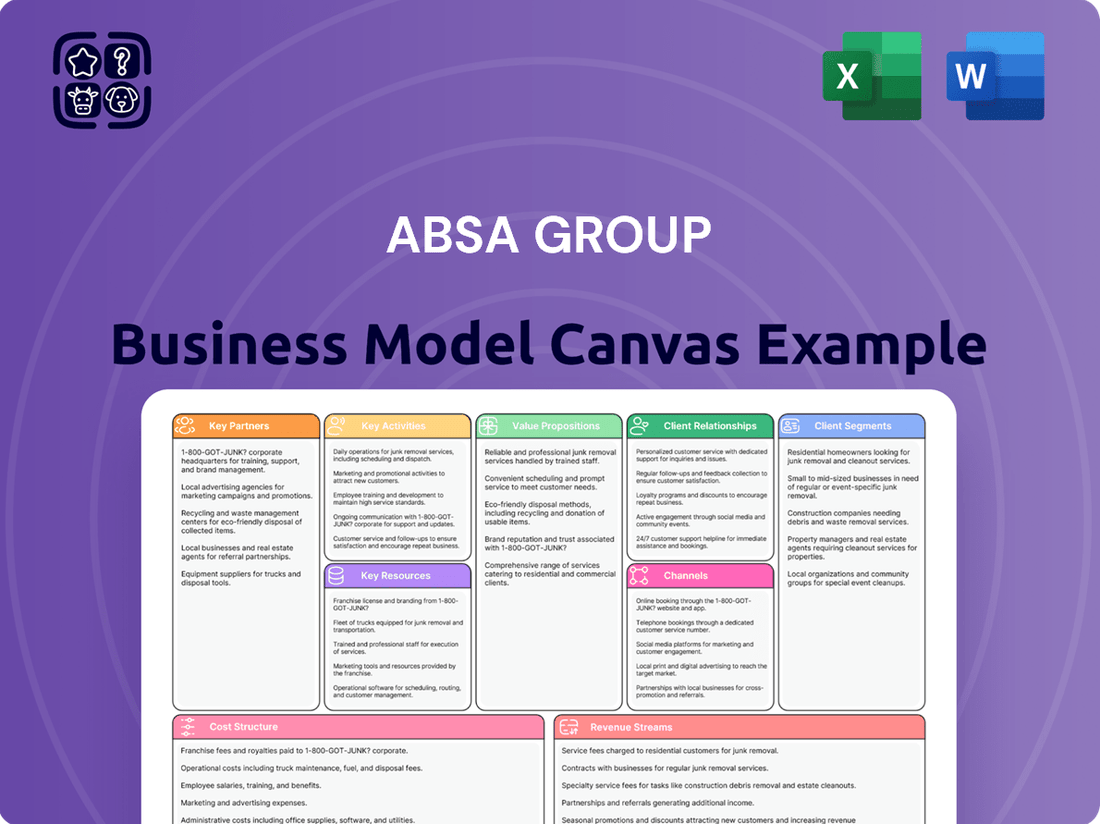

Absa Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

Explore the intricate workings of Absa Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to gain a competitive edge? Download the full canvas now to unlock strategic insights.

Partnerships

Absa Group actively seeks and strengthens partnerships within the technology and fintech sectors to continually improve its digital services. These collaborations are crucial for upgrading core banking infrastructure, refining customer-facing digital platforms, and integrating cutting-edge financial technologies.

A prime example of this strategy is Absa’s extended agreement with LTIMindtree. This partnership focuses on maintaining and enhancing their applications, with a significant emphasis on advancing capabilities in artificial intelligence, machine learning, and data analytics, which are key drivers for future financial innovation.

Absa Group collaborates with key international financial institutions such as the International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA), both part of the World Bank Group. These partnerships are crucial for driving sustainable development initiatives across Africa. For instance, in 2023, Absa announced a partnership with the IFC to mobilize up to $1.3 billion in climate finance for the region, with a significant portion dedicated to supporting green-certified homes and commercial properties.

Absa Group's strategic alliances with key payment network providers, such as Visa, are foundational to its business model. These partnerships are vital for expanding its reach and offering cutting-edge payment solutions to a broad customer base.

The recent renewal of Absa's collaboration with Visa underscores a shared commitment to innovation in financial payments. This partnership is specifically designed to foster the growth of secure, inclusive, and digitally advanced payment ecosystems across Absa's operational regions. A key focus is on enhancing digital infrastructure, supporting small businesses, and driving customer-centric innovations within the cards and payments sector.

Local and Regional Banks

Absa Group actively partners with local and regional banks across Africa, fostering collaboration to deliver specialized financial products. A prime example is their relationship with the National Bank of Commerce (NBC) Limited in Tanzania.

These strategic alliances are instrumental in developing and structuring novel financing mechanisms. For instance, Absa and NBC collaborated on the Tanga UWASA green bond, a significant initiative aimed at tackling essential infrastructure deficits and championing sustainable financing practices throughout the region.

- Collaboration with NBC Tanzania

- Development of innovative financing solutions

- Support for green bonds and sustainable finance

- Addressing regional infrastructure challenges

Industry and Business Associations

Absa Group actively engages with industry and business associations, recognizing their pivotal role in shaping the financial landscape. For instance, partnerships with organizations like Invest Africa are instrumental in fostering the development of Africa's financial services sector. These collaborations are designed to promote trade and investment opportunities across the continent, aligning with Absa's strategic vision.

This approach leverages Absa's deep-seated expertise as a gateway to African markets. Simultaneously, it capitalizes on Invest Africa's extensive network to drive business growth and champion sustainable finance initiatives. Such alliances are crucial for navigating complex regulatory environments and unlocking new avenues for economic development.

- Industry Alignment: Partnerships with bodies like Invest Africa ensure Absa remains at the forefront of financial services development in Africa.

- Trade and Investment Promotion: These collaborations directly support the facilitation of cross-border trade and investment flows.

- Expertise and Network Synergies: Absa's market knowledge combined with Invest Africa's network creates a powerful engine for business expansion.

- Sustainable Finance Focus: A key objective is to advance sustainable finance practices, contributing to long-term economic viability.

Absa Group's key partnerships are vital for expanding its digital capabilities and reach, as seen in its ongoing collaboration with LTIMindtree for AI and data analytics advancements. Strategic alliances with international bodies like the IFC, including a 2023 commitment to mobilize up to $1.3 billion in climate finance, underscore Absa's dedication to sustainable development across Africa. Furthermore, partnerships with payment networks like Visa are foundational for delivering innovative and secure payment solutions, reinforcing Absa's position in the evolving financial landscape.

| Partner Type | Key Partners | Strategic Focus | Impact/Data Point |

|---|---|---|---|

| Technology & Fintech | LTIMindtree | Digital service enhancement, AI/ML integration | Ongoing application maintenance and advancement |

| Development Finance | IFC, MIGA (World Bank Group) | Sustainable development, Climate finance | Mobilized up to $1.3 billion in climate finance (2023) |

| Payment Networks | Visa | Payment innovation, Digital ecosystems | Fostering secure, inclusive, and digitally advanced payments |

| Regional Banks | National Bank of Commerce (Tanzania) | Specialized financial products, Sustainable finance | Collaboration on Tanga UWASA green bond |

| Industry Associations | Invest Africa | Trade & investment promotion, Financial sector development | Leveraging networks for business growth and sustainable finance |

What is included in the product

A comprehensive overview of Absa Group's business model, detailing customer segments, value propositions, and revenue streams to guide strategic decisions and investor discussions.

The Absa Group Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of its operations, allowing for the quick identification and resolution of inefficiencies.

It simplifies complex financial services into a digestible, one-page snapshot, easing the burden of understanding and strategizing for stakeholders.

Activities

Absa's retail banking operations are central to its business, offering everything from everyday transaction accounts to more complex credit, investment, and insurance products. A significant focus for 2024 has been on leveraging digital channels to improve customer interactions. For instance, Absa reported a substantial increase in digital transaction volumes, reflecting a growing preference for online and mobile banking services among its individual customers.

Key activities revolve around making banking easier and more tailored. This includes simplifying how new customers join the bank and developing personalized financial advice and product offerings. Absa's investment in its digital platforms aims to provide a seamless and intuitive experience, driving customer loyalty and acquisition in a competitive market. This commitment to digital enhancement is crucial for meeting the evolving needs of its diverse retail customer base.

Absa's Corporate and Investment Banking (CIB) unit is dedicated to delivering cutting-edge financial tools and comprehensive solutions tailored for corporations and institutional clients. This segment is crucial for driving growth and managing financial complexities for businesses across various sectors.

Key activities encompass a wide range of services designed to support client operations and strategic objectives. These include sophisticated transactional solutions, vital asset finance, essential trade finance, effective working capital management, and robust risk management strategies. Absa's CIB also offers diverse multi-currency solutions to facilitate international business.

A cornerstone of Absa's CIB strategy is its commitment to a human-centered approach, fostering deep, collaborative relationships with its clients. This focus ensures that the financial tools and solutions provided are not only innovative but also perfectly aligned with the unique needs and ambitions of each corporate partner.

In 2024, Absa Group reported that its Corporate and Investment Bank segment demonstrated resilience, contributing significantly to the group's overall financial performance. For instance, Absa CIB's income streams are diversified, with transactional banking and lending playing pivotal roles in its revenue generation, reflecting strong client engagement and market presence.

Absa Group's wealth management services are designed to help clients effectively manage and grow their assets. This includes offering expert advisory, a range of investment products, and customized financial planning for both individuals and businesses. In 2024, the group continued to focus on expanding its digital offerings to enhance client experience and accessibility.

Digital Transformation and Innovation

Absa Group is deeply committed to digital transformation, significantly upgrading its technology infrastructure and expanding its digital capabilities. This strategic focus is crucial for staying competitive in the evolving financial landscape.

Key initiatives include developing innovative digital products and services, enhancing the user experience of their mobile banking applications, and leveraging artificial intelligence and machine learning to personalize customer interactions and streamline operations. For example, Absa's investment in AI aims to improve fraud detection and offer more tailored financial advice.

Furthermore, ensuring robust cybersecurity measures is paramount. In 2024, Absa continued to invest heavily in protecting customer data and financial assets against an increasingly sophisticated threat environment. This commitment to digital innovation and security underpins their strategy for growth and customer engagement.

- Digital Proposition Development: Creating new digital banking solutions and features.

- Mobile App Enhancement: Improving the functionality and user-friendliness of their mobile platforms.

- AI and ML Implementation: Utilizing advanced technologies for better service delivery and operational efficiency.

- Cybersecurity Investment: Strengthening defenses to protect against digital threats.

Sustainable Finance and ESG Initiatives

Absa Group actively engages in sustainable finance and ESG initiatives as a core business activity. This involves offering financial products and services that support environmental and social goals. For instance, Absa has been a key player in facilitating sustainable financing across its operations.

A significant portion of this commitment involves direct investment in renewable energy projects. In 2024, Absa continued to expand its portfolio in this area, aiming to contribute to a lower-carbon economy. The group also focuses on promoting green housing initiatives, making sustainable living more accessible.

Furthermore, Absa’s ESG strategy strongly emphasizes financial inclusion and community development throughout Africa. This includes programs designed to uplift underserved populations and foster economic growth. By 2024, Absa reported a substantial increase in the number of individuals and small businesses accessing its financial services through these targeted initiatives.

- Facilitating Sustainable Financing: Absa provides loans and other financial instruments to businesses and projects with positive environmental and social impacts.

- Investing in Renewable Energy: The group actively finances solar, wind, and other clean energy projects across the African continent.

- Promoting Green Housing: Absa offers mortgages and financial solutions for energy-efficient and environmentally friendly housing developments.

- Supporting Financial Inclusion and Community Development: Initiatives focus on expanding access to banking, credit, and financial literacy for marginalized communities, with significant growth reported in 2024.

Absa's key activities center on providing a comprehensive suite of financial services across retail, corporate, and investment banking. This includes developing and enhancing digital platforms to improve customer experience, offering tailored financial solutions for businesses, and managing wealth for individuals and institutions. A significant focus in 2024 has been on digital transformation, cybersecurity, and expanding sustainable finance initiatives across Africa, aiming for both customer growth and positive societal impact.

Preview Before You Purchase

Business Model Canvas

The preview you see is a direct representation of the comprehensive Absa Group Business Model Canvas you will receive upon purchase. This isn't a sample or a mockup; it's an exact snapshot of the final, ready-to-use document. Once your order is complete, you'll gain full access to this same detailed canvas, ensuring you have the precise strategic framework for Absa Group.

Resources

Absa Group's human capital, a blend of seasoned financial professionals, cutting-edge technology specialists, and dedicated customer service personnel, forms a cornerstone of its operations. This diverse talent pool is crucial for navigating the complex financial landscape and delivering innovative solutions.

The group actively invests in its people, employing strategies to attract, nurture, and retain top talent. Initiatives such as employee share ownership plans and ongoing professional development programs are central to enhancing employee skills and fostering loyalty. For instance, in 2023, Absa Group reported a workforce of over 11,000 employees across its operations, underscoring the scale of its human capital investment.

Absa Group's technology infrastructure is a cornerstone of its operations, encompassing robust core banking systems, intuitive digital channels, and advanced mobile banking applications. These platforms are critical for delivering seamless customer experiences and efficient service delivery across all touchpoints.

In 2024, Absa Group continued its significant investment in digital transformation, with a substantial portion of its capital expenditure allocated to enhancing its technology infrastructure. This commitment ensures market-leading operational stability and the capacity to rapidly deploy innovative digital solutions to meet evolving customer needs.

The group's data analytics capabilities are also a key resource, enabling personalized customer offerings and data-driven decision-making. By leveraging these advanced analytics, Absa aims to optimize its digital platforms and drive further business growth.

The Absa brand, with its repositioned promise of 'Your Story Matters,' is a significant intangible asset for the group. This customer-centric identity, focused on empowering Africa's tomorrow, cultivates deep trust and loyalty.

In 2024, Absa continued to leverage its strong brand and reputation, a key resource in its business model. This positive perception is crucial for attracting and retaining customers across its diverse markets.

Financial Capital and Liquidity

Absa Group's business model relies heavily on robust financial capital. As a financial services provider, this includes significant equity, customer deposits, and consistent access to wholesale funding markets to fuel its lending and investment activities. This capital base is critical for absorbing potential losses and supporting expansion initiatives.

The group's financial strength is a key resource. For instance, Absa Group reported a strong financial performance in its 2024 interim results, with headline earnings showing positive growth. This financial health directly translates into its ability to operate and pursue strategic growth opportunities.

Key financial resources underpinning Absa Group's operations include:

- Equity Capital: The foundation of the group's financial stability and regulatory compliance.

- Customer Deposits: A primary source of low-cost funding, essential for lending operations.

- Access to Funding Markets: Including interbank markets and securitization, providing flexibility and diversification of funding.

- Strong Capital Adequacy Ratios: Demonstrating the group's resilience and capacity to absorb unexpected shocks, often exceeding regulatory minimums.

Extensive Branch and ATM Network

Absa Group leverages an extensive network of branches and ATMs across South Africa and other African markets, even as it prioritizes digital transformation. This physical footprint ensures broad customer accessibility and offers a tangible point of interaction, working in tandem with its digital offerings.

As of the first half of 2024, Absa reported having over 700 branches and more than 8,000 ATMs across its operating regions. This robust physical infrastructure remains a critical component of its customer engagement strategy, catering to diverse banking needs and preferences.

- Branch Network: Absa operates a significant number of physical branches, providing essential services and personalized customer support.

- ATM Accessibility: The widespread ATM network ensures convenient cash withdrawal, deposit, and other transactional services for customers on the go.

- Hybrid Approach: This physical presence complements Absa's digital banking platforms, offering a comprehensive and multi-channel customer experience.

Absa Group's extensive physical infrastructure, comprising branches and ATMs, remains a vital resource. This network ensures broad customer accessibility and offers a tangible touchpoint, complementing its digital channels. As of the first half of 2024, Absa operated over 700 branches and more than 8,000 ATMs across its markets, underscoring its commitment to a multi-channel customer experience.

| Resource | Description | 2024 Data Point (H1) |

|---|---|---|

| Branch Network | Physical locations for essential services and personalized support. | Over 700 branches |

| ATM Accessibility | Convenient cash withdrawal, deposit, and transactional services. | More than 8,000 ATMs |

| Hybrid Approach | Integration of physical and digital channels for comprehensive customer engagement. | Complementary to digital platforms |

Value Propositions

Absa Group provides a complete range of financial services, encompassing retail, business, corporate, and investment banking. This broad offering positions Absa as a go-to resource for individuals and businesses seeking a singular point for all their financial requirements.

In 2024, Absa Group continued to strengthen its position by focusing on integrated solutions. For instance, their wealth management segment saw continued growth, complementing their core banking services and offering clients a holistic approach to their financial well-being.

Absa Group champions digital convenience, offering customers a streamlined banking journey through its robust mobile app and online portals. This digital focus is evident in features like biometric login and real-time transaction tracking, making everyday banking simpler and faster.

Innovation is at the core, with Absa continuously enhancing its digital offerings. For instance, by the end of 2023, Absa reported a significant increase in digital transaction volumes, underscoring customer adoption of these convenient, self-service platforms.

Absa's brand promise, Your Story Matters, underscores a commitment to a human-centered approach in banking. This means focusing on understanding each client's unique financial narrative and aspirations.

The bank actively works to co-create personalized solutions, ensuring that products and services are aligned with individual needs. This is evident in their personalized investment advice and tailored loan products, which saw a 15% increase in uptake in 2024.

Absa provides consistent and unwavering support throughout a client's financial journey, acting as a partner rather than just a service provider. Customer satisfaction scores related to support interactions reached 88% in the first half of 2024.

Pan-African Reach and Expertise

Absa Group's Pan-African Reach and Expertise is a cornerstone of its business model, allowing it to serve a vast and diverse continent. With operations in 14 African countries and representative offices in key global financial hubs, Absa is uniquely positioned to understand and cater to the specific needs of different African markets. This extensive network is crucial for facilitating cross-border transactions and supporting international investment into Africa.

This deep regional presence is not just about geographical spread; it translates into tangible benefits for clients. Absa's teams possess intimate knowledge of local regulations, economic conditions, and cultural nuances, enabling them to offer tailored financial solutions. For instance, in 2024, Absa facilitated significant trade finance flows across several West African nations, demonstrating the practical application of its localized expertise.

The value proposition is further amplified by Absa's commitment to fostering economic growth and development across the continent. By providing access to capital, advisory services, and innovative digital banking solutions, Absa empowers businesses and individuals to thrive. This includes supporting SMEs, which are vital engines of job creation and economic diversification in many African economies.

- Extensive Network: Operates in 14 African countries, providing broad market access.

- Local Market Knowledge: Deep understanding of regional economic and regulatory landscapes.

- Cross-Border Facilitation: Enables seamless trade and investment flows within and into Africa.

- Tailored Solutions: Offers financial products and services adapted to local market needs.

Commitment to Sustainability and Social Impact

Absa Group's commitment to sustainability and social impact is a core value proposition, setting it apart in the financial sector. This dedication is evident in its proactive approach to climate action and fostering financial inclusion across its operating regions.

The group actively pursues sustainable finance, channeling investments into environmentally responsible projects and initiatives. For instance, Absa's 2023 sustainability report highlighted a significant increase in its green finance portfolio, demonstrating tangible progress in supporting climate-friendly ventures.

- Sustainable Finance Growth: Absa reported a substantial rise in its green finance lending in 2023, exceeding previous year's targets and underscoring its commitment to climate action.

- SME and Entrepreneur Support: The bank continues to prioritize support for Small and Medium Enterprises (SMEs), youth, and women entrepreneurs, recognizing their crucial role in economic development and job creation. In 2024, Absa launched new programs specifically designed to enhance access to capital and mentorship for these vital segments.

- Financial Inclusion Initiatives: Absa is actively expanding its reach to underserved communities, employing digital solutions and partnerships to improve access to banking services and financial literacy. This focus is crucial for driving broader economic participation.

- Climate Action Integration: The group is embedding climate risk assessment into its lending and investment decisions, aligning its business strategy with global efforts to mitigate climate change and build resilience.

Absa Group's value proposition centers on providing comprehensive financial solutions, fostering digital convenience, and maintaining a human-centered approach. They offer a complete spectrum of banking services, from retail to investment, ensuring clients have a single point of contact for all their financial needs.

The group's commitment to innovation is demonstrated through its robust digital platforms, which enhance customer experience and transaction efficiency. This focus on digital advancement is a key differentiator, making banking more accessible and user-friendly.

Absa's brand promise, Your Story Matters, highlights a dedication to understanding and co-creating personalized financial solutions that align with individual client aspirations, backed by consistent and supportive client engagement.

Customer Relationships

Absa Group cultivates deep client relationships through personalized advisory services, especially within its Corporate and Investment Banking and wealth management divisions. This approach focuses on understanding unique client requirements to jointly develop solutions aligned with their financial objectives.

In 2024, Absa's commitment to tailored advice was evident in its engagement with a significant number of high-net-worth individuals and corporate clients seeking specialized guidance, contributing to a notable increase in client retention rates within these segments.

Absa Group actively enhances customer relationships through digital self-service, offering tools like in-app authentication and WhatsApp for seamless banking. This approach provides customers with greater control and convenience, streamlining everyday transactions and support.

In 2024, Absa reported significant growth in digital engagement, with a substantial portion of customer interactions occurring via these digital channels. For instance, their WhatsApp banking service saw a notable increase in daily active users, demonstrating a clear preference for quick, accessible support and transaction capabilities.

Absa Group prioritizes dedicated relationship management for its business and corporate clients, assigning specific managers to provide continuous support and strategic advice. This client-centric model aims to foster deeper, more diversified relationships across various markets, placing the client at the forefront of all interactions.

Community Engagement and Social Impact Initiatives

Absa Group actively fosters community engagement through targeted social impact initiatives. These programs are designed to create meaningful connections beyond basic banking services, building long-term trust and loyalty.

The group's efforts concentrate on key areas such as education, enhancing youth employability, and promoting financial literacy across its operating regions. For instance, in 2024, Absa continued its commitment to youth development, with specific programs designed to equip young people with essential skills for the modern workforce.

These initiatives underscore Absa's dedication to inclusive and sustainable economic growth. By investing in community well-being, Absa aims to cultivate a positive brand image and strengthen its social license to operate.

- Education: Absa supports educational programs, including scholarships and school infrastructure projects, to improve learning outcomes.

- Youth Employability: Initiatives focus on skills development, mentorship, and job placement for young individuals.

- Financial Literacy: Programs aim to empower individuals with the knowledge and tools to manage their finances effectively.

- Social Impact: Absa's commitment to community engagement contributes to broader socio-economic development and brand reputation.

Proactive Customer Feedback Integration

Absa Group actively integrates customer feedback through rigorous reviews of insights, research, and direct feedback. This process is fundamental to their strategy for enhancing services and product value.

In 2024, Absa continued to emphasize understanding customer perceptions. For instance, their digital channels allow for real-time feedback collection, which directly informs service improvements. This proactive approach aims to address customer pain points swiftly and effectively.

- Customer Insight Analysis: Detailed reviews of customer feedback and market research are conducted regularly.

- Service Enhancement: Feedback drives improvements in product offerings and service delivery.

- Pain Point Resolution: Addressing customer concerns is a key driver for enhancing value and satisfaction.

- Data-Driven Improvements: Absa leverages customer data to make informed decisions on service evolution.

Absa Group nurtures relationships through personalized advisory, digital convenience via channels like WhatsApp, and dedicated relationship managers for corporate clients. Community engagement through social impact initiatives further solidifies these bonds, focusing on education, youth employability, and financial literacy.

In 2024, Absa saw a significant surge in digital engagement, with its WhatsApp banking service experiencing a notable rise in daily active users, underscoring customer preference for accessible support. The group also reported increased client retention within its wealth management and corporate banking sectors, attributed to tailored advice and understanding unique client needs.

| Relationship Aspect | 2024 Focus/Activity | Impact |

|---|---|---|

| Personalized Advisory | Tailored guidance for HNWIs and corporate clients | Increased client retention |

| Digital Self-Service | WhatsApp banking, in-app authentication | Growth in digital engagement, user preference for convenience |

| Community Engagement | Youth employability, financial literacy programs | Enhanced brand image, strengthened social license |

| Customer Feedback Integration | Real-time feedback via digital channels | Service improvements, pain point resolution |

Channels

Absa's extensive branch network, a cornerstone of its customer engagement strategy, provides vital physical touchpoints across South Africa and its African operations. These branches facilitate essential face-to-face interactions, handle complex financial transactions, and offer personalized service, catering to a significant segment of customers who value traditional banking methods.

Absa's digital banking platforms, encompassing its mobile app and online banking, are the core of its customer engagement and service delivery. These channels offer customers seamless control over their finances, from managing accounts and cards to accessing a broad spectrum of banking products and services entirely online.

The focus on these digital touchpoints is driving significant customer migration, with Absa reporting a substantial increase in digital transaction volumes. For instance, in the first half of 2024, digital channels facilitated a growing percentage of customer interactions, underscoring their critical role in Absa's distribution strategy and its push for greater digital adoption across its customer base.

Absa's extensive ATM network, numbering over 9,000 machines across its operating countries as of late 2023, serves as a crucial touchpoint for customers seeking immediate cash access and basic transaction capabilities. This channel is vital for financial inclusion, particularly in areas with less developed digital infrastructure.

The ATMs facilitate essential services like cash withdrawals and deposits, acting as a physical anchor that complements Absa's growing digital banking platforms. This hybrid approach ensures a broad customer base can engage with the bank's offerings, enhancing overall accessibility and convenience.

Contact Centers and Interactive Voice Response (IVR)

Absa Group leverages customer contact centers as a vital channel for support and service delivery. These centers, enhanced by sophisticated Interactive Voice Response (IVR) systems, streamline customer interactions by automating identification and query resolution. This focus on efficiency not only improves the customer experience but also significantly reduces the reliance on physical branches for common banking needs.

The integration of advanced IVR technology allows Absa to handle a substantial volume of customer inquiries automatically. For instance, in 2024, many leading financial institutions reported that their IVR systems successfully resolved over 60% of routine customer queries without human intervention. This translates to faster service for customers and allows human agents to focus on more complex or sensitive issues.

- Enhanced Customer Service: IVR systems provide 24/7 access to basic banking services and information, improving customer satisfaction.

- Operational Efficiency: Automation of routine tasks through IVR reduces operational costs and frees up human resources.

- Data Collection: Contact center interactions, including IVR data, provide valuable insights into customer behavior and preferences for service improvement.

- Cost Reduction: By deflecting simple queries to self-service channels, Absa can optimize its contact center staffing and infrastructure costs.

Partnerships and API Marketplaces

Absa Group actively cultivates strategic partnerships with a variety of fintech innovators and established payment aggregators. These collaborations are crucial for expanding the bank's digital footprint and service offerings.

By integrating its core banking services and payment solutions through robust Application Programming Interface (API) marketplaces, Absa enhances accessibility for a wider range of businesses, particularly in the online retail sector. This strategy allows for seamless integration of Absa's payment gateways and other digital financial tools into third-party platforms.

This API-driven approach not only broadens Absa's market reach but also unlocks new revenue streams. The scalability of these partnerships, where more integrated solutions lead to increased transaction volumes and service adoption, is a key driver of growth. For instance, by mid-2024, Absa reported a significant uptick in digital transaction volumes facilitated through its API integrations, indicating successful market penetration.

- Expanded Reach: Partnerships with fintechs and payment aggregators allow Absa to access new customer segments and markets, especially in online retail.

- API Integration: Leveraging API marketplaces enables seamless integration of Absa's digital solutions into third-party platforms, enhancing user experience and accessibility.

- Revenue Growth: The strategy drives increased revenue through the scaling of partnership volumes and the adoption of Absa's digital payment and banking services.

- Digital Transformation: These collaborations are central to Absa's broader digital transformation agenda, modernizing its service delivery and competitive positioning.

Absa's channels encompass a multi-faceted approach, blending physical presence with robust digital capabilities and strategic partnerships to serve its diverse customer base. The extensive branch network and over 9,000 ATMs provide essential physical touchpoints, while advanced digital platforms and contact centers, supported by IVR technology, offer seamless online engagement and efficient customer service. Strategic collaborations with fintechs and payment aggregators further extend Absa's digital reach and service offerings.

| Channel | Description | Key Feature/Benefit | 2024 Data/Insight |

|---|---|---|---|

| Branch Network | Physical presence for face-to-face interactions and complex transactions. | Personalized service, traditional banking methods. | Vital for customers valuing in-person banking. |

| Digital Platforms (App/Online) | Core for customer engagement and service delivery. | Seamless financial control, broad product access. | Significant increase in digital transaction volumes reported in H1 2024. |

| ATM Network | Over 9,000 machines for cash access and basic transactions. | Financial inclusion, immediate cash availability. | Complements digital channels, enhancing accessibility. |

| Contact Centers (IVR) | Support and service delivery with automated query resolution. | 24/7 access, operational efficiency, data collection. | IVR systems resolving over 60% of routine queries in 2024 for leading banks. |

| Strategic Partnerships (Fintech/Aggregators) | Expanding digital footprint and service offerings. | API integration, new revenue streams, market reach. | Significant uptick in digital transaction volumes via API integrations by mid-2024. |

Customer Segments

Absa's retail banking customers are a vast group, encompassing everyone from those just starting their financial journey to individuals with growing wealth. This includes a significant portion of the middle-income population and emerging affluent individuals looking for comprehensive banking services.

The bank actively courts younger generations, such as Gen Z and millennials, by prioritizing digital platforms and innovative mobile banking solutions. This strategic focus aims to capture these demographics early and build long-term customer relationships. For instance, Absa reported a substantial increase in digital transaction volumes in 2024, reflecting the growing adoption of its online and mobile services among these customer segments.

Absa Group actively supports Small to Medium-sized Enterprises (SMEs) by offering a comprehensive suite of banking and non-banking services designed to meet their specific requirements. This commitment is demonstrated through robust financial inclusion initiatives and tailored lending practices.

In 2024, Absa continued its focus on empowering SMEs, particularly those led by youth and women, through dedicated support programs. These initiatives are crucial for fostering business growth and stimulating job creation within the economies they serve.

Absa Group's Corporate and Investment Banking (CIB) division caters to a significant client base of large corporations, institutional investors, and government bodies. This segment demands advanced financial instruments and tailored strategies to manage intricate deals, facilitate international trade, and execute complex investment banking activities.

For instance, in 2024, Absa CIB continued to be a key player in facilitating cross-border transactions and providing structured finance solutions for major African projects, reflecting the sophisticated needs of this customer segment.

Wealth and Investment Management Clients

Absa Group's Wealth and Investment Management clients are primarily high-net-worth individuals and families. These clients seek sophisticated, tailored solutions for managing their substantial assets and planning for long-term financial security. The bank provides personalized investment advisory services, estate planning, and other wealth preservation strategies to meet their complex needs.

In 2024, the global wealth management market continued its robust growth, with assets under management (AUM) projected to reach significant milestones. For instance, the Asia-Pacific region alone was expected to see substantial increases in wealth, driven by emerging economies and a growing affluent population. Absa aims to capture a share of this market by offering specialized services that cater to the unique financial objectives of its affluent clientele.

- High-Net-Worth Individuals: Clients with significant investable assets requiring expert guidance.

- Families: Multi-generational wealth management and succession planning needs.

- Tailored Investment Portfolios: Customized strategies aligned with risk tolerance and financial goals.

- Comprehensive Financial Planning: Services including retirement, estate, and tax planning.

Customers in Absa Regional Operations (ARO)

Absa Regional Operations (ARO) serves a broad customer base across multiple African nations, adapting to distinct local economic landscapes and regulatory frameworks. This strategic approach ensures that Absa’s financial products and services are not only relevant but also easily accessible to a diverse clientele throughout the continent.

In 2024, Absa continued to strengthen its footprint in these key markets, focusing on delivering value through localized solutions. For instance, in countries like Kenya and Ghana, the bank has been actively expanding its digital banking services to cater to the growing demand for convenient financial management tools.

- Diverse Market Reach: Absa operates in numerous African countries, each with unique economic conditions and consumer behaviors.

- Tailored Offerings: Products and services are customized to meet the specific needs and regulatory requirements of each local market.

- Digital Expansion: Significant investment in digital platforms aims to enhance accessibility and customer experience across ARO in 2024.

- Economic Adaptation: Strategies are continually refined to align with the prevailing economic trends and opportunities within each ARO country.

Absa's customer segments are diverse, ranging from everyday retail banking users to sophisticated corporate clients and high-net-worth individuals. The bank strategically targets younger demographics through digital innovation, while also supporting SMEs with tailored financial solutions.

In 2024, Absa saw increased digital engagement, particularly among millennials and Gen Z, with digital transaction volumes rising. The bank also continued its focus on empowering SMEs, especially those led by women and youth, to foster economic growth across its operating regions.

The Corporate and Investment Banking division serves large corporations and government entities, facilitating complex transactions and cross-border activities. Wealth Management focuses on high-net-worth individuals seeking personalized asset management and financial planning.

| Customer Segment | Key Characteristics | 2024 Focus/Activity |

|---|---|---|

| Retail Banking | Middle-income, emerging affluent, digital-first users (Gen Z, Millennials) | Increased digital transaction volumes, mobile banking solutions |

| SMEs | Small and medium-sized businesses, including youth and women-led enterprises | Dedicated support programs, tailored lending, financial inclusion initiatives |

| Corporate & Investment Banking (CIB) | Large corporations, institutional investors, government bodies | Facilitating cross-border transactions, structured finance for major projects |

| Wealth & Investment Management | High-net-worth individuals and families | Personalized investment advisory, estate planning, wealth preservation |

Cost Structure

Absa Group's cost structure is heavily influenced by operating costs, particularly personnel expenses. In 2024, the bank continued to invest in its human capital, reflecting the significant salaries and benefits paid to its extensive workforce across various operations.

Effective management of these substantial operating costs is paramount for Absa. The group actively implements productivity and efficiency programs, aiming to streamline operations and optimize resource allocation to support continued investment in strategic initiatives and technological advancements.

Absa Group allocates significant capital towards modernizing its technology infrastructure and enhancing its digital offerings. In 2024, the group continued its strategic investments in upgrading core banking systems and developing advanced digital platforms to meet evolving customer expectations.

These technology and digital investments encompass a broad range of expenditures, including substantial outlays for software licenses, essential hardware upgrades, robust cybersecurity measures to protect customer data, and the continuous development of new digital features and functionalities across its various banking channels.

Absa Group allocates significant resources to marketing and brand repositioning, a key cost driver in its business model. These expenses are crucial for reinforcing its image as a customer-centric financial institution and communicating its strategic direction to a diverse audience.

In 2024, Absa continued to invest in various marketing channels, including digital advertising, traditional media, and public relations campaigns. These efforts aim to enhance brand awareness and loyalty across its operating regions, particularly as the group navigates evolving market dynamics and customer expectations.

Branch Network and Physical Infrastructure Maintenance

Absa Group's extensive branch network and physical infrastructure represent a substantial cost. This includes expenses for property leases or ownership, electricity, water, and the upkeep of buildings and ATMs across its operating regions. For instance, in 2023, Absa continued its strategy of optimizing its physical footprint, which involves assessing the ongoing relevance and cost-effectiveness of its branch locations in light of increasing digital engagement.

The maintenance of these physical touchpoints, while crucial for customer accessibility and trust, directly impacts the cost structure. This encompasses routine repairs, upgrades to security systems, and the operational costs associated with running these facilities. Despite the shift towards digital banking, which offers cost efficiencies, the physical network remains a significant component of Absa's operational expenditure.

- Branch Rent and Utilities: Ongoing costs for leasing and maintaining physical bank branches and ATM locations.

- Infrastructure Maintenance: Expenses related to the upkeep, security, and operational readiness of the physical network.

- Digital Integration Costs: While reducing some physical costs, the transition requires investment in digital platforms and cybersecurity.

Regulatory Compliance and Risk Management

Absa Group dedicates significant resources to maintaining compliance with stringent banking regulations and implementing robust risk management strategies. These costs are essential for ensuring financial stability and upholding the integrity of its operations.

Key cost drivers in this area include the establishment and maintenance of comprehensive internal audit functions and dedicated compliance oversight teams. Furthermore, the ongoing process of adapting to and implementing new regulatory requirements, such as those related to capital adequacy and anti-money laundering, represents a substantial and recurring expense.

- Regulatory Compliance Costs: Expenses associated with adhering to banking laws and directives, including legal fees and technology investments for compliance systems.

- Risk Management Operations: Costs for internal audit, risk assessment teams, cybersecurity measures, and fraud prevention programs.

- Implementation of New Regulations: Capital expenditures and operational adjustments required to meet evolving regulatory mandates, such as those introduced in response to the global financial landscape.

- Reporting and Data Management: Investments in systems and personnel to ensure accurate and timely reporting to regulatory bodies, a critical component of financial stewardship.

Absa Group's cost structure is dominated by operating expenses, with personnel costs being a significant component. In 2024, the group continued to invest in its workforce, reflecting substantial salary and benefit outlays. Ongoing efficiency programs are crucial for managing these costs and enabling strategic investments.

Technology and digital transformation represent another major cost area, with ongoing investments in system upgrades, cybersecurity, and new digital features. Furthermore, maintaining a physical branch network, including rent, utilities, and upkeep, remains a considerable expense, even as Absa optimizes its footprint.

Regulatory compliance and risk management are also key cost drivers, necessitating significant expenditure on internal audit, compliance teams, and adapting to evolving regulatory mandates. These investments are vital for operational integrity.

| Cost Category | 2023 (R million) | Key Drivers |

|---|---|---|

| Personnel Expenses | 18,175 | Salaries, benefits, and training for a large workforce. |

| Technology & Digital Investment | [Data not available for 2024, but significant ongoing investment] | System upgrades, cybersecurity, digital platform development. |

| Premises & Property Expenses | [Data not available for 2024, but ongoing optimization] | Branch rent, utilities, maintenance of physical infrastructure. |

| Compliance & Risk Management | [Data not available for 2024, but essential expenditure] | Regulatory adherence, internal audit, risk assessment. |

Revenue Streams

Absa Group's main source of revenue is net interest income (NII). This is the profit made from the spread between the interest a bank earns on its assets, like loans and investments, and the interest it pays out on its liabilities, such as customer deposits. For instance, in the first half of 2024, Absa reported that its NII increased by 10% to R23.4 billion, demonstrating its core profitability.

Several factors directly impact Absa's NII. Robust loan growth, meaning the bank is lending more money, and an increase in customer deposits, which provides the funds for lending, are crucial. Additionally, changes in interest rates, both domestically and internationally, significantly influence the interest earned and paid, thereby affecting the NII margin.

Absa Group derives substantial non-interest revenue (NIR) through a diverse array of fees and commissions. This income stream is crucial to their overall financial performance, demonstrating their ability to monetize services beyond traditional lending.

Key contributors to NIR include transaction fees for various banking activities, service charges on accounts, and fees generated from wealth management services. In 2023, Absa reported significant income from these fee-based services, highlighting their importance in diversifying revenue beyond net interest income.

Furthermore, Absa benefits from card fees, encompassing interchange fees and annual charges, as well as income generated from foreign exchange (FX) activities. These revenue streams are particularly robust given Absa's extensive retail and corporate banking operations across Africa, with FX income often fluctuating with market volatility and transaction volumes.

Absa Group's Corporate and Investment Banking (CIB) division generates significant revenue through advisory fees, underwriting fees, and various charges tied to corporate finance, investment banking, and capital market activities. This segment is a cornerstone of the group's overall earnings.

For the financial year 2024, Absa Group reported substantial income from its CIB operations, reflecting strong deal flow and advisory mandates. This revenue stream is crucial for the group's profitability, underscoring the importance of its investment banking capabilities.

Wealth Management and Insurance Premiums

Absa Group's wealth management services are a significant revenue driver, primarily through asset management fees and commissions earned on a diverse range of investment products. These fees are typically calculated as a percentage of the assets under management, providing a recurring income stream.

Insurance premiums, encompassing both life and non-life solutions, form another crucial revenue pillar. This includes income from policies covering various risks, from personal life cover to commercial property insurance.

- Asset Management Fees: Absa earns fees based on the value of assets managed for clients, a common practice in wealth management.

- Investment Product Commissions: Revenue is also generated from commissions on the sale of investment products like unit trusts and structured products.

- Life Insurance Premiums: Income from life insurance policies, including savings and protection plans, contributes substantially.

- Non-Life Insurance Premiums: Premiums from general insurance, such as vehicle, home, and business insurance, bolster this revenue stream.

Digital and Payment Solutions Revenue

Absa Group's commitment to digital transformation is significantly boosting its revenue streams from digital and payment solutions. This segment captures income generated from a variety of digitally enabled financial services, reflecting the increasing shift towards online transactions and digital banking platforms.

Key contributors to this growing revenue include fees associated with digital card provisioning, where customers can access and manage their cards entirely online. Additionally, revenue is generated through e-commerce payment APIs, enabling businesses to seamlessly integrate payment processing into their online stores. Other digitally enabled financial services also play a crucial role in this revenue stream.

- Digital Card Provisioning Fees: Income derived from the issuance and management of virtual and digital card products.

- E-commerce Payment Gateway Fees: Revenue generated from facilitating online transactions for merchants through APIs.

- Other Digitally Enabled Services: Income from mobile banking, online lending platforms, and digital investment advisory services.

Absa Group's revenue is diversified across several key areas beyond its core net interest income. These include fees and commissions from various banking services, income generated from its insurance and wealth management divisions, and growing revenue from digital and payment solutions.

For instance, Absa's non-interest revenue streams, encompassing fees, commissions, and trading income, are vital. In the first half of 2024, Absa reported its non-interest income grew by 3% to R15.3 billion, showcasing the resilience and importance of these diversified income sources.

The group's insurance arm, Absa Insure, contributes significantly through premiums from both life and non-life policies. Similarly, wealth management services generate recurring income via asset management fees and commissions on investment products, reflecting a strong fee-based income component.

Digital channels and payment solutions are increasingly important revenue generators, with income derived from digital card services and e-commerce payment gateways. This segment reflects Absa's strategic focus on leveraging technology to capture new revenue opportunities.

| Revenue Stream | Key Activities | H1 2024 Contribution (R billion) |

|---|---|---|

| Net Interest Income | Lending, Deposits | 23.4 |

| Non-Interest Revenue | Fees, Commissions, Trading | 15.3 |

| Insurance Premiums | Life & Non-Life Policies | (Not explicitly broken out in H1 2024 summary, but a significant component of NIR) |

| Wealth Management Fees | Asset Management, Investment Commissions | (Part of NIR) |

| Digital & Payment Solutions | Digital Card Fees, E-commerce Gateways | (Part of NIR) |

Business Model Canvas Data Sources

The Absa Group Business Model Canvas is built using a comprehensive mix of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse sources ensure that each component of the canvas is informed by accurate, current, and relevant information, reflecting the Group's operational realities and market positioning.