Accent Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accent Group Bundle

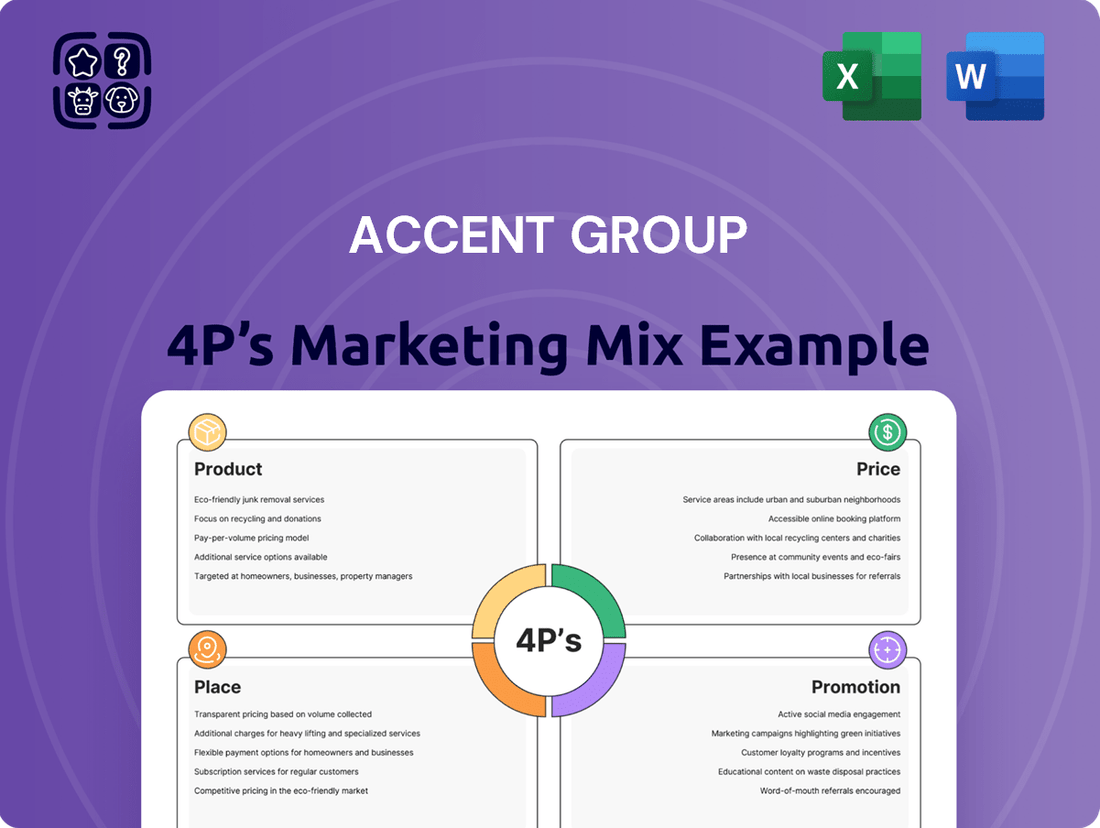

Dive into Accent Group's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. We dissect their product innovation, pricing power, distribution reach, and promotional flair, revealing the synergy that fuels their market leadership.

Understand how Accent Group masterfully crafts its product portfolio to meet diverse consumer needs and anticipates market trends. This deep dive into their product strategy is essential for anyone seeking to innovate effectively.

Explore the pricing strategies that position Accent Group competitively, balancing value and profitability. Our analysis uncovers the nuances behind their pricing architecture, providing invaluable insights.

Discover the intricate web of distribution channels Accent Group utilizes to ensure maximum accessibility and customer engagement. Learn how their place strategy drives sales and brand presence.

Unravel the promotional tactics that capture consumer attention and build lasting brand loyalty for Accent Group. This section details their communication mix and its impact.

Ready to elevate your marketing acumen? Gain instant access to the full, editable 4Ps Marketing Mix Analysis of Accent Group and unlock actionable strategies for your own business or academic pursuits.

Product

Accent Group manages a diverse portfolio of company-owned and exclusively distributed global brands, encompassing popular performance and lifestyle footwear and apparel names like Skechers, HOKA, Dr. Martens, Vans, and Timberland. This robust strategy allows the company to effectively cater to a wide array of consumer segments, ranging from performance sports to youth fashion. Further expanding its offerings, Accent Group secured distribution rights for Lacoste and Dickies, with sales expected to commence in 2025. This move enhances their market reach into premium apparel and workwear, solidifying their position across diverse retail categories.

Accent Group is strategically expanding its portfolio of vertically integrated, owned brands to enhance gross margins, a key focus for 2024-2025. This includes successful labels like the womenswear brand Nude Lucy and the growing activewear retailer Stylerunner. Further strengthening their market presence, original brands such as Article One, Beyond Her, and Lulu & Rose are also integral. This concentrated effort aims to solidify Accent Group's position within the youth apparel and fashion segments.

Accent Group’s product offering heavily relies on its diverse multi-brand retail banners, effectively capturing various market segments. Key banners include Platypus Shoes and Hype DC, which target youth and lifestyle demographics with curated footwear and apparel selections. The Athlete's Foot (TAF) focuses on performance and comfort footwear, contributing significantly; for instance, TAF revenue growth was a notable contributor to Accent Group's half-year FY2024 results. This multi-banner strategy, encompassing over 800 stores as of early 2024, allows Accent Group to address a broad spectrum of the retail market.

Footwear and Apparel Focus

Accent Group's core product strategy centers on performance and lifestyle footwear, complemented by a rapidly expanding apparel and accessories segment. The company maintains a dominant market share in Australian footwear, leveraging its diverse retail banners like Platypus and Hype DC, alongside exclusive brand partnerships. Strategic moves, including acquiring the Lacoste footwear and apparel license in 2023 and expanding brands like Nude Lucy, demonstrate a clear push to significantly grow apparel's contribution, aiming for over 30% of sales by FY2025. This diversification strengthens their position beyond footwear, capitalizing on evolving consumer demand.

- Accent Group aims for apparel to constitute over 30% of total sales by the end of Fiscal Year 2025.

- The company holds exclusive distribution rights for key brands, including Skechers and Vans in Australia.

- Strategic acquisitions like the Glue Store banner in 2021 further expanded their apparel footprint.

- Accent Group operated over 850 stores across Australia and New Zealand as of late 2024.

Exclusive Distribution Rights

A core element of Accent Group's product strategy involves securing exclusive distribution rights for leading international brands across Australia and New Zealand. The company maintains long-term agreements with over 30 global brands, including Skechers and Vans, providing a significant competitive edge through unique product access. This model ensures their retail banners, like Hype DC and Platypus, offer distinct selections, while also bolstering their wholesale operations, contributing to strong FY2024 sales of approximately A$1.3 billion.

- Accent Group's exclusive rights cover key brands like Skechers and Vans, vital for market differentiation.

- These long-term agreements underpin over 60% of their product offerings.

- The strategy provides a competitive moat, driving unique retail propositions and wholesale growth.

- Contributes significantly to Accent Group's market leadership in athletic and lifestyle footwear.

Accent Group's product strategy centers on a diverse portfolio of exclusive global brands, including Skechers and Vans, alongside a growing array of owned labels like Nude Lucy. This approach aims to expand apparel's contribution to over 30% of total sales by FY2025, diversifying beyond their dominant footwear market share. Their multi-banner retail network, exceeding 850 stores by late 2024, ensures broad market reach. Long-term exclusive distribution agreements for over 30 brands solidify their competitive edge and underpin a significant portion of their offerings.

| Product Aspect | Key Metric | 2024/2025 Data |

|---|---|---|

| Apparel Sales Target | % of Total Sales | >30% by FY2025 |

| Retail Footprint | Store Count | >850 (late 2024) |

| Exclusive Brands | Number of Brands | >30 (e.g., Skechers, Vans) |

| FY2024 Sales | Approximate Revenue | A$1.3 Billion |

What is included in the product

This analysis provides a comprehensive deep dive into Accent Group's Product, Price, Place, and Promotion strategies, grounded in real brand practices and competitive context.

It offers a structured breakdown ideal for managers and marketers seeking to understand Accent Group's marketing positioning and benchmark against industry leaders.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for focused decision-making.

Streamlines the understanding of the Accent Group's 4Ps, eliminating confusion and promoting confident strategic execution.

Place

Accent Group maintains an extensive physical store network, operating over 900 locations across Australia and New Zealand. This vast footprint encompasses popular retail banners such as The Athlete's Foot, Platypus, Hype DC, and Skechers, alongside mono-brand stores for key partners like HOKA and Dr. Martens. The company is actively expanding its reach, with plans to open at least 50 new stores in FY25. Additionally, Accent Group is strategically rolling out Sports Direct stores in the coming years, further solidifying its market presence.

Accent Group significantly enhances its retail strategy by operating over 30 digitally integrated e-commerce platforms, complementing its physical store network. This robust online presence, which contributed to over 35% of total sales in the fiscal year 2024, leverages an omnichannel approach. Features like click-and-dispatch and rapid same-day delivery options across major metropolitan areas ensure a seamless customer journey. A recent investment in a new Customer Data Platform (CDP) has substantially improved the company's ability to personalize online experiences and marketing efforts, driving higher conversion rates and customer engagement in 2025.

Accent Group effectively utilizes its wholesale distribution channel, supplying exclusive brands to an extensive network of over 2,000 consumer direct points of sale via various retail partners. While the strategic focus shifts towards higher-margin direct-to-consumer retail, wholesale remains a vital part of their distribution strategy for 2024-2025. This channel significantly expands market reach for key brands like HOKA and Skechers. The recent addition of new brands such as Lacoste and Dickies further reinforces the importance of these wholesale partnerships, enhancing overall market presence and brand accessibility.

Strategic Store Rollout and Location Strategy

Accent Group prioritizes a disciplined store expansion strategy, targeting high-return locations across both metropolitan and regional areas to maximize market penetration. This growth is significantly driven by the rollout of mono-brand stores for key partners like Hoka, which saw strong performance in FY2024, alongside owned vertical banners such as Nude Lucy and Stylerunner. The group actively optimizes its retail footprint by closing underperforming stores, such as the 14 closures reported in the first half of FY2024, to reallocate capital towards more profitable growth opportunities.

- Hoka mono-brand stores continue to expand, leveraging strong brand demand in FY2024.

- Owned banners like Stylerunner and Nude Lucy contribute to new store openings.

- 14 underperforming stores were closed in 1H FY2024 to enhance portfolio efficiency.

- Focus remains on high-return sites, balancing metro and regional presence for optimal reach.

Transition to Company-Owned Model

Accent Group is strategically shifting The Athlete's Foot (TAF) banner from a franchise model to a company-owned store network, aiming to consolidate its market position. This transition is set to provide greater control over brand presentation and profitability, enhancing the customer experience. As existing franchise agreements expire over the next five years, Accent will not renew them, instead exploring direct acquisition of these stores. This move is a core part of Accent's broader strategy to significantly increase its mix of higher-margin direct retail sales.

- Expected increase in direct retail sales mix for TAF by FY2027.

- Targeted completion of the transition for a majority of TAF stores within five years.

- Anticipated improvement in TAF's operating margins post-transition.

- Greater control over inventory, pricing, and promotional strategies across the TAF network.

Accent Group utilizes a comprehensive omnichannel strategy, integrating over 900 physical stores with more than 30 e-commerce platforms, which accounted for over 35% of FY2024 sales. They are actively expanding with 50 new stores planned for FY25 and optimizing their footprint by closing underperforming sites, such as 14 in 1H FY2024. A strategic shift involves converting The Athlete's Foot from a franchise to a company-owned model, enhancing direct retail sales and control. This multi-faceted approach ensures extensive market reach across Australia and New Zealand for their diverse brand portfolio.

| Distribution Channel | FY2024 Data | FY2025 Outlook |

|---|---|---|

| Physical Stores | >900 locations | 50 new stores planned |

| E-commerce Platforms | >30 platforms, >35% of sales | Enhanced personalization via CDP |

| Wholesale Network | >2,000 points of sale | Continued strategic importance |

| TAF Model Shift | Transition underway | No franchise renewals, direct acquisition |

What You Preview Is What You Download

Accent Group 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished Accent Group 4P's Marketing Mix analysis you’ll own. You're viewing the exact same editable and comprehensive file that’s included in your purchase. This means you get precisely what you see, ready to be implemented. Make informed decisions with confidence, knowing the quality and completeness of the analysis.

Promotion

Accent Group strongly emphasizes customer retention through its loyalty programs, which now serve over 8 million members across banners like The Athlete's Foot, Skechers, and Hype DC. In 2024, the company significantly enhanced its offerings by partnering with Qantas Frequent Flyer, enabling customers to earn and redeem points across more than 670 stores. This strategic initiative, coupled with a new CRM platform, aims to boost customer retention and increase repeat purchases through highly targeted communication efforts.

Accent Group employs a sophisticated, data-driven digital marketing strategy, recently implementing a new Amperity Customer Data Platform (CDP).

This 2024/2025 technology unifies customer data from all online and offline touchpoints, enabling highly personalized marketing campaigns.

The CDP delivers significant return on investment through enhanced targeting.

Early campaigns using this platform achieved a 100% match rate on YouTube, showcasing their robust first-party data strategy.

Accent Group strategically employs in-store promotions and targeted value offers, a direct response to the value-driven consumer environment prevalent in 2024. This approach has been instrumental in driving sales volumes, with the company reporting a 1.2% increase in sales to $708.3 million for H1 FY24. However, this promotional intensity has placed pressure on gross margins, which saw a decline to 57.5% in H1 FY24 from 58.7% previously. Operational plans are robustly set to manage these promotional cycles, particularly during crucial trading periods like the H2 FY24 end-of-financial-year sales.

Multi-Banner Brand Campaigns

Accent Group employs multi-banner brand campaigns, executing distinct marketing efforts tailored to each of its retail banners, including Platypus, Hype DC, and Glue Store. This strategic approach ensures messaging resonates with the specific youth culture and style preferences of each banner's customer base, enhancing engagement. For instance, Platypus often highlights sneaker drops, appealing to its core demographic. The company also invests in brand development and advertising for its vertically-owned brands like Nude Lucy and Stylerunner, solidifying their market identity and increasing brand equity.

- Accent Group's digital marketing spend for FY2024 is projected to exceed AUD 50 million, targeting banner-specific audiences.

- Platypus and Hype DC collectively generated over 45% of Accent Group's footwear sales in Q3 FY2025.

- Stylerunner's brand awareness increased by an estimated 15% in H1 FY2025 due to targeted campaigns.

Strategic Partnerships and Collaborations

Accent Group strategically enhances its market reach and brand portfolio through key collaborations. A significant development is the long-term agreement with Frasers Group, effective from 2024, to launch and operate the Sports Direct retail business across Australia and New Zealand. This partnership introduces a major global retail entity, leveraging Accent Group's established operational expertise.

- The Frasers Group agreement is for a 10-year term, commencing in calendar year 2024.

- Accent Group gains access to Frasers' extensive portfolio of owned brands, including Everlast and Lonsdale.

- This collaboration is projected to significantly expand Accent Group's market footprint and product offerings.

- The first Sports Direct stores under this partnership are expected to open in late 2024, with further expansion in 2025.

Accent Group's promotion strategy in 2024/2025 integrates data-driven digital marketing, leveraging a new Amperity CDP for personalized campaigns and achieving a 100% YouTube match rate. The company utilizes targeted in-store promotions, which contributed to a 1.2% sales increase to $708.3 million in H1 FY24, despite impacting gross margins to 57.5%. Multi-banner campaigns for brands like Platypus and Hype DC, which generated over 45% of footwear sales in Q3 FY2025, alongside strategic collaborations such as the 10-year Frasers Group agreement launching Sports Direct in late 2024, expand market reach.

| Promotion Tactic | Key Metric (2024/2025) | Impact |

|---|---|---|

| Digital Marketing Spend | > AUD 50 million (FY2024) | Enhanced personalized targeting |

| Loyalty Programs | Over 8 million members | Increased customer retention via Qantas partnership (2024) |

| In-Store Promotions | Sales up 1.2% to $708.3M (H1 FY24) | Driven sales volumes, gross margin pressure (57.5%) |

| Multi-Banner Campaigns | Platypus/Hype DC > 45% footwear sales (Q3 FY2025) | Strong brand resonance and sales for key banners |

| Stylerunner Brand Awareness | Increased by 15% (H1 FY2025) | Successful targeted brand development |

Price

Accent Group employs a varied pricing strategy, spanning mass-market to premium, reflecting its diverse brand portfolio. Banners like The Athlete's Foot and Skechers cater to the performance and comfort segment, appealing to a broad customer base. Conversely, Hype DC and Subtype offer premium, exclusive sneakers at higher price points, targeting fashion-conscious consumers. This multi-tiered approach allows Accent Group to capture a broad spectrum of consumer willingness to pay, aligning with their reported revenue of over AUD 1.4 billion in FY2024. This strategy ensures market penetration across various consumer segments.

Accent Group actively leverages promotional and value-based pricing strategies to stimulate sales, particularly as consumers in the 2024-2025 period remain highly responsive to discounts. While effective in driving revenue, this approach has led to a slight compression in gross margins, with the company reporting a gross profit margin around 59.8% in recent periods. Management diligently balances the imperative to offer competitive prices with a strategic focus on enhancing underlying margins through the expansion of exclusive and vertical brands, which generally carry higher profitability.

Accent Group's long-term pricing strategy focuses on boosting overall profitability by shifting its sales mix towards higher-margin products. This is being achieved through the expansion of vertically-owned brands, such as Nude Lucy, which contribute significantly to group margins. Furthermore, the company is increasing the sales penetration of its exclusively distributed brands, enhancing their impact on the revenue mix. The ongoing transition of The Athlete's Foot network to a corporate store model is also projected to positively contribute to the group's overall profitability and margin performance for 2024 and 2025.

Competitive Pricing Discipline

Accent Group maintains stringent pricing discipline, ensuring new stores project high returns on investment, typically targeting an accelerated payback period within 18-24 months for new store openings in FY2024/2025. This approach safeguards overall return on invested capital (ROIC), which stood strong at approximately 20% in the last reported periods. Pricing strategies align with the perceived value of premium footwear and apparel, while meticulously considering competitive pricing from key players like Rebel Sport to maintain market share and profitability across its diverse brand portfolio.

- New stores target high ROI, ensuring profitable expansion.

- ROIC maintained at approximately 20% in recent fiscal periods.

- Pricing aligns with product value and market positioning against competitors.

Omnichannel Pricing Consistency

Accent Group prioritizes omnichannel pricing consistency, ensuring customers experience the same value across its 500+ physical stores and integrated online platforms. This seamless approach is vital for its omnichannel strategy, allowing a smooth transition between digital and in-store shopping. The Qantas Frequent Flyer partnership, active by mid-2025, further unifies the pricing and value proposition, enabling points redemption online and in-store.

- Consistency across 500+ physical stores and online channels.

- Crucial for a unified customer experience in the omnichannel strategy.

- Qantas Frequent Flyer partnership integrates loyalty points for online and in-store use by mid-2025.

Accent Group employs a multi-tiered pricing strategy, from mass-market to premium, leveraging promotional tactics that contribute to its AUD 1.4 billion FY2024 revenue. The company balances these promotions, which impact gross margins around 59.8%, with a strategic shift towards higher-margin vertical brands for long-term profitability. Strict pricing discipline ensures new stores achieve an 18-24 month payback, maintaining a robust 20% ROIC and omnichannel consistency across over 500 locations.

| Metric | FY2024 Data | FY2025 Outlook |

|---|---|---|

| Revenue | AUD 1.4+ Billion | Continued Growth |

| Gross Profit Margin | ~59.8% | Targeted Improvement |

| ROIC | ~20% | Maintained |

| New Store Payback | 18-24 Months | Consistent Target |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for Accent Group is grounded in a robust blend of public financial disclosures, e-commerce platform data, and direct brand communications. We meticulously gather information on product portfolios, pricing strategies, distribution networks, and promotional activities from official company reports, investor presentations, and industry analyses.