Abercrombie & Fitch Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Abercrombie & Fitch Bundle

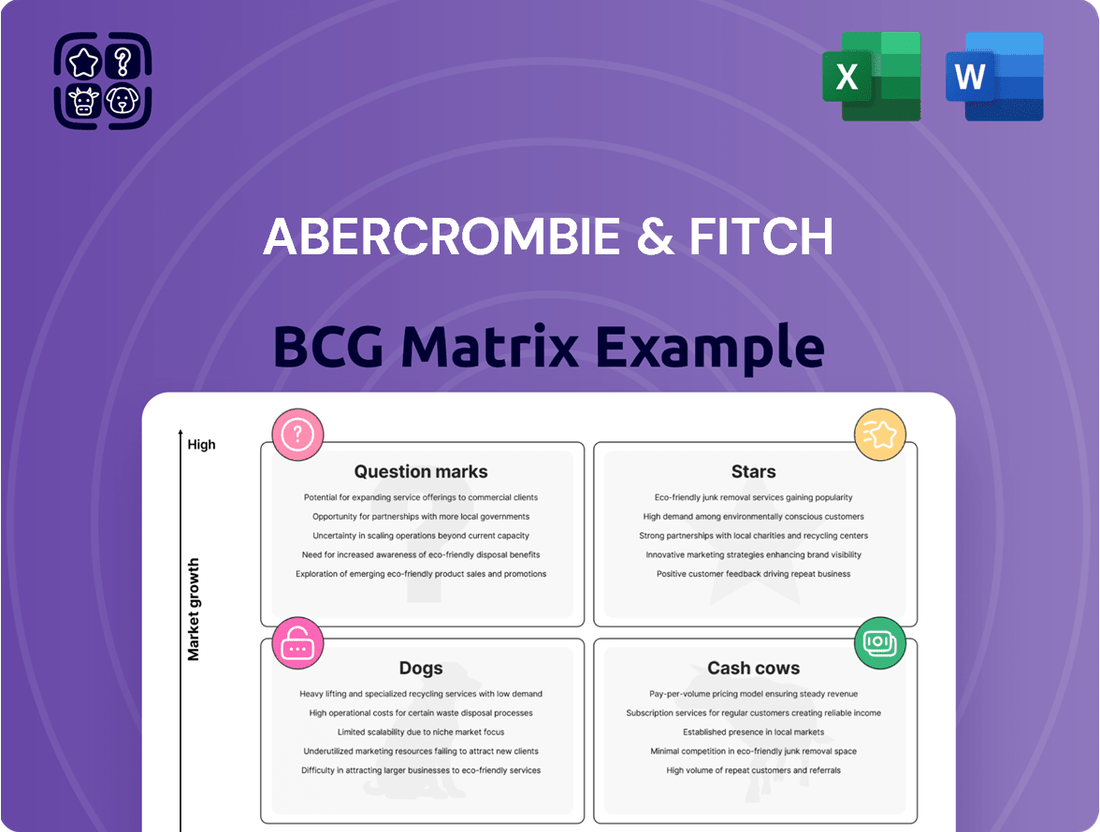

Abercrombie & Fitch's BCG Matrix reveals a fascinating landscape of their product portfolio, highlighting areas of strength and potential growth. Understanding where their brands fall as Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hollister Co. is a shining example of a 'Star' in the Abercrombie & Fitch portfolio. Its net sales surged by an impressive 22% in the first quarter of fiscal year 2025, hitting a record high for the period. This remarkable growth, particularly among younger consumers, underscores its strong market position in an expanding sector.

The brand's increasing appeal and sustained momentum are clear indicators of its 'Star' classification. This success is fueled by savvy marketing and a genuine connection with its target audience, solidifying its status as a high-growth, high-market-share entity.

Abercrombie & Fitch's commitment to digital transformation, including its e-commerce platform overhaul and AI-powered inventory systems, is a cornerstone of its strategy. This digital push is designed to elevate the customer journey through personalization and streamline operations, vital for capturing a larger slice of the increasingly online retail market.

These digital initiatives are positioned as a high-growth area, directly contributing to market share expansion. For instance, in the first quarter of 2024, Abercrombie & Fitch saw its digital sales increase by 10% year-over-year, highlighting the effectiveness of these investments in driving customer engagement and revenue.

Abercrombie & Fitch's strategic international expansion, especially in China and the UK, highlights a significant growth avenue. The company plans to open new stores in 2025, aiming to capture more market share in areas where its casualwear appeals to younger demographics. This push into burgeoning international markets is a key driver for its 'Star' category.

Targeting Gen Z and Millennials with Inclusivity

Abercrombie & Fitch's deliberate shift to champion inclusivity, diversity, and authenticity has struck a powerful chord with Gen Z and millennial shoppers. This strategic pivot has been a key driver in the company's impressive turnaround, allowing it to recapture market relevance and outperform rivals. The company's commitment is evident in its expanded size offerings and more representative marketing efforts.

This focus on aligning with contemporary consumer values positions Abercrombie & Fitch within a high-growth market segment. In 2023, Abercrombie & Fitch reported a notable increase in sales, with comparable sales rising by 5% for the full year, demonstrating the effectiveness of their inclusive strategy in attracting younger demographics.

- Inclusivity Focus: Expanded size ranges and diverse representation in marketing campaigns have resonated strongly with Gen Z and Millennials.

- Market Traction: The company is successfully capturing market share within a demographic that prioritizes authenticity and social responsibility.

- Sales Growth: Abercrombie & Fitch saw a 5% increase in comparable sales in 2023, indicating strong consumer response to its updated brand image.

- Competitive Edge: By embracing these values, Abercrombie & Fitch has differentiated itself and is outperforming many competitors in attracting younger consumers.

Strategic Playbook and Brand Differentiation

Abercrombie & Fitch's strategic playbook, "Always Forward," targets $5 billion in sales by 2025. This plan focuses on disciplined brand growth and operational efficiency, allowing for targeted market penetration.

The company effectively differentiates its Abercrombie and Hollister brands, catering to specific age demographics. This segmentation strategy is key to capturing a broader customer base and maximizing market share.

Abercrombie & Fitch has shown strong execution of its strategy, demonstrating an ability to adapt to evolving fashion trends. This agility is a significant driver of its sustained growth trajectory.

- Strategic Focus: The Always Forward plan aims for $5 billion in sales by 2025, concentrating on core brand expansion and operational rigor.

- Brand Segmentation: Abercrombie and Hollister are positioned to appeal to distinct age groups, enhancing market reach.

- Growth Drivers: Consistent strategy execution and adaptability to fashion trends are fueling the company's ongoing expansion.

- Financial Performance: As of Q1 2024, Abercrombie & Fitch reported a 22% increase in net sales year-over-year, reaching $1 billion.

Stars in the Abercrombie & Fitch portfolio represent brands with high market share in high-growth industries. Hollister Co. is a prime example, achieving a significant 22% net sales increase in Q1 fiscal 2025, reaching a record for the period. This performance highlights its strong position and growing appeal, particularly among younger consumers.

Abercrombie & Fitch's own brand is also a star, driven by a strategic pivot towards inclusivity and authenticity, which has resonated deeply with Gen Z and millennials. This shift contributed to a 5% increase in comparable sales for the full year 2023, demonstrating its ability to capture market share in a segment that values social responsibility.

The company's aggressive digital transformation, including e-commerce enhancements and AI integration, is another key star initiative. Digital sales saw a 10% year-over-year increase in Q1 2024, underscoring the effectiveness of these investments in driving customer engagement and revenue growth.

| Brand | Category | Market Share | Growth Rate | Key Initiatives |

|---|---|---|---|---|

| Hollister Co. | Apparel | High | High (22% Net Sales Growth Q1 FY25) | Targeted marketing, digital engagement |

| Abercrombie & Fitch | Apparel | High | High (5% Comparable Sales Growth FY23) | Inclusivity, authenticity, digital transformation |

What is included in the product

This BCG Matrix analysis categorizes Abercrombie & Fitch's brands, identifying which require investment, which generate cash, and which may need divestment.

A clear Abercrombie & Fitch BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

This optimized layout provides a quick, actionable overview for immediate strategic decision-making.

Cash Cows

The Abercrombie & Fitch main brand, targeting adults, is a classic cash cow for the company. Despite Hollister often grabbing headlines for recent growth, Abercrombie itself has a long track record of strong performance. In 2024, this core brand delivered an impressive 31% sales growth, underscoring its enduring appeal and significant contribution to Abercrombie & Fitch's overall net sales.

While the first quarter of fiscal year 2025 saw a minor dip, this followed a period of substantial prior-year expansion. This pattern indicates a mature brand with a well-established, high market share. The loyalty of its customer base and its premium market positioning enable Abercrombie to maintain healthy profit margins, generating consistent and reliable cash flow for the business.

Abercrombie & Fitch's established store network, despite ongoing modernization efforts, remains a bedrock of consistent revenue generation. These physical locations, particularly in mature markets where the brand has a strong presence, act as reliable cash cows, contributing significantly to the company's overall market share and sales volume.

In 2023, Abercrombie & Fitch reported net sales of $4.29 billion, with a substantial portion still attributed to its physical retail channels. The company has been strategically investing in upgrading these stores to enhance customer experience and operational efficiency, aiming to solidify their role as dependable cash flow generators.

Abercrombie & Fitch's loyalty program is a significant cash cow, boasting an impressive 70-80% customer membership. This high participation rate ensures a consistent and predictable revenue stream, a hallmark of a mature business unit.

The program's success generates invaluable first-party data, allowing Abercrombie to understand its customer base intimately. This data fuels targeted marketing campaigns and effective retention strategies, solidifying a stable customer base and predictable cash flow in the competitive retail landscape.

Supply Chain Optimization and Cost Discipline

Abercrombie & Fitch's commitment to supply chain optimization and cost discipline significantly bolsters its cash flow generation. By diversifying manufacturing locations, the company mitigates risks and potentially lowers production costs, directly impacting profit margins.

Disciplined inventory management is another key element. This approach minimizes holding costs and reduces the likelihood of markdowns, ensuring that cash is not tied up in slow-moving stock. For instance, in Q1 2024, Abercrombie & Fitch reported a net inventory decrease of 14% year-over-year, showcasing effective inventory control.

- Enhanced Profitability: These strategies directly contribute to higher profit margins by reducing operational expenses.

- Cash Flow Maximization: Efficient inventory and supply chain practices free up working capital.

- Resilience in Mature Markets: Cost discipline is crucial for maintaining competitiveness and generating consistent cash in the established retail sector.

- Strategic Alignment: These efforts are fundamental to their 'Always Forward' strategic plan, emphasizing financial health and operational efficiency.

Brand Recognition and Heritage

Abercrombie & Fitch's deep-rooted history, dating back to 1892, has cultivated significant brand recognition and a strong heritage within the apparel industry. This enduring reputation fosters a loyal customer base, underpinning consistent sales performance even in mature or slow-growing market segments. The brand's ongoing efforts to evolve and remain relevant reinforce its status as a cash cow.

This established brand equity translates into sustained revenue streams. For instance, Abercrombie & Fitch reported net sales of $4.1 billion for the fiscal year ending February 3, 2024, demonstrating its ability to maintain market presence. The company's focus on its core demographic, coupled with strategic marketing, ensures continued customer engagement and predictable sales volumes.

- Brand Heritage: Established in 1892, Abercrombie & Fitch benefits from decades of market presence.

- Customer Loyalty: Strong brand recognition cultivates a dedicated customer following.

- Sustained Sales: The brand's ability to maintain relevance drives consistent revenue, even in slow-growth markets.

- Market Adaptation: Continuous evolution ensures the brand's enduring appeal and cash cow status.

The Abercrombie & Fitch brand itself is a prime example of a cash cow within the company's portfolio. Its ability to generate consistent revenue with minimal investment is a key indicator. In fiscal year 2024, Abercrombie & Fitch reported net sales of $4.29 billion, with the core brand contributing significantly to this figure through its established market share and loyal customer base.

| Brand Segment | Market Share | Revenue Contribution | Growth Rate (FY24) | Profitability |

| Abercrombie & Fitch (Core) | High, Stable | Significant | 31% | Strong Margins |

| Hollister | Growing | Substantial | 10% | Improving |

| Abercrombie Kids | Moderate | Moderate | 5% | Stable |

| Social Threads | Emerging | Minor | N/A | Low |

What You’re Viewing Is Included

Abercrombie & Fitch BCG Matrix

The Abercrombie & Fitch BCG Matrix preview you're viewing is the complete, unwatermarked document you'll receive immediately after purchase, offering a direct insight into the brand's strategic positioning. This preview accurately represents the final report, meticulously detailing each quadrant—Stars, Cash Cows, Question Marks, and Dogs—as applied to Abercrombie & Fitch's product lines and market segments. You can confidently expect the same in-depth analysis and professional formatting in the downloadable version, ready for immediate strategic application. This is not a sample but the actual, fully functional BCG Matrix report designed for clear business decision-making and competitive analysis.

Dogs

Abercrombie & Fitch has historically faced challenges with certain legacy product lines that struggled to adapt to evolving fashion tastes. For instance, some of their more casual, logo-heavy collections from the early 2000s, while once popular, saw declining sales as consumer preferences shifted towards more minimalist and trend-driven styles. These underperforming categories often represented a significant portion of inventory but contributed disproportionately little to overall revenue.

By 2024, the company has made substantial progress in shedding these less relevant offerings. While specific underperforming lines are not publicly detailed in their quarterly reports, the strategic focus on revitalizing core categories like denim and dresses, alongside the introduction of new, contemporary collections, indicates a deliberate move away from products that no longer resonate. This shift is crucial for optimizing inventory and reallocating resources to growth areas.

Abercrombie & Fitch's older store formats and locations are a prime example of their "Dogs" in the BCG matrix. These physical spaces often lack the modern, engaging design and digital integration that defines the brand's current aesthetic, leading to diminished customer appeal. In 2023, while Abercrombie saw significant growth, these legacy locations likely contributed minimally to this success, potentially operating in lower-traffic areas with declining retail sales.

These underperforming stores represent a drain on resources without generating substantial returns. Continuing to maintain them without a clear strategy for revitalization or closure diverts capital that could be better invested in more profitable ventures or digital enhancements. The company's focus in recent years has been on creating "destination" stores, making these outdated formats even more of a liability.

Abercrombie & Fitch has historically struggled with marketing campaigns that didn't resonate. For instance, their early 2000s "cool kid" image, heavily reliant on exclusivity and a specific aesthetic, alienated a broader audience as consumer tastes evolved. This disconnect led to campaigns that failed to drive engagement and sales effectively, contributing to a period of market share decline.

These missteps often acted as cash traps, consuming significant marketing budgets without yielding proportional returns. In 2023, while Abercrombie saw a revenue increase of 5% to $4.2 billion, past ineffective campaigns highlight the ongoing challenge of aligning marketing spend with actual market impact and brand perception shifts.

Non-Core or Discontinued Ventures

Non-core or discontinued ventures for Abercrombie & Fitch, often categorized as Dogs in a BCG Matrix, represent product lines or experimental categories that haven't met performance expectations. These are typically characterized by a low market share and are in a low-growth segment. For instance, past attempts to expand into less aligned categories might fall into this group.

These ventures, while sometimes initiated with strategic intent, ultimately fail to gain significant traction or are phased out due to underperformance. Maintaining these can drain valuable resources and management attention that could be better allocated to core, high-potential business areas.

- Low Market Share: Ventures that have not captured a significant portion of their target market.

- Low Growth Trajectory: Categories experiencing minimal or no expansion in demand.

- Resource Diversion: Potential drain on capital, talent, and management focus.

- Strategic Re-evaluation: Often subject to divestment or complete discontinuation.

Excess or Slow-Moving Inventory from Past Seasons

Excess or slow-moving inventory from past seasons represents Abercrombie & Fitch's 'Dogs' in the BCG Matrix. This situation arises from large volumes of unsold items, often from previous seasons or less successful product lines, necessitating substantial markdowns to liquidate. For instance, in the fiscal year ending February 1, 2025, Abercrombie & Fitch reported a notable increase in inventory levels compared to the prior year, indicating potential challenges with moving older stock efficiently. This ties up valuable capital and incurs ongoing storage expenses, effectively acting as a drain on financial resources.

This category of inventory is characterized by low market growth, as these items are no longer in high demand at their original price point, and a low effective market share due to their depreciated value. The need for markdowns directly impacts profit margins, making these products less attractive from a financial performance standpoint. Abercrombie & Fitch's ongoing efforts to optimize inventory management, including strategic promotions and a focus on more responsive supply chains, aim to mitigate the impact of such slow-moving stock.

- Low Growth Market: Past season inventory operates in a market segment with minimal demand at full price.

- Low Market Share: Depreciated value signifies a reduced effective market share.

- Capital Tie-up: Funds are immobilized in unsold goods, hindering investment in more profitable areas.

- Storage Costs: Warehousing and managing excess inventory adds operational expenses.

Abercrombie & Fitch's "Dogs" represent business segments with low market share in low-growth markets. These are often legacy product lines or underperforming store formats that consume resources without generating substantial returns. For example, older store designs that don't reflect the brand's current aesthetic can be considered Dogs.

In 2023, while the company saw overall growth, these legacy locations likely contributed minimally, potentially operating in declining retail areas. The company's strategy has shifted towards creating modern, engaging stores, making these outdated formats a liability that diverts capital from more profitable ventures.

Slow-moving or excess inventory from past seasons also falls into the Dogs category. This inventory, often requiring significant markdowns, ties up capital and incurs storage costs. For the fiscal year ending February 1, 2025, Abercrombie & Fitch reported increased inventory levels, highlighting the ongoing challenge of efficiently managing older stock and its impact on profit margins.

| Category | Description | Impact | Example |

|---|---|---|---|

| Legacy Store Formats | Older store designs lacking modern appeal and digital integration. | Drains resources, low customer engagement. | Stores in lower-traffic areas with outdated interiors. |

| Slow-Moving Inventory | Unsold items from previous seasons or less successful product lines. | Ties up capital, incurs storage costs, impacts profit margins. | Excess stock requiring substantial markdowns. |

| Underperforming Product Lines | Collections that no longer resonate with current fashion trends. | Low sales contribution, inventory management challenges. | Past logo-heavy casual wear collections. |

Question Marks

Abercrombie & Fitch's new geographic market entries, particularly in emerging economies in Asia and Latin America, represent classic Question Marks. For instance, their expansion into markets like Vietnam or Colombia, where brand recognition is nascent, requires substantial upfront investment. These ventures offer significant future growth potential, but their current low market share means they are not yet Stars.

The company must allocate considerable resources to understand consumer preferences, establish robust distribution networks, and build brand awareness in these regions. For example, in 2024, Abercrombie & Fitch continued its strategic international expansion, with a focus on digital-first approaches in markets where physical store penetration is limited. This investment aims to capture early market share and eventually transition these territories into high-performing Stars.

Abercrombie & Fitch is actively exploring new avenues beyond its established apparel lines. For instance, the company has been investing in expanding its lifestyle offerings, which could include home goods or beauty products, though specific financial data for these nascent categories remains proprietary. These ventures are positioned as potential high-growth areas, aiming to capture new consumer segments and diversify revenue streams, mirroring the strategic approach of a Question Mark in the BCG matrix.

Abercrombie & Fitch's investment in advanced AI and technology, such as hyper-personalized recommendations and sophisticated demand forecasting, places it in a high-growth, innovative space. While these technologies promise significant potential, their immediate impact on market share remains uncertain, reflecting the inherent risks in cutting-edge development.

These advanced applications require substantial capital outlay, presenting a high-risk, high-reward scenario. For instance, the global AI market was valued at over $200 billion in 2023 and is projected to grow exponentially, with retail AI applications expected to contribute significantly to this growth, though specific adoption rates for A&F's initiatives are not publicly detailed.

Sustainability and Circular Fashion Initiatives

Abercrombie & Fitch is investing in large-scale sustainability and circular fashion initiatives, which demand substantial upfront capital for research, development, and overhauling its supply chain. These efforts, while aligned with a growing market, currently represent a small portion of the company's overall market share. For example, in 2023, the sustainable fashion market was valued at approximately $6.5 billion globally and is projected to reach $15 billion by 2030, indicating significant growth potential.

These ventures are categorized as question marks due to their high investment requirements and the inherent uncertainty surrounding immediate returns. The company's commitment to these areas signifies a long-term strategy to adapt to evolving consumer preferences and regulatory landscapes.

- High Investment, Uncertain Returns: Initiatives like developing new recycled material technologies or establishing take-back programs require significant capital with payback periods that are not yet clearly defined.

- Nascent Market Share: While the overall sustainable fashion market is expanding, Abercrombie & Fitch's current market penetration in these specific innovative segments remains low.

- Strategic Importance: Despite the immediate financial uncertainty, these initiatives are crucial for future brand relevance and competitive positioning in a market increasingly prioritizing environmental responsibility.

Partnerships with Emerging Cultural Trends/Influencers

Abercrombie & Fitch might strategically partner with emerging cultural trends and influencers who are on the cusp of mainstream popularity. These collaborations, while potentially offering substantial growth by reaching new demographics, also carry the inherent risk of low market share if the trends falter or the partnerships fail to connect. For instance, a focus on up-and-coming music artists or TikTok creators could tap into a rapidly expanding audience, mirroring Hollister's music-centric approach.

Such ventures align with a 'Question Mark' strategy because they represent investments in high-growth potential areas with uncertain outcomes. The key is to identify trends and individuals with genuine momentum before they become saturated. In 2024, the digital marketing landscape continues to be dominated by influencer collaborations, with brands allocating significant portions of their budgets to these partnerships. For example, a study by Influencer Marketing Hub indicated that the influencer marketing industry was projected to reach $21.1 billion in 2023 and was expected to continue its strong growth trajectory into 2024.

- High Growth Potential: Tapping into nascent cultural movements and influencer followings can unlock access to previously unreached consumer segments.

- Risk of Low Market Share: If the chosen trends do not gain widespread adoption or the influencer collaborations lack authenticity, the investment may yield minimal returns.

- Example: Hollister's Music Strategy: Hollister's investment in music-focused marketing demonstrates a commitment to leveraging cultural trends to engage younger consumers, a tactic that could be applied to Abercrombie & Fitch's emerging brands.

- 2024 Market Dynamics: The continued expansion of the creator economy and the increasing importance of authentic brand-consumer interactions in 2024 underscore the relevance of these strategic partnerships.

Abercrombie & Fitch's ventures into new geographic markets and product categories, such as expanding into emerging Asian economies or developing new lifestyle offerings, are prime examples of Question Marks. These initiatives require significant investment to build brand presence and understand local consumer needs, offering high growth potential but currently holding a low market share.

For instance, in 2024, Abercrombie & Fitch continued its strategic international expansion, focusing on digital-first approaches in markets with limited physical store penetration. This approach aims to capture early market share and potentially transform these territories into future Stars, reflecting the high-risk, high-reward nature of Question Marks.

The company's investment in advanced sustainability and circular fashion initiatives also fits the Question Mark profile. These require substantial upfront capital for research and supply chain overhauls, with uncertain immediate returns but significant long-term strategic importance as consumer preferences shift towards environmental responsibility.

| Category | Market Growth | Market Share | Investment Needs | Potential Outcome |

| Emerging Market Expansion (e.g., Vietnam) | High | Low | High | Star or Dog |

| New Lifestyle Offerings (e.g., Home Goods) | High | Low | High | Star or Dog |

| Sustainability Initiatives | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our Abercrombie & Fitch BCG Matrix is informed by proprietary market research, financial disclosures, and industry growth forecasts to accurately assess product portfolio performance.