Accenture Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

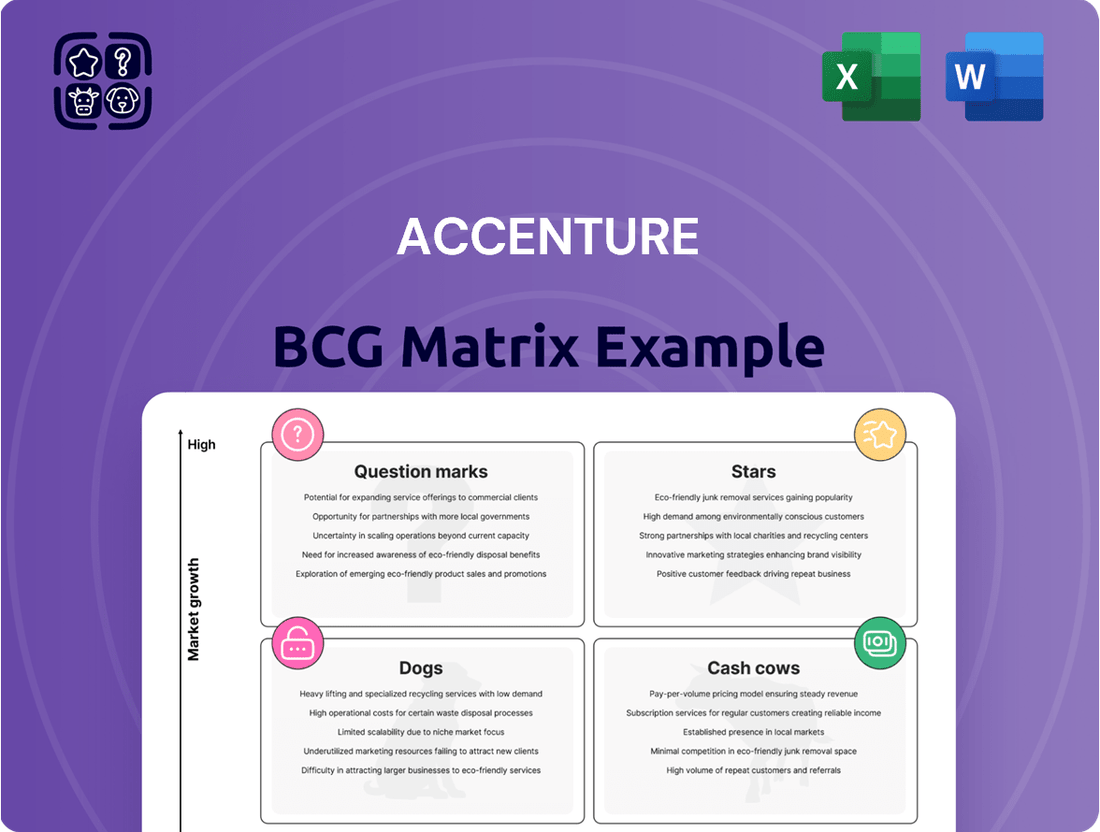

Unlock the strategic potential of this company's product portfolio with a glance at its BCG Matrix. See where its Stars shine, its Cash Cows generate revenue, its Dogs lag, and its Question Marks demand attention.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Accenture's generative AI services are a strong Star in the BCG matrix, demonstrating high growth and market share. The company reported a significant increase in generative AI bookings, reaching approximately $2 billion in the first half of fiscal year 2024. This surge highlights the technology's role as a key growth engine for Accenture.

Accenture is a standout leader in cloud transformation services, consistently achieving double-digit growth in its cloud business. This strong performance highlights their ability to tap into the vast opportunities presented by cloud adoption and modernization.

The company leverages its expertise to deliver advanced solutions across diverse cloud environments, effectively addressing the evolving needs of clients seeking to optimize their IT infrastructure and operations. Their focus remains on unlocking the full potential of cloud for businesses.

Accenture's Digital Transformation Solutions are a cornerstone of their strategy, reflecting a broad and high-growth market need. Businesses globally are increasingly reliant on adapting to swift technological advancements, and Accenture positions itself as a vital ally in driving these significant changes across organizations. This strategic focus aligns with the ongoing digital imperative faced by companies worldwide.

In 2024, the digital transformation market continued its robust expansion, with global spending projected to reach trillions of dollars. Accenture's extensive portfolio, covering areas like cloud migration, data analytics, AI implementation, and cybersecurity, directly addresses these critical business demands. The company's ability to deliver end-to-end solutions makes it a preferred partner for enterprises navigating complex digital journeys.

Strategic Acquisitions in Emerging Tech

Accenture's strategic acquisitions are a cornerstone of its growth, especially in rapidly evolving sectors like artificial intelligence and cybersecurity. These moves are designed to bolster its market position and expand its service offerings in high-demand areas.

The company's acquisition spree in 2024 alone saw significant investments in specialized engineering and digital product development. For instance, the acquisition of Systema aimed to enhance its manufacturing automation capabilities, while the addition of Yumemi bolstered its digital product development expertise. These targeted integrations allow Accenture to quickly scale its offerings and deepen its specialized knowledge in burgeoning technological fields.

- AI and Cloud: Accenture's acquisitions in these areas aim to capture market share in a sector projected to grow significantly by 2025.

- Cybersecurity Expansion: Investments in cybersecurity firms are crucial given the increasing global threat landscape.

- Specialized Engineering: Acquiring niche engineering firms allows Accenture to offer more integrated solutions to clients.

- Digital Product Development: This focus is key to helping clients innovate and adapt in a fast-changing digital economy.

Data and Applied Intelligence

Accenture is significantly boosting its data and applied intelligence offerings, aiming to grow its specialized workforce. This strategic move is geared towards providing clients with sophisticated analytics and predictive capabilities, ultimately enhancing operational efficiency and unlocking new avenues for business growth.

The company's investment in this area is substantial, with a clear objective to deliver tangible value through data-driven insights. By expanding its talent pool, Accenture is better positioned to tackle complex client challenges, leveraging advanced technologies to foster innovation and competitive advantage.

- Talent Expansion: Accenture plans to increase its specialized talent in data and applied intelligence by a significant percentage in the coming years, building on its existing strong base.

- Advanced Analytics: The focus is on delivering cutting-edge analytics, including predictive modeling and AI-driven insights, to optimize client operations.

- Business Value Creation: Accenture aims to drive new business value for clients by transforming data into actionable strategies and solutions.

- 2024 Investment: In 2024, Accenture allocated a substantial portion of its R&D budget towards enhancing its data and applied intelligence capabilities, reflecting a commitment to this growth area.

Accenture's generative AI services are a strong Star in the BCG matrix, demonstrating high growth and market share. The company reported approximately $2 billion in generative AI bookings in the first half of fiscal year 2024, underscoring its position as a key growth engine.

Accenture's leadership in cloud transformation services, marked by consistent double-digit growth, highlights its ability to capitalize on the expanding cloud adoption market. They effectively deliver advanced solutions across diverse cloud environments, meeting client needs for IT infrastructure optimization.

Digital Transformation Solutions are a core component of Accenture's strategy, addressing the widespread demand for technological adaptation. With global digital transformation spending projected to reach trillions in 2024, Accenture's comprehensive portfolio, including cloud, data analytics, AI, and cybersecurity, positions them as a vital partner for businesses undergoing digital change.

Strategic acquisitions are a significant growth driver for Accenture, particularly in high-demand sectors like AI and cybersecurity. In 2024, acquisitions like Systema (manufacturing automation) and Yumemi (digital product development) bolstered their specialized capabilities and market reach.

Accenture is heavily investing in data and applied intelligence to expand its specialized workforce, aiming to provide clients with advanced analytics and predictive capabilities. This focus is expected to drive significant business value through data-driven insights and operational enhancements.

| Category | Growth Rate | Market Share | Accenture's Position |

| Generative AI | High | High | Star |

| Cloud Transformation | High (Double-Digit) | High | Star |

| Digital Transformation | High (Trillions in Global Spend) | High | Star |

| Data & Applied Intelligence | High | High | Star |

What is included in the product

Strategic guidance on allocating resources to products based on market growth and share.

The Accenture BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Accenture's core consulting and strategy services are a classic cash cow. This mature business, with its established global presence, consistently commands a significant market share, translating into robust and reliable revenue streams. In fiscal year 2023, Accenture's Consulting segment alone generated $24.3 billion in revenue, showcasing its enduring strength and profitability.

These stable, high-margin offerings are the bedrock of Accenture's financial health, providing the essential cash flow needed to fuel innovation and expansion into emerging markets. The predictable nature of these services allows for consistent profit generation, making them a vital component for funding future growth initiatives.

Accenture's established managed services, a core offering, function as robust cash cows within its business portfolio. These services, deeply embedded in supporting traditional IT operations and infrastructure for a wide range of clients, generate a substantial and predictable revenue stream. This stability is largely due to the prevalence of long-term contracts and the strong, established relationships Accenture maintains with its clientele, ensuring consistent cash flow without demanding significant new investment for expansion.

Accenture's deep expertise and strong client relationships in mature sectors like financial services, communications, and resources fuel a significant market share for their specialized solutions. These industry-tailored offerings generate reliable revenue streams, supported by persistent client demand and Accenture's established market presence.

For instance, in 2024, Accenture reported that its Communications, Media & Technology segment, which includes many mature industries, generated approximately $13.5 billion in revenue, highlighting the enduring value of these cash cow businesses.

Global Delivery Network and Scale

Accenture's vast global delivery network, boasting over 740,000 employees as of May 31, 2024, is a cornerstone of its competitive strength. This extensive reach allows for efficient, cost-effective service delivery across diverse markets, catering to a broad client base with a wide spectrum of needs.

This operational scale translates directly into a significant competitive advantage. By leveraging its global workforce and infrastructure, Accenture can offer services at competitive price points while maintaining high quality, solidifying its dominant market position and ensuring consistent revenue streams.

- Global Reach: Accenture operates in over 120 countries, demonstrating its unparalleled ability to serve clients worldwide.

- Skilled Workforce: With a workforce exceeding 740,000 professionals as of May 2024, the company possesses a deep pool of talent across various industries and technologies.

- Cost Efficiency: The distributed delivery model enables optimized resource allocation and cost management, contributing to strong profitability.

- Market Dominance: This scale and efficiency allow Accenture to capture significant market share, generating stable and predictable cash flows, characteristic of a cash cow.

Traditional Business Process Outsourcing (BPO)

Accenture's traditional Business Process Outsourcing (BPO) services, especially those handling standardized back-office tasks, remain a significant cash cow. This segment benefits from Accenture's extensive operational expertise and well-developed infrastructure, ensuring consistent revenue generation.

These established BPO operations contribute substantially to Accenture's overall financial performance by providing a steady stream of cash. The company's ability to manage these large-scale, often repetitive processes efficiently underpins their stability.

- Market Share: Accenture holds a strong position in the global BPO market, which was valued at approximately $257.4 billion in 2023 and is projected to grow.

- Revenue Contribution: While specific segment breakdowns are proprietary, BPO services are a foundational element of Accenture's broader Operations segment, known for its consistent revenue.

- Operational Efficiency: The mature nature of these services allows Accenture to leverage economies of scale and optimized processes, directly translating into reliable cash flow.

- Cash Generation: These mature BPO offerings act as a stable source of cash, funding investments in newer, high-growth areas of the business.

Accenture's core consulting and strategy services, along with its established managed services, are prime examples of cash cows. These mature offerings benefit from strong market share, long-term client relationships, and efficient global delivery networks, ensuring consistent and predictable revenue streams.

These stable, high-margin businesses provide the essential cash flow needed to fund innovation and expansion into emerging areas. For instance, Accenture's Consulting segment generated $24.3 billion in revenue in fiscal year 2023, underscoring its role as a significant cash generator.

The company's deep expertise in mature sectors like financial services and communications, coupled with its vast workforce of over 740,000 professionals as of May 2024, further solidifies these offerings as reliable cash cows. This scale and efficiency allow Accenture to maintain market dominance and generate stable profits.

Accenture's traditional Business Process Outsourcing (BPO) services also function as robust cash cows, leveraging operational expertise and infrastructure for consistent revenue. These mature BPO operations contribute substantially to overall financial performance by providing a steady stream of cash, supporting investments in newer, high-growth areas.

| Business Area | Revenue (FY23/FY24 Data) | Key Characteristics |

| Consulting & Strategy | $24.3 billion (FY23) | Mature, high market share, stable demand |

| Managed Services | Integral part of Operations segment | Long-term contracts, strong client relationships, predictable revenue |

| BPO Services | Contributes to Operations segment | Operational expertise, economies of scale, consistent cash flow |

| Mature Sector Solutions (e.g., Comms, Media & Tech) | ~$13.5 billion (FY24 estimate for segment) | Deep industry expertise, established market presence, persistent demand |

Delivered as Shown

Accenture BCG Matrix

The preview you see is the exact Accenture BCG Matrix document you will receive after purchase, ensuring no surprises and immediate usability for your strategic planning. This comprehensive report is fully formatted and ready for immediate application, reflecting the same professional quality and analytical depth you'd expect. You can confidently use this preview as a direct representation of the final, unwatermarked file that will be delivered to you upon completion of your purchase. This means you're getting a ready-to-deploy tool designed to help you categorize and analyze your business portfolio for optimal resource allocation and growth strategies.

Dogs

Accenture's legacy IT system maintenance segment, often found in the 'Cash Cows' or potentially 'Dogs' quadrant of a BCG matrix depending on its market share and growth prospects, likely faces challenges. These services, focused on keeping older systems operational, typically see low growth as businesses aim to modernize. For instance, in 2024, many enterprises are still grappling with the costs and complexities of migrating from COBOL-based systems, a common legacy technology, indicating continued demand but also a ceiling on expansion without significant investment in modernization.

Commoditized IT staff augmentation services, characterized by intense competition and limited differentiation, typically fall into the Dogs quadrant of the BCG matrix. These offerings often experience slow market growth and a declining market share, reflecting their mature and less innovative nature.

In 2024, the IT staffing market continued to see significant price pressures in commoditized segments, with average hourly rates for basic IT roles remaining relatively stable or even declining in some regions due to oversupply. This intense competition directly impacts profit margins, making it challenging for firms like Accenture to achieve substantial returns from these service lines.

Accenture's federal business, a significant contributor to its overall performance, has encountered challenges stemming from slower government procurement cycles and intensified contract reviews. This environment has particularly impacted segments within the federal sector that are less aligned with current strategic priorities or are subject to intense competition from other service providers.

For instance, in fiscal year 2023, Accenture reported that its Public Service segment, which includes its federal business, saw revenue growth of 6%, a slowdown compared to previous periods. This indicates that while the segment remains a core part of Accenture's operations, certain sub-segments are indeed facing a more difficult market dynamic, potentially reflecting a shift in government spending priorities or increased market saturation.

Services with Declining Industry Demand

Services targeting industries with shrinking customer bases or facing significant technological obsolescence, where Accenture's market presence is minimal, would fall into the dog category. For instance, consulting for legacy print media companies, which saw a global revenue decline of approximately 5% in 2024, could be a prime example if Accenture's share in this niche is small.

These segments typically represent areas where the firm is unlikely to achieve substantial growth or market leadership. Consequently, they would not warrant significant capital allocation and might be considered for potential divestment or managed for minimal resource drain. For example, IT services for industries heavily reliant on outdated hardware, facing a rapid shift to cloud-native solutions, could be categorized as such.

Consider these factors for identifying potential dog services:

- Industry Structural Decline: Services focused on sectors experiencing consistent revenue contraction, like traditional brick-and-mortar retail facing e-commerce disruption.

- Technological Disruption: Offerings tied to technologies being rapidly superseded, such as on-premise software maintenance for systems being phased out.

- Low Market Share: Areas where Accenture holds a negligible position, making it difficult to gain traction or compete effectively against established players.

- Limited Growth Potential: Segments with no foreseeable expansion opportunities due to market saturation or fundamental shifts in consumer or business behavior.

Outdated Proprietary Software/Platforms

Accenture's legacy proprietary software or platforms that haven't kept pace with market advancements, such as cloud-native or open-source solutions, can be categorized as dogs in the BCG matrix. These systems often demand significant upkeep without contributing meaningfully to new revenue streams or strategic growth.

For instance, a proprietary CRM system developed in the early 2010s, requiring substantial annual maintenance costs estimated at 15-20% of its original development cost, might fall into this category if it lacks modern integration capabilities and user experience enhancements. In 2024, Accenture's focus is on migrating clients to scalable, cloud-based platforms, making older, on-premise solutions less attractive.

- High Maintenance Costs: Legacy platforms can incur disproportionately high costs for support and updates compared to their market value.

- Limited Scalability and Agility: Outdated software struggles to adapt to evolving business needs or integrate with newer technologies.

- Declining Market Relevance: Competitors offering more modern, flexible solutions often capture market share, diminishing the value of older proprietary systems.

Dogs represent business units or service lines with low market share in a low-growth industry. For Accenture, these are often legacy IT maintenance services or commoditized staffing, which face intense competition and limited expansion opportunities. These segments typically require minimal investment and may even be considered for divestment to free up resources for more promising areas.

Question Marks

Accenture's commitment to incubating new ventures in emerging technologies like quantum computing, IoT, and blockchain positions them firmly in the question mark quadrant of the BCG matrix. These initiatives represent significant investment in areas with high growth potential but currently limited market share, demanding careful strategic evaluation to transition them into future stars.

In 2024, Accenture continued to pour resources into these nascent fields. For instance, their investments in quantum computing research and development are aimed at unlocking new capabilities for clients, though widespread commercial adoption is still in its early stages. Similarly, their work in IoT solutions and blockchain platforms, while growing, has not yet achieved dominant market penetration, reflecting the inherent uncertainty of these developing markets.

Within Industry X, hyper-specialized applications represent emerging question marks on the BCG matrix. These are solutions tailored for very specific industrial segments, like advanced automation for niche manufacturing sectors, which, while targeting high-growth areas, are still in their nascent stages of market adoption for Accenture.

For example, a new suite of AI-driven quality control systems for specialized aerospace component manufacturing, while promising significant efficiency gains, might still be in pilot phases with limited commercial rollout. Accenture's investment in these areas reflects a strategic bet on future market leadership in these underserved, high-potential niches.

Accenture's strategic push into emerging markets, like Vietnam and Colombia, often begins with a question mark in the BCG matrix. These regions offer substantial long-term growth potential, but require significant upfront investment to build brand recognition and operational infrastructure. For instance, Accenture's 2023 revenue from emerging markets showed a robust 15% year-over-year growth, indicating a commitment to these dynamic areas, though profitability in these nascent ventures remains a key focus.

Responsible AI and AI Ethics Consulting

The responsible AI and AI ethics consulting market is experiencing significant growth, with projections indicating a substantial expansion in the coming years. For instance, the global AI ethics market was valued at approximately $1.5 billion in 2023 and is expected to reach over $10 billion by 2030, demonstrating a compound annual growth rate of around 30%. Accenture is making strategic moves to capture a share of this burgeoning sector, recognizing its potential to reshape business operations and customer trust.

While the market share within AI ethics consulting is still fluid, many organizations are beginning to prioritize ethical AI development and deployment. This is driven by increasing regulatory scrutiny and a growing awareness of the potential risks associated with unchecked AI. Accenture's investment in this area reflects a forward-looking strategy to address these evolving client needs.

- Market Growth: The AI ethics market is a rapidly expanding sector, with significant growth anticipated through 2030.

- Accenture's Position: Accenture is actively building its capabilities and market presence in responsible AI and AI ethics consulting.

- Adoption Trends: Widespread adoption of these services is still developing, but the business impact is becoming increasingly evident.

- Key Drivers: Regulatory pressures and the need for trustworthy AI are fueling the demand for ethical AI consulting.

Capital Projects in Data Center Development

Accenture's strategic acquisitions, such as its 2023 investment in a leading data center design and engineering firm, underscore its ambition in the capital projects sector, especially for data centers. This move positions data center development as a question mark within its portfolio, reflecting a high-growth market where Accenture is actively building capabilities and market presence.

The global data center market is experiencing significant expansion, with projections indicating continued robust growth. For instance, the market was valued at approximately $240 billion in 2023 and is expected to reach over $300 billion by 2025, driven by AI, cloud computing, and IoT demands. Accenture's investment aims to capture a larger share of this burgeoning sector.

- Market Growth: The data center construction market is a significant capital expenditure area, with global spending projected to exceed $200 billion annually in the coming years.

- Accenture's Strategy: Recent acquisitions focus on integrating specialized expertise in areas like hyperscale data center design, construction management, and sustainability solutions.

- Capability Consolidation: Accenture is working to consolidate its market share and demonstrate integrated capabilities, leveraging its acquisitions to offer end-to-end solutions for complex data center projects.

- Investment Focus: The high capital intensity and specialized nature of data center development make it a strategic, albeit developing, area for Accenture’s capital projects business.

Accenture's ventures into areas like quantum computing, IoT, and blockchain clearly place them in the question mark quadrant of the BCG matrix. These are high-growth potential markets where Accenture is investing heavily but has not yet established a dominant market share, requiring careful strategic management to develop into future stars.

In 2024, Accenture continued to allocate significant resources to these nascent technologies. Their quantum computing initiatives, for example, are designed to unlock new client capabilities, though widespread commercial use is still in its early stages. Similarly, while Accenture's IoT and blockchain solutions are seeing growth, they haven't yet achieved widespread market penetration, reflecting the inherent uncertainties of these developing markets.

Accenture's strategic expansion into emerging markets, such as Vietnam and Colombia, often begins with a question mark. These regions offer substantial long-term growth potential but necessitate considerable upfront investment to build brand recognition and operational infrastructure. Accenture's 2023 revenue from emerging markets saw a robust 15% year-over-year increase, underscoring their commitment to these dynamic areas, though profitability in these developing ventures remains a key focus.

| Area of Investment | Market Growth Potential | Accenture's Current Market Share | Strategic Focus |

|---|---|---|---|

| Quantum Computing | Very High | Nascent | R&D, capability building for future client solutions |

| IoT Solutions | High | Developing | Expanding platform offerings and industry-specific applications |

| Blockchain Platforms | High | Developing | Exploring use cases in supply chain, finance, and digital identity |

| Emerging Markets (e.g., Vietnam, Colombia) | High | Low to Moderate | Building presence, local partnerships, and tailored service offerings |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of proprietary market research, financial performance data, and competitive landscape analysis to provide a comprehensive view.