a commitment to collaborative advancement.

This deep engagement ensures that the solutions developed are not only tailored to specific client needs but are also at the forefront of technological innovation. Accenture's investment in these collaborative spaces underscores their strategy to drive client success through shared discovery and development.

- Co-creation Hubs: Accenture operates numerous innovation centers globally, facilitating direct collaboration with clients.

- AI Readiness: Programs designed to assess and improve client capabilities in adopting artificial intelligence technologies.

- Rapid Prototyping: Accelerating the development cycle to quickly test and refine new ideas and solutions.

- Bespoke Solutions: Tailoring services and technologies to meet the unique challenges and goals of each client.

Thought Leadership and Industry Insights

Accenture cultivates deep customer relationships through consistent thought leadership and the sharing of critical industry insights. This proactive approach keeps clients informed about emerging trends and provides strategic direction.

Key to this strategy are Accenture's annual flagship reports, such as the Accenture Technology Vision and Life Trends. These publications offer forward-looking perspectives on the evolving business and technology landscapes, solidifying Accenture's role as a trusted advisor.

- Accenture Technology Vision 2024: This report, released in early 2024, identified key technological shifts like Artificial Intelligence and Generative AI as transformative forces shaping industries.

- Life Trends 2024: Published in late 2023, this report highlighted evolving consumer behaviors and societal shifts, offering clients crucial context for strategic planning.

- Industry-Specific Insights: Accenture regularly publishes detailed analyses and case studies tailored to various sectors, demonstrating deep domain expertise and practical application of trends.

- Executive Briefings and Webinars: Beyond reports, Accenture engages clients through personalized briefings and webinars, fostering direct dialogue and knowledge exchange on critical business challenges.

Accenture fosters deep, collaborative relationships by acting as a strategic partner, not just a service provider. This involves co-creation, where clients actively participate in developing solutions, a strategy that in 2024 continued to drive high client satisfaction and loyalty.

The company emphasizes building trust through dedicated teams and personalized account management, ensuring clients receive tailored support. This deep integration into client operations leads to sustained revenue and long-term partnerships.

Accenture measures and communicates tangible value using frameworks like their 360° Value approach, which considers financial metrics alongside client experience, talent development, and sustainability. In 2024, clients reported an average of 15% improvement in key experience metrics through these engagements.

Innovation hubs and academies facilitate co-creation and rapid prototyping, particularly in areas like AI. Accenture's 2023 launch of its Generative AI Co-creation Lab exemplifies this commitment to collaborative technological advancement.

Channels

Accenture's primary channel is direct sales, where its vast network of consultants engages clients to identify needs and craft bespoke solutions. This direct interaction is crucial for building strong client relationships and delivering personalized services.

This direct engagement model is the bedrock for acquiring new business and nurturing ongoing client partnerships. In fiscal year 2024, Accenture reported net revenue of $64.1 billion, underscoring the scale and success of its direct client relationships.

Accenture's digital platforms, including its extensive website and active social media presence, are central to its customer relationships. These channels not only highlight the company's capabilities and thought leadership but also serve as a primary avenue for client acquisition and initial engagement. In 2024, Accenture continued to invest heavily in its digital footprint, recognizing its importance in reaching a global audience and disseminating valuable industry insights.

The company's investor relations website is a critical component of its online presence, offering stakeholders access to financial reports, earnings calls, and other essential corporate information. This transparency reinforces trust and provides the data necessary for informed investment decisions. Accenture's commitment to digital communication ensures that financial performance and strategic direction are readily accessible to the market.

Accenture leverages industry events, conferences, and webinars as crucial channels for engaging potential clients and partners. These gatherings provide a platform to showcase their expertise, share insights on emerging trends, and foster valuable connections within the business community.

In 2024, Accenture actively participated in and hosted numerous events, including major tech conferences and specialized industry forums. For instance, their presence at events like the World Economic Forum and various digital transformation summits allowed them to demonstrate their capabilities in areas like AI and cloud computing to a global audience.

These events are not just about visibility; they are significant lead-generation opportunities. By presenting their thought leadership and innovative solutions, Accenture aims to attract new business and strengthen existing relationships, contributing directly to their revenue growth strategies.

Strategic Partnerships and Alliances

Accenture leverages its vast network of alliances with major technology firms like Microsoft, Amazon Web Services (AWS), and Google Cloud. These collaborations are crucial for co-developing solutions and joint sales efforts, expanding Accenture's market reach. For instance, in 2023, Accenture announced an expanded partnership with Google Cloud to accelerate cloud migration and AI adoption for clients.

These strategic alliances are instrumental in accessing new client segments and geographical markets. By integrating partner technologies and services, Accenture can offer more comprehensive solutions, thereby broadening its service portfolio. This symbiotic relationship allows for shared innovation and a stronger competitive edge.

- Technology Alliances: Partnerships with leading tech giants like Microsoft, AWS, and SAP.

- Joint Go-to-Market: Collaborative sales and marketing efforts to reach new clients.

- Market Expansion: Access to new industries and geographies through partner networks.

- Service Augmentation: Enhancing Accenture's offerings with specialized partner capabilities.

Acquisitions and Integration

Accenture strategically utilizes acquisitions as a key channel to rapidly enhance its service offerings and market reach. These acquisitions are crucial for gaining immediate access to new client portfolios and expanding into untapped geographic regions or specialized industry sectors. For instance, in fiscal year 2023, Accenture completed 33 acquisitions, demonstrating a consistent commitment to inorganic growth and capability expansion.

The integration of these acquired entities allows Accenture to seamlessly absorb their client bases and unique expertise. This process is vital for leveraging the acquired talent and customer relationships to bolster its existing service lines and create new growth opportunities. By effectively integrating, Accenture can quickly scale its operations and diversify its revenue streams.

- Strategic Expansion: Acquisitions enable rapid entry into new markets and acquisition of specialized skills.

- Client Portfolio Growth: Integrations provide immediate access to new client relationships and revenue streams.

- Capability Enhancement: Acquiring companies with niche expertise strengthens Accenture's overall service delivery.

- Market Diversification: Acquisitions allow for quicker diversification across industries and geographies.

Accenture's channels are multifaceted, combining direct client engagement with robust digital outreach and strategic partnerships. These diverse avenues ensure broad market penetration and effective service delivery, supported by significant investments in technology alliances and strategic acquisitions.

The company's direct sales force and digital platforms are primary for client acquisition and relationship management. In fiscal year 2024, Accenture's net revenue reached $64.1 billion, reflecting the success of these core channels.

Accenture also actively uses industry events and webinars to showcase expertise and generate leads, with significant participation in major tech and digital transformation summits throughout 2024.

Furthermore, strategic alliances with tech leaders like Microsoft and AWS, alongside 33 acquisitions in fiscal year 2023, significantly expand Accenture's market reach and service capabilities.

| Channel Type | Description | Fiscal Year 2024 Data/Impact |

|---|---|---|

| Direct Sales | Consultants engaging clients for bespoke solutions | Foundation of client acquisition and relationship building; Net revenue of $64.1 billion |

| Digital Platforms | Website and social media for showcasing capabilities and thought leadership | Key for global reach and initial client engagement; Continued investment in digital footprint |

| Industry Events & Webinars | Platforms for expertise sharing and networking | Significant lead generation; Participation in major tech and digital transformation summits |

| Technology Alliances | Partnerships with firms like Microsoft, AWS, Google Cloud | Co-development and joint sales efforts; Expanded partnership with Google Cloud in 2023 |

| Acquisitions | Rapid enhancement of service offerings and market reach | 33 acquisitions completed in FY23; Access to new client portfolios and geographic expansion |

Customer Segments

Accenture's core customer base consists of large enterprises and multinational corporations, often including a significant portion of the Fortune Global 500. These clients typically engage Accenture for large-scale, complex transformation initiatives that demand extensive resources and global capabilities.

These organizations seek Accenture's expertise to navigate intricate challenges and drive significant change, leveraging the company's broad spectrum of services. In 2023, Accenture reported serving over 9,000 clients globally, underscoring the breadth of its reach across diverse industries and business needs.

Accenture collaborates with government bodies and public service entities to modernize their digital infrastructure, streamline operations, and improve citizen engagement. This sector demands specialized knowledge of public sector regulations and operational complexities, making Accenture's public sector transformation capabilities vital.

The Health & Public Service segment demonstrated robust growth, contributing significantly to Accenture's overall performance in fiscal year 2024. This indicates a strong demand for Accenture's services in modernizing public services and enhancing their digital delivery.

Financial Services Institutions, encompassing banking, insurance, and capital markets, represent a cornerstone customer segment for Accenture. These clients rely on Accenture for critical support in navigating digital transformation, enhancing risk management strategies, and optimizing operational efficiency in a rapidly evolving landscape.

Accenture's commitment to this sector is evident in its substantial revenue contributions; for instance, in fiscal year 2023, the Financial Services segment generated approximately $14.5 billion in revenue, underscoring its strategic importance and the deep client relationships cultivated within the industry.

Communications, Media & Technology Companies

Accenture serves a broad range of clients within the Communications, Media & Technology (CMT) sector, encompassing telecommunications providers, media conglomerates, and high-tech and software firms. The company's offerings are designed to assist these businesses in adapting to swift technological evolution, innovating digital products, and enhancing customer engagement.

Despite a reported revenue decline in this segment for fiscal year 2024, it continues to be a critical area of strategic importance for Accenture. For instance, in Q1 2024, Accenture noted a 7% decrease in revenue for its Communications, Media & Technology segment compared to the previous year, reflecting broader market headwinds in certain sub-sectors.

- Telecommunications: Assisting telcos with 5G deployment, network modernization, and customer retention strategies.

- Media: Helping media companies pivot to digital-first content delivery, optimize advertising platforms, and manage intellectual property.

- High Tech & Software: Supporting technology firms with cloud migration, cybersecurity solutions, and the development of AI-driven applications.

- Digital Transformation: Driving digital product innovation and enhancing customer experience through data analytics and personalized services.

Resource and Industry X Clients

Accenture’s Resource and Industry X clients are primarily companies within the chemicals, oil and gas, natural resources, and utilities sectors. These businesses are increasingly looking to digital solutions to modernize their operations.

Through its Industry X services, Accenture aids these industrial clients in digitally transforming core functions like manufacturing, engineering, and product development. The goal is to leverage digital technologies to create smarter, more connected industrial environments.

- Digital Transformation Focus: Clients aim to integrate digital technologies across their value chains.

- Key Objectives: Seeking enhanced resilience, improved productivity, and greater sustainability in their operations.

- Industry X Impact: Accenture helps clients achieve these goals by digitizing manufacturing processes and product lifecycles.

- Market Trends: The resources sector saw significant investment in digital transformation initiatives in 2024, driven by efficiency demands and environmental regulations.

Accenture's customer segments are diverse, ranging from large global enterprises to public sector organizations. These clients seek Accenture's expertise for complex digital transformation, operational efficiency, and strategic innovation across various industries.

The company's client portfolio includes major players in Financial Services, Communications, Media & Technology, Health & Public Service, and the Resources sector. This broad reach highlights Accenture's ability to cater to distinct industry needs and regulatory environments.

In fiscal year 2024, Accenture continued to serve a vast number of clients, with a notable emphasis on driving digital advancements and addressing evolving market demands. The company's strategic focus remains on delivering tangible business outcomes through its comprehensive service offerings.

| Customer Segment | Key Focus Areas | Notable 2024 Trends/Data |

|---|---|---|

| Financial Services | Digital transformation, risk management, operational efficiency | Segment revenue was a significant contributor, with continued investment in AI and cloud solutions. |

| Communications, Media & Technology (CMT) | Digital product innovation, customer engagement, cloud migration | Experienced market headwinds, with a 7% revenue decrease in Q1 2024, but remains a strategic focus. |

| Health & Public Service | Modernizing digital infrastructure, improving citizen engagement | Showed robust growth in FY24, indicating strong demand for public sector digital transformation. |

| Resources (incl. Industry X) | Digitizing manufacturing, enhancing operational resilience and sustainability | Significant investment in digital transformation initiatives driven by efficiency and regulatory demands. |

Cost Structure

Accenture's cost structure is heavily influenced by its vast global workforce, with personnel expenses representing a significant outlay. In 2024, the company employed roughly 774,000 individuals, and the associated costs include salaries, benefits, and substantial investments in ongoing training and reskilling initiatives to maintain a competitive edge.

Further underscoring this commitment, Accenture allocated $1.1 billion to learning and development programs in fiscal year 2024. This focus on talent development is crucial for equipping its employees with the latest skills necessary to deliver cutting-edge services to clients across various industries.

Accenture's cost structure heavily features technology and infrastructure investments, encompassing the development, upkeep, and enhancement of its digital backbone. This includes significant outlays for cloud platforms, data centers, and specialized innovation hubs designed to foster cutting-edge solutions.

A substantial portion of these costs is dedicated to research and development in rapidly advancing fields such as artificial intelligence, blockchain, and quantum computing. For fiscal year 2024, Accenture reported $1.2 billion in R&D spending, underscoring its commitment to staying at the forefront of technological innovation.

Accenture's growth strategy heavily relies on acquiring and integrating other companies, which incurs significant acquisition and integration expenses. These costs are a crucial part of their business model, enabling them to expand service offerings and market reach.

In fiscal year 2024, Accenture made substantial investments in this area, completing 46 acquisitions totaling $6.6 billion. This figure highlights the aggressive pace and scale of their M&A activity.

These expenses encompass a range of activities, from the initial due diligence and the actual purchase price of the acquired businesses to the complex and often costly process of integrating their operations, systems, and cultures into Accenture's existing framework.

Sales, Marketing, and Administrative Overheads

Accenture's cost structure significantly includes expenses for sales, marketing, and administrative functions. These overheads are crucial for managing its vast global operations, which span over 200 cities across 52 countries. These costs underpin the company's ability to deliver a wide array of services and maintain its extensive international reach.

For fiscal year 2023, Accenture reported selling, general, and administrative (SG&A) expenses of $5.9 billion. This figure reflects the substantial investment required to support its global sales force, marketing initiatives, and the administrative backbone necessary for a company of its scale and complexity.

- Sales and Marketing: Costs associated with client acquisition, brand building, and relationship management globally.

- General and Administrative: Expenses covering corporate functions, IT infrastructure, legal, HR, and office space across its numerous locations.

- Global Operations Support: The financial outlay to maintain a presence and operational capacity in over 200 cities and 52 countries.

- Service Delivery Infrastructure: Costs tied to the administrative and support systems enabling Accenture's diverse service portfolio.

Operational Delivery Costs

Operational delivery costs are a significant component of Accenture's business model, directly tied to providing professional services. These include expenses incurred on specific client projects, such as the technology and resources deployed, as well as travel and accommodation for consultants. For instance, in fiscal year 2023, Accenture reported consulting and outsourcing revenue of $62.1 billion, underscoring the scale of operations and associated delivery costs.

Subcontractor fees are also a key part of these operational delivery costs, allowing Accenture to scale its workforce based on client demand and project requirements. These variable costs are carefully managed to maintain profitability and ensure efficient service delivery across a wide range of industries and geographies. The company's ability to control these project-specific expenses is crucial for its financial performance.

- Project-Specific Expenses: Costs directly attributable to client engagements, including technology, software licenses, and other project resources.

- Travel and Accommodation: Expenses related to consultants traveling to client sites for meetings, workshops, and project execution.

- Subcontractor Fees: Payments to third-party service providers engaged for specialized skills or to augment Accenture's internal workforce.

- Efficiency Management: Continuous efforts to optimize these costs through effective resource allocation and operational streamlining.

Accenture's cost structure is dominated by its global workforce, with personnel expenses, including salaries and benefits for its approximately 774,000 employees in 2024, being a primary driver. Significant investments in training, such as the $1.1 billion allocated to learning and development in FY2024, are also key to maintaining its competitive edge.

Technology and infrastructure are substantial cost centers, encompassing cloud platforms, data centers, and innovation hubs. Research and development, particularly in AI and quantum computing, saw $1.2 billion in spending in FY2024, highlighting a commitment to innovation.

Acquisition and integration costs are also significant, with 46 acquisitions totaling $6.6 billion in FY2024 reflecting a strategic growth approach. These expenses cover due diligence, purchase prices, and the complex integration of acquired entities.

Sales, marketing, and administrative functions represent another major cost category, with $5.9 billion in SG&A expenses reported in FY2023 to support global operations across over 200 cities in 52 countries.

| Cost Category | FY2024/FY2023 Data | Significance |

|---|---|---|

| Personnel Expenses | ~774,000 employees (2024) | Largest cost driver due to global workforce. |

| Learning & Development | $1.1 billion (FY2024) | Investment in talent to maintain competitive skills. |

| Research & Development | $1.2 billion (FY2024) | Focus on innovation in AI, blockchain, etc. |

| Acquisitions | $6.6 billion (46 acquisitions, FY2024) | Strategic growth through M&A. |

| SG&A Expenses | $5.9 billion (FY2023) | Supports global sales, marketing, and administration. |

Revenue Streams

Accenture generates revenue from its consulting services, which encompass strategy, management consulting, and technology advisory. These services help clients navigate digital transformation, optimize business processes, and refine strategic planning.

In fiscal year 2024, consulting revenue experienced a slight decline of 1%. Despite this, it continues to represent a substantial component of Accenture's total revenue, underscoring its importance in the company's business model.

Managed Services revenue is generated through long-term agreements where Accenture takes on the responsibility of managing and operating clients' core business processes and IT infrastructure. This encompasses a wide range of outsourcing functions, from finance and human resources to complex IT operations.

For fiscal year 2024, this segment saw a 4% revenue increase. Looking specifically at the fourth quarter of fiscal year 2024, managed services revenue experienced a robust 7% growth when measured in local currency, indicating strong demand for these ongoing operational support services.

Accenture's digital and cloud services are a significant revenue engine, encompassing cloud migration, cloud-native development, digital transformation, and advanced analytics. This segment is experiencing robust growth, fueled by businesses increasingly adopting cloud technologies and AI solutions. For instance, Accenture reported a 23% increase in its Cloud First business in fiscal year 2023, reaching $14.1 billion in revenue.

AI and Generative AI Solutions Revenue

Accenture is experiencing a significant uplift in revenue through its AI and Generative AI solutions. This burgeoning segment caters to a wide array of industries seeking to leverage advanced AI capabilities for transformation.

The company’s strategic focus on AI is yielding substantial financial results. For the full fiscal year 2024, Accenture reported generative AI new bookings hitting an impressive $3 billion, underscoring robust client demand for these cutting-edge services.

- AI and Generative AI Solutions: Development and implementation of AI-driven strategies and technologies for clients.

- Generative AI New Bookings (FY24): Reached $3 billion, indicating strong market adoption and Accenture's leading position.

- Industry-Wide Demand: Clients across diverse sectors are actively seeking AI-powered solutions for efficiency and innovation.

Industry X and Specialized Services Revenue

Accenture's Industry X segment generates significant revenue by providing specialized digital reinvention services for industrial clients. This includes offerings like smart manufacturing, digital engineering, and the Internet of Things (IoT), helping businesses modernize their operations and create connected ecosystems. For instance, in fiscal year 2023, Accenture reported that its Industry X business saw substantial growth, reflecting strong demand for these advanced digital solutions. This diversified approach allows Accenture to address unique client challenges across various industrial sectors.

This revenue stream is further bolstered by other highly specialized services and solutions meticulously crafted to meet the distinct needs of specific industries. These tailored offerings ensure that Accenture can effectively cater to a wide spectrum of client requirements, from optimizing supply chains to implementing predictive maintenance strategies. The ability to deliver customized, high-value services is a key driver for this revenue segment.

- Digital Reinvention: Revenue from transforming industrial clients' operations through smart manufacturing, digital engineering, and IoT solutions.

- Specialized Solutions: Income generated from unique, industry-specific services and custom-built solutions.

- Industry X Growth: Accenture's Industry X business experienced robust growth in fiscal year 2023, indicating strong market demand for its specialized digital services.

- Client Diversification: The segment's diversified offerings enable Accenture to serve a broad range of industrial clients with tailored digital transformation strategies.

Accenture's revenue streams are diverse, encompassing consulting, managed services, and specialized digital offerings. The company's ability to adapt to market demands, particularly in areas like AI and cloud, is a key driver of its financial performance.

In fiscal year 2024, consulting revenue saw a 1% decrease, while managed services grew by 4%. The robust growth in generative AI new bookings, reaching $3 billion in FY24, highlights a significant shift towards advanced technology solutions.

Accenture's Cloud First business demonstrated strong momentum, with revenue reaching $14.1 billion in fiscal year 2023, signaling continued client investment in cloud adoption. The Industry X segment also experienced substantial growth in FY23, reflecting the demand for digital reinvention in industrial sectors.

| Revenue Stream | FY2024 Performance | Key Drivers |

|---|---|---|

| Consulting | -1% | Strategy, management, and technology advisory |

| Managed Services | +4% (7% in Q4 FY24 local currency) | Outsourcing of core business processes and IT infrastructure |

| Digital & Cloud | Strong Growth (Cloud First $14.1B in FY23) | Cloud migration, digital transformation, advanced analytics |

| AI & Generative AI | $3B New Bookings (FY24) | AI-driven strategies, generative AI solutions |

| Industry X | Substantial Growth (FY23) | Smart manufacturing, digital engineering, IoT |

Business Model Canvas Data Sources

The Accenture Business Model Canvas is informed by a blend of internal Accenture data, client project insights, and extensive market research. This comprehensive approach ensures a robust understanding of the business landscape and our strategic positioning.