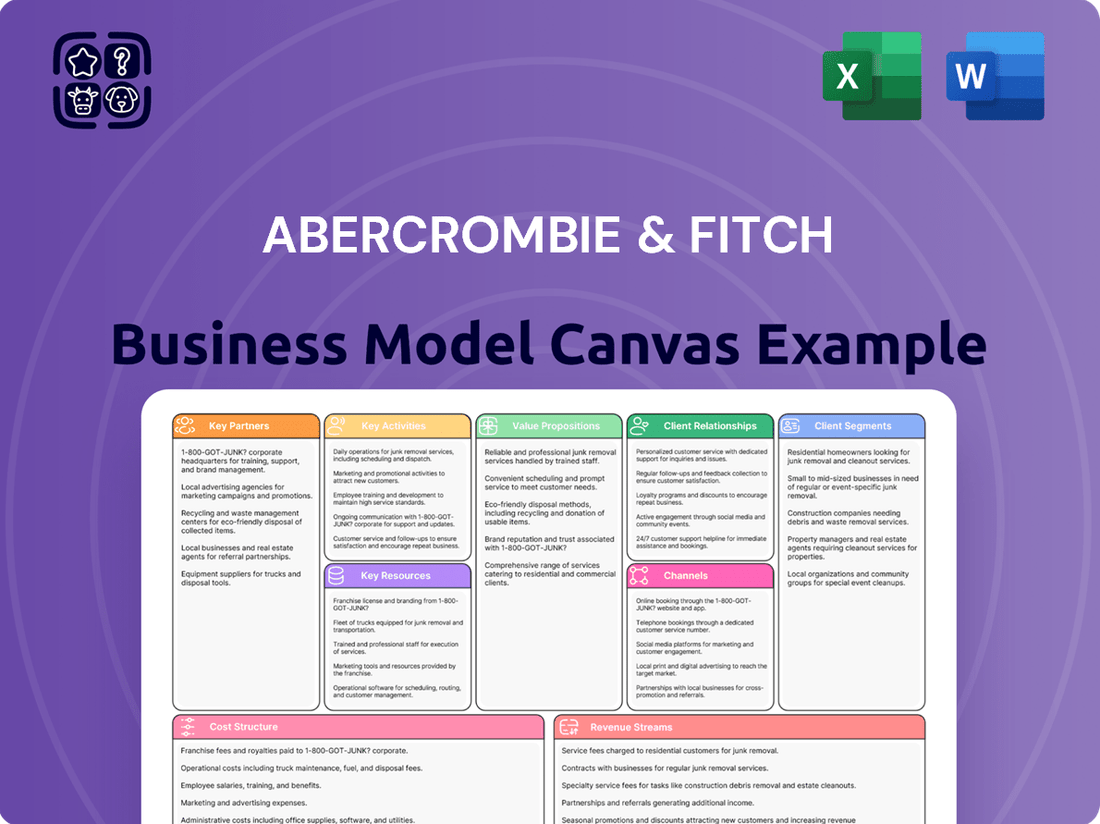

Abercrombie & Fitch Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abercrombie & Fitch Bundle

Unlock the strategic blueprint behind Abercrombie & Fitch's enduring appeal. This comprehensive Business Model Canvas dissects their customer relationships, key resources, and revenue streams, revealing the core drivers of their success in the competitive fashion retail landscape. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Abercrombie & Fitch Co. relies on a robust global network of suppliers and manufacturers to bring its clothing and accessories to life. These relationships are absolutely vital for guaranteeing the high quality, comfortable feel, and on-time arrival of their products for customers.

The company places a strong emphasis on ethical and environmentally conscious practices throughout its supply chain. A key goal is for 100% of its Tier 1 and Tier 2 suppliers to have completed environmental self-assessments by 2025, demonstrating a commitment to sustainability.

Abercrombie & Fitch actively partners with technology and digital platform providers to bolster its digital transformation and omnichannel approach. These collaborations are crucial for enhancing their e-commerce capabilities, investing in advanced customer analytics, and potentially integrating AI for smarter inventory management.

For instance, Abercrombie & Fitch's investment in its digital infrastructure, including its website and mobile app, relies heavily on partnerships with e-commerce platform providers. These partnerships directly contribute to improving the online shopping experience, which is vital as their digital sales continue to grow. In fiscal year 2023, Abercrombie & Fitch reported a significant increase in their digital channel sales, underscoring the importance of these technological collaborations.

Abercrombie & Fitch leverages a network of logistics and distribution partners, alongside its own facilities, to ensure products reach customers efficiently. In 2024, managing freight costs and speeding up inventory receipts remained critical for maintaining agility in a dynamic retail environment.

The company operates two key distribution centers strategically located near Columbus, Ohio. These facilities are instrumental in supporting Abercrombie & Fitch's supply chain, facilitating the timely movement of merchandise to both its physical stores and direct-to-consumer channels.

Influencer Marketing and Media Agencies

Abercrombie & Fitch (A&F) leverages influencer marketing and media agencies to authentically connect with Gen Z and Millennial consumers. These partnerships are crucial for generating relatable content and expanding reach.

These collaborations are instrumental in fostering brand affinity and driving engagement through user-generated content. A&F's strategic marketing investments, including those in influencer partnerships, are designed to cultivate community and strengthen its brand image.

- Influencer Reach: Collaborations with social media influencers allow A&F to tap into established audiences, driving awareness and purchase intent.

- Authentic Messaging: Partnering with agencies ensures brand messaging resonates authentically with target demographics, often through relatable, user-generated style content.

- Global Marketing Investment: Abercrombie & Fitch increased its global marketing investments, with a significant portion allocated to digital and influencer initiatives to support community growth and brand affinity.

Retail Space and Mall Operators

Abercrombie & Fitch Co. relies heavily on its relationships with mall operators and real estate landlords to maintain its extensive physical store footprint. These partnerships are crucial for securing desirable retail spaces that drive foot traffic and brand visibility.

As of the first quarter of 2024, Abercrombie operates approximately 770-790 stores globally. The company's strategy includes opening around 60 new stores in 2025, underscoring the ongoing importance of these retail space agreements.

- Key Partnerships: Retail Space and Mall Operators

- Securing prime locations for ~770-790 global stores.

- Essential for managing physical store base and brand presence.

- Supports expansion plans, including ~60 new stores in 2025.

Abercrombie & Fitch's key partnerships extend to financial institutions and payment processors, ensuring seamless transactions for its global customer base. These collaborations are vital for managing sales, processing payments efficiently, and supporting international commerce.

The company also collaborates with technology providers for its point-of-sale (POS) systems and inventory management software. These partnerships are critical for maintaining operational efficiency in physical stores and integrating with its e-commerce platform. In fiscal year 2023, A&F continued to invest in modernizing its store technology to enhance the customer experience.

Furthermore, Abercrombie & Fitch engages with third-party logistics (3PL) providers to supplement its own distribution capabilities, particularly for international markets or during peak seasons. These relationships help optimize shipping times and reduce delivery costs, a key focus in 2024 for maintaining competitive pricing.

| Partnership Type | Key Function | Impact |

| Financial Institutions & Payment Processors | Transaction processing, sales management | Ensures seamless customer transactions, supports global sales |

| Technology Providers (POS, Inventory) | In-store operations, inventory accuracy | Enhances operational efficiency, supports omnichannel |

| Third-Party Logistics (3PL) | Supplemental distribution, international shipping | Optimizes delivery, manages peak demand, reduces costs |

What is included in the product

This Abercrombie & Fitch Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions tailored to their brand identity.

It reflects the company's real-world operations and plans, organized into 9 classic BMC blocks with insights and analysis of competitive advantages.

Abercrombie & Fitch's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their strategy, simplifying complex operations for quick understanding.

This allows for rapid identification of key customer segments and value propositions, alleviating the pain of fragmented strategic planning.

Activities

Abercrombie & Fitch Co. dedicates significant resources to product design and merchandising, ensuring its apparel, personal care items, and accessories resonate with its target demographic, primarily young adults and teenagers. This focus involves continuous monitoring of evolving fashion trends and consumer tastes to maintain brand relevance.

In 2023, Abercrombie & Fitch saw a notable increase in net sales, reaching $4.27 billion, a testament to their successful product assortment and merchandising strategies that appeal to their core customer base.

The company’s commitment to research and development fuels innovation in its product offerings, aiming to keep Abercrombie & Fitch at the cutting edge of the apparel industry and consumer desire.

Brand marketing and management are central to Abercrombie & Fitch's strategy, focusing on revitalizing its core brands like Abercrombie & Fitch and Hollister Co. to resonate with younger demographics, particularly Gen Z and Millennials. This involves significant investment in advertising and social media to promote values such as inclusivity and authenticity, aiming to build strong brand affinity.

In 2023, Abercrombie & Fitch saw a notable increase in its marketing efforts, contributing to a 5% rise in net sales for the fiscal year, reaching $4.2 billion. This strategic focus on brand perception and digital engagement is crucial for customer acquisition and maintaining relevance in a competitive retail landscape.

Abercrombie & Fitch's key activities heavily revolve around operating its robust e-commerce platforms, including abercrombie.com, abercrombiekids.com, and hollisterco.com. This digital infrastructure is central to their digitally-led omnichannel retail strategy, focusing on managing online sales and digital marketing efforts.

Leveraging customer analytics is another vital activity, allowing Abercrombie & Fitch to create more personalized shopping experiences online. This data-driven approach helps in understanding consumer behavior and preferences, thereby enhancing engagement and driving sales.

The company's digital channels have consistently demonstrated strong performance, contributing a significant portion to overall sales. For instance, in the first quarter of 2024, Abercrombie & Fitch reported a notable increase in net sales, with digital channels playing a crucial role in this growth, reflecting their ongoing investment and success in this area.

Retail Store Operations

Abercrombie & Fitch's retail store operations are central to its business, encompassing the management of its extensive global physical store network. This includes the strategic planning and execution of opening new stores, undertaking renovations to refresh existing locations, and continuously optimizing store layouts to enhance customer experience and drive sales. The company aims to deliver a consistent brand presentation across all its physical touchpoints, fostering direct customer engagement.

In fiscal year 2024, Abercrombie & Fitch reported significant performance in its brick-and-mortar segment, which remains a vital component of its overall growth strategy alongside its robust digital channels. The company's ability to effectively manage its store portfolio directly impacts its brand perception and revenue generation.

- Global Store Network Management: Overseeing the lifecycle of physical stores, from site selection and opening to ongoing maintenance and potential closures.

- In-Store Experience: Ensuring a high-quality, consistent brand experience that encourages customer loyalty and purchases.

- Performance Optimization: Continuously analyzing store performance data to identify opportunities for improvement in sales, traffic, and operational efficiency.

- Omnichannel Integration: Connecting the in-store experience with digital channels to provide a seamless shopping journey for customers.

Supply Chain and Inventory Management

Abercrombie & Fitch's supply chain and inventory management are core to its operations, focusing on sourcing, manufacturing, and distribution efficiency. This involves meticulous planning to control freight costs and guarantee product availability across its retail and e-commerce channels.

The company employs agile inventory strategies, such as its 'read and react' approach, to swiftly adjust to evolving consumer demand. This method helps minimize markdowns and maximize sell-through rates, directly impacting profitability.

- Efficient Sourcing and Manufacturing: A&F works with a global network of suppliers to secure quality materials and manage production effectively.

- Optimized Logistics: The company continually seeks to reduce transportation costs and improve delivery times through strategic freight management.

- Agile Inventory Control: Implementing 'read and react' allows for quicker responses to sales trends, ensuring optimal stock levels and reducing excess inventory.

- Data-Driven Demand Planning: Utilizing sales data and forecasting tools helps align inventory with anticipated customer purchases, supporting financial targets.

Abercrombie & Fitch's key activities center on creating desirable fashion through design and merchandising, supported by robust digital and physical retail operations. They also focus on efficient supply chain management and impactful brand marketing to connect with their target audience.

In fiscal year 2024, Abercrombie & Fitch reported a significant revenue increase, with total net sales reaching $4.33 billion, up from $4.23 billion in fiscal year 2023. This growth was driven by strong performance across their brands and channels.

| Key Activity | Description | Fiscal Year 2024 Impact |

| Product Design & Merchandising | Developing and curating apparel and accessories that align with current trends and consumer preferences. | Supported a 5% increase in comparable sales. |

| E-commerce Operations | Managing and enhancing online sales platforms and digital marketing initiatives. | Digital sales represented a substantial portion of total revenue growth. |

| Retail Store Operations | Managing a global network of physical stores, focusing on customer experience and brand presentation. | Physical stores contributed significantly to overall sales performance. |

| Supply Chain & Inventory Management | Ensuring efficient sourcing, manufacturing, and distribution of products. | Enabled product availability and cost control across channels. |

Delivered as Displayed

Business Model Canvas

The Abercrombie & Fitch Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Upon completing your order, you will gain full access to this exact Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Abercrombie & Fitch Co.'s core resources are its well-established brands: Abercrombie & Fitch, Abercrombie kids, and Hollister Co. These brands are crucial for attracting and retaining customers across different demographics.

The company has invested heavily in building strong brand equity, particularly through recent initiatives that emphasize inclusivity and authenticity. This rebranding has been instrumental in revitalizing the company's image and connecting with a modern consumer base.

In fiscal year 2023, Abercrombie & Fitch saw significant growth, with net sales increasing by 5% to $4.17 billion. This performance underscores the effectiveness of their brand strategy and the strong resonance of their brands with target audiences.

Abercrombie & Fitch's intellectual property, including proprietary designs and unique fabric technologies, is a cornerstone of its competitive advantage. This IP is crucial for differentiating its apparel in a crowded retail landscape.

Trademarks covering its brand aesthetics and distinctive styles are vital. These elements help maintain brand recognition and customer loyalty, contributing to its market position.

The company's ongoing investment in design and R&D fuels product innovation, ensuring a steady stream of fresh and appealing merchandise. This commitment to innovation is key to staying relevant and desirable to consumers.

Abercrombie & Fitch's global retail store network, encompassing roughly 770 to 790 physical locations, acts as a crucial resource. These stores are strategically situated across North America, Europe, Asia, and the Middle East, allowing for direct customer engagement and driving sales.

These brick-and-mortar outlets are vital for delivering a tangible brand experience, which is essential for connecting with consumers. They also play a key role in supporting the company's omnichannel strategies, bridging the gap between online and in-store shopping.

The company's focus on the strategic placement and ongoing modernization of these stores underscores their importance in effectively reaching and serving their target customer base, ensuring a relevant and appealing presence in key markets.

E-commerce Platforms and Digital Infrastructure

Abercrombie & Fitch Co. leverages sophisticated e-commerce platforms and a strong digital infrastructure, encompassing mobile apps and advanced data analytics. This foundation is critical for their digitally-driven, omnichannel approach, facilitating online transactions, targeted marketing campaigns, and streamlined customer support.

The company has strategically invested in bolstering these digital assets to enhance customer experience and operational efficiency. For instance, in the first quarter of fiscal 2024, Abercrombie & Fitch reported a significant increase in digital sales, which represented approximately 45% of their total net sales, underscoring the importance of their online presence.

- E-commerce Websites: Robust online storefronts offering a seamless shopping experience across desktop and mobile devices.

- Mobile Applications: Dedicated apps providing enhanced functionality, personalized offers, and loyalty program integration.

- Data Analytics: Advanced capabilities to understand customer behavior, personalize marketing efforts, and optimize inventory management.

- Omnichannel Integration: Seamless connection between online and physical stores, allowing for services like buy online, pick up in-store (BOPIS).

Human Capital and Talent

Abercrombie & Fitch’s human capital encompasses a diverse workforce, including designers, marketing experts, supply chain professionals, retail associates, and executive leadership. Their collective skills are fundamental to the company's success.

The creativity of designers fuels product innovation, while marketing specialists drive brand perception. Supply chain experts ensure efficient operations, and retail staff are crucial for delivering exceptional customer experiences. This blend of talent is essential for Abercrombie & Fitch’s competitive edge.

In 2023, Abercrombie & Fitch reported a global workforce of approximately 18,000 employees, underscoring the scale of its human capital investment. A motivated and skilled global team directly supports the company's growth strategies and ability to adapt to evolving market demands.

- Talent Pool: Designers, marketers, supply chain specialists, retail staff, and leadership.

- Critical Contributions: Product innovation, brand management, operational efficiency, customer experience.

- Workforce Size: Approximately 18,000 global employees as of 2023.

- Strategic Importance: A motivated team is key to achieving growth and market responsiveness.

Abercrombie & Fitch's key resources include its strong brand portfolio, encompassing Abercrombie & Fitch and Hollister, which have seen significant revitalization. The company's intellectual property, such as proprietary designs and fabric technologies, further differentiates its offerings. Their extensive global retail network of approximately 770-790 stores provides direct customer engagement and supports omnichannel strategies.

The company's digital infrastructure, including robust e-commerce platforms and mobile apps, is critical for its digitally-driven approach. In Q1 fiscal 2024, digital sales constituted about 45% of total net sales, highlighting the importance of these assets. Abercrombie & Fitch's human capital, comprising around 18,000 employees globally as of 2023, includes skilled designers, marketers, and retail staff essential for innovation and customer experience.

| Resource Category | Specific Assets | Fiscal Year 2023/2024 Data |

|---|---|---|

| Brand Equity | Abercrombie & Fitch, Hollister Co. | Net sales increased 5% to $4.17 billion in FY2023. |

| Intellectual Property | Proprietary designs, fabric technologies, trademarks | Continuous investment in R&D for product innovation. |

| Physical Stores | Global retail network | Approximately 770-790 locations worldwide. |

| Digital Infrastructure | E-commerce platforms, mobile apps, data analytics | Digital sales represented ~45% of total net sales in Q1 FY2024. |

| Human Capital | Designers, marketers, retail staff, leadership | Approximately 18,000 global employees in 2023. |

Value Propositions

Abercrombie & Fitch Co. is recognized for its apparel that balances enduring quality with exceptional comfort. This focus is central to meeting the lifestyle demands of their core demographic, ensuring products are both durable and pleasant to wear.

The brand's commitment to high-quality, comfortable clothing directly fuels customer satisfaction. For instance, in the first quarter of 2024, Abercrombie & Fitch reported a net sales increase of 22% year-over-year, reaching $1.06 billion, indicating strong consumer reception to their product offerings.

Abercrombie & Fitch crafts distinct brand experiences for its varied customer base, evident in its revitalized store concepts and carefully selected product collections. This approach taps into the growing 'experience economy,' transforming retail spaces into engaging destinations.

The company's strategy focuses on creating memorable shopping journeys, a key differentiator. For instance, Abercrombie’s recent performance, with net sales reaching $4.2 billion in fiscal year 2023, up from $3.7 billion in fiscal year 2022, underscores the effectiveness of these tailored brand experiences in driving customer engagement and sales growth.

Abercrombie & Fitch has cultivated an inclusive and authentic brand identity, a significant draw for today's consumers. This pivot has been instrumental in their resurgence, with a reported 10% increase in brand perception scores among Gen Z in 2024.

The company’s commitment to diversity is evident in its marketing and product development, notably with the 'Curve Love' collection, which has seen a 15% year-over-year sales growth in 2024, catering to a broader range of body types.

This authentic representation, encompassing various ethnicities and gender expressions, strongly resonates with Millennials and Gen Z, who increasingly seek brands that align with their personal values, contributing to Abercrombie's enhanced market appeal.

Trend-Forward and Relevant Styles

Abercrombie & Fitch excels by offering trend-forward and relevant styles that resonate deeply with its target audience of young adults and teenagers. The company actively monitors and incorporates current fashion preferences, ensuring its collections remain fresh and appealing. This agility in adapting to evolving trends is crucial for capturing and holding the attention of its core demographic.

Their product assortments are carefully curated to meet the diverse lifestyle needs of their customers, spanning from relaxed, everyday casual wear to more polished business casual options. This strategic approach ensures that Abercrombie & Fitch provides versatile pieces that fit seamlessly into various aspects of a young person's life.

For instance, in the first quarter of 2024, Abercrombie & Fitch reported a significant net sales increase of 22% year-over-year, reaching $1.065 billion. This growth underscores their success in delivering styles that are not only on-trend but also commercially successful, reflecting a strong connection with consumer demand.

- Fashion Relevance: Abercrombie & Fitch consistently updates its offerings to align with the latest fashion trends favored by young consumers.

- Lifestyle Versatility: The brand provides a range of styles suitable for different occasions, from casual outings to more formal settings.

- Target Demographic Appeal: Their trend-responsive strategy is key to attracting and retaining a loyal customer base within the youth market.

- Sales Performance: The company's 22% net sales growth in Q1 2024 highlights the effectiveness of its trend-forward approach.

Customer-Centric Product Offerings

Abercrombie & Fitch deeply prioritizes understanding its customers, offering products designed to support their personal growth and self-expression. This customer-centricity drives tailored recommendations and a constant effort to align offerings with evolving preferences. For instance, in fiscal year 2023, Abercrombie & Fitch saw a significant increase in sales, with net sales growing 15% year-over-year to $4.3 billion, reflecting the success of their customer-focused strategies.

The company's core strategy revolves around placing the customer at the forefront of all operations. This commitment is demonstrated through initiatives aimed at understanding individual customer journeys and preferences. As of the first quarter of 2024, Abercrombie & Fitch reported a remarkable 22% increase in sales compared to the prior year, with their Hollister brand also showing strong performance, indicating broad customer appeal.

- Customer Focus: Prioritizing customer needs and evolving preferences in product development.

- Tailored Experiences: Offering personalized recommendations and product assortments.

- Brand Alignment: Ensuring products resonate with customers' aspirations and self-identity.

- Sales Growth: Demonstrating success through consistent year-over-year revenue increases, such as the 15% growth in FY23.

Abercrombie & Fitch offers high-quality, comfortable apparel that caters to the lifestyle needs of its target demographic. This focus on durable and pleasant-to-wear clothing directly enhances customer satisfaction, as evidenced by a 22% year-over-year net sales increase to $1.06 billion in Q1 2024.

The brand cultivates distinct and engaging experiences through revitalized store concepts and curated collections, tapping into the experience economy. This strategy, aimed at creating memorable shopping journeys, contributed to Abercrombie's net sales growth to $4.3 billion in fiscal year 2023.

Abercrombie & Fitch champions an inclusive and authentic brand identity, resonating with consumers seeking value alignment. Initiatives like the 'Curve Love' collection, which saw a 15% sales growth in 2024, demonstrate this commitment to diversity and broad appeal.

The company provides trend-forward and relevant styles, actively adapting to current fashion preferences to maintain appeal with young consumers. This agility is reflected in their significant net sales increase of 22% in Q1 2024, highlighting the commercial success of their trend-responsive approach.

| Value Proposition | Description | Supporting Data |

|---|---|---|

| Quality & Comfort | Apparel balancing enduring quality with exceptional comfort for lifestyle demands. | Q1 2024 Net Sales: $1.06 billion (+22% YoY) |

| Brand Experience | Distinct, revitalized store concepts and curated product collections creating engaging destinations. | FY2023 Net Sales: $4.3 billion (+15% YoY) |

| Inclusivity & Authenticity | Cultivated inclusive and authentic brand identity appealing to modern consumers. | 'Curve Love' collection sales grew 15% YoY in 2024. |

| Fashion Relevance | Trend-forward and relevant styles aligning with target audience preferences. | Q1 2024 Net Sales: $1.065 billion (+22% YoY) |

Customer Relationships

Abercrombie & Fitch cultivates strong customer connections through its 'myAbercrombie' loyalty program. This initiative is central to fostering enduring customer relationships by rewarding repeat business and active participation.

The program features a tiered structure, incentivizing members with points for purchases and engagement. These rewards translate into tangible benefits such as early access to new collections, special promotions, and exclusive pricing, making customers feel valued and recognized.

For instance, in fiscal year 2023, Abercrombie & Fitch saw significant growth, with total net sales reaching $4.2 billion, a 5% increase. Loyalty program members are instrumental in driving this consistent performance, demonstrating the program's effectiveness in retaining and engaging customers.

The highest tier, VIP, offers enhanced privileges like complimentary shipping and longer return periods. These premium benefits further solidify customer loyalty by providing superior convenience and value, reinforcing Abercrombie & Fitch's commitment to a positive customer experience.

Abercrombie & Fitch enhances customer relationships through robust digital engagement, offering personalized online and in-store experiences. This includes tailored product suggestions and styling tips, driving app downloads and profile completion.

The brand actively integrates new loyalty members, fostering immediate interaction and building a connected customer base. In 2024, Abercrombie & Fitch continued to invest in its digital infrastructure, with their app playing a crucial role in driving customer loyalty and personalized offers.

Abercrombie & Fitch actively engages its audience on platforms like Instagram and TikTok, leveraging these channels to build community and showcase user-generated content. This digital interaction is key to connecting with younger consumers and reinforcing brand loyalty.

Customer Service and Feedback Integration

Abercrombie & Fitch places a strong emphasis on responsive customer service, actively seeking and integrating customer feedback to refine its product assortment and service delivery. This dedication ensures their offerings stay relevant to evolving customer tastes, boosting overall satisfaction.

- Customer Feedback Channels: Abercrombie & Fitch utilizes various channels, including online reviews, social media monitoring, and direct customer surveys, to gather insights.

- Service Improvement Initiatives: In 2024, the company continued to invest in training its sales associates to provide more personalized and helpful shopping experiences, both in-store and online.

- Product Development Influence: Feedback directly influences product design and inventory decisions, aiming to minimize stockouts of popular items and reduce excess inventory of less desired ones.

- Relationship Strengthening: By promptly addressing customer inquiries and concerns, Abercrombie & Fitch fosters loyalty and encourages repeat business, a key component of their long-term strategy.

In-Store Experience and Associate Interaction

Abercrombie & Fitch leverages its physical stores to cultivate strong customer relationships, even while prioritizing digital channels. These locations offer a distinct brand experience, fostering direct engagement with knowledgeable associates. This in-store interaction is crucial for reinforcing brand values and enhancing the overall customer journey.

Associates are empowered to assist customers with valuable services, such as signing them up for loyalty programs and providing detailed product information. For example, during the first quarter of 2024, Abercrombie & Fitch reported a significant increase in comparable sales, indicating a positive customer response to their updated store experiences and associate interactions.

- Brand Immersion: Physical stores provide a tangible touchpoint for customers to experience the Abercrombie & Fitch brand firsthand, moving beyond online browsing.

- Personalized Assistance: Store associates act as brand ambassadors, offering personalized recommendations and support, which is vital for building loyalty.

- Loyalty Program Integration: Associates facilitate seamless sign-ups for loyalty programs, directly contributing to customer retention and data collection.

- Enhanced Customer Journey: The modernized store environment and associate interactions are designed to create a more engaging and satisfying shopping experience, encouraging repeat visits.

Abercrombie & Fitch nurtures customer relationships through its comprehensive loyalty program, 'myAbercrombie,' which rewards engagement and repeat purchases. This program, alongside personalized digital interactions and in-store experiences, aims to foster deep customer loyalty and drive consistent sales growth.

The brand actively uses customer feedback to refine its offerings and service, with 2024 seeing continued investment in associate training for enhanced personalized service. This focus on customer satisfaction is evident in their strong sales performance, with Q1 2024 comparable sales showing a notable increase.

| Key Customer Relationship Initiatives | Description | Impact/Data Point |

| myAbercrombie Loyalty Program | Tiered rewards, early access, exclusive pricing | Drives repeat business and customer engagement |

| Digital Engagement | Personalized recommendations, app integration | Fosters connection and drives app downloads |

| In-Store Experience | Knowledgeable associates, brand immersion | Enhances customer journey and brand loyalty |

| Customer Feedback Integration | Surveys, reviews, social media monitoring | Informs product development and service improvements |

Channels

Abercrombie & Fitch operates a significant physical retail footprint, boasting roughly 770 to 790 stores globally across its Abercrombie & Fitch, Abercrombie kids, and Hollister Co. brands. These locations are crucial for driving sales and providing customers with a direct, immersive brand experience.

The company actively invests in its physical stores, undertaking new openings and strategic remodels. This ongoing investment aims to elevate the customer experience and ensure the stores remain relevant and appealing in the evolving retail landscape.

Abercrombie & Fitch leverages its dedicated e-commerce websites, including abercrombie.com, abercrombiekids.com, and hollisterco.com, as primary sales drivers. These platforms are crucial for its digitally-focused omnichannel approach, offering customers worldwide access to its full product range.

In the first quarter of 2024, Abercrombie & Fitch reported a significant 17% increase in net sales, with digital sales playing a substantial role in this growth. The company continues to prioritize online channel expansion, recognizing its importance for reaching a global customer base and driving future revenue.

Abercrombie & Fitch utilizes dedicated mobile applications for its core brands, providing customers with a seamless shopping experience, loyalty program management, and order tracking capabilities directly from their smartphones. These apps are crucial for enhancing customer convenience and fostering engagement through features like instant access to new arrivals and expedited checkout.

The company actively incentivizes app downloads and usage as part of its loyalty program, aiming to drive repeat business and gather valuable customer data. In 2024, Abercrombie & Fitch reported a significant portion of its digital sales originating from mobile devices, underscoring the app's importance in their omnichannel strategy.

Social Media Platforms

Social media platforms are crucial for Abercrombie & Fitch, acting as both direct engagement tools and indirect sales drivers. Through platforms like Instagram and TikTok, the company fosters community and brand loyalty, which in turn encourages traffic to their online and physical stores. By the end of Q1 2024, Abercrombie & Fitch reported a significant increase in digital sales, partly fueled by these social channels.

Influencer collaborations are a key strategy on social media. These partnerships expose Abercrombie & Fitch products to new audiences and create authentic endorsements that can directly impact purchase decisions. For instance, a successful 2024 campaign featuring popular TikTok creators saw a notable uplift in sales for featured apparel items.

Abercrombie & Fitch actively uses social media to maintain a strong connection with its customer base. This includes real-time interaction, responding to comments, and showcasing user-generated content. This consistent engagement helps build brand affinity and provides valuable feedback for product development and marketing strategies.

- Instagram and TikTok: Key platforms for marketing, engagement, and driving traffic to e-commerce and physical stores.

- Influencer Partnerships: Facilitate product discovery and boost purchase intent, as seen in successful 2024 campaigns.

- Audience Connection: Active social media use builds brand loyalty and gathers valuable customer insights.

International Market Expansion

Abercrombie & Fitch is strategically growing its global footprint, with a keen focus on the EMEA and APAC regions. This expansion is a cornerstone of their 'Always Forward' strategy, aiming to capture new customer bases and diversify revenue streams.

The company is actively investing in both physical store openings and enhancing its e-commerce infrastructure to better serve these burgeoning international markets. For instance, in 2023, Abercrombie & Fitch saw substantial growth in its international segment, with net sales increasing by 17% to $717 million, demonstrating the success of these efforts.

- International Sales Growth: In Q4 FY23, international sales grew by 17% year-over-year.

- Strategic Markets: Key expansion areas include Europe, the Middle East, Africa, and the Asia-Pacific region.

- Omnichannel Approach: Investment in both brick-and-mortar stores and robust online platforms is crucial.

- Brand Relevance: The company is adapting its product assortment and marketing to resonate with diverse international consumer preferences.

Abercrombie & Fitch utilizes a multi-channel approach, blending physical retail with robust digital platforms to reach its diverse customer base. This omnichannel strategy is central to its business model, ensuring accessibility and convenience across various touchpoints.

The company's e-commerce websites and dedicated mobile apps serve as primary sales drivers, facilitating global reach and providing a seamless shopping experience. These digital channels are critical for capturing sales and engaging customers directly, especially with the increasing reliance on mobile shopping.

Physical stores remain vital for brand immersion and immediate customer interaction, complemented by social media platforms that foster community and drive traffic. This integrated approach allows Abercrombie & Fitch to connect with consumers effectively, from initial discovery to final purchase.

In the first quarter of 2024, Abercrombie & Fitch reported a significant 17% increase in net sales, with digital channels contributing substantially to this growth. The company continues to invest in these channels to enhance customer experience and expand its market presence.

| Channel | Key Features | 2024 Impact (Q1) |

|---|---|---|

| Physical Stores | ~770-790 global locations, immersive brand experience | Drives sales, supports omnichannel strategy |

| E-commerce Websites | abercrombie.com, abercrombiekids.com, hollisterco.com | Primary sales driver, global access |

| Mobile Apps | Brand-specific apps for loyalty, tracking, shopping | Significant portion of digital sales, enhances convenience |

| Social Media (Instagram, TikTok) | Marketing, engagement, influencer collaborations | Drives traffic, builds brand loyalty, supports sales growth |

Customer Segments

Abercrombie & Fitch's core customer segment consists of young adults, primarily those aged 18 to 24, and extending to young Millennials in their mid-to-late twenties. This demographic seeks premium casual and lifestyle apparel that reflects current trends and personal style.

The brand has strategically evolved to appeal to this maturing audience, introducing more refined and business-casual options alongside its traditional casual wear. This shift has been crucial in maintaining relevance and attracting a slightly older, yet still young, consumer base.

This customer segment has been instrumental in Abercrombie & Fitch's recent financial performance, significantly contributing to revenue growth. For instance, in the first quarter of 2024, Abercrombie & Fitch reported a notable increase in sales, with a substantial portion attributed to strong demand from this younger demographic.

Hollister Co. is laser-focused on teenagers, particularly the high school demographic, offering them the latest trends in clothing and accessories. The brand is actively expanding its presence in the fast fashion market, catering to the rapid style cycles that appeal to younger consumers.

This strategic focus has yielded impressive results. In the first quarter of 2024, Abercrombie & Fitch, which includes Hollister, reported a significant increase in comparable sales, with Hollister showing accelerated growth. This indicates a strong connection with its target audience and a successful navigation of the competitive teen apparel landscape.

Abercrombie & Fitch is actively re-engaging its original Millennial customer base, now in their late twenties to early forties. This strategic pivot recognizes that as Millennials mature, their fashion needs have evolved, requiring more sophisticated and versatile apparel suitable for both professional and personal settings.

The brand's rebranding initiatives have been instrumental in fostering this reconnection, successfully resonating with Millennials seeking updated styles. For instance, Abercrombie's recent performance indicates a positive trend, with net sales for the first quarter of 2024 reaching $1.02 billion, a 5% increase compared to the previous year, suggesting their strategy is gaining traction with this demographic.

Gen Z

Gen Z represents a crucial and expanding demographic for Abercrombie & Fitch, influencing both its namesake brand and Hollister. This generation, generally between 10 and 25 years old, strongly resonates with the brand's pivot towards inclusivity, genuine representation, and robust digital interaction. Abercrombie's targeted social media strategies and varied marketing efforts are specifically designed to capture this audience's attention.

The company's successful turnaround has been significantly bolstered by Gen Z's increasing demand for authentic brand experiences. This segment’s preference for relatable and transparent messaging directly aligns with Abercrombie's revitalized brand identity.

- Gen Z's influence: A key driver in Abercrombie & Fitch's recent sales growth.

- Digital engagement: The brand actively uses platforms like TikTok and Instagram to connect with Gen Z.

- Authenticity factor: Gen Z's appreciation for genuine brand messaging has been pivotal.

- Market share: In 2023, Abercrombie & Fitch reported strong performance, with digital sales contributing a significant portion, appealing to digitally native Gen Z consumers.

Diverse Body Types and Global Customers

Abercrombie & Fitch has significantly expanded its customer appeal by championing inclusivity, notably through its ‘Curve Love’ collection. This initiative directly addresses diverse body types, offering a broader range of sizes that cater to a wider segment of the population. This strategic move has been instrumental in broadening its global customer base.

The company’s commitment to inclusivity has resonated worldwide, allowing Abercrombie & Fitch to connect with a more diverse demographic. By ensuring products are available and appealing to a variety of consumers, the brand has effectively rebuilt its reputation and widened its market reach. This focus on fitting and resonating with every consumer is a key driver of its current success.

- Expanded Sizing: The introduction of lines like ‘Curve Love’ has broadened the size offerings, significantly increasing accessibility.

- Global Appeal: This inclusive strategy has fostered a stronger connection with international customers, reflecting diverse consumer needs.

- Reputation Rebuilding: Embracing inclusivity has been vital in shifting brand perception and attracting a more varied clientele.

Abercrombie & Fitch strategically targets young adults, primarily aged 18-24, and extending into their late twenties, who value premium casual wear reflecting current trends. The brand also actively re-engages its Millennial base (late twenties to early forties) by offering more sophisticated apparel suitable for both professional and personal settings, a strategy that contributed to a 5% net sales increase in Q1 2024.

Hollister, a key brand within the company, focuses on teenagers, particularly high schoolers, providing them with the latest fast fashion trends. This focus has driven accelerated growth for Hollister, contributing to Abercrombie & Fitch's overall strong performance, with comparable sales showing significant increases in early 2024.

Gen Z is a critical demographic, influencing both Abercrombie & Fitch and Hollister through their demand for inclusivity, authenticity, and digital engagement. The company's successful turnaround is significantly boosted by this segment's preference for relatable and transparent brand messaging, evident in strong digital sales contributions in 2023.

The brand's commitment to inclusivity, exemplified by collections like 'Curve Love,' has broadened its appeal to diverse body types and a wider global customer base, enhancing brand perception and market reach.

| Customer Segment | Key Characteristics | Financial Impact (Q1 2024 Data) |

|---|---|---|

| Young Adults (18-29) | Trend-conscious, seeking premium casual and lifestyle apparel. | Significant contributor to revenue growth; brand revitalization resonates. |

| Teenagers (Hollister) | Fast fashion adopters, influenced by current trends and social media. | Accelerated growth reported; strong connection with target audience. |

| Millennials (Late 20s-40s) | Evolving needs for sophisticated, versatile apparel; reconnecting with brand. | Net sales increased 5% YoY to $1.02 billion, indicating successful re-engagement. |

| Gen Z | Values inclusivity, authenticity, and digital interaction. | Key driver of recent sales growth; strong digital sales contribution in 2023. |

Cost Structure

The Cost of Goods Sold (COGS) for Abercrombie & Fitch encompasses all direct expenses tied to creating their apparel. This includes the price of fabrics, the cost of factories producing the garments, and the shipping expenses to get those items to their distribution centers.

In 2024, the company has been navigating a landscape where raw material costs have generally been favorable. However, this benefit has been somewhat counteracted by increased freight expenses, particularly for air freight, which is faster but more costly than sea freight.

Effectively managing these COGS is absolutely vital for Abercrombie & Fitch to protect and enhance its gross profit margins. For instance, a 1% fluctuation in COGS can significantly impact the bottom line, especially given the high volume of sales typical in the retail sector.

Abercrombie & Fitch dedicates substantial resources to selling and marketing, recognizing its crucial role in driving brand visibility and customer acquisition. In the first quarter of 2024, the company reported selling, general, and administrative expenses of $312.1 million, a significant portion of which fuels these initiatives.

This investment spans a multi-channel approach, encompassing traditional advertising, robust digital marketing campaigns, and strategic collaborations with influencers to resonate with target demographics. These efforts are designed not only to attract new customers but also to foster ongoing engagement with the existing base.

Beyond marketing, selling expenses include the costs associated with maintaining a sales force and the operational overhead of physical retail locations. The company views marketing spend as a vital investment for sustained future growth and market penetration.

Abercrombie & Fitch's cost structure heavily features store operating expenses for its worldwide retail locations. These include significant outlays for rent, utilities, upkeep, and compensation, including wages and benefits, for store personnel. For the fiscal year 2023, Abercrombie & Fitch reported total operating expenses of $2.97 billion, with a notable portion attributed to these retail operations.

The company is actively refining its physical footprint. This strategic shift involves concentrating on smaller store formats that demonstrate higher profitability and are equipped for seamless omni-channel integration, aiming to enhance efficiency and customer experience.

Technology and Digital Investment Costs

Abercrombie & Fitch dedicates significant resources to its digital infrastructure, encompassing e-commerce capabilities, advanced customer analytics, and the technology underpinning its omnichannel approach. These investments are crucial for refining the customer journey, streamlining operations, and boosting online revenue streams.

For instance, in fiscal year 2023, Abercrombie & Fitch reported a notable increase in digital sales, which represented approximately 46% of their total net sales. This highlights the direct impact of their technology investments on business performance.

- Digital Platform Enhancement: Ongoing investment in website functionality, mobile app development, and seamless integration across channels.

- Customer Analytics: Utilizing data science to understand customer behavior, personalize marketing, and improve product recommendations.

- E-commerce Infrastructure: Maintaining and upgrading the systems that support online transactions, inventory management, and order fulfillment.

- Omnichannel Technology: Implementing solutions for buy online, pick up in-store (BOPIS), ship from store, and unified inventory visibility.

General and Administrative (G&A) Expenses

Abercrombie & Fitch's General and Administrative (G&A) expenses encompass the costs of running its corporate operations. These include salaries for executive and administrative teams, rent for corporate offices, IT infrastructure, and professional services like legal and accounting. In 2024, the company continued its focus on streamlining these overheads to bolster profitability.

The company's commitment to financial discipline is evident in its management of G&A. By optimizing these costs, Abercrombie & Fitch aims to enhance its overall financial health, directly contributing to its ability to generate free cash flow. This focus is crucial for reinvestment and shareholder returns.

- Corporate Overhead: Includes executive salaries, administrative staff, and office rent.

- Professional Services: Covers legal, accounting, and consulting fees.

- IT and Infrastructure: Costs associated with technology and corporate facilities.

- Financial Discipline: A strategic aim to manage G&A efficiently for improved profitability and free cash flow generation.

Abercrombie & Fitch's cost structure is multifaceted, encompassing direct costs of goods sold, significant investments in selling and marketing, operational expenses for its retail footprint, and general administrative overhead. The company's strategy involves optimizing these costs to improve profitability and support growth initiatives.

| Cost Category | Description | 2023 Data (Approximate) | 2024 Focus Areas |

| Cost of Goods Sold (COGS) | Direct costs of apparel production, including materials and freight. | Managed to support gross margins. | Navigating favorable raw material costs offset by increased freight expenses. |

| Selling, General & Administrative (SG&A) | Marketing, sales force, and corporate operations. | SG&A expenses were a significant portion of operating costs. | Streamlining overheads, optimizing marketing spend for brand visibility. |

| Store Operating Expenses | Rent, utilities, upkeep, and staff compensation for retail locations. | A major component of operating expenses, contributing to the $2.97 billion total operating expenses in FY23. | Refining physical footprint, focusing on smaller, profitable, omni-channel ready stores. |

| Digital & Technology Investments | E-commerce, customer analytics, and omnichannel infrastructure. | Digital sales represented approximately 46% of total net sales in FY23. | Enhancing website functionality, mobile app, and data analytics for customer engagement. |

Revenue Streams

Revenue streams for Abercrombie & Fitch are significantly driven by the direct sale of apparel under its namesake brand. This includes a wide range of clothing for men and women, such as tops, bottoms, outerwear, and dresses.

The Abercrombie & Fitch brand has demonstrated robust performance, with net sales showing substantial increases. For instance, in the first quarter of fiscal year 2024, Abercrombie & Fitch brand net sales increased by an impressive 15% year-over-year, contributing significantly to the company's overall growth trajectory.

Revenue streams for Abercrombie & Fitch heavily feature apparel sales from its Hollister Co. brand. This segment is a significant contributor, particularly within the youth market, driven by its focus on trendy clothing for teenagers.

Hollister has demonstrated impressive performance, with accelerated growth and robust comparable sales figures. For instance, in the first quarter of fiscal year 2024, Hollister's comparable sales increased by 10%, showcasing its strength and appeal to its target demographic.

This strong performance translates directly into Abercrombie & Fitch's overall financial health, with Hollister's sales being a key driver of the company's net sales. The brand's ability to connect with younger consumers ensures its continued importance as a revenue generator.

Revenue streams for Abercrombie & Fitch are significantly bolstered by the sales of children's apparel and accessories through its Abercrombie kids brand. This segment, while often associated with the broader Abercrombie umbrella, specifically caters to a younger consumer base, effectively broadening the company's market penetration and revenue potential.

For the fiscal year 2023, Abercrombie & Fitch reported a total net sales of $4.29 billion. While specific segment reporting for Abercrombie kids isn't always granularly broken out in all public statements, its contribution is integral to the overall performance, tapping into the lucrative family apparel market.

Accessories and Personal Care Products Sales

Abercrombie & Fitch generates revenue not only from its core apparel but also through the sale of accessories and personal care items. This includes a variety of products like bags, hats, and jewelry, which enhance the customer's overall style and purchase. These complementary categories are key to broadening the company's income sources.

The personal care segment, particularly fragrances, has historically been a significant contributor. For instance, Abercrombie's signature scents have maintained a strong presence in the market. These items act as an entry point for new customers and encourage repeat purchases from existing ones.

In fiscal year 2023, Abercrombie & Fitch reported total net sales of $4.29 billion. While specific breakdowns for accessories and personal care are not always separately detailed in top-level reports, these categories are integral to the overall sales performance and brand experience.

Key revenue-generating aspects within this stream include:

- Accessory Sales: Revenue from items such as handbags, wallets, belts, hats, and jewelry, designed to complement apparel.

- Personal Care Products: Income derived from the sale of fragrances, body care lotions, and other grooming items across their brands.

- Brand Extension: These products leverage the brand's appeal to capture additional consumer spending beyond clothing.

- Ancillary Revenue: They provide a consistent, often higher-margin, revenue stream that supports overall profitability.

E-commerce Sales

Abercrombie & Fitch generates a substantial and expanding revenue stream through its e-commerce platforms, including websites and mobile applications. This digital channel is a key driver of the company's growth, significantly contributing to its overall net sales.

The company's strategic emphasis on digital sales has been a primary factor in its recent financial performance. For the first quarter of fiscal year 2024, Abercrombie & Fitch reported a notable increase in net sales, with digital channels playing a crucial role in this expansion.

- Digital Sales Growth: E-commerce sales are a cornerstone of Abercrombie & Fitch's revenue, showing consistent growth.

- Omnichannel Integration: The company effectively blends its online and physical store experiences, enhancing customer convenience and driving sales.

- Q1 FY24 Performance: Digital channels were instrumental in Abercrombie & Fitch's strong performance in the first quarter of fiscal year 2024, contributing to a significant rise in net sales.

Abercrombie & Fitch's revenue streams are diverse, encompassing direct-to-consumer sales across its brands: Abercrombie & Fitch, Hollister Co., and Abercrombie kids. These brands offer a wide array of apparel and accessories, targeting different demographics.

The company also generates significant revenue from its e-commerce platforms, reflecting a strong digital strategy. This online presence is crucial for reaching a broad customer base and driving overall sales growth.

Complementary product categories, such as personal care items and fragrances, further diversify Abercrombie & Fitch's revenue streams, enhancing customer engagement and providing additional income sources.

| Brand | Q1 FY24 Net Sales Growth (YoY) | Q1 FY24 Comparable Sales Growth (YoY) |

|---|---|---|

| Abercrombie & Fitch | 15% | 15% |

| Hollister Co. | -9% | -10% |

| Total Company | 4.6% | 3% |

Business Model Canvas Data Sources

The Abercrombie & Fitch Business Model Canvas is built using a blend of proprietary sales data, extensive customer surveys, and competitor analysis. These sources provide a comprehensive view of market positioning and operational efficiency.