Accent Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accent Group Bundle

The Accent Group demonstrates notable strengths in its established brand recognition and a diverse portfolio. However, potential weaknesses lie in its reliance on specific market segments and the ongoing challenge of adapting to rapidly evolving consumer preferences.

Opportunities for Accent Group are abundant, particularly in expanding into emerging markets and leveraging digital transformation to enhance customer engagement. Yet, threats such as intense competition and economic downturns demand careful navigation.

Want the full story behind Accent Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Accent Group boasts a robust brand portfolio, including popular names like Hype DC, Platypus, Skechers, and Dr. Martens. This diverse range caters to varied consumer tastes, minimizing reliance on any single trend. As of their H1 FY2025 results, the company maintains exclusive distribution rights for 14 international brands across Australia and New Zealand. This strong brand mix contributes significantly to their market resilience and broad customer appeal.

Accent Group leverages an extensive multi-channel retail network, featuring over 895 stores throughout Australia and New Zealand. This is complemented by a robust e-commerce presence, including more than 30 distinct websites. This integrated omnichannel strategy ensures a seamless customer experience and effectively captures sales across both physical and digital touchpoints. The company plans to open at least 50 new stores during the 2025 financial year, further expanding its physical footprint and market reach.

Accent Group boasts a substantial and loyal customer base, evidenced by 10.2 million contactable customers and 8.1 million loyalty program members. This extensive database facilitates highly targeted marketing and personalized offers, significantly boosting customer engagement. Such focused efforts drive repeat purchases and cultivate strong brand loyalty among consumers. The ongoing implementation of a new CRM platform is set to further refine these capabilities, enhancing data utilization for improved customer interactions in 2024-2025.

Strategic Partnerships and Acquisitions

Accent Group's 25-year agreement with Frasers Group to launch Sports Direct in Australia and New Zealand is a significant growth driver, projecting at least 50 new stores. This partnership, active from FY2024, provides access to a new portfolio of global brands, enhancing market reach. Furthermore, the acquisition of Frasers' MySale is set to strengthen Accent Group's online presence and digital capabilities, aligning with evolving consumer purchasing habits.

- 25-year Sports Direct agreement with Frasers Group.

- Rollout of at least 50 new Sports Direct stores by FY2025.

- MySale acquisition boosts online presence and e-commerce.

Solid Financial Performance and Position

Accent Group demonstrates resilient financial performance despite a challenging retail environment, with total sales increasing to $1.61 billion in fiscal year 2024.

The company maintains a robust balance sheet and a flexible business model, crucial for navigating market fluctuations.

While net profit has seen a decline, the strategic focus on rigorous cost management and gross margin improvement positions Accent Group strongly for enhanced future profitability.

- FY24 Sales: $1.61 billion total sales.

- Financial Health: Strong balance sheet.

- Strategic Focus: Cost management and gross margin improvement.

Accent Group's strong brand portfolio, including 14 exclusive international brands, drives market appeal. Their extensive omnichannel network, with 895+ stores and 30+ websites, ensures broad reach. Strategic partnerships like the 25-year Sports Direct agreement, targeting 50 new stores by FY2025, and resilient FY2024 sales of $1.61 billion underpin robust growth.

| Key Strength | FY2024/2025 Data | Impact | ||

|---|---|---|---|---|

| Exclusive Brands | 14 international brands | Diversified revenue streams | ||

| Retail Network | 895+ stores, 30+ websites | Extensive market presence | ||

| Strategic Growth | 50 new Sports Direct stores (FY2025) | Future expansion, market share gain |

What is included in the product

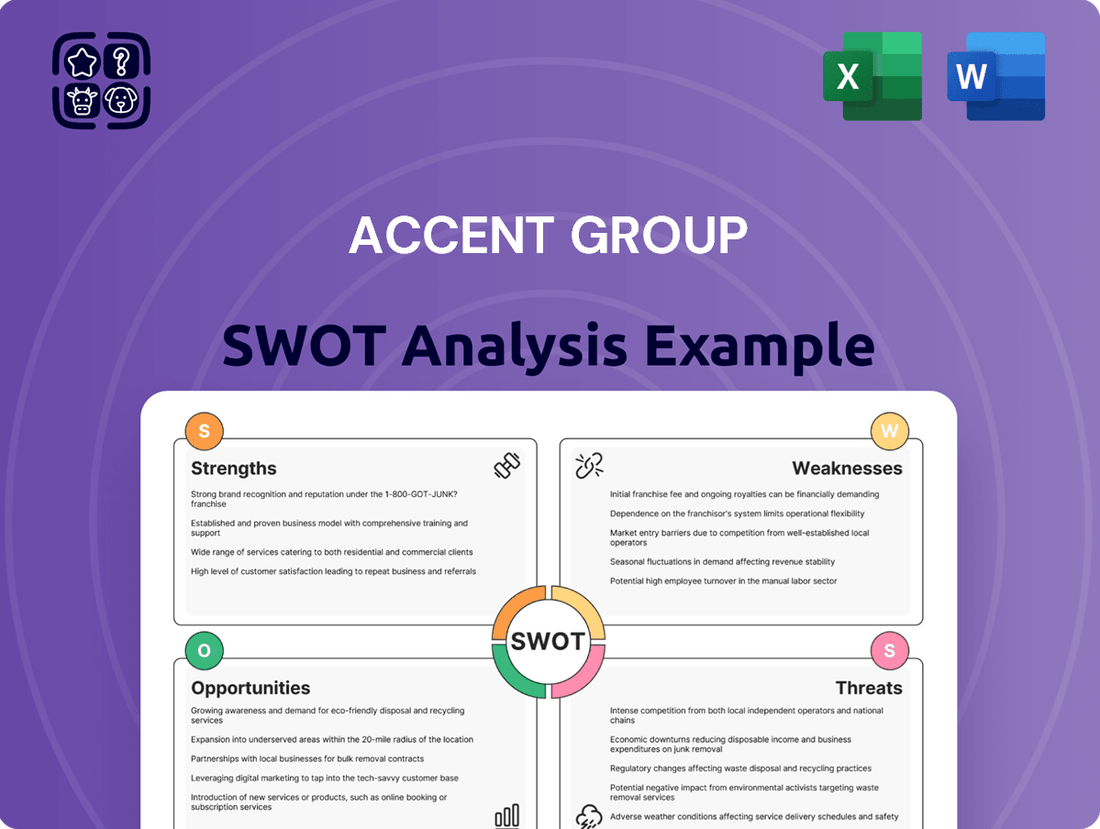

Delivers a strategic overview of Accent Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Simplifies complex strategic planning by breaking down key internal and external factors.

Weaknesses

Accent Group's revenue is significantly tied to consumer discretionary spending, making it vulnerable to economic shifts. When inflation is high, like the 3.6% reported in Australia for Q1 2024, or interest rates climb, consumers often reduce non-essential purchases such as footwear and apparel. This directly impacts sales and profitability, as seen with Accent Group's reported 63% plunge in net profit after tax to $14.1 million for H1 FY24. The challenging consumer environment, marked by reduced spending power, continues to pose a significant headwind for the company's financial performance into late 2024 and early 2025.

Accent Group's declining profitability presents a key weakness. For the full year ended June 30, 2024, net profit after tax plunged 32.9% to $59.53 million. Earnings before interest and taxes (EBIT) also fell 20.5% to $110.4 million. This significant decline, despite a marginal increase in sales, indicates severe pressure on margins and rising operating costs impacting the company's financial health and future outlook.

Accent Group has recently faced challenges with underperforming segments, necessitating strategic divestitures and closures. This includes the closure of 17 Glue stores, which did not meet performance expectations, and the sale of the Trybe business in 2024. Furthermore, the distribution agreement for the CAT brand is not being renewed beyond its current expiry, indicating a re-evaluation of brand profitability. These actions, while crucial for long-term operational health, highlight areas where certain ventures have not yielded desired returns or market traction, impacting overall profitability and resource allocation.

Pressure on Gross Margins

Accent Group faces significant pressure on its gross margins, largely driven by the highly competitive and promotional retail landscape. For the first half of fiscal year 2025, the company reported a gross margin decrease of 100 basis points compared to the prior year. This decline reflects a value-driven consumer environment and the need for increased promotional activity. Managing these margin pressures remains a key challenge amidst evolving market conditions.

- H1 FY2025 gross margin decreased by 100 basis points.

- Competitive retail environment necessitates promotional pricing.

- Value-driven consumer behavior impacts profitability.

Increasing Debt-to-Equity Ratio

Accent Group's debt-to-equity ratio has been on an upward trend, reaching 1.29 in 2024. This increasing leverage could pose a higher financial risk, particularly if profitability continues to be challenged. While the company's equity ratio remains relatively stable, this indicates a greater reliance on debt to finance its assets relative to equity. Such a position may constrain future investment capacity or increase borrowing costs.

- Debt-to-equity ratio reached 1.29 in 2024.

- Increased reliance on debt for asset financing.

- Potential for higher financial risk if profitability declines.

Accent Group's profitability is significantly vulnerable to consumer discretionary spending, evidenced by a 63% profit plunge in H1 FY24. The company also faces declining overall net profit, down 32.9% to $59.53 million in FY24, and pressure on gross margins, which decreased by 100 basis points in H1 FY25. Strategic divestitures like Glue stores and an increasing debt-to-equity ratio, reaching 1.29 in 2024, further underscore its financial challenges.

| Metric | H1 FY24 | FY24 | H1 FY25 |

|---|---|---|---|

| Net Profit After Tax Change | -63% | -32.9% | N/A |

| Net Profit After Tax Value | $14.1M | $59.53M | N/A |

| Gross Margin Change | N/A | N/A | -100 bps |

| Debt-to-Equity Ratio | N/A | 1.29 | N/A |

Same Document Delivered

Accent Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a strategic overview of Accent Group's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights into their competitive landscape and internal capabilities. Purchase unlocks the entire in-depth version for your analysis.

Opportunities

Accent Group is actively pursuing a clear growth strategy focused on significantly expanding its retail footprint. The company plans to open at least 50 new stores during the 2025 financial year. This expansion offers substantial rollout opportunities for its core brands and emerging businesses. Targeting outer metro and regional areas is key, as lower rents in these locations can yield comparable margins to metro stores. This strategic expansion enhances market reach and customer accessibility.

Accent Group has a significant opportunity for continued growth in online sales, leveraging its portfolio of over 30 websites. Ongoing investment in digital capabilities, including a new CRM platform, will enable more personalized marketing strategies, driving customer engagement. This digital focus is projected to enhance the omnichannel experience, which is vital as Australian e-commerce sales are expected to reach AUD 73.5 billion by late 2024. A strong digital presence is crucial for capturing future market share and maximizing returns.

The long-term strategic partnership with Frasers Group stands as a key growth catalyst for Accent Group in 2024-2025. This collaboration facilitates the launch of Sports Direct across Australia and New Zealand, providing access to a diverse range of international brands. Accent Group anticipates opening up to 100 new stores through this alliance, significantly expanding its retail footprint. This strategic move is poised to enhance market share and drive substantial revenue growth.

Growth of Vertically Owned and Distributed Brands

Accent Group has a significant opportunity to enhance its gross margin by strategically increasing the sales contribution from its vertically owned and distributed brands, such as Nude Lucy and Stylerunner. These brands inherently offer superior margins, often exceeding 60%, and provide Accent Group with greater control over their supply chains, optimizing costs and responsiveness. This focus on proprietary brands is a core element of the company's profitability enhancement strategy for the 2024-2025 financial year, aiming for continued growth in this segment.

- Vertically owned brands like Stylerunner contributed significantly to Accent Group's revenue, showcasing their margin potential.

- The company targets increasing the sales mix of these high-margin brands to over 20% by FY25.

- Direct control over design and distribution allows for quicker market response and reduced third-party costs.

Market Share Gains in the Footwear Market

The Australian footwear market is projected to grow significantly, reaching USD 13.0 billion by 2033. Accent Group is strategically positioned to capture a substantial share of this expansion. The ongoing growth of its extensive store network, combined with a diversified brand portfolio, including the integration of Sports Direct, further strengthens its market dominance. These strategic moves are set to solidify Accent Group's leading position within this expanding sector.

- Australian footwear market projected to reach USD 13.0 billion by 2033.

- Accent Group is well-positioned to capture significant growth.

- Expansion of store network and brand portfolio enhances market share.

- Integration of Sports Direct strengthens its market-leading position.

Accent Group has strong opportunities for retail footprint expansion, planning 50 new stores in FY25, alongside up to 100 Sports Direct locations through its Frasers Group alliance. Significant online sales growth is possible as Australian e-commerce is projected to reach AUD 73.5 billion by late 2024. Increasing the sales mix of high-margin vertically owned brands to over 20% by FY25 will boost profitability. The Australian footwear market’s projected growth to USD 13.0 billion by 2033 offers substantial long-term gains.

| Opportunity | Key Metric | 2024/2025 Data |

|---|---|---|

| Retail Expansion | New Stores (FY25) | 50+ (Accent), up to 100 (Sports Direct) |

| Online Sales | Australian E-commerce Market | AUD 73.5 billion (late 2024) |

| Vertically Owned Brands | Sales Mix Target | >20% by FY25 |

| Footwear Market Growth | Market Value Projection | USD 13.0 billion by 2033 |

Threats

The Australian footwear and apparel retail market is intensely competitive, with global giants like JD Sports and Nike posing significant threats. JD Sports continued its aggressive expansion throughout 2024, reportedly aiming for over 50 stores by mid-2025, intensifying direct competition for Accent Group's key brands and potentially impacting market share. The increasing presence of these global retailers can heighten price competition, as evidenced by promotional activities seen in late 2024. Accent Group's ability to effectively differentiate its diverse brand portfolio and maintain strong customer loyalty is crucial to navigating these competitive pressures and preserving profitability into 2025.

The retail sector, including Accent Group, is highly sensitive to broader economic conditions. High inflation, with Australia's CPI at 3.6% in Q1 2024, coupled with persistent high interest rates, directly curtails discretionary consumer spending. This challenging economic environment has already impacted Accent Group's financial performance, with recent reports indicating a slowdown in sales growth.

The fashion and footwear industry faces constant shifts in consumer preferences, demanding Accent Group continuously refine its product lines and marketing. For instance, the rise in demand for sustainable and ethically produced footwear, projected to grow significantly through 2025, requires adaptation to avoid losing market share. A failure to quickly align with trends, like the current preference for comfort-driven athleisure wear, could lead to stagnant sales and a diminished brand perception across its diverse portfolio.

Supply Chain Risks

Accent Group faces significant supply chain risks as a distributor of global brands, including potential disruptions and cost volatility. Reliance on international manufacturing exposes the company to delays, such as those seen with ongoing Red Sea diversions impacting global shipping in early 2024, increasing transit times and freight expenses. Furthermore, the risk of human rights violations within the broader manufacturing industry, particularly in regions like Southeast Asia, poses a severe threat to brand reputation and consumer trust if not diligently managed. Effectively mitigating these complex supply chain vulnerabilities is crucial for maintaining consistent product availability and upholding corporate responsibility into 2025.

- Global freight costs saw fluctuations, with some routes experiencing over 150% increases in early 2024 due to geopolitical events.

- Lead times for apparel and footwear imports from Asia to Australia remained elevated through Q1 2024 compared to pre-pandemic levels.

- Consumer scrutiny over ethical sourcing intensified, with 60% of consumers in a 2024 survey indicating willingness to pay more for ethically produced goods.

- Compliance with modern slavery acts requires continuous auditing of international suppliers, a substantial operational burden.

Increasing Costs of Doing Business

Accent Group faces significant pressure from increasing operational costs, directly impacting its profitability as of early 2025. Rising wage expenses, including the 3.75% increase to the National Minimum Wage effective July 2024, alongside escalating lease costs, continue to compress retail margins. The company's first-half FY24 results reflected a gross margin decline to 59.4%, partly due to these pressures. While an operating cost review is underway, managing these persistent cost escalations remains a critical challenge.

- Wage costs increased by 3.75% for the National Minimum Wage from July 2024.

- Gross margin for Accent Group declined to 59.4% in H1 FY24.

Accent Group faces significant threats from intense market competition, with global players like JD Sports expanding aggressively to over 50 stores by mid-2025. Challenging economic conditions, including Australia's Q1 2024 CPI at 3.6%, curtail consumer spending and impact sales growth. Rising operational costs, such as the 3.75% wage increase from July 2024 and escalating freight expenses (up to 150% in early 2024), compress margins, evidenced by a H1 FY24 gross margin of 59.4%. Adapting to evolving consumer preferences and mitigating complex supply chain disruptions remain critical for profitability into 2025.

| Threat Factor | Key Metric | 2024/2025 Data |

|---|---|---|

| Competitive Pressure | JD Sports Expansion Target | >50 stores by mid-2025 |

| Economic Headwinds | Australia CPI (Q1 2024) | 3.6% |

| Operational Costs | National Minimum Wage Increase | 3.75% from July 2024 |

| Profitability Impact | Accent Group Gross Margin (H1 FY24) | 59.4% |

| Supply Chain Costs | Global Freight Cost Increases | Up to 150% (early 2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Accent Group's financial reports, market intelligence gathered from industry publications, and expert opinions from analysts and consultants to ensure a robust and accurate assessment.