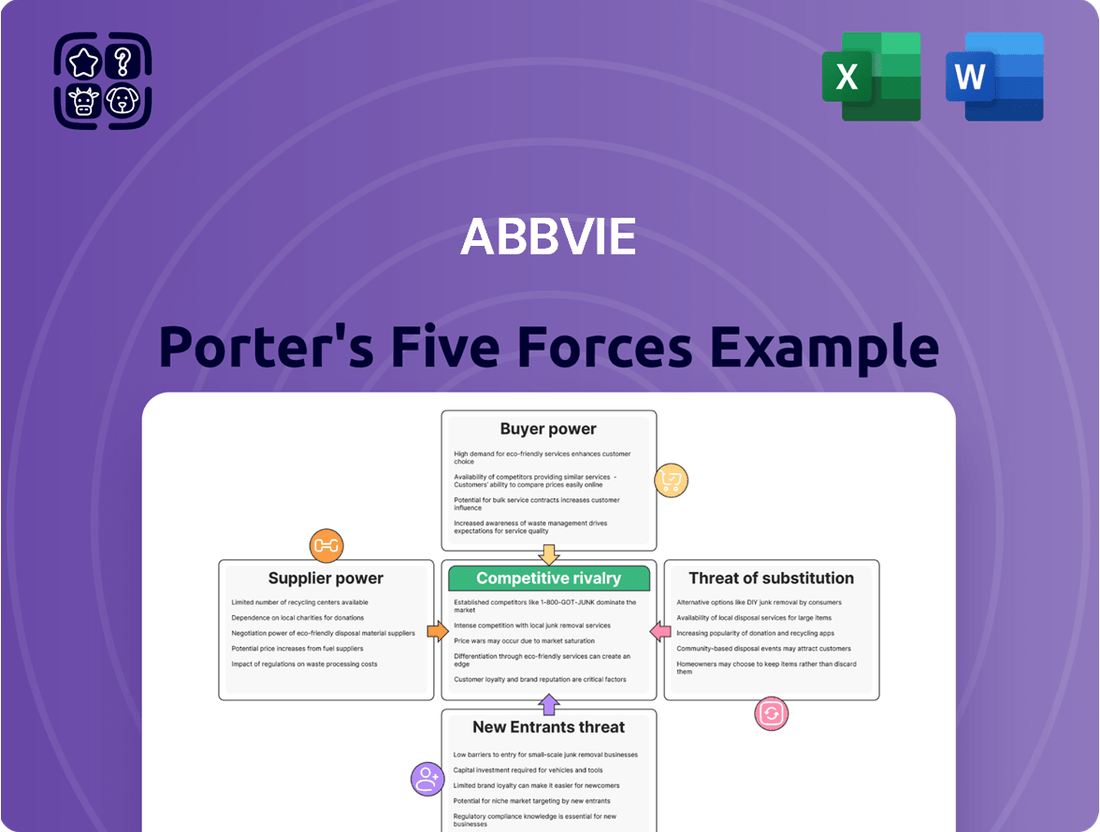

AbbVie Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AbbVie Bundle

AbbVie's competitive landscape is shaped by powerful forces, from the intense rivalry among established players to the significant threat of substitute therapies. Understanding these dynamics is crucial for navigating the pharmaceutical industry.

The full Porter's Five Forces Analysis reveals the real forces shaping AbbVie’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biopharmaceutical sector, including companies like AbbVie, often depends on a limited number of specialized suppliers for critical components such as active pharmaceutical ingredients (APIs), unique raw materials, and sophisticated manufacturing machinery. When a small group of suppliers holds a dominant position in these specialized markets, they gain considerable leverage. This can translate into increased costs for AbbVie or disruptions in its supply chain, impacting production and product availability.

AbbVie's significant expenditure of $15.7 billion on suppliers globally in 2024 underscores its deep reliance on this network. This substantial investment highlights the importance of maintaining strong relationships with these specialized providers and managing the inherent risks associated with a concentrated supplier base.

Switching suppliers in the pharmaceutical industry, especially for critical raw materials or specialized manufacturing processes, presents significant hurdles for companies like AbbVie. These hurdles are amplified by extensive regulatory compliance, including FDA validation, which can take years and millions of dollars to complete for a new supplier. This lengthy and expensive process inherently raises switching costs.

The potential for supply chain disruption during a transition is another major concern. A misstep in qualifying a new supplier could lead to production delays, impacting product availability and revenue. These high switching costs effectively bolster the bargaining power of AbbVie's current, established suppliers, as the cost and risk of finding and validating alternatives are substantial.

For instance, in 2024, the pharmaceutical manufacturing sector continued to grapple with supply chain complexities. Companies often face lead times of 12-18 months for qualifying new suppliers for active pharmaceutical ingredients (APIs) or specialized excipients. This extended timeline underscores the difficulty and expense involved, directly impacting AbbVie's ability to easily change suppliers.

Suppliers offering highly specialized or patented inputs, like novel compounds for drug development, wield significant bargaining power. AbbVie's commitment to advanced therapies often necessitates reliance on suppliers possessing unique intellectual property or highly specialized manufacturing processes, thereby granting these suppliers considerable leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into pharmaceutical manufacturing or development significantly amplifies their bargaining power. While less likely for basic raw material providers, this risk is more pronounced with highly specialized contract manufacturing organizations (CMOs) possessing advanced production and R&D capabilities. For instance, in 2023, the global pharmaceutical contract manufacturing market was valued at approximately $150 billion, indicating substantial capacity and potential for expansion into finished product development.

AbbVie actively counters this threat by maintaining robust in-house manufacturing infrastructure and strategically investing in its U.S.-based production facilities. This vertical integration strategy reduces reliance on external CMOs and provides greater control over its supply chain, thereby diminishing the leverage suppliers might otherwise wield.

- Supplier Forward Integration Threat: Suppliers integrating into pharmaceutical manufacturing or development increases their bargaining power.

- CMO Capabilities: This threat is more relevant for advanced Contract Manufacturing Organizations (CMOs).

- AbbVie's Mitigation: AbbVie uses its own manufacturing facilities and invests in U.S. production to reduce supplier leverage.

Importance of AbbVie to Suppliers

AbbVie's significance as a customer directly impacts its suppliers' bargaining power. If a supplier relies heavily on AbbVie for a substantial portion of its revenue, it's less likely to push for unfavorable terms. For instance, if AbbVie accounts for a large percentage of a supplier's sales, that supplier has a greater incentive to maintain a positive relationship and may concede on pricing or other demands.

Conversely, when AbbVie is a minor client for a large, specialized supplier, the supplier's bargaining power increases. This is because the supplier has other significant customers and can afford to be less accommodating to AbbVie. AbbVie's considerable global expenditure, however, indicates it is a major client for many of its suppliers, which can temper the suppliers' individual bargaining leverage.

In 2023, AbbVie's total revenue reached approximately $54.3 billion. This substantial figure underscores its role as a significant purchaser across various supply chains, from raw materials for drug manufacturing to specialized equipment and services. The sheer scale of AbbVie's operations means that many suppliers derive a considerable portion of their business from the pharmaceutical giant.

- Supplier Dependence: If a supplier generates a large percentage of its income from AbbVie, its ability to demand higher prices or stricter terms is diminished.

- AbbVie's Spending Power: With revenues exceeding $54 billion in 2023, AbbVie represents a substantial and attractive client for most suppliers.

- Specialized vs. General Suppliers: The bargaining power dynamic shifts based on whether a supplier offers highly specialized products or more commoditized goods.

Suppliers of specialized inputs, like active pharmaceutical ingredients (APIs) or unique compounds, hold significant sway over AbbVie due to the high switching costs involved. These costs are amplified by lengthy regulatory validation processes, often taking years and substantial investment, making it difficult for AbbVie to change providers. For example, qualifying a new API supplier can take 12-18 months, as seen in the pharmaceutical manufacturing sector in 2024.

AbbVie's substantial global supplier expenditure, reaching $15.7 billion in 2024, highlights its reliance on these entities. When suppliers offer patented or highly specialized materials, their bargaining power increases, especially if they possess unique intellectual property or advanced manufacturing capabilities.

The threat of suppliers integrating forward into pharmaceutical manufacturing or development also bolsters their leverage. While less common for basic material providers, this risk is more pronounced with advanced Contract Manufacturing Organizations (CMOs). AbbVie mitigates this by investing in its own U.S.-based manufacturing facilities, reducing its dependence on external CMOs.

AbbVie's significant purchasing power, with 2023 revenues of approximately $54.3 billion, generally limits supplier leverage. However, if AbbVie represents a small fraction of a specialized supplier's business, that supplier's bargaining power increases, as they have other substantial clients to rely on.

| Factor | Description | Impact on AbbVie | 2024 Data Point | 2023 Data Point |

| Supplier Concentration | Limited number of specialized suppliers for critical inputs. | Increases supplier leverage, potentially raising costs. | AbbVie spent $15.7 billion on suppliers. | N/A |

| Switching Costs | High due to regulatory validation (e.g., FDA) and R&D. | Makes it difficult and expensive to change suppliers. | 12-18 month lead times for API supplier qualification. | N/A |

| Input Differentiation | Suppliers offering patented or highly specialized inputs. | Grants suppliers significant bargaining power. | Reliance on unique compounds for advanced therapies. | N/A |

| Forward Integration Threat | Suppliers moving into manufacturing or development. | Amplifies supplier leverage, especially for CMOs. | Global pharmaceutical contract manufacturing market valued at ~$150 billion in 2023. | N/A |

| AbbVie's Customer Importance | AbbVie's significant portion of a supplier's revenue. | Reduces supplier leverage if AbbVie is a key client. | N/A | AbbVie's total revenue: $54.3 billion. |

What is included in the product

AbbVie's Porter's Five Forces analysis reveals the intense competitive pressures from rivals and the threat of new entrants, while also highlighting the significant bargaining power of buyers and the moderate influence of suppliers on its pharmaceutical market position.

Effortlessly identify and mitigate competitive threats, empowering AbbVie to proactively address market pressures and protect its revenue streams.

Customers Bargaining Power

Customers in the pharmaceutical sector, encompassing governments, insurers, and pharmacy benefit managers (PBMs), exhibit significant price sensitivity. This is largely driven by escalating healthcare expenditures and a concerted push for cost containment. For example, the U.S. government's Medicare Part D program negotiates drug prices, directly impacting pharmaceutical company revenues.

The emergence of biosimilars has dramatically heightened price competition, particularly for blockbuster drugs. Following Humira's patent expiration, multiple biosimilars entered the market, forcing AbbVie to offer significant discounts. This competitive pressure is evident in market share shifts; by early 2024, biosimilars had captured a notable portion of the Humira market in key regions.

Major players like CVS Caremark demonstrated this shift by removing branded Humira from their formularies in 2024, actively steering patients towards more affordable biosimilar alternatives. This strategic move by large payers underscores their power to influence prescribing patterns and drive down drug costs for their beneficiaries.

The rise of biosimilars directly amplifies customer bargaining power, especially concerning former blockbuster medications like AbbVie's Humira. These more affordable alternatives, with some launching at over 40% less than the original biologic, give patients and payers more options and leverage.

While branded Humira continues to hold a substantial market presence, the increasing adoption of biosimilars means customers can more readily negotiate prices or switch to less expensive treatments, thereby pressuring AbbVie's pricing strategies.

Large payers, including major Pharmacy Benefit Managers (PBMs) and government programs like Medicare, wield significant bargaining power due to their concentrated nature and substantial purchasing volumes. These entities can heavily influence which drugs are included on formularies and negotiate for more favorable pricing, directly impacting pharmaceutical companies. For instance, CVS Caremark and Express Scripts have signaled their intention to reduce or eliminate branded Humira from their formularies by mid-2025, demonstrating this leverage.

Information Availability to Customers

Customers in the pharmaceutical sector, particularly for AbbVie, are increasingly benefiting from greater access to information. This transparency covers crucial aspects like drug efficacy, safety profiles, and pricing, empowering them to make more informed choices. For instance, by mid-2024, numerous patient advocacy groups and independent health websites were providing detailed comparisons of treatment options and their associated costs, directly influencing patient and payer decisions.

This enhanced information availability significantly strengthens the bargaining power of customers. They can now more effectively question pricing structures and demand greater value for their money, especially when alternative treatments exist or when comparing the cost-effectiveness of different therapies. By late 2023 and into 2024, payers, including large insurance providers and government health programs, were leveraging this data to negotiate more aggressively with pharmaceutical companies on drug prices, impacting revenue streams for companies like AbbVie.

The trend towards greater healthcare transparency means customers are no longer solely reliant on physician recommendations. They actively research and compare. This shift directly translates into increased leverage for buyers, forcing companies to be more competitive in their pricing and demonstrate clear value propositions.

- Increased access to drug efficacy data allows patients to compare treatments more effectively.

- Pricing transparency empowers customers to negotiate better terms with pharmaceutical providers.

- Patient advocacy groups and independent health websites play a crucial role in disseminating information by mid-2024.

- Payers are using comparative data to drive down drug costs, affecting companies like AbbVie.

Threat of Backward Integration by Customers

While the threat of customers backward integrating into pharmaceutical manufacturing is generally low for AbbVie, large healthcare systems or integrated delivery networks (IDNs) could theoretically explore developing their own generic versions of certain drugs to lower costs. For instance, some large hospital systems have explored in-house compounding of certain medications, though this is distinct from full-scale drug manufacturing. The significant capital investment, complex regulatory pathways, and specialized expertise required for drug development and production represent substantial barriers to entry for most customers.

The pharmaceutical industry's stringent regulations, including Good Manufacturing Practices (GMP) and lengthy drug approval processes, further deter backward integration by customers. For example, the U.S. Food and Drug Administration (FDA) oversees drug manufacturing, requiring extensive quality control and validation. In 2024, the cost and time to bring a new drug to market remain exceptionally high, making it an unfeasible strategy for most healthcare providers seeking cost savings.

The bargaining power of customers in this specific context is therefore limited by these high barriers. AbbVie's proprietary drug portfolio, protected by patents and complex intellectual property, also reduces the immediate threat of customers developing comparable alternatives through backward integration. While cost pressures exist, the practicalities of pharmaceutical production make direct competition through manufacturing unlikely for most customer segments.

Customers, particularly large payers like PBMs and government programs, wield considerable influence due to their purchasing volume and focus on cost containment. The introduction of biosimilars for AbbVie's Humira, with some launching at discounts exceeding 40% in 2024, significantly amplifies this power. Payers are actively leveraging these cheaper alternatives to negotiate lower prices or shift patient preference, impacting AbbVie's revenue streams.

The increasing transparency in drug pricing and efficacy data by mid-2024 further empowers customers. Patient advocacy groups and health websites provide comparative information, enabling more informed choices and strengthening negotiation leverage. This shift forces companies like AbbVie to demonstrate greater value and competitiveness in their pricing strategies.

While the threat of customers backward integrating into drug manufacturing is minimal due to high regulatory and capital barriers, their collective bargaining power remains substantial. This is driven by the availability of biosimilars and enhanced market information, pushing for more favorable pricing and treatment cost reductions.

| Customer Segment | Bargaining Power Factor | Impact on AbbVie (2024-2025) |

|---|---|---|

| PBMs (e.g., CVS Caremark) | Volume purchasing, Formulary control | Increased pressure on Humira pricing, potential formulary exclusion of branded version |

| Government Programs (e.g., Medicare Part D) | Price negotiation mandates | Direct impact on drug reimbursement rates and net pricing |

| Patients | Access to comparative data, Biosimilar adoption | Shift towards lower-cost alternatives, demanding value demonstration |

| Healthcare Systems/IDNs | Potential for in-house compounding (limited) | Minimal direct threat of backward integration, but cost scrutiny remains |

Full Version Awaits

AbbVie Porter's Five Forces Analysis

This preview showcases the comprehensive AbbVie Porter's Five Forces Analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into AbbVie's competitive landscape.

Rivalry Among Competitors

AbbVie competes in a dynamic global biopharmaceutical landscape populated by many well-established companies and innovative biotech startups. Major rivals like Johnson & Johnson, Pfizer, Merck, Roche, Amgen, Eli Lilly, and AstraZeneca boast significant research and development prowess and broad product offerings.

The pharmaceutical industry's growth rate, while generally positive, is tempered by fierce competition. Companies like AbbVie are under constant pressure to innovate, launching new products to offset the revenue impact of older, patent-expired drugs. This dynamic necessitates a strategic focus on research and development to maintain market leadership.

AbbVie's proactive approach to this challenge is evident in its strategy to counter the expected decline in Humira sales. The company is heavily investing in and promoting its newer immunology blockbusters, Skyrizi and Rinvoq. These drugs are anticipated to achieve robust high-single-digit revenue growth through 2029, demonstrating AbbVie's commitment to portfolio evolution and sustained market relevance.

Competitive rivalry in the pharmaceutical sector, particularly for companies like AbbVie, is intensely fueled by the relentless pursuit of novel therapies. These innovations often focus on addressing severe and complex diseases where unmet medical needs are significant.

AbbVie actively cultivates product differentiation and maintains its competitive edge through a robust pipeline and strategic acquisitions. Key areas of focus include oncology, neuroscience, and eye care, where the company aims to introduce groundbreaking treatments.

Significant investment in research and development is a cornerstone of AbbVie's strategy. For instance, the company allocated $10.8 billion to R&D in 2024, underscoring its commitment to innovation and staying ahead in a highly competitive market.

Exit Barriers

The pharmaceutical industry, including companies like AbbVie, faces substantial exit barriers. These are primarily driven by the immense capital investment required for research and development, specialized manufacturing facilities, and stringent regulatory compliance. For instance, bringing a new drug to market can cost billions of dollars and take over a decade, making it incredibly difficult for companies to simply walk away from such an investment. This high sunk cost means that even when profitability is low, firms may continue to operate, thereby intensifying competition among existing players.

These high fixed costs create a situation where exiting the market is economically unfeasible for many pharmaceutical companies. The specialized nature of their assets, such as advanced laboratories and sterile production lines, means they have limited alternative uses. Consequently, firms often stay in the market, even if facing financial difficulties, which can lead to prolonged periods of intense rivalry as companies fight to maintain market share and recoup their investments.

Exit barriers in the pharmaceutical sector contribute significantly to competitive rivalry. Consider these points:

- High R&D Investment: Pharmaceutical companies often invest billions in drug discovery and development, with significant portions of these costs being unrecoverable upon exit. For example, in 2023, the pharmaceutical industry's R&D spending was estimated to be over $200 billion globally.

- Specialized Assets: Manufacturing plants and equipment are highly specialized for drug production and often cannot be repurposed for other industries, making them difficult to sell or redeploy.

- Regulatory Hurdles: The extensive regulatory approval processes for drugs, including those by the FDA and EMA, represent significant investments that are tied to specific products and markets.

Impact of Biosimilars and Generics

The competitive rivalry for AbbVie has intensified significantly with the introduction of biosimilars, especially for its flagship product, Humira. This has led to considerable price erosion and a redistribution of market share. For instance, in the first quarter of 2024, AbbVie reported Humira sales of $3.07 billion, a decrease from $3.57 billion in the same period of 2023, reflecting the impact of biosimilar competition in the US market.

Despite the pressure on Humira, AbbVie is strategically pivoting to its newer immunology treatments, Skyrizi and Rinvoq. These products are experiencing strong growth, helping to offset the decline in Humira sales. Skyrizi sales reached $2.37 billion in Q1 2024, up from $1.77 billion in Q1 2023, while Rinvoq sales were $1.06 billion, an increase from $867 million in the prior year.

- Biosimilar Entry Impact: Increased competition from biosimilars, particularly for Humira, has driven down prices and shifted market dynamics.

- Humira Sales Decline: AbbVie's Humira sales saw a notable decrease in early 2024 due to biosimilar competition, falling to $3.07 billion in Q1 2024.

- Growth of Next-Gen Products: AbbVie's focus on Skyrizi and Rinvoq is yielding positive results, with substantial year-over-year sales growth.

- Strategic Shift: The company is actively managing the transition from Humira to its newer immunology portfolio to maintain its competitive edge.

Competitive rivalry in the biopharmaceutical sector is exceptionally intense, driven by a limited number of large, established players and a constant influx of innovative smaller firms. AbbVie faces formidable competition from giants like Johnson & Johnson, Pfizer, and Merck, all of whom possess substantial R&D capabilities and broad product portfolios. This dynamic necessitates continuous innovation and strategic portfolio management to maintain market share and profitability.

The market for blockbuster drugs is particularly competitive, with companies vying for dominance in therapeutic areas with significant unmet needs. AbbVie’s strategy to counter the impact of Humira biosimilars by focusing on Skyrizi and Rinvoq highlights this competitive pressure. These newer drugs are expected to drive significant growth, demonstrating the critical importance of a strong pipeline in this environment.

The introduction of biosimilars, especially for AbbVie’s Humira, has dramatically intensified competition, leading to price erosion and market share shifts. For example, Humira sales declined to $3.07 billion in Q1 2024 from $3.57 billion in Q1 2023. Conversely, Skyrizi and Rinvoq showed robust growth, with Skyrizi sales reaching $2.37 billion and Rinvoq sales hitting $1.06 billion in Q1 2024, underscoring the strategic importance of these next-generation products.

AbbVie's significant investment in R&D, with $10.8 billion allocated in 2024, reflects the high stakes involved in staying competitive. This spending is crucial for developing novel therapies and maintaining a differentiated product offering in a market where innovation is paramount.

| Key Competitor | 2024 R&D Spending (Estimated/Actual) | Key Therapeutic Areas |

| Johnson & Johnson | ~$15 billion (2023) | Oncology, Immunology, Neuroscience |

| Pfizer | ~$10 billion (2023) | Oncology, Vaccines, Inflammation & Immunology |

| Merck | ~$13 billion (2023) | Oncology, Vaccines, Hospital Acute Care |

| Roche | ~$14 billion (2023) | Oncology, Immunology, Neuroscience |

| AbbVie | $10.8 billion (2024) | Immunology, Oncology, Neuroscience, Eye Care |

SSubstitutes Threaten

The most significant threat of substitutes for AbbVie stems from biosimilars and generics, especially impacting its flagship drug, Humira. These alternatives provide comparable therapeutic results but at a reduced price point, directly eroding revenue from the original branded medication. By late 2023, multiple biosimilar versions of adalimumab were available in the US market, intensifying this competitive pressure.

Beyond direct biosimilar competition, the threat of substitutes for AbbVie's established therapies comes from entirely new therapeutic modalities. These novel approaches, such as gene therapies, advanced cell therapies, or highly targeted small molecules, could offer significantly better efficacy, safety profiles, or patient convenience, potentially making current treatments less attractive. For instance, the rapid advancements in gene editing technologies like CRISPR offer the potential to address the root cause of genetic diseases, a fundamental shift from AbbVie's current biologic-focused portfolio.

Changing treatment paradigms represent a significant threat of substitutes for AbbVie, particularly concerning its blockbuster drug Humira. Shifts in clinical guidelines or evolving physician preferences can drive patients toward alternative therapies, even those within AbbVie's own portfolio. For instance, a notable trend involves patients transitioning from Humira to newer biologics with different mechanisms of action, such as AbbVie's Skyrizi and Rinvoq. This internal substitution highlights a broader industry movement towards optimizing treatment for chronic conditions like rheumatoid arthritis and Crohn's disease.

Preventive Measures and Lifestyle Changes

The threat of substitutes for AbbVie's products, particularly in areas where preventive measures or lifestyle changes can mitigate disease progression, is a long-term consideration. While not a direct threat to treatments for severe or chronic conditions like those AbbVie often addresses, advancements in diagnostics or new preventative strategies could reduce the overall demand for certain pharmaceuticals.

For instance, breakthroughs in early detection of conditions like rheumatoid arthritis or advancements in personalized medicine that identify individuals at high risk for certain cancers could lead to interventions that lessen the reliance on traditional drug therapies down the line. This indirect substitution, while currently less impactful for AbbVie's core portfolio, represents a dynamic element in the pharmaceutical landscape.

- Preventive Health Focus: Growing public and governmental emphasis on preventative healthcare could steer individuals towards lifestyle modifications and early interventions, potentially reducing the long-term need for certain prescription medications.

- Diagnostic Advancements: Improved diagnostic tools allowing for earlier detection and management of diseases might shift focus from treatment to prevention or less invasive interventions.

- Lifestyle Interventions: Increased awareness and accessibility of effective lifestyle changes, such as diet, exercise, and stress management, can sometimes serve as alternatives or complements to pharmaceutical treatments for certain conditions.

- Indirect Impact: While less of a threat for severe, chronic, or rare diseases where AbbVie holds strong positions, the cumulative effect of these trends could subtly influence market dynamics over extended periods.

Cost-Effectiveness of Substitutes

The cost-effectiveness of potential substitutes significantly impacts AbbVie's market position. As payers and healthcare systems globally focus on value-based care, treatments offering a better price-to-outcome ratio gain traction. This pressure is particularly acute for biologics, where the advent of biosimilars directly challenges the economic proposition of originator products.

Biosimilars, by offering comparable efficacy at a reduced price point, present a substantial threat. For instance, by mid-2024, several biosimilars for AbbVie's blockbuster Humira (adalimumab) were available in the US market, leading to significant price erosion. This competition directly impacts AbbVie's revenue streams for its key products.

- Biosimilar Price Advantage: Biosimilars typically launch at a discount ranging from 15-35% compared to their reference biologic, directly impacting AbbVie's pricing power.

- Payer Influence: Healthcare payers, including insurance companies and government programs, are actively encouraging the use of biosimilars to manage costs, creating a demand shift away from branded biologics.

- Market Penetration of Biosimilars: In markets where biosimilars have been established for a longer period, such as Europe, they have captured substantial market share, demonstrating the tangible threat to originator products like AbbVie's.

The threat of substitutes for AbbVie is primarily driven by biosimilars and generics, which offer comparable efficacy at lower prices. This is particularly evident with Humira, where multiple biosimilars entered the US market by late 2023, directly impacting its revenue. Beyond direct copies, novel therapeutic modalities like gene therapies and advanced cell therapies pose a future threat by offering potentially superior outcomes or convenience.

Shifting treatment paradigms also contribute to this threat, as seen with patients moving from Humira to newer biologics like Skyrizi and Rinvoq, even within AbbVie's own portfolio. While less immediate, advancements in diagnostics and preventive healthcare could also reduce the long-term demand for certain pharmaceutical treatments.

The cost-effectiveness of substitutes is a critical factor, with payers increasingly favoring value-based care and encouraging biosimilar use. For example, biosimilars for Humira launched with discounts of 15-35%, directly challenging AbbVie's pricing power and market share.

| Product | Type of Substitute | Market Entry (US) | Potential Impact |

|---|---|---|---|

| Humira (adalimumab) | Biosimilars | Multiple by late 2023 | Significant price erosion, revenue loss |

| Various Biologics | Novel Therapies (e.g., gene therapy) | Emerging | Potential displacement of current treatments |

| Various Treatments | Lifestyle Interventions/Prevention | Ongoing trend | Reduced long-term demand for certain drugs |

Entrants Threaten

The pharmaceutical industry, where AbbVie operates, presents a formidable barrier to new entrants due to exceptionally high research and development (R&D) costs. Bringing a new biopharmaceutical drug to market is an incredibly expensive and lengthy process, often requiring investments that run into the billions of dollars. This substantial financial commitment, coupled with a high probability of failure at various stages of development, acts as a significant deterrent for potential new players.

For context, AbbVie itself demonstrated this commitment by investing $10.8 billion in R&D during 2024. Such massive R&D expenditures create a substantial capital requirement that new companies must overcome, effectively limiting the number of credible new entrants capable of competing at this level.

Stringent regulatory approval processes act as a significant barrier to entry in the biopharmaceutical sector. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose lengthy and complex requirements for drug and medical device approval.

These rigorous pathways demand substantial investment in research, clinical trials, and extensive documentation, often taking years and costing hundreds of millions of dollars. For instance, the average cost to develop a new drug is estimated to be over $2 billion, with a success rate of less than 10% from initial discovery to market approval.

This high hurdle necessitates specialized expertise in regulatory affairs, scientific research, and manufacturing quality control, making it exceptionally difficult for new, unfunded players to compete with established companies that possess the necessary resources and experience.

Strong patent protections for AbbVie's key drugs, like Humira, create a formidable barrier for new entrants. For instance, Humira's primary US patent expired in 2023, but AbbVie has a robust portfolio of secondary patents and regulatory exclusivities that extend protection for various formulations and indications, significantly delaying biosimilar competition. This necessitates new players investing billions in R&D to develop truly novel therapeutics, a substantial hurdle compared to simply replicating existing successful drugs.

Need for Established Distribution and Market Access

New companies entering the biopharmaceutical market, like the one AbbVie operates in, face significant hurdles in building the necessary infrastructure. This includes developing sophisticated manufacturing processes, securing reliable supply chains for raw materials and finished products, and gaining access to key distribution channels. For instance, in 2024, the cost of building a new, state-of-the-art biopharmaceutical manufacturing facility can easily run into hundreds of millions of dollars, a substantial barrier for any new player.

Established players like AbbVie benefit immensely from their existing, well-developed networks. These networks encompass relationships with Pharmacy Benefit Managers (PBMs), major hospital systems, and a vast array of healthcare providers. These established connections are crucial for market access and reimbursement, allowing AbbVie to efficiently get its therapies to patients. New entrants often struggle to replicate this level of market penetration and influence, which can take years and substantial investment to build.

Economies of scale further solidify the position of incumbents. AbbVie’s large-scale operations allow for lower per-unit production costs and greater bargaining power with suppliers. This cost advantage makes it difficult for smaller, newer companies to compete on price, especially when factoring in the research and development costs inherent in the pharmaceutical industry. By 2024, the average R&D spend for a major pharmaceutical company can exceed $5 billion annually, a figure that new entrants may struggle to match while simultaneously investing in manufacturing and distribution.

- Manufacturing Capabilities: New entrants require immense capital to establish advanced manufacturing facilities, often costing hundreds of millions of dollars.

- Supply Chain Development: Building robust and compliant supply chains for specialized pharmaceutical ingredients and distribution is complex and time-consuming.

- Market Access: Securing contracts and favorable formulary placement with PBMs and healthcare systems is a critical, yet challenging, hurdle for new entrants.

- Economies of Scale: Established companies like AbbVie leverage their size for cost efficiencies, making it difficult for new companies to compete on price.

Brand Recognition and Trust

In the biopharmaceutical industry, where patient well-being is paramount, brand recognition and trust are significant barriers for new entrants. Established players like AbbVie have cultivated deep-seated confidence among healthcare providers and patients through a consistent track record of product efficacy and safety. This trust is not easily replicated, requiring substantial investment and time for newcomers to build.

For instance, AbbVie's Humira, a blockbuster drug, has been a cornerstone of treatment for various autoimmune diseases for years, solidifying its brand as a reliable option. New companies entering this space must not only demonstrate comparable or superior clinical outcomes but also navigate the established relationships and perceptions that favor incumbents. The sheer weight of years of positive patient experiences and physician endorsements presents a formidable hurdle.

- Brand Loyalty: Healthcare professionals and patients often exhibit strong loyalty to brands that have consistently delivered positive results.

- Reputation Management: New entrants face the challenge of building a reputation for reliability and safety in a sector where failures can have severe consequences.

- Marketing and Education: Overcoming established brand recognition requires extensive marketing and educational efforts to inform stakeholders about new products and their benefits.

- Clinical Trials and Data: New entrants must present robust clinical trial data that not only matches but ideally surpasses the efficacy and safety profiles of established treatments.

The threat of new entrants in AbbVie's operating environment is generally low, primarily due to the immense capital requirements for research and development, which reached $10.8 billion for AbbVie in 2024. Stringent regulatory hurdles, such as the FDA's approval process, demand significant investment and expertise, with drug development costs often exceeding $2 billion. Furthermore, established patent portfolios and the need for extensive manufacturing and distribution infrastructure create substantial barriers, making it exceedingly difficult for newcomers to gain a foothold.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AbbVie is built upon comprehensive data from company annual reports, SEC filings, and industry-specific market research reports. We also leverage insights from pharmaceutical trade publications and economic databases to capture the full competitive landscape.