Absa Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

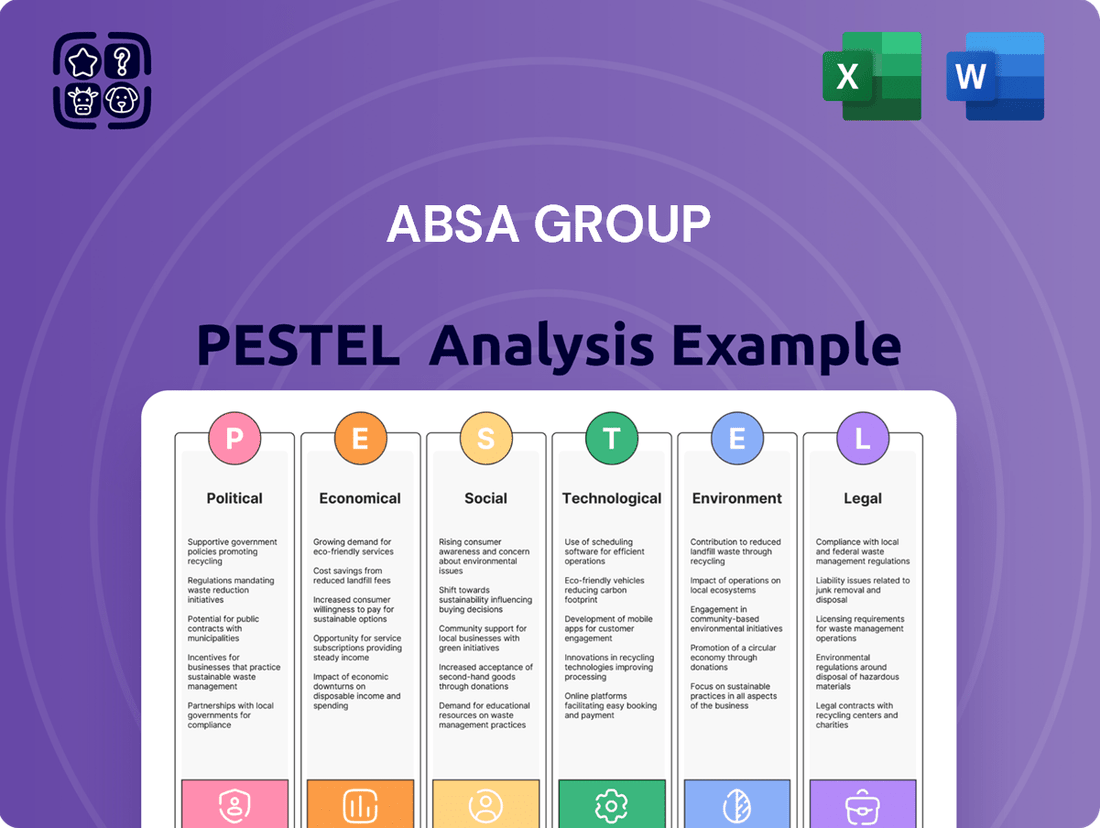

Navigate the complex external forces shaping Absa Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks are impacting its operations and strategic direction. Gain the foresight needed to anticipate challenges and capitalize on opportunities.

Unlock actionable intelligence to inform your investment decisions and strategic planning. Our PESTLE analysis provides a deep dive into the external landscape affecting Absa Group, offering critical insights for investors, analysts, and business leaders. Purchase the full report now to gain a competitive edge.

Political factors

The political landscape in South Africa, a core market for Absa, is a key consideration. While the country has a democratic framework, shifts in governance and policy direction can influence investor sentiment. For instance, the 2024 general election results, indicating a coalition government, introduce a new dynamic for policy formulation, particularly concerning economic reforms and state-owned entities, which Absa closely monitors.

Absa's operations across various African nations mean it must navigate diverse political environments. Policy changes affecting foreign investment, banking regulations, or currency controls in countries like Nigeria or Kenya can directly impact Absa's profitability and expansion plans. For example, evolving foreign ownership rules in certain African markets require continuous adaptation of Absa's strategic approach.

The banking sector in Absa's key markets, particularly South Africa, continues to be shaped by evolving regulatory landscapes. For instance, South Africa's Prudential Authority (PA) has been actively updating capital adequacy requirements, with the Basel III reforms being progressively implemented. These measures, aimed at enhancing financial stability, directly influence Absa's risk-weighted asset calculations and capital management strategies, impacting its operational efficiency and profitability.

Furthermore, the group faces a complex web of anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations across its operating countries. In 2024, increased scrutiny on digital transactions and cross-border flows means Absa must continually invest in robust compliance systems and personnel. Failure to adhere to these stringent AML/CFT frameworks can result in significant penalties and reputational damage, as seen in other financial institutions globally.

Consumer protection laws are also a critical consideration. Regulations designed to safeguard customers against predatory lending practices and ensure fair treatment are becoming more prescriptive. Absa’s commitment to customer-centricity is therefore not just a strategic choice but a regulatory imperative, requiring ongoing investment in transparent product disclosures and dispute resolution mechanisms to maintain its license to operate and foster trust.

Geopolitical tensions in various African regions, alongside ongoing regional conflicts, directly impact Absa Group's operational stability and its ability to execute expansion plans. For instance, instability in key markets can disrupt financial services and increase the cost of doing business.

The African Continental Free Trade Area (AfCFTA), which officially began trading in January 2024, presents a significant opportunity for Absa. By reducing trade barriers, the AfCFTA is projected to boost intra-African trade by 81% by 2035, creating new avenues for Absa to offer cross-border financial solutions and support increased investment flows across the continent.

Corruption and Governance

The level of corruption and the strength of governance in countries where Absa operates directly impact the financial sector's trustworthiness and the overall business environment. For Absa, this means that countries with robust anti-corruption laws and effective oversight tend to offer a more stable and predictable operating landscape, reducing potential financial and reputational risks.

Strong governance by governments can significantly boost investor confidence. For instance, Transparency International's 2023 Corruption Perception Index (CPI) ranked South Africa at 42 out of 100, indicating persistent challenges. In contrast, countries with higher CPI scores generally attract more foreign investment, which can translate into increased economic activity and opportunities for financial institutions like Absa.

- Impact on Financial System Integrity: High corruption can undermine trust in financial institutions and lead to increased regulatory scrutiny.

- Ease of Doing Business: Effective governance reduces bureaucratic hurdles and the likelihood of illicit demands, streamlining Absa's operations.

- Investor Confidence: Countries demonstrating a commitment to fighting corruption are more attractive to both local and international investors, benefiting the broader economy.

- Operational Risks: Absa must navigate varying governance standards, with robust frameworks mitigating risks related to compliance and reputational damage.

Fiscal and Monetary Policy Direction

Government fiscal policies, such as changes in taxation and public spending, alongside central bank monetary policies like interest rate adjustments and currency management, significantly influence Absa's profitability and the broader lending landscape. For instance, the South African Reserve Bank's (SARB) decision in late 2024 to maintain the repo rate at 8.25% provides a degree of stability, though the potential for future hikes due to persistent inflation remains a consideration. This stability is vital for Absa to effectively manage its financial position and evaluate credit risks.

Sound and predictable macroeconomic policies are foundational for Absa's strategic planning and risk assessment. The South African government's commitment to fiscal consolidation, aiming to reduce the budget deficit, can impact economic growth and, consequently, demand for banking services.

Key policy impacts on Absa include:

- Interest Rate Environment: Monetary policy directly affects Absa's net interest income and the cost of borrowing for its customers.

- Fiscal Stance: Government spending and taxation policies can influence economic activity, thereby impacting loan demand and credit quality.

- Regulatory Stability: Consistent and clear fiscal and monetary policy frameworks reduce uncertainty, enabling more accurate financial forecasting and risk management for Absa.

The 2024 South African general election resulted in a coalition government, introducing a new policy environment that Absa is closely monitoring, especially regarding economic reforms and state-owned enterprises. This shift impacts the bank's strategic outlook and operational planning across its key markets.

Absa must navigate diverse political landscapes across Africa, where policy changes on foreign investment and banking regulations, such as evolving foreign ownership rules in Nigeria and Kenya, directly affect profitability and expansion. The African Continental Free Trade Area (AfCFTA), operational since January 2024, is projected to boost intra-African trade by 81% by 2035, presenting significant opportunities for Absa's cross-border financial solutions.

Regulatory shifts, including the progressive implementation of Basel III reforms by South Africa's Prudential Authority, are enhancing financial stability but directly influence Absa's capital management and operational efficiency. Stringent anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations, with increased scrutiny on digital transactions in 2024, necessitate continuous investment in compliance systems to avoid penalties and reputational damage.

Government fiscal policies, such as taxation and public spending, alongside monetary policies like interest rate adjustments, significantly influence Absa's profitability. The South African Reserve Bank's decision in late 2024 to maintain the repo rate at 8.25% offers stability, crucial for Absa's risk assessment and financial management.

| Political Factor | Impact on Absa | Relevant Data/Event (2024/2025) |

|---|---|---|

| South African Election Outcome | Policy uncertainty and potential shifts in economic strategy | Formation of a coalition government following the May 2024 elections. |

| African Continental Free Trade Area (AfCFTA) | Increased opportunities for cross-border trade finance and investment | AfCFTA officially began trading in January 2024; projected to boost intra-African trade by 81% by 2035. |

| Banking Regulation (e.g., Basel III) | Impacts capital adequacy, risk-weighted assets, and operational efficiency | Ongoing progressive implementation of Basel III reforms by South Africa's Prudential Authority. |

| Monetary Policy (Interest Rates) | Affects net interest income and loan demand/pricing | South African Reserve Bank maintained repo rate at 8.25% in late 2024, with ongoing inflation monitoring. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Absa Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It aims to equip stakeholders with actionable insights into market dynamics and regulatory landscapes, fostering strategic decision-making and identifying potential growth opportunities.

A concise PESTLE analysis for Absa Group offers a pain point reliever by providing a clear, summarized overview of external factors, enabling faster strategic decision-making and reducing the burden of sifting through extensive data.

Economic factors

South Africa's GDP growth is projected to be around 1.5% in 2024, with a slight uptick to 1.7% in 2025, according to the South African Reserve Bank's March 2024 forecast. This moderate expansion directly influences demand for Absa's core banking services, impacting loan origination and transactional volumes.

Across Absa's key African markets, economic growth forecasts for 2024-2025 generally show a positive trend, though with regional variations. For instance, Nigeria's GDP is anticipated to grow by approximately 3.0% in 2024, while Kenya's economy is expected to expand by over 5.0% in the same period. These figures are crucial for Absa's strategic allocation of resources and product development across its diverse geographical footprint.

High inflation rates, such as the 5.3% recorded in South Africa in early 2024, directly impact Absa Group by diminishing consumer purchasing power and potentially increasing the bank's operational expenses. Central banks' responses, like the South African Reserve Bank's decision to hold its repo rate at 8.25% in May 2024, significantly influence Absa's net interest margin, a key driver of profitability.

A predictable interest rate landscape is crucial for Absa's financial planning. For instance, if interest rates were to stabilize or decline predictably, Absa could more effectively price its lending products, such as mortgages and business loans, and manage the risks associated with its asset and liability structure, thereby enhancing financial stability and forecasting accuracy.

Fluctuations in currencies like the South African Rand against major global currencies, such as the US Dollar, directly influence Absa Group's international dealings. For instance, in early 2024, the Rand experienced significant swings, impacting the value of Absa's foreign currency assets and the ease of bringing profits back from its operations across Africa.

When a local currency depreciates sharply, it can also weaken the ability of Absa's customers to repay loans, thereby raising the risk of defaults. This was a notable concern in several African markets where Absa operates, as economic headwinds in 2024 led to increased currency pressures.

Unemployment and Income Levels

Unemployment and income levels significantly shape Absa Group's operational landscape. High unemployment, such as the reported 32.9% expanded unemployment rate in South Africa for Q1 2024, directly curtails demand for financial services. This means fewer individuals seeking loans, savings accounts, or investment advice, impacting Absa's revenue streams.

Conversely, improvements in employment and income are a boon for the banking sector. For instance, if South Africa's formal sector employment were to see consistent growth, it would translate to increased disposable income. This scenario would naturally boost demand for credit products, mortgages, and wealth management services, expanding Absa's potential customer base and market penetration.

- South Africa's unemployment rate: The expanded unemployment rate stood at 32.9% in Q1 2024, indicating a substantial portion of the workforce is without jobs.

- Impact on demand: High unemployment directly reduces consumer spending power and the ability to access credit, dampening demand for Absa's core banking products.

- Income growth correlation: Rising real disposable incomes are crucial for increasing financial inclusion and driving demand for a wider range of financial services, benefiting Absa's growth prospects.

- Job creation as a driver: Policies focused on job creation and wage growth are therefore critical economic factors influencing Absa's future performance and market opportunities.

Global Economic Conditions and Commodity Prices

Global economic conditions directly influence commodity prices, a critical factor for Absa Group given its extensive operations across Africa. Many African economies rely heavily on commodity exports, meaning fluctuations in global prices can drastically affect government revenues, currency stability, and overall business activity within Absa's key markets. For instance, a sharp decline in oil prices, a major export for several African nations, can lead to reduced government spending and a slowdown in economic growth, impacting loan demand and banking sector performance.

The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, but still below historical averages. This moderate global growth outlook suggests continued, albeit potentially uneven, demand for commodities. However, geopolitical tensions and supply chain disruptions, which have been prominent in recent years, can cause significant price volatility. For example, the price of Brent crude oil, a benchmark for many African oil producers, experienced substantial swings in 2023 and early 2024 due to these factors.

- Commodity Dependence: Approximately 80% of sub-Saharan Africa's export revenue comes from commodities, making it highly susceptible to global price shifts.

- Foreign Direct Investment (FDI): Global economic downturns can reduce FDI inflows into Africa, impacting Absa's corporate and investment banking divisions that facilitate such capital. In 2023, FDI into Africa saw a modest increase, but remained below pre-pandemic levels.

- Exchange Rate Volatility: Commodity price drops often weaken African currencies against major global currencies, increasing the cost of imports and potentially impacting the value of Absa's foreign currency holdings and earnings.

- Trade Performance: Global economic upturns can boost demand for African exports, improving trade balances and fostering a more conducive environment for Absa's trade finance services.

South Africa's economic trajectory significantly shapes Absa's performance. The projected GDP growth of 1.5% in 2024 and 1.7% in 2025, as forecasted by the South African Reserve Bank, indicates moderate expansion that will influence demand for banking services. High inflation, at 5.3% in early 2024, erodes purchasing power and increases operational costs, while the repo rate holding at 8.25% in May 2024 impacts net interest margins. Fluctuations in the Rand, evident in early 2024, affect international dealings and loan repayment capabilities.

Across Absa's African markets, growth varies, with Nigeria expected to grow by 3.0% and Kenya by over 5.0% in 2024. Unemployment in South Africa, at an expanded rate of 32.9% in Q1 2024, directly curtails demand for financial products. Global economic conditions, with projected growth of 3.2% in 2024, influence commodity prices, a vital factor for many African economies and Absa's operations. Reduced FDI inflows in 2023, remaining below pre-pandemic levels, also present challenges.

| Economic Indicator | Value/Projection | Source/Period | Impact on Absa |

| South Africa GDP Growth | 1.5% (2024), 1.7% (2025) | South African Reserve Bank (March 2024) | Influences demand for banking services, loan origination. |

| South Africa Inflation Rate | 5.3% (Early 2024) | Statistics South Africa | Reduces consumer purchasing power, increases operational costs. |

| South Africa Repo Rate | 8.25% (May 2024) | South African Reserve Bank | Affects net interest margins and lending product pricing. |

| South Africa Expanded Unemployment Rate | 32.9% (Q1 2024) | Statistics South Africa | Curtails demand for financial services, impacts revenue. |

| Nigeria GDP Growth | ~3.0% (2024) | Various economic forecasts | Key market growth indicator for Absa's operations. |

| Kenya GDP Growth | >5.0% (2024) | Various economic forecasts | Key market growth indicator for Absa's operations. |

| Global GDP Growth | 3.2% (2024) | International Monetary Fund (IMF) | Impacts commodity prices and FDI flows into Africa. |

Preview the Actual Deliverable

Absa Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Absa Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Africa's demographic landscape is rapidly changing, with a significant portion of the population being young. For instance, by 2025, it's projected that over 40% of Africa's population will be under 25 years old. This youthful demographic, coupled with increasing urbanization across the continent, presents Absa Group with substantial opportunities to grow its retail banking services by catering to the financial needs of this expanding segment.

As more people move to cities, their financial requirements evolve, often demanding more sophisticated banking products and digital solutions. Absa's ability to understand and adapt to the financial behaviors of these burgeoning urban populations, particularly the youth, will be key to its success in developing relevant products and effectively penetrating new markets in the coming years.

High income inequality in key Absa markets, such as South Africa, presents a dual challenge. While it limits the disposable income of a large portion of the population, it also highlights a substantial segment of unbanked or underbanked individuals. For instance, in 2023, an estimated 10% of South African adults remained unbanked, indicating a significant market gap.

Absa can strategically address this by expanding financial inclusion through innovative digital platforms and product development. By offering accessible, low-cost banking services and tailored financial literacy programs, Absa can tap into these underserved markets. This approach not only broadens Absa's customer base but also plays a vital role in fostering economic growth and reducing poverty in the regions it serves.

Consumer preferences are rapidly shifting towards digital banking solutions, with a significant portion of customers now preferring mobile apps for transactions and inquiries. This trend is particularly pronounced among younger demographics, who expect seamless, personalized experiences and readily available financial advice through digital platforms.

Absa has observed this evolution, with digital channels accounting for a substantial and growing percentage of customer interactions. For instance, in 2024, mobile banking transactions saw a notable year-on-year increase, demonstrating the critical need for Absa to continuously enhance its digital offerings to meet these evolving demands and maintain a competitive edge.

Education Levels and Digital Literacy

The educational attainment and digital proficiency of a population directly influence how readily people embrace sophisticated financial instruments and digital banking solutions. For Absa Group, understanding these trends is crucial for tailoring its service offerings and financial education initiatives, particularly as it strives to become a leading digital bank across its various operating regions.

In South Africa, for instance, while tertiary education enrollment has seen growth, significant disparities remain. As of 2023, approximately 25% of the South African population aged 25-64 had attained tertiary education, a figure that highlights a segment ready for complex digital products. However, a substantial portion of the population still requires foundational digital literacy support, impacting the uptake of advanced mobile banking features or investment platforms.

Absa's strategy must therefore account for this spectrum of digital and financial literacy across its customer base. This involves:

- Developing tiered digital banking services catering to varying levels of user expertise.

- Investing in accessible financial literacy programs that bridge the digital divide.

- Leveraging data analytics to identify customer segments needing enhanced digital support.

- Partnering with educational institutions to boost digital and financial skills from an early age.

Social Stability and Community Development

Social stability significantly shapes Absa's operating landscape. Factors such as crime rates and the strength of social cohesion directly impact business security and consumer confidence. For instance, in South Africa, a key market for Absa, while overall crime statistics have seen some fluctuations, persistent concerns in certain areas can affect economic activity and investment. Effective social welfare programs contribute to a more predictable and stable consumer base.

Absa's engagement in corporate social responsibility (CSR) and community development is crucial for building brand equity. Initiatives focused on financial literacy and economic empowerment in underserved communities not only foster goodwill but also expand Absa's potential customer reach. In 2023, Absa reported investing significantly in various CSI projects across its operating regions, aiming to address socio-economic challenges and promote inclusive growth.

- Social Cohesion: Strong community bonds can lead to increased consumer spending and reduced operational risks for Absa.

- Crime Rates: Lower crime rates generally correlate with higher investor confidence and a more stable business environment.

- CSR Impact: Absa's community development programs, like those supporting small businesses, enhance its reputation and customer loyalty.

- Social Welfare Effectiveness: Robust social safety nets can stabilize demand for financial services by providing a more secure economic foundation for individuals and families.

Africa's youthful demographic, projected to have over 40% under 25 by 2025, presents Absa with significant growth opportunities in retail banking, especially as urbanization drives demand for sophisticated digital financial solutions. Income inequality, particularly in South Africa where an estimated 10% of adults remained unbanked in 2023, highlights a substantial market gap that Absa can address through financial inclusion initiatives and accessible digital platforms.

Technological factors

Absa Group's strategic focus on digital transformation is evident in its ongoing investment in advanced technologies. The bank is actively integrating artificial intelligence and machine learning to streamline operations and enhance customer interactions, aiming to deliver more personalized banking experiences. This commitment is crucial for maintaining a competitive edge in the fast-paced financial sector.

In 2024, Absa continued to prioritize cloud computing adoption, a move designed to boost scalability and operational agility. This technological shift supports the bank's ambition to accelerate product development cycles and respond swiftly to market demands. Such innovations are key to improving efficiency and customer satisfaction.

The escalating complexity of cyber threats, coupled with stringent data privacy mandates like South Africa's Protection of Personal Information Act (POPIA) and global GDPR-like regulations, demands significant investment in cybersecurity for Absa. In 2024, financial institutions globally reported an average cost of data breaches exceeding $4 million, underscoring the financial imperative for robust defenses.

Safeguarding customer information and the security of financial operations are critical for Absa's reputation and its ability to retain customer loyalty. Failure to comply with data privacy laws can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher, a risk Absa must actively mitigate.

The increasing penetration of mobile phones across Africa, projected to reach over 600 million unique subscribers by 2025, is a significant technological driver for Absa Group. This widespread adoption, coupled with improving internet connectivity, underpins Absa's digital-first strategy, enabling it to extend its reach to previously underserved populations.

Absa's investment in expanding its mobile banking services is crucial for tapping into this growth. For instance, in 2023, Absa reported a substantial increase in digital transactions, highlighting customer preference for convenient, mobile-enabled financial solutions. This trend is expected to accelerate, making mobile platforms the primary channel for customer interaction and service delivery.

FinTech Partnerships and Disruptors

The financial technology (FinTech) landscape is rapidly evolving, presenting Absa Group with both challenges and significant opportunities. FinTech startups and non-traditional players are increasingly disrupting established financial services, forcing incumbents like Absa to adapt. For instance, in 2024, FinTech funding globally saw a notable uptick, with investments in areas like digital payments and embedded finance accelerating, indicating continued innovation and competition.

Absa can leverage these trends through strategic collaborations. Partnering with or acquiring FinTech firms allows Absa to quickly integrate cutting-edge technologies, bolstering its digital offerings and customer experience. This approach can unlock access to specialized services, such as AI-driven credit scoring or blockchain-based payment solutions, which might otherwise require substantial in-house development time and investment. By embracing these partnerships, Absa can enhance its competitive edge and meet the growing demand for agile, digitally-native financial products.

- FinTech Investment Growth: Global FinTech funding showed resilience and growth in early 2024, with significant capital flowing into areas like digital banking and payments.

- Partnership Benefits: Strategic FinTech alliances can accelerate product development and market entry for Absa.

- Competitive Pressure: Unbundling of financial services by FinTechs necessitates Absa's proactive engagement with new technologies.

- Innovation Acceleration: Acquisitions of FinTechs can provide Absa with immediate access to advanced technological capabilities and customer bases.

Blockchain and Distributed Ledger Technologies (DLT)

Blockchain and Distributed Ledger Technologies (DLT) present significant opportunities for Absa Group to streamline operations. Potential applications in areas like cross-border payments and trade finance could fundamentally alter traditional banking, offering greater efficiency and lower transaction costs. By 2024, the global blockchain in banking market was projected to reach over $1.8 billion, highlighting the growing adoption of these technologies.

Absa's strategic engagement with DLT could unlock enhanced transparency and security across its services. For instance, identity verification processes could become more robust and less prone to fraud. The global DLT market size was estimated to exceed $10 billion in 2023, indicating a substantial and expanding technological landscape for Absa to leverage.

- Cross-border payments: DLT can reduce settlement times from days to minutes, significantly cutting costs.

- Trade finance: Smart contracts on blockchain can automate and secure complex trade processes.

- Identity verification: Secure digital identities can improve KYC/AML compliance and customer onboarding.

Absa Group's technological strategy centers on digital transformation, leveraging AI and machine learning for enhanced customer experiences and operational efficiency. The bank's continued investment in cloud computing in 2024 boosts scalability and agility, crucial for rapid product development. Globally, financial institutions faced an average data breach cost of over $4 million in 2024, underscoring Absa's need for robust cybersecurity to comply with data privacy laws like POPIA.

The increasing mobile phone penetration across Africa, projected to exceed 600 million unique subscribers by 2025, fuels Absa's digital-first approach, expanding its reach to new customer segments. This trend is supported by a rise in digital transactions, as seen in Absa's 2023 performance, indicating a strong customer preference for mobile banking. The FinTech sector continues to evolve, with global funding in digital banking and payments showing growth in early 2024, presenting both competitive challenges and partnership opportunities for Absa.

Blockchain and DLT offer Absa significant operational improvements, particularly in cross-border payments and trade finance, with the global blockchain in banking market projected to exceed $1.8 billion by 2024. These technologies can enhance transparency and security, as evidenced by the global DLT market size surpassing $10 billion in 2023, offering Absa avenues for improved KYC/AML processes and reduced transaction costs.

| Technology Area | Absa's Focus/Action | Market Trend/Data (2024/2025 Projection) | Impact on Absa |

|---|---|---|---|

| Digital Transformation | AI/ML integration, Cloud adoption | Continued investment in digital banking solutions | Improved customer experience, operational efficiency |

| Cybersecurity | Robust defense against threats | Average data breach cost >$4M (2024) | Reputation protection, regulatory compliance |

| Mobile Technology | Expansion of mobile banking services | >600M unique mobile subscribers in Africa (2025) | Expanded market reach, increased digital transactions |

| FinTech | Strategic partnerships/acquisitions | Global FinTech funding growth in digital payments | Access to innovation, competitive edge |

| Blockchain/DLT | Streamlining payments and trade finance | Blockchain in banking market >$1.8B (2024) | Enhanced efficiency, security, reduced costs |

Legal factors

Absa Group navigates a stringent regulatory landscape, encompassing capital adequacy rules like Basel III, liquidity mandates, and comprehensive risk management frameworks across its operating countries. For instance, as of early 2024, South African banks, including Absa, are working towards implementing the final Basel III reforms, which aim to bolster resilience by increasing capital requirements for certain risk exposures.

Failure to comply with these evolving banking regulations can result in significant penalties, such as the R200 million fine imposed on Standard Bank in South Africa during 2023 for control failures, underscoring the financial and reputational risks Absa faces. Maintaining robust compliance systems is therefore paramount for Absa's operational stability and market standing.

Consumer protection laws, like those mandating fair lending practices and transparent disclosure, significantly shape Absa's product development and customer service. For instance, the Financial Sector Conduct Authority (FSCA) in South Africa, which oversees Absa, enforces regulations aimed at preventing predatory lending and ensuring clear communication about financial products. Failure to comply can lead to hefty fines and reputational damage, impacting customer trust and market share.

Absa Group operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) legislation. These regulations are designed to prevent financial crimes and the financing of terrorism, requiring thorough customer verification and ongoing monitoring of transactions. For instance, in 2023, global financial institutions reported significant investments in AML compliance technology, with some estimates suggesting spending exceeding $10 billion to meet evolving regulatory demands and avoid substantial fines.

Data Protection and Privacy Laws

Absa Group faces a complex legal landscape, particularly concerning data protection and privacy. With the exponential growth in customer data, adherence to evolving legislation like South Africa's Protection of Personal Information Act (POPIA) is paramount. This means implementing robust measures for secure data collection, storage, processing, and sharing.

Compliance with POPIA and similar global regulations is not merely a legal obligation but a critical component of maintaining customer trust and brand reputation. Failure to safeguard personal information can lead to severe penalties, including substantial fines and reputational damage, as seen in various data breach incidents across the financial sector.

- POPIA Compliance: Absa must ensure all data handling practices align with South Africa's POPIA.

- Data Security: Implementing advanced cybersecurity measures is essential to prevent breaches and protect sensitive customer information.

- Customer Trust: Transparent and secure data management practices are vital for fostering and maintaining customer confidence.

- Regulatory Fines: Non-compliance can result in significant financial penalties, impacting profitability and operational continuity.

Competition Law and Market Conduct Regulations

Competition laws across Absa's operating regions, including South Africa, are crucial for maintaining a fair financial landscape. These regulations actively curb anti-competitive practices, ensuring that Absa and its peers engage in responsible market conduct. For instance, in South Africa, the Competition Act, 1998, governs market behavior and prohibits collusion and abuse of dominance, impacting how Absa prices its services and develops new products.

These legal frameworks directly shape Absa's strategic decisions, particularly concerning pricing strategies and product innovation. They also significantly influence the feasibility and structure of potential mergers and acquisitions, ensuring that any consolidation does not stifle competition or harm consumer interests. For example, the South African Reserve Bank and the Competition Commission scrutinize banking mergers to maintain market stability and prevent undue market power concentration.

- South Africa's Competition Act, 1998: Prohibits anti-competitive behavior and abuse of market dominance.

- Merger Control: Absa's potential acquisitions are subject to review by competition authorities to ensure market fairness.

- Pricing Regulations: Influence how Absa sets fees and interest rates to prevent predatory pricing or collusion.

- Consumer Protection: Laws are in place to safeguard consumers from unfair practices within the financial sector.

Absa Group operates under a robust legal framework that dictates capital adequacy, liquidity, and risk management, with ongoing adjustments to regulations like Basel III. For example, as of early 2024, South African banks are implementing final Basel III reforms to enhance resilience through increased capital requirements.

Non-compliance carries substantial financial and reputational risks; a 2023 fine of R200 million on Standard Bank for control failures highlights this. Absa's adherence to consumer protection laws, such as fair lending and transparent disclosure enforced by bodies like South Africa's FSCA, is crucial for maintaining customer trust and avoiding penalties.

Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations necessitate significant investment in compliance technology, with global spending estimated to exceed $10 billion in 2023. Data protection laws, including South Africa's POPIA, also demand secure data handling, with non-compliance risking severe fines and reputational damage.

Competition laws, such as South Africa's Competition Act, 1998, influence Absa's pricing and product development, and potential mergers are subject to scrutiny by authorities like the Competition Commission to prevent market dominance.

| Legal Factor | Description | Impact on Absa Group | Example/Data Point |

|---|---|---|---|

| Banking Regulation | Capital adequacy, liquidity, risk management | Operational stability, compliance costs | Implementation of Basel III reforms (early 2024) |

| Consumer Protection | Fair lending, transparent disclosure | Product design, customer relations, risk of fines | FSCA enforcement in South Africa |

| AML/KYC | Preventing financial crime, customer verification | Compliance technology investment, risk of penalties | Global AML tech spend >$10 billion (2023) |

| Data Protection | Privacy of customer information | Data security measures, reputational risk, fines | POPIA compliance in South Africa |

| Competition Law | Preventing anti-competitive practices | Pricing strategies, merger feasibility, market conduct | South Africa's Competition Act, 1998 |

Environmental factors

Climate change presents Absa Group with significant physical risks, such as extreme weather events impacting its asset base and loan portfolios, alongside transition risks stemming from evolving regulations and market shifts toward a low-carbon economy. For instance, the increasing frequency of droughts and floods in regions where Absa operates can directly affect the value of collateral for loans and the ability of borrowers to repay.

These risks are compounded by the global push for decarbonization, which can lead to stranded assets in carbon-intensive sectors and necessitate adjustments in lending strategies. Absa's exposure to sectors like agriculture and property development, which are particularly vulnerable to climate-related disruptions, requires careful risk management and scenario planning.

Conversely, climate change opens avenues for Absa in green finance, sustainable lending, and advisory services. The group can capitalize on the growing demand for financing renewable energy projects, green infrastructure, and businesses committed to environmental, social, and governance (ESG) principles. In 2024, the global sustainable finance market is projected to continue its robust growth, offering substantial opportunities for financial institutions that can effectively support clients in their transition to more environmentally sound practices.

Absa Group, like other financial institutions, faces growing environmental regulations that shape its lending and investment strategies. These rules can impact the types of projects Absa finances, pushing it towards more sustainable ventures and potentially altering its risk assessments for environmentally sensitive industries.

Compliance with environmental impact assessments for financed projects is crucial for Absa's reputation and legal standing. For instance, the increasing focus on Scope 3 emissions for financed activities means Absa must carefully consider the environmental footprint of its clients' operations to maintain its license to operate and attract environmentally conscious investors.

Absa's commitment to internal carbon emission targets, a trend seen across the financial sector leading up to 2025, is also a key environmental factor. Achieving these targets demonstrates responsible corporate citizenship and can mitigate regulatory risks, as well as appeal to a growing segment of ESG-focused investors.

Resource scarcity, particularly concerning water and energy, presents a tangible challenge for Absa Group. Fluctuations in the availability and cost of these essential resources directly influence operational expenditures, impacting everything from maintaining its vast branch network to powering its critical data centers. For instance, rising global energy prices in 2024 and projected increases for 2025 will likely exert upward pressure on utility bills.

Absa's strategic response involves a commitment to resource-efficient practices and investments in sustainable alternatives. By optimizing water usage and increasing the adoption of renewable energy sources, the group aims to not only mitigate the financial risks associated with resource volatility but also bolster its long-term environmental sustainability credentials. This proactive approach can lead to significant cost savings over time, as seen with other large corporations that have successfully integrated green energy solutions, reducing their energy spend by up to 15% in some cases.

ESG Reporting Requirements and Investor Pressure

Absa Group faces increasing demands from investors, regulators, and other stakeholders for detailed Environmental, Social, and Governance (ESG) reporting. This trend is pushing the company to be more transparent and accountable in its operations. For instance, by the end of 2024, many global financial institutions are expected to align their reporting with evolving frameworks like the ISSB Standards, which Absa will likely need to comply with.

Strong ESG performance directly impacts Absa's appeal to a growing segment of responsible investors. Those investors are channeling significant capital into companies demonstrating robust sustainability practices. In 2024, sustainable investment funds globally are projected to reach trillions of dollars, making it crucial for Absa to showcase its commitment. This enhanced attractiveness can also improve Absa's ability to secure sustainable finance, such as green bonds or sustainability-linked loans, which are becoming more prevalent in the market.

- Investor Scrutiny: A significant portion of institutional investors, estimated at over 70% in recent surveys, now integrate ESG factors into their investment decisions, directly influencing Absa's valuation and cost of capital.

- Regulatory Landscape: Emerging regulations, particularly in key markets like South Africa and Europe, mandate more standardized ESG disclosures, requiring Absa to invest in data collection and reporting infrastructure.

- Access to Capital: Companies with strong ESG ratings often benefit from lower borrowing costs and better access to capital markets, a trend that is expected to intensify through 2025.

- Reputational Risk: Failure to meet ESG expectations can lead to reputational damage, impacting customer loyalty and employee morale, which are critical intangible assets for Absa.

Biodiversity Loss and Ecosystem Services

The escalating global issue of biodiversity loss and the degradation of vital ecosystem services present indirect but significant risks for Absa Group. These environmental shifts can destabilize economies by impacting sectors like agriculture, tourism, and natural resource management, which are often financed by the bank. For instance, a decline in pollinator populations, critical for crop yields, could lead to reduced agricultural output and increased food prices, affecting consumer spending and overall economic health.

Absa's exposure to these risks is amplified as industries reliant on healthy ecosystems face operational challenges and reduced profitability. The bank's commitment to responsible banking practices necessitates a keen understanding of how these environmental factors can translate into financial risks. This includes assessing the long-term viability of businesses that depend on natural capital, such as those involved in forestry or fisheries.

By 2024, the economic impact of ecosystem degradation was already substantial, with estimates suggesting that nature loss could cost the global economy trillions of dollars annually. For example, the World Economic Forum has highlighted that over half of the world's GDP ($44 trillion) is moderately or highly dependent on nature and its services. This underscores the importance for financial institutions like Absa to integrate biodiversity considerations into their risk management frameworks and investment strategies.

- Economic Vulnerability: Ecosystem degradation can directly impact sectors Absa finances, such as agriculture and tourism, leading to financial instability.

- Reputational Risk: Association with industries that contribute to biodiversity loss can damage Absa's reputation and stakeholder trust.

- Regulatory Pressure: Increasing global focus on environmental, social, and governance (ESG) factors may lead to stricter regulations affecting financial institutions.

- Investment Opportunities: Conversely, Absa can identify opportunities by financing sustainable businesses and nature-based solutions.

Climate change poses both physical and transition risks for Absa Group, influencing its asset base and lending strategies. For instance, extreme weather events can impact collateral values, while the global shift to a low-carbon economy necessitates adjustments in financing carbon-intensive sectors. By 2024, sustainable finance markets were showing robust growth, presenting opportunities for Absa in green finance initiatives.

Absa faces increasing regulatory scrutiny and demands for ESG reporting, with many global institutions aligning with frameworks like the ISSB Standards by the end of 2024. Strong ESG performance is crucial for attracting responsible investors, who channeled trillions of dollars into sustainable funds globally in 2024, enhancing Absa's access to capital and improving its borrowing costs.

Resource scarcity, particularly water and energy, directly affects Absa’s operational costs, with rising energy prices in 2024 and projected increases for 2025 impacting utility bills. The bank is investing in resource-efficient practices and renewable energy to mitigate these financial risks and improve its sustainability credentials, potentially reducing energy spend as seen in other corporations.

Biodiversity loss and ecosystem degradation create indirect financial risks by destabilizing sectors Absa finances, such as agriculture and tourism. The World Economic Forum noted that over half of global GDP ($44 trillion) depends on nature, highlighting the need for Absa to integrate these environmental factors into its risk management by 2024.

| Environmental Factor | Impact on Absa Group | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Risks | Physical and transition risks, affecting loan portfolios and asset values. | Increasing frequency of extreme weather events; growing demand for green finance. |

| Regulatory Compliance | Need for adherence to environmental impact assessments and ESG reporting frameworks. | Mandatory ESG disclosures expected to align with ISSB Standards by end of 2024. |

| Resource Scarcity | Increased operational costs due to fluctuations in water and energy prices. | Projected rise in global energy prices through 2024 and into 2025. |

| Biodiversity Loss | Economic instability in nature-dependent sectors (agriculture, tourism). | Nature loss could cost global economy trillions annually; 50%+ of global GDP depends on nature. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Absa Group is built on a comprehensive foundation of data from reputable sources, including financial reports from regulatory bodies like the South African Reserve Bank and international organizations such as the IMF and World Bank. We also incorporate insights from leading business publications, industry-specific market research, and government policy documents to ensure a holistic view.