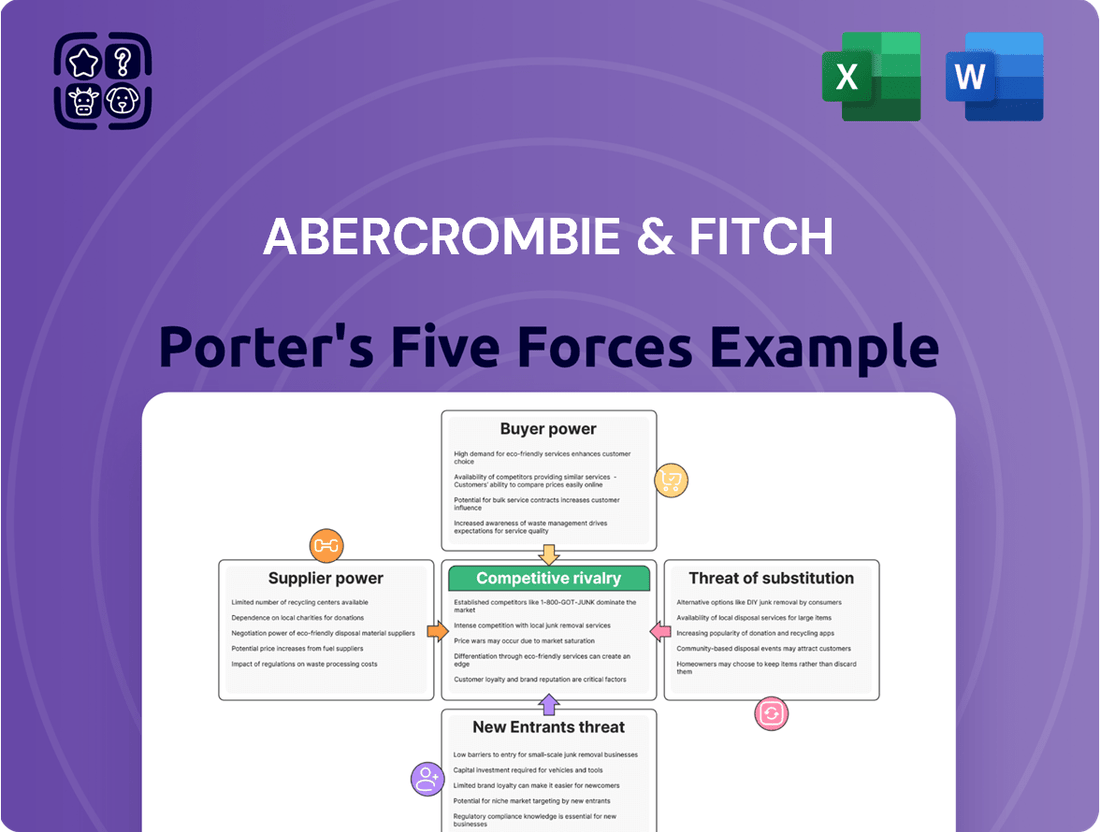

Abercrombie & Fitch Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abercrombie & Fitch Bundle

Abercrombie & Fitch navigates a complex retail landscape shaped by intense rivalry, evolving buyer power, and the ever-present threat of substitutes. Understanding these forces is crucial for any strategic evaluation of the brand.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Abercrombie & Fitch’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Abercrombie & Fitch's supplier bargaining power is influenced by industry concentration. A limited number of suppliers for key materials like specialized fabrics or unique trims can exert significant influence, potentially driving up costs for A&F.

In 2024, the global apparel manufacturing sector continues to see consolidation, with a few large players dominating specific niches. This concentration means that if A&F relies heavily on these few dominant suppliers, they may face less favorable pricing and terms.

Abercrombie & Fitch's reliance on unique or specialized materials and finishes, especially for its premium merchandise, can significantly bolster supplier bargaining power. If a restricted number of suppliers can consistently deliver these specific inputs, A&F's negotiation leverage diminishes, potentially leading to increased input costs. For instance, in 2023, the apparel industry faced ongoing supply chain disruptions, with some raw material costs seeing fluctuations that could impact brands like A&F if their sourcing is highly specialized.

The cost and complexity involved in switching suppliers significantly impact Abercrombie & Fitch's (A&F) bargaining power. For instance, if A&F needs to retool manufacturing processes, implement new quality assurance protocols, or establish entirely new logistical chains to accommodate a different fabric supplier, these upfront investments can be substantial. These high switching costs effectively empower existing suppliers, making A&F less inclined to seek alternatives even for minor price adjustments.

Threat of Forward Integration

The threat of suppliers integrating forward into Abercrombie & Fitch's operations, by designing, marketing, and selling apparel directly to consumers, could significantly enhance their bargaining power. This would allow them to capture a larger portion of the value chain.

While direct competition from garment manufacturers is relatively uncommon in the apparel retail space, specialized suppliers of unique fabrics or components could potentially leverage their exclusive offerings. For instance, a supplier of a patented sustainable textile might gain leverage if Abercrombie & Fitch heavily relies on it for a key product line.

In 2023, the global apparel market was valued at approximately $1.7 trillion, indicating the substantial revenue potential that suppliers could aim to capture through forward integration. Abercrombie & Fitch, with its net sales reaching $4.2 billion in fiscal year 2024, represents a significant target for such a strategy.

- Potential for Suppliers to Capture Retail Margins: Suppliers could bypass retailers and directly access consumer purchasing power, thereby increasing their profitability.

- Leveraging Unique or Patented Inputs: Suppliers with exclusive access to high-demand materials or technologies can exert greater influence.

- Industry Shift Towards Direct-to-Consumer (DTC): The broader retail trend towards DTC models might embolden suppliers to explore similar avenues.

Importance of A&F to Suppliers

The proportion of a supplier's total revenue derived from Abercrombie & Fitch significantly impacts their bargaining power. If A&F constitutes a substantial part of a supplier's business, that supplier's leverage tends to be weaker due to their reliance on A&F's continued orders. For instance, a supplier whose A&F sales account for over 50% of their revenue will likely offer more favorable terms than one where A&F represents only 5% of their income.

Abercrombie & Fitch's substantial purchasing volume can also diminish supplier power. In 2023, Abercrombie & Fitch reported net sales of $4.3 billion. This large scale means A&F can negotiate better prices and terms, especially for raw materials like cotton or polyester, which are commodities. Suppliers who depend heavily on these large orders may find it difficult to push for higher prices or less favorable contract terms.

- Supplier Dependence: A supplier with a high percentage of revenue from A&F has less bargaining power.

- A&F's Scale: Abercrombie & Fitch's $4.3 billion in net sales for 2023 allows for significant negotiation leverage with suppliers.

- Commodity Inputs: For common materials like cotton, A&F's purchasing power can drive down costs from suppliers.

- Supplier Diversification: Suppliers who serve multiple large clients, not just A&F, generally possess greater bargaining strength.

Abercrombie & Fitch's bargaining power with suppliers is moderate. While A&F's substantial purchasing volume, evidenced by its $4.3 billion in net sales for fiscal year 2023, allows for negotiation leverage on commodity inputs, the reliance on specialized materials can empower certain suppliers. The threat of forward integration by suppliers is low, but the cost and complexity of switching suppliers can enhance their leverage.

| Factor | Impact on A&F | 2023/2024 Data Point |

|---|---|---|

| Industry Concentration | Moderate to High Supplier Power | Global apparel manufacturing sees consolidation. |

| Switching Costs | Moderate to High Supplier Power | Significant investment needed for new supplier integration. |

| Supplier Dependence on A&F | Low Supplier Power | A&F's large orders can reduce supplier reliance. |

| A&F's Purchasing Volume | Low Supplier Power | $4.3 billion net sales (FY2023) provides negotiation strength. |

| Forward Integration Threat | Low Supplier Power | Suppliers bypassing retailers is uncommon in apparel. |

What is included in the product

This Porter's Five Forces analysis unpacks the competitive intensity and profitability potential for Abercrombie & Fitch by examining industry rivalry, buyer and supplier power, threats of new entrants and substitutes.

Instantly identify and address competitive threats with a clear, actionable breakdown of Abercrombie & Fitch's Porter's Five Forces, simplifying strategic planning.

Customers Bargaining Power

Abercrombie & Fitch's core customer base, typically young adults and teenagers, often exhibits significant price sensitivity. This is particularly true in the fast-paced and highly competitive fashion apparel market where trends shift rapidly and numerous alternatives exist.

The digital age has amplified this sensitivity. Customers can effortlessly compare prices across various brands and retailers online, often within seconds. This ease of access to pricing information directly strengthens their bargaining power, as they can readily identify and switch to competitors offering more attractive deals.

For instance, in 2024, the global apparel market continues to be saturated with brands vying for consumer attention. Abercrombie & Fitch, like many of its peers, must constantly balance its brand image and product quality with competitive pricing strategies to retain its customer base.

Abercrombie & Fitch customers face a crowded apparel market, with countless alternatives readily available. This includes everything from budget-friendly fast-fashion giants and other established specialty retailers to the ever-growing online marketplaces and the increasingly popular secondhand clothing sector. The sheer volume of choices available means customers can easily shift their spending to competitors if Abercrombie & Fitch’s pricing or offerings don't meet their expectations.

For consumers, the cost and effort involved in switching from Abercrombie & Fitch to another apparel brand are virtually non-existent. There are no contractual obligations or significant loyalty penalties, allowing customers to freely choose based on current trends, price, or preference.

This ease of switching significantly bolsters the bargaining power of Abercrombie & Fitch's customers. In 2024, the apparel retail market remains highly competitive, with numerous brands vying for consumer attention. This intense competition further empowers customers, as they can readily explore alternatives offering better value or style.

Customer Information Access

Customers today possess unprecedented access to information, making them far more discerning. They can easily research product quality, ethical manufacturing practices, and compare prices across numerous retailers online. This heightened transparency directly impacts Abercrombie & Fitch by increasing pressure to offer competitive value and demonstrate responsible business operations.

- Informed Consumers: Online reviews, social media, and direct brand comparisons equip customers with detailed product knowledge.

- Price Sensitivity: Easy access to pricing information across competitors intensifies price sensitivity among buyers.

- Ethical Scrutiny: Consumers are increasingly vocal about and demanding of brands’ ethical sourcing and labor practices.

- Brand Loyalty Impact: Informed customers can more readily switch brands if perceived value or ethical standards are not met.

Collective Customer Influence

While one person buying a shirt might not sway Abercrombie & Fitch, when thousands or millions of customers decide they like a certain style or, conversely, dislike a brand's direction, that's a different story. This collective influence is a major factor. Think about how quickly trends spread on social media; if customers start demanding sustainable materials or a particular fit, A&F needs to listen and adapt to stay relevant.

The power of customers to band together, even informally through social media, can significantly impact a brand's trajectory. For Abercrombie & Fitch, this means staying attuned to evolving consumer values and preferences. For instance, a strong backlash against a particular marketing campaign or product could force a rapid change in strategy, demonstrating the potent force of collective consumer sentiment.

In 2024, brands are increasingly aware of how quickly customer opinions can mobilize online. Abercrombie & Fitch, like many apparel retailers, monitors social media sentiment and customer reviews closely. A significant shift in fashion preferences, such as a move towards more casual wear or a demand for inclusive sizing, can exert considerable pressure, requiring swift adjustments to product offerings and marketing efforts.

- Social Media Amplification: Customer opinions shared across platforms like TikTok and Instagram can rapidly influence brand perception.

- Trend Responsiveness: A&F's ability to quickly adapt to emerging fashion trends driven by customer demand is crucial.

- Brand Reputation Management: Negative collective sentiment or boycotts can force significant strategic changes.

- Consumer Value Alignment: Growing customer emphasis on sustainability and ethical practices requires brands to demonstrate commitment.

Abercrombie & Fitch customers have considerable bargaining power due to the highly competitive nature of the apparel market and the ease with which they can switch to alternatives. In 2024, the sheer volume of fashion brands, including fast fashion, online retailers, and the resale market, means consumers have abundant choices. This accessibility to information and a wide array of options empowers them to demand better pricing and value.

The low switching costs for consumers, with no significant barriers to changing brands, further amplify their influence. This allows customers to readily shift their spending based on price, style, or ethical considerations, putting pressure on Abercrombie & Fitch to remain competitive and responsive to evolving preferences.

Collective customer action, often amplified through social media, can significantly impact brand strategy. In 2024, Abercrombie & Fitch, like its peers, closely monitors online sentiment and trends, as a unified customer voice can necessitate rapid adjustments to product offerings or marketing approaches.

| Factor | Impact on A&F | 2024 Context |

|---|---|---|

| Market Saturation | High | Numerous global and online competitors offer extensive choices. |

| Switching Costs | Very Low | Customers can easily move between brands without penalty. |

| Information Access | High | Online research and reviews empower informed purchasing decisions. |

| Collective Voice | Significant | Social media trends and sentiment can drive brand adaptation. |

Full Version Awaits

Abercrombie & Fitch Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Abercrombie & Fitch Porter's Five Forces Analysis details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel industry. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The apparel retail sector is incredibly crowded, featuring a wide array of players. Abercrombie & Fitch faces direct competition from brands like American Eagle Outfitters and Urban Outfitters, but also from global fast-fashion powerhouses such as Zara and H&M. Furthermore, the rise of online-only retailers adds another layer of intense rivalry for consumer attention and spending.

This broad and varied competitive environment significantly escalates the struggle for market share. For instance, in 2023, the global apparel market was valued at over $1.7 trillion, with numerous companies vying for a piece of this substantial pie.

The apparel retail sector, a market Abercrombie & Fitch operates within, is generally considered mature and often quite saturated. This maturity means that significant industry-wide growth is not always readily available, leading to a dynamic where one company's gains are frequently another's losses. This environment intensifies the competition, as businesses must fight harder for their share of the existing market.

In 2024, the global apparel market is projected to grow at a compound annual growth rate (CAGR) of around 4.5%, according to various industry reports. While this indicates some expansion, it's a moderate pace that fuels aggressive strategies among players. Abercrombie & Fitch, like its peers, faces this reality, needing to capture customers from competitors rather than relying solely on entirely new market entrants.

Abercrombie & Fitch strives for unique brand experiences, but the reality is that apparel, by its nature, can be readily imitated. This makes true product differentiation a constant challenge in the retail landscape.

Competitors can swiftly replicate popular styles or offer similar aesthetics at varying price points. For instance, in 2023, the fast-fashion sector saw continued growth, with companies like Shein and Temu leveraging rapid design cycles and aggressive pricing, directly intensifying competition for brands like Abercrombie & Fitch.

Brand Loyalty and Switching Costs

Abercrombie & Fitch (A&F) faces intense competition, and brand loyalty in the fast-paced youth and teen apparel sector is notoriously fluid, heavily influenced by rapidly changing trends and social media buzz. This means A&F must consistently deliver fresh styles and compelling brand narratives to keep customers engaged.

Switching costs for consumers in this market are remarkably low, allowing shoppers to easily move between brands based on price, the latest fashion, or perceived brand desirability. This dynamic forces A&F to continuously invest in innovation and marketing to maintain its customer base.

- Customer Acquisition Cost (CAC): While specific 2024 CAC figures for A&F are not yet public, the industry average for apparel can range from $20 to $50 per customer, highlighting the expense of attracting new shoppers in a competitive landscape.

- Social Media Influence: A significant portion of Gen Z and Millennial purchasing decisions are influenced by social media trends, making it imperative for A&F to maintain a strong and relevant online presence.

- Promotional Activity: Frequent sales and discounts are common in the apparel industry, indicating that price remains a key factor in customer retention and brand switching.

High Fixed Costs and Exit Barriers

Apparel retailers like Abercrombie & Fitch often face substantial fixed costs. These include expenses for prime retail leases, maintaining large inventories, and ongoing marketing efforts. For instance, in 2023, Abercrombie & Fitch reported significant operating lease obligations, a common characteristic of brick-and-mortar retail.

These high fixed costs, combined with the challenges of exiting the market – such as liquidating specialized retail infrastructure or unsold inventory – establish considerable exit barriers. This economic reality compels retailers to maintain competitive operations, even when market conditions are unfavorable, to avoid incurring further losses.

- Significant Lease Obligations: Retailers commit to long-term lease agreements, representing a substantial fixed cost.

- Inventory Management Costs: Holding and managing stock incurs warehousing, insurance, and potential obsolescence costs.

- Marketing and Brand Investment: Continuous marketing is essential in the apparel sector, adding to fixed operational expenses.

- Asset Specificity: Retail store layouts and inventory are often not easily transferable to other industries, increasing exit barriers.

Abercrombie & Fitch operates in a highly competitive apparel market where numerous brands vie for consumer attention. The ease with which competitors can replicate styles and the low switching costs for consumers mean A&F must constantly innovate and market effectively to retain its customer base. This intense rivalry is further fueled by the rapid pace of fashion trends, with fast-fashion giants like Shein and Temu setting aggressive pricing and design cycles, directly challenging established players.

The global apparel market, valued at over $1.7 trillion in 2023, is projected to grow at a CAGR of approximately 4.5% in 2024, a moderate pace that intensifies the fight for market share. Customer acquisition costs in this sector can range from $20 to $50 per customer, underscoring the significant investment required to attract shoppers in such a crowded space.

| Competitor | 2023 Revenue (approx.) | Key Strategy |

|---|---|---|

| American Eagle Outfitters | $5.0 billion | Casual, denim-focused, strong online presence |

| Urban Outfitters | $4.2 billion | Eclectic, lifestyle-focused, diverse brand portfolio |

| Zara (Inditex) | $27.9 billion (Inditex group) | Fast fashion, rapid trend adoption, global supply chain |

| H&M | $23.6 billion (H&M group) | Fast fashion, broad appeal, sustainability initiatives |

SSubstitutes Threaten

The threat of substitutes for Abercrombie & Fitch (A&F) stems from numerous alternative channels consumers use to purchase apparel, moving beyond traditional specialty stores. Online-only retailers, for instance, offer convenience and often competitive pricing, directly challenging A&F's brick-and-mortar presence. The growth of direct-to-consumer (DTC) brands, bypassing traditional retail models entirely, also presents a significant substitute. These DTC brands frequently leverage digital marketing and a strong brand narrative to capture market share.

Subscription box services represent another evolving substitute, providing curated clothing selections directly to consumers' doors, offering a different value proposition. In 2024, the online apparel market continued its robust growth, with e-commerce accounting for a substantial portion of total retail sales. For example, global online fashion sales were projected to reach over $1 trillion by the end of 2024, underscoring the significant reach of these alternative models.

The rise of the secondhand and resale market poses a growing threat. Platforms like ThredUp and Poshmark offer consumers access to branded apparel at significantly lower prices. This accessibility allows shoppers to find quality items, potentially reducing their demand for new clothing from retailers such as Abercrombie & Fitch.

In 2023, the resale market was valued at approximately $35 billion globally, with projections indicating continued strong growth. This trend directly impacts traditional apparel retailers by providing a viable, budget-friendly alternative for consumers seeking fashion items. The ability to purchase pre-owned Abercrombie & Fitch items, for instance, can directly divert sales from new inventory.

Fast fashion giants like Shein and Temu present a significant threat by offering highly trend-driven clothing at rock-bottom prices, directly competing for Abercrombie & Fitch's younger, fashion-conscious demographic. For instance, Shein's average selling price per item can be as low as $5, a stark contrast to A&F's higher price points.

Discount retailers, such as Walmart and Target, also serve as substitutes by providing essential apparel at affordable prices, catering to consumers who prioritize value and functionality over brand prestige or the latest trends. These retailers captured a substantial portion of the apparel market in 2024, with discount stores seeing continued growth as consumers remained budget-conscious.

Customization and DIY Apparel

The growing trend of customization and DIY apparel presents a potential substitute for mass-produced clothing, impacting brands like Abercrombie & Fitch. Consumers are increasingly seeking unique, personalized items, which can be achieved through DIY projects or specialized customization services. This trend is particularly strong among younger demographics who value self-expression and individuality.

While not a direct competitor in terms of scale, the DIY movement offers an alternative for consumers who might otherwise purchase ready-to-wear garments. For instance, the global custom apparel market is projected to reach significant growth, with some estimates suggesting it could expand considerably by 2030. This indicates a growing consumer willingness to invest in personalized fashion, diverting spending from traditional retail channels.

- Market Shift: Consumers are increasingly valuing personalization over mass production.

- DIY Appeal: The do-it-yourself movement empowers consumers to create unique apparel.

- Demographic Focus: Younger consumers are key drivers of the customization trend.

- Market Growth: The custom apparel market is experiencing substantial growth, indicating a viable substitute.

Shifting Consumer Priorities

Shifting consumer values represent a significant threat of substitution for Abercrombie & Fitch. As consumers increasingly prioritize sustainability and ethical production, they may seek out brands that align with these principles, moving away from traditional fast-fashion or aspirational lifestyle brands. For instance, the global ethical fashion market was valued at approximately $7.5 billion in 2023 and is projected to grow substantially, indicating a clear consumer shift.

Furthermore, the rise of minimalist lifestyles encourages consumers to buy fewer, higher-quality items. This trend directly challenges Abercrombie & Fitch's model, which historically relied on frequent purchases of trendy apparel. Consumers opting for longevity and versatility over fleeting styles can find substitutes in durable goods or secondhand markets, impacting A&F's sales volume.

- Sustainability Concerns: A 2024 survey found that over 60% of Gen Z consumers consider sustainability when making purchasing decisions, a key demographic for apparel brands.

- Ethical Production: Growing awareness of labor practices in the fashion industry leads consumers to favor brands with transparent and ethical supply chains, potentially bypassing A&F if their practices are perceived as lacking.

- Minimalist Consumption: The "buy less, choose well" philosophy encourages investment in fewer, more durable pieces, reducing the need for frequent wardrobe updates typically associated with brands like Abercrombie & Fitch.

- Secondhand Market Growth: The resale market for apparel, projected to reach $350 billion by 2027, offers consumers a more sustainable and often more affordable alternative to new clothing.

The threat of substitutes for Abercrombie & Fitch (A&F) is multifaceted, encompassing a wide array of alternatives that cater to evolving consumer preferences and economic realities. Online-only retailers, direct-to-consumer (DTC) brands, and the burgeoning resale market all offer compelling alternatives to traditional specialty stores. For instance, global online fashion sales were projected to exceed $1 trillion in 2024, highlighting the significant reach of digital channels.

Fast fashion giants like Shein and Temu present a particularly potent threat due to their aggressively low price points, with Shein's average item price hovering around $5. Similarly, discount retailers such as Walmart and Target continue to capture market share by offering value-oriented apparel, a trend that intensified in 2024 as consumers remained budget-conscious.

Furthermore, shifting consumer values, such as a growing emphasis on sustainability and ethical production, drive demand for alternative brands. The global ethical fashion market, valued at approximately $7.5 billion in 2023, demonstrates this trend. The rise of minimalist consumption and the do-it-yourself apparel movement also offer substitutes by promoting longevity and personalization over mass-produced, trend-driven items.

| Substitute Category | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Online-Only Retailers & DTC Brands | Convenience, competitive pricing, digital marketing focus | Global online fashion sales projected over $1 trillion |

| Resale Market | Affordability, sustainability, access to branded items | Resale market valued at ~$35 billion in 2023, projected strong growth |

| Fast Fashion (e.g., Shein, Temu) | Trend-driven, extremely low price points | Shein's average item price ~ $5 |

| Discount Retailers (e.g., Walmart, Target) | Value, functionality, essential apparel | Discount stores saw continued growth in 2024 |

| Customization & DIY Apparel | Uniqueness, self-expression, personalization | Growing consumer willingness for personalized fashion |

| Ethical & Sustainable Brands | Environmental and social responsibility | Global ethical fashion market valued at ~$7.5 billion in 2023 |

Entrants Threaten

The significant capital required to establish a new apparel retail brand, complete with physical stores, a global supply chain, and robust marketing, acts as a formidable barrier. For instance, launching a new brand in 2024 with even a modest brick-and-mortar presence and online infrastructure could easily necessitate millions of dollars in upfront investment.

This substantial financial hurdle discourages many aspiring entrepreneurs from entering the market directly against established retailers like Abercrombie & Fitch, thereby limiting the threat of new entrants.

Abercrombie & Fitch, along with its sister brands Abercrombie kids and Hollister Co., has cultivated strong brand recognition and deep customer loyalty over decades. This established presence makes it difficult for new players to gain traction. For instance, in the first quarter of 2024, Abercrombie & Fitch reported a net sales increase of 5% to $1 billion, demonstrating continued customer engagement with its established brands.

New entrants must overcome the substantial hurdle of building brand awareness and trust. They need to forge an emotional connection with consumers that can rival the decades of marketing and customer experience Abercrombie & Fitch has invested in. This requires significant capital and a compelling value proposition to even begin competing.

Securing prime retail locations, establishing efficient e-commerce platforms, and building robust global supply chains are significant hurdles for new entrants. Abercrombie & Fitch, for instance, has spent decades cultivating its physical and digital presence, making it difficult for newcomers to replicate its reach.

New players often find it challenging to gain the same favorable access to distribution channels and the economies of scale that established brands like A&F benefit from. This disparity in access can significantly impact a new entrant's ability to compete on price and availability.

Economies of Scale

Existing large retailers like Abercrombie & Fitch benefit from significant economies of scale in sourcing, manufacturing, marketing, and distribution. For instance, in 2023, Abercrombie & Fitch reported net sales of $4.06 billion, indicating a substantial operational volume that allows for cost reductions per unit.

New entrants, operating at smaller volumes, cannot initially match these cost efficiencies, putting them at a competitive disadvantage. This disparity in cost structure makes it challenging for newcomers to compete on price with established players who have already optimized their supply chains and marketing spends.

- Economies of Scale: Abercrombie & Fitch's large operational footprint in 2023, with $4.06 billion in net sales, allows for greater purchasing power and lower per-unit production costs compared to new, smaller competitors.

- Sourcing Advantages: Bulk purchasing of materials and finished goods by established retailers leads to lower input costs.

- Marketing Efficiency: Larger marketing budgets can be spread across a wider customer base, reducing the cost per acquisition for established brands.

- Distribution Network: Existing players often have well-established and efficient distribution networks, lowering logistics costs for each item sold.

Regulatory and Trade Barriers

Navigating the intricate web of international trade regulations, import duties, and labor laws presents a significant hurdle for potential new entrants in the apparel sector. For instance, in 2024, the U.S. fashion industry faced ongoing discussions and potential adjustments to trade policies with key manufacturing countries, impacting cost structures and supply chain complexities. Abercrombie & Fitch, with its established global operations, possesses the in-house expertise and financial muscle to effectively manage these compliance requirements, thereby creating a substantial barrier for nascent competitors attempting to enter the market.

Intellectual property rights, encompassing brand trademarks and design patents, further fortify this barrier. New entrants must invest heavily in legal counsel and compliance to avoid infringement, a cost that established players have already absorbed. In 2023, the apparel industry saw a notable increase in legal actions related to counterfeit goods, underscoring the importance of robust IP protection. A&F's long-standing brand recognition and legal framework provide a significant advantage, making it challenging for newcomers to establish a legitimate and protected presence.

The sheer complexity and cost associated with adhering to diverse national and international regulations, from product safety standards to environmental impact reporting, deter many aspiring fashion brands. By 2024, many regions were implementing stricter sustainability reporting mandates for businesses, adding another layer of compliance. Abercrombie & Fitch's established infrastructure and experience in managing these diverse regulatory landscapes create a formidable entry barrier.

- Regulatory Complexity: New entrants must grapple with varying import duties, labor laws, and product safety standards across different markets.

- Intellectual Property: Protecting brand trademarks and designs requires significant legal investment, a cost already borne by established firms like A&F.

- Compliance Costs: Adhering to international trade agreements and evolving regulations, such as those concerning sustainability in 2024, demands substantial resources.

- Expertise Advantage: Established companies possess the in-house knowledge and experience to navigate these regulatory hurdles efficiently.

The threat of new entrants for Abercrombie & Fitch is relatively low, primarily due to high capital requirements and established brand loyalty. Launching a new apparel brand in 2024 with a significant retail presence and marketing campaign could easily cost millions, a substantial barrier for newcomers. Abercrombie & Fitch's strong brand recognition, built over decades, makes it difficult for new players to capture market share. For instance, in Q1 2024, Abercrombie & Fitch saw net sales rise to $1 billion, showcasing continued customer engagement.

| Barrier Type | Description | Example for A&F (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High upfront investment for stores, supply chain, marketing. | Launching a new brand in 2024 could require millions in initial investment. |

| Brand Loyalty & Recognition | Established customer base and brand equity. | Q1 2024 net sales reached $1 billion, indicating strong customer engagement. |

| Economies of Scale | Cost advantages from large-scale operations. | 2023 net sales of $4.06 billion allow for lower per-unit costs. |

| Distribution Channels | Access to prime retail locations and efficient logistics. | Decades of investment in physical and digital presence create a hurdle for replication. |

| Regulatory Compliance | Navigating complex international trade laws and product standards. | Managing global operations efficiently, with evolving sustainability mandates in 2024. |

Porter's Five Forces Analysis Data Sources

Our Abercrombie & Fitch Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, financial disclosures from Abercrombie & Fitch and its competitors, and data from leading retail analytics firms.