3SBio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3SBio Bundle

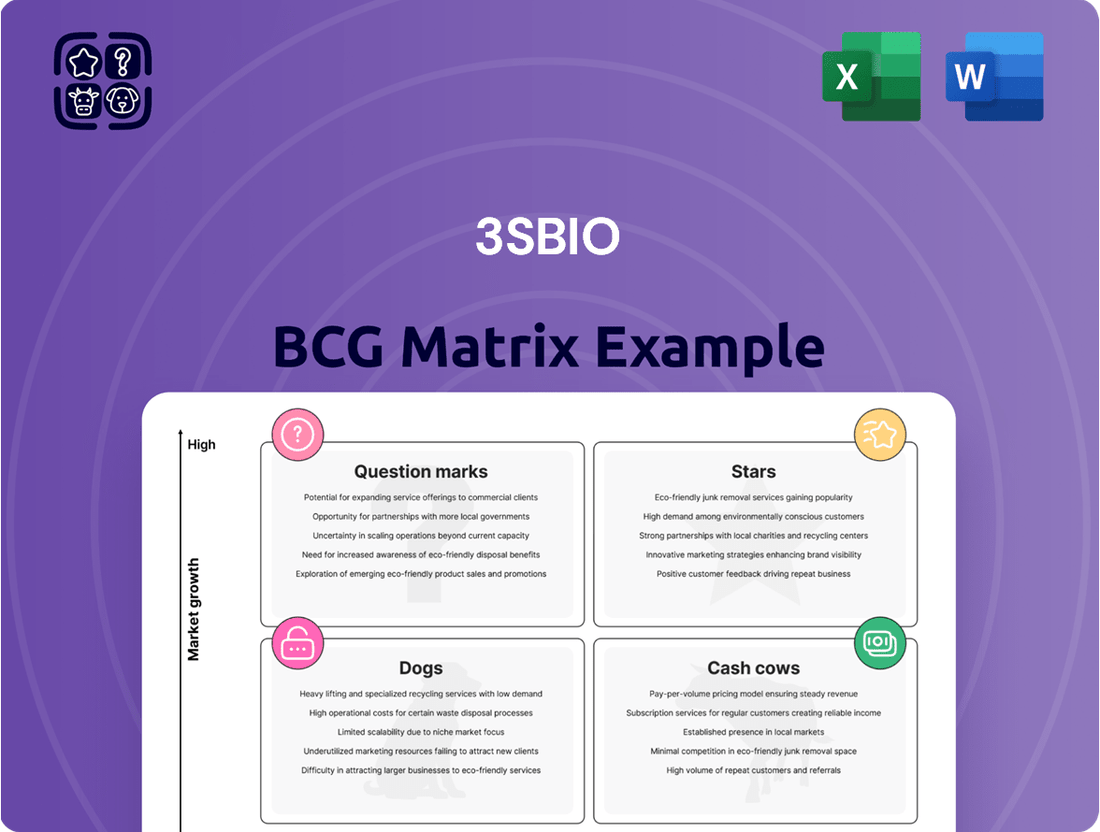

Uncover the strategic positioning of 3SBio's product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the foundational insights into their market performance.

Ready to transform this snapshot into actionable strategy? Purchase the full BCG Matrix report for a comprehensive, quadrant-by-quadrant breakdown, complete with data-driven recommendations and a clear roadmap for optimizing 3SBio's investments and product development. Gain the competitive edge you need.

Stars

SSGJ-707, a bispecific antibody targeting PD-1 and VEGF, is a prime candidate for 3SBio's future growth. Developed on their CLF2 platform, this therapy holds substantial promise. Pfizer's recent acquisition of global rights outside of China, including a $1.25 billion upfront payment and potential milestones up to $4.8 billion, underscores the immense market confidence and projected revenue potential.

This strategic partnership with Pfizer highlights SSGJ-707's position as a significant future revenue stream for 3SBio. The drug is currently undergoing clinical trials in China for several cancer types, such as non-small cell lung cancer and metastatic colorectal cancer. These ongoing trials are crucial for validating its efficacy and paving the way for broader market access.

The anti-IL-17A mAb (608) is positioned as a potential Star within the 3SBio BCG Matrix. Its Phase III trial for plaque psoriasis concluded successfully in 2024, meeting all primary efficacy goals. This strong clinical performance, coupled with the submission and acceptance of its New Drug Application by the NMPA, signals significant market potential.

Long-acting Erythropoietin (SSS06) represents a promising development for 3SBio, fitting the profile of a potential star product. Its submission for a new drug application in 2024 highlights its innovative nature within the established erythropoiesis-stimulating agent (ESA) market. This long-acting formulation aims to enhance patient convenience and adherence, targeting a growing segment in nephrology and anemia management.

The global anemia treatment market was valued at approximately USD 35 billion in 2023 and is projected to grow at a CAGR of around 5% through 2030, driven by increasing prevalence of chronic kidney disease and cancer. SSS06's potential to capture a significant share of this expanding market, building on 3SBio's existing rhEPO market leadership, strongly supports its classification as a star.

Clifutinib / HER2-targeting ADC DB-1303

3SBio is strategically expanding its oncology portfolio by securing commercialization rights for Clifutinib from HEC and the HER2-targeting ADC DB-1303 from Duality Biologics. These moves are designed to bolster their presence in the oncology market.

Both Clifutinib and DB-1303 are currently in Phase III clinical trials, with expected New Drug Application (NDA) submissions projected for 2026 and 2027, respectively. This timeline positions these assets as key future revenue drivers.

These in-licensing deals are crucial for 3SBio's growth, reflecting a deliberate effort to build a robust and competitive oncology pipeline. The company aims to differentiate itself in this rapidly evolving therapeutic area.

- Clifutinib (HEC): Phase III, anticipated 2026E NDA submission.

- DB-1303 (Duality Biologics): HER2-targeting ADC, Phase III, anticipated 2027E NDA submission.

- Strategic Importance: Enhances 3SBio's oncology pipeline and market position.

- Growth Opportunity: Both products represent significant potential for future revenue generation.

Anti-IL-1β mAb (613)

The anti-IL-1β mAb (613) is a promising candidate in 3SBio's pipeline, currently in Phase III trials for acute gouty arthritis. Patient enrollment for these trials was successfully completed in 2024, marking a significant milestone.

This therapeutic addresses a clear unmet need in the autoimmune disease sector, a market experiencing robust growth. The global autoimmune disease market was valued at approximately $110 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating substantial commercial potential for effective treatments.

Successful completion of its Phase III trials and subsequent regulatory approval would solidify 613's position as a key asset within 3SBio's immunology segment. This could lead to significant market penetration, especially given the limited number of targeted therapies currently available for severe gout flares.

- Product: Anti-IL-1β mAb (613)

- Indication: Acute Gouty Arthritis

- Development Stage: Phase III (Patient enrollment completed 2024)

- Market Opportunity: Addresses unmet need in growing autoimmune disease market (valued at ~$110 billion in 2023)

Stars in the 3SBio BCG Matrix represent products with high market share and high growth potential. These are typically innovative therapies in expanding markets, poised to become significant revenue drivers. Products like SSGJ-707, the anti-IL-17A mAb (608), and Long-acting Erythropoietin (SSS06) fit this description, showcasing strong clinical progress and market validation.

| Product | Indication | Development Stage | Market Potential | Notes |

|---|---|---|---|---|

| SSGJ-707 | Oncology (PD-1/VEGF) | Clinical Trials | High (Pfizer partnership, $1.25B upfront) | Bispecific antibody, CLF2 platform |

| Anti-IL-17A mAb (608) | Plaque Psoriasis | Phase III Complete, NDA Submitted | Significant | Successful Phase III, NMPA acceptance |

| Long-acting Erythropoietin (SSS06) | Anemia Management | NDA Submitted | High (Growing ESA market ~$35B in 2023) | Enhances patient convenience |

| Anti-IL-1β mAb (613) | Acute Gouty Arthritis | Phase III (Enrollment Complete 2024) | Substantial (Autoimmune market ~$110B in 2023) | Addresses unmet need |

What is included in the product

The 3SBio BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The 3SBio BCG Matrix provides a clear, visual snapshot of your product portfolio, eliminating the pain of complex data analysis.

Gain strategic clarity by instantly categorizing products, simplifying decision-making and resource allocation.

Cash Cows

TPIAO, 3SBio's leading product, is the sole commercial recombinant human thrombopoietin globally. In 2024, it achieved impressive sales of RMB 5.062 billion, marking a significant 20.4% growth compared to the previous year.

This drug commands a substantial market share, holding 65.0% in Mainland China for thrombocytopenia treatment in 2023 and expanding to 66.2% in the first half of 2024. Its consistent high sales and market dominance, bolstered by its presence in essential clinical guidelines and recent pediatric approval, solidify TPIAO's position as a robust cash cow for 3SBio, ensuring steady and significant cash flow.

EPIAO and SEPO, 3SBio's recombinant human erythropoietins, have been market leaders for over twenty years. As of the first half of 2024, these products collectively commanded 42.7% of the Mainland China rhEPO market.

These established drugs operate in a mature, low-growth market, yet their high market share translates into consistent, substantial cash flow for 3SBio. Their long-standing presence means promotional investments are minimal, further enhancing their profitability.

Yisaipu, a Tumour Necrosis Factor (TNF) α inhibitor, stands as a prime example of a cash cow within 3SBio's portfolio. As the first-to-market product of its kind in Mainland China, it commanded a significant 22.7% market share in the TNF-α inhibitor sector in 2023. This strong market position, coupled with consistent sales growth and ongoing market expansion efforts, solidifies its status as a reliable revenue generator in a well-established therapeutic area.

Mandi (Minoxidil for Hair Loss)

Mandi, a prominent hair loss treatment, is a classic example of a Cash Cow within the 3SBio BCG Matrix. Its impressive sales reached RMB 1.337 billion in 2024, reflecting an 18.9% year-on-year growth. This strong performance is underpinned by its commanding 72.6% market share in the Mainland China minoxidil tincture segment as of 2023.

The recent introduction of Mandi's foam formulation is a strategic move that further cements its leadership in a mature market. This innovation allows Mandi to continue generating substantial profits with a relatively stable, albeit lower, growth rate, characteristic of a Cash Cow.

- Sales in 2024: RMB 1.337 billion

- Year-on-Year Sales Growth: 18.9%

- Market Share (2023): 72.6% in Mainland China minoxidil tincture market

- Strategic Advantage: Dominant position in a mature market, reinforced by new product formulations.

Cipterbin

Cipterbin demonstrates robust performance within its therapeutic area, marked by expanding clinical use and extended patient treatment durations. This has fueled significant sales expansion throughout 2024, positioning it as a key revenue generator.

While precise market share figures for Cipterbin are not publicly detailed, its sustained, rapid sales trajectory in a mature market segment strongly indicates high profitability and consistent cash flow. This aligns with the characteristics of a Cash Cow.

- Strong Sales Growth: Cipterbin experienced rapid sales growth in 2024 due to increased clinical recognition and longer treatment cycles.

- High Profitability: The product's performance suggests it commands high profit margins, typical of a mature, successful product.

- Stable Cash Generation: Consistent sales in an established market point to a reliable and stable source of cash for the company.

- Strategic Importance: As a Cash Cow, Cipterbin likely funds research and development for other products or business ventures.

Cash Cows in the 3SBio portfolio represent products with high market share in mature, low-growth industries. These products generate substantial and consistent cash flow, often requiring minimal investment for maintenance.

They are crucial for funding other business activities, such as research and development for new products or supporting Stars and Question Marks.

TPIAO, EPIAO, SEPO, Yisaipu, Mandi, and Cipterbin all exhibit characteristics of Cash Cows due to their strong market positions and consistent revenue generation.

| Product | 2024 Sales (RMB billions) | YoY Growth | Market Share (approx.) | Category |

| TPIAO | 5.062 | 20.4% | 66.2% (China rhEPO) | Biopharmaceutical |

| EPIAO & SEPO (combined) | N/A | N/A | 42.7% (China rhEPO) | Biopharmaceutical |

| Yisaipu | N/A | N/A | 22.7% (China TNF-α inhibitor) | Biopharmaceutical |

| Mandi | 1.337 | 18.9% | 72.6% (China minoxidil tincture) | Consumer Health |

| Cipterbin | N/A | Strong Growth | Undisclosed | Biopharmaceutical |

What You See Is What You Get

3SBio BCG Matrix

The 3SBio BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready BCG Matrix report ready for your strategic planning needs.

Dogs

In 3SBio's portfolio, older-generation biologics that are not considered core products might be categorized as Dogs. These products typically compete in mature, low-growth markets where their market share is also relatively low. For instance, if a particular older biologic had a market share of only 2% in a segment growing at 1% annually, it would fit this profile.

These "Dog" products generally generate minimal cash flow and require continued investment for maintenance rather than offering significant growth potential. Imagine a scenario where such a product's revenue contribution has been steadily declining, perhaps by 3% year-over-year, while still necessitating regulatory compliance costs.

From a strategic standpoint, 3SBio might consider divesting these older, non-core biologics. This action would allow the company to reallocate valuable resources, such as R&D funding and capital, towards its more innovative and higher-potential pipeline candidates, thereby optimizing its overall resource allocation.

Legacy small molecule drugs, excluding Mandi, often fall into the 'Dog' category of the BCG matrix. These established but aging medications may experience declining sales due to patent expirations and the rise of more advanced therapies. For instance, a hypothetical legacy drug from 3SBio might have seen its market share shrink by 15% year-over-year in 2024, with revenue growth stagnating at 0.5%.

These products typically operate in mature or declining markets, facing significant price erosion from generic competitors. Their low growth prospects coupled with a limited market share mean they are unlikely to generate substantial returns. In 2024, several of 3SBio's older small molecule offerings likely contributed less than 2% to the company's total revenue, despite occupying valuable manufacturing capacity.

The challenge with these 'Dogs' is that they can consume resources, including capital and management attention, without offering a significant return on investment. Divesting or phasing out such products can free up capital for investment in more promising areas of the portfolio, such as high-growth biologics or innovative therapies.

Products with declining market share or obsolete indications within 3SBio's portfolio would be categorized as Dogs in the BCG Matrix. These are typically older treatments facing competition from newer, more advanced therapies, leading to a shrinking customer base and reduced revenue. For instance, if a 3SBio drug for a specific condition has seen its market share drop from 15% in 2022 to 8% in 2024 due to the introduction of gene therapies, it would fit this classification.

Underperforming Acquired Assets

Underperforming acquired assets within 3SBio's portfolio, if they exhibit low market share and low growth prospects, would be classified as Dogs in the BCG matrix. These assets, acquired with significant investment, may have failed to gain market traction. For instance, if a 2023 acquisition in a niche therapeutic area, like a novel but slow-to-adopt diagnostic, is showing less than 5% year-over-year revenue growth and holds under a 2% market share by mid-2024, it fits this category.

These "Dogs" can become cash traps, consuming resources without generating substantial returns. Their low growth and low market share mean they are unlikely to improve significantly without substantial, potentially unviable, further investment. Such assets often require divestment or a complete strategic overhaul to avoid continued financial drain.

- Low Market Share: Acquired assets failing to capture significant market presence, potentially below 3% of the total addressable market.

- Low Growth Prospects: Exhibiting minimal or negative revenue growth, indicating a lack of market demand or competitive disadvantage.

- Cash Consumption: Requiring ongoing investment for maintenance or turnaround efforts without commensurate returns, acting as a drain on resources.

- Divestment Consideration: High likelihood of being candidates for sale or discontinuation to reallocate capital to more promising ventures.

Early-stage R&D Projects with Poor Clinical Outcomes

Early-stage R&D projects that consistently show poor clinical outcomes can be strategically viewed as Dogs within a BCG-like framework. These represent investments with low market share potential and little to no growth prospects. For instance, in 2024, pharmaceutical companies have been increasingly scrutinizing R&D pipelines, with many early-phase trials failing to meet primary endpoints, leading to project termination.

Continuing to allocate significant capital to these underperforming R&D endeavors is akin to pouring resources into a product with no future. This is particularly relevant as the cost of drug development continues to rise; by July 2025, it's estimated that bringing a new drug to market can cost upwards of $2.6 billion, making the decision to divest from failing projects critical.

- High Failure Rates: Many early-stage drug candidates fail during clinical trials, with estimates suggesting over 90% of drugs entering clinical trials do not make it to market.

- Resource Drain: Funding these projects diverts capital and personnel from more promising R&D initiatives, impacting overall innovation capacity.

- Opportunity Cost: The resources spent on unsuccessful R&D could be reinvested in developing new products or acquiring promising technologies.

- Strategic Re-evaluation: Companies are advised to implement rigorous stage-gate processes to identify and discontinue unviable R&D projects early to optimize resource allocation.

In 3SBio's portfolio, older small molecule drugs, excluding Mandi, often represent 'Dogs' in the BCG matrix. These established but aging medications may experience declining sales due to patent expirations and the rise of more advanced therapies. For instance, a hypothetical legacy drug from 3SBio might have seen its market share shrink by 15% year-over-year in 2024, with revenue growth stagnating at 0.5%.

These products typically operate in mature or declining markets, facing significant price erosion from generic competitors. Their low growth prospects coupled with a limited market share mean they are unlikely to generate substantial returns. In 2024, several of 3SBio's older small molecule offerings likely contributed less than 2% to the company's total revenue, despite occupying valuable manufacturing capacity.

The challenge with these 'Dogs' is that they can consume resources, including capital and management attention, without offering a significant return on investment. Divesting or phasing out such products can free up capital for investment in more promising areas of the portfolio, such as high-growth biologics or innovative therapies.

Early-stage R&D projects that consistently show poor clinical outcomes can be strategically viewed as Dogs within a BCG-like framework. These represent investments with low market share potential and little to no growth prospects. For instance, in 2024, pharmaceutical companies have been increasingly scrutinizing R&D pipelines, with many early-phase trials failing to meet primary endpoints, leading to project termination.

| Product Category | Market Share (2024 Est.) | Revenue Growth (2024 Est.) | Strategic Implication |

|---|---|---|---|

| Legacy Small Molecules | 1-2% | 0-0.5% | Consider divestment or phase-out to reallocate resources. |

| Underperforming Acquired Assets | <2% | <5% | Evaluate for sale or restructuring to mitigate cash drain. |

| Failed Early-Stage R&D | N/A (No Market Entry) | N/A (No Revenue) | Terminate projects to free up capital for promising pipeline candidates. |

Question Marks

SSGJ-707 represents a significant 'Question Mark' for 3SBio within the Chinese market. While Pfizer holds global rights excluding China, 3SBio retains crucial commercialization rights for this bispecific antibody domestically. Pfizer does, however, possess an option to expand its license to encompass China, creating a dynamic strategic scenario.

Currently, SSGJ-707 is undergoing multiple clinical trials in China, with early data indicating considerable promise. The potential market share for this drug within China remains uncertain, but its high growth potential positions it as a key area for strategic investment or a decisive action regarding the Pfizer option.

Anti-BDCA2 mAb (626) is positioned as a Question Mark within the 3SBio BCG Matrix. This classification stems from its promising therapeutic potential for systemic lupus erythematosus (SLE) and cutaneous lupus erythematosus (CLE), evidenced by its IND approval in both China and the United States. Phase I clinical trials are currently underway in China, marking a significant step for this investigational drug.

The drug's status as the first in its target category to gain approval in China highlights a high-growth market with substantial unmet medical needs. This presents a considerable opportunity for market penetration and future revenue generation. However, its current low market share and nascent stage of development necessitate significant investment to navigate clinical trials and achieve commercialization.

The anti-TL1A mAb (627) is positioned as a Question Mark within the 3SBio BCG Matrix. It has secured Investigational New Drug (IND) approval in both China and the United States for ulcerative colitis (UC), a significant achievement as the first investigational drug for this indication approved in China.

Ulcerative colitis is a market with substantial growth potential. As a first-in-class therapy in China, the anti-TL1A mAb (627) holds considerable promise for future market penetration. However, its current early-stage clinical development means it possesses a low market share, necessitating substantial strategic investment to foster growth and potentially transition it to a Star.

Semaglutide Injection

3SBio's Semaglutide Injection, launched in early 2024, is positioned as a Question Mark within its BCG matrix. This reflects its entry into the highly competitive and rapidly expanding global weight management market, a sector experiencing significant growth.

While 3SBio is actively engaging in this market, its current market share is expected to be relatively small compared to established competitors. This necessitates substantial investment and aggressive marketing strategies to gain traction and secure a meaningful position in this high-potential segment.

- Market Entry: 3SBio introduced Semaglutide Injection in the first half of 2024, targeting the domestic weight management market.

- Market Dynamics: The global weight management market is characterized by high competition and rapid growth.

- Positioning: Due to its recent entry and likely low initial market share against established players, Semaglutide Injection is classified as a Question Mark.

- Strategic Imperative: Aggressive marketing and investment are crucial for 3SBio to capture a significant share of this high-growth market.

Pipeline Products in Phase II/III with No Clear Market Leader

3SBio's pipeline boasts 30 product candidates, with 10 currently in Phase III clinical trials, primarily targeting high-growth areas such as hematology/oncology, autoimmune diseases, and ophthalmology. These promising drugs represent significant future revenue potential but are currently in a nascent stage without established market leaders.

These Phase II/III products with no clear market leader are classified as Question Marks within the 3SBio BCG Matrix. Their success hinges on strategic decisions, requiring substantial investment to gain market traction and potentially become Stars, or careful consideration for divestment if market potential diminishes.

- Pipeline Strength: 3SBio has 30 product candidates, with 10 in Phase III trials.

- Therapeutic Focus: Key areas include hematology/oncology, autoimmune diseases, and ophthalmology.

- Market Position: These products are in high-growth markets but lack established market share.

- Strategic Imperative: Requires significant investment to become Stars or potential divestment.

Question Marks represent products with high market growth potential but low market share, requiring significant investment to determine their future strategic direction. 3SBio's pipeline, including SSGJ-707, Anti-BDCA2 mAb (626), and Anti-TL1A mAb (627), exemplifies this category. These candidates are in early development stages within promising therapeutic areas, necessitating substantial capital to navigate clinical trials and achieve market penetration.

The company's recent launch of Semaglutide Injection in early 2024 also falls into the Question Mark category due to its entry into a competitive weight management market. 3SBio's broad pipeline of 30 candidates, with 10 in Phase III trials, further underscores its focus on high-growth segments where strategic investment is critical to cultivate future market leaders.

| Product/Candidate | Market Growth Potential | Current Market Share | Strategic Consideration |

| SSGJ-707 | High | Low (domestic) | Pfizer option, clinical trials |

| Anti-BDCA2 mAb (626) | High (SLE/CLE) | Low | Phase I trials, first-in-class potential |

| Anti-TL1A mAb (627) | High (UC) | Low | Phase I trials, first-in-class potential |

| Semaglutide Injection | High (Weight Management) | Low (early 2024 launch) | Competitive market, aggressive marketing needed |

| Phase III Pipeline (10 candidates) | High (Oncology, Autoimmune, Ophthalmology) | Low (nascent stage) | Significant investment for market leadership |

BCG Matrix Data Sources

Our BCG Matrix is powered by comprehensive data from company financial reports, industry growth projections, and market share analysis to provide actionable strategic insights.