AbbVie PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AbbVie Bundle

Navigating the complex pharmaceutical landscape requires a deep understanding of external forces. Our AbbVie PESTLE analysis dives into the political, economic, social, technological, legal, and environmental factors that are shaping its present and future. Discover how regulatory shifts, economic volatility, and evolving healthcare demands present both challenges and opportunities for AbbVie.

Gain a competitive advantage by leveraging our expert-crafted PESTLE analysis of AbbVie. This comprehensive report provides actionable insights into the macro-environmental trends impacting the biopharmaceutical giant. Download the full version now to unlock strategic intelligence and make informed decisions.

Political factors

Government healthcare policies are a huge deal for companies like AbbVie. Think about it: rules about drug pricing, how easily a new medicine can get to patients, and what insurance will pay for all directly affect AbbVie's bottom line. For example, in the U.S., discussions around Medicare drug price negotiation, as seen with provisions in the Inflation Reduction Act, can put pressure on revenue for certain high-cost therapies.

In Europe, each country has its own system, but there's a general trend towards cost-effectiveness evaluations that can influence market access. For 2024 and into 2025, we're seeing continued scrutiny on pharmaceutical spending across many developed nations. AbbVie's ability to navigate these varying regulatory landscapes and demonstrate the value of its treatments is key to its success.

The global discussion and legislative actions concerning drug pricing and reimbursement remain a significant political hurdle for AbbVie. Governments worldwide are increasingly scrutinizing drug costs, with potential for stricter regulations or outright price controls that could directly impact the profitability of AbbVie's groundbreaking treatments.

For instance, in 2024, the US Inflation Reduction Act continues to empower Medicare to negotiate prices for certain high-cost prescription drugs, a move that could affect AbbVie's key products. Navigating these intricate and evolving regulatory environments is crucial for AbbVie to maintain sustainable market access and ensure its innovative therapies are valued appropriately.

Global trade policies and geopolitical shifts significantly influence AbbVie's international reach. For instance, the ongoing evolution of trade agreements, such as potential renegotiations of existing pacts or the emergence of new regional blocs, directly impacts AbbVie's ability to import raw materials and export finished pharmaceutical products. In 2024, the World Trade Organization (WTO) reported that global trade growth was projected to be modest, reflecting ongoing uncertainties in the international landscape.

Geopolitical tensions, particularly in regions where AbbVie has substantial operations or market presence, can disrupt supply chains and create market access challenges. For example, trade disputes or sanctions between major economic powers could lead to increased tariffs on imported pharmaceuticals, raising the cost of goods for AbbVie and potentially affecting consumer pricing. The company's robust global manufacturing footprint, with facilities in numerous countries, necessitates careful navigation of these complex international relations to ensure uninterrupted production and distribution.

Regulatory Approval Processes

The political landscape significantly shapes the rigor and speed of regulatory approvals for pharmaceuticals, impacting companies like AbbVie. For instance, shifts in government priorities, such as a push for faster patient access to innovative therapies, can influence the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) in their review processes. Conversely, increased political emphasis on drug safety and pricing can lead to more stringent oversight.

Political pressure can directly affect AbbVie's product launch timelines and the allocation of resources for research and development. For example, in 2024, ongoing debates around drug pricing in the United States, influenced by political discourse, could lead to greater scrutiny on R&D investment returns. A stable and predictable regulatory framework, however, is crucial for long-term strategic planning and investment in new drug development.

Key aspects of regulatory approval processes influenced by political factors include:

- FDA and EMA Review Timelines: Political mandates for expedited review of breakthrough therapies can shorten approval cycles, as seen with certain oncology drugs.

- Post-Market Surveillance Requirements: Political emphasis on drug safety can result in more demanding post-market surveillance and data collection obligations.

- Pricing and Reimbursement Policies: Government policies on drug pricing and reimbursement, often politically driven, directly impact market access and profitability for new drugs.

Intellectual Property Protection Policies

Government stances on intellectual property (IP) protection are paramount for biopharmaceutical giants like AbbVie. Strong IP rights, particularly patent protection, are the bedrock upon which these companies build their innovative drug portfolios. Without robust enforcement, the significant investments made in research and development could be jeopardized.

Policies that dilute IP enforcement or accelerate generic market entry pose a direct threat to AbbVie's revenue streams. For instance, the loss of patent exclusivity on key products can lead to substantial market share erosion, directly impacting the company's ability to fund future groundbreaking research. In 2024, the global pharmaceutical market continued to grapple with patent cliff challenges, with several major drug patents nearing expiration, highlighting the ongoing importance of IP policy.

- Patent Exclusivity: AbbVie's revenue is heavily dependent on the market exclusivity granted by patents for its innovative therapies.

- R&D Investment: Weakened IP protection can deter the substantial capital required for biopharmaceutical research and development.

- Generic Competition: Policies favoring faster generic entry directly challenge the market position of patented AbbVie drugs.

- Global IP Landscape: Variations in IP laws across different countries create a complex operating environment for multinational pharmaceutical firms.

Government healthcare policies, especially regarding drug pricing and reimbursement, significantly influence AbbVie's market access and profitability. For example, the US Inflation Reduction Act of 2022, which began impacting drug pricing negotiations in 2024, directly affects high-cost therapies. Many nations are scrutinizing pharmaceutical spending, with potential for stricter regulations or price controls that could impact AbbVie's revenue streams for its innovative treatments.

What is included in the product

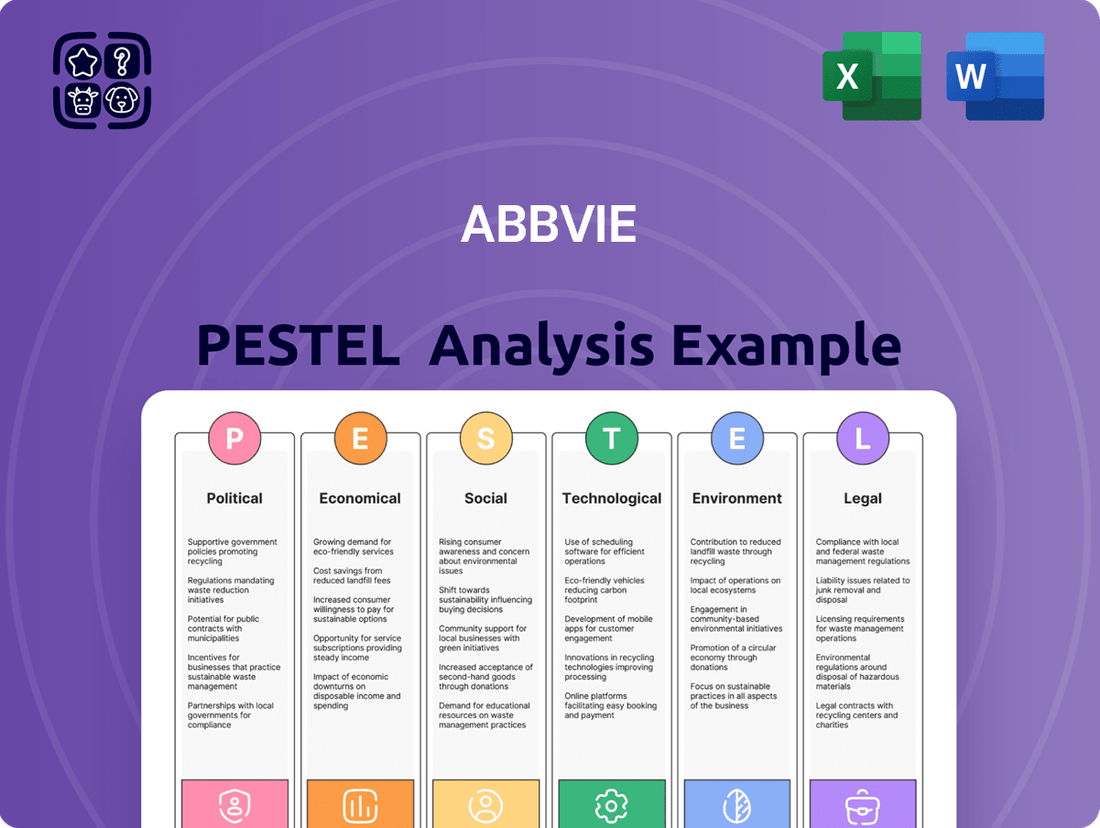

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing AbbVie, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on AbbVie's operations and market position.

A concise PESTLE analysis for AbbVie that distills complex external factors into actionable insights, simplifying strategic planning and mitigating potential risks.

Economic factors

Global economic growth significantly shapes healthcare expenditure. In 2024, the IMF projected a 3.2% global growth rate, a figure maintained for 2025, indicating a stable, albeit moderate, economic environment. This stability generally supports consistent healthcare spending, benefiting companies like AbbVie.

However, economic slowdowns can directly impact pharmaceutical sales. For instance, a recessionary environment might force governments and insurers to scrutinize healthcare budgets more closely, potentially delaying or reducing access to high-cost treatments. This could affect AbbVie's revenue streams, particularly for its immunology and oncology portfolios.

Conversely, periods of strong economic expansion, such as the projected 2.5% GDP growth in developed economies for 2025, tend to foster greater investment in innovative medical solutions. This environment is favorable for AbbVie, as it allows for broader adoption of its advanced therapies and supports research and development funding.

Rising inflation in 2024 and early 2025 continues to exert pressure on AbbVie's operational costs. Increased prices for raw materials, components, and energy directly impact manufacturing expenses, while higher shipping and transportation charges escalate logistics costs across AbbVie's global supply chain.

These inflationary pressures, particularly evident in the pharmaceutical sector's reliance on specialized inputs, necessitate careful management. For instance, the cost of active pharmaceutical ingredients (APIs) and specialized packaging materials saw notable increases throughout 2024, directly affecting AbbVie's cost of goods sold.

AbbVie's strategy to mitigate these rising costs involves optimizing its procurement processes and exploring more efficient distribution networks. The company must balance absorbing these increased expenses with the need to maintain competitive pricing for its diverse portfolio of products, including key biologics like Humira and Skyrizi, in a sensitive market environment.

As a global biopharmaceutical company, AbbVie's financial results are significantly influenced by currency exchange rate fluctuations. With operations and sales across numerous countries, revenues earned in foreign currencies are translated into U.S. dollars, AbbVie's reporting currency. This translation process means that changes in exchange rates can directly affect reported earnings and the overall financial health of the company.

For instance, if the U.S. dollar strengthens against other major currencies, AbbVie's foreign earnings will translate into fewer dollars, potentially impacting revenue and profit figures. Conversely, a weaker dollar could boost reported results. This dynamic introduces a layer of unpredictability into financial planning and necessitates robust risk management strategies, such as currency hedging, to mitigate potential negative impacts.

In the first quarter of 2024, AbbVie reported that foreign exchange had a modest unfavorable impact on net revenues. While specific figures can vary, this highlights the ongoing need for the company to monitor and manage currency exposures to maintain financial stability and achieve its strategic objectives in a global marketplace.

Interest Rates and Access to Capital

Changes in interest rates directly impact AbbVie's cost of capital, influencing decisions on research and development funding, potential acquisitions, and necessary capital expenditures. For instance, the Federal Reserve's monetary policy decisions in 2024 and early 2025 will shape borrowing costs for companies like AbbVie. Higher interest rates can increase the expense of financing new projects, potentially moderating the pace of expansion and innovation.

Affordable access to capital remains a critical enabler for AbbVie's substantial investments in its robust R&D pipeline, which is essential for developing new therapies and maintaining a competitive edge in the pharmaceutical sector.

- Interest Rate Environment: The Federal Reserve maintained its benchmark interest rate range between 5.25% and 5.50% through early 2024, a level not seen in over two decades, impacting borrowing costs.

- Impact on R&D: Higher borrowing costs can strain budgets allocated for the significant, long-term investments required for drug discovery and clinical trials.

- M&A Activity: Increased financing costs can make large-scale mergers and acquisitions, a common growth strategy in the pharmaceutical industry, less attractive or feasible.

- Capital Expenditures: Investments in manufacturing facilities and infrastructure may be re-evaluated if the cost of debt financing rises considerably.

Healthcare Reimbursement and Payer Dynamics

The economic health of healthcare reimbursement, encompassing both government programs like Medicare and Medicaid and private insurers, is a critical determinant of AbbVie's revenue generation. For instance, in 2023, Medicare Part D spending on prescription drugs reached approximately $226 billion, highlighting the significant role of public payers in the pharmaceutical market. Fluctuations in payer solvency or changes in reimbursement rates directly affect the financial viability of AbbVie's product sales.

Shifting payer dynamics present a substantial challenge and opportunity for AbbVie. An increasing focus on value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, necessitates demonstrating the cost-effectiveness and clinical superiority of AbbVie's treatments. This trend is evidenced by the growing adoption of outcomes-based contracts by payers, aiming to control overall healthcare spending.

- Payer Scrutiny: Increased scrutiny over drug pricing and market access by payers, including pharmacy benefit managers (PBMs), can lead to stricter formulary placement and higher patient co-pays, impacting AbbVie's market penetration.

- Value-Based Contracts: The expansion of value-based agreements, where payment is tied to patient outcomes, requires AbbVie to provide robust real-world evidence of its products' efficacy and economic benefits.

- Government Reimbursement Policies: Changes in government reimbursement policies, such as those influenced by the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, directly impact the revenue potential of AbbVie's key therapies.

- Commercial Payer Negotiations: AbbVie's ability to negotiate favorable terms with large commercial insurers, which cover a significant portion of the US population, remains crucial for broad market access and consistent revenue streams.

Global economic stability, projected at 3.2% growth for both 2024 and 2025 by the IMF, generally supports consistent healthcare spending, benefiting companies like AbbVie. However, economic downturns could lead to tighter healthcare budgets, potentially impacting sales of high-cost treatments. Conversely, strong economic expansion, with developed economies expected to grow by 2.5% in 2025, fosters greater investment in innovative medical solutions, which is favorable for AbbVie's advanced therapies.

Inflationary pressures in 2024 and early 2025 increased AbbVie's operational costs, particularly for raw materials and logistics, impacting its cost of goods sold. The company is focused on optimizing procurement and distribution to manage these rising expenses while maintaining competitive pricing for its products.

Currency exchange rate fluctuations significantly influence AbbVie's reported earnings. A stronger U.S. dollar can reduce foreign earnings, while a weaker dollar can boost them, necessitating robust risk management strategies like currency hedging.

Interest rates, with the Federal Reserve maintaining rates between 5.25% and 5.50% through early 2024, impact AbbVie's cost of capital, influencing R&D funding and potential acquisitions. Higher borrowing costs can strain budgets for long-term investments in drug discovery.

The economic health of healthcare reimbursement, including Medicare and private insurers, is critical for AbbVie's revenue. For example, Medicare Part D drug spending reached approximately $226 billion in 2023. Changes in payer policies, such as value-based care models and government price negotiations, directly affect market access and revenue potential.

What You See Is What You Get

AbbVie PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AbbVie PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to an in-depth examination of the external forces shaping AbbVie's operations and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market dynamics, regulatory shifts, and competitive pressures relevant to AbbVie's global pharmaceutical business.

Sociological factors

The world's population is getting older. By 2050, it's estimated that nearly 1 in 6 people globally will be 65 years or older, a significant jump from about 1 in 11 in 2015. This demographic shift directly impacts healthcare needs, as age-related conditions like Alzheimer's, Parkinson's, and certain types of cancer become more common. AbbVie's focus on immunology, neuroscience, and oncology positions it well to address these growing health challenges.

This aging trend creates substantial market opportunities for companies like AbbVie that develop treatments for chronic and complex diseases prevalent in older adults. For instance, the global market for neurological drugs alone was valued at over $70 billion in 2023 and is projected to grow. However, it also means a continuous need for research and development to create more effective and accessible therapies to meet the evolving demands of an aging patient base.

Societal shifts towards more sedentary lifestyles and processed food consumption are contributing to a rise in chronic diseases like diabetes and cardiovascular conditions. This trend, evident globally, means AbbVie needs to stay ahead of evolving patient needs, particularly in areas like immunology and oncology where lifestyle factors play a significant role. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle, accounted for 74% of all deaths worldwide, highlighting the critical link between societal changes and disease incidence.

Growing public awareness regarding specific diseases, such as autoimmune conditions and cancer, directly impacts demand for innovative therapies. In 2024, patient advocacy groups are increasingly vocal, influencing treatment guidelines and payer decisions. AbbVie's engagement with these groups is crucial for understanding patient needs and ensuring access to its portfolio, like Humira and Skyrizi, which saw combined sales of over $21 billion in 2023.

Access to Healthcare and Health Equity

Societal concerns regarding fair access to healthcare and persistent health disparities directly impact how pharmaceutical giants like AbbVie are perceived and regulated. When communities lack equitable access to treatments, it can lead to public outcry and increased government oversight.

AbbVie's proactive efforts to broaden access to its innovative therapies, particularly for populations facing socioeconomic barriers, are crucial for maintaining its social license to operate and safeguarding its brand reputation. This focus on equity is no longer optional; it's a core component of responsible business practice.

For instance, in 2024, the World Health Organization highlighted that significant gaps remain in access to advanced medicines globally, with low-income countries often facing the greatest challenges. AbbVie's initiatives, such as patient assistance programs and partnerships aimed at lowering medication costs, directly address these inequities. In 2023, AbbVie reported investing over $2.8 billion in research and development, with a significant portion dedicated to addressing unmet medical needs across diverse patient groups.

- Patient Assistance Programs: AbbVie offers programs that provide financial assistance to eligible patients struggling with the cost of their medications, aiming to bridge the affordability gap.

- Global Access Initiatives: The company engages in partnerships and collaborations to improve healthcare infrastructure and medicine availability in underserved regions worldwide.

- Health Equity Research: AbbVie supports research focused on understanding and addressing the social determinants of health that contribute to disparities in disease outcomes.

- Advocacy and Policy Engagement: The company actively participates in discussions with policymakers and stakeholders to advocate for policies that promote equitable access to healthcare.

Public Perception of Pharmaceutical Industry

Public perception of the pharmaceutical industry significantly shapes AbbVie's operating environment. Growing concerns over drug pricing, particularly in the US, have led to increased scrutiny and calls for greater affordability. For instance, in 2023, the Inflation Reduction Act began allowing Medicare to negotiate prices for certain high-cost drugs, a move that could affect future AbbVie revenue streams and market access.

Ethical practices and corporate responsibility are also key drivers of public sentiment. AbbVie, like its peers, faces ongoing discussions about clinical trial transparency, marketing practices, and its role in addressing global health disparities. A 2024 survey indicated that while a majority of respondents recognized the importance of pharmaceutical innovation, a substantial portion expressed concerns about the industry's pricing models and perceived profit motives.

Maintaining a positive public image is therefore crucial for AbbVie. This involves proactive engagement with stakeholders, clear communication about the value and R&D investment behind its medicines, and demonstrating a commitment to ethical conduct. For example, AbbVie's patient assistance programs and efforts to expand access to its therapies are often highlighted to counter negative perceptions.

- Drug Pricing Debates: Public and governmental pressure on drug prices continues, with legislative actions like the Inflation Reduction Act impacting pricing strategies.

- Ethical Scrutiny: Concerns regarding clinical trial data, marketing, and corporate accountability remain prominent in public discourse.

- Innovation vs. Affordability: A persistent tension exists between acknowledging the need for pharmaceutical innovation and demanding more affordable access to medicines.

- Corporate Social Responsibility: AbbVie's initiatives in patient access and global health are vital for shaping its brand image and fostering trust.

Societal trends like an aging global population and increasing prevalence of chronic diseases directly fuel demand for AbbVie's specialized therapies. By 2050, nearly 1 in 6 people will be over 65, increasing the need for treatments in areas like neuroscience and oncology where AbbVie is a key player. The company's focus on immunology, neuroscience, and oncology aligns with these demographic shifts, positioning it to address growing health needs.

Growing public awareness and advocacy for specific diseases, particularly autoimmune conditions and cancer, significantly influence treatment demand and payer decisions. In 2023, AbbVie's immunology products like Humira and Skyrizi generated over $21 billion in sales, reflecting the impact of patient engagement and demand for innovative treatments.

Concerns about equitable healthcare access and persistent health disparities impact public perception and regulatory oversight of pharmaceutical companies. AbbVie's commitment to improving access through patient assistance programs and global initiatives is crucial for its social license to operate and brand reputation, especially as the WHO highlights ongoing access gaps in 2024.

Public scrutiny over drug pricing, exemplified by the Inflation Reduction Act's Medicare negotiation provisions starting in 2023, creates a challenging environment for pharmaceutical companies. AbbVie's ethical practices and corporate responsibility, including transparency and addressing affordability, are vital for maintaining public trust amidst these pressures.

| Societal Factor | Impact on AbbVie | Relevant Data (2023/2024) |

| Aging Population | Increased demand for treatments in neuroscience, oncology, and immunology. | By 2050, nearly 1 in 6 people globally will be 65+, up from 1 in 11 in 2015. |

| Chronic Disease Rise | Growth opportunities for therapies addressing lifestyle-related illnesses. | Non-communicable diseases accounted for 74% of global deaths in 2024 (WHO). |

| Patient Advocacy | Influences treatment guidelines and payer decisions, boosting demand for innovative therapies. | AbbVie's immunology portfolio (Humira, Skyrizi) achieved over $21 billion in sales. |

| Healthcare Access & Equity | Affects public perception and regulatory scrutiny; necessitates access initiatives. | AbbVie invested over $2.8 billion in R&D in 2023, focusing on unmet medical needs. |

| Drug Pricing Concerns | Leads to increased scrutiny and potential impact on revenue and market access. | Inflation Reduction Act began Medicare drug price negotiation in 2023. |

Technological factors

AbbVie is navigating a landscape where rapid technological advancements, particularly in genomics, proteomics, and artificial intelligence, are fundamentally reshaping drug discovery and development.

To maintain its competitive edge, AbbVie's commitment to R&D investment is crucial. In 2023, the company reported $7.7 billion in R&D expenses, underscoring its dedication to leveraging these cutting-edge technologies. This investment aims to boost R&D efficiency, expedite the identification of novel therapeutic targets, and ultimately accelerate the delivery of groundbreaking treatments to patients.

Innovations in biologics manufacturing, encompassing cell line development and purification, are vital for efficient biopharmaceutical production. For instance, advancements in continuous manufacturing processes are streamlining production, potentially reducing costs and increasing yield for complex molecules. AbbVie's focus on these areas supports its ability to bring novel therapies to market.

Furthermore, breakthroughs in drug delivery systems, like subcutaneous formulations and advanced injection devices, are enhancing patient convenience and treatment efficacy. These innovations can significantly improve adherence, leading to better patient outcomes and expanding the market reach for biologics. AbbVie's investment in these delivery technologies directly addresses patient needs and market growth opportunities.

The growing use of digital health tools, like wearables and telehealth, offers AbbVie chances to better connect with patients and track how well treatments are working. For instance, the global telemedicine market was valued at approximately $110 billion in 2023 and is projected to grow significantly, indicating a strong shift towards remote patient care and data collection.

By weaving these technologies into its operations, AbbVie can boost its patient support initiatives and gain crucial insights for developing and marketing new drugs. The real-world data collected through these platforms can inform clinical trial design and post-market surveillance, leading to more effective and targeted therapies.

Data Analytics and Artificial Intelligence in Healthcare

The integration of big data analytics and artificial intelligence (AI) is fundamentally reshaping the healthcare landscape, impacting everything from drug development to patient care. AbbVie can harness these powerful tools to refine clinical trial methodologies, tailor treatments to individual patient profiles, predict emerging market demands, and enhance the efficiency of its operational framework. This strategic adoption fosters more data-driven and effective decision-making across the organization.

By leveraging AI, AbbVie can accelerate drug discovery and development timelines. For instance, AI algorithms can analyze vast datasets of genomic information and patient outcomes to identify novel drug targets and predict treatment efficacy. In 2024, the global AI in healthcare market was valued at approximately $20.3 billion, with projections indicating substantial growth, underscoring the technology's increasing importance.

AbbVie's commercial operations can also see significant improvements through data analytics. Understanding patient journeys, physician prescribing patterns, and market dynamics allows for more targeted marketing campaigns and optimized supply chain management. This data-centric approach is crucial for navigating the complex and competitive biopharmaceutical sector, where precision and efficiency are paramount for success.

- AI in Drug Discovery: AI can analyze millions of molecular compounds to identify potential drug candidates, significantly reducing the time and cost associated with early-stage research.

- Personalized Medicine: By analyzing patient genetic data and medical history, AI can help predict individual responses to therapies, enabling more personalized and effective treatment plans.

- Operational Efficiency: Data analytics can optimize AbbVie's manufacturing processes, predict equipment failures, and streamline logistics, leading to cost savings and improved product availability.

- Market Trend Analysis: AI-powered tools can monitor real-time market signals, identify unmet medical needs, and forecast demand for specific therapies, informing strategic product development and commercialization efforts.

Patent Expiration and Biosimilar Competition

The expiration of patents on key AbbVie drugs, like Humira, opens the door for biosimilar competition, a significant technological and market factor. This emergence of biosimilars directly impacts revenue streams for previously protected blockbuster products.

For instance, Humira, which generated approximately $21.2 billion in sales in 2023, faced biosimilar entries in the US in 2023. AbbVie's strategy to counter this involves a robust pipeline of new therapies and expansion into novel therapeutic areas to offset anticipated revenue decline.

- Patent Expirations: Key patents for blockbuster drugs are expiring, allowing for the market entry of lower-cost biosimilar alternatives.

- Biosimilar Market Entry: The US saw biosimilar versions of Humira become available in 2023, impacting its market exclusivity.

- Revenue Erosion: Biosimilar competition is a direct threat to the revenue generated by originator biologics.

- Innovation Imperative: AbbVie must continuously innovate its drug pipeline and explore new therapeutic areas to maintain market share and financial stability.

Technological advancements are a double-edged sword for AbbVie, driving innovation while also creating competitive pressures. The company's substantial R&D investment, reaching $7.7 billion in 2023, reflects its commitment to harnessing these changes, particularly in areas like AI for drug discovery and personalized medicine. These investments are crucial for developing novel therapies and improving manufacturing processes.

The rise of digital health tools and big data analytics presents significant opportunities for AbbVie to enhance patient engagement and gather real-world evidence. The global telemedicine market, valued at approximately $110 billion in 2023, highlights the growing trend towards remote patient care. By integrating these technologies, AbbVie can gain valuable insights to refine its drug development and commercialization strategies.

The impact of technological factors is also evident in the competitive landscape, particularly with the advent of biosimilars. The US market saw biosimilar versions of Humira, which generated about $21.2 billion in sales in 2023, become available in 2023. This necessitates continuous innovation and pipeline development to mitigate revenue erosion from these lower-cost alternatives.

| Technology Area | AbbVie's Investment/Focus | Market Impact/Opportunity | 2023/2024 Data Point |

|---|---|---|---|

| AI in Drug Discovery | R&D investment, leveraging algorithms for target identification | Accelerated R&D timelines, identification of novel drug candidates | Global AI in healthcare market valued at ~$20.3 billion in 2024 |

| Digital Health & Telemedicine | Integration of wearables, telehealth for patient monitoring | Enhanced patient engagement, real-world data collection for treatment efficacy | Global telemedicine market valued at ~$110 billion in 2023 |

| Biosimilars | Pipeline development, expansion into new therapeutic areas | Competition for blockbuster drugs, revenue erosion | Humira biosimilars entered the US market in 2023 |

Legal factors

AbbVie navigates a complex web of regulations, with bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) dictating product approval and marketing. For instance, in 2023, the FDA continued its rigorous review process for new drug applications, impacting timelines for AbbVie's pipeline. Failure to comply with these mandates can result in significant financial penalties, product recalls, and even market exclusion.

AbbVie's business heavily relies on intellectual property, particularly patents, to maintain market exclusivity for its groundbreaking drugs. This protection is crucial for recouping substantial research and development investments and ensuring continued innovation. For instance, the company's Humira, a blockbuster drug, faced numerous patent challenges, highlighting the importance of robust IP defense.

The company actively engages in patent litigation to protect its market share from generic and biosimilar competitors. These legal battles are essential for safeguarding its revenue streams, as generic entry can significantly erode sales. In 2023, AbbVie reported significant legal expenses related to ongoing patent disputes, underscoring the financial implications of defending its intellectual property.

AbbVie operates under a stringent global antitrust and competition law framework. These regulations are designed to foster fair market competition and prevent monopolistic practices, directly influencing AbbVie's strategic moves like mergers and acquisitions. For instance, the U.S. Federal Trade Commission (FTC) actively scrutinizes pharmaceutical deals, and in 2023, the FTC filed a complaint to block a proposed $2.1 billion acquisition of Seagen by Pfizer, highlighting the intense regulatory oversight on industry consolidation.

Failure to adhere to these laws can result in severe repercussions. AbbVie could face extensive investigations, substantial financial penalties, and operational restrictions. Such outcomes can significantly impede its ability to pursue growth strategies, including product development pipelines and market expansion, as demonstrated by past antitrust cases in the pharmaceutical sector that have led to divestitures or blocked mergers, impacting companies' long-term strategic trajectories.

Data Privacy and Cybersecurity Regulations

AbbVie operates under stringent global data privacy regulations, including the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. These laws dictate how the company can collect, store, and utilize sensitive patient and clinical trial data. Failure to comply can lead to substantial fines; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is greater.

Ensuring robust cybersecurity measures is paramount for AbbVie to safeguard this sensitive information. Data breaches not only carry significant legal liabilities, potentially leading to costly lawsuits and regulatory penalties, but also pose a severe risk to the company's reputation. In 2023, the healthcare sector experienced a significant number of data breaches, highlighting the ongoing challenges in protecting patient information.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Penalties: Fines can range from $100 to $50,000 per violation, with annual maximums up to $1.5 million for repeat offenses.

- Cybersecurity Investment: Pharmaceutical companies are increasingly investing heavily in cybersecurity, with global spending projected to exceed $100 billion by 2025.

- Reputational Risk: A data breach can erode patient trust, impacting clinical trial participation and product adoption.

Product Liability and Consumer Protection Laws

As a pharmaceutical giant, AbbVie navigates a complex landscape of product liability and consumer protection laws. The potential for lawsuits stemming from adverse drug reactions or perceived inefficacy is a constant concern. For instance, in 2023, the pharmaceutical industry saw significant settlements and ongoing litigation related to drug safety, underscoring the financial and reputational risks involved. AbbVie's commitment to rigorous clinical trials and post-market surveillance is therefore crucial.

Maintaining robust pharmacovigilance systems is not just a regulatory requirement but a strategic imperative. These systems are designed to detect, assess, and manage any potential safety signals from AbbVie's products. In 2024, regulatory bodies worldwide continue to emphasize the importance of timely and transparent adverse event reporting, with increased scrutiny on how companies handle and communicate such information. Failure in this area can lead to hefty fines and damage consumer trust.

Consumer protection laws globally mandate fair practices, accurate labeling, and transparent marketing of pharmaceutical products. AbbVie must ensure its promotional materials and product information are not misleading and comply with the diverse regulatory frameworks in its operating markets. The company's 2023 annual report highlighted ongoing investments in compliance and regulatory affairs to address these evolving legal requirements and safeguard its market position.

- Product Liability Exposure: AbbVie faces potential litigation over drug safety and efficacy, a persistent risk in the pharmaceutical sector.

- Consumer Protection Compliance: Adherence to laws ensuring fair practices and accurate product information is vital for market integrity.

- Pharmacovigilance Importance: Robust systems for monitoring and reporting adverse events are critical for risk mitigation and regulatory standing.

- Litigation Trends: The pharmaceutical industry's ongoing settlements and legal challenges in 2023 highlight the significant financial implications of product-related issues.

AbbVie's operations are significantly shaped by intellectual property laws, particularly patents, which are essential for protecting its drug innovations and recouping R&D costs. The company actively engages in patent litigation to defend its market exclusivity against generic and biosimilar competition, as seen in ongoing disputes surrounding its key products. These legal battles are critical for maintaining revenue streams, with significant legal expenses often incurred in 2023 and anticipated for 2024.

| Legal Factor | Description | Impact on AbbVie | 2023/2024 Data/Trend |

| Patent Protection & Litigation | Safeguarding exclusive rights to pharmaceuticals through patents and defending against challenges. | Crucial for revenue generation and market share preservation. | Ongoing patent disputes in 2023 led to significant legal expenses; continued vigilance required in 2024. |

| Regulatory Compliance (FDA, EMA) | Adherence to stringent regulations for drug approval, marketing, and safety. | Dictates product launch timelines, market access, and operational procedures. | Rigorous FDA review processes in 2023 impacted development timelines; ongoing focus on compliance in 2024. |

| Antitrust & Competition Laws | Compliance with regulations preventing monopolistic practices and ensuring fair market competition. | Influences M&A strategies and market conduct. | Increased FTC scrutiny on pharmaceutical deals in 2023 highlights the need for careful strategic planning. |

Environmental factors

AbbVie's dedication to sustainable manufacturing is a key focus, with initiatives aimed at cutting energy use, water consumption, and waste across its global operations. For instance, in 2023, the company reported a 15% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating tangible progress in its environmental stewardship.

Adopting greener operational methods not only bolsters AbbVie's public image and attracts environmentally conscious investors but also offers significant cost savings. By optimizing resource efficiency, AbbVie can mitigate risks associated with fluctuating energy prices and stricter environmental mandates, ensuring long-term operational resilience.

AbbVie's vast global supply chain, encompassing everything from sourcing raw materials to delivering finished products, carries a significant environmental footprint. This includes emissions generated during manufacturing, transportation, and packaging, as well as resource consumption and waste generation at various stages.

In 2023, AbbVie reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, highlighting efforts to address operational impacts. The company is actively working with its suppliers to improve environmental performance, focusing on areas like energy efficiency and waste reduction across its extended network.

Managing and reducing emissions, waste, and resource depletion throughout its supplier network is vital for AbbVie to demonstrate genuine environmental stewardship and meet the growing expectations of investors, regulators, and the public. This commitment is increasingly tied to corporate reputation and long-term business sustainability.

Climate change poses a significant threat to AbbVie's global operations. Extreme weather events, like the increased frequency of hurricanes and floods observed in recent years, could disrupt manufacturing facilities and logistics networks, impacting product delivery. For instance, the intensification of droughts in key agricultural regions, where some raw materials might originate, could lead to supply shortages and price volatility.

Waste Management and Pollution Control

AbbVie faces significant environmental responsibilities concerning pharmaceutical waste, particularly hazardous materials. Proper disposal and treatment are paramount to prevent soil and water contamination. In 2023, AbbVie reported a 10% reduction in hazardous waste generation compared to 2022, a testament to their ongoing efforts in waste management.

Controlling air and water pollution from manufacturing sites is another critical area. The company invests in advanced filtration and wastewater treatment technologies to meet stringent regulatory standards. For instance, their North Chicago facility implemented a new air pollution control system in late 2024, projected to reduce volatile organic compound (VOC) emissions by 15%.

Compliance with environmental protection laws, such as the Resource Conservation and Recovery Act (RCRA) in the US and similar regulations globally, is non-negotiable. AbbVie's commitment to minimizing its ecological footprint is reflected in its sustainability reports, which detail initiatives like water conservation and energy efficiency improvements across its operations.

Key environmental considerations for AbbVie include:

- Pharmaceutical Waste Management: Implementing best practices for the handling, treatment, and disposal of hazardous and non-hazardous pharmaceutical waste, aiming for waste reduction and recycling where feasible.

- Air Emissions Control: Utilizing advanced technologies to minimize emissions of pollutants from manufacturing processes, ensuring compliance with air quality standards.

- Water Pollution Prevention: Employing robust wastewater treatment systems to protect water bodies from contamination by manufacturing byproducts and chemicals.

- Regulatory Compliance and Impact Mitigation: Adhering to all applicable environmental laws and regulations, and proactively seeking ways to reduce the company's overall environmental impact.

Corporate Social Responsibility and ESG Reporting

AbbVie's commitment to corporate social responsibility is increasingly scrutinized through the lens of Environmental, Social, and Governance (ESG) factors. Investors and the public are demanding greater transparency and accountability regarding the company's environmental impact. This focus directly influences AbbVie's ability to attract sustainable investment and maintain crucial stakeholder confidence.

Demonstrating tangible progress on environmental goals is no longer optional but a strategic imperative. AbbVie's 2023 ESG report highlighted a 15% reduction in greenhouse gas emissions intensity compared to a 2020 baseline, a key metric for stakeholders evaluating its environmental stewardship.

- Investor Demand: A growing number of institutional investors, including BlackRock and Vanguard, are integrating ESG criteria into their investment decisions, impacting capital availability for companies like AbbVie.

- Regulatory Landscape: Evolving environmental regulations in key markets, such as potential carbon pricing mechanisms, could directly affect AbbVie's operational costs and strategic planning.

- Reputational Risk: Negative publicity surrounding environmental incidents or a lack of progress on sustainability targets can significantly damage AbbVie's brand reputation and public trust.

- Operational Efficiency: Investments in energy efficiency and waste reduction, often driven by ESG goals, can lead to long-term cost savings and improved operational performance for AbbVie.

AbbVie's environmental strategy focuses on reducing its operational footprint, including greenhouse gas emissions and waste generation. The company achieved a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023 against its 2019 baseline, showcasing progress in its sustainability efforts.

Managing pharmaceutical waste, particularly hazardous materials, is a critical environmental responsibility for AbbVie to prevent pollution. In 2023, the company reported a 10% decrease in hazardous waste generation compared to the previous year, reflecting its commitment to responsible waste management.

The company is actively working to mitigate the impacts of climate change, such as extreme weather events, which could disrupt its global supply chain and manufacturing operations. AbbVie is also investing in advanced technologies to control air and water pollution from its sites, as evidenced by a new air pollution control system implemented in late 2024 projected to cut VOC emissions by 15%.

Investor and regulatory pressure regarding Environmental, Social, and Governance (ESG) factors are significant drivers for AbbVie's environmental performance. For instance, a 15% reduction in greenhouse gas emissions intensity reported in 2023 against a 2020 baseline demonstrates tangible progress in meeting stakeholder expectations.

| Environmental Metric | 2022 Data | 2023 Data | Change |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Intensity (vs. 2019 baseline) | -5% | -10% | -5 percentage points |

| Hazardous Waste Generation | 100% (baseline) | 90% | -10% |

| Greenhouse Gas Emissions Intensity (vs. 2020 baseline) | -10% | -15% | -5 percentage points |

PESTLE Analysis Data Sources

Our AbbVie PESTLE Analysis is informed by a comprehensive blend of public and proprietary data. We draw from leading economic indicators, regulatory updates from health authorities worldwide, and technological advancements in the life sciences sector.