Absa Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Absa Group faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations in the dynamic financial services landscape. Understanding these forces is crucial for navigating the industry's complexities.

The complete report reveals the real forces shaping Absa Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Absa Group's reliance on technology providers and software vendors is substantial, particularly for its digital banking platforms and core operational systems. The bargaining power of these suppliers is influenced by factors such as the proprietary nature of their software and the integration complexity of their solutions. For instance, a specialized fintech provider offering a unique AI-driven fraud detection system could wield considerable influence due to the difficulty and cost of finding and implementing an equivalent alternative.

In 2024, the financial services industry continued to see significant investment in digital transformation, meaning companies like Absa are often dependent on a select few vendors for critical infrastructure. The ease of switching can be very low if a vendor's software is deeply embedded in Absa's existing IT architecture, making the cost and time associated with migration a significant barrier. This dependence grants these technology partners a degree of leverage in negotiations over pricing and service level agreements.

Financial market infrastructure providers, like payment networks and clearing houses, wield significant bargaining power. Their regulated nature and high entry barriers make it challenging for Absa Group to switch or develop its own systems, thereby limiting Absa's leverage.

The increasing complexity of financial regulations, such as the upcoming Joint Standard 2 for Cybersecurity in 2024, further solidifies the dependence on these specialized providers. This regulatory push means Absa must ensure its infrastructure is compliant, reinforcing the suppliers' strong position.

The availability of specialized talent, particularly in high-demand fields like cybersecurity, artificial intelligence, and digital transformation, significantly influences the bargaining power of suppliers in the form of human capital. A scarcity of these skilled professionals can empower employees and recruitment agencies, potentially driving up labor costs and creating retention difficulties for Absa Group. For instance, reports in late 2023 and early 2024 indicated a persistent global shortage of AI and cybersecurity experts, with average salaries for these roles seeing substantial increases.

Absa's strategic investment in training its employees, especially in areas like Generative AI (GenAI) as highlighted in their 2024 initiatives, directly addresses this challenge. By fostering internal talent development, Absa aims to mitigate the external reliance on scarce specialized skills, thereby reducing the bargaining power of external human capital suppliers and ensuring a more stable and cost-effective talent pipeline.

Data and Analytics Service Providers

Absa Group's strategic pivot towards becoming a digitally-led bank significantly amplifies the bargaining power of data and analytics service providers. As data is now a core strategic asset, the suppliers of high-quality data sets, advanced analytics platforms, and specialized AI capabilities hold considerable sway. The increasing reliance on these external partners for crucial insights and technological advancements means Absa must carefully manage these relationships to mitigate potential cost escalations or service disruptions.

The uniqueness and proprietary nature of certain data sources or sophisticated analytical models developed by these providers can further enhance their leverage. For instance, specialized financial data aggregators or AI algorithm developers might possess capabilities that are difficult for Absa to replicate internally in the short to medium term. This dependence grants them a stronger negotiating position, impacting contract terms and pricing.

- Increased Reliance: Absa's commitment to data-driven decision-making and applied AI means a greater dependence on external analytics and data providers.

- Proprietary Assets: The unique nature of some data sets and analytical models held by suppliers grants them significant leverage.

- Cost Implications: The bargaining power of these suppliers can translate into higher costs for Absa for essential data and analytics services.

- Strategic Partnerships: Absa's need for advanced capabilities necessitates strong partnerships, but also highlights the suppliers' influence.

Regulatory and Compliance Service Providers

Suppliers of regulatory and compliance services wield considerable power over Absa Group, particularly given the intricate and constantly changing financial regulations in South Africa and the broader African continent. The necessity of adhering to these rules, with penalties for non-compliance being substantial, makes these specialized services essential for Absa. For instance, the implementation of the Joint Standard for IT Governance and Risk Management in 2024 highlights the critical nature of these compliance providers.

- High switching costs: Absa faces significant costs and disruption in changing its regulatory compliance software or legal advisory partners due to the deep integration and specialized knowledge required.

- Indispensable nature of services: Failure to comply with regulations can result in severe financial penalties and reputational damage, making these services non-negotiable for Absa.

- Concentration of expertise: A limited number of providers possess the deep understanding of specific financial regulations and the technical capabilities to offer effective compliance solutions.

- Impact of new regulations: The introduction of new regulatory frameworks, such as those related to data privacy and cybersecurity, further enhances the bargaining power of suppliers who can facilitate adherence.

The bargaining power of Absa Group's suppliers is elevated by the increasing reliance on specialized technology and data providers, particularly for digital transformation initiatives ongoing in 2024. Proprietary software, deep integration, and the high cost of switching vendors grant these suppliers significant leverage in pricing and service agreements.

Financial market infrastructure providers, such as payment networks, also hold substantial power due to regulatory oversight and high entry barriers, making it difficult for Absa to find alternatives. This dependence is further amplified by evolving regulations like Joint Standard 2 for Cybersecurity in 2024, necessitating compliance with specialized providers.

The scarcity of talent in fields like AI and cybersecurity, evident in rising salaries in late 2023 and early 2024, empowers human capital suppliers. Absa's investment in internal training, including Generative AI in 2024, aims to counter this by building internal expertise.

Data and analytics service providers gain leverage as data becomes a core asset, with unique datasets and models strengthening their negotiating position. Absa's need for advanced capabilities means managing these partnerships carefully to avoid cost escalations or service disruptions.

What is included in the product

This analysis unpacks the competitive forces shaping Absa Group's banking environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and their collective impact on profitability.

Gain actionable insights into competitive pressures, enabling Absa Group to proactively adjust strategies and mitigate potential threats.

Customers Bargaining Power

Individual retail customers wield considerable bargaining power, primarily because the banking landscape offers a plethora of choices. From established traditional banks to agile, digital-first challengers, customers can easily switch providers based on who offers the best interest rates, the lowest fees, or the most seamless digital experience. This ease of comparison and switching means banks must constantly innovate and offer competitive packages to retain their retail base.

In 2024, the competition among banks for retail deposits and lending intensified. For instance, reports indicated that several digital banks in South Africa were offering savings accounts with interest rates exceeding 7%, a significant draw for customers seeking higher returns compared to many traditional offerings. Absa, like its peers, recognizes that customer loyalty is increasingly tied to value propositions that go beyond basic transactional services, encompassing personalized financial advice and robust digital platforms.

Small and Medium-sized Enterprises (SMEs) are experiencing a significant rise in their bargaining power within the financial services sector. This is largely due to a surge of new entrants and innovative fintech companies actively targeting this segment with specialized lending and payment solutions. These businesses are increasingly seeking accessible credit and efficient digital tools, making them highly receptive to competitive offers that simplify their financial operations.

Absa Group, alongside other established banks, must contend with this evolving competitive landscape. The growing demand for tailored financial products means that SMEs can now more effectively negotiate terms and seek out the best value propositions. For instance, in South Africa, the SME sector is a crucial driver of economic growth, with reports indicating that SMEs contribute significantly to employment, making their satisfaction a key focus for financial institutions.

Large corporate and institutional clients wield significant bargaining power with Absa Group. Their substantial transaction volumes allow them to negotiate favorable terms and pricing for financial services. In 2024, these clients often have access to a wide array of sophisticated financial products and services from numerous global and local providers, increasing their leverage.

Absa's Corporate and Investment Banking division actively courts these clients, recognizing their importance. These relationships are built on providing comprehensive solutions tailored to complex needs, often involving international trade finance, capital markets access, and sophisticated risk management tools. The ability of these clients to easily switch providers if dissatisfied further amplifies their bargaining strength.

Digital Natives and Tech-Savvy Customers

The increasing digital fluency of customers, especially across Africa, significantly amplifies their bargaining power. These consumers expect intuitive digital interfaces, cutting-edge functionalities, and immediate support, compelling established financial institutions like Absa Group to expedite their digital evolution and allocate resources to sophisticated technologies. Absa's own data highlights this shift, with a growing proportion of its customer base actively engaging through digital channels.

This digital empowerment translates into tangible demands:

- Demand for Seamless Digital Experiences: Customers expect effortless navigation, integrated services, and personalized interactions across all digital touchpoints.

- Expectation of Innovative Features: The rapid pace of technological advancement means customers anticipate banks offering novel digital tools and services that simplify their financial lives.

- Requirement for Instant Service and Support: Digital natives are accustomed to immediate responses, pushing banks to provide real-time customer service through chat, social media, and self-service portals.

- Price Sensitivity and Comparison: The ease of comparing financial products and services online means customers can readily switch to providers offering better value or lower fees, increasing pressure on banks to remain competitive.

Financially Excluded and Underbanked Populations

The bargaining power of financially excluded and underbanked populations is on the rise. This is largely due to the rapid growth of mobile money and fintech innovations specifically aimed at bringing more people into the financial system. These customers are particularly sensitive to costs and how easy it is to access services, making them a key focus for new digital banks and inclusive financial products.

Absa Group recognizes this shift. Their initiatives supporting financial inclusion, particularly through entrepreneurship programs, demonstrate an understanding of this segment's increasing influence. For instance, in 2024, Absa reported significant growth in its digital banking channels, reaching previously underserved communities. This strategic focus aims to capture a larger share of this expanding market.

- Growing Digital Adoption: In 2024, mobile money transactions in Africa saw a substantial increase, with billions of dollars processed, highlighting the reach of digital financial services to previously unbanked individuals.

- Fee Sensitivity: Research from late 2024 indicates that over 70% of underbanked individuals cite high fees as a primary barrier to traditional banking.

- Fintech Innovation: New fintech entrants in 2024 have successfully onboarded millions of new users by offering low-cost, accessible digital accounts and payment solutions.

- Absa's Inclusion Efforts: Absa's 2024 financial reports detailed investments in programs designed to foster small business growth, indirectly serving and empowering financially excluded segments.

Customers' bargaining power is significantly shaped by the availability of alternatives and the ease of switching. In 2024, the banking sector saw intense competition, with digital banks offering attractive rates, sometimes exceeding 7% on savings accounts, directly challenging traditional institutions like Absa. This forces banks to focus on value-added services and digital experiences to retain customers.

The rise of fintech and specialized providers has empowered SMEs, enabling them to negotiate better terms for credit and digital tools. With SMEs being vital to economic growth, their satisfaction is paramount, driving banks to offer tailored, competitive solutions.

Large corporate clients, due to their transaction volumes and access to global providers, possess substantial leverage. They can negotiate favorable pricing and terms, and their ability to switch providers easily compels banks to offer comprehensive, sophisticated financial solutions.

Digital fluency among customers, especially in Africa, has amplified their bargaining power. Expectations for seamless digital interfaces and instant support are high, pushing institutions like Absa to invest heavily in technology. In 2024, mobile money transactions in Africa processed billions, underscoring the shift and customer expectations for accessible, low-cost digital financial services.

What You See Is What You Get

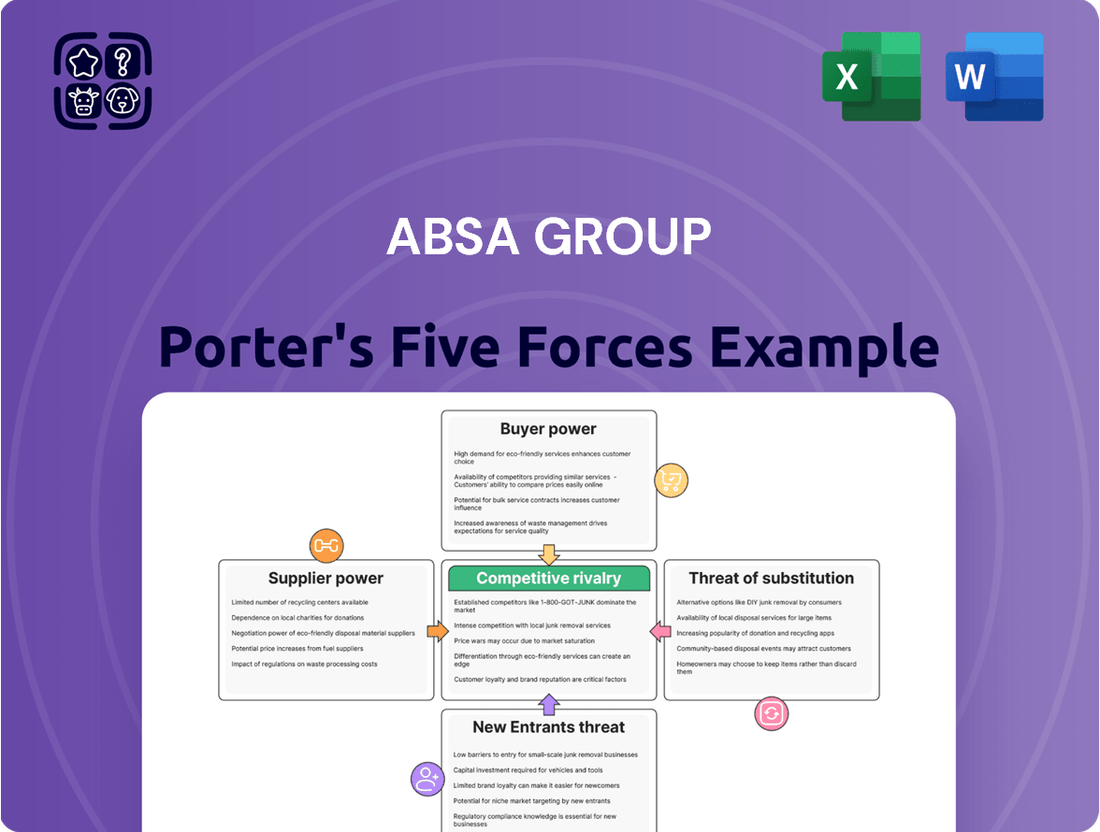

Absa Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Absa Group, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides critical insights into the strategic landscape impacting Absa Group's profitability and market position, enabling informed decision-making for stakeholders. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

The South African banking landscape is highly concentrated, with Absa Group facing stiff competition from established giants like Standard Bank, FNB, and Nedbank. This oligopolistic structure means these major players are constantly vying for market share.

These banks offer very similar, comprehensive product and service portfolios, forcing them to differentiate through innovation in digital offerings, customer experience, and pricing strategies. For instance, in 2023, the combined headline earnings of the top four South African banks exceeded R100 billion, underscoring the scale of competition and profitability within the sector.

The banking landscape is increasingly shaped by agile, asset-light digital-only banks and a dynamic fintech sector. These disruptors, often targeting specific market segments, introduce innovative, cost-effective, and user-friendly digital solutions that directly challenge established banking operations.

For instance, TymeBank's impressive growth trajectory in South Africa, reaching over 8 million customers by early 2024, exemplifies the success of this digital-first approach. This surge in digital banking adoption, coupled with the proliferation of fintech companies across Africa, significantly heightens competitive rivalry for incumbent institutions like Absa Group.

Absa Group faces intense competitive rivalry as it expands geographically across Africa. Major banks, including competitors like Standard Bank and Ecobank, are also actively pursuing pan-African strategies, creating a crowded marketplace for market share. This regional competition means Absa must not only contend with established local players in each country but also with other large, diversified African banking groups.

Product and Service Diversification

Competitive rivalry within the banking sector is significantly fueled by the ongoing diversification of products and services. Banks are not just offering traditional lending and deposit accounts anymore; they are actively expanding into areas like wealth management, insurance, and investment banking. This broadens the competitive arena considerably.

This drive for comprehensive financial solutions means banks are constantly innovating to meet a wider range of customer needs. By cross-selling various financial products to their existing customer base, they create a more interconnected and competitive landscape. Absa Group's own diverse portfolio, encompassing retail banking, corporate and investment banking, and wealth management, positions it directly within this dynamic environment.

- Diversification Drivers: Banks are expanding into wealth management, insurance, and investment banking to offer all-inclusive financial solutions.

- Innovation Focus: Continuous product and service innovation is key to attracting and retaining customers in this broad competitive landscape.

- Cross-Selling Strategy: Leveraging existing customer relationships to offer a wider array of financial products is a common tactic.

- Absa's Position: Absa's diversified offerings across retail, corporate, and wealth management are central to its competitive strategy.

Technological Innovation and Digital Transformation

The financial services industry is characterized by fierce competition driven by rapid technological innovation. Banks like Absa are locked in a battle to leverage advancements such as artificial intelligence, cloud computing, and sophisticated data analytics to gain an edge. This technological race is crucial for enhancing customer experiences, streamlining operations, and introducing novel products and services.

Absa Group's strategic commitment to becoming a digitally-led institution underscores the intensity of this rivalry. The group's significant investments in technology are a direct response to the need to stay competitive in a landscape where digital transformation is paramount. For instance, in 2023, Absa continued to prioritize digital channels, with mobile banking transactions forming a substantial portion of their overall customer interactions, reflecting the industry-wide shift.

- Digital Investment: Banks globally are pouring billions into digital transformation initiatives, with a focus on AI and cloud adoption.

- Customer Experience: Enhanced digital platforms are key differentiators, directly impacting customer acquisition and retention.

- Operational Efficiency: Technology adoption aims to reduce costs and improve the speed and accuracy of financial services.

- New Revenue Streams: Innovation allows for the creation of new digital products and services, expanding market reach.

Absa Group operates in a highly concentrated South African banking sector, facing intense rivalry from major players like Standard Bank, FNB, and Nedbank. These established banks offer similar product suites, compelling them to compete on digital innovation, customer experience, and pricing. The sector's profitability is substantial, with the top four South African banks collectively reporting over R100 billion in headline earnings in 2023, highlighting the competitive intensity.

The rise of agile, digital-only banks and fintech firms further intensifies this rivalry. Companies like TymeBank, which had surpassed 8 million customers by early 2024, demonstrate the disruptive potential of digital-first strategies. This trend, coupled with the broader expansion of fintech across Africa, forces incumbent banks like Absa to continuously adapt and innovate to maintain market share and relevance.

Competitive rivalry is also fueled by the ongoing diversification of financial services. Banks are expanding beyond traditional offerings into wealth management, insurance, and investment banking, creating a broader competitive landscape. Absa's own diverse portfolio, spanning retail, corporate, and wealth management, positions it directly within this dynamic and expanding competitive arena.

The drive for technological advancement, including AI and cloud computing, is a critical battleground for banks. Absa's strategic focus on digital transformation and significant technology investments are direct responses to this. In 2023, mobile banking transactions represented a substantial portion of Absa's customer interactions, reflecting the industry-wide shift towards digital channels.

| Competitor | Key Differentiator/Strategy | 2023 Performance Indicator (Illustrative) |

|---|---|---|

| Standard Bank | Pan-African expansion, digital services | Headline Earnings: ~R30 billion |

| FNB (FirstRand) | Digital innovation, integrated offerings | Headline Earnings: ~R20 billion |

| Nedbank | Sustainability focus, digital transformation | Headline Earnings: ~R12 billion |

| TymeBank | Digital-only, low-cost model | Customer Growth: 8+ million by early 2024 |

SSubstitutes Threaten

Mobile money platforms, especially dominant in Africa, present a strong threat of substitution for traditional banking services. These platforms facilitate payments, remittances, and basic savings, directly competing with core banking functions. For example, M-Pesa, a leading mobile money service, has empowered millions, particularly in Kenya, by offering accessible and often more affordable financial solutions than conventional banks.

The rise of alternative lending and Buy Now, Pay Later (BNPL) services presents a significant threat of substitutes for Absa Group's traditional credit offerings. These fintech solutions, often mobile-first, are capturing market share by providing faster, more accessible financing options, particularly for consumers and small to medium-sized enterprises (SMEs).

For instance, the global BNPL market was projected to reach over $3.6 trillion by 2030, indicating a substantial shift in consumer payment preferences away from traditional credit cards and loans. This trend directly impacts banks like Absa by offering consumers and businesses readily available alternatives for purchases and operational funding, often with simpler approval processes and more transparent fee structures.

Cryptocurrencies and blockchain technology represent a burgeoning threat of substitutes for Absa Group. These digital assets and distributed ledger systems offer alternative methods for transactions and asset storage, bypassing traditional banking infrastructure. South Africa, a key market for Absa, has seen substantial cryptocurrency adoption, with estimates suggesting over 10% of the adult population owned crypto by early 2024, highlighting the growing appeal of these alternatives.

Informal Financial Systems

Informal financial systems, like stokvels and community savings groups, remain significant substitutes for formal banking in many African markets, particularly for rural and lower-income populations. These systems often foster a sense of trust and community that traditional institutions find challenging to match. For instance, in South Africa, stokvels are estimated to manage billions of dollars annually, demonstrating their substantial economic influence.

Absa Group's strategy to enhance financial inclusion directly addresses this threat by aiming to integrate these segments into formal banking channels. By offering accessible and relevant financial products, Absa seeks to capture market share currently served by these informal networks.

- Stokvels' Economic Impact: In South Africa, stokvels collectively hold significant assets, estimated to be in the tens of billions of US dollars, representing a substantial portion of household savings.

- Community Trust: Informal systems leverage strong social ties and peer-to-peer accountability, offering a level of personalized service and trust that formal banks often struggle to replicate.

- Financial Inclusion Gap: A considerable portion of the African population remains unbanked or underbanked, relying on informal mechanisms for savings, credit, and insurance, creating a persistent competitive landscape for formal institutions like Absa.

In-house Corporate Finance Departments

Large corporations with robust in-house finance departments can indeed act as a substitute for certain investment banking services. These internal teams often handle treasury management, internal capital allocation, and even some direct investment activities, thereby reducing their need for external financial institutions. For instance, a significant portion of treasury operations, which might otherwise be outsourced, can be managed internally, particularly by companies with substantial financial resources and expertise.

This trend is driven by the desire for greater control and potential cost savings. In 2024, many large enterprises continued to invest in building out their internal finance capabilities, recognizing the strategic advantage of managing core financial functions in-house. This allows them to tailor financial strategies precisely to their unique business needs.

- Reduced Reliance: Companies can decrease their dependence on external banks for services like cash management and intercompany lending.

- Cost Efficiency: In-house management can sometimes be more cost-effective than paying fees to external providers, especially for high-volume activities.

- Strategic Control: Maintaining these functions internally provides greater oversight and alignment with the company's overall strategic objectives.

- Talent Development: Investing in in-house finance teams fosters specialized expertise within the organization.

The threat of substitutes for Absa Group is multifaceted, encompassing digital payment platforms, alternative lending, cryptocurrencies, and informal financial systems. These substitutes often offer greater convenience, lower costs, or unique community-based trust, directly challenging traditional banking services.

Mobile money, exemplified by M-Pesa in Kenya, provides accessible financial solutions, while BNPL services are reshaping consumer credit. Cryptocurrencies offer alternative transaction methods, and informal systems like South African stokvels manage billions annually, highlighting the diverse competitive landscape.

| Substitute Type | Key Characteristics | Impact on Absa | Example/Data Point |

|---|---|---|---|

| Mobile Money | Convenience, low fees, accessibility | Direct competition for payments & remittances | M-Pesa adoption in Africa |

| Alternative Lending (BNPL) | Fast, simple credit access | Erodes traditional credit card/loan market share | Global BNPL market projected >$3.6T by 2030 |

| Cryptocurrencies | Decentralized transactions, digital assets | Bypasses traditional banking infrastructure | >10% SA adult crypto ownership (early 2024) |

| Informal Systems (Stokvels) | Community trust, peer accountability | Captures savings & credit market segments | Stokvels manage billions annually in SA |

Entrants Threaten

The banking sector's highly regulated nature, featuring strict licensing and capital adequacy rules, presents a substantial hurdle for potential new entrants. These established barriers are designed to ensure financial stability and protect consumers.

However, the landscape is evolving. In 2024, the South African Reserve Bank gazetted new mutual banking licenses, and further new bank launches are anticipated, suggesting a potential diversification or slight easing of these entry pathways, which could introduce new competitive pressures.

The capital required to establish a full-service commercial bank is immense, covering everything from physical branches and advanced technology to meeting stringent regulatory demands. This high entry cost acts as a significant deterrent for potential new players. For instance, in 2024, major banks continue to invest billions in digital transformation and cybersecurity, further escalating the capital threshold.

While digital-only banks may seem more agile, they still necessitate substantial financial backing to develop robust technology platforms and aggressively acquire customers in a competitive market. The established 'Big Four' banks, including Absa Group, leverage their considerable existing scale and widespread geographic presence, giving them a distinct advantage in terms of operational efficiency and market reach that newcomers struggle to replicate.

Absa Group, like other established banks, enjoys a significant advantage due to its deeply ingrained brand recognition and the trust it has cultivated over many years. This makes it challenging for new players to attract customers, as building a new banking brand requires substantial marketing expenditure and a considerable amount of time to earn consumer confidence. For instance, in 2023, Absa reported a brand value increase, reflecting ongoing efforts to strengthen its market position.

Technological Advancements and Digital Infrastructure

Technological advancements can indeed lower some barriers to entry, particularly for digital-first banks. However, the requirement for substantial investment in robust, secure, and scalable digital infrastructure remains a significant hurdle. This includes sophisticated cybersecurity defenses and advanced data analytics capabilities, areas where established players like Absa Group have already made considerable investments. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the scale of investment needed to compete effectively.

New entrants must also contend with evolving regulatory landscapes, especially concerning data privacy and cybersecurity. These regulations necessitate ongoing compliance investments, further increasing the capital required to establish a competitive digital presence. The complexity and cost of meeting these stringent requirements can deter many potential new entrants, even with technological enablers.

- High Infrastructure Costs: Building and maintaining secure, scalable digital banking platforms requires significant upfront and ongoing capital expenditure.

- Cybersecurity Demands: Meeting advanced cybersecurity standards, crucial for customer trust and regulatory compliance, is a substantial cost driver.

- Regulatory Compliance: Adhering to evolving data protection and cybersecurity regulations adds complexity and financial burden for new entrants.

Niche Market Entry and Fintech Innovation

New entrants, especially fintech companies, are adept at sidestepping direct competition with established players like Absa Group. They often target underserved or specific market segments, such as mobile payments or specialized lending, which allows them to build a customer base and gradually broaden their services. This indirect approach presents a persistent and evolving challenge across Absa's various business lines.

The African continent has seen a significant surge in fintech innovation, illustrating this threat. For instance, by mid-2024, mobile money transactions in Africa were projected to reach hundreds of billions of dollars annually, demonstrating the rapid adoption of these alternative financial services. This growth indicates that new entrants are not just emerging but are capturing substantial market share by offering tailored, accessible solutions.

- Fintechs focus on niche markets: Many new entrants concentrate on specific services like digital wallets or peer-to-peer lending, avoiding head-on competition with traditional banks.

- Gradual market penetration: These companies build traction in their chosen niches before expanding into broader financial services, creating an indirect competitive pressure.

- Rapid African fintech growth: The increasing adoption of mobile money and digital banking platforms across Africa, with transaction volumes soaring, highlights the growing threat from nimble, tech-focused competitors.

While substantial capital and regulatory hurdles exist, the banking sector is seeing new entrants, particularly in the digital space. In 2024, new mutual banking licenses were introduced in South Africa, signaling potential shifts. These new players often target niche markets, leveraging technology to offer specialized services, thereby presenting an evolving competitive dynamic for established institutions like Absa Group.

Fintech innovation continues to lower entry barriers, especially in mobile payments and lending, as seen in the projected hundreds of billions in annual mobile money transactions across Africa by mid-2024. These agile competitors build customer bases in specific segments before expanding, creating indirect pressure across various banking services.

The significant investments required for robust digital infrastructure and cybersecurity remain a deterrent, with the global cybersecurity market exceeding $300 billion in 2024. Despite technological advancements, new entrants must still overcome substantial costs to build secure, scalable platforms and gain customer trust, a challenge amplified by Absa's established brand recognition and market presence.

| Factor | Impact on Absa Group | 2024 Data/Trend |

|---|---|---|

| Capital Requirements | High barrier for traditional banks | Billions invested in digital transformation by major banks |

| Regulatory Hurdles | Compliance costs are significant | New mutual banking licenses introduced in South Africa |

| Technological Advancements | Enables digital-first entrants | Global cybersecurity market projected over $300 billion |

| Fintech Niche Targeting | Indirect competition | Projected hundreds of billions in African mobile money transactions |

| Brand Recognition & Trust | Advantage for incumbents | Absa reported brand value increase in 2023 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Absa Group is built upon a foundation of comprehensive data, including Absa's annual reports, investor presentations, and official regulatory filings. We supplement this with insights from reputable financial news outlets and industry-specific market research reports to provide a robust competitive landscape assessment.