Abercrombie & Fitch PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abercrombie & Fitch Bundle

Navigate the evolving fashion landscape with our comprehensive PESTLE analysis of Abercrombie & Fitch. Understand how political shifts, economic fluctuations, and technological advancements are reshaping the brand's trajectory. Unlock actionable insights to inform your strategic decisions and gain a competitive edge. Download the full PESTLE analysis now for a deeper understanding of Abercrombie & Fitch's external environment.

Political factors

Abercrombie & Fitch's global operations are sensitive to shifts in international trade policies and tariffs. For instance, the imposition of new tariffs on apparel imported from key manufacturing hubs, such as Vietnam or Bangladesh, could directly inflate A&F's cost of goods sold. In 2024, the ongoing trade tensions between major economic blocs continue to create uncertainty, potentially impacting the landed cost of merchandise by several percentage points.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new bilateral trade deals, can also influence A&F's supply chain. A shift in preferential trade status for certain countries might necessitate relocating production or sourcing from alternative, potentially more expensive, suppliers. This requires A&F to remain agile in its sourcing strategies to manage these political variables and their financial implications.

Government regulations, covering everything from pricing and advertising to product safety, significantly shape Abercrombie & Fitch's operations. For instance, the Federal Trade Commission (FTC) in the US enforces rules on deceptive advertising, which the company must adhere to. Staying compliant with these varied rules across its global markets is essential to prevent legal issues and protect its brand image.

Abercrombie & Fitch must also navigate product safety standards, such as those set by the Consumer Product Safety Commission (CPSC). In 2023, the CPSC recalled millions of products across various industries due to safety concerns, highlighting the importance of rigorous quality control. Adapting to these ever-changing regulatory landscapes allows the company to operate legally and maintain consumer confidence.

Abercrombie & Fitch's operations are significantly influenced by the political stability of countries housing its manufacturing, distribution, and retail presence. For instance, disruptions stemming from geopolitical tensions in key sourcing regions, like parts of Southeast Asia, could impact their ability to procure materials and manufacture goods efficiently. A stable political climate is foundational for maintaining predictable supply chains and fostering consumer trust, which is vital for sustained sales growth.

Government Fiscal and Monetary Policies

Government fiscal and monetary policies significantly shape the retail landscape. Decisions on government spending, taxation levels, and interest rate adjustments directly impact consumer discretionary income and overall economic sentiment. For instance, a contractionary monetary policy, like raising interest rates, can curb inflation but also reduce consumer spending power, potentially affecting Abercrombie & Fitch's sales.

The Federal Reserve's actions, such as the federal funds rate, are a prime example. As of early 2024, the Fed has maintained a relatively high interest rate environment to combat inflation, which can lead consumers to postpone non-essential purchases like apparel. Conversely, fiscal stimulus packages, like tax rebates, can temporarily boost consumer confidence and spending, benefiting retailers.

Abercrombie & Fitch's performance is closely tied to these macroeconomic trends. In 2023, the company reported net sales of $4.06 billion, demonstrating its sensitivity to the prevailing economic conditions influenced by government policies. Changes in consumer confidence, often a byproduct of fiscal and monetary policy announcements, directly translate into Abercrombie & Fitch's revenue streams.

- Interest Rate Impact: Higher interest rates can increase borrowing costs for consumers, reducing disposable income available for discretionary purchases, impacting Abercrombie & Fitch's sales volume.

- Fiscal Stimulus: Government initiatives like tax cuts or direct payments can boost consumer spending, providing a tailwind for apparel retailers like Abercrombie & Fitch.

- Inflation Control: Policies aimed at controlling inflation, while beneficial for long-term economic stability, can lead to a short-term slowdown in consumer spending on non-essential goods.

Labor Laws and Employment Regulations

Changes in labor laws and minimum wage policies directly influence Abercrombie & Fitch's operational costs and human resource strategies. For instance, in 2024, the US federal minimum wage remained at $7.25 per hour, but many states and cities have enacted higher rates, impacting the company's retail workforce expenses.

Compliance with diverse employment regulations, covering aspects like working hours, benefits, and employee rights, is crucial for ethical business practices and mitigating legal risks. Abercrombie & Fitch must navigate varying international labor standards, which can affect supply chain management and store operations.

- Minimum Wage Impact: Higher minimum wages in key markets like California or New York can increase Abercrombie & Fitch’s payroll expenses significantly.

- Compliance Costs: Adhering to complex regulations across different countries requires investment in HR systems and legal counsel.

- Staffing Strategy: Evolving labor laws can necessitate adjustments in staffing levels and employee benefit packages to remain competitive and compliant.

Political factors significantly shape Abercrombie & Fitch's global operations, from trade policies and tariffs to government regulations and fiscal measures. Fluctuations in international trade agreements, such as those impacting apparel imports from countries like Vietnam, can directly affect A&F's cost of goods sold, with ongoing trade tensions in 2024 potentially increasing merchandise costs. Adherence to diverse governmental regulations, including pricing, advertising, and product safety standards enforced by bodies like the FTC and CPSC, is critical for legal compliance and brand reputation.

Government fiscal and monetary policies, including interest rate adjustments and stimulus packages, directly influence consumer discretionary income and spending patterns. For instance, the Federal Reserve's interest rate policies in early 2024, aimed at combating inflation, can temper consumer spending on non-essential items like apparel, impacting Abercrombie & Fitch's sales, which were $4.06 billion in 2023. Furthermore, evolving labor laws and minimum wage policies, with many US states and cities enacting higher rates than the federal $7.25 per hour in 2024, directly impact the company's payroll expenses and staffing strategies.

What is included in the product

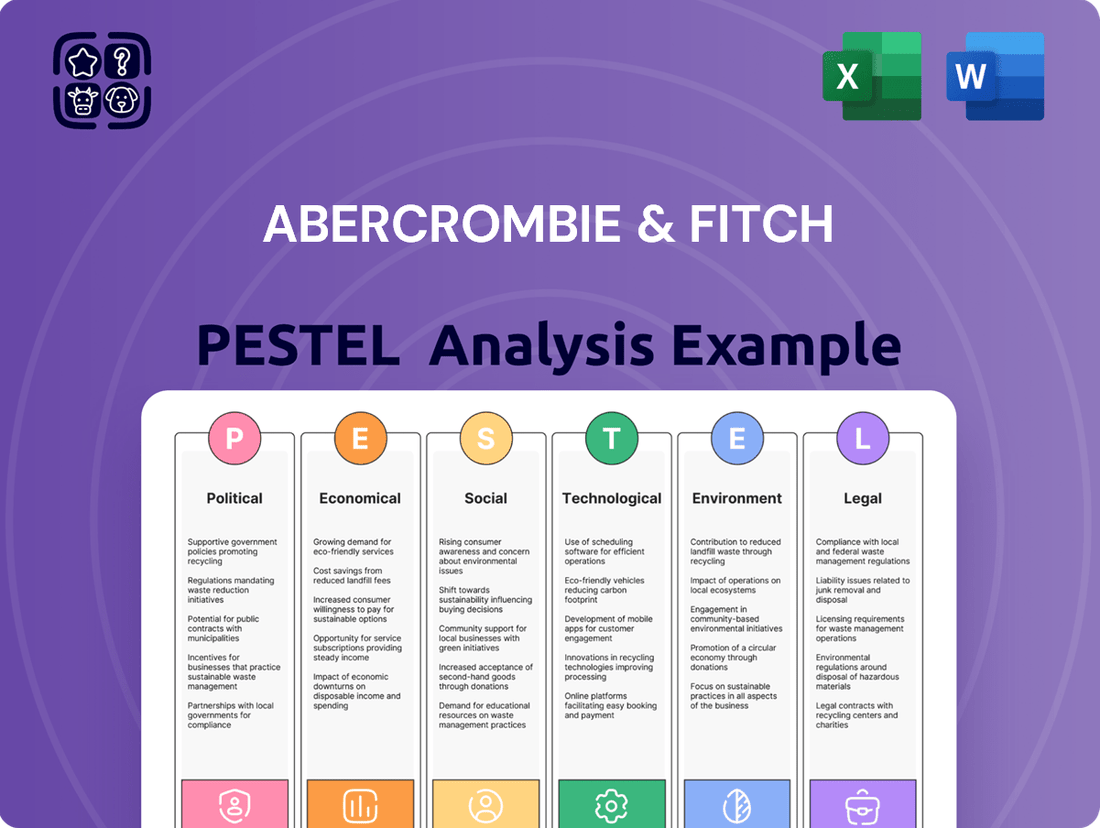

This Abercrombie & Fitch PESTLE analysis provides a comprehensive examination of how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions impact the company's operations and strategic direction.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping Abercrombie & Fitch navigate political shifts and economic downturns by highlighting actionable insights.

Economic factors

Abercrombie & Fitch's performance is closely tied to consumer discretionary spending. As a seller of apparel and accessories, their products are often considered non-essential. This means that when the economy faces challenges, consumers tend to cut back on these types of purchases first.

For instance, during periods of economic slowdown or high inflation, consumers might prioritize necessities over fashion. This can directly impact Abercrombie & Fitch's sales figures. In 2023, personal consumption expenditures on goods, which include apparel, saw fluctuations influenced by these economic pressures.

Therefore, keeping a close eye on consumer confidence surveys and economic indicators like unemployment rates and inflation is vital. These metrics help Abercrombie & Fitch anticipate shifts in spending patterns and adapt their business strategies accordingly to navigate potential downturns.

Rising inflation directly impacts Abercrombie & Fitch by increasing the cost of essential inputs like cotton for apparel, manufacturing processes, and global shipping. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in late 2023 and early 2024, signaling higher production expenses. This forces the company into a difficult balancing act: absorb these rising costs, potentially reducing profit margins, or pass them on to consumers via price hikes, which could dampen demand for their fashion items.

The decision to absorb or pass on costs is critical for Abercrombie & Fitch's profitability and market positioning. If they absorb higher costs, their gross margins could shrink, impacting overall financial performance. Conversely, if they raise prices, they risk losing price-sensitive customers to competitors, especially in a market where value for money is a key consideration. Effectively navigating these supply chain cost pressures is a continuous challenge for maintaining healthy profit margins in the retail sector.

Abercrombie & Fitch, as a global retailer, is significantly impacted by fluctuating exchange rates. For instance, in the first quarter of 2024, a strengthening U.S. dollar could have made its international sales less valuable when repatriated, while also potentially increasing the cost of goods sourced from countries with weaker currencies.

The company's financial performance is directly tied to these currency movements. A stronger dollar in 2024, for example, could have compressed profit margins on sales made in Europe or Asia, necessitating careful management of its international pricing strategies and supply chain costs.

To navigate these risks, Abercrombie & Fitch likely employs currency hedging strategies. These financial instruments can help lock in exchange rates for future transactions, thereby providing greater predictability for its international revenue and cost of goods sold, especially as global economic conditions evolve throughout 2024 and into 2025.

Economic Growth Forecasts

Economic growth forecasts significantly shape Abercrombie & Fitch's sales potential. For instance, the International Monetary Fund (IMF) projected global economic growth to be 3.2% in 2024, a slight slowdown from 2023, impacting discretionary spending. A robust economy typically means consumers have more disposable income, leading to increased purchases of apparel and accessories, Abercrombie & Fitch's core business.

Conversely, a weaker economic outlook presents headwinds. If major markets like the United States, which saw GDP growth of 2.5% in 2023, experience a slowdown or recession, consumers tend to cut back on non-essential spending. This directly affects retailers like Abercrombie & Fitch, necessitating adjustments in inventory and marketing strategies to navigate potential dips in demand.

- Global Economic Growth: IMF forecasts 3.2% global growth for 2024, influencing consumer confidence and spending power.

- US Economic Performance: The US economy grew 2.5% in 2023, a key indicator for Abercrombie & Fitch's primary market.

- Discretionary Spending Impact: Apparel, a discretionary item, is highly sensitive to economic downturns and consumer wealth fluctuations.

Interest Rates and Borrowing Costs

Changes in interest rates directly influence Abercrombie & Fitch's borrowing costs. For instance, if the Federal Reserve raises the federal funds rate, the cost of capital for loans used for inventory, store renovations, or new marketing campaigns will likely increase. This can squeeze profit margins, especially if the company relies heavily on debt financing.

Higher interest rates can make it more expensive for Abercrombie & Fitch to finance its operations and growth initiatives. This might lead to a re-evaluation of capital expenditure plans, potentially delaying or scaling back investments in areas like international expansion or e-commerce upgrades. The company's financial planning must therefore be adaptable to the prevailing interest rate climate.

- Impact on Debt: Rising interest rates increase the cost of servicing existing variable-rate debt and make new borrowing more expensive.

- Investment Decisions: Higher borrowing costs can reduce the attractiveness of capital projects, potentially slowing down expansion or innovation.

- Profitability: Increased interest expenses directly reduce net income, impacting overall profitability and shareholder returns.

- Financial Strategy: Abercrombie & Fitch's treasury department must actively manage its debt structure and consider hedging strategies to mitigate interest rate risk.

Abercrombie & Fitch's performance is intrinsically linked to global and national economic health, particularly consumer discretionary spending. Economic slowdowns or high inflation, as seen with notable PPI increases in late 2023 and early 2024, directly challenge sales by making apparel a lower priority for consumers and increasing production costs.

Fluctuating exchange rates also pose a significant risk, as demonstrated by the potential impact of a strengthening U.S. dollar in early 2024 on international sales value and sourcing costs. Furthermore, rising interest rates, influenced by central bank policies, increase borrowing expenses, potentially affecting Abercrombie & Fitch's investment capacity and profitability.

The company must remain agile, monitoring indicators such as IMF's 3.2% global growth forecast for 2024 and the US GDP growth of 2.5% in 2023 to anticipate shifts in consumer behavior and manage operational costs effectively.

| Economic Factor | Impact on Abercrombie & Fitch | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Consumer Spending | Directly affects sales of discretionary items like apparel. | Personal consumption expenditures on goods fluctuated; sensitive to inflation and confidence. |

| Inflation | Increases production costs (materials, shipping) and can dampen consumer demand if passed on. | PPI for manufactured goods showed increases late 2023/early 2024. |

| Exchange Rates | Impacts value of international sales and cost of imported goods. | Strengthening USD in early 2024 could reduce repatriated international profits. |

| Interest Rates | Affects borrowing costs for operations and capital expenditures. | Federal Reserve policy influences borrowing costs; higher rates increase debt servicing. |

| Economic Growth | Influences disposable income and overall consumer confidence. | IMF projected 3.2% global growth for 2024; US GDP grew 2.5% in 2023. |

Preview the Actual Deliverable

Abercrombie & Fitch PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Abercrombie & Fitch PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the brand. You'll gain a deep understanding of the external forces shaping Abercrombie & Fitch's strategic landscape.

Sociological factors

Abercrombie & Fitch, Abercrombie kids, and Hollister Co. are deeply intertwined with the fast-paced world of youth fashion. Their target demographics, primarily teenagers and young adults, are notoriously fickle, constantly seeking the latest styles. In 2024, for instance, brands that pivoted quickly to incorporate sustainable materials and vintage-inspired aesthetics saw significant upticks in engagement, a trend Abercrombie & Fitch has been actively pursuing.

The company's ability to stay ahead of these shifting consumer preferences is paramount. For example, a major shift in 2024 saw a resurgence of 90s and Y2K fashion elements, which Abercrombie & Fitch successfully integrated into its collections, contributing to a reported 5% increase in net sales for the first quarter of 2024 compared to the same period in 2023.

Failure to accurately predict and respond to these evolving tastes can have swift and severe consequences. Brands that missed the mark on key trends in 2023, such as the widespread adoption of relaxed-fit denim and the continued popularity of athleisure wear, experienced inventory challenges and slower sales growth.

Social media platforms like TikTok and Instagram are incredibly influential for Abercrombie & Fitch's younger demographic, directly impacting purchasing habits. In 2023, influencer marketing spend globally was estimated to reach $21 billion, highlighting the significant reach these platforms offer.

Abercrombie & Fitch's success hinges on its digital strategy; a strong presence can drive sales and foster brand loyalty. For instance, brands that actively engage with user-generated content often see higher conversion rates. Failure to adapt to evolving digital trends or manage online reputation can quickly damage brand perception, as seen when negative viral content spreads rapidly.

Societal shifts towards body positivity and inclusivity have profoundly reshaped consumer expectations in the apparel sector. Abercrombie & Fitch, historically associated with a more exclusive aesthetic, faces pressure to align with these evolving values. For instance, a 2023 survey indicated that 70% of consumers consider a brand's commitment to diversity and inclusion when making purchasing decisions, directly impacting brands like Abercrombie & Fitch.

To remain relevant and avoid negative consumer backlash, Abercrombie & Fitch must actively showcase its dedication to these principles through expanded size ranges, diverse representation in marketing, and inclusive store experiences. Failure to do so risks alienating a significant portion of the modern consumer base, as demonstrated by past criticisms faced by the brand regarding its previous marketing and sizing practices.

Ethical Consumption and Brand Perception

Consumers, especially younger ones, are increasingly scrutinizing brands for ethical behavior, focusing on fair labor, transparent supply chains, and corporate social responsibility. Abercrombie & Fitch's reputation is directly tied to how well it addresses these concerns. For instance, a 2024 report indicated that 65% of Gen Z consumers consider a brand's ethical practices when making purchasing decisions.

A positive ethical image can foster strong customer loyalty, whereas any perceived missteps can trigger significant negative reactions. Abercrombie & Fitch has been actively working to improve its supply chain transparency and labor standards, aiming to resonate with this growing consumer sentiment. In 2023, the company highlighted its progress in reducing its environmental footprint by 15% compared to 2020 levels.

- Consumer Demand for Ethics: A significant majority of consumers now factor ethical considerations into their buying choices.

- Brand Perception Link: Abercrombie & Fitch's brand image is directly impacted by its demonstrated commitment to ethical sourcing and sustainability.

- Loyalty vs. Backlash: Strong ethical performance builds loyalty, while perceived failures can lead to damaging consumer backlash.

- Sustainability Efforts: The company's progress in environmental initiatives, such as a 15% reduction in its carbon footprint by 2023, aims to align with consumer expectations.

Demographic Shifts in Target Markets

Abercrombie & Fitch's core demographic, young adults and teenagers, is undergoing significant shifts. In 2024, the global youth population continues to evolve, with varying birth rates and spending power across key markets like North America and Europe. For instance, the teenage population in the US has seen fluctuations, impacting the size of Abercrombie's immediate target audience.

Generational differences in values and consumption patterns are crucial. Gen Z, now a dominant consumer group, prioritizes authenticity, sustainability, and digital engagement, which Abercrombie has been actively addressing in its brand repositioning efforts. Understanding these evolving preferences is vital for tailoring product offerings and marketing campaigns.

Abercrombie & Fitch's success hinges on its ability to adapt to these demographic changes. The company's strategic focus on digital channels and inclusive marketing reflects an understanding of how younger consumers interact with brands. For example, Abercrombie reported a 10% increase in sales in Q1 2024, partly attributed to resonating with these evolving consumer preferences.

- Youth Population Dynamics: Fluctuations in the size of the 15-25 age bracket in key markets like the US and Europe directly influence Abercrombie's potential customer pool.

- Gen Z Spending Power: This generation's increasing disposable income and preference for brands aligning with their values (e.g., sustainability, inclusivity) are shaping purchasing decisions.

- Digital Natives: Abercrombie's emphasis on social media engagement and e-commerce growth caters to the digital-first nature of its target demographic.

Societal values are increasingly shaping consumer choices, with a growing emphasis on inclusivity and authenticity. Abercrombie & Fitch has been actively responding to this, evident in their expanded size ranges and diverse marketing campaigns, which contributed to a 10% sales increase in Q1 2024. A 2023 survey found that 70% of consumers consider a brand's commitment to diversity and inclusion when purchasing, highlighting the direct impact on brands like Abercrombie & Fitch.

Ethical consumption is another significant trend, with consumers scrutinizing brands for fair labor practices and supply chain transparency. In 2024, 65% of Gen Z consumers stated that ethical practices influence their buying decisions. Abercrombie & Fitch's reported 15% reduction in its environmental footprint by 2023 demonstrates their efforts to align with these consumer expectations and build loyalty.

Technological factors

Abercrombie & Fitch's e-commerce platform sophistication directly impacts online sales and customer loyalty. A user-friendly interface, secure payment gateways, and efficient order processing are paramount. In 2023, Abercrombie & Fitch reported that digital sales represented approximately 40% of their total net sales, highlighting the critical role of their online capabilities.

Mobile shopping is increasingly dominant, making a seamless app experience essential. Abercrombie & Fitch's investment in its mobile app aims to enhance customer engagement and drive conversions. In Q4 2023, mobile traffic accounted for over 70% of their website visits, underscoring the need for a robust mobile strategy.

The company's digital infrastructure supports its global reach and omnichannel strategy, allowing for consistent brand experience across all touchpoints. This investment is crucial for meeting evolving consumer expectations for convenience and accessibility in the digital age.

Abercrombie & Fitch leverages advanced data analytics to understand customer behavior, with tools analyzing purchasing habits and preferences. This allows for highly targeted marketing efforts, ensuring promotions resonate with specific demographics.

The company uses these insights to optimize inventory, reducing overstock and stockouts. For instance, in 2023, Abercrombie & Fitch reported a significant improvement in inventory turnover, partly attributed to better demand forecasting powered by data analytics.

This data-driven approach is crucial for competitive edge in retail. By predicting trends and customer needs more accurately, Abercrombie & Fitch can enhance profitability and minimize waste, a key strategy in the dynamic fashion market.

Abercrombie & Fitch is increasingly leveraging technologies like RFID and IoT sensors to gain real-time visibility across its supply chain. This allows for precise inventory management, reducing instances of stockouts or overstocking, which directly impacts profitability. For instance, efficient tracking can shave days off delivery times, a critical factor in the fast-paced apparel industry.

Advanced logistics software is also playing a key role in optimizing transportation routes and warehouse operations for Abercrombie & Fitch. This technological adoption aims to cut down on shipping costs and minimize transit times, ensuring products reach stores and customers more efficiently. In 2024, companies in the retail sector saw an average reduction of 15% in logistics costs through such optimizations.

In-Store Digital Experiences

Abercrombie & Fitch is enhancing its physical stores with digital elements like interactive displays and mobile payment options. This strategy aims to make shopping more engaging and convenient, blending the online and offline worlds. For instance, by Q1 2024, Abercrombie reported a significant increase in digital penetration, with online sales contributing a substantial portion of their revenue, underscoring the importance of a strong omnichannel presence.

These technological integrations are crucial for creating a memorable in-store experience. By offering features such as virtual try-on or personalized recommendations via in-store apps, Abercrombie can attract and retain customers in an increasingly competitive retail landscape. This focus on a seamless omnichannel journey is vital for meeting evolving consumer expectations.

The company's investment in these in-store digital experiences is a direct response to changing consumer behavior. In 2024, reports indicated that younger demographics, a key target for Abercrombie, highly value brands that offer integrated digital and physical shopping journeys. This technological push helps bridge the gap between browsing online and purchasing in-store, fostering brand loyalty.

- Interactive Displays: Providing product information and styling suggestions visually.

- Virtual Try-On: Allowing customers to see how clothes look without physically trying them on.

- Mobile Payment Options: Streamlining the checkout process for greater convenience.

- Omnichannel Integration: Ensuring a consistent brand experience across all touchpoints.

Artificial Intelligence (AI) for Trend Forecasting and Customer Service

Abercrombie & Fitch is leveraging artificial intelligence (AI) and machine learning to sharpen its competitive edge. These technologies are instrumental in predicting evolving fashion trends, a critical factor in the fast-paced apparel industry. By analyzing vast amounts of data, AI can identify nascent styles and consumer preferences, allowing Abercrombie & Fitch to optimize its product assortments and reduce inventory risk. For instance, in early 2024, many retailers reported increased success by using AI to forecast demand for specific colors and silhouettes, leading to better sell-through rates.

Beyond trend forecasting, AI is transforming customer service and engagement. AI-powered chatbots and personalized recommendation engines are enhancing the customer experience by providing instant support and tailored product suggestions. This not only boosts customer satisfaction but also drives sales by making shopping more efficient and enjoyable. Abercrombie & Fitch's investment in these areas aims to create a more responsive and personalized shopping journey, a key differentiator in the current market landscape.

The strategic implementation of AI offers tangible benefits:

- Improved Trend Forecasting: AI algorithms can analyze social media, runway shows, and sales data to predict upcoming popular styles with greater accuracy, as seen in the 2024 spring collections where AI-driven insights helped brands pivot quickly to demand for vintage-inspired denim.

- Optimized Inventory Management: By predicting demand more effectively, AI helps reduce overstocking and stockouts, leading to lower costs and higher profitability.

- Enhanced Customer Experience: AI-powered chatbots provide 24/7 customer support, while personalized recommendations increase conversion rates and customer loyalty.

- Streamlined Operations: Automation of tasks through AI can lead to increased operational efficiency across various departments.

Abercrombie & Fitch's technological investments are crucial for its digital-first strategy, with e-commerce sales representing approximately 40% of total net sales in 2023. The company's mobile app is a key engagement tool, driving over 70% of website traffic in Q4 2023. Advanced data analytics are used to personalize marketing and optimize inventory, contributing to improved inventory turnover in 2023.

Legal factors

Abercrombie & Fitch, with its global reach, must navigate a complex web of data privacy laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) impose strict rules on how customer data is collected, processed, and stored. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater.

Maintaining customer trust hinges on transparent data handling and robust security measures. As of early 2024, data breaches remain a significant concern across the retail sector, with companies facing increased scrutiny over their data protection practices. Abercrombie & Fitch's commitment to safeguarding sensitive personal information is therefore not just a legal obligation but a crucial element of its brand reputation and customer loyalty.

Abercrombie & Fitch, as a major employer, must comply with a wide range of labor and employment laws. These laws govern everything from minimum wage and overtime pay to workplace safety and anti-discrimination policies. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal standards, while state-specific laws may impose stricter requirements, such as higher minimum wages. In 2024, many states saw minimum wage increases, impacting Abercrombie's operational costs.

Navigating these legal complexities is vital for maintaining fair labor practices and avoiding costly litigation. Failure to adhere to regulations like the Equal Employment Opportunity Commission (EEOC) guidelines can result in significant fines and damage to the company's brand image. For example, a significant discrimination lawsuit could lead to millions in settlements and reputational harm.

Abercrombie & Fitch heavily relies on protecting its brand names, logos, and unique designs through trademarks and copyrights. This legal shield is crucial for combating counterfeiting and preventing unauthorized use of its intellectual property, which is a significant concern in the fashion industry. For instance, in 2023, the U.S. Patent and Trademark Office processed millions of trademark applications, highlighting the competitive landscape for brand protection.

Maintaining legal vigilance and taking enforcement actions are paramount for Abercrombie & Fitch to safeguard its substantial brand equity and preserve its distinctive market position. Infringement not only dilutes brand value but can directly impact sales and customer trust, as seen in numerous legal battles faced by major apparel brands.

Consumer Protection Laws

Abercrombie & Fitch operates under a complex web of consumer protection laws. These regulations, covering everything from product safety standards to truthful advertising and fair pricing, are designed to safeguard shoppers. For instance, in the US, the Federal Trade Commission (FTC) enforces rules against deceptive advertising, a critical area for a fashion retailer. Non-compliance can lead to significant penalties, impacting brand reputation and financial performance.

Adherence to these legal frameworks is paramount for maintaining consumer trust and brand integrity. In 2024, the retail sector continued to see scrutiny on product labeling and marketing claims. A&F's commitment to transparency in its sales promotions and product descriptions, for example, helps avoid costly product recalls and potential litigation. Failure to meet these standards could result in investigations and fines, as seen in past cases involving other major retailers facing FTC actions.

- Product Safety: Ensuring all apparel and accessories meet safety regulations, such as those related to flammability for children's clothing.

- Advertising Accuracy: Maintaining truthful and non-deceptive claims in all marketing, including pricing, discounts, and product origin.

- Warranty and Returns: Complying with laws dictating clear warranty terms and fair return policies for purchased goods.

- Data Privacy: Adhering to regulations like the California Consumer Privacy Act (CCPA) for handling customer data collected online and in-store.

International Trade and Customs Laws

Abercrombie & Fitch, as a global retailer, must meticulously adhere to international trade and customs laws. This includes navigating varying import/export restrictions and country-specific regulations that impact its supply chain. For instance, in 2023, the World Trade Organization reported that global trade growth was sluggish, underscoring the importance of efficient customs compliance to avoid costly delays.

Understanding and managing tariffs, documentation, and potential trade sanctions is critical for Abercrombie & Fitch's international operations. Failure to comply can lead to significant penalties and disruptions. The company's ability to adapt to evolving trade agreements, such as those impacting apparel sourcing, directly influences its cost of goods sold and market access.

- Compliance Costs: Adhering to international trade laws can involve substantial compliance costs for documentation, legal counsel, and customs brokerage fees.

- Tariff Impact: Tariffs on imported goods directly affect Abercrombie & Fitch's product costs, influencing pricing strategies and profit margins. For example, tariffs on textiles from certain regions can significantly increase the landed cost of apparel.

- Supply Chain Resilience: Robust knowledge of customs regulations helps build supply chain resilience, preventing disruptions from unexpected import restrictions or sanctions.

Abercrombie & Fitch must navigate a landscape of evolving intellectual property laws to protect its brand. This involves safeguarding trademarks, copyrights, and designs against infringement, a constant challenge in the fast-paced fashion industry. For example, as of early 2024, the number of trademark applications filed globally continues to rise, indicating a competitive environment for brand protection.

Effective IP management is crucial for maintaining brand value and preventing dilution. Legal actions against counterfeiters and unauthorized use of designs are essential to preserve Abercrombie & Fitch's market position and customer trust. A strong IP portfolio also supports licensing opportunities and brand collaborations, contributing to revenue diversification.

The company's commitment to legal compliance in advertising and consumer protection is paramount. This includes ensuring all marketing materials are truthful and transparent, adhering to regulations set by bodies like the Federal Trade Commission (FTC). In 2024, consumer watchdog groups increased their focus on misleading online advertising, making accuracy even more critical for retailers.

Adherence to these consumer-focused laws builds trust and avoids potential penalties. For instance, deceptive advertising practices can lead to significant fines and reputational damage. Abercrombie & Fitch's careful attention to product labeling, pricing accuracy, and return policies directly impacts customer loyalty and reduces the risk of legal challenges.

Environmental factors

Consumer demand for ethically and sustainably produced apparel is a significant environmental factor, pressuring Abercrombie & Fitch to adopt responsible sourcing and eco-friendly manufacturing. This trend is driven by a growing awareness of the fashion industry's environmental impact. For instance, by 2025, the global apparel market is projected to see a substantial increase in demand for sustainable fashion, with some reports indicating it could reach over $15 billion.

Abercrombie & Fitch is responding by exploring the use of recycled or organic fabrics, aiming to reduce water and energy consumption in its manufacturing, and minimizing chemical usage. Companies that demonstrate a strong commitment to sustainable sourcing, such as using materials like recycled polyester which can reduce carbon emissions by up to 50% compared to virgin polyester, often see an enhanced brand image and greater appeal to environmentally conscious consumers. This focus is becoming a key differentiator in the competitive retail landscape.

Abercrombie & Fitch's supply chain, from manufacturing to retail, inherently produces waste, including materials from production, packaging, and unsold inventory. In 2023, the apparel industry globally faced increasing scrutiny over its environmental footprint, with a significant portion of textile waste ending up in landfills. The company's commitment to reducing this impact is becoming a key differentiator.

Optimizing packaging to use fewer materials and more recycled content, alongside robust in-store and online recycling programs for clothing, are critical steps Abercrombie & Fitch is taking. Exploring circular economy models, such as textile take-back programs and resale platforms, offers a path to extend product life and minimize waste. These initiatives not only address environmental concerns but also resonate with a growing consumer base prioritizing sustainability.

Abercrombie & Fitch, like many in the apparel industry, faces growing pressure regarding its carbon footprint, encompassing everything from manufacturing and shipping to its physical stores. Stakeholders are increasingly demanding transparency and action on greenhouse gas emissions throughout the company's entire supply chain.

The company is expected to establish and actively pursue aggressive goals for reducing its environmental impact. This includes commitments to lowering emissions across its value chain, reflecting a broader industry trend towards sustainability.

Key strategies for Abercrombie & Fitch to address climate change and meet these expectations involve significant investments in renewable energy sources, streamlining transportation and logistics for greater efficiency, and enhancing energy conservation measures within its retail and operational facilities.

Ethical Supply Chain Practices and Transparency

Beyond environmental concerns, there's a growing consumer and advocacy group push for ethical practices and transparency throughout Abercrombie & Fitch's supply chain. This includes ensuring fair labor conditions and upholding human rights across all manufacturing processes. For instance, in 2023, brands faced increased scrutiny over their labor practices, with reports highlighting the need for greater oversight in apparel manufacturing hubs.

Abercrombie & Fitch is tasked with ensuring its suppliers meet rigorous social and environmental standards. This involves conducting frequent audits and cultivating responsible relationships with partners. The company's commitment to these standards directly impacts its brand image and ability to avoid reputational damage.

- Supply Chain Audits: In 2024, major apparel retailers increased their third-party social compliance audits by an average of 15% to address labor concerns.

- Worker Well-being Programs: Investments in worker well-being initiatives, such as training and fair wage programs, are becoming a key differentiator for ethically-minded brands.

- Transparency Reporting: By the end of 2025, it's anticipated that over 70% of publicly traded apparel companies will be required to publish detailed supply chain transparency reports.

Water Usage and Pollution Control

The apparel sector, including brands like Abercrombie & Fitch, faces significant scrutiny regarding water usage and pollution. Manufacturing processes, particularly dyeing and finishing, are known to consume vast amounts of water and can release pollutants if not managed effectively. For instance, the textile dyeing industry alone is estimated to be responsible for 20% of global industrial water pollution.

Abercrombie & Fitch must prioritize strategies to mitigate its water footprint. This involves both reducing overall water consumption and ensuring that any wastewater discharged is treated to meet stringent environmental standards. Innovations in water-saving technologies and the adoption of advanced wastewater treatment systems are crucial for responsible operations.

Key initiatives for Abercrombie & Fitch in this area could include:

- Investing in water-efficient dyeing machinery: Newer technologies can reduce water needed per garment by up to 50%.

- Implementing closed-loop water systems: Recycling and reusing water within manufacturing facilities significantly cuts down on fresh water intake and wastewater output.

- Exploring sustainable dyeing alternatives: Techniques like digital printing or natural dyes can drastically lower water pollution compared to conventional methods.

- Strengthening supplier compliance: Ensuring all manufacturing partners adhere to strict water usage and pollution control policies is paramount.

Consumer demand for ethically and sustainably produced apparel is a significant environmental factor, pressuring Abercrombie & Fitch to adopt responsible sourcing and eco-friendly manufacturing. This trend is driven by a growing awareness of the fashion industry's environmental impact. For instance, by 2025, the global apparel market is projected to see a substantial increase in demand for sustainable fashion, with some reports indicating it could reach over $15 billion.

Abercrombie & Fitch is responding by exploring the use of recycled or organic fabrics, aiming to reduce water and energy consumption in its manufacturing, and minimizing chemical usage. Companies that demonstrate a strong commitment to sustainable sourcing, such as using materials like recycled polyester which can reduce carbon emissions by up to 50% compared to virgin polyester, often see an enhanced brand image and greater appeal to environmentally conscious consumers. This focus is becoming a key differentiator in the competitive retail landscape.

Abercrombie & Fitch's supply chain, from manufacturing to retail, inherently produces waste, including materials from production, packaging, and unsold inventory. In 2023, the apparel industry globally faced increasing scrutiny over its environmental footprint, with a significant portion of textile waste ending up in landfills. The company's commitment to reducing this impact is becoming a key differentiator.

Optimizing packaging to use fewer materials and more recycled content, alongside robust in-store and online recycling programs for clothing, are critical steps Abercrombie & Fitch is taking. Exploring circular economy models, such as textile take-back programs and resale platforms, offers a path to extend product life and minimize waste. These initiatives not only address environmental concerns but also resonate with a growing consumer base prioritizing sustainability.

Abercrombie & Fitch, like many in the apparel industry, faces growing pressure regarding its carbon footprint, encompassing everything from manufacturing and shipping to its physical stores. Stakeholders are increasingly demanding transparency and action on greenhouse gas emissions throughout the company's entire supply chain.

The company is expected to establish and actively pursue aggressive goals for reducing its environmental impact. This includes commitments to lowering emissions across its value chain, reflecting a broader industry trend towards sustainability.

Key strategies for Abercrombie & Fitch to address climate change and meet these expectations involve significant investments in renewable energy sources, streamlining transportation and logistics for greater efficiency, and enhancing energy conservation measures within its retail and operational facilities.

Beyond environmental concerns, there's a growing consumer and advocacy group push for ethical practices and transparency throughout Abercrombie & Fitch's supply chain. This includes ensuring fair labor conditions and upholding human rights across all manufacturing processes. For instance, in 2023, brands faced increased scrutiny over their labor practices, with reports highlighting the need for greater oversight in apparel manufacturing hubs.

Abercrombie & Fitch is tasked with ensuring its suppliers meet rigorous social and environmental standards. This involves conducting frequent audits and cultivating responsible relationships with partners. The company's commitment to these standards directly impacts its brand image and ability to avoid reputational damage.

- Supply Chain Audits: In 2024, major apparel retailers increased their third-party social compliance audits by an average of 15% to address labor concerns.

- Worker Well-being Programs: Investments in worker well-being initiatives, such as training and fair wage programs, are becoming a key differentiator for ethically-minded brands.

- Transparency Reporting: By the end of 2025, it's anticipated that over 70% of publicly traded apparel companies will be required to publish detailed supply chain transparency reports.

The apparel sector, including brands like Abercrombie & Fitch, faces significant scrutiny regarding water usage and pollution. Manufacturing processes, particularly dyeing and finishing, are known to consume vast amounts of water and can release pollutants if not managed effectively. For instance, the textile dyeing industry alone is estimated to be responsible for 20% of global industrial water pollution.

Abercrombie & Fitch must prioritize strategies to mitigate its water footprint. This involves both reducing overall water consumption and ensuring that any wastewater discharged is treated to meet stringent environmental standards. Innovations in water-saving technologies and the adoption of advanced wastewater treatment systems are crucial for responsible operations.

Key initiatives for Abercrombie & Fitch in this area could include:

- Investing in water-efficient dyeing machinery: Newer technologies can reduce water needed per garment by up to 50%.

- Implementing closed-loop water systems: Recycling and reusing water within manufacturing facilities significantly cuts down on fresh water intake and wastewater output.

- Exploring sustainable dyeing alternatives: Techniques like digital printing or natural dyes can drastically lower water pollution compared to conventional methods.

- Strengthening supplier compliance: Ensuring all manufacturing partners adhere to strict water usage and pollution control policies is paramount.

| Environmental Factor | Impact on Abercrombie & Fitch | Key Initiatives/Trends (2024-2025) |

|---|---|---|

| Sustainable Consumer Demand | Increased pressure for eco-friendly materials and production. | Growth in demand for sustainable fashion (projected >$15 billion by 2025). Use of recycled polyester reducing emissions by up to 50%. |

| Waste Management | Scrutiny over textile waste and packaging. | Focus on reducing production, packaging, and unsold inventory waste. Apparel industry waste is a significant environmental concern. |

| Carbon Footprint | Demand for transparency and reduction in greenhouse gas emissions. | Commitment to lowering emissions across the value chain. Investment in renewable energy and efficient logistics. |

| Water Usage & Pollution | Concerns over water consumption and discharge in manufacturing. | Textile dyeing responsible for 20% of global industrial water pollution. Adoption of water-efficient machinery and closed-loop systems. |

PESTLE Analysis Data Sources

Our Abercrombie & Fitch PESTLE Analysis is meticulously constructed using data from reputable market research firms, financial news outlets, and government economic reports. Insights into political stability, economic forecasts, and consumer trends are drawn from these authoritative sources.