Absa Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Absa Group Bundle

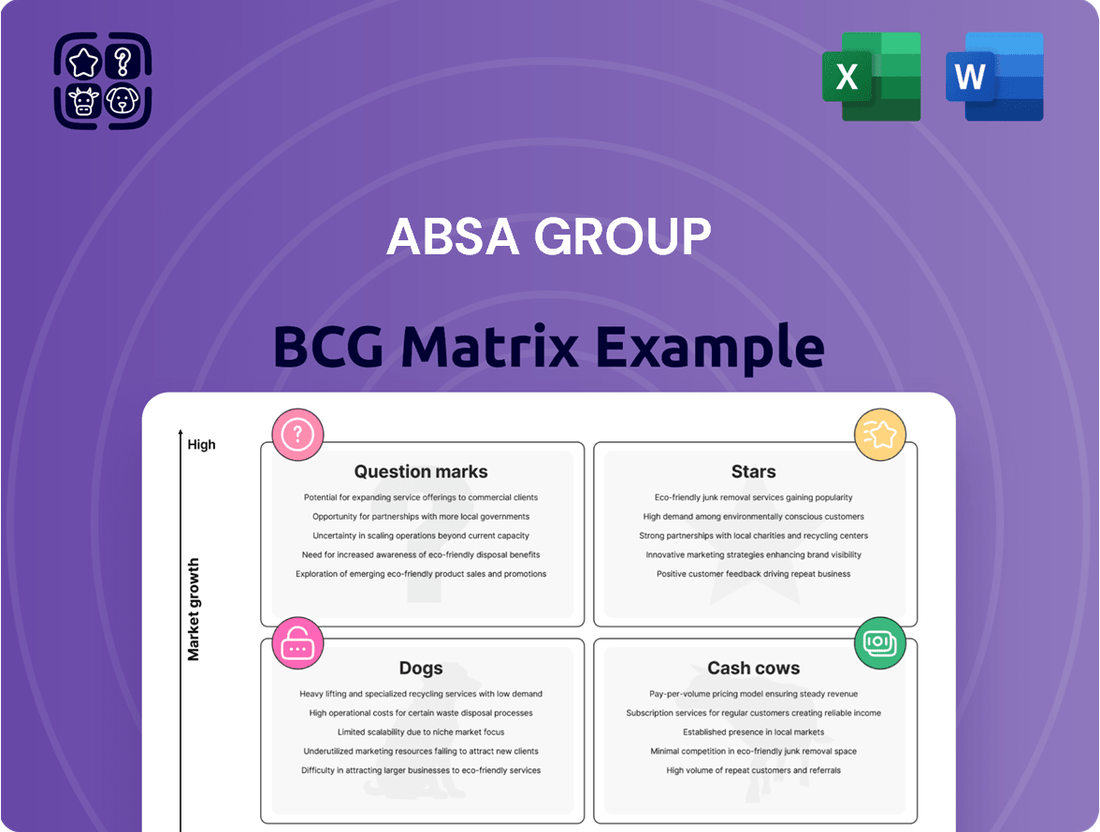

Curious about Absa Group's strategic positioning? Our BCG Matrix analysis reveals which of their business units are market leaders (Stars), consistent revenue generators (Cash Cows), resource drains (Dogs), or potential future successes (Question Marks). This preview offers a glimpse into their portfolio's health.

To truly understand Absa Group's competitive landscape and make informed investment decisions, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap to optimizing their product portfolio for maximum growth and profitability.

Stars

Absa's Corporate and Investment Banking (CIB) division is a powerhouse within the group, contributing significantly to its financial health. In 2024, this division posted an impressive 6% rise in headline earnings, reaching R11.7 billion. This robust performance underscores its role as a market leader in various financial services, aligning perfectly with Absa's ambition to be a digitally-driven bank across the African continent.

The CIB division's strength lies in its ability to generate substantial cash flow, a key indicator of its success. Operating within high-growth sectors in emerging African markets, and leveraging its extensive pan-African network, CIB clearly qualifies as a 'Star' in the BCG matrix. Its strategic importance and consistent financial generation position it for continued expansion and market dominance.

Absa Group's commitment to digital transformation is a significant driver in its BCG Matrix positioning. The company is channeling substantial investment into modernizing its core banking infrastructure, expanding its digital customer touchpoints, and integrating cutting-edge fintech solutions. This strategic emphasis on digital capabilities is yielding tangible results, evidenced by a notable 14% surge in digitally active customers across the Group in 2024.

These digital initiatives are poised to capture a larger market share as adoption grows, solidifying Absa's standing as a digital frontrunner. Consequently, these ventures are evolving into potential cash cows, generating increased revenue and profitability for the group.

Absa Group's sustainable finance initiatives are a clear strength, as evidenced by their achievement of surpassing the R100 billion mobilization target a full year ahead of schedule. Since 2021, they've channeled over R121 billion into crucial areas like renewable energy, infrastructure, and social development.

This impressive financial mobilization highlights Absa's strong market standing in the rapidly expanding sustainable finance sector. Their dedication to climate action, financial inclusion, and diversity makes their sustainable finance products highly attractive to investors and businesses prioritizing environmental and social impact.

Absa Regional Operations (ARO) Retail & Business Banking in Select Markets

Absa Regional Operations (ARO) Retail and Business Banking (RBB) experienced a mixed performance in 2024. While headline earnings saw a dip in the first half of the year, primarily due to unfavorable exchange rates, the full year presented a more positive picture. The segment reported a notable 12% increase in full-year headline earnings for 2024.

This growth was underpinned by robust constant currency revenue expansion and a rise in active customer numbers across several key markets. This suggests that specific regions within ARO RBB are performing exceptionally well, outperforming broader market trends and indicating Absa's growing market presence and leadership in these areas.

- Strong Constant Currency Revenue Growth: This indicates underlying business strength independent of currency movements.

- Increase in Active Customers: A growing customer base signifies successful customer acquisition and retention strategies.

- Market Share Gains: Positive performance in select markets suggests Absa is outperforming competitors and solidifying its position.

- Resilience Despite Exchange Rate Headwinds: The ability to grow earnings even with currency challenges highlights operational efficiency and strategic market focus.

Product Solutions Cluster (PSC)

Absa's Product Solutions Cluster (PSC), encompassing vital offerings like home loans, vehicle asset financing, and insurance, demonstrated robust performance in 2024. This cluster achieved a notable 38% surge in headline earnings, signaling a healthy expansion within these key financial product areas. This growth suggests Absa is effectively capturing more market share or increasing its customer engagement in these sectors.

The PSC's strong performance positions it as a 'Star' within Absa's business portfolio. This classification is due to its high growth trajectory and its expanding role in contributing to the group's overall financial success. The increasing demand for these financial products, especially in a dynamic economic environment, further solidifies the PSC's status as a star performer.

- Product Solutions Cluster (PSC) Performance: Experienced a 38% increase in headline earnings in 2024.

- Key Offerings: Includes home loans, vehicle asset financing, and insurance.

- Growth Drivers: Indicates market share gains or deeper penetration in core product areas.

- BCG Matrix Classification: Positioned as a 'Star' due to high growth and increasing contribution.

Absa's Corporate and Investment Banking (CIB) division is a clear 'Star' in the BCG matrix. In 2024, it achieved a 6% rise in headline earnings, reaching R11.7 billion, demonstrating strong market leadership and cash flow generation. Its operations in high-growth African markets and extensive network further solidify its position for continued expansion and dominance.

The Product Solutions Cluster (PSC) also shines as a 'Star'. In 2024, it saw a remarkable 38% surge in headline earnings, driven by strong performance in home loans, vehicle asset financing, and insurance. This high growth and increasing contribution to group financials underscore its 'Star' status.

| Business Unit | BCG Classification | 2024 Headline Earnings Growth | Key Drivers |

| Corporate and Investment Banking (CIB) | Star | 6% | Market leadership, strong cash flow, pan-African network |

| Product Solutions Cluster (PSC) | Star | 38% | High demand for home loans, vehicle finance, insurance |

What is included in the product

This BCG Matrix overview details Absa Group's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear Absa Group BCG Matrix overview visually simplifies complex portfolio decisions, relieving the pain of strategic uncertainty.

Cash Cows

Absa's South African retail banking, encompassing transactional accounts and basic lending, is a significant Cash Cow. Despite economic headwinds in South Africa, these established services consistently deliver robust and predictable cash flows, a testament to their substantial market share.

In 2024, Absa Group reported that its South African retail and business banking segment remained a core contributor to its earnings, highlighting the enduring strength of these traditional services. These operations are optimized for efficiency, milking their established customer base to fund growth areas like digital transformation and expansion into other African markets.

Absa Group's Everyday Banking (EB) unit in South Africa, covering card services, personal loans, and transactional accounts, is a clear Cash Cow. In 2024, this segment saw an impressive 18% surge in headline earnings, underscoring its robust financial performance.

The EB division consistently delivers significant non-interest revenue, a testament to its mature yet highly effective operational model. Furthermore, the unit benefits from a welcome trend of moderating impairment charges, boosting its profitability.

With a deeply entrenched customer base and predictable revenue streams, EB requires relatively modest investment for continued success. This combination of stable income generation and low capital expenditure needs firmly solidifies its status as a vital Cash Cow for Absa Group.

Absa's Relationship Banking (RB) in South Africa, encompassing SME, commercial, and private wealth segments, demonstrated robust performance in 2024. This division reported a 4% increase in headline earnings, a positive outcome primarily fueled by substantial growth in net interest income.

The RB segment caters to a well-established client base, including small and medium-sized enterprises (SMEs), larger commercial entities, and high-net-worth individuals. This focus on clients with existing financial needs and a history of engagement allows for the generation of stable, high-margin revenue streams, a hallmark of a Cash Cow.

Absa's strategy within RB emphasizes deepening relationships with its current clientele rather than aggressively pursuing market share expansion. This approach ensures consistent profitability and contributes reliably to the overall financial health of the Absa Group, solidifying its position as a key Cash Cow.

Established Wealth and Investment Management

Absa's established wealth and investment management services are a cornerstone of its operations, particularly catering to high-net-worth individuals and institutional clients. This segment thrives in a mature market, benefiting from a stable and loyal customer base. For instance, in 2023, Absa Wealth and Investment Management reported a significant contribution to the group's overall profitability, demonstrating its role as a consistent revenue generator.

These services are characterized by their ability to generate consistent fee-based income, leading to strong profit margins. The strategic focus here is on client retention and nurturing existing relationships, which ensures a reliable and predictable cash flow for Absa Group. This approach minimizes the need for substantial new investments, allowing the business to operate efficiently and profitably without aggressive growth mandates.

- Consistent Fee-Based Income: Absa's wealth management arm generates predictable revenue through management fees and advisory charges, contributing to the group's financial stability.

- Strong Profit Margins: The mature nature of the market and established client relationships allow for healthy profit margins in these services.

- Client Retention Focus: Emphasis is placed on deepening existing client relationships rather than solely on new client acquisition, ensuring a loyal customer base.

- Low Investment Requirement: As a cash cow, this segment requires minimal new capital expenditure, freeing up resources for other strategic initiatives within Absa Group.

Property Finance (Home Loans)

Absa's Property Finance, or home loans division, is a cornerstone of its business. In 2024, the bank maintained a substantial 22% share of the South African home loans market, a figure that remained largely stable.

This segment acts as a reliable Cash Cow for Absa Group. It consistently generates significant interest income, contributing steadily to the group's overall financial performance, even within a somewhat subdued market environment.

The mature nature of the home loans market and Absa's well-established presence solidify its position as a Cash Cow. While growth prospects may be more limited compared to newer ventures, it offers dependable returns.

- Market Share: Absa held approximately 22% of the South African home loans market in 2024.

- Revenue Generation: The segment provides consistent interest income, a stable revenue stream for the group.

- BCG Matrix Classification: Property Finance is categorized as a Cash Cow due to its high market share in a mature, low-growth industry.

- Strategic Importance: It serves as a foundational business unit, supporting overall group profitability and stability.

Absa's Everyday Banking (EB) segment, encompassing transactional accounts and card services, is a prime example of a Cash Cow. In 2024, this division reported an 18% surge in headline earnings, demonstrating its consistent profitability. The segment benefits from a deeply entrenched customer base, allowing for stable revenue generation with minimal need for substantial new investment.

Relationship Banking (RB), covering SME, commercial, and private wealth clients, also functions as a Cash Cow. In 2024, RB saw a 4% increase in headline earnings, driven by net interest income growth. Its strategy focuses on deepening existing client relationships, ensuring predictable, high-margin revenue streams.

The Wealth and Investment Management services, particularly for high-net-worth individuals, are another key Cash Cow. This segment consistently generates fee-based income with strong profit margins. The emphasis on client retention rather than aggressive acquisition solidifies its role as a stable revenue generator requiring low capital expenditure.

Absa's Property Finance, or home loans division, is a foundational Cash Cow, holding a stable 22% market share in South Africa in 2024. It provides consistent interest income, contributing reliably to the group's profitability in a mature, low-growth market. This stability makes it a vital component of Absa's financial strength.

| Segment | BCG Classification | 2024 Performance Highlight | Key Characteristics |

| Everyday Banking (EB) | Cash Cow | 18% surge in headline earnings | Deeply entrenched customer base, stable revenue |

| Relationship Banking (RB) | Cash Cow | 4% increase in headline earnings | Focus on deepening existing relationships |

| Wealth & Investment Management | Cash Cow | Consistent fee-based income, strong margins | Client retention focus, low investment needs |

| Property Finance | Cash Cow | Stable 22% market share | Consistent interest income, mature market |

Preview = Final Product

Absa Group BCG Matrix

The Absa Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive document, meticulously crafted by strategy professionals, contains no watermarks or demo content, ensuring you get a polished, ready-to-use analysis of Absa Group's business units.

Dogs

Absa Group's commitment to digital transformation necessitates the phasing out of underperforming legacy systems. These older technologies, often characterized by low internal adoption rates and limited growth prospects, represent a drag on resources. For instance, in 2024, Absa continued its multi-year investment in modernizing its core banking platforms, a process that inherently identifies and isolates less efficient legacy components.

These legacy systems function as cash cows in a negative sense; they consume significant capital for maintenance and support, yet offer minimal return on investment in terms of innovation or competitive edge. This resource drain is a key consideration as Absa strategically allocates capital towards newer, more agile digital solutions, making these older systems prime candidates for divestiture or complete retirement.

Absa Group's presence in challenging African markets means some business units might be classified as 'Dogs' in the BCG matrix. These are typically operations with a low market share in slow-growing or declining sectors, often facing intense competition or navigating difficult economic conditions. For example, a specific retail banking operation in a country experiencing high inflation and political instability might fit this description.

Such units often consume more capital than they generate, requiring significant investment to maintain their position without a clear path to substantial future growth. In 2024, several African economies faced headwinds, including currency depreciation and supply chain disruptions, which would exacerbate the performance of already weak business segments within Absa. For instance, if a particular insurance product line in a smaller West African market saw its market share shrink to below 5% while the overall market growth slowed to 2%, it would be a prime candidate for a 'Dog' classification.

Certain less digitally adopted customer segments within Absa Group might be categorized as Dogs in the BCG Matrix. These are customers who continue to rely heavily on traditional, more expensive banking channels, potentially due to age, location, or lower digital literacy. For instance, Absa's 2024 digital adoption initiatives aim to onboard more customers, but pockets of resistance or slower uptake in certain rural areas or among older demographics could represent these Dog segments.

These segments typically exhibit low digital engagement and limited potential for increased digital product adoption. Consequently, they can represent a higher cost to serve for Absa, as their transactions and service needs are met through less efficient, non-digital means. In 2024, Absa continued to invest in digital transformation, aiming to migrate customers to more cost-effective channels, but the persistence of these less digitally inclined groups poses a challenge to optimizing operational costs.

Specific, Niche Product Offerings with Stagnant Growth

Within Absa Group's diverse financial services, some highly specialized products may be experiencing a decline in demand or facing fierce competition. These niche offerings, characterized by a low market share and minimal growth prospects, are prime candidates for the 'Dog' quadrant of the BCG matrix. For instance, if a particular legacy wealth management product, like a specialized offshore bond fund, has seen its market share shrink from 5% to 2% between 2022 and 2024 due to evolving investor preferences and the rise of digital advisory platforms, it would fit this category.

Such products, if they don't align with Absa's strategic future growth areas or consume significant resources without yielding adequate returns, represent a strategic challenge. For example, a report from early 2024 indicated that the operational costs for maintaining a specific niche insurance product line, which only contributed 0.5% to the group's total revenue, were disproportionately high. This situation necessitates a careful evaluation.

- Declining Market Share: A specific niche product's market share may have fallen from 3% in 2022 to 1.5% by the end of 2024.

- Stagnant or Negative Growth: The product's revenue growth rate has been consistently below 1% annually since 2021.

- High Resource Consumption: Maintaining the product line requires a dedicated team and IT infrastructure that represents a significant portion of the division's operating budget.

- Strategic Misalignment: The product does not fit Absa's broader digital transformation strategy or its focus on expanding into high-growth emerging markets.

Inefficient Operational Processes Not Yet Digitized

Absa Group, like many established financial institutions, may grapple with legacy operational processes that haven't fully embraced digitization. These manual, often paper-based workflows, are inherently less efficient and more prone to errors than their automated counterparts. For instance, in 2024, many banks still reported significant time spent on manual data entry and reconciliation, impacting turnaround times for customer services and internal reporting.

These inefficient processes can be viewed as 'Dogs' in the BCG matrix context because they consume resources without generating substantial growth or competitive advantage. They are often necessary for compliance or specific functions, but their low efficiency means they act as drains on profitability. For example, a manual loan processing system might require multiple human touchpoints, increasing operational costs and slowing down the time to revenue.

The challenge for Absa is to identify and systematically digitize these 'Dog' processes. This involves strategic investment in automation, robotic process automation (RPA), and integrated digital platforms. By doing so, Absa can reduce operational costs, improve accuracy, and free up human capital for higher-value activities. For instance, implementing an automated KYC (Know Your Customer) process can drastically reduce onboarding time and associated manual effort, directly impacting efficiency metrics.

- Inefficient Processes: Manual, paper-based operations that are time-consuming and costly.

- Resource Drain: These processes consume significant resources without contributing to growth or competitive advantage.

- Digitalization Imperative: The need for continued automation and process optimization to improve profitability.

- Example: Manual loan processing or outdated customer onboarding systems represent 'Dogs' that require modernization.

Dogs within Absa Group's BCG Matrix represent business units, products, or customer segments with low market share in slow-growing industries. These entities often consume more capital than they generate, presenting a challenge for resource allocation. For instance, a specific retail banking operation in a market experiencing economic instability might be classified as a Dog.

These 'Dogs' are characterized by their inability to capture significant market share and their operation within sectors that offer limited future growth potential. In 2024, Absa continued its strategic review of such underperforming assets, aiming to streamline operations and redeploy capital to more promising areas. For example, a niche insurance product line with declining sales and high maintenance costs would fit this profile.

The focus for these 'Dogs' is typically on minimizing losses or divesting them entirely, rather than investing further. Absa's ongoing digital transformation efforts in 2024, which involved phasing out legacy systems and optimizing customer engagement channels, implicitly identified and began to address these 'Dog' elements within the organization.

Identifying and managing these 'Dog' segments is crucial for Absa's overall strategic efficiency and profitability. By strategically addressing these areas, the group can free up resources to invest in its 'Stars' and 'Question Marks', driving future growth and innovation.

Question Marks

Absa Group is strategically investing in emerging fintech partnerships and innovations, focusing on areas like digital payment ecosystems and advanced business expense management. These initiatives are positioned within high-growth fintech sectors, reflecting their potential but also their current early-stage market penetration.

These ventures are considered 'Question Marks' because while they operate in promising, rapidly expanding markets, their market share is currently modest. Their trajectory hinges on substantial future investment and successful adoption to transition into 'Stars' within Absa's portfolio.

Absa Group's strategy to expand into new African markets and niche segments aligns with the characteristics of a Question Mark in the BCG matrix. These ventures, like Absa's push into markets such as Mozambique or its focus on digital banking for youth, offer considerable growth potential but begin with a small market share.

For instance, Absa's digital banking initiatives are targeting a demographic that is rapidly growing but currently has a low adoption rate for traditional banking services. This requires significant investment in technology and marketing to capture market share, mirroring the high resource needs of Question Marks.

The success of these expansions is not guaranteed; they are indeed 'question marks' due to the inherent risks and the substantial capital and strategic execution needed to transform them into Stars or Cash Cows. Absa's 2024 financial reports will likely show increased investment in these growth areas, reflecting their strategic importance despite the uncertain returns.

Absa Group is actively investing in advanced AI and machine learning, with a focus on Generative AI. The group has provided training to a substantial portion of its workforce in these technologies, signaling a strategic commitment to leveraging AI for future growth.

While the potential for AI to drive efficiency and create new financial products is significant, its current direct market share in fully commercialized, revenue-generating applications within Absa may still be developing. This indicates that these AI initiatives, including the Generative AI training, are in a growth phase.

Continued investment in research, development, and seamless integration of these AI capabilities is crucial. This sustained effort is necessary for Absa to fully translate its technological advancements into a tangible competitive advantage and a measurable increase in market share in the evolving financial landscape.

New Sustainable and Green Finance Products Beyond Core Offerings

Absa Group's exploration into new sustainable and green finance products, such as green mortgages and specialized sustainable investment funds, places them in the question mark category of the BCG matrix. While the global sustainable finance market is experiencing robust growth, with the sustainable bond market alone projected to reach $5 trillion by 2025 according to some industry estimates, these specific product offerings from Absa might still be in their early stages of development and market penetration.

- Nascent Stage: Newer, specialized green finance products like green mortgages or dedicated sustainable investment funds are likely in their infancy for Absa, requiring significant investment in product development and customer education.

- Rapid Market Growth: The demand for sustainable financial products is accelerating globally. For instance, assets under management in ESG funds saw substantial inflows in 2023, indicating a strong market appetite.

- Low Market Penetration: Despite market growth, Absa’s share in these niche green finance segments might be relatively small currently, presenting an opportunity for expansion.

- Targeted Development: To capitalize on this expanding market, Absa will need to focus on targeted marketing campaigns and further product innovation to capture a larger customer base for these emerging sustainable offerings.

Development of Differentiated Digital Identity and Metaverse Solutions

Absa Group is actively investigating the potential of differentiated digital identity and metaverse solutions, signaling a strategic pivot towards future-forward banking. These represent high-growth, yet nascent, market segments where Absa currently holds a minimal market share, underscoring the inherent uncertainty and speculative nature of these ventures.

These exploratory initiatives are akin to question marks in the BCG matrix, demanding significant research and development investment. A clear, well-defined strategy is crucial to ascertain their long-term viability and their capacity to evolve into substantial revenue streams or key market differentiators.

For instance, the global digital identity market is projected to reach USD 79.4 billion by 2027, growing at a CAGR of 13.5%, according to MarketsandMarkets. Similarly, the metaverse market, though still in its early stages, is anticipated to expand considerably, with some estimates suggesting it could reach trillions of dollars in value by 2030.

- Digital Identity: Absa's exploration here could lead to enhanced customer onboarding, fraud prevention, and personalized banking experiences, leveraging technologies like blockchain and biometrics.

- Metaverse Solutions: The bank might develop virtual branches, offer financial services within metaverse platforms, or create immersive brand experiences, tapping into a new frontier of customer engagement.

- Investment Strategy: Significant R&D funding is required, with a focus on agile development and strategic partnerships to navigate the evolving technological landscape and regulatory frameworks.

- Market Potential: While current market share is negligible, the long-term potential for these digital assets to redefine customer interaction and create new revenue models is substantial, justifying the exploratory investment.

Absa Group's ventures into emerging fintech, new African markets, AI integration, sustainable finance, and digital identity/metaverse solutions all represent 'Question Marks' in the BCG matrix. These are areas with high growth potential but currently low market share, requiring significant investment and strategic execution to succeed.

For instance, Absa's 2024 focus on Generative AI training for its workforce signifies an investment in a high-growth area, though its direct revenue impact is still developing. Similarly, the burgeoning sustainable finance market, while globally expanding, represents a niche where Absa's current product penetration is likely modest.

The success of these 'Question Marks' is contingent on substantial capital allocation and effective strategy. Absa's financial reports for 2024 are expected to detail increased investment in these strategic growth areas, acknowledging their uncertain but potentially high future returns.

Navigating these 'Question Marks' requires Absa to carefully manage resources, foster innovation, and adapt to evolving market dynamics to convert them into 'Stars' or 'Cash Cows'.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Absa Group's financial disclosures, internal performance metrics, and extensive market research reports to accurately position each business unit.