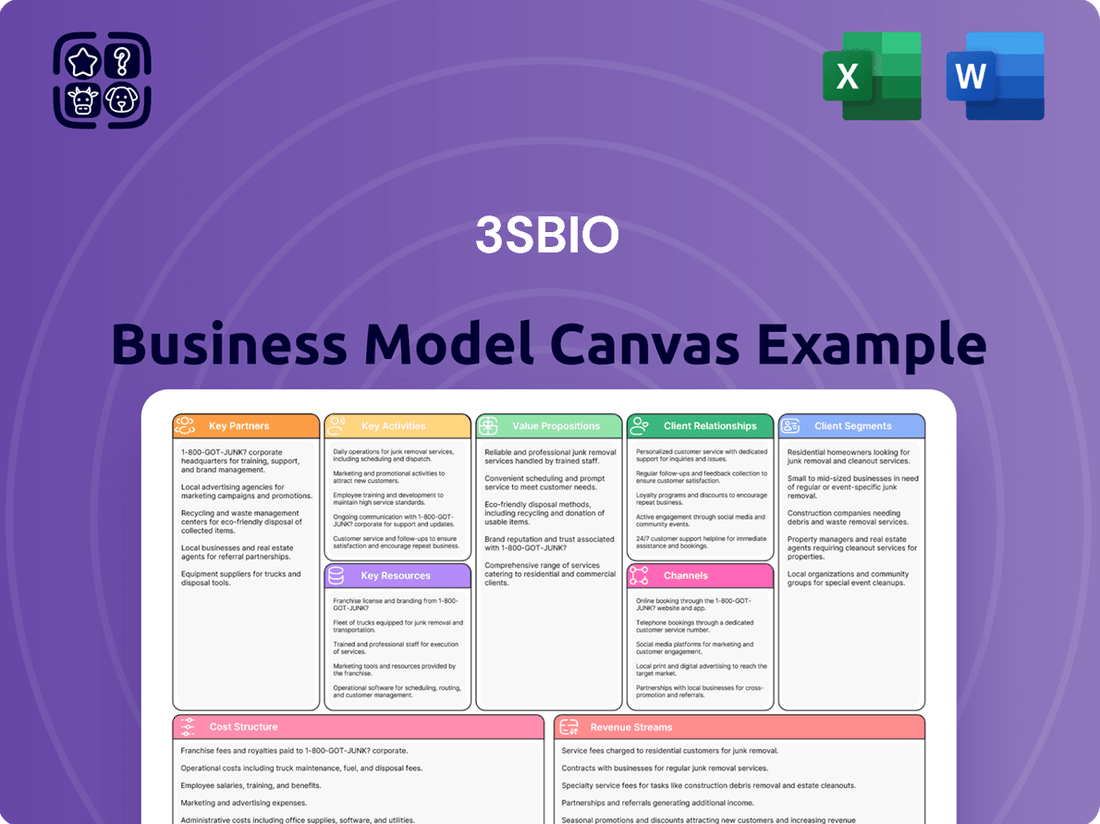

3SBio Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3SBio Bundle

Discover the strategic engine driving 3SBio's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind 3SBio's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

See how the pieces fit together in 3SBio’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

3SBio actively cultivates key partnerships with other pharmaceutical and biotech firms. These collaborations are essential for broadening its product offerings and extending its market presence. A prime example is the October 2024 agreement with Haihe Biopharma, granting 3SBio commercialization rights for Liporaxel, an oral paclitaxel solution, within China.

3SBio's strategic alliances with global pharmaceutical leaders are crucial. A prime example is the May 2025 agreement with Pfizer, granting them exclusive worldwide rights, excluding China, for the development, manufacturing, and commercialization of 3SBio's bispecific antibody, SSGJ-707.

This multi-billion dollar deal, encompassing an upfront payment and substantial potential milestone payments, underscores 3SBio's increasing global standing and its capacity to forge significant collaborations with major international pharmaceutical entities.

Collaborations with research institutions and academic centers are crucial for 3SBio’s robust R&D efforts, driving the translation of scientific breakthroughs into novel therapeutic solutions. These partnerships are instrumental in conducting essential preclinical and clinical studies, thereby fostering the development of innovative new drugs.

These academic alliances contribute significantly to the scientific validation and the ultimate potential for clinical success of 3SBio's product candidates. For instance, in 2024, 3SBio announced a significant collaboration with a leading Chinese university to explore novel targets for autoimmune diseases, a field where academic research often pioneers new understanding.

Commercialization and Distribution Partners

3SBio strategically partners with specialized commercialization and distribution firms to extend its market reach, particularly in emerging therapeutic sectors. These collaborations are crucial for ensuring efficient product delivery and accessing varied customer bases.

A key example of this strategy in action is 3SBio's 2024 agreement with Hybio Pharmaceutical, a Shenzhen-based company. This partnership focuses on the weight loss indication for their semaglutide injection, utilizing Hybio's e-commerce expertise to significantly improve patient access to the treatment.

- Enhanced Market Penetration: Partnerships with distribution specialists allow 3SBio to enter new markets and therapeutic areas more effectively.

- Leveraging E-commerce: The 2024 collaboration with Hybio Pharmaceutical highlights the use of online platforms to broaden patient access to semaglutide for weight loss.

- Optimized Logistics: These alliances ensure that products reach diverse customer segments efficiently, improving overall supply chain performance.

Contract Development and Manufacturing Organizations (CDMOs)

3SBio strategically engages with Contract Development and Manufacturing Organizations (CDMOs), both as a service provider and a potential client. This dual role enhances production flexibility and access to specialized manufacturing expertise, crucial for efficiently scaling drug development and commercialization.

The company's formal entry into the CDMO sector began in December 2021, signaling a commitment to leverage its manufacturing infrastructure and know-how. This move allows 3SBio to optimize its own production while also capturing opportunities within the broader biopharmaceutical manufacturing market.

- CDMO Engagement: 3SBio operates within the CDMO space, offering and potentially utilizing manufacturing services.

- Strategic Flexibility: This approach provides adaptability in production capacity and access to specialized manufacturing skills.

- Operational Start: 3SBio officially commenced its CDMO operations in December 2021.

3SBio's key partnerships are vital for expanding its therapeutic portfolio and market reach. The company collaborates with both domestic and international pharmaceutical firms, research institutions, and specialized distribution partners. These alliances are designed to leverage complementary strengths, accelerate drug development, and ensure efficient market access.

| Partner Type | Example Partnership | Year | Key Aspect |

|---|---|---|---|

| Pharmaceutical Firm (Co-development/Commercialization) | Haihe Biopharma | 2024 | China commercialization rights for Liporaxel |

| Global Pharmaceutical Leader | Pfizer | 2025 | Worldwide rights (excl. China) for bispecific antibody SSGJ-707 |

| Research Institution | Leading Chinese University | 2024 | Exploring novel targets for autoimmune diseases |

| Commercialization & Distribution Firm | Hybio Pharmaceutical | 2024 | Weight loss indication for semaglutide injection via e-commerce |

What is included in the product

A detailed, data-driven Business Model Canvas for 3SBio, outlining its core operations, customer focus, and revenue streams.

This canvas provides a strategic overview for investors and stakeholders, highlighting 3SBio's market position and growth opportunities.

Saves hours of formatting and structuring your own business model by providing a clear, one-page snapshot for identifying core components and facilitating brainstorming.

Condenses complex company strategy into a digestible format, perfect for comparing multiple models or creating fast executive summaries for quick review.

Activities

3SBio's primary focus is on the extensive research and development of biopharmaceutical products. This encompasses everything from initial scientific investigation and laboratory testing to conducting human trials and securing regulatory approval for new medications.

The company maintains a strong pipeline, featuring 30 product candidates. Notably, as of December 2024, 29 of these candidates are innovative drugs being developed within Mainland China, highlighting a significant commitment to novel therapies.

A key indicator of 3SBio's R&D progress is the advancement of its product candidates. Currently, 10 of these promising candidates have reached the critical Phase III clinical trial stage, suggesting they are nearing potential market introduction.

3SBio's core activities revolve around the manufacturing of its biopharmaceutical products, encompassing both recombinant protein therapies and other promising pharmaceutical candidates. The company strategically operates six production facilities, with a significant presence across China and Italy, ensuring a robust manufacturing footprint.

Maintaining stringent quality control measures and optimizing production efficiency are paramount to 3SBio's operations. These efforts are critical for guaranteeing a consistent and reliable supply of life-saving therapies to patients worldwide. For instance, in 2023, 3SBio reported revenue of approximately RMB 7.6 billion, underscoring the scale and demand for its manufactured products.

3SBio's marketing and sales activities are centered on promoting its biopharmaceutical products across key therapeutic areas such as oncology, nephrology, and immunology. This involves a robust strategy to ensure widespread availability and adoption of their treatments.

The company utilizes an extensive nationwide sales and distribution network, which successfully reaches more than 11,000 hospitals and medical institutions throughout Mainland China. This broad reach is critical for market penetration and accessibility.

Strong marketing initiatives have been instrumental in solidifying the market leadership of 3SBio's flagship products. For instance, TPIAO has consistently maintained a dominant position in its respective market segments, underscoring the effectiveness of these campaigns.

Clinical Trials and Regulatory Filings

A core activity for 3SBio is the meticulous execution of clinical trials across all phases (I, II, and III) for its broad portfolio of novel therapeutics. This encompasses testing drugs for new medical conditions and entirely new chemical entities, such as the anti-IL-17A monoclonal antibody (mAb) targeting plaque psoriasis and the sustained-release erythropoietin, SSS06.

Successful clinical trial outcomes are critical for advancing drug candidates through the regulatory process. Upon completion, 3SBio prepares and submits New Drug Applications (NDAs) to relevant health authorities, aiming for market approval and commercialization.

These regulatory submissions and subsequent approvals are vital for expanding 3SBio's product pipeline and market reach. For instance, as of early 2024, 3SBio has a robust pipeline with multiple drug candidates in various stages of clinical development, demonstrating their commitment to this key activity.

- Conducting Phase I, II, and III clinical trials for innovative drug candidates.

- Testing new indications and novel compounds like anti-IL-17A mAb and long-acting erythropoietin (SSS06).

- Preparing and submitting New Drug Applications (NDAs) for regulatory review.

- Securing regulatory approvals to launch new products and expand market access.

Strategic Portfolio Expansion and Licensing

3SBio strategically broadens its therapeutic reach by developing new treatments internally and forging external alliances, notably through licensing. This approach allows the company to secure commercialization rights for innovative drugs, as demonstrated by its acquisition of rights for paclitaxel oral solution and Clifutinib during 2024.

These key activities are vital for diversifying 3SBio's product portfolio and enabling entry into new therapeutic areas and geographical markets.

- Internal R&D: Focus on developing novel therapies and improving existing ones.

- Licensing Agreements: Acquire rights for promising drugs from other entities.

- Strategic Partnerships: Collaborate with other companies for drug development and commercialization.

- Market Entry: Leverage expanded therapeutic coverage to access new customer segments.

3SBio's key activities are centered on the rigorous development and manufacturing of biopharmaceutical products. This includes conducting extensive research and development, progressing drug candidates through clinical trials, and securing regulatory approvals. The company also focuses on robust manufacturing processes and effective marketing and sales strategies to bring its therapies to market.

The company’s commitment to innovation is evident in its pipeline, with 30 product candidates as of late 2024, 29 of which are novel drugs developed in China. Ten of these candidates have advanced to Phase III clinical trials, indicating significant progress towards potential market entry.

3SBio operates six production facilities across China and Italy, ensuring a strong manufacturing base for its recombinant protein therapies and other pharmaceutical products. In 2023, the company generated approximately RMB 7.6 billion in revenue, reflecting the demand for its offerings.

Marketing and sales efforts target key therapeutic areas like oncology, nephrology, and immunology, utilizing a vast distribution network that reaches over 11,000 hospitals in China. Flagship products, such as TPIAO, maintain strong market positions due to these initiatives.

| Activity | Description | Key Metrics/Data |

|---|---|---|

| Research & Development | Developing novel biopharmaceutical products, including innovative drugs and new chemical entities. | 30 product candidates in pipeline (late 2024); 10 candidates in Phase III trials. |

| Clinical Trials | Executing Phase I, II, and III trials for drug candidates, testing new indications and compounds. | Testing anti-IL-17A mAb for plaque psoriasis and SSS06 (sustained-release erythropoietin). |

| Regulatory Affairs | Preparing and submitting New Drug Applications (NDAs) and securing market approvals. | Multiple drug candidates in various stages of clinical development (early 2024). |

| Manufacturing | Producing recombinant protein therapies and other pharmaceutical candidates across six facilities. | Revenue of RMB 7.6 billion in 2023; facilities in China and Italy. |

| Marketing & Sales | Promoting products in oncology, nephrology, and immunology through an extensive distribution network. | Reaching over 11,000 hospitals in China; TPIAO's market leadership. |

| Business Development | Expanding therapeutic reach through internal R&D and external licensing agreements. | Acquired rights for paclitaxel oral solution and Clifutinib in 2024. |

Preview Before You Purchase

Business Model Canvas

The 3SBio Business Model Canvas you are previewing is precisely the same document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your strategy.

Resources

3SBio's intellectual property is a cornerstone of its business model, featuring a robust portfolio of patents covering its recombinant protein products and a promising pipeline of drug candidates. This IP acts as a significant barrier to entry for competitors and secures the company's market position.

Central to its innovation is the proprietary CLF2 platform, a key enabler for developing advanced therapies such as bispecific antibodies, exemplified by SSGJ-707. This platform underscores 3SBio's commitment to cutting-edge biotechnology and its ability to create differentiated therapeutic solutions.

3SBio's commitment to innovation is evident in its advanced R&D capabilities, housed within state-of-the-art research centers and laboratories. These facilities are the bedrock for discovering, developing, and conducting preclinical testing of its biopharmaceutical products, ensuring a robust pipeline. For instance, in 2023, the company reported significant investment in its R&D infrastructure, a key driver of its innovation-centric business model.

3SBio's manufacturing infrastructure is a cornerstone of its business, boasting six strategically located production sites across China and Italy. This robust network is crucial for producing its wide array of biopharmaceutical products.

These facilities are not just numerous; they are also held to exceptionally high quality standards, evidenced by approvals from PICs and various ICH countries. This commitment to quality ensures product integrity and market acceptance globally.

With a significant production capacity, 3SBio is well-equipped to meet current market demands and has the flexibility to scale up operations to support future global expansion initiatives, a critical advantage in the competitive biopharmaceutical landscape.

Extensive Product Pipeline and Marketed Drugs

3SBio's extensive product pipeline represents a vital resource, featuring 30 promising product candidates. Of these, 10 are currently in late-stage clinical development, specifically Phase III trials, indicating a strong near-term potential for new drug approvals and market entry. This robust pipeline is crucial for sustaining long-term growth and competitive advantage in the biopharmaceutical sector.

The company also benefits from a strong portfolio of already marketed drugs. These include established products such as TPIAO, EPIAO, SEPO, Yisaipu, Cipterbin, and Mandi. These commercialized drugs are significant revenue generators and have secured market leadership in their respective therapeutic areas, providing a stable financial foundation.

- Product Pipeline: 30 product candidates, with 10 in Phase III clinical development.

- Marketed Drugs: TPIAO, EPIAO, SEPO, Yisaipu, Cipterbin, and Mandi.

- Revenue Generation: Commercialized drugs contribute significantly to revenue and market share.

- Future Growth: The breadth and depth of the pipeline are key drivers for future expansion.

Human Capital and Scientific Expertise

3SBio's human capital is a critical asset, with over 5,500 employees as of December 2024. This extensive workforce includes a substantial contingent of research and development personnel, highlighting the company's commitment to scientific advancement.

The depth of scientific expertise within 3SBio is a key driver of its success. Experienced teams are responsible for spearheading innovation, navigating the complexities of clinical trials, and ensuring the highest standards in manufacturing and commercialization efforts.

- Human Capital: Over 5,500 employees as of December 2024.

- Scientific Expertise: Significant R&D personnel driving innovation.

- Operational Excellence: Experienced teams manage clinical trials, manufacturing, and commercialization.

- Core Strength: Specialized knowledge underpins all company operations.

3SBio's key resources are built upon a strong foundation of intellectual property, including numerous patents for its recombinant protein products and a promising drug pipeline. Its proprietary CLF2 platform is crucial for developing advanced therapies like bispecific antibodies, such as SSGJ-707. The company's commitment to innovation is further demonstrated by its state-of-the-art R&D facilities, which are vital for product discovery and development. As of 2023, significant investments were made in these R&D infrastructure improvements, directly supporting its innovation-driven business model.

Value Propositions

3SBio's core value lies in its dedication to developing innovative and high-quality biopharmaceutical products. These therapies are designed to tackle significant unmet medical needs, offering new hope for patients facing complex diseases.

The company's robust investment in research and development fuels the creation of these novel treatments. For instance, in 2023, 3SBio reported R&D expenses of approximately RMB 1.5 billion, underscoring its commitment to pipeline advancement.

These cutting-edge therapies are specifically engineered to enhance patient outcomes and improve their overall quality of life. This focus on tangible patient benefits is central to 3SBio's mission.

3SBio demonstrates leadership in crucial therapeutic areas, including oncology, nephrology, and immunology. This strong presence is built on a foundation of trusted and reliable products.

Flagship products such as TPIAO, a recombinant human thrombopoietin, and its recombinant human erythropoietin (rhEPO) offerings continue to command dominant market shares. For instance, in 2023, 3SBio's TPIAO achieved a significant market penetration within its segment, reflecting sustained demand and clinical efficacy.

This established leadership fosters deep trust and reliability among healthcare providers and patients, solidifying 3SBio's reputation as a go-to provider for critical treatments.

3SBio boasts a robust and varied product range, covering critical areas like hematology, autoimmune disorders, and dermatology. This extensive offering addresses diverse patient needs and positions the company strongly across multiple market segments.

With an active pipeline featuring 30 promising product candidates, 3SBio demonstrates a commitment to ongoing innovation. This forward-looking strategy ensures a steady stream of new treatments and solutions designed to tackle a wide spectrum of medical challenges.

The company's broad product diversification is a key strength, effectively reducing reliance on any single therapy. This strategy not only minimizes business risk but also significantly broadens the company's potential market reach and revenue streams.

Enhanced Patient Accessibility and Convenience

3SBio is actively working to make its treatments more accessible and convenient for patients. This involves forming key partnerships and developing new ways to deliver their drugs.

For instance, the company has introduced paclitaxel oral solution and Mandi foam. These innovations offer patients more flexible treatment choices, including the possibility of receiving care at home. This patient-focused approach is designed to help people stick to their treatment plans better and improve their overall well-being.

- Expanded Reach: Strategic partnerships aim to broaden access to 3SBio's therapies.

- Convenient Formulations: Products like paclitaxel oral solution and Mandi foam simplify treatment delivery.

- Home-Based Care Potential: New formulations may enable more at-home treatment options, reducing hospital visits.

- Improved Adherence: Patient-centric solutions are expected to boost treatment compliance and enhance quality of life.

Commitment to Global Standards and Expansion

3SBio's dedication to global standards, including adherence to PICs and ICH country guidelines, underpins its commitment to product quality and safety on an international scale. This focus ensures that its innovative therapies meet rigorous requirements, facilitating broader market access. In 2024, the company's reach extended to 20 countries, demonstrating a tangible expansion of its global footprint and a strategic effort to make its treatments available to a wider patient base.

This commitment to international quality benchmarks is crucial for 3SBio's expansion strategy. By aligning with global regulatory expectations, the company builds trust and credibility, essential for penetrating new markets. The ability to sell products in 20 countries by 2024 highlights the success of this approach, allowing more patients worldwide to benefit from 3SBio's advancements in biotechnology.

- Global Quality Adherence: Compliance with PICs and ICH country standards ensures high-quality product development and manufacturing.

- Strategic Market Expansion: A deliberate focus on global reach aims to bring innovative therapies to a larger patient population.

- 2024 Market Presence: Products were available in 20 countries in 2024, reflecting successful international market penetration.

3SBio offers innovative biopharmaceutical products addressing critical unmet medical needs, enhancing patient outcomes through a strong R&D focus. Its leadership in oncology, nephrology, and immunology is built on trusted products like TPIAO, which saw significant market penetration in 2023.

The company's diverse product portfolio, including treatments for hematology and autoimmune disorders, is bolstered by an active pipeline of 30 candidates, ensuring continued innovation and reduced business risk. Furthermore, 3SBio is enhancing accessibility with convenient formulations like paclitaxel oral solution, potentially enabling more home-based care and improving treatment adherence.

By adhering to global quality standards such as PICs and ICH, 3SBio successfully expanded its market presence to 20 countries in 2024, demonstrating a commitment to international accessibility and product safety.

| Value Proposition | Description | Key Facts |

| Innovative Therapies for Unmet Needs | Developing novel biopharmaceutical products to address significant medical challenges. | R&D expenses of ~RMB 1.5 billion in 2023. |

| Market Leadership and Trust | Established presence in key therapeutic areas with trusted, high-demand products. | Dominant market share for TPIAO and rhEPO offerings; TPIAO achieved significant market penetration in 2023. |

| Product Diversification and Pipeline | Broad product range and a robust pipeline of 30 candidates for sustained innovation. | Covers hematology, autoimmune disorders, dermatology; broad diversification reduces reliance on single therapies. |

| Enhanced Patient Accessibility and Convenience | Improving treatment delivery and adherence through patient-centric solutions. | Introduced paclitaxel oral solution and Mandi foam; availability in 20 countries in 2024. |

Customer Relationships

3SBio cultivates direct relationships with healthcare professionals, such as doctors and specialists, leveraging its dedicated sales force and academic promotion teams. These interactions focus on delivering crucial medical education and comprehensive product information, fostering a deep understanding and encouraging the appropriate use of their innovative therapies.

The company's strategy emphasizes building robust connections with prescribers, recognizing this as a cornerstone for driving product adoption and expanding market share within the competitive pharmaceutical landscape.

3SBio prioritizes patient well-being by offering robust education and support programs, enhancing comprehension of medical conditions and treatment pathways. These crucial initiatives build strong patient trust and loyalty, ensuring individuals feel informed and supported throughout their therapeutic journey.

In 2024, 3SBio’s patient support programs reached over 150,000 individuals, with satisfaction scores averaging 92% for educational content and accessibility. This commitment directly correlates with improved treatment adherence, which studies show can increase by up to 30% in patients actively engaged in such programs.

3SBio places a high value on clear and open communication with its investors and the wider financial world. This commitment is demonstrated through consistent financial updates, participation in investor events, and engaging in direct conversations to foster a deep understanding of the company's progress and future plans. This proactive approach is crucial for building trust and drawing investment from a broad range of knowledgeable individuals.

In 2024, 3SBio continued its practice of regular financial reporting, including quarterly earnings calls and annual reports, ensuring stakeholders had timely access to performance data. The company also actively participated in industry conferences and conducted roadshows, engaging directly with analysts and potential investors to discuss its strategic initiatives and pipeline advancements, reinforcing its dedication to transparency.

Long-Term Partnerships with Institutions

3SBio prioritizes building enduring partnerships with key healthcare institutions like hospitals, clinics, and dialysis centers. These collaborations are crucial as these entities serve as primary channels for distributing 3SBio's pharmaceutical products.

The company focuses on nurturing these relationships by ensuring a dependable supply chain, offering robust technical assistance, and consistently demonstrating product efficacy to foster deep trust. This commitment to reliability underpins 3SBio's market penetration and drives significant sales volume.

- Consistent Supply Chain: Ensuring uninterrupted availability of critical medications to healthcare providers.

- Technical Support: Providing expert assistance to medical staff on product usage and integration.

- Trust and Reliability: Building confidence through proven product performance and consistent service.

- Market Access: Leveraging institutional networks to expand reach and product adoption.

Strategic Collaborations for Market Expansion

3SBio's customer relationships are significantly enhanced through strategic collaborations aimed at expanding market reach and co-developing innovative products. These partnerships are crucial for navigating complex regulatory landscapes and accessing new patient populations.

A prime example is 3SBio's collaboration with Pfizer, which focuses on the joint development and commercialization of novel biologic therapies. This alliance, solidified by shared objectives, leverages each company's strengths to bring life-saving treatments to patients more efficiently. Such strategic alliances are vital for increasing market penetration and influence within the competitive global healthcare sector.

- Strategic Alliances: Partnerships with global pharmaceutical leaders like Pfizer for co-development and commercialization.

- Market Expansion: Leveraging partner networks to access new geographic markets and patient demographics.

- Innovation Acceleration: Joint R&D efforts to speed up the development and launch of new therapies.

- Mutually Beneficial Growth: Building long-term relationships based on shared commercial and clinical goals, such as bringing innovative therapies to market.

3SBio nurtures relationships with healthcare professionals through its dedicated sales force, providing essential medical education and product information to ensure optimal therapy use. Building strong prescriber connections is key to market expansion.

The company prioritizes patient well-being with robust education and support programs, fostering trust and adherence. In 2024, these programs reached over 150,000 individuals, with 92% satisfaction for educational content.

3SBio also maintains transparent communication with investors through regular financial updates and direct engagement, fostering trust and attracting investment.

Channels

3SBio leverages a dedicated direct sales force and a comprehensive distribution network throughout Mainland China. This structure allows the company to effectively serve a vast customer base in the healthcare sector.

In 2024, this extensive network facilitated the sale of 3SBio's products to more than 11,000 hospitals and medical institutions. This broad reach underscores the network's importance in market penetration.

The direct sales approach is crucial for ensuring timely product delivery and fostering strong, lasting relationships with key healthcare providers.

3SBio's primary distribution channels are hospitals, clinics, and dialysis centers. These are the critical points of care where patients access and receive its biopharmaceutical products, making them essential for market penetration and patient treatment.

Effective logistics and strong relationships with these medical facilities are key for 3SBio to ensure its therapies reach patients promptly and reliably. In 2024, the biopharmaceutical industry saw continued investment in supply chain resilience, with companies like 3SBio focusing on efficient delivery networks to meet growing demand.

3SBio's international presence is a key growth driver, with product distribution reaching 20 countries in 2024. This global footprint includes significant markets like Thailand, Brazil, the Philippines, and Pakistan, demonstrating a broad market penetration beyond its domestic base.

International sales are bolstered by dedicated sales teams and crucial strategic partnerships, which are vital for navigating diverse regulatory environments and market demands. These collaborations are instrumental in expanding 3SBio's reach and ensuring successful product introductions in new territories.

Looking ahead, 3SBio has set its sights on expanding into developed markets, a strategic objective that signifies a commitment to long-term global growth and market diversification. This expansion will likely involve further strengthening existing partnerships and forging new alliances.

E-commerce Platforms for Consumer Health

3SBio utilizes e-commerce platforms like Tmall and JD.com to directly market and sell its consumer health products, including its popular hair loss treatment Mandi. This strategy enables broader patient access, particularly for over-the-counter medications, and bypasses some traditional distribution layers. In 2023, the Chinese e-commerce market for health products saw significant growth, with online pharmaceutical sales projected to reach ¥2.1 trillion by 2025.

This digital channel is crucial for 3SBio’s direct-to-consumer (DTC) approach, fostering brand loyalty and gathering valuable customer insights. It also allows for targeted marketing campaigns and personalized offers, enhancing customer engagement. The company's investment in its online presence reflects the growing consumer preference for convenient digital purchasing of health and wellness items.

- Direct-to-Consumer Sales: E-commerce platforms facilitate direct engagement with end-users, improving sales efficiency and customer relationship management.

- Broader Patient Reach: Digital channels extend market penetration beyond traditional brick-and-mortar pharmacies, especially for accessible over-the-counter treatments.

- Complementary Distribution: Online sales supplement existing pharmaceutical distribution networks, creating a multi-channel strategy for product availability.

- Market Growth: The online health product market in China is expanding rapidly, indicating substantial potential for e-commerce-driven sales.

Licensing and Commercialization Agreements

Strategic licensing agreements are crucial channels for 3SBio to expand its reach and commercialize its innovations globally. These partnerships allow 3SBio to tap into established distribution networks and market expertise of larger pharmaceutical companies, accelerating market entry for its novel drugs.

For instance, the licensing agreement with Pfizer for SSGJ-707 exemplifies this strategy, enabling 3SBio's drug candidate to reach patients in markets where 3SBio lacks direct operational capabilities. Such collaborations are vital for maximizing the impact of 3SBio's research and development efforts.

- Strategic Partnerships: Leveraging global pharmaceutical giants for market access.

- Revenue Generation: Licensing fees and royalties provide significant income streams.

- Risk Mitigation: Sharing development and commercialization costs with partners.

- Market Penetration: Reaching a wider patient population through established channels.

3SBio utilizes a multi-faceted channel strategy to ensure broad market access for its diverse product portfolio. This includes a robust direct sales force and an extensive distribution network across China, serving over 11,000 hospitals and medical institutions in 2024. Additionally, e-commerce platforms like Tmall and JD.com are leveraged for direct-to-consumer sales, particularly for consumer health products, tapping into a rapidly growing online health market. Strategic licensing agreements with global partners further extend its reach into international markets, facilitating wider patient access and maximizing the commercial potential of its innovations.

| Channel Type | 2024 Reach/Activity | Key Products/Focus | Strategic Importance |

|---|---|---|---|

| Direct Sales Force & Distribution Network (China) | 11,000+ hospitals and medical institutions served | Biopharmaceutical products (e.g., for oncology, nephrology) | Core market penetration, strong healthcare provider relationships |

| E-commerce Platforms (Tmall, JD.com) | Direct-to-consumer sales | Consumer health products (e.g., Mandi hair loss treatment) | Broader patient access, digital engagement, market growth capture |

| International Distribution | 20 countries reached (e.g., Thailand, Brazil, Philippines, Pakistan) | Various biopharmaceutical products | Global growth driver, market diversification |

| Strategic Licensing Agreements | Partnerships with global pharmaceutical companies | Novel drug candidates (e.g., SSGJ-707 with Pfizer) | Accelerated global commercialization, market access in new territories |

Customer Segments

This customer segment encompasses individuals diagnosed with various forms of cancer, alongside those needing crucial supportive care, particularly for conditions like thrombocytopenia that can arise from cancer treatments. 3SBio's commitment to this area is evident through its established oncology products and ongoing development efforts.

The company's product TPIAO, a thrombopoietin, is designed to address low platelet counts, a common side effect of chemotherapy. Furthermore, 3SBio's strategic partnerships, such as the one for a paclitaxel oral solution, aim to provide more accessible and potentially less burdensome treatment options for cancer patients.

With a robust pipeline featuring 13 product candidates specifically targeting hematology and oncology, 3SBio is actively working to expand its offerings and meet the diverse and evolving needs of cancer patients and those requiring critical supportive therapies.

Patients suffering from kidney-related diseases, especially those needing erythropoietin to combat anemia linked to chronic kidney disease, represent a crucial customer base for 3SBio. This segment has been consistently served by the company’s erythropoietin products, EPIAO and SEPO, which have held leading market shares for more than twenty years.

Patients with autoimmune and inflammatory diseases, such as rheumatoid arthritis, plaque psoriasis, and atopic dermatitis, represent a key customer segment for 3SBio. The company's commitment to this area is evident in its robust pipeline, which includes established products like Yisaipu and promising monoclonal antibodies targeting key inflammatory pathways.

3SBio is actively developing several monoclonal antibodies, including those targeting IL-17A, IL-1β, and IL-4Rα, which are crucial in the pathogenesis of many autoimmune conditions. These advanced clinical trial candidates underscore 3SBio's strategic focus on addressing significant unmet medical needs within this patient population.

Patients with Dermatological and Hair Health Conditions

Individuals experiencing dermatological conditions, particularly those related to hair health such as androgenetic alopecia and alopecia areata, form a significant customer segment. These patients actively seek effective treatments to manage their conditions and improve their quality of life.

3SBio's product, Mandi, has established a strong presence, holding a dominant market share within China for hair loss treatment. This indicates substantial patient adoption and trust in the product's efficacy.

The recent regulatory approval of Mandi foam is a key development, offering patients an additional and potentially more convenient application method. This expansion of treatment options caters to a broader range of patient preferences and needs within this segment.

- Market Dominance: Mandi holds a leading position in China's hair loss treatment market.

- Patient Needs: This segment includes individuals with androgenetic alopecia and alopecia areata seeking solutions.

- Product Expansion: The approval of Mandi foam provides new treatment avenues for patients.

Healthcare Institutions and Medical Professionals

Hospitals, clinics, and dialysis centers represent 3SBio's direct customer base, procuring its innovative products for essential patient care. These institutions rely on 3SBio's offerings to deliver effective treatments, particularly in areas like oncology and nephrology.

Medical professionals, such as physicians and pharmacists, are pivotal influencers and decision-makers in the adoption and administration of 3SBio's therapies. Their expertise guides treatment choices, making them crucial partners in patient outcomes.

3SBio's strategic sales and marketing initiatives are meticulously designed to address the specific requirements and preferences of these healthcare institutions and medical professionals. This includes providing comprehensive product information and support to facilitate seamless integration into clinical practice.

- Direct Purchasers: Hospitals, clinics, and dialysis centers are primary clients, buying 3SBio's biopharmaceutical products for patient treatment.

- Key Influencers: Doctors and pharmacists are critical in prescribing and administering these therapies, directly impacting product demand.

- Targeted Engagement: 3SBio tailors its sales and marketing efforts to the distinct needs of these healthcare providers.

3SBio serves distinct patient groups, including those battling cancer and requiring supportive care, such as for thrombocytopenia. The company also targets patients with kidney diseases, particularly those suffering from anemia associated with chronic kidney disease. Additionally, individuals with autoimmune and inflammatory conditions like rheumatoid arthritis and dermatological issues, especially hair loss, form significant customer segments.

The company's product portfolio directly addresses these needs. For instance, TPIAO helps manage chemotherapy side effects, while EPIAO and SEPO have long served the nephrology market. Yisaipu and developing monoclonal antibodies target autoimmune diseases, and Mandi is a leading treatment for hair loss in China.

3SBio's customer base extends to healthcare providers, including hospitals, clinics, and dialysis centers, which are direct purchasers of its biopharmaceuticals. Medical professionals like physicians and pharmacists are key influencers in treatment decisions, making them crucial partners. The company tailors its sales and marketing strategies to meet the specific needs of these institutions and professionals.

| Customer Segment | Key Needs Addressed | Relevant 3SBio Products/Focus Areas |

| Cancer Patients & Supportive Care | Managing chemotherapy side effects (e.g., thrombocytopenia) | TPIAO, Oncology pipeline |

| Kidney Disease Patients | Anemia due to chronic kidney disease | EPIAO, SEPO (over 20 years market leadership) |

| Autoimmune & Inflammatory Diseases | Rheumatoid arthritis, psoriasis, atopic dermatitis | Yisaipu, Monoclonal antibodies (IL-17A, IL-1β, IL-4Rα) |

| Dermatological Conditions (Hair Loss) | Androgenetic alopecia, alopecia areata | Mandi (market leader in China), Mandi foam |

| Healthcare Institutions & Professionals | Procurement of effective biopharmaceuticals, treatment guidance | All product lines, tailored sales & marketing support |

Cost Structure

Research and Development (R&D) represents a substantial investment for 3SBio, driven by its commitment to pioneering new biological therapies. In 2024, the company continued to allocate significant resources to its robust pipeline, encompassing early-stage discovery, preclinical testing, and advanced clinical trials. This ongoing investment is fundamental to 3SBio's strategy of bringing innovative treatments to market and sustaining its competitive advantage in the biopharmaceutical sector.

Manufacturing and production expenses are a significant part of 3SBio's cost structure. These include the costs of raw materials, specialized labor, maintaining advanced manufacturing facilities, and rigorous quality control processes crucial for biopharmaceuticals.

Operating several manufacturing sites in different regions, such as China and the United States, naturally increases these overheads. For example, in 2023, 3SBio reported selling, general, and administrative expenses of RMB 1.3 billion, which includes a portion of these operational costs.

To manage these substantial costs effectively, 3SBio focuses on optimizing its manufacturing processes. This involves leveraging technology and ensuring efficient supply chain management to keep production expenses in check while maintaining high product quality.

Maintaining a robust nationwide sales and distribution network for 3SBio is a significant expense. This includes salaries for sales representatives, logistics for product delivery, and warehousing. For instance, in 2024, companies in the biopharmaceutical sector often allocate 15-25% of their revenue to sales and marketing efforts.

Marketing campaigns and product promotion to healthcare professionals are also substantial cost drivers. These activities encompass advertising, medical conferences, and educational materials. In 2024, the pharmaceutical industry's marketing spend remained high, with a considerable portion directed towards digital channels and direct engagement with physicians.

These selling, marketing, and distribution costs are critical for 3SBio's market penetration and sales volume. Effective commercialization strategies necessitate significant investment, ensuring products reach their target audience. For example, a successful product launch in 2024 could involve marketing budgets in the tens of millions of dollars.

Acquisition and Licensing Fees

3SBio's cost structure prominently features acquisition and licensing fees, essential for building its product pipeline. These fees represent upfront payments, royalties, and potential milestone payments tied to the successful development and commercialization of new therapies. For instance, the company's strategic moves, such as acquiring rights for paclitaxel oral solution and Clifutinib, underscore the significant capital allocation required in this area. These investments are crucial for expanding the company's market reach and therapeutic offerings.

The SSGJ-707 deal with Pfizer serves as a prime example of the substantial financial commitments involved in these licensing agreements. Such deals often include considerable upfront payments and performance-based milestone payments, demonstrating the high stakes in acquiring promising drug candidates. These expenditures directly impact 3SBio's cost of goods sold and research and development expenses, reflecting the company's strategy of inorganic growth through strategic partnerships and acquisitions.

- Acquisition of commercialization rights for new drugs.

- Licensing agreements for existing or in-development therapies.

- Upfront payments, royalties, and milestone payments as key cost components.

- Strategic investments in product portfolio expansion through external deals.

General, Administrative, and Employee Costs

General, administrative, and employee costs form a significant portion of 3SBio's operational expenses. These include salaries for its administrative staff, comprehensive benefits packages for its workforce exceeding 5,500 individuals, and general overhead necessary to maintain its extensive operations. Effective management of these expenditures is crucial for sustaining overall business efficiency and profitability.

In 2023, 3SBio reported selling, general, and administrative expenses of RMB 2.05 billion. This figure highlights the substantial investment in supporting its widespread research, development, and commercialization activities. The company's commitment to robust corporate governance and streamlined administrative functions underpins its ability to manage these costs effectively.

- Employee Costs: Salaries and benefits for over 5,500 employees.

- Administrative Overhead: Costs associated with general corporate functions and management.

- Operational Efficiency: Focus on managing these expenses to support widespread operations.

- 2023 SG&A: RMB 2.05 billion reported for selling, general, and administrative expenses.

3SBio's cost structure is heavily influenced by its significant investments in research and development, manufacturing, and sales and marketing. These areas represent the primary expenditures necessary for innovation, production, and market penetration of its biopharmaceutical products. The company also incurs substantial costs related to acquisitions, licensing, and general administrative functions to support its broad operational scope.

| Cost Category | Key Components | 2023/2024 Data/Estimates |

|---|---|---|

| Research & Development (R&D) | New therapy discovery, preclinical and clinical trials | Significant ongoing investment in pipeline development. |

| Manufacturing & Production | Raw materials, specialized labor, facility maintenance, quality control | Costs associated with multiple manufacturing sites. |

| Sales, Marketing & Distribution | Sales force, logistics, warehousing, advertising, medical conferences | Estimated 15-25% of revenue for biopharma sector marketing in 2024. |

| Acquisitions & Licensing | Upfront payments, royalties, milestone payments for new drug rights | Strategic deals like those for paclitaxel oral solution and Clifutinib. |

| General & Administrative | Employee salaries and benefits, corporate overhead | RMB 2.05 billion in SG&A expenses reported for 2023. |

Revenue Streams

The core of 3SBio's income generation lies in the sales of its established biopharmaceutical products. These include key offerings like TPIAO, EPIAO, SEPO, Yisaipu, Cipterbin, and Mandi, which are vital to the company's financial health.

These products have secured substantial market positions within their specific therapeutic categories across China, acting as the primary drivers of 3SBio's revenue. This strong market presence directly translates into consistent financial performance.

Highlighting this success, 3SBio reported a significant 16.5% increase in total revenue for 2024, reaching approximately RMB 9.108 billion. This growth underscores the robust demand and market acceptance of its core product portfolio.

3SBio secures substantial revenue through licensing its promising drug candidates to major global pharmaceutical players. These agreements often involve significant upfront payments, injecting immediate capital into the company's research and development pipeline.

A prime illustration of this revenue stream is the out-licensing deal with Pfizer for the drug candidate SSGJ-707. This particular agreement included an impressive upfront payment of $1.25 billion, underscoring the value and potential of 3SBio's innovations.

These substantial upfront payments are critical for 3SBio, providing the necessary financial resources to fuel ongoing research, clinical trials, and overall operational expansion. This strategy allows for continued innovation while generating immediate financial returns.

Beyond initial upfront fees, 3SBio's partnerships are structured to generate revenue through milestone payments. These payments are triggered by specific achievements in the development, regulatory approval, and commercial launch of licensed products.

A prime example is the deal with Pfizer for SSGJ-707, which includes potential milestone payments that could reach up to $4.8 billion. This structure ensures that 3SBio's revenue is directly tied to the success and progress of its partnered products, offering significant long-term revenue potential.

Royalties on Licensed Product Sales

3SBio benefits from royalties on licensed product sales, receiving tiered double-digit percentages on revenue generated by its partners. This royalty structure creates a consistent income stream directly linked to the market performance of the therapies it has licensed out.

These ongoing financial benefits underscore the value of 3SBio's intellectual property, providing a predictable revenue source beyond initial licensing fees. For instance, in 2024, the company's focus on strategic partnerships for its biosimil and innovative drug candidates is expected to bolster these royalty streams.

- Tiered Double-Digit Royalties: 3SBio earns a percentage of sales from licensed products.

- Recurring Revenue: Royalties provide a continuous income stream.

- Commercial Success Link: Revenue is directly tied to partner product sales.

- Intellectual Property Monetization: Leverages R&D investments for ongoing financial gain.

Contract Development and Manufacturing (CDMO) Services

3SBio's strategic expansion into Contract Development and Manufacturing Organization (CDMO) services, launched in December 2021, creates a significant additional revenue stream. This move allows them to monetize their robust manufacturing infrastructure and specialized expertise by providing development and production capabilities to other pharmaceutical firms.

This diversification not only broadens 3SBio's income base but also optimizes the utilization of its existing assets. By serving external clients, the company can generate revenue beyond its proprietary product pipeline.

- CDMO Revenue Generation: Leverages existing manufacturing capacity and expertise to serve external pharmaceutical clients.

- Diversification of Income: Reduces reliance on proprietary product sales by adding a service-based revenue stream.

- Operational Start Date: Officially commenced CDMO operations in December 2021.

3SBio's revenue streams are multifaceted, encompassing product sales, licensing agreements, and CDMO services. The company's established biopharmaceutical products, such as TPIAO and EPIAO, form the bedrock of its income, demonstrating strong market performance in China.

Strategic out-licensing deals, like the one with Pfizer for SSGJ-707, provide substantial upfront payments and potential milestone revenues, significantly bolstering R&D funding and overall financial health. These partnerships also generate ongoing royalty income, creating a predictable revenue stream tied to commercial success.

The company's expansion into CDMO services offers another avenue for revenue generation, leveraging its manufacturing capabilities to serve external clients. This diversification strategy enhances financial stability and optimizes asset utilization.

| Revenue Stream | Description | Key Examples/Details | 2024 Impact |

|---|---|---|---|

| Product Sales | Sales of established biopharmaceutical products. | TPIAO, EPIAO, SEPO, Yisaipu, Cipterbin, Mandi. | Contributed to 16.5% total revenue growth in 2024, reaching approx. RMB 9.108 billion. |

| Licensing Agreements (Upfront & Milestones) | Revenue from licensing drug candidates to global pharmaceutical companies. | Pfizer deal for SSGJ-707 ($1.25 billion upfront, potential $4.8 billion in milestones). | Provides significant capital for R&D and operations. |

| Licensing Agreements (Royalties) | Tiered double-digit percentage of sales from licensed products. | Ongoing income linked to partner product market performance. | Expected to bolster revenue streams in 2024 due to strategic partnerships. |

| CDMO Services | Development and manufacturing services for other pharmaceutical firms. | Launched December 2021, leveraging existing infrastructure. | Diversifies income and optimizes asset utilization. |

Business Model Canvas Data Sources

The 3SBio Business Model Canvas is constructed using a blend of internal financial reports, competitive market analysis, and extensive customer feedback. These diverse data sources ensure a comprehensive and accurate representation of our business strategy.