AbbVie Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AbbVie Bundle

Curious about AbbVie's product portfolio performance? This glimpse into their BCG Matrix reveals how their key offerings are positioned, highlighting potential growth areas and those requiring strategic attention. Don't miss out on the full picture; purchase the complete BCG Matrix for a deep dive into Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights to drive AbbVie's future success.

Stars

Skyrizi stands out as a significant growth engine within AbbVie's immunology segment, consistently achieving high double-digit sales increases. Its performance is vital for counterbalancing the revenue dip from Humira.

In the second quarter of 2025, Skyrizi achieved global sales of $4.423 billion, representing a substantial 61.8% operational growth. This remarkable trajectory positions it, alongside Rinvoq, to collectively surpass $25 billion in sales for the current year.

Rinvoq, a key player in AbbVie's immunology portfolio, demonstrated robust growth with global sales reaching $2.028 billion in Q2 2025, marking a significant 41.2% operational increase. This strong performance is driven by its expanding therapeutic reach, with multiple approvals secured across rheumatology, gastroenterology, and dermatology, including a recent FDA green light for giant cell arteritis.

AbbVie's neuroscience division is a significant growth engine, demonstrating impressive double-digit expansion. This success is largely attributed to the strong performance of flagship products such as Vraylar and Vyalev, alongside a burgeoning migraine treatment line.

In the second quarter of 2025, the neuroscience segment delivered robust results, generating $2.683 billion in revenue. This figure signifies a substantial 24.0% operational increase, underscoring the portfolio's increasing market penetration within a highly competitive and expanding therapeutic landscape.

Vraylar

Vraylar stands out as a key player in AbbVie's neuroscience segment, demonstrating robust growth. In the second quarter of 2025, it achieved global net revenues of $900 million.

This strong financial performance underscores Vraylar's position as a high-growth product. Its expanding market presence and continued patient uptake are critical drivers for AbbVie's success in the neuroscience therapeutic area.

- Vraylar's Q2 2025 global net revenues: $900 million

- Therapeutic Area: Neuroscience

- Market Position: High-growth product

Elahere

Elahere, a key asset acquired through ImmunoGen, is a significant contributor to AbbVie's oncology pipeline, especially in its focus on ovarian cancer treatment.

This drug demonstrated robust financial performance in the second quarter of 2025. Its global net revenues reached $159 million, marking an impressive operational increase of 23.7%.

- Elahere's Acquisition: Acquired via ImmunoGen, bolstering AbbVie's oncology presence.

- Oncology Focus: Showing strong potential, particularly in the ovarian cancer market.

- Q2 2025 Performance: Achieved $159 million in global net revenues.

- Growth Metric: Recorded an operational revenue increase of 23.7% in Q2 2025.

AbbVie's immunology blockbusters, Skyrizi and Rinvoq, are undeniably its Stars in the BCG matrix. These products are experiencing rapid market growth and hold significant market share, driving substantial revenue increases for the company. Their combined sales are projected to exceed $25 billion in 2025, a testament to their market dominance and continued expansion across multiple indications.

| Product | Segment | Q2 2025 Sales (Global) | Operational Growth (Q2 2025) | BCG Category |

|---|---|---|---|---|

| Skyrizi | Immunology | $4.423 billion | 61.8% | Star |

| Rinvoq | Immunology | $2.028 billion | 41.2% | Star |

| Vraylar | Neuroscience | $900 million | N/A (High Growth) | Star |

| Elahere | Oncology | $159 million | 23.7% | Question Mark/Potential Star |

What is included in the product

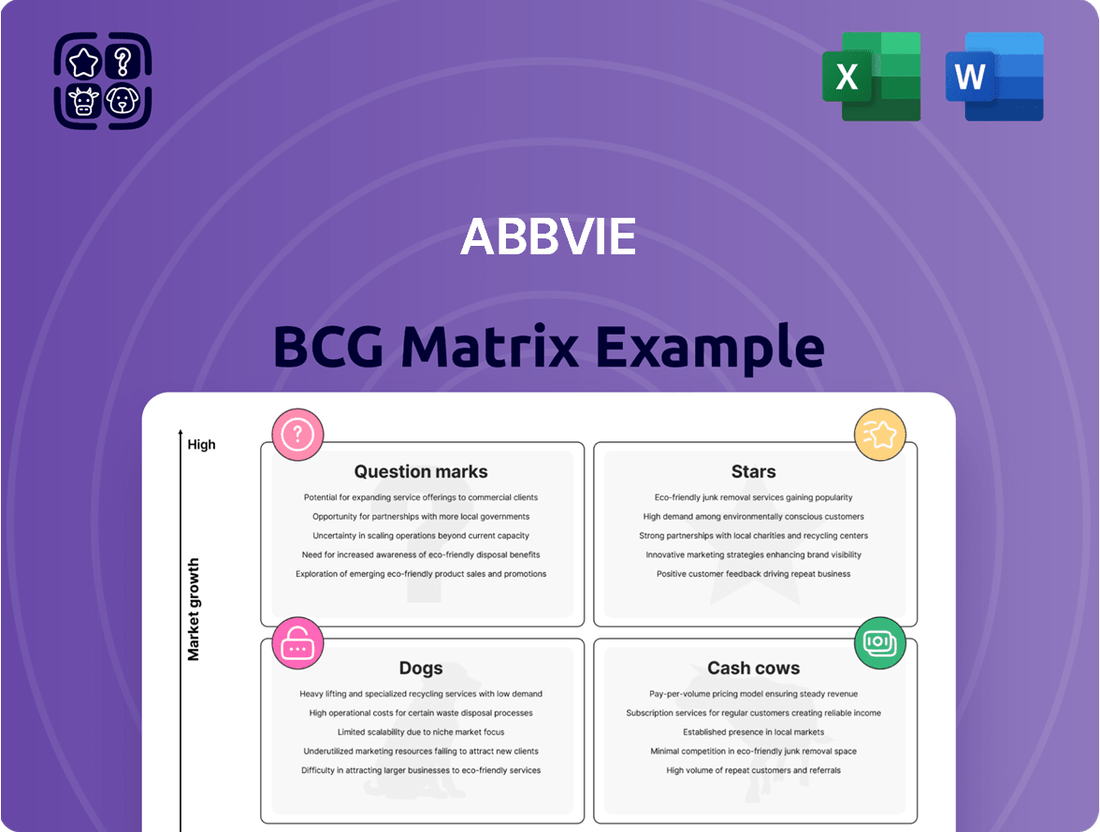

AbbVie's BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which products to nurture, maintain, or divest based on market share and growth.

The AbbVie BCG Matrix provides a clear, actionable overview of its product portfolio, easing the pain of resource allocation decisions.

Cash Cows

Botox Therapeutic is a significant cash cow for AbbVie, consistently delivering robust cash flow due to its dominant market share in critical therapeutic areas like chronic migraine, spasticity, and urology.

Despite some headwinds in the broader aesthetics market, Botox Therapeutic remains a dependable revenue generator. In the second quarter of 2025, it achieved global net revenues of $928 million, underscoring its enduring financial strength and market leadership.

Venclexta, also known as venetoclax, remains a powerhouse for AbbVie, especially in treating chronic lymphocytic leukemia (CLL). Its consistent performance highlights its role as a mature, high-revenue product within the company's oncology offerings.

In the second quarter of 2025, Venclexta achieved global net revenues of $691 million. This represents a healthy 8.3% operational increase, a testament to its sustained demand, particularly when used in combination therapies. This growth solidifies Venclexta's strong market position in the established CLL treatment landscape.

Ubrelvy and Qulipta are key components of AbbVie's neuroscience offerings, acting as reliable revenue generators within its portfolio. Their consistent performance underscores their established position in the competitive migraine market.

These migraine treatments are integral to AbbVie's neuroscience portfolio, consistently contributing to its stable revenue. Combined global net revenues for Ubrelvy and Qulipta were $605 million in Q2 2025, indicating their established presence and ability to generate steady cash flow in the migraine prevention and acute treatment market.

Diversified Immunology Portfolio (ex-Skyrizi/Rinvoq)

Even with the significant success of Skyrizi and Rinvoq, AbbVie's diversified immunology portfolio, excluding these two blockbusters, continues to be a substantial cash generator. This broader base of immunology products, which includes established treatments, provides a stable revenue foundation for the company.

AbbVie's strategic approach centers on nurturing this diversified immunology platform. The aim is to ensure consistent and reliable income streams within the competitive and maturing immunology market, leveraging the strength of its existing product lines.

- Humira's Decline and Diversification: While Humira faces biosimilar competition, its historical strength has paved the way for a more diversified immunology pipeline.

- Continued Cash Flow: Other immunology products within AbbVie's portfolio continue to contribute significantly to the company's overall cash flow, supporting ongoing research and development.

- Market Stability: This diversified approach helps maintain revenue stability in a market segment characterized by established treatments and increasing competition.

Established Neuroscience Products

Beyond the significant growth seen with Vraylar, AbbVie’s neuroscience division benefits from a stable base of established products. These therapies, addressing conditions like Parkinson's disease and other neurological ailments, act as dependable cash cows, generating consistent revenue streams for the company.

These established neuroscience products are critical to AbbVie's overall financial health, providing a predictable income that supports ongoing research and development. For instance, in 2023, AbbVie's neuroscience segment reported total net revenues of $7.2 billion, with a substantial portion attributed to these mature but vital treatments.

- Established Parkinson's Disease Therapies: These products offer consistent revenue, underpinning the neuroscience segment.

- Other Neurological Disorder Treatments: These contribute to a stable financial foundation, mitigating risk.

- 2023 Neuroscience Revenue: The segment generated $7.2 billion in net revenues, highlighting the importance of its established products.

AbbVie’s established immunology products, excluding the high-growth Skyrizi and Rinvoq, form a crucial segment of its cash cow portfolio. These mature treatments continue to generate significant and stable revenue, providing a reliable financial foundation for the company.

This diversified immunology base is key to AbbVie's strategy, ensuring consistent income even as newer products gain traction. The company actively manages this segment to maintain revenue stability in a competitive market.

While Humira faces biosimilar pressures, other immunology offerings maintain their market presence, contributing to AbbVie's overall cash flow. This allows for continued investment in innovation and pipeline development.

| Product Category | Q2 2025 Net Revenue (Millions USD) | Key Contribution |

|---|---|---|

| Botox Therapeutic | 928 | Dominant market share in chronic migraine, spasticity, urology |

| Venclexta | 691 | Strong demand in chronic lymphocytic leukemia (CLL) treatment |

| Ubrelvy & Qulipta | 605 | Established migraine treatments, consistent revenue generators |

| Other Immunology Products | (Undisclosed, but significant) | Stable revenue base, supports R&D |

| Established Neuroscience Products | (Portion of $7.2B 2023 Neuroscience Revenue) | Predictable income for Parkinson's and other neurological disorders |

What You’re Viewing Is Included

AbbVie BCG Matrix

The AbbVie BCG Matrix preview you are currently viewing is the identical, fully realized document you will receive upon purchase. This means you are seeing the complete, professionally formatted analysis, free from any watermarks or placeholder content, ready for your immediate strategic application.

Dogs

Humira, formerly AbbVie's flagship product, has transitioned into the 'Dog' category of the BCG Matrix. Its global sales have seen a significant downturn, primarily driven by the emergence of biosimilar competitors, especially within the United States.

The impact of this competition is starkly reflected in the Q2 2025 financial results, where global net revenues for Humira dropped by a substantial 58.2% operationally, reaching $1.180 billion. This sharp decline has eroded its market share considerably, marking a definitive shift for a drug that was once a top performer.

Imbruvica, a key oncology drug, is currently positioned as a 'Dog' within AbbVie's BCG Matrix. This classification stems from its declining global net revenues, which reached $754 million in Q2 2025, marking a significant 9.5% decrease year-over-year.

The primary driver for this downturn is increased competition within the chronic lymphocytic leukemia (CLL) market, a segment where Imbruvica previously held a strong position. This erosion of market share, coupled with a mature market landscape, has led to its 'Dog' status, indicating low growth and market share.

AbbVie's aesthetics portfolio, a key area for the company, has seen a noticeable downturn. This segment's performance is often sensitive to economic conditions, and recent trends reflect this.

In the second quarter of 2025, the company reported that its aesthetics revenues dropped by 8.0% on an operational basis, bringing in $1.279 billion. This decline isn't isolated to a single product but signifies a broader challenge across the entire aesthetics product line.

Factors such as prevailing economic headwinds and a general dip in consumer confidence have contributed to this softer performance. The impact is felt across the board, highlighting a tougher market landscape for these consumer-focused offerings.

Botox Cosmetic

Botox Cosmetic, a key product within AbbVie's aesthetics portfolio, is currently positioned as a 'Dog' in the BCG Matrix. This classification stems from its recent revenue performance, indicating a mature product facing market challenges.

In the second quarter of 2025, Botox Cosmetic generated global net revenues of $692 million. This figure represents a decrease of 4.9% on an operational basis, highlighting a downward trend in its financial performance.

- Botox Cosmetic's Q2 2025 global net revenues: $692 million.

- Operational revenue decline in Q2 2025: 4.9%.

- Market positioning: 'Dog' within the BCG Matrix due to revenue headwinds.

Juvederm

Juvederm, a prominent player in the aesthetics market, has faced considerable headwinds. Its performance in Q2 2025 saw a significant downturn, with global net revenues plummeting by 24.0%. This sharp decline underscores its challenging position within AbbVie's product portfolio.

The substantial revenue decrease for Juvederm firmly places it in the 'Dog' category of the BCG Matrix. This classification reflects its struggle to gain market share in an environment increasingly influenced by economic pressures that impact consumer spending on discretionary aesthetic treatments.

- Product: Juvederm

- Market Segment: Aesthetics

- Q2 2025 Global Net Revenues: Decreased by 24.0%

- BCG Matrix Classification: Dog

AbbVie's 'Dog' category products represent those with low market share and low growth potential, often requiring careful management to minimize losses or eventual divestment. Humira's sharp revenue decline, down 58.2% operationally to $1.180 billion in Q2 2025 due to biosimilar competition, exemplifies this. Similarly, Imbruvica, facing increased competition in the CLL market, saw its global net revenues fall 9.5% year-over-year to $754 million in Q2 2025. The aesthetics portfolio also shows challenges, with Botox Cosmetic revenues decreasing 4.9% to $692 million and Juvederm experiencing a significant 24.0% revenue drop in the same quarter.

| Product | BCG Category | Q2 2025 Global Net Revenues | Year-over-Year Operational Change |

| Humira | Dog | $1.180 billion | -58.2% |

| Imbruvica | Dog | $754 million | -9.5% |

| Botox Cosmetic | Dog | $692 million | -4.9% |

| Juvederm | Dog | N/A (reported as % decline) | -24.0% |

Question Marks

AbbVie is channeling substantial resources into promising early-stage oncology assets such as ABBV-969, a dual-targeted antibody-drug conjugate (ADC) aimed at prostate cancer, and ABBV-514, a CCR8 targeting antibody for various solid tumors. These investigational molecules are currently in Phase 1 clinical trials, positioning them within the rapidly expanding oncology sector.

The oncology market itself is a significant growth area, with projections indicating continued expansion driven by unmet medical needs and advancements in treatment modalities. For instance, the global oncology market was valued at approximately $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, reaching over $400 billion.

While these early-stage assets represent a substantial R&D investment for AbbVie, their current market share is negligible. This is characteristic of "question marks" in the BCG matrix, as their future success and market penetration are uncertain, hinging on the outcomes of ongoing clinical development and regulatory approvals.

AbbVie's acquisition of Cerevel Therapeutics in August 2024 for $8.7 billion injected a promising neuroscience pipeline into its portfolio, targeting conditions like schizophrenia and Parkinson's disease. These early-stage assets, while holding significant potential in a high-growth, high-need market, are still in development and demand considerable investment to reach commercialization, positioning them as Question Marks within AbbVie's BCG Matrix.

AbbVie's acquisition of Capstan Therapeutics for its in vivo CAR-T platform is a strategic move into early-stage, high-potential cell therapy. This technology, still in development, represents a significant investment in future oncology and immunology treatments. While it currently has no market share, its potential for rapid growth positions it as a question mark in AbbVie's portfolio, requiring substantial R&D funding to mature.

Emraclidine (Neuroscience)

Emraclidine, a neuroscience drug candidate, has experienced a significant intangible asset impairment charge. This suggests AbbVie anticipates lower future cash flows from this asset than previously projected. For instance, AbbVie recorded a $475 million impairment charge related to Emraclidine in its Q1 2024 earnings report, reflecting a reassessment of its commercial potential.

This situation places Emraclidine in a precarious position within AbbVie's portfolio, potentially aligning it with the 'Question Mark' category in the BCG Matrix. Such assets require careful consideration regarding future investment. The impairment indicates that Emraclidine may not be generating the expected returns, necessitating a strategic decision on whether to divest, invest further to improve its prospects, or discontinue development.

The neuroscience market is competitive and requires substantial ongoing investment in research and development. Emraclidine's current trajectory highlights the risks associated with drug development, especially in complex therapeutic areas. AbbVie's decision on how to proceed with Emraclidine will be crucial in managing its R&D pipeline and overall portfolio performance.

- Emraclidine faces an intangible asset impairment charge, signaling reduced future cash flow expectations.

- AbbVie recorded a $475 million impairment charge for Emraclidine in Q1 2024.

- This positions Emraclidine as a potential 'Question Mark' in the BCG Matrix, requiring strategic re-evaluation.

- The neuroscience sector demands significant R&D investment, making Emraclidine's future uncertain without further strategic action.

New Indications and Combination Therapies for Existing Drugs

AbbVie actively pursues new uses and combination treatments for its established medications. A prime example is the supplemental New Drug Application (sNDA) for Venclexta in combination with acalabrutinib, targeting previously untreated Chronic Lymphocytic Leukemia (CLL).

These strategic moves are designed to tap into expanding markets, particularly in oncology. For instance, the global CLL market was valued at approximately $7.5 billion in 2023 and is projected to grow, offering significant potential for successful combination therapies.

However, the ultimate success and market penetration of these new indications and combinations remain subject to regulatory approvals and physician adoption. AbbVie's investment in these areas reflects a commitment to lifecycle management and maximizing the value of its existing drug portfolio.

- Venclexta/acalabrutinib sNDA for untreated CLL

- Expansion into high-growth oncology markets

- Market adoption and regulatory success are key uncertainties

- Focus on lifecycle management for existing assets

Question Marks represent AbbVie's early-stage pipeline assets with uncertain future market potential, requiring significant investment. These include promising oncology candidates like ABBV-969 and ABBV-514, currently in Phase 1 trials. The acquisition of Cerevel Therapeutics also brought in early-stage neuroscience assets with high growth potential but unproven commercial success.

AbbVie's investment in the Capstan Therapeutics in vivo CAR-T platform exemplifies a strategic move into a nascent, high-potential area. While these assets have no current market share, their future success hinges on extensive R&D and regulatory navigation, characteristic of Question Marks.

The impairment of intangible assets for Emraclidine, a neuroscience drug candidate, highlights the inherent risks. AbbVie's $475 million impairment charge in Q1 2024 underscores the uncertainty surrounding its commercial viability, necessitating a strategic decision on continued investment.

AbbVie's strategy to expand existing drug franchises, such as Venclexta in combination therapies for CLL, also places some of these new indications in the Question Mark category until regulatory approval and market adoption are confirmed. The global CLL market, valued at approximately $7.5 billion in 2023, offers potential but success is not guaranteed.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.