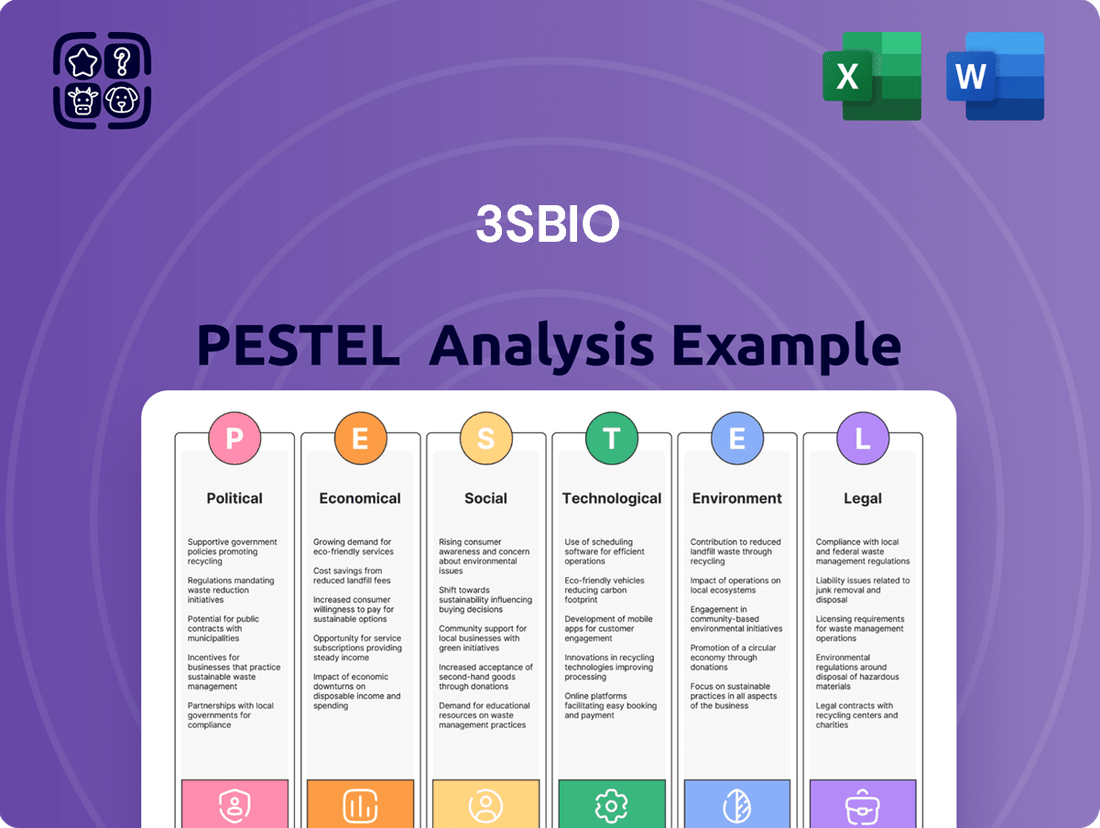

3SBio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3SBio Bundle

Unlock the critical external factors shaping 3SBio's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends present both challenges and opportunities for the company. Gain a strategic advantage by downloading the full report, packed with actionable insights for investors and decision-makers.

Political factors

Government policies, especially in China, are a major driver for the biotech industry. These policies often include direct subsidies, attractive tax breaks, and ambitious national strategies designed to boost innovation. For instance, China's 14th Five-Year Plan (2021-2025) specifically targets advanced manufacturing and emerging industries, including biotechnology, earmarking significant investment and support.

These supportive measures create a fertile ground for companies like 3SBio to thrive. By offering financial incentives and a strategic roadmap, governments can significantly speed up research and development efforts. This allows 3SBio to expand its product pipeline more effectively, bringing new treatments and technologies to market faster.

National healthcare policies significantly influence drug pricing and reimbursement in China, directly impacting 3SBio's market access and revenue. For instance, the implementation of volume-based procurement (VBP) programs can lead to substantial price reductions. In 2023, VBP rounds continued to affect various drug categories, with some biologics experiencing price cuts exceeding 50% in certain tenders, thereby pressuring 3SBio's profit margins on these products.

The strength and enforcement of intellectual property (IP) laws are paramount for 3SBio, safeguarding its significant investments in research and development and its portfolio of patented biopharmaceutical products. Effective IP protection directly fuels innovation by providing a secure environment for discovery, while also acting as a critical defense against the emergence of generic competitors.

Weak IP enforcement, conversely, poses a substantial risk, potentially leading to the erosion of market share for 3SBio's novel therapies and diminishing the financial returns on its cutting-edge scientific endeavors. For instance, in 2023, the global pharmaceutical market saw a notable increase in patent litigation, highlighting the ongoing importance of strong legal frameworks to protect biopharmaceutical innovations.

Regulatory reforms and approvals

Evolving regulatory frameworks, particularly from China's National Medical Products Administration (NMPA), significantly influence the pace and expense of drug approvals. For instance, in 2024, the NMPA continued to emphasize faster review pathways for innovative drugs, aiming to shorten the time to market. This can either accelerate 3SBio's new therapy launches or, conversely, introduce new compliance hurdles if processes become more stringent.

The impact of these regulatory shifts on 3SBio is substantial. A more streamlined approval process, as seen with certain expedited pathways introduced in recent years, could reduce development timelines and associated costs. Conversely, any tightening of standards or additional data requirements could lead to delays and increased investment in compliance efforts, potentially affecting 3SBio's competitive positioning.

- NMPA's focus on innovation: Continued emphasis on prioritizing and expediting reviews for novel therapies in 2024.

- Impact on market entry: Streamlined processes can reduce time-to-market, while stricter requirements may cause delays.

- Compliance costs: Regulatory changes necessitate ongoing investment in ensuring adherence to evolving standards.

Geopolitical tensions and trade policies

Geopolitical tensions and evolving trade policies present significant considerations for 3SBio. Shifts in international relations can directly impact the company's global supply chain, affecting the availability and cost of crucial raw materials. For instance, the ongoing trade friction between major economies in 2024 has led to increased scrutiny on technology transfers, potentially hindering 3SBio's access to advanced manufacturing components and research collaborations.

Furthermore, the imposition of tariffs or the escalation of trade disputes could disrupt 3SBio's ability to expand into new international markets or even impact existing export operations. Analysts predict that global trade protectionism could see a continued rise through 2025, creating a more complex operating environment for companies with a significant international footprint.

- Supply Chain Vulnerability: Geopolitical instability can disrupt the flow of essential raw materials and finished goods, impacting production schedules and costs.

- Market Access Restrictions: Tariffs and trade barriers can limit 3SBio's ability to export products and access new customer bases, thereby capping growth potential.

- Technology Transfer Limitations: Increased national security concerns can lead to restrictions on the movement of sensitive technologies, potentially slowing innovation and R&D.

- Regulatory Uncertainty: Evolving trade agreements and sanctions create an unpredictable regulatory landscape, requiring constant adaptation and risk management.

Government initiatives, particularly China's focus on innovation and biopharmaceutical development, directly support companies like 3SBio. These policies often involve substantial R&D funding and preferential treatment for domestic biotech firms, as evidenced by the continued allocation of resources within national development plans for 2024-2025.

What is included in the product

This 3SBio PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of its operating landscape.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential growth avenues.

The 3SBio PESTLE analysis provides a clear, summarized version of complex external factors, acting as a pain point reliever by enabling easy referencing and quick interpretation during critical meetings and presentations.

Economic factors

Healthcare spending growth is a critical economic factor for 3SBio. In 2023, global healthcare spending was projected to reach over $10 trillion, a significant increase that directly expands the market for biopharmaceutical products. This upward trend, fueled by factors like aging populations and increased health consciousness, suggests a larger addressable market for 3SBio's innovative therapies.

Economic conditions significantly influence the capital available for biotechnology research and development. A strong economy typically translates to increased R&D funding, enabling companies like 3SBio to support their ambitious pipelines and crucial clinical trials. For instance, in 2024, global biotech R&D spending was projected to reach over $250 billion, a testament to the sector's reliance on economic buoyancy for innovation.

This investment is vital for 3SBio's long-term growth and its ability to bring novel therapies to market. The economic outlook for 2025 suggests continued, albeit potentially more cautious, investment in life sciences, with a particular focus on areas demonstrating clear clinical and commercial potential. This environment necessitates strategic allocation of resources to maximize the impact of R&D expenditures.

Economic stability directly influences 3SBio's market. For instance, in 2024, global economic growth forecasts, such as those from the IMF, suggest a moderate but potentially uneven recovery. This can impact consumer spending on healthcare and the ability of healthcare systems to fund advanced biopharmaceutical treatments.

Consumer purchasing power is a critical driver for 3SBio. If inflation remains elevated or economic downturns occur, consumers may cut back on non-essential spending, including newer, more expensive therapies. Conversely, a strong economy with rising disposable incomes generally supports higher demand for innovative biopharmaceuticals.

Healthcare system budgets are also sensitive to economic conditions. During periods of fiscal constraint, governments and insurance providers might scrutinize healthcare expenditures, potentially leading to price negotiations or slower adoption of high-cost treatments. This was a concern highlighted in discussions around healthcare spending in major markets throughout 2024.

Inflation and cost of goods

Inflationary pressures significantly impact 3SBio's operational costs. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, with core inflation also remaining elevated. This directly translates to higher expenses for raw materials, manufacturing processes, and general operational overheads, potentially squeezing profit margins.

Effectively managing these rising costs is paramount for 3SBio's financial health. This involves implementing robust supply chain management strategies to secure favorable pricing and exploring innovative manufacturing techniques to boost efficiency. Furthermore, strategic pricing adjustments, carefully considering market elasticity and competitive positioning, will be crucial to maintain profitability amidst an inflationary environment.

- Rising Material Costs: Increased CPI figures directly correlate with higher input costs for pharmaceuticals and biotechnology, affecting everything from active pharmaceutical ingredients to packaging.

- Operational Expense Hikes: Energy prices and labor costs, often influenced by inflation, contribute to increased manufacturing and distribution expenses for 3SBio.

- Profit Margin Sensitivity: Companies like 3SBio must balance absorbing cost increases with passing them on to consumers, a delicate act impacting profitability.

- Strategic Pricing Power: The ability to adjust product pricing in response to inflation without significantly impacting demand is a key competitive advantage.

Access to capital and funding

Access to capital is a critical driver for 3SBio's growth, particularly for its research and development initiatives. The biotechnology sector is inherently capital-intensive, requiring significant investment in drug discovery, clinical trials, and manufacturing. In 2024, global venture capital funding for biotech saw a notable uptick, with deal volumes increasing, although valuations remained somewhat cautious compared to earlier years. This indicates a continued, albeit more discerning, appetite for promising biotech ventures.

Public markets also play a crucial role. For a company like 3SBio, the ability to raise funds through equity offerings or debt financing is directly tied to prevailing economic sentiment and investor liquidity. As of late 2024, the IPO market for biotech remained selective, favoring companies with strong clinical data and clear commercialization pathways. Private equity firms, conversely, have shown increasing interest in later-stage biotech companies with established products or late-stage pipelines, offering alternative funding avenues.

- 2024 Venture Capital Investment: Global biotech VC funding experienced a moderate increase in deal volume, signaling renewed investor interest despite valuation pressures.

- Public Market Access: 3SBio's ability to tap into public markets for capital depends on investor confidence, which is influenced by broader economic stability and the company's specific performance metrics.

- Private Equity Engagement: Private equity interest in the biotech sector is growing, particularly for companies with de-risked assets, offering a potential funding source for 3SBio's expansion.

- Cost of Capital: Economic factors such as interest rates and inflation directly impact the cost of borrowing and the required rate of return for equity investors, affecting the overall expense of capital for 3SBio.

Global economic growth forecasts for 2025, such as those from the IMF, anticipate moderate expansion, but with potential regional disparities. This economic backdrop directly impacts 3SBio's market by influencing healthcare spending and the affordability of biopharmaceutical products. A stable economic environment generally supports increased demand for innovative therapies, while downturns could lead to budget constraints within healthcare systems.

Inflationary pressures remain a key economic consideration for 3SBio. For instance, the US CPI was 3.4% year-over-year in April 2024, impacting operational costs for raw materials and manufacturing. Managing these rising expenses through efficient supply chains and strategic pricing will be critical for maintaining profitability in 2025.

Access to capital is vital for 3SBio's R&D pipeline. While global biotech venture capital saw increased deal volume in 2024, valuations remained cautious. Public market access, particularly for IPOs, is expected to remain selective in 2025, favoring companies with strong clinical data and clear commercialization strategies.

| Economic Factor | 2024/2025 Projection/Data | Impact on 3SBio |

|---|---|---|

| Global Economic Growth | Moderate, with regional variations (IMF forecast) | Influences healthcare spending and affordability of treatments. |

| Inflation Rate (US CPI) | 3.4% YoY (April 2024) | Increases operational costs for materials and manufacturing. |

| Biotech VC Funding | Increased deal volume in 2024, cautious valuations | Affects capital availability for R&D and pipeline development. |

| IPO Market Selectivity | Expected to remain selective in 2025 | Impacts 3SBio's ability to raise capital through public offerings. |

Full Version Awaits

3SBio PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 3SBio PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial strategic insights.

Sociological factors

The global population is getting older, and this is especially true in China. By 2023, China's population aged 65 and over reached over 210 million, representing about 15% of its total population. This demographic shift means more people are likely to develop age-related conditions.

Conditions like cancer and chronic kidney disease are becoming more common as people live longer. These are precisely the areas where 3SBio focuses its efforts. The increasing prevalence of these diseases directly translates to a larger potential patient pool for 3SBio's biopharmaceutical products.

This growing demand for treatments for age-related illnesses presents a significant opportunity for 3SBio. The company is well-positioned to meet the healthcare needs of an aging society, potentially driving revenue growth as more patients require their innovative therapies.

Rising health awareness is a significant driver for 3SBio. As people become more informed about preventing diseases, catching them early, and the benefits of modern treatments, the demand for cutting-edge biopharmaceutical products naturally increases. This trend directly supports companies like 3SBio, which focus on developing these innovative solutions.

This heightened health consciousness translates into patients actively seeking out high-quality biopharmaceutical options. For instance, in 2024, global healthcare spending was projected to reach over $10 trillion, reflecting a growing commitment to health and wellness. This environment is highly favorable for companies like 3SBio, as it fuels demand for their advanced therapies and diagnostic tools.

Societal expectations for equitable access to advanced therapies are a significant driver in healthcare. In 2024, for instance, public advocacy groups in China, where 3SBio operates, have been increasingly vocal about ensuring that innovative treatments, including biologics for chronic diseases, are accessible to a wider patient population. This growing demand often pressures governments to expand national health insurance coverage, which directly impacts patient uptake of products like those developed by 3SBio.

This societal push for broader inclusion can lead to policy changes that favor reimbursement for cutting-edge treatments. For example, if public opinion strongly supports access to novel cancer immunotherapies, governments might adjust their reimbursement policies to include these therapies more readily. Such shifts can significantly boost patient access to 3SBio's advanced therapies, potentially increasing market penetration and revenue streams for the company.

Changing lifestyle diseases

Shifting lifestyles and dietary habits globally are directly contributing to a significant rise in chronic diseases. This trend creates new, unmet medical needs across various therapeutic areas, impacting population health and healthcare system demands. For instance, the World Health Organization (WHO) reported in 2024 that non-communicable diseases (NCDs), largely driven by lifestyle factors like poor diet and lack of physical activity, accounted for an estimated 74% of all deaths worldwide. This presents a clear opportunity for pharmaceutical companies to develop innovative treatments and preventative solutions.

While 3SBio's current strategic focus is on oncology, nephrology, and immunology, a deeper understanding of these broader health trends is crucial. By analyzing the increasing prevalence of conditions such as diabetes, cardiovascular diseases, and obesity, 3SBio can identify potential adjacencies and future research and development (R&D) avenues. This proactive approach allows for the anticipation of evolving market demands and the exploration of new market opportunities beyond its existing core competencies.

The growing burden of lifestyle diseases directly translates into increased demand for pharmaceuticals and healthcare services.

- Rising NCDs: In 2024, NCDs were responsible for 74% of global deaths, highlighting a significant health challenge.

- Market Expansion: The increasing prevalence of conditions like diabetes and cardiovascular disease opens avenues for new drug development.

- R&D Foresight: Understanding these trends allows 3SBio to align future R&D with emerging patient needs and market opportunities.

Public trust in biotechnology

Public trust in biotechnology is a critical sociological factor for 3SBio. Surveys in late 2024 indicated that while public interest in novel therapies, particularly for rare diseases, remains high, concerns about genetic engineering persist. A significant portion of the population still expresses apprehension regarding the long-term effects of genetically modified organisms, which can impact the adoption rates of certain biotechnological advancements.

Maintaining robust public confidence requires 3SBio to prioritize ethical research and transparent communication. For instance, a 2025 report highlighted that companies with clear, accessible information about their clinical trials and product development processes saw higher patient engagement. This trust is not just about product acceptance but also influences the regulatory landscape, with public opinion often shaping policy decisions.

The willingness of individuals to embrace new treatments, such as advanced gene therapies or CRISPR-based innovations, is directly tied to their perception of safety and efficacy. In 2024, studies showed a correlation between media coverage of biotech advancements and public sentiment; positive portrayals often led to increased demand for treatments, while negative coverage, even if anecdotal, could create significant headwinds for market penetration.

To foster this trust, 3SBio should focus on:

- Engaging in proactive public education campaigns about the benefits and safety protocols of their biotechnological products.

- Ensuring absolute transparency in all research and development phases, including data sharing where appropriate.

- Collaborating with patient advocacy groups to address concerns and build community support.

- Highlighting successful patient outcomes and the rigorous scientific validation behind their therapies.

Societal shifts towards preventative healthcare and increased health consciousness are significantly boosting demand for biopharmaceutical products. As individuals become more proactive about their well-being, they actively seek advanced treatments and early detection methods, creating a fertile ground for companies like 3SBio. This trend is underscored by the projected global healthcare spending exceeding $10 trillion in 2024, reflecting a strong societal commitment to health.

The aging global population, particularly in China where 3SBio operates, presents a substantial opportunity. By 2023, over 210 million individuals in China were aged 65 and above, signifying a growing demographic susceptible to age-related diseases like cancer and kidney disease. This demographic trend directly expands the potential patient base for 3SBio's specialized biopharmaceutical offerings.

Public advocacy for equitable access to innovative therapies is also shaping the market. In 2024, there was increased pressure on governments, especially in China, to broaden health insurance coverage for advanced treatments. This societal push can lead to policy changes that improve patient access to cutting-edge biopharmaceuticals, positively impacting companies like 3SBio.

Technological factors

Breakthroughs in genomics and proteomics are significantly accelerating 3SBio's ability to identify novel drug targets. For instance, advancements in gene sequencing technology, like those seen in the rapid expansion of genomic databases throughout 2024, allow for more precise understanding of disease mechanisms.

Immunology research, particularly in areas like immunotherapy, is directly impacting 3SBio's product development. The growing success of CAR T-cell therapies, with market growth projected to exceed $20 billion by 2028, highlights the potential for immune-based treatments that 3SBio can leverage.

The swift progress in these biological fields enables 3SBio to develop more sophisticated and targeted biopharmaceutical solutions. This scientific momentum is crucial for maintaining a competitive edge in the rapidly evolving biotechnology landscape.

Manufacturing process innovations are significantly impacting biopharmaceutical production. Advancements in areas like single-use bioreactors and advanced cell culture media are streamlining operations, potentially leading to higher yields and reduced contamination risks for companies like 3SBio. The global biopharmaceutical contract manufacturing market, for instance, was valued at approximately $17.4 billion in 2023 and is projected to grow substantially, underscoring the industry's investment in these technological leaps.

Continuous processing, moving away from traditional batch methods, offers greater efficiency and control over product quality. This shift allows for more consistent output and can significantly lower manufacturing costs. For 3SBio, adopting these advanced techniques is crucial for maintaining a competitive edge in a market that increasingly demands both high-quality biologics and cost-effective production.

The healthcare sector's rapid digitalization presents significant opportunities for 3SBio. The increasing adoption of digital health platforms and telemedicine allows for enhanced patient monitoring and more efficient clinical trial management, potentially accelerating drug development and data analysis. For instance, by mid-2024, the global digital health market was projected to reach over $300 billion, indicating a substantial shift towards tech-enabled healthcare solutions.

Electronic health records (EHRs) are becoming standard, offering 3SBio access to valuable real-world evidence. This data can inform research, personalize treatment approaches, and streamline operations. By leveraging these digital advancements, 3SBio can aim to improve patient outcomes and gain a competitive edge in the evolving biopharmaceutical landscape.

AI and data analytics in drug discovery

Artificial intelligence (AI) and big data analytics are revolutionizing drug discovery, making the process significantly faster and more efficient. These technologies are instrumental in identifying potential drug targets and optimizing the design of clinical trials. For instance, in 2024, AI-driven platforms are being used to analyze vast biological datasets, leading to a projected reduction in early-stage drug discovery timelines by up to 50%.

By integrating AI and advanced analytics, 3SBio can gain a competitive edge. This allows for the more precise identification of drug candidates with higher probabilities of success, ultimately streamlining the path to market. Companies are reporting that AI can accelerate the identification of novel drug targets by analyzing complex genomic and proteomic data, a task that previously took years.

The impact on clinical trials is also substantial. AI can improve patient selection, predict trial outcomes, and identify potential adverse events earlier. This not only saves time and resources but also enhances patient safety. By 2025, it's estimated that AI will be involved in optimizing at least 30% of all ongoing clinical trials globally.

- AI can cut early-stage drug discovery time by up to 50% (2024 estimates).

- Big data analytics aids in identifying novel drug targets from complex biological information.

- AI is projected to optimize 30% of global clinical trials by 2025.

- Faster drug development translates to quicker market entry and potential revenue generation.

Gene editing and cell therapy breakthroughs

Gene editing technologies, particularly CRISPR-Cas9, are rapidly advancing, opening new avenues for treating genetic diseases. This innovation presents significant potential for companies like 3SBio to develop novel therapies. For instance, the global gene editing market was valued at approximately USD 1.9 billion in 2023 and is projected to reach over USD 7.5 billion by 2030, demonstrating substantial growth.

Cell therapy, another burgeoning field, involves using cells to treat diseases, with CAR-T therapy being a prominent example. These therapies are showing remarkable success in certain cancers. The cell therapy market is experiencing robust expansion, with estimates suggesting it could reach over USD 20 billion by 2027.

These technological breakthroughs offer 3SBio strategic opportunities.

- Product Diversification: Gene editing and cell therapy can lead to the development of entirely new product lines beyond current offerings.

- Strategic Partnerships: Collaborating with research institutions or specialized biotech firms can accelerate the integration of these advanced technologies.

- Market Leadership: Early adoption and successful implementation can position 3SBio as a leader in these cutting-edge therapeutic areas.

Technological advancements in genomics and AI are reshaping biopharmaceutical research and development, enabling 3SBio to identify novel drug targets and accelerate discovery timelines. The rapid growth of digital health platforms and EHRs also provides valuable real-world data for optimizing clinical trials and patient monitoring.

Innovations in manufacturing, such as single-use bioreactors and continuous processing, are enhancing production efficiency and quality control for biologics. Emerging gene editing and cell therapy technologies, like CRISPR and CAR-T, present significant opportunities for 3SBio to diversify its product portfolio and develop next-generation treatments.

| Technology Area | Key Advancement | Impact on 3SBio | Market Data (2024/2025 Estimates) |

| Genomics & Proteomics | Advanced gene sequencing | Precise understanding of disease mechanisms | Genomic databases expanding rapidly |

| Immunotherapy | CAR T-cell therapies | Leveraging immune-based treatments | Market projected to exceed $20 billion by 2028 |

| Manufacturing | Single-use bioreactors, continuous processing | Streamlined operations, higher yields, cost reduction | Biopharma contract manufacturing market ~$17.4 billion (2023) |

| Digital Health | Telemedicine, EHRs | Enhanced patient monitoring, clinical trial management | Global digital health market projected over $300 billion (mid-2024) |

| AI & Big Data | AI-driven drug discovery | Faster target identification, optimized trials | AI to reduce early-stage discovery time by up to 50% (2024) |

| Gene Editing | CRISPR-Cas9 | Novel therapies for genetic diseases | Gene editing market ~$1.9 billion (2023), projected to reach >$7.5 billion by 2030 |

| Cell Therapy | CAR-T therapy | Treating diseases with cellular interventions | Cell therapy market estimated >$20 billion by 2027 |

Legal factors

3SBio's ability to navigate China's rigorous drug registration and approval processes, overseen by the National Medical Products Administration (NMPA), is critical for market entry. For instance, the NMPA's evolving guidelines on clinical trial data requirements and post-market surveillance directly influence the timeline and financial investment needed for new product launches, impacting 3SBio's revenue streams.

The evolving legal landscape for patent protection directly impacts 3SBio's market exclusivity. In 2024, the pharmaceutical industry continued to see significant patent litigation, with ongoing disputes over blockbuster drugs highlighting the financial stakes involved. For instance, patent challenges can lead to substantial revenue losses if generic competitors enter the market prematurely.

3SBio's ability to vigorously defend its intellectual property through patent litigation is paramount. Proactive strategies, such as robust patent filing and monitoring for potential infringements, are crucial. This ensures that the company can protect its research and development investments, which are substantial in the biopharmaceutical sector, estimated to be in the hundreds of millions annually for leading companies.

Strict data privacy laws, especially concerning patient health information vital for 3SBio's clinical trials and real-world data initiatives, present a substantial compliance challenge. Failure to adhere to regulations like China's Personal Information Protection Law (PIPL) can result in severe penalties, impacting operational continuity and brand reputation. For instance, PIPL mandates stringent consent requirements and data transfer protocols, directly affecting how 3SBio gathers and utilizes sensitive biological data.

Product liability and safety standards

3SBio operates under stringent product liability and safety regulations, particularly critical for its biopharmaceutical offerings. Failure to meet these standards can result in severe financial penalties and operational disruptions.

The biopharmaceutical sector in 2024 continues to face intense scrutiny regarding product safety. For instance, regulatory bodies like the FDA and EMA are continuously updating pharmacovigilance requirements, demanding more proactive monitoring of adverse events. A significant product recall, which can cost millions in lost revenue and remediation, remains a constant threat for companies like 3SBio.

- Regulatory Scrutiny: Biopharmaceutical companies must comply with evolving global safety standards, impacting R&D and manufacturing processes.

- Litigation Risks: Adverse event reporting and product liability lawsuits pose significant financial and reputational risks, with potential damages reaching hundreds of millions.

- Quality Control Investment: Maintaining robust quality control and pharmacovigilance systems is paramount, requiring substantial ongoing investment in technology and personnel.

- Market Access Impact: Safety concerns can directly affect market access and pricing power, as seen in past instances where drug approvals were delayed or withdrawn due to safety signals.

Anti-corruption and compliance laws

Operating in the pharmaceutical industry, 3SBio must meticulously adhere to stringent anti-corruption and compliance laws. These regulations govern everything from marketing strategies to interactions with healthcare professionals, aiming to prevent bribery and ensure ethical business conduct. Failure to comply can result in severe legal repercussions, including substantial fines and significant damage to the company's reputation.

The global pharmaceutical market, valued at approximately $1.5 trillion in 2023 and projected to grow, faces increasing scrutiny regarding compliance. For instance, the U.S. Department of Justice and the Securities and Exchange Commission actively enforce the Foreign Corrupt Practices Act (FCPA), which penalizes companies for bribing foreign officials. In 2023, several major pharmaceutical firms faced multi-million dollar settlements for compliance violations, underscoring the critical need for robust internal controls.

- FCPA Enforcement: In 2023, pharmaceutical companies paid over $400 million in FCPA-related settlements.

- Marketing Regulations: Strict guidelines exist in major markets like the EU and US regarding pharmaceutical promotion and physician engagement.

- Reputational Risk: Compliance failures can lead to loss of public trust, impacting sales and market access.

- Compliance Costs: Companies invest billions annually in compliance programs to mitigate these legal and reputational risks.

Navigating China's evolving regulatory framework, particularly the NMPA's stringent approval processes for new drugs, directly impacts 3SBio's market entry timelines and R&D investment. Patent protection is paramount, as demonstrated by ongoing litigation in 2024 that can cost companies hundreds of millions in lost revenue if generic competition emerges prematurely. Furthermore, strict data privacy laws like China's PIPL necessitate careful handling of patient health information, with non-compliance potentially leading to severe penalties and reputational damage.

| Legal Factor | Impact on 3SBio | Relevant Data/Example (2023-2024) |

|---|---|---|

| Drug Approval & Registration | Market access and revenue generation | NMPA guidelines impact clinical trial data requirements and post-market surveillance, affecting launch timelines. |

| Intellectual Property Rights | Market exclusivity and R&D investment protection | Patent litigation in 2024 highlights potential revenue losses from premature generic entry; R&D costs for leading biopharma firms can reach hundreds of millions annually. |

| Data Privacy (e.g., PIPL) | Clinical trial data integrity and operational continuity | PIPL mandates strict consent and data transfer protocols for sensitive biological data, with non-compliance risking severe penalties. |

| Product Liability & Safety | Reputation, market access, and financial risk | Increased scrutiny on pharmacovigilance by bodies like FDA/EMA; product recalls can cost millions. |

| Anti-corruption & Compliance (e.g., FCPA) | Reputational standing and operational legality | In 2023, pharmaceutical companies paid over $400 million in FCPA-related settlements; strict marketing regulations are enforced globally. |

Environmental factors

Increasing scrutiny on environmental impact is compelling biotechnology firms like 3SBio to embrace sustainable manufacturing. This involves actively reducing waste generation, optimizing energy consumption, and minimizing their overall carbon footprint. For instance, the global chemical industry, a key supplier to biotech, aims for a 30% reduction in greenhouse gas emissions by 2030, a trend that will directly influence 3SBio's supply chain and operational choices.

Adopting green chemistry principles and eco-friendly production methods offers dual benefits for 3SBio. Beyond bolstering corporate reputation and aligning with growing investor demand for ESG (Environmental, Social, and Governance) performance, these practices can also lead to significant operational efficiencies. Companies that prioritize resource conservation often see lower input costs and improved process yields, contributing positively to the bottom line.

Biowaste management is a critical environmental factor for 3SBio, given the strict regulations surrounding the disposal of materials from research, development, and manufacturing. Failure to comply can lead to significant fines and environmental damage. For instance, in 2024, the global biowaste management market was valued at approximately $1.3 trillion, highlighting the scale and importance of this sector.

Environmental ethics, especially regarding biological materials and the ecological effects of biotech, significantly shape public opinion and regulatory scrutiny. 3SBio's dedication to ethical R&D is paramount for maintaining its social license to operate, a factor increasingly weighted by investors and consumers.

Climate change impact on health

Climate change is increasingly impacting global health, which in turn can affect pharmaceutical market dynamics. For instance, shifting weather patterns can influence the spread of vector-borne diseases like malaria and dengue fever, potentially increasing demand for related treatments. The World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhoea and heat stress alone.

These health shifts necessitate strategic foresight from companies like 3SBio. Understanding how climate change might alter disease prevalence and geographical distribution is crucial for long-term R&D investment and product portfolio planning. This includes anticipating potential growth areas for therapies addressing environmentally influenced health conditions.

Consider these potential impacts:

- Increased prevalence of respiratory illnesses: Air pollution, often exacerbated by climate change-related events like wildfires, can lead to a rise in conditions like asthma and COPD, boosting demand for respiratory medications.

- Expansion of vector-borne diseases: Warmer temperatures and altered rainfall patterns can expand the geographical range of disease vectors such as mosquitoes and ticks, potentially increasing the market for antimalarials, antivirals, and treatments for Lyme disease.

- Heat-related health issues: More frequent and intense heatwaves can lead to heatstroke, dehydration, and cardiovascular stress, creating a need for supportive therapies and preventative measures.

Supply chain environmental footprint

The environmental footprint of 3SBio's supply chain, encompassing everything from raw material acquisition to final product delivery, is becoming a critical consideration. This includes the impact of sourcing, manufacturing processes, and logistics. For instance, the pharmaceutical industry, in general, faces scrutiny over waste generation and energy consumption throughout its value chain.

Mitigating this footprint involves a multi-faceted approach. This includes evaluating and reducing greenhouse gas emissions from transportation, a significant contributor for many global companies. In 2023, the logistics sector accounted for approximately 25% of global CO2 emissions, highlighting the scale of this challenge.

Furthermore, ensuring supplier sustainability is paramount. This means working with partners who adhere to environmental standards and practices. Companies are increasingly looking at metrics like water usage, waste management, and biodiversity impact from their suppliers. For example, a growing number of companies are setting targets for reducing Scope 3 emissions, which often originate from their supply chains.

- Transportation Emissions: A key focus area, with efforts to optimize logistics and explore lower-emission transport options.

- Supplier Sustainability: Assessing and engaging with suppliers on their environmental performance, including waste reduction and resource efficiency.

- Resource Management: Implementing strategies to minimize water consumption and energy use across the supply chain.

- Waste Reduction: Developing programs for responsible waste disposal and exploring circular economy principles in packaging and product lifecycle.

Environmental regulations are tightening globally, pushing companies like 3SBio to adopt greener practices and manage biowaste meticulously. The increasing focus on ESG performance means that sustainable operations, from reducing carbon footprints to ensuring supplier environmental responsibility, are now critical for investor appeal and market access. Climate change itself is also a significant factor, potentially altering disease patterns and thus influencing the demand for specific pharmaceutical products, requiring strategic R&D adjustments.

| Environmental Factor | Impact on 3SBio | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Regulatory Scrutiny | Increased compliance costs, need for sustainable processes | Global chemical industry aiming for 30% GHG reduction by 2030; stricter biowaste disposal rules. |

| Climate Change & Health | Shifting disease prevalence, potential market growth for specific therapies | WHO projects 250,000 additional deaths/year (2030-2050) due to climate change impacts; potential rise in respiratory and vector-borne diseases. |

| Supply Chain Sustainability | Pressure to reduce Scope 3 emissions, ensure supplier environmental standards | Logistics sector accounted for ~25% of global CO2 emissions in 2023; growing corporate targets for Scope 3 reduction. |

PESTLE Analysis Data Sources

Our 3SBio PESTLE Analysis is meticulously constructed using data from leading scientific journals, regulatory bodies, and market intelligence firms. We integrate insights from peer-reviewed research, government health statistics, and industry-specific trend reports to provide a comprehensive view.