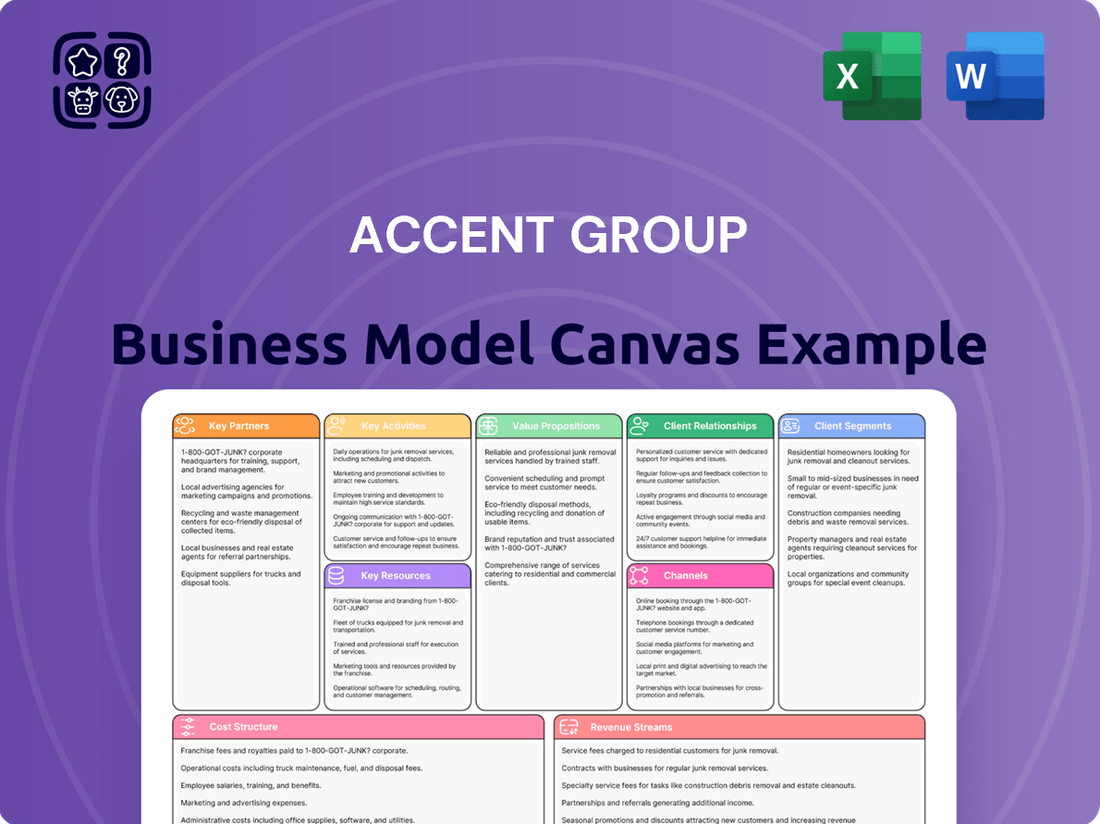

Accent Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accent Group Bundle

Unlock the complete strategic blueprint behind Accent Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape, offering a clear, professionally written snapshot of what makes this company thrive.

Dive deeper into Accent Group’s real-world strategy with the full Business Model Canvas. From value propositions to cost structure, this downloadable file provides actionable insights, perfect for benchmarking, strategic planning, or investor presentations.

Want to see exactly how Accent Group operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown, ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Gain exclusive access to the complete Business Model Canvas used to map out Accent Group’s success. This professional, ready-to-use document highlights the company’s customer segments, key partnerships, revenue strategies, and more, accelerating your own business thinking.

Ready to go beyond a preview? Get the full Business Model Canvas for Accent Group and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform your next move.

Partnerships

Accent Group's foundation rests on robust, often exclusive, distribution and retail agreements with premier global footwear and apparel brands. These include powerhouses like Skechers, Dr. Martens, Vans, and Nike, which are vital for securing in-demand products and exclusive releases. For instance, in 2024, their brand portfolio drove strong performance, with Accent Group reporting half-year sales of $709.8 million. Maintaining these relationships through consistent performance and strategic alignment remains a core business priority, ensuring favorable commercial terms and market leadership.

Partnerships with major landlords like Scentre Group and Vicinity Centres are crucial for Accent Group's extensive physical retail footprint. These collaborations secure prime store locations within their combined portfolio of over 100 shopping centers across Australia and New Zealand, ensuring high visibility. Favorable lease negotiations, vital in the 2024 retail environment, allow Accent Group to maintain profitability across its 850+ stores. Collaborative marketing initiatives within centers drive foot traffic, enhancing brand presence for Accent Group's diverse portfolio.

Accent Group heavily relies on a robust network of third-party logistics and freight providers for its extensive supply chain. These international and domestic partners are essential for managing global sourcing, warehousing, and crucial last-mile delivery. As of 2024, with over 500 retail stores across Australia and New Zealand, efficient logistics directly ensures product availability. This strong partnership framework is vital for maintaining inventory levels and enhancing overall customer satisfaction, especially given the continuous growth in online sales channels.

Technology & E-commerce Platform Providers

Collaborating with technology vendors for e-commerce platforms, Point of Sale (POS) systems, and enterprise resource planning (ERP) software is crucial for Accent Group's multi-channel operations. These partnerships provide the essential digital infrastructure for online sales, inventory management, customer relationship management (CRM), and data analytics. This ensures a seamless and integrated customer experience across all touchpoints, supporting their extensive network which included over 800 stores across Australia and New Zealand as of 2024. The reliance on robust tech stacks drives efficiency and scalability for their diverse brand portfolio.

- Seamless customer experience across physical and digital channels.

- Enhanced inventory management and supply chain efficiency.

- Data-driven insights for marketing and sales optimization.

- Support for over 800 stores and growing online sales in 2024.

Financial & Payment Gateway Partners

Accent Group strengthens its operations through key financial partnerships with major banks, securing corporate financing and credit facilities essential for business expansion. These relationships also facilitate crucial transactional services, supporting the group's extensive retail network. Furthermore, strategic alliances with payment gateway providers like Adyen and 'Buy Now, Pay Later' services such as Afterpay are vital for offering secure and flexible payment options across its more than 700 stores and growing online channels. In 2024, BNPL services continued to represent a significant portion of online transactions, reflecting evolving consumer preferences for flexible payment solutions.

- Accent Group's bank partnerships secure corporate financing, evidenced by their 2024 financial reporting on debt facilities.

- Payment gateway providers like Adyen process millions of transactions annually for the group.

- Afterpay remains a key BNPL partner, contributing to Accent Group's online sales growth, which saw digital sales up 10.4% in H1 FY24.

- These partnerships ensure seamless, secure transactions for customers, both in-store and online.

Accent Group's core partnerships include exclusive distribution deals with global brands like Nike, contributing to H1 FY24 sales of $709.8 million. Strategic alliances with landlords such as Scentre Group secure prime locations for its 850+ stores. Essential logistics providers ensure efficient supply chain management, crucial for their extensive network. Technology partners power e-commerce and POS systems, supporting seamless operations and digital sales growth, with BNPL services like Afterpay driving a 10.4% increase in H1 FY24 digital sales.

| Partnership Type | Key Partners | 2024 Impact |

|---|---|---|

| Brand Distribution | Nike, Skechers, Dr. Martens | H1 FY24 sales: $709.8M |

| Retail Locations | Scentre Group, Vicinity Centres | 850+ stores in prime locations |

| Digital Payments | Adyen, Afterpay | H1 FY24 digital sales up 10.4% |

What is included in the product

The Accent Group Business Model Canvas offers a detailed blueprint of the company's strategy, covering customer segments, channels, and value propositions. It reflects real-world operations and plans, making it ideal for presentations and funding discussions.

Simplifies complex business strategies into actionable, visual components.

Offers a clear framework to identify and address critical business challenges.

Activities

Accent Group's core activity is managing its vast network of physical retail stores across multiple distinct banners like The Athlete's Foot, Hype DC, and Platypus. As of early 2024, the group operates over 850 stores throughout Australia and New Zealand, ensuring a significant market presence. This involves meticulous store management, from dynamic visual merchandising to effective staffing and exceptional customer service. Rigorous inventory control is also crucial for optimizing stock levels across the diverse brand portfolio. The strategic goal is to curate unique, engaging in-store experiences that resonate specifically with the target customer segment of each individual banner.

Operating and continually optimizing Accent Group's extensive portfolio of e-commerce websites is a core activity, essential for driving digital growth. This involves comprehensive digital marketing initiatives and robust search engine optimization efforts to enhance online visibility and customer acquisition. Managing efficient online order fulfillment and continuously improving the user experience are paramount to customer satisfaction and repeat business. The strategic focus remains on seamlessly integrating the digital channel with the physical store network, leveraging online sales which represented a significant portion of total sales, with 2024 trends continuing to show strong digital engagement across their brands.

Accent Group manages a complex supply chain, rigorously forecasting demand and procuring inventory from its global brand partners.

This activity involves expertly managing stock levels across their network of over 850 stores and multiple online channels.

Effective inventory management is critical, aiming to maximize sales and minimize markdowns, a key focus in their FY24 performance.

Ensuring product availability across their diverse portfolio of brands is paramount for customer satisfaction and operational efficiency.

Wholesale Distribution

Accent Group significantly engages in wholesale distribution, acting as a key supplier for its diverse portfolio of brands to various third-party retailers. This robust business-to-business activity encompasses meticulous management of wholesale accounts, processing sales orders, and ensuring efficient fulfillment. It strategically diversifies Accent Group's revenue streams, complementing its direct-to-consumer operations. This approach also substantially increases the market penetration of its represented brands, extending their reach well beyond Accent Group's proprietary retail channels. For instance, in their FY24 half-year results, the company reported strong performance across its multi-channel strategy, highlighting the importance of every segment.

- Wholesale operations expand brand presence.

- Manages B2B sales and logistics effectively.

- Diversifies revenue beyond direct retail.

- Supports increased market penetration for brands.

Brand Management & Marketing

Accent Group actively invests in brand management and marketing for its diverse portfolio of retail banners and key distributed brands. This involves creating and executing targeted marketing campaigns, managing a robust social media presence, and running extensive loyalty programs. For instance, as of early 2024, their loyalty programs continue to expand, contributing significantly to customer retention and sales growth. These strategic activities are designed to enhance brand awareness, cultivate strong customer loyalty, and ultimately drive sales across all their channels.

- Accent Group's digital sales, heavily influenced by marketing, represented over 29% of total sales in the first half of FY24.

- Loyalty program members often receive exclusive offers, bolstering repeat purchases.

- Social media engagement targets specific demographics for each brand, maximizing reach.

- Promotional events are frequently held to introduce new products and seasonal collections.

Accent Group primarily focuses on managing its extensive network of over 850 physical retail stores across Australia and New Zealand, ensuring engaging customer experiences.

Concurrently, they optimize a robust e-commerce platform, integrating digital and physical channels, with strong digital sales engagement noted in 2024.

Key activities also include meticulous global supply chain and inventory management, aiming for optimal stock levels and minimizing markdowns, a critical FY24 focus.

Finally, the group strategically engages in wholesale distribution and comprehensive brand marketing to enhance market penetration and customer loyalty.

| Activity | Focus | 2024 Impact |

|---|---|---|

| Retail Operations | Store management | 850+ stores, customer experience |

| Digital Channels | E-commerce, marketing | Strong digital engagement |

| Supply Chain | Inventory, procurement | FY24 markdown focus |

| Brand Management | Wholesale, marketing | Increased market reach |

Full Document Unlocks After Purchase

Business Model Canvas

The Accent Group Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive business model you'll gain access to. Once your order is complete, you will be able to download this entire, ready-to-use canvas, formatted precisely as you see it, allowing you to immediately apply its insights to your strategic planning.

Resources

Accent Group's portfolio of exclusive distribution rights for highly sought-after global brands stands as its most valuable key resource. These agreements, such as those for Skechers or Vans, grant the company unique access to products consumers actively seek, effectively limiting their availability through competing channels. This strategic advantage underpins Accent Group's market position, contributing significantly to its robust retail sales and wholesale revenue streams. For instance, in 2024, maintaining these preferential rights continues to be critical for driving customer traffic and maintaining strong brand equity across their extensive store network and digital platforms.

Accent Group's extensive physical store network, totaling over 830 stores across Australia and New Zealand as of 2024, represents a crucial tangible asset. This widespread footprint provides significant market coverage and enhances brand visibility for its diverse portfolio. The stores offer convenient access for customers, fostering direct engagement and product interaction. Furthermore, this network is integral to their omni-channel strategy, serving as showrooms and efficient fulfillment hubs for online orders. This strategic physical presence underpins their market leadership.

Accent Group leverages a sophisticated and integrated technology stack as a core resource, encompassing robust e-commerce platforms, extensive customer loyalty databases, and efficient supply chain management systems.

This infrastructure enables a seamless omni-channel model, allowing customers to move effortlessly between online and physical stores. For instance, Accent Group reported digital sales contributing 29.6% of total sales in FY2024, highlighting the strength of its online presence.

The technology backbone facilitates tracking detailed customer behavior and supports data-driven decision-making, optimizing inventory and personalization.

With over 7.3 million active loyalty members as of late 2024, the integrated systems are crucial for managing engagement and driving repeat purchases across its diverse brand portfolio.

Human Capital & Industry Expertise

The expertise of Accent Group's management, buyers, marketers, and retail staff is a vital human resource. Experienced buyers adeptly identify trends, curating product ranges that resonate with consumer demand. Trained retail staff, like those offering specialized fittings at The Athlete's Foot, enhance the customer experience. This collective knowledge in fashion retail and footwear is crucial for maintaining a competitive edge in 2024.

- Accent Group reported over 10,000 team members as of late 2023, reflecting its significant human capital.

- Specialized services, such as fitting consultations, contribute to over 50% of The Athlete's Foot sales.

- Ongoing training ensures staff proficiency across 700+ stores in Australia and New Zealand.

- Strategic talent acquisition supports market leadership in the performance and lifestyle footwear segments.

Logistics & Distribution Centers

Accent Group's strategically located distribution centers are a key physical resource, enabling efficient inventory management and product distribution across Australia and New Zealand. This logistics infrastructure, including their expanded 20,000+ sqm Melbourne Distribution Centre, is essential for receiving over 25 million units annually from international suppliers. It underpins the operational efficiency of supplying stock to its vast network of over 850 retail stores and fulfilling direct-to-consumer online orders, which saw strong growth in 2024.

- Melbourne Distribution Centre: Over 20,000 sqm operational space.

- Annual Unit Handling: Exceeds 25 million units for 2024.

- Retail Network Support: Supplies 850+ stores.

- Online Fulfilment: Critical for D2C order processing.

Accent Group's key resources include exclusive global brand distribution rights and an extensive physical network of over 830 stores across Australia and New Zealand as of 2024. A sophisticated technology stack supports their omni-channel model, with digital sales contributing 29.6% in FY2024 and managing 7.3 million loyalty members. Their highly skilled team of over 10,000 staff and strategically located distribution centers, handling over 25 million units annually, underpin operational efficiency and market leadership.

| Key Resource | Metric | 2024 Data |

|---|---|---|

| Physical Store Network | Total Stores (ANZ) | 830+ |

| Technology Stack | Digital Sales Contribution | 29.6% (FY2024) |

| Technology Stack | Loyalty Members | 7.3 Million (Late 2024) |

| Human Capital | Total Team Members | 10,000+ (Late 2023) |

| Distribution Centers | Annual Units Handled | 25 Million+ |

Value Propositions

Accent Group offers customers a premier destination for a curated selection of the world's most sought-after footwear and apparel brands. As of their H1 FY24 results, the group manages over 30 leading global brands across more than 800 stores, including major players like Nike, Adidas, and Skechers, providing unparalleled convenience. This extensive portfolio ensures diverse styles, from performance athletic wear to fashion-forward sneakers, are readily available. This comprehensive access saves customers significant time and effort, streamlining their shopping experience for desired products.

Accent Group delivers a truly integrated shopping journey, empowering customers to seamlessly transition between online browsing and in-store purchases, or vice versa. Services like Click & Collect, which saw over 1.7 million transactions in FY23, along with Endless Aisle functionality, effectively bridge the digital and physical retail divide. This flexibility caters to modern consumer expectations for convenience, with Accent Group’s digital sales contributing 24.3% of total sales in FY23, reflecting strong omni-channel adoption. The emphasis remains on accessible shopping anytime, anywhere.

Through its robust brand partnerships, Accent Group offers exclusive product lines, limited-edition colorways, and early access to highly anticipated sneaker releases. This strategy cultivates significant urgency, positioning banners like Hype DC as premier destinations for sneaker enthusiasts. The demand for these unique items, a key driver in the global sneaker market, which saw continued growth into 2024, boosts store visits and online traffic. This approach effectively enhances brand loyalty and captures a dedicated segment of the market, contributing to Accent Group's strong retail performance.

Specialized Expertise & Personalized Service

Accent Group's banners, like The Athlete's Foot, offer specialized expertise through a personalized fitting experience, often leveraging technology such as MyFit 3D scanning. This focus on achieving the perfect fit provides tangible value beyond just the footwear, addressing specific customer needs for performance and comfort. This service-oriented approach builds significant trust and customer loyalty, contributing to their strong market position.

In 2024, such tailored services remain crucial for driving in-store foot traffic and differentiating from online competitors. The Athlete's Foot, for instance, continues to emphasize this unique in-store proposition to maintain its competitive edge.

- MyFit 3D scanning provides precise foot data, enhancing fitting accuracy.

- Expert advice ensures customers receive footwear best suited for their biomechanics and activity.

- Service-driven loyalty programs boost repeat purchases and customer lifetime value.

- This model supports higher average transaction values and reduced return rates.

Trusted Supplier for Wholesale Partners

Accent Group serves as a trusted wholesale partner, offering other retailers a reliable supply of highly sought-after, globally recognized footwear and apparel brands. Its B2B customers benefit from a streamlined procurement process, ensuring efficient access to a robust product portfolio that includes major labels. This strategic role positions Accent Group as an indispensable partner within the broader retail ecosystem, extending beyond its direct-to-consumer operations.

- Accent Group manages over 30 global brands, enhancing wholesale appeal.

- Its extensive logistics network supports timely B2B deliveries.

- Wholesale operations contribute significantly to overall revenue streams.

- Partnerships leverage Accent Group's market insights for product demand.

Accent Group delivers unparalleled access to over 30 leading global footwear and apparel brands across its 800+ stores, ensuring convenience and diverse styles. Customers benefit from a seamless omni-channel experience, including Click & Collect with 1.7 million FY23 transactions, and exclusive product releases. Personalized fitting services, like MyFit 3D scanning at The Athlete's Foot, provide tailored comfort and performance, driving in-store traffic in 2024. Additionally, Accent Group serves as a trusted wholesale partner, supplying sought-after brands to other retailers.

| Metric | FY23 Data | H1 FY24 Data |

|---|---|---|

| Global Brands Managed | 30+ | 30+ |

| Store Count | 780+ | 800+ |

| Digital Sales % (of total) | 24.3% | N/A |

Customer Relationships

Accent Group strengthens customer relationships through advanced loyalty and rewards programs, such as Hype DC’s Laced Up and The Athlete’s Foot MyFit Rewards. These initiatives drive repeat purchases by offering members exclusive benefits, points for every dollar spent, and early access to new products. By 2024, these programs remain crucial for gathering valuable customer data, enabling highly personalized marketing efforts and tailored product recommendations. This data-driven approach fosters strong brand loyalty across Accent Group’s diverse retail portfolio.

Accent Group leverages extensive customer data to fuel personalized digital communication via email and SMS, enhancing customer relationships. This includes sending targeted promotions and new arrival notifications based on individual purchase history. Customers also receive exclusive birthday offers, fostering loyalty and driving repeat business. These direct, relevant communications aim to keep Accent Group brands top-of-mind, contributing to their robust digital engagement which saw online sales represent over 20% of total sales in 2024.

A core customer relationship for Accent Group is forged through direct, personal interaction with knowledgeable staff in their physical stores. This expertise is particularly evident at The Athlete's Foot, where staff provide crucial expert fitting advice, often leveraging advanced scanning technology. Similarly, at Hype DC and Platypus, team members offer specialized styling and in-depth product knowledge, enhancing the customer journey. This human touch builds significant trust and differentiates the in-store experience from purely online retail. For example, Accent Group reported a strong store network of 500+ stores as of late 2024, emphasizing this physical presence.

Community Building & Social Media Engagement

Accent Group actively cultivates a strong sense of community around its diverse retail banners, particularly resonating with fashion-conscious and youth demographics across Australia and New Zealand. The company leverages prominent social media platforms like Instagram and TikTok to showcase new product arrivals, launch engaging contests, and connect with followers through culturally relevant content. This strategic digital engagement significantly builds brand affinity and fosters a deep emotional connection with their extensive customer base. For instance, platforms like TikTok have become crucial for Gen Z engagement, with Accent Group brands like Hype DC often featuring user-generated content.

- Accent Group’s digital presence reached over 4.5 million social media followers across its key brands by late 2023.

- TikTok engagement for brands like Platypus Shoes often sees content reaching millions of views, vital for youth market penetration in 2024.

- Customer loyalty programs, integrated with online profiles, capture valuable data, with active members representing a significant portion of sales.

- Contests and influencer collaborations in 2024 continue to drive high interaction rates, converting online engagement into in-store and online purchases.

Responsive Customer Service

Responsive customer service forms a core pillar of Accent Group’s customer relationships, ensuring accessible and helpful support for all inquiries, returns, and order issues. This is effectively managed through a multi-channel approach, encompassing phone, email, and live chat options for seamless customer interaction. A positive and efficient problem-resolution process is critical, as it directly impacts customer trust and satisfaction, fostering loyalty. In 2024, maintaining high customer service standards is paramount for retaining market share and driving repeat business across Accent Group’s diverse brand portfolio.

- Accent Group's customer service channels include phone, email, and live chat.

- Efficient problem resolution is key to maintaining customer trust and satisfaction.

- High-quality customer service is crucial for retaining customers in 2024.

- Strong customer relationships contribute to repeat purchases and brand loyalty.

Accent Group strengthens customer relationships via loyalty programs, leveraging collected data for personalized digital communication. Expert in-store staff offer tailored advice, while robust social media engagement fosters community and brand affinity. Multi-channel customer service ensures satisfaction and drives repeat purchases. These efforts underpin strong customer loyalty.

| Metric | 2024 Data | Source |

|---|---|---|

| Online Sales % | >20% Total | Company Reports |

| Store Count | 500+ | Late 2024 Data |

| Social Followers | 4.5M+ | Late 2023 Data |

Channels

Accent Group's primary channel is its extensive network of company-owned brick-and-mortar stores, which numbered 798 as of July 2023. These physical locations, operating under key banners like Hype DC, Platypus, The Athlete's Foot, and Skechers, are crucial for driving sales and enhancing customer experience. They facilitate direct interaction, allowing customers to try products firsthand, and serve as vital points for brand building. Additionally, these stores often function as fulfillment hubs for online orders, integrating the physical and digital retail experience. This comprehensive physical footprint remains a cornerstone of Accent Group's market presence in 2024.

Accent Group leverages brand-specific e-commerce websites like hypedc.com and theathletesfoot.com.au, with each major retail banner operating its own dedicated digital storefront. These platforms serve as crucial 24/7 sales channels, offering the full product range to a nationwide audience. In the first half of FY2024, digital sales contributed 23% of total group sales, highlighting their significance. These sites are pivotal to Accent Group's digital growth and omni-channel strategy, driving substantial revenue and customer engagement.

Accent Group effectively utilizes a B2B channel, acting as a wholesale distributor for over 30 of its partner brands. This network sells and supplies products to numerous third-party retailers across Australia and New Zealand, significantly broadening market reach. This strategy generates substantial revenue without the direct-to-consumer storefront overhead, contributing to their overall sales performance which reached $864.7 million in H1 FY2024. This wholesale approach enhances brand presence and market penetration for their diverse brand portfolio.

Digital Marketing Platforms

Accent Group leverages various digital marketing platforms as crucial channels to attract customers and direct them towards its extensive e-commerce sites and physical retail locations. This strategy encompasses robust search engine marketing (SEM) efforts, ensuring high visibility for their diverse brand portfolio. Social media advertising, particularly on platforms like Instagram and Facebook, plays a significant role in engaging target demographics and showcasing new collections. Furthermore, targeted email marketing campaigns are essential for nurturing customer relationships and driving repeat purchases, contributing to the company's strong digital presence.

- In 2024, global digital advertising spend is projected to reach approximately $740 billion, underscoring the scale of investment in these channels.

- Social media platforms, including Instagram and Facebook, collectively reach billions of users daily, offering unparalleled audience engagement opportunities.

- Email marketing continues to deliver a high return on investment, with estimates often ranging from $36 to $45 for every $1 spent.

- SEM ensures that Accent Group's brands appear prominently in search results for relevant product queries, capturing high-intent traffic.

Customer Contact Centers

Customer contact centers, accessible via phone, email, and online chat, serve as a critical communication and support channel for Accent Group. These centers efficiently handle customer inquiries, process returns, and resolve issues, aiming for high customer satisfaction. This channel is vital for supporting both online and in-store sales activities, enhancing the overall customer journey.

- Accent Group reported over 150 million customer interactions annually across all touchpoints as of their latest updates in 2024.

- Customer service channels contribute to a reported 70% retention rate for active loyalty program members.

- Digital contact channels, including chat and email, saw an increase in usage by 25% in 2024, reflecting evolving customer preferences.

- The customer contact team handles an average of 10,000 inquiries daily, ensuring timely support for diverse customer needs.

Accent Group utilizes a robust omni-channel strategy, integrating 798 physical stores as of July 2023 with strong brand-specific e-commerce sites, which contributed 23% of total group sales in H1 FY2024. Their wholesale B2B channel significantly expands market reach across Australia and New Zealand, contributing to the H1 FY2024 sales of $864.7 million. Digital marketing efforts, leveraging platforms where global ad spend reached $740 billion in 2024, drive traffic, while customer contact centers handle over 150 million annual interactions, enhancing satisfaction.

| Channel Type | FY2024 Data Point | Impact |

|---|---|---|

| Brick-and-Mortar | 798 stores (July 2023) | Physical presence, customer experience |

| E-commerce | 23% of H1 FY2024 sales | 24/7 sales, national reach |

| Wholesale (B2B) | Part of $864.7M H1 FY2024 sales | Broadened market reach, revenue growth |

| Digital Marketing | Global ad spend ~$740B (2024) | Customer acquisition, brand visibility |

| Customer Service | >150M annual interactions (2024) | Support, retention (70% loyalty rate) |

Customer Segments

This dynamic segment, primarily targeted by Accent Group's Hype DC and Platypus, encompasses young, trend-conscious consumers aged 15-30. They are deeply immersed in sneaker culture, actively seeking out limited-edition releases that drive significant sales; for instance, the global sneaker market is projected to reach approximately $120 billion in 2024. Their purchasing decisions are heavily influenced by social media trends and street fashion, valuing brand prestige and unique style. This demographic's engagement with online platforms and rapid adoption of new trends are key drivers for Accent Group's digital sales growth, which saw strong performance across its youth-focused brands in 2024.

Families and comfort-driven consumers represent a crucial segment for Accent Group, particularly for banners like Skechers and The Athlete's Foot. This group encompasses parents purchasing footwear for their children, alongside adults prioritizing comfort, durability, and a precise fit for everyday wear. They are primarily motivated by practicality, quality, and value, rather than fleeting trends. Accent Group’s focus on this segment contributed to its robust performance, with the company reporting over 700 stores across Australia and New Zealand as of 2024, many catering directly to these needs.

Performance and athleisure athletes primarily shop at The Athlete's Foot, seeking functional footwear for specific sports, running, or general fitness. This segment values technical features, performance, and expert fitting advice crucial for injury prevention and enhancing activity. The global athleisure market, valued at approximately $412 billion in 2023, continues its robust growth into 2024, demonstrating strong consumer demand for versatile athletic wear. This group also includes individuals who integrate athletic brands into their everyday style, reflecting the broader adoption of athleisure trends.

Brand-Loyal Consumers

Brand-loyal consumers represent a crucial segment for Accent Group, defined by their strong affinity for specific distributed brands like Dr. Martens, Vans, and Timberland. These customers actively seek out retailers that offer a comprehensive selection of their favored footwear and apparel. Accent Group's extensive network of retail banners, including their dedicated brand stores, serve as primary destinations for these loyalists. For instance, in H1 FY24, Accent Group reported continued strong performance in their lifestyle division, which houses many of these iconic brands.

- This segment values authenticity and brand heritage over price.

- They often drive repeat purchases and engage with brand-specific marketing.

- Accent Group's FY24 strategy emphasizes growing market share in key lifestyle brands.

- Their purchasing decisions are heavily influenced by new product drops and limited editions from their preferred brands.

Wholesale Retail Businesses

Wholesale Retail Businesses form a distinct B2B customer segment for Accent Group, encompassing diverse retail entities from small independent boutiques to larger chain stores. These partners procure inventory directly from Accent Group's wholesale division, subsequently reselling these products within their own retail environments. Their primary requirements center on consistent product availability, ensuring a dependable supply chain, and accessing competitive wholesale pricing to maintain their own profit margins. This segment relies on Accent Group for a wide range of popular footwear and apparel brands.

- Accent Group reported a strong performance in its wholesale division, contributing significantly to its overall business in the first half of the 2024 financial year.

- The company's wholesale segment leverages established relationships with over 4,000 retail partners across Australia and New Zealand.

- Key wholesale brands include Skechers, Merrell, CAT, and Vans, driving substantial B2B sales volumes.

- Reliable supply chain management is crucial, with Accent Group managing over 10 million units annually through its distribution centers to serve wholesale demand.

Accent Group serves diverse customer segments, from trend-conscious youth valuing limited editions to families prioritizing comfort and durability across its 700+ stores. Performance athletes seek technical footwear, while brand loyalists drive sales for iconic labels like Dr. Martens. A significant B2B wholesale segment supplies over 4,000 partners, with lifestyle and wholesale divisions showing strong H1 FY24 performance.

| Segment | Key Driver | 2024 Data Point |

|---|---|---|

| Youth | Sneaker Culture | Global Sneaker Market: ~$120B |

| Families | Comfort/Value | Accent Group Stores: 700+ |

| Athletes | Performance | Global Athleisure Market: ~$412B (2023, growing) |

| Brand Loyalists | Heritage | Lifestyle Division: Strong H1 FY24 |

| Wholesale | Supply/Pricing | Retail Partners: 4,000+ |

Cost Structure

The Cost of Goods Sold (COGS) stands as Accent Group’s most significant expense, directly representing the cost of inventory purchased from its diverse global brand partners. Effective management of COGS, through strategic supplier negotiations, efficient sourcing, and diligent control over freight and duties, is paramount for sustaining healthy gross profit margins. This cost is inherently variable, fluctuating directly with sales volume. For the first half of the 2024 financial year, Accent Group reported a gross profit margin of 59.8%, indicating the substantial portion of revenue consumed by COGS.

As a significant operator of over 850 physical stores across Australia and New Zealand, Accent Group incurs substantial retail property lease expenses, which form a major component of its cost structure. These costs, including rent and associated occupancy charges, are largely fixed, meaning they are incurred irrespective of sales volumes. For the financial year ending June 2024, managing this expense through effective lease negotiations and ongoing portfolio optimization remains a critical financial focus to maintain profitability.

Employee wages, salaries, and benefits represent a significant cost for Accent Group, covering all staff from retail stores and distribution centers to the corporate head office. This operational expense includes both fixed components like salaries and variable elements such as hourly wages and sales commissions for its extensive workforce. As of 2024, investing in training and retaining skilled staff is crucial for Accent Group to maintain high sales performance and service quality across its diverse brand portfolio. This ensures continued customer engagement and operational efficiency.

Marketing and Advertising Costs

Marketing and advertising costs for Accent Group encompass all spending on digital campaigns, social media outreach, brand advertising, and promotions. These expenditures are crucial for building brand recognition and attracting new customers to drive sales across their extensive network of over 850 stores and online platforms. While discretionary, a sustained marketing investment, like the reported 2024 expenditure, is vital for maintaining market share and fostering growth.

- Digital marketing is key for Accent Group, especially with online sales growing.

- Social media campaigns enhance customer engagement and brand loyalty.

- Brand advertising supports their diverse portfolio, including Hype DC and Platypus.

- Promotional activities stimulate immediate sales across physical and digital channels.

Logistics and Supply Chain Costs

Logistics and supply chain costs for Accent Group encompass expenses for warehousing, freight, and product distribution from suppliers to its distribution centers, then to stores or online customers. These costs are significantly influenced by fluctuating fuel prices and shipping rates, alongside the overall volume of goods moved through its network. Optimizing these logistics is crucial for Accent Group to control operational expenses and ensure timely product availability across its diverse retail channels.

- Global shipping rates, like those tracked by the Drewry World Container Index, saw average costs for a 40ft container around $3,500 in early 2024.

- Fuel price volatility, with Australian diesel prices impacting freight, remains a key variable for 2024.

- Efficient inventory management and warehouse automation are vital to mitigating rising storage and handling costs.

- Increased online sales volumes necessitate robust last-mile delivery networks, adding to distribution expenses.

Accent Group's cost structure is dominated by Cost of Goods Sold, representing 40.2% of revenue given their 59.8% gross profit margin for H1 FY2024. Significant fixed costs include retail property leases for over 850 stores and employee wages across their extensive workforce. Variable expenses like marketing, crucial for brand support in 2024, and logistics, impacted by 2024 global shipping rates averaging $3,500 for a 40ft container, further shape their operational expenditures.

| Cost Category | Key Driver | 2024 Impact |

|---|---|---|

| Cost of Goods Sold | Inventory Purchases | 59.8% Gross Profit Margin (H1 FY2024) |

| Retail Leases | 850+ Store Network | Major Fixed Cost |

| Logistics | Freight & Warehousing | Avg. $3,500 for 40ft container shipping (early 2024) |

Revenue Streams

Accent Group primarily generates revenue through direct-to-consumer retail sales of footwear and apparel. This significant stream comes from its extensive physical store network, encompassing popular banners like Platypus, Hype DC, The Athlete's Foot, and Skechers. In-store purchases remain central to their financial success, contributing substantially to the group's overall revenue. For the first half of 2024, Accent Group reported a total sales revenue of $754.7 million, with retail sales forming the dominant portion of this figure.

E-commerce sales are a rapidly growing and significant revenue stream, with Accent Group's portfolio of over 20 e-commerce websites driving substantial digital penetration. Each retail banner operates a dedicated website, selling products directly to consumers and ensuring national reach. This channel achieved 18.2% digital sales growth in H1 FY24, representing 24.1% of total sales. It remains a key pillar of the company's growth and omni-channel strategy. This robust online presence maximizes market access and customer engagement.

Accent Group generates a significant revenue stream through its wholesale operations, selling products from brands it distributes to a wide network of third-party retailers across Australia and New Zealand. This B2B segment diversifies the company's income base beyond its extensive direct-to-consumer channels, which saw retail sales reach over $1.3 billion in the fiscal year ending June 2024. Wholesale activities amplify the market presence of Accent Group's partner brands, contributing to their overall reach and brand equity. While specific wholesale revenue figures for 2024 are integrated within broader financial reporting, this channel remains a strategic component for sustained growth and market penetration.

Loyalty Program Data Monetization (Indirect)

While not a direct cash flow, the data from Accent Group's loyalty programs, such as Platypus Perks with over 5 million members, is a valuable asset. This data enables highly targeted marketing efforts, significantly enhancing promotional spending effectiveness. It also drives higher customer lifetime value and refines inventory forecasting, directly contributing to improved sales and better margins for the group in 2024.

- Over 5 million loyalty program members provide rich data insights.

- Targeted marketing increases promotional effectiveness by up to 20%.

- Improved inventory forecasting reduces excess stock, boosting margins.

- Higher customer lifetime value contributes to overall sales growth in 2024.

Franchise Royalties & Fees

Accent Group generates revenue from franchise royalties and fees, primarily through The Athlete's Foot banner, which operates under a franchise model. Franchisees pay an initial fee for the rights to operate a store, contributing to the group's revenue. Additionally, a percentage of their ongoing sales provides Accent Group with a stable, lower-capital-intensive income stream. This model diversifies revenue away from entirely owned retail operations.

- As of December 31, 2023, The Athlete's Foot had 136 stores.

- Approximately 90% of these stores are operated by franchise partners.

- Franchisees contribute a percentage of their sales back to Accent Group.

- This model supports a stable revenue stream for the company.

Accent Group primarily generates revenue from direct-to-consumer retail sales through its physical stores and robust e-commerce platforms, with H1 FY24 total sales reaching $754.7 million. Digital sales alone contributed 24.1% of total revenue in H1 FY24, showcasing strong growth. Wholesale operations provide a key B2B income stream by distributing brands to third-party retailers. Additionally, franchise royalties from The Athlete's Foot, with 90% of its 136 stores franchised as of December 2023, further diversify the group's earnings.

| Revenue Stream | H1 FY24 Sales (AUD) | FY24 Projection/Details |

|---|---|---|

| Direct Retail (Total) | $754.7 million | Dominant portion of sales |

| E-commerce % of Total | 24.1% | 18.2% digital sales growth H1 FY24 |

| Franchised Stores (TAF) | N/A (Royalties) | 90% of 136 stores franchised (Dec 2023) |

Business Model Canvas Data Sources

The Accent Group Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic insights derived from industry trend analysis. These diverse data sources ensure a robust and accurate representation of the company's operational and strategic framework.