Accent Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accent Group Bundle

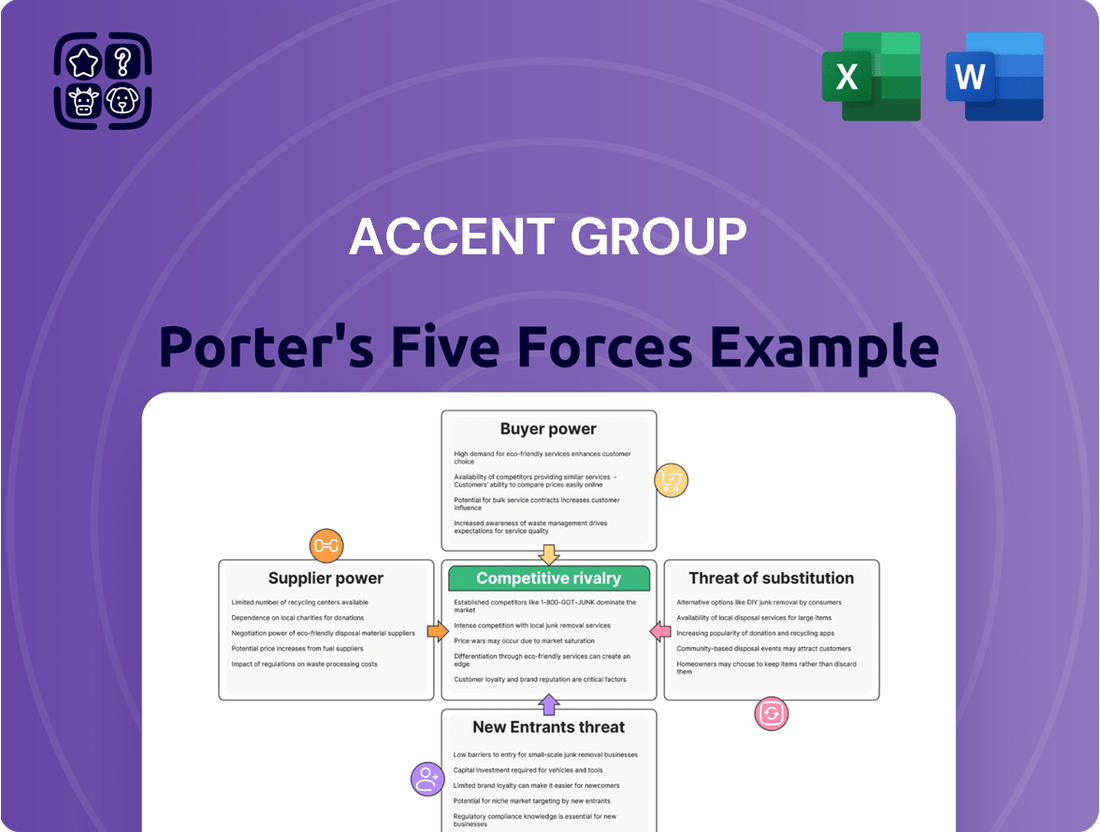

Accent Group navigates a dynamic retail landscape, where understanding the competitive forces is paramount to success. Our analysis delves into the bargaining power of both buyers and suppliers, evaluating how easily customers can switch brands and how much leverage suppliers hold over Accent Group.

We also scrutinize the threat of new entrants, assessing how difficult it is for new competitors to enter the market and challenge Accent Group's established position. Furthermore, the intensity of rivalry among existing competitors is a key focus, revealing the pressures Accent Group faces from direct rivals.

Finally, the threat of substitute products or services is thoroughly examined, highlighting alternative ways customers can meet their needs, potentially bypassing Accent Group's offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Accent Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Accent Group's financial performance is intrinsically linked to its partnerships with major global brands like Nike, Adidas, and Skechers. These powerful suppliers wield significant influence over product allocation, pricing structures, and distribution terms, potentially impacting Accent Group's profitability. For instance, in fiscal year 2024, a substantial portion of Accent Group's revenue was derived from these key brand relationships. The potential loss or reduced allocation from just one major brand could severely impact Accent Group's sales and market positioning, given their strong consumer pull.

Accent Group's exclusive distribution agreements for brands like Skechers and Vans significantly mitigate the bargaining power of these specific suppliers, as the company acts as a crucial gateway to the Australian and New Zealand markets. These long-standing agreements foster a strong dependency of the supplier on Accent Group for extensive market penetration and sales, evidenced by their over 20 brands and 800 stores in 2024. However, the negotiation and periodic renewal of these exclusive contracts remain critical junctures where the supplier's inherent power can resurface, impacting terms or distribution scope.

The global footwear industry is dominated by a few major brands such as Nike, Adidas, and Puma, which collectively held significant market share, with Nike alone accounting for approximately 27% of the global athletic footwear market in 2024. This high supplier concentration grants these dominant brands substantial bargaining power in negotiations with distributors like Accent Group. For instance, in its 2024 financial reports, Accent Group highlighted the critical importance of maintaining strong relationships with its diverse portfolio of over 100 brands, including key players like Skechers and Vans, to mitigate this leverage. This strategic diversification is essential for Accent Group to maintain competitive pricing and product availability, ensuring resilience against potential supply chain disruptions or unfavorable terms from any single major supplier.

Suppliers' Direct-to-Consumer (DTC) Ambitions

A rising trend sees footwear and apparel brands heavily investing in their own direct-to-consumer (DTC) channels, a move that significantly lessens their dependence on wholesale partners like Accent Group. This strategic shift inherently boosts suppliers' bargaining power as they gain direct access to their customer base. For instance, global sportswear brands continued to expand their DTC revenue streams, with some reporting over 40% of their total sales coming from DTC channels by early 2024. Accent Group must consistently highlight the unique value of its extensive retail footprint and deep customer engagement to remain a crucial distribution partner.

- By 2024, many major footwear brands expanded their DTC sales, reducing wholesale reliance.

- This direct engagement increases supplier control over pricing and distribution.

- Accent Group's extensive network and customer relationships are key differentiators.

- The group must demonstrate value beyond simple product distribution.

Input Cost Pressures

Input Cost Pressures

Suppliers to Accent Group face dynamic cost fluctuations in raw materials, manufacturing, and shipping. These rising costs, such as the 2024 global shipping rate increases, are frequently passed on, tightening Accent Group’s profit margins. This inherently strengthens the bargaining position of suppliers who adeptly manage their own cost structures.

- Global container shipping rates saw increases of over 100% year-on-year in early 2024 on key routes.

- Manufacturing input costs for footwear and apparel producers continued to rise through 2024.

- Suppliers with efficient logistics and production gain leverage due to cost stability.

The bargaining power of Accent Group's suppliers is significantly shaped by the dominance of key global brands like Nike and Adidas, which held substantial market shares in 2024. While exclusive distribution agreements for brands such as Skechers mitigate some leverage, the rising direct-to-consumer strategies of suppliers, with some achieving over 40% DTC sales by early 2024, increase their influence. Furthermore, escalating input costs, including over 100% year-on-year increases in global shipping rates on key routes in early 2024, empower suppliers to pass on higher expenses.

| Factor | 2024 Data Point | Impact on Supplier Power |

|---|---|---|

| Global Athletic Footwear Market Share | Nike: Approx. 27% | High concentration grants significant power. |

| DTC Sales Growth (Selected Brands) | Over 40% of total sales (early 2024) | Reduces reliance on wholesalers. |

| Global Shipping Rate Increases (Key Routes) | Over 100% year-on-year (early 2024) | Increased cost pass-through. |

What is included in the product

This analysis of Accent Group's competitive landscape breaks down the five key forces shaping its industry, offering strategic insights into competitive intensity, buyer and supplier power, and potential market threats.

Instantly visualize competitive intensity across all five forces, allowing for rapid identification of key strategic vulnerabilities.

Customers Bargaining Power

Customers in the footwear and apparel market demonstrate high price sensitivity, driven by the vast array of purchasing options available both in-store and online. The ease of comparing prices across retailers, often through digital platforms, significantly empowers consumers to demand competitive pricing. For Accent Group, maintaining customer loyalty and attracting new buyers requires a meticulously managed pricing strategy, especially given the intense competition and promotional activity observed across the sector in early 2024. This sensitivity compels Accent Group to balance profitability with market share.

Customers face very low switching costs in the footwear retail market, making it easy and inexpensive to shift from one retailer to another. This lack of friction means that customer loyalty to Accent Group's brands like Platypus or Hype DC can be fleeting and must be continuously earned. To counter this, Accent Group employs loyalty programs, with their collective loyalty database exceeding 10 million members as of early 2024. These programs, alongside exclusive product offerings, are crucial strategies to enhance customer retention and mitigate the impact of easy switching.

Modern consumers possess significant bargaining power due to immediate access to information. They can easily compare Accent Group's product prices and styles across various retailers and online platforms, checking reviews and fashion trends before purchasing. This transparency empowers customers to evaluate offerings, making a strong digital presence and positive online reputation crucial. For instance, Accent Group reported digital sales representing 20.3% of total sales in FY23, highlighting the importance of their online channels where customer reviews and comparisons are readily available.

Brand-Driven Demand

While customers generally hold bargaining power, their strong desire for specific, high-demand brands can significantly temper this. Accent Group strategically curates an extensive portfolio of popular and often exclusive brands, making their stores a primary destination for shoppers seeking these items. This brand-driven demand shifts a portion of the power back to Accent Group, as consumers are less likely to substitute or negotiate for brands like HOKA or Dr. Martens. For example, Accent Group reported strong performance from their owned and exclusive brands, which contributed significantly to their total sales in the first half of FY2024.

- Accent Group's diverse portfolio includes over 20 brands, many with exclusive distribution rights in Australia and New Zealand.

- Popular brands like HOKA and Skechers continue to drive strong foot traffic and online sales for Accent Group in 2024.

- The group's performance in H1 FY2024 showed continued growth in its owned and exclusive brands segment.

- This brand curation strategy reduces direct price competition for highly sought-after products.

Omnichannel Shopping Expectations

Customers increasingly demand a seamless shopping journey across online and physical channels. This expectation empowers them to choose retailers offering superior omnichannel services, such as efficient click-and-collect or hassle-free returns. Accent Group's strategic investments in digital and physical integration directly address this strong customer demand, enhancing convenience and loyalty. Their focus includes optimizing online platforms and in-store pick-up points.

- Accent Group's digital sales grew significantly in FY2024.

- Over 70% of Australian consumers use omnichannel shopping.

- Click-and-collect services saw a 25% increase in adoption in 2024.

- Easy returns are a top priority for 60% of online shoppers.

Customers hold substantial bargaining power due to low switching costs and immediate access to price comparisons across numerous retail channels. Accent Group mitigates this through a loyalty program exceeding 10 million members and by curating exclusive, high-demand brands like HOKA and Skechers. Their strategic omnichannel investments, including a 25% increase in click-and-collect adoption in 2024, also enhance customer retention and loyalty. This balance of customer empowerment and Accent's strategic responses shapes market dynamics.

| Factor | Impact | 2024 Data/Strategy |

|---|---|---|

| Price Sensitivity | High | Loyalty database over 10M members (early 2024) |

| Switching Costs | Low | Over 20 exclusive brands in portfolio |

| Information Access | High | Digital sales 20.3% of total (FY23); Omnichannel adoption 70%+ |

| Omnichannel Demand | High | Click-and-collect adoption up 25% in 2024 |

Preview Before You Purchase

Accent Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Accent Group, providing an in-depth look at the competitive landscape within the footwear and apparel industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This analysis is crucial for understanding Accent Group's strategic positioning and identifying potential opportunities and challenges. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

Accent Group faces significant competitive rivalry within Australia's highly fragmented footwear and sports apparel market. This crowded landscape includes numerous specialty retailers like Foot Locker and Platypus, major department stores such as Myer and David Jones, and sporting goods chains like Rebel Sport, alongside a growing array of online pure-plays. The intense competition for market share, particularly as the Australian online retail sector continues its robust growth, estimated to reach A$73 billion in 2024, consistently exerts pressure on pricing and overall profitability across all participants.

The growth of e-commerce has unleashed intense competition from both domestic and international online retailers. These digital-first players often operate with significantly lower overheads, enabling aggressive pricing strategies. Accent Group's digital sales, which reached A$270 million in FY23, are crucial for maintaining market share. The Australian online retail market continues to expand, with NAB reporting a 3.4% year-on-year growth in online sales as of May 2024. Therefore, Accent Group's ongoing digital transformation is essential to effectively compete and sustain profitability in this environment.

Direct-to-Consumer (DTC) channels from the very brands Accent Group distributes pose a significant competitive challenge, as the company effectively competes with its own suppliers for the end consumer. This complex dynamic intensifies as brands like Vans and Skechers continue to expand their own retail footprints and online sales. In its FY24 outlook, Accent Group highlighted ongoing investment in its digital channels, a strategic response to this growing rivalry. This evolving landscape necessitates agile strategies to maintain market share against increasingly powerful brand-direct offerings.

Price and Promotional Pressure

The Australian footwear and apparel market sees intense competitive rivalry, leading to significant price and promotional pressure for players like Accent Group. This high competition often results in frequent sales, discounts, and promotional activities across the industry, eroding profit margins. Consumers are increasingly conditioned to await deals, as seen with promotional periods like Black Friday and Boxing Day which continued strong into 2024, impacting full-price sales.

To mitigate this, effective brand building and a focus on an elevated customer experience are essential to compete on more than just price. Accent Group aims to counter this through its diverse brand portfolio and strategic store network.

- Accent Group reported a 2024 first-half gross margin of 58.7%, reflecting ongoing promotional pressures.

- Industry-wide, promotional activity increased in late 2023 and early 2024, impacting footwear and apparel retailers.

- Online sales, a key channel for promotions, continued to grow, with Australian online retail spending reaching approximately $66.8 billion in the 12 months to January 2024.

- Retailers are focusing on loyalty programs and omnichannel strategies to retain customers beyond price.

Mature and Slow-Growth Market

The footwear and apparel markets across Australia and New Zealand are notably mature, presenting limited avenues for significant overall growth. This fundamental characteristic means that any expansion for a company like Accent Group often necessitates acquiring market share directly from competitors. This zero-sum dynamic inherently intensifies competitive rivalry within the sector, pushing brands to innovate and differentiate more aggressively to capture consumer spending.

- Australian retail apparel and footwear sales growth moderated to approximately 3.7% in 2024, a notable slowdown from previous years.

- New Zealand's retail trade, including clothing and footwear, saw a slight decline in volume by 0.3% in Q1 2024.

- Accent Group's market share growth depends on strategic acquisitions and strong brand performance.

Accent Group navigates an Australian and New Zealand market characterized by intense competitive rivalry, driven by fragmentation and mature growth conditions. The robust growth of online retail, projected to reach A$73 billion in Australia for 2024, fuels aggressive pricing and promotional activity across the sector. Direct-to-consumer strategies from key brands further challenge Accent Group, necessitating agile responses to maintain market share and profitability amid a landscape of increased industry-wide promotions.

| Metric | 2024 Data | Implication for Accent Group |

|---|---|---|

| Australian Online Retail Market (projected) | A$73 billion | Intensified digital competition and pricing pressure. |

| Accent Group H1 2024 Gross Margin | 58.7% | Reflects ongoing promotional pressures in the market. |

| Australian Apparel/Footwear Sales Growth (2024) | ~3.7% | Market maturity necessitates gaining share from rivals. |

SSubstitutes Threaten

Consumers face a wide array of choices for footwear and apparel, with many brands and retailers offering similar products. This includes numerous substitute products for nearly every item Accent Group sells, from competing sports shoes to alternative fashion apparel styles. The Australian retail market for clothing, footwear, and personal accessories, valued at approximately AUD 4.5 billion in March 2024, is highly fragmented. This extensive availability of alternatives significantly heightens the threat of substitution for Accent Group's diverse brand portfolio.

A significant substitute threat for Accent Group comes from private label and store brands offered by various retailers. These alternatives often present comparable styles at more competitive price points, attracting budget-conscious consumers. For instance, major retailers like Kmart and Big W continue to expand their affordable apparel and footwear ranges, impacting market share. Accent Group actively mitigates this by leveraging its strong portfolio of vertically integrated brands, which accounted for a substantial portion of its sales in the first half of fiscal year 2024. This strategy allows Accent Group to maintain price competitiveness while controlling product quality and design.

The increasing popularity of the circular economy and online resale platforms presents a growing substitute. Consumers are increasingly opting for pre-owned fashion items, with the global second-hand apparel market projected to reach over $350 billion by 2027, impacting new product sales for retailers like Accent Group. This trend is particularly strong among younger, environmentally conscious shoppers, influencing purchasing decisions in 2024. Platforms like Depop and The RealReal offer accessible alternatives, diverting sales from traditional retail channels.

Shifting Discretionary Spending

A significant substitute threat for Accent Group arises from consumers reallocating discretionary income away from footwear and apparel. Instead, they might prioritize experiences, travel, or electronics. Economic conditions and consumer confidence heavily influence these choices, especially as inflation impacts household budgets. In 2024, Australian consumer confidence remains subdued, influencing cautious discretionary spending patterns.

- Australian consumer confidence for June 2024, according to ANZ-Roy Morgan, was 80.3 points, remaining below the long-run average.

- This lower confidence often translates to reduced spending on non-essential items like fashion.

- Post-pandemic, there has been a noticeable shift towards spending on services and experiences.

- Rising interest rates in 2024 also tighten household budgets, diverting funds from retail.

Cross-Category Retailers

Large-format retailers like department stores and hypermarkets pose a significant substitute threat, offering footwear and apparel alongside a vast product assortment. While they may lack Accent Group's specialized expertise, their convenience as a one-stop-shop remains highly compelling for many consumers. This broad appeal can divert sales, especially for everyday footwear needs.

- Australian consumers prioritize convenience, with multi-category shopping trips increasing in 2024.

- Major department store chains continue to invest in expanding their apparel and footwear sections.

- Hypermarkets leverage competitive pricing across diverse product lines to attract budget-conscious buyers.

- Online platforms of these retailers amplify their reach and substitute potential.

Accent Group faces a high threat of substitutes from the fragmented AUD 4.5 billion Australian footwear and apparel market, offering vast brand and product alternatives. This includes private label brands and the rapidly growing global second-hand market, projected to exceed $350 billion by 2027. Subdued Australian consumer confidence, at 80.3 points in June 2024, also reallocates discretionary spending towards experiences rather than fashion. Large-format retailers further amplify this threat by offering convenient, broad product assortments.

| Substitute Category | Impact on Accent Group | 2024 Data/Trend |

|---|---|---|

| Private Label Brands | Price competition, market share erosion | Major retailers expanding affordable ranges |

| Second-Hand Market | Reduced new product sales | Global market >$350B by 2027; strong among young consumers |

| Discretionary Spending Shift | Lower demand for non-essentials | Australian consumer confidence 80.3 (June 2024) |

Entrants Threaten

The capital outlay required to establish a widespread network of physical retail stores poses a significant barrier to new entrants in the footwear and apparel market. This encompasses substantial costs for securing prime retail leases, extensive store fit-outs, and acquiring diverse initial inventory, which can easily run into millions of dollars per store. For instance, a typical new retail store fit-out in Australia in 2024 can exceed $500,000, not including rent or stock. This high investment protects established players like Accent Group, with its extensive portfolio of over 850 stores, from new, large-scale physical competitors.

Accent Group boasts extensive, long-standing distribution and brand relationships, representing over 40 global brands across Australia and New Zealand. New entrants face a significant hurdle replicating these intricate supply chains and securing exclusive rights, a process that can take years. For instance, in 2024, Accent Group continued to leverage its strong portfolio including Skechers and Vans, making it exceptionally challenging for newcomers to access such high-demand, established brands. This deep market integration acts as a powerful barrier, protecting Accent Group's dominant position.

Accent Group's retail banners like Platypus, Hype DC, and The Athlete's Foot possess significant brand equity and a highly loyal customer base across Australia and New Zealand, supported by over 700 stores as of 2024. New entrants face a substantial hurdle, needing immense investment in marketing and brand building to rival this established trust and recognition. For instance, Accent Group's FY23 revenue reached A$1.41 billion, demonstrating their strong market penetration. This makes it exceptionally difficult for any newcomer to swiftly capture meaningful market share in the competitive footwear and apparel retail sector.

Economies of Scale

Accent Group's extensive operational scale significantly reduces its per-unit costs across procurement, distribution, and promotional activities. New entrants, lacking this volume, face higher fixed costs spread over fewer sales, making it challenging to match Accent Group's competitive pricing strategies. This inherent cost disadvantage creates a formidable barrier, reinforcing the company's market position.

- Accent Group operated over 870 stores as of early 2024, demonstrating significant retail footprint.

- Their extensive supply chain network, supporting brands like Skechers and HOKA, optimizes logistics.

- Bulk purchasing power allows for lower per-unit costs on inventory and raw materials.

- Marketing efficiencies are achieved through large-scale campaigns across diverse channels.

Lower Barrier for Niche Online Entrants

While establishing a large-scale retail presence like Accent Group remains challenging, the barrier to launching a niche online retail business is significantly lower. New e-commerce brands efficiently leverage social media and digital marketing, reaching targeted customer segments without extensive physical infrastructure. This dynamic means Accent Group faces a constant threat from smaller, agile online players who can quickly adapt to emerging fashion trends and consumer preferences, potentially eroding market share in specific categories.

- Australian online retail sales growth was projected to reach A$73.8 billion in 2024, indicating a robust environment for new entrants.

- Digital advertising spend in Australia is expected to exceed A$17 billion in 2024, highlighting the accessibility of targeted marketing for new brands.

- The ease of setting up e-commerce platforms allows niche players to launch with minimal capital, fostering rapid market entry.

While substantial capital, strong brand relationships, and established retail networks make large-scale physical entry difficult for new players, the threat from niche online retailers remains significant. These agile e-commerce brands can leverage digital marketing and lower overheads to quickly capture market segments. For instance, Australian online retail sales are projected to reach A$73.8 billion in 2024, indicating a robust environment for new digital entrants to challenge incumbents like Accent Group in specific product categories.

| Threat Factor | Impact on Accent Group | 2024 Data Point |

|---|---|---|

| Physical Retail Entry Barriers | High capital outlay protects market share | Typical store fit-out >A$500,000 |

| Online Retail Entry Ease | Increased competition from niche players | Australian online retail sales A$73.8 billion |

| Brand & Distribution Access | Difficult for new entrants to replicate | Accent Group represents 40+ global brands |

Porter's Five Forces Analysis Data Sources

Our Accent Group Porter's Five Forces analysis is built upon a foundation of reliable data, drawing from company annual reports, investor presentations, and industry-specific market research reports.

We supplement this with insights from financial news outlets, competitor websites, and publicly available market share data to provide a comprehensive view of Accent Group's competitive landscape.