AbbVie SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AbbVie Bundle

AbbVie, a biopharmaceutical giant, boasts a robust pipeline and strong market positions in immunology and oncology, but faces significant patent cliffs and increasing competition. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for navigating its future.

Want the full story behind AbbVie’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AbbVie has masterfully shifted its revenue base, moving beyond its reliance on Humira. This strategic diversification is clearly paying off, as evidenced by the impressive growth in its immunology franchise. Skyrizi and Rinvoq, in particular, are exceeding sales targets, with projections indicating combined annual sales could reach a substantial $31 billion by 2027.

This expansion isn't limited to immunology; AbbVie's robust performance across neuroscience, oncology, and eye care segments further solidifies its diversified product portfolio. Such breadth significantly mitigates the risk associated with any single product's performance, creating a more resilient and sustainable revenue model.

AbbVie's dedication to innovation is evident in its significant R&D spending. The company boasts a substantial pipeline with roughly 90 compounds, devices, or indications currently under development, and approximately 50 of these are in mid-to-late stage clinical trials, signaling strong future product potential.

Strategic moves, such as the acquisitions of ImmunoGen and Cerevel Therapeutics in 2024, significantly enhance AbbVie's R&D capabilities and diversify its therapeutic focus. These investments, alongside a focus on cutting-edge areas like RNA therapeutics and CAR-T cell therapies, are designed to fuel long-term growth and solidify its competitive edge in the biopharmaceutical landscape.

AbbVie demonstrated impressive financial resilience in early 2025, navigating the impact of Humira's loss of exclusivity. The company's first-quarter 2025 performance surpassed analyst expectations, with adjusted earnings per share reaching $2.50 and total net revenue climbing to $14.2 billion, showcasing robust operational strength.

Further bolstering its positive outlook, AbbVie uplifted its full-year 2025 adjusted earnings per share guidance to a range of $11.00 to $11.20. This upward revision signals strong confidence in the company's ability to achieve sustained growth and manage its evolving product portfolio effectively.

Strategic Acquisitions and Collaborations

AbbVie has consistently leveraged strategic acquisitions and collaborations to bolster its product pipeline and diversify revenue streams. Recent significant moves, such as the early 2024 acquisition of ImmunoGen for approximately $3.7 billion, bolster its oncology portfolio. Furthermore, the acquisition of Cerevel Therapeutics for around $8.7 billion in early 2024 significantly expands its presence in the neuroscience sector. These strategic actions are designed to fortify AbbVie's growth trajectory by integrating innovative therapies and expanding into new, high-potential therapeutic areas.

These strategic maneuvers are crucial for maintaining AbbVie's competitive edge. The integration of companies like Capstan Therapeutics, focused on CAR-T cell therapies for autoimmune conditions, highlights a commitment to cutting-edge treatments. This proactive approach to M&A allows AbbVie to address unmet medical needs and capture new market opportunities, ensuring sustained development beyond its established franchises.

- ImmunoGen Acquisition: Strengthens oncology pipeline, valued at approximately $3.7 billion.

- Cerevel Therapeutics Acquisition: Expands neuroscience offerings, valued at approximately $8.7 billion.

- Capstan Therapeutics Collaboration: Focuses on CAR-T cell therapies for autoimmune diseases.

- Diversification Strategy: Aims to reduce reliance on core products and drive future revenue growth.

Consistent Dividend Growth and Shareholder Value

AbbVie has a strong history of increasing its quarterly dividend, showing a dedication to rewarding its shareholders. This consistent dividend growth is backed by robust operating cash flow, which also gives the company financial room to maneuver for future growth initiatives, debt management, or buying back its own stock.

The company's financial performance reflects this shareholder focus. For instance, AbbVie announced a 5% increase in its quarterly cash dividend to $0.57 per share in early 2024, continuing its trend of consistent payouts. This commitment to returning capital is a significant strength, appealing to income-focused investors.

Further underscoring its strength, AbbVie's stock performance has been notable. In the year leading up to early 2024, the company's stock price saw significant appreciation, outperforming both the broader S&P 500 index and its direct biopharmaceutical competitors. This suggests a favorable risk-reward balance for investors.

- Consistent Dividend Growth: AbbVie has a proven track record of increasing its quarterly dividend, demonstrating a commitment to shareholder returns.

- Strong Operating Cash Flow: The company's substantial operating cash flow supports dividend payments and provides financial flexibility.

- Shareholder Value: A 5% dividend increase to $0.57 per share in early 2024 highlights this focus.

- Market Outperformance: AbbVie's stock has outperformed the S&P 500 and biopharma peers over the past year, indicating a compelling investment profile.

AbbVie's strategic diversification beyond Humira is a significant strength, with immunology products like Skyrizi and Rinvoq projected to achieve combined annual sales of $31 billion by 2027. This broad product portfolio across neuroscience, oncology, and eye care reduces reliance on any single therapy, fostering a more stable revenue stream. The company's commitment to innovation is evident in its substantial R&D investment and a pipeline of approximately 90 compounds, many in advanced clinical stages.

Recent acquisitions, including ImmunoGen for $3.7 billion and Cerevel Therapeutics for $8.7 billion in early 2024, significantly bolster AbbVie's oncology and neuroscience offerings, respectively. These strategic moves, coupled with collaborations like the one with Capstan Therapeutics for CAR-T cell therapies, position AbbVie at the forefront of cutting-edge treatments and future growth opportunities.

AbbVie demonstrates a strong commitment to shareholder returns, evidenced by consistent dividend increases. In early 2024, the quarterly dividend rose by 5% to $0.57 per share, supported by robust operating cash flow. This financial discipline, combined with stock performance that has outpaced the S&P 500 and biopharma peers leading into early 2024, highlights its appeal to investors.

| Product/Area | 2023 Sales (Approx.) | 2025 Guidance/Projections | Strategic Significance |

|---|---|---|---|

| Skyrizi & Rinvoq (Immunology) | ~$10 billion | Combined $31 billion annual sales by 2027 | Key growth drivers post-Humira |

| Oncology | Growing | Enhanced by ImmunoGen acquisition | Strengthened pipeline |

| Neuroscience | Growing | Expanded by Cerevel Therapeutics acquisition | Entry into new high-potential market |

| R&D Pipeline | Significant Investment | ~90 compounds in development (~50 mid-to-late stage) | Future innovation and product potential |

What is included in the product

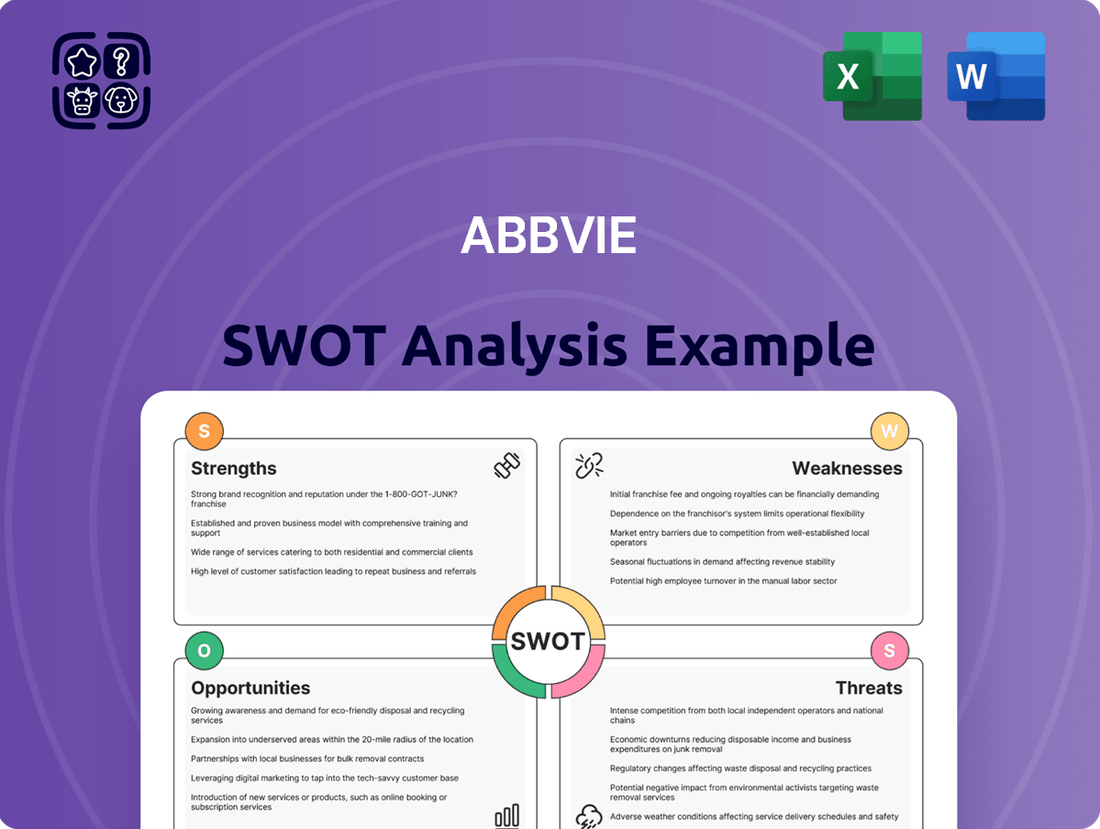

Delivers a strategic overview of AbbVie’s internal strengths and weaknesses, alongside external market opportunities and threats.

Provides a clear SWOT framework for identifying AbbVie's pain points and opportunities in pain management drug development.

Weaknesses

Despite AbbVie's efforts to diversify, a substantial portion of its revenue remains tied to a select few blockbuster drugs. Skyrizi and Rinvoq are crucial for offsetting the anticipated decline of Humira, but this concentrated reliance presents a potential vulnerability.

This dependence on Skyrizi and Rinvoq, while a current driver of growth, could become a significant weakness. Should these key products encounter unforeseen challenges such as intensified competition, unexpected clinical trial failures, or shifts in market demand, AbbVie's overall financial performance could be severely impacted.

AbbVie's primary weakness continues to be the ongoing erosion of Humira sales stemming from biosimilar competition. Despite efforts to pivot, the speed at which Humira's market share is diminishing poses a substantial risk.

In the first quarter of 2024, Humira net revenue saw a significant drop of 10.7% to $3.57 billion, highlighting the persistent impact of biosimil entrants in the U.S. market. This decline is a direct threat to AbbVie's revenue stability.

The critical concern is whether the growth from newer products like Skyrizi and Rinvoq can adequately compensate for the accelerating decline in Humira revenue. If Humira's sales fall faster than anticipated, it could negatively impact AbbVie's overall financial performance, even with strong performance from its newer blockbusters.

AbbVie's aesthetics business, a significant component acquired through the Allergan deal, has encountered notable challenges, leading to revised growth projections. The portfolio experienced an operational revenue decline, with key products like Juvederm showing substantial decreases in sales. This ongoing underperformance raises concerns regarding the segment's future strategic importance and its competitive standing in the market.

Pipeline Setbacks and R&D Challenges

The pharmaceutical sector is inherently risky, and AbbVie has certainly faced its share of setbacks in research and development. For instance, the company experienced a significant blow with the failed Phase 2 studies of emraclidine, a drug intended to treat schizophrenia. This kind of outcome isn't just a scientific disappointment; it can translate into substantial financial hits.

When R&D projects falter, especially those with the potential to become major revenue sources, companies often have to book significant impairment charges. These charges directly reduce a company's reported earnings. Moreover, the loss of a promising drug candidate means losing out on potential blockbuster sales, which can negatively impact future growth forecasts. For example, in 2023, AbbVie reported impairment charges related to certain acquired intangible assets, reflecting the challenges in bringing new therapies to market.

- Pipeline Setbacks: AbbVie has encountered challenges in its R&D pipeline, including the discontinuation of emraclidine for schizophrenia after Phase 2 trials.

- Financial Impact: Such failures can lead to substantial impairment charges, directly affecting profitability and future financial projections.

- Revenue Loss: The inability to bring potential blockbuster drugs to market removes significant future revenue drivers, impacting long-term growth.

- Industry Risk: These R&D challenges are characteristic of the high-risk, high-reward nature of the pharmaceutical industry.

Increased Debt Levels from Acquisitions

AbbVie's pursuit of growth through acquisitions, notably the significant Allergan deal, has consequently increased its debt burden. As of the first quarter of 2024, AbbVie reported total debt of approximately $50.4 billion. While the company's robust cash flow generation helps manage this debt, it still represents a moderate level of financial risk. This elevated debt level could potentially constrain future capital allocation for additional strategic investments or impact the flexibility for returning capital to shareholders.

The company's financial leverage, while a tool for expansion, introduces vulnerabilities. High debt levels can increase interest expenses, potentially impacting profitability, especially in a rising interest rate environment. Furthermore, a substantial portion of its cash flow is dedicated to servicing this debt, which might limit its capacity for other strategic initiatives or dividend increases in the short to medium term.

- Debt Burden: AbbVie's total debt stood at around $50.4 billion in Q1 2024, a consequence of its aggressive acquisition strategy.

- Financial Risk: Despite strong cash flow, the significant debt level indicates a moderate financial risk profile for the company.

- Capital Constraints: High debt may limit the capital available for future strategic investments or shareholder returns.

AbbVie's significant reliance on a few key products, particularly Humira, presents a major weakness as biosimilar competition erodes its market share. While Skyrizi and Rinvoq are showing strong growth, their ability to fully offset Humira's decline remains a critical concern. In Q1 2024, Humira sales dropped 10.7% year-over-year to $3.57 billion, underscoring the ongoing revenue pressure.

What You See Is What You Get

AbbVie SWOT Analysis

This is the actual AbbVie SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full AbbVie SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for AbbVie's future.

This is a real excerpt from the complete AbbVie SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

Opportunities

AbbVie has a significant runway for growth by expanding the approved uses of its blockbuster immunology drugs, Skyrizi and Rinvoq. These medications have already proven highly effective, and there's a clear opportunity to bring them to patients with other autoimmune conditions.

Rinvoq, for instance, recently secured new approvals in the European Union, broadening its reach. Similarly, Skyrizi is awaiting crucial approvals in the United States. These additional indications are key drivers for future revenue, with analysts projecting substantial market penetration and sales growth in the coming years.

AbbVie's neuroscience and oncology pipelines are poised for significant expansion, offering robust growth avenues. The company is anticipating key data readouts and regulatory submissions for several promising late-stage candidates in 2025, which could lead to new product approvals.

Strategic moves, including the acquisition of ImmunoGen for approximately $10.1 billion in 2023 and the pending acquisition of Cerevel Therapeutics for $8.7 billion, are set to significantly strengthen these therapeutic areas. These acquisitions are designed to introduce innovative therapies and bolster AbbVie's market position in high-growth segments.

AbbVie has a compelling opportunity to grow by expanding its reach into emerging markets. This strategy leverages its established product lines, particularly in immunology and neuroscience, to access new patient populations. By 2024, emerging markets represented a significant portion of global pharmaceutical growth, and AbbVie's continued investment in these regions is poised to capture a larger share of this expanding market.

Advancements in Novel Therapeutic Modalities

AbbVie is actively investing in pioneering technologies like antibody-drug conjugates (ADCs) and in vivo CAR-T platforms. These cutting-edge areas hold immense promise for discovering and developing novel treatments. For instance, the global ADC market was valued at approximately $7.9 billion in 2023 and is projected to reach $22.7 billion by 2030, showcasing significant growth potential.

These advancements open doors to breakthrough therapies, particularly in areas with high unmet medical needs such as oncology and autoimmune diseases. AbbVie's commitment to these novel modalities positions them to address complex health challenges effectively.

Key opportunities stemming from these advancements include:

- Expansion into new therapeutic areas: Developing treatments for previously untreatable or poorly managed conditions.

- Enhanced drug efficacy and safety: Leveraging targeted delivery mechanisms to improve patient outcomes and reduce side effects.

- Pipeline diversification: Reducing reliance on existing blockbuster drugs by building a robust portfolio of next-generation therapies.

- Strategic partnerships and acquisitions: Collaborating with or acquiring companies at the forefront of these novel technologies to accelerate development.

Strategic Partnerships and Licensing Agreements

AbbVie can significantly bolster its product pipeline and expand its market presence by forging new strategic partnerships and securing licensing agreements. These collaborations are crucial for accessing innovative drug candidates and cutting-edge technologies, thereby alleviating the pressure on internal research and development efforts. This strategy also allows for a broader range of therapeutic solutions to be offered to patients.

Recent strategic moves highlight this focus. For instance, AbbVie entered into a licensing agreement in 2023 for an obesity treatment, demonstrating its commitment to expanding into high-growth therapeutic areas. Furthermore, the company has actively pursued collaborations aimed at developing T-cell engagers, a promising modality for oncology applications, signaling a forward-looking approach to cancer treatment innovation.

- Obesity Treatment Licensing: Secured rights to a novel obesity treatment in 2023, expanding its metabolic disease portfolio.

- Oncology Collaborations: Engaged in partnerships to advance T-cell engager technologies for cancer therapies, aiming to leverage external innovation.

- Pipeline Enhancement: These agreements provide access to promising late-stage and early-stage assets, diversifying AbbVie's future revenue streams.

- R&D Efficiency: Outsourcing early-stage development and licensing mature assets can optimize R&D spending and accelerate market entry for new treatments.

AbbVie is well-positioned to capitalize on the expanding indications for its immunology blockbusters, Skyrizi and Rinvoq. These drugs have demonstrated significant efficacy, and further approvals for additional autoimmune conditions are anticipated, driving future revenue growth.

The company's neuroscience and oncology pipelines represent substantial growth opportunities, with key data readouts and regulatory submissions expected in 2025. Acquisitions of ImmunoGen and Cerevel Therapeutics are strategically strengthening these areas, introducing innovative therapies and enhancing market position.

Expanding into emerging markets offers a significant growth avenue, leveraging existing product lines to reach new patient populations. AbbVie's investment in these regions aligns with global pharmaceutical growth trends, aiming to capture a larger market share.

Investment in pioneering technologies like antibody-drug conjugates (ADCs) and in vivo CAR-T platforms presents a chance to develop novel treatments. The global ADC market's projected growth from $7.9 billion in 2023 to $22.7 billion by 2030 underscores the potential in these cutting-edge areas.

Threats

AbbVie's primary threat stems from the escalating biosimilar competition for its blockbuster drug Humira. This has already led to a substantial decline in Humira's sales, with U.S. Humira sales dropping by 25% in the first quarter of 2024, amounting to $3.1 billion, as biosimilar versions entered the market.

The patent expirations are not limited to Humira; other significant products within AbbVie's portfolio are also vulnerable to generic or biosimilar entry. This pipeline risk could lead to a broader erosion of revenue across key therapeutic areas as these cheaper alternatives gain market share.

AbbVie, like its peers, navigates significant drug pricing pressures. The ongoing scrutiny from governments and payers worldwide creates policy risks, particularly concerning healthcare reforms. For instance, the Inflation Reduction Act in the US allows Medicare to negotiate prices for certain high-cost drugs, a move that could impact AbbVie’s revenue streams for key products.

Potential pharmaceutical sectoral tariffs or further changes to Medicare prescription drug negotiation policies represent tangible threats. These policy shifts can directly affect profitability by reducing net prices or limiting market access. In 2023, AbbVie reported total revenue of $54.3 billion, and any substantial changes to pricing power could significantly alter this trajectory.

The pharmaceutical industry is inherently risky, and AbbVie is no exception. The company faces the constant threat of research and development failures, where promising drug candidates may not make it through the rigorous clinical trial process. This is a significant concern, as successful drug development is crucial for future revenue streams.

A prime example of this risk was the setback with emraclidine, a potential treatment for schizophrenia. The discontinuation of its development in Phase 2 trials in late 2023 represented a substantial financial write-off for AbbVie, estimated to be in the hundreds of millions of dollars. Such failures can erode investor confidence and dampen future growth expectations, forcing a re-evaluation of pipeline strategies.

Economic Pressures Affecting Discretionary Spending

Economic headwinds, including inflation and potential recessionary fears, are a significant threat to AbbVie’s aesthetics business. Consumers tend to cut back on non-essential spending, like cosmetic procedures, when their financial outlook is uncertain. This directly impacts demand for products within AbbVie's aesthetics portfolio, which has already faced challenges.

For instance, in 2023, while AbbVie reported overall strong performance, its aesthetics segment experienced a decline. This trend is likely to persist or worsen if economic conditions deteriorate further in 2024 and 2025, putting pressure on sales growth in this area.

- Consumer Confidence: Declining consumer confidence, a key indicator of discretionary spending, directly correlates with reduced demand for aesthetic treatments.

- Inflationary Impact: Rising costs for consumers can lead to prioritization of essential goods and services over elective procedures.

- Market Sensitivity: The aesthetics market is particularly sensitive to economic downturns, making it vulnerable to shifts in consumer sentiment and disposable income.

Increased Competition in Core Therapeutic Areas

AbbVie faces significant competitive pressure in its key markets like immunology and oncology. For instance, in immunology, where Humira has been a dominant force, biosimilar competition is intensifying. By 2024, the market for adalimumab biosimilars is projected to be substantial, directly impacting Humira's revenue streams and market share.

The oncology sector is also a hotbed of innovation, with numerous companies actively developing novel treatments. This constant influx of new therapies, often targeting similar patient populations, could erode AbbVie's market position and limit its pricing flexibility for both established products and those in its pipeline.

- Intensifying Biosimilar Landscape: The increasing availability of biosimilars for key AbbVie products, particularly in immunology, presents a direct threat to market share and pricing power.

- R&D Race in Oncology: Competitors are heavily investing in oncology research, leading to a rapid introduction of new treatments that could challenge AbbVie's existing and future oncology portfolio.

- Pipeline Competition: Emerging therapies from rivals in neuroscience and other core areas could capture market attention and patient adoption, potentially diverting focus from AbbVie's pipeline advancements.

AbbVie's primary threat is the increasing competition from biosimilars for its flagship drug, Humira. This competition has already significantly impacted sales, with U.S. Humira revenue dropping by 25% in Q1 2024 to $3.1 billion. Beyond Humira, other key products face patent expirations, opening the door for cheaper alternatives and potentially eroding revenue across multiple therapeutic areas.

The company also faces substantial pricing pressures from governments and payers globally, exacerbated by healthcare reforms like the Inflation Reduction Act, which allows Medicare to negotiate drug prices. This policy risk could directly affect AbbVie's revenue, which stood at $54.3 billion in 2023, by reducing net prices or limiting market access.

Research and development failures pose a continuous threat, as seen with the discontinuation of emraclidine for schizophrenia in late 2023, a setback costing hundreds of millions. Economic downturns also impact AbbVie's aesthetics business, as consumers cut back on non-essential spending, a trend observed in 2023 that could continue if economic conditions worsen.

| Threat Category | Specific Risk | Impact | 2024/2025 Data/Projection |

|---|---|---|---|

| Competition | Biosimilar entry for Humira | Revenue erosion, market share loss | U.S. Humira sales down 25% in Q1 2024. |

| Regulatory/Policy | Drug price negotiations (e.g., IRA) | Reduced net pricing, limited market access | Potential impact on key product revenues. |

| Pipeline Risk | R&D failures | Financial write-offs, delayed growth | Emraclidine discontinuation (late 2023) |

| Economic Factors | Downturn impacting aesthetics | Reduced discretionary spending on elective procedures | Aesthetics segment faced challenges in 2023. |

SWOT Analysis Data Sources

This AbbVie SWOT analysis is constructed using a robust blend of data sources, including publicly available financial statements, comprehensive market research reports, and insights from reputable industry publications. These sources provide a solid foundation for understanding AbbVie's current standing and future potential.