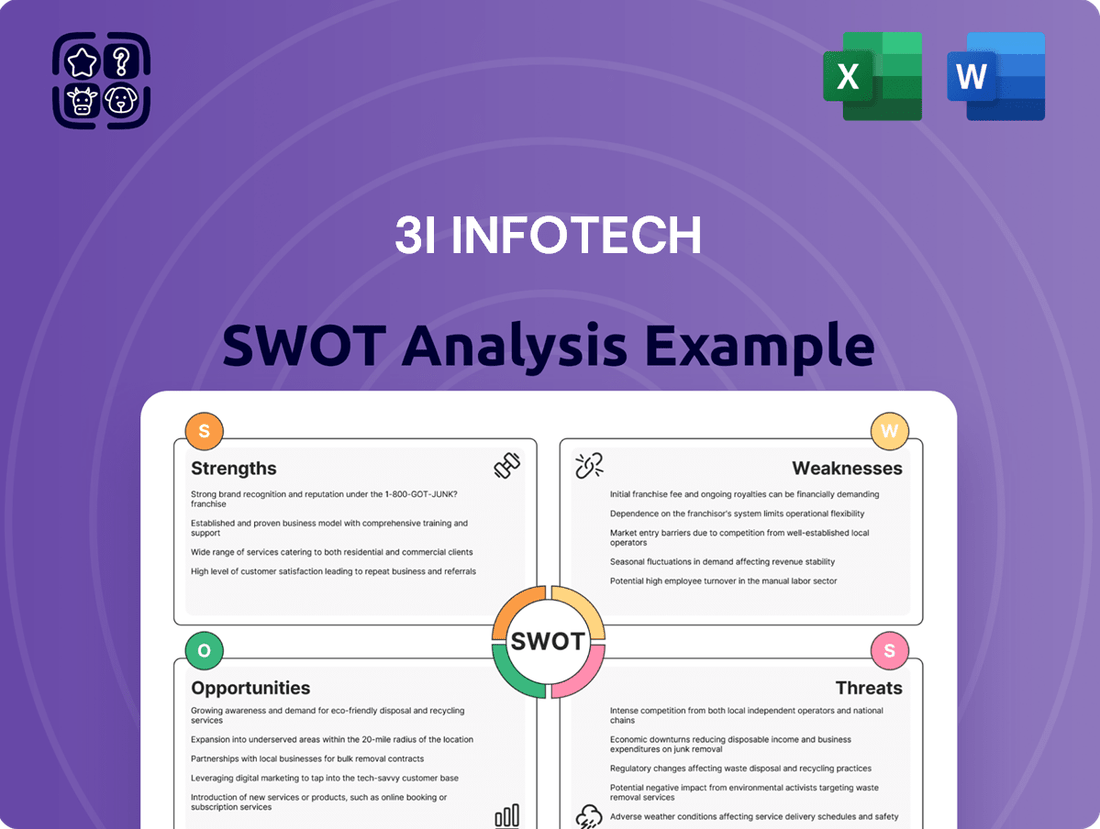

3i Infotech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Infotech Bundle

3i Infotech showcases strong capabilities in digital transformation and a robust product portfolio, but faces challenges in intense market competition and evolving technological landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their potential.

Want the full story behind 3i Infotech’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research, offering actionable insights for your next move.

Strengths

3i Infotech boasts a remarkably diverse service portfolio, encompassing everything from BFSI solutions and ERP systems to cloud computing, data analytics, and infrastructure management. This extensive offering allows them to address a wide spectrum of client requirements. For instance, their focus on BFSI solutions is crucial in a sector that saw global IT spending reach an estimated $2.1 trillion in 2024, with a significant portion dedicated to digital transformation initiatives.

Their deep domain expertise across key sectors like banking, financial services, insurance (BFSI), healthcare, and government is a significant strength. This specialized knowledge enables 3i Infotech to provide tailored solutions that truly resonate with industry-specific challenges and opportunities. In 2024, the BFSI sector continued to invest heavily in digital innovation, with companies like 3i Infotech playing a vital role in facilitating this evolution.

3i Infotech's strength lies in its deep specialization in digital transformation, helping businesses adopt and integrate emerging technologies. Their expertise spans areas like Artificial Intelligence (AI), Machine Learning (ML), edge computing, 5G, blockchain, and cloud solutions.

This focus places them at the cutting edge of technological innovation, allowing them to offer forward-thinking solutions. For instance, in the fiscal year ending March 31, 2024, 3i Infotech reported a significant increase in its digital transformation services revenue, reflecting strong market demand for their capabilities.

3i Infotech's strategic realignment, emphasizing high-growth sectors and a 'Protect-Consolidate-Grow' philosophy, positions it for future expansion. This focus is supported by operational excellence initiatives, including robust internal controls and advanced technology integration.

These efforts are designed to boost profitability and efficiency, as evidenced by the company's commitment to proactive governance. For instance, in the fiscal year ending March 31, 2024, 3i Infotech reported a significant improvement in its operational performance, with revenue from its digital transformation services growing by 15% year-over-year.

Global Presence and Client Base

3i Infotech boasts a significant global reach, operating in key markets like North America, the Middle East, Africa, Asia Pacific, and its home base of India. This widespread presence is a core strength, enabling the company to serve a diverse clientele and tap into varied economic landscapes.

The company's extensive client roster, exceeding 2000 partners across more than 50 countries, underscores its ability to deliver solutions on an international scale. This broad customer base not only signifies market acceptance but also provides a robust platform for sustained growth and revenue stream diversification.

- Global Market Penetration: Presence in North America, Middle East, Africa, Asia Pacific, and India.

- Extensive Client Network: Partnered with over 2000+ clients.

- International Reach: Operations span more than 50 countries.

- Foundation for Growth: Global footprint supports future expansion and revenue diversification.

Improved Financial Performance and Debt Management

3i Infotech has demonstrated a notable turnaround in its financial performance, with a consolidated net profit reported for the March 2025 quarter and a positive net income in the first quarter of 2025. This recovery signals improved operational efficiency and market reception.

The company's financial health is further bolstered by its prudent debt management. With a low debt-to-equity ratio, 3i Infotech exhibits a strong balance sheet, minimizing financial risk and enhancing its capacity for future investments and growth initiatives.

Furthermore, 3i Infotech has actively focused on optimizing its working capital by reducing receivables. This strategic move improves cash flow and demonstrates a commitment to efficient financial operations, which is a key strength.

- Improved Profitability: Reported consolidated net profit in March 2025 quarter and positive net income in Q1 2025.

- Strong Debt Management: Maintains a low debt-to-equity ratio, indicating financial stability.

- Working Capital Efficiency: Demonstrated focus on reducing receivables to enhance cash flow.

3i Infotech's diverse service portfolio, covering BFSI, ERP, cloud, and analytics, allows it to cater to a broad range of client needs. Their deep domain expertise in sectors like banking and insurance is a significant advantage, enabling tailored solutions. The company's specialization in digital transformation, encompassing AI, ML, and cloud, positions it at the forefront of technological advancements.

The company's strategic focus on high-growth areas and operational excellence, including robust internal controls, drives efficiency and profitability. This is reflected in their fiscal year ending March 31, 2024, revenue growth from digital transformation services of 15% year-over-year.

Their global presence across North America, the Middle East, Africa, Asia Pacific, and India, coupled with over 2000 clients in more than 50 countries, provides a strong foundation for sustained growth and revenue diversification.

Financially, 3i Infotech has shown a positive turnaround, reporting a consolidated net profit in the March 2025 quarter and positive net income in Q1 2025. This is supported by prudent debt management, evidenced by a low debt-to-equity ratio, and improved working capital efficiency through reduced receivables.

| Strength | Description | Supporting Data/Fact |

| Diverse Service Portfolio | Offers a wide range of IT solutions across multiple industries. | Covers BFSI, ERP, cloud, data analytics, and infrastructure management. |

| Domain Expertise | Possesses specialized knowledge in key sectors. | Deep focus on BFSI, healthcare, and government sectors. |

| Digital Transformation Focus | Specializes in helping businesses adopt emerging technologies. | Expertise in AI, ML, edge computing, 5G, blockchain, and cloud solutions. Fiscal year ending March 31, 2024, saw 15% YoY revenue growth in digital transformation services. |

| Global Reach | Operates in key international markets with a broad client base. | Presence in North America, Middle East, Africa, Asia Pacific, and India; partnered with over 2000 clients in more than 50 countries. |

| Financial Turnaround & Stability | Demonstrates improved profitability and sound financial management. | Reported consolidated net profit in March 2025 quarter; low debt-to-equity ratio; focus on working capital efficiency. |

What is included in the product

Delivers a strategic overview of 3i Infotech’s internal and external business factors, highlighting its strengths in digital transformation, weaknesses in market share, opportunities in emerging technologies, and threats from intense competition.

Offers a clear, actionable SWOT analysis that identifies key areas for improvement, helping 3i Infotech address internal weaknesses and external threats effectively.

Weaknesses

Despite recent efforts to bolster its financial performance, 3i Infotech has grappled with inconsistent profitability. The company reported a net loss for the fiscal year 2024, underscoring a persistent challenge in achieving sustained positive earnings.

This pattern of negative earnings per share in prior periods highlights a critical weakness, suggesting that the company’s financial stability remains a key area requiring significant improvement and consistent management focus to overcome.

3i Infotech has faced revenue headwinds, with a notable decline in 2024 compared to the prior year. This trend continued into the quarter ending March 2025, which saw a slight dip in sales year-over-year.

A key factor contributing to these top-line challenges is the company's strategic decision to divest from low-margin contracts. While this move aims to improve profitability, it has directly impacted overall revenue figures, creating a recognized decline.

3i Infotech continues to grapple with its legacy systems, which have contributed to a substantial amount of current liabilities. As of the third quarter of fiscal year 2024, the company reported total current liabilities of approximately ₹1,200 crore, a figure that could strain its financial flexibility.

The company has also experienced challenges with cash flow timing, where payment cycles often outpace collections. This mismatch, evidenced by a receivables turnover ratio that has hovered around 5-6 times in recent periods, can create short-term liquidity pressures, potentially impacting its ability to meet immediate financial obligations.

Highly Competitive IT Sector

The IT sector is incredibly crowded, with many companies vying for market share. This intense competition means 3i Infotech must constantly innovate and adapt to keep up. For instance, the global IT services market was valued at approximately $1.3 trillion in 2024, a figure expected to grow steadily, highlighting the sheer scale of the competitive landscape.

Sustaining growth and maintaining market position requires significant investment in research and development, as well as agile business strategies. Failure to do so can quickly lead to a decline in relevance and profitability. By the end of 2024, many IT firms were reporting increased R&D spending to combat this, with some allocating upwards of 15-20% of their revenue to innovation.

- Intense Rivalry: Numerous global and regional players compete for the same IT services contracts.

- Innovation Pressure: Constant need to develop new solutions and update existing ones to meet evolving client demands.

- Price Sensitivity: Competitive pricing pressures can impact profit margins.

- Talent Acquisition: Attracting and retaining skilled IT professionals is a challenge amidst high demand.

Management Restructuring and Leadership Changes

3i Infotech has experienced notable management restructuring, including a new CEO appointment and key executive departures. This can introduce a period of adjustment, potentially impacting the speed of executing new growth initiatives as the leadership team solidifies its direction.

The company's recent leadership shifts, while intended to drive transformation, may create temporary operational hurdles. For instance, the transition period following a new CEO's onboarding can sometimes lead to a pause in strategic decision-making as the new leadership assesses existing plans and organizational structure.

- Leadership Instability: Recent management changes, including a new CEO, can lead to a temporary lack of clear direction.

- Execution Delays: Restructuring efforts might slow down the implementation of ambitious growth strategies.

- Talent Retention Concerns: Resignations of key personnel could impact institutional knowledge and operational continuity.

3i Infotech's financial performance has been inconsistent, marked by a net loss in fiscal year 2024 and negative earnings per share in prior periods, indicating a critical need for improved financial stability.

The company faces revenue challenges, with a decline in 2024 and a slight year-over-year dip in the quarter ending March 2025, partly due to the strategic divestment of low-margin contracts.

Legacy systems contribute to substantial current liabilities, with total current liabilities reaching approximately ₹1,200 crore by Q3 FY24, potentially limiting financial flexibility.

Cash flow timing mismatches, where payment cycles outpace collections, create short-term liquidity pressures, evidenced by a receivables turnover ratio of 5-6 times.

| Financial Metric | FY24 (Approx.) | Q4 FY25 (Approx.) | Impact |

|---|---|---|---|

| Net Profit/Loss | Net Loss | Slight improvement expected | Profitability concerns |

| Revenue | Decline YoY | Slight dip YoY | Top-line pressure |

| Current Liabilities | ₹1,200 crore (Q3 FY24) | Strain on financial flexibility | |

| Receivables Turnover | 5-6 times | Liquidity pressure |

Same Document Delivered

3i Infotech SWOT Analysis

This preview reflects the real document you'll receive—a comprehensive SWOT analysis of 3i Infotech, detailing its Strengths, Weaknesses, Opportunities, and Threats. You're seeing an accurate representation of the professional, structured content you'll gain access to. Purchase unlocks the complete, in-depth report, ready for your strategic planning.

Opportunities

The widespread drive for digital transformation across various sectors is a major opportunity for 3i Infotech. Businesses are actively seeking to modernize operations, enhance customer experiences, and improve efficiency through technology. This trend is fueling a robust demand for services that 3i Infotech offers, particularly in areas like cloud migration, data analytics, and artificial intelligence.

3i Infotech's strategic alignment with these market needs is evident in its service portfolio. The company's investments and expertise in cloud computing, data analytics, and AI directly address the core requirements of businesses undergoing digital overhauls. For instance, the global digital transformation market was valued at over $7.5 trillion in 2023 and is projected to grow significantly, with many enterprises prioritizing cloud adoption and data-driven decision-making. This creates a fertile ground for 3i Infotech to leverage its capabilities and capture market share.

3i Infotech is strategically moving beyond its core BFSI sector to capture opportunities in high-growth verticals. The company is actively targeting mid-tier enterprises within Telecom, Media & Entertainment (TME), manufacturing, and healthcare, areas demonstrating significant digital transformation needs.

This expansion is coupled with a strong focus on increasing its global presence. 3i Infotech is prioritizing value-driven business acquisition and growth in key international markets, particularly the United States, aiming to diversify its revenue streams and tap into larger addressable markets.

3i Infotech actively pursues strategic partnerships and co-innovation initiatives, leveraging a startup ecosystem to tap into emerging technologies. This collaborative approach allows them to access specialized tech areas, speeding up digital transformation for clients. For instance, in early 2024, 3i Infotech announced a partnership with a leading cloud provider to enhance their managed cloud services, aiming to deliver more cost-effective and agile solutions.

Leveraging Cloud-First and Edge-Ready Offerings

3i Infotech's strategic focus on cloud-first and edge-ready solutions, exemplified by products like NuRe Cloud and NuRe Edge, positions them to capture significant market share. The increasing global demand for cloud services, projected to reach $1.3 trillion by 2025, underscores the immense opportunity. These offerings are designed to deliver enhanced security, agility, and cost efficiency, directly addressing the evolving needs of businesses seeking to modernize their IT infrastructure.

The company's investment in these advanced technologies allows them to tap into the burgeoning edge computing market, which is expected to grow substantially in the coming years. This strategic alignment with key technological trends enables 3i Infotech to provide clients with solutions that are not only future-proof but also deliver tangible benefits.

- Cloud Adoption Growth: The global public cloud market is anticipated to grow at a compound annual growth rate (CAGR) of 16.3% from 2023 to 2030, reaching an estimated $1.3 trillion by 2025.

- Edge Computing Potential: Edge computing is projected to see significant expansion, with the market expected to reach $108.7 billion by 2027, indicating strong demand for localized processing and data management.

- Client Demand for Flexibility: Surveys indicate that over 70% of organizations are increasing their investment in cloud and edge technologies to improve operational efficiency and data processing capabilities.

- NuRe Product Strategy: 3i Infotech's NuRe Cloud and NuRe Edge platforms are specifically developed to meet these growing demands for scalable, secure, and cost-effective IT solutions.

Investments in Talent and Centers of Excellence (COEs)

3i Infotech is strategically investing in its workforce, aiming to equip its teams with next-generation technology skills. This focus on talent development is crucial for staying competitive in the rapidly evolving IT landscape. The company's commitment to upskilling its employees ensures they are prepared to handle advanced technological challenges and deliver cutting-edge solutions.

The establishment of Centers of Excellence (COEs) across India and key global markets is a significant opportunity for 3i Infotech. These specialized hubs will concentrate on emerging technologies and specific industry verticals. For instance, COEs focusing on insurance, credit unions, mortgage, capital markets, 5G, and cognitive computing will bolster the company's expertise and service offerings in these high-growth areas. This strategic move is projected to enhance service capabilities and foster innovation, driving future revenue streams.

These investments are expected to yield tangible benefits. By building specialized expertise in areas like cognitive computing and 5G, 3i Infotech can position itself as a leader in these transformative technologies. For example, the company reported a significant increase in its digital transformation service revenue in FY24, a trend it aims to accelerate through these targeted investments in talent and COEs. This proactive approach to skill development and specialization is a key enabler for sustained growth and market differentiation.

Key areas of investment and focus include:

- Next-generation tech-savvy resources: Building a workforce proficient in AI, machine learning, cloud computing, and cybersecurity.

- Centers of Excellence (COEs): Establishing specialized units for insurance, credit unions, mortgage, capital markets, 5G, and cognitive computing.

- Enhanced Service Capabilities: Deepening expertise to offer more sophisticated and tailored solutions to clients.

- Future Growth Drivers: Leveraging specialized knowledge to capture opportunities in emerging technology sectors.

3i Infotech's strategic expansion into new verticals like Telecom, Media & Entertainment, manufacturing, and healthcare presents a significant growth avenue. The company's focus on increasing its global footprint, particularly in the United States, aims to diversify revenue and tap into larger markets. Furthermore, strategic partnerships and leveraging the startup ecosystem for co-innovation allow 3i Infotech to access and integrate emerging technologies rapidly, enhancing its digital transformation capabilities for clients.

The company's investment in cloud-first and edge-ready solutions, such as NuRe Cloud and NuRe Edge, directly addresses the escalating global demand for cloud services, projected to exceed $1.3 trillion by 2025. This positions 3i Infotech to capitalize on the burgeoning edge computing market, expected to reach $108.7 billion by 2027. By developing a workforce skilled in next-generation technologies and establishing specialized Centers of Excellence for areas like AI, 5G, and cognitive computing, 3i Infotech is building deep expertise to drive future revenue and market differentiation.

| Opportunity Area | Market Projection/Stat | 3i Infotech Strategy |

|---|---|---|

| Digital Transformation Services | Global digital transformation market > $7.5 trillion (2023) | Modernizing operations, enhancing customer experience |

| Cloud Computing | Global public cloud market ~$1.3 trillion (2025) | NuRe Cloud, cloud migration services |

| Edge Computing | Edge computing market $108.7 billion (2027) | NuRe Edge, localized processing solutions |

| Talent Development & Specialization | Increasing demand for AI, ML, cloud skills | Centers of Excellence for emerging tech and verticals |

Threats

The IT services landscape is fiercely competitive, featuring numerous established firms and emerging players. This intense rivalry often translates into significant pricing pressures, impacting profit margins and making it harder to win and keep clients. For instance, the global IT services market was valued at approximately $1.3 trillion in 2024, with growth projected to continue, but this also signifies a crowded marketplace where differentiation is key.

The relentless pace of technological evolution, with new platforms and disruptive business models emerging constantly, presents a significant challenge for 3i Infotech. Failure to keep up means risking outdated solutions and losing market relevance.

To counter this, 3i Infotech must invest heavily in research and development, ensuring its service portfolio remains cutting-edge. For instance, the global IT services market is projected to reach $1.5 trillion by 2025, highlighting the immense opportunity but also the intense competition driven by innovation.

Global economic headwinds, including inflation and potential recessions, pose a significant threat to 3i Infotech. A slowdown in client spending on IT services, particularly in sectors sensitive to economic cycles, could shrink project pipelines and directly impact revenue streams throughout 2024 and into 2025. For instance, a projected 0.5% contraction in global GDP for late 2024 could translate to a notable decrease in discretionary IT budgets for many enterprises.

Talent Acquisition and Retention Challenges

The IT sector, including companies like 3i Infotech, faces a significant hurdle in acquiring and keeping skilled professionals. The demand for expertise in areas such as artificial intelligence, cloud computing, and cybersecurity is soaring, creating a competitive landscape for talent. For instance, global IT services market growth was projected to reach $1.3 trillion in 2024, underscoring the need for skilled personnel.

This intense demand can make it difficult for 3i Infotech to attract top-tier candidates and retain its existing workforce. Failure to secure and hold onto these critical employees could hinder the company's capacity to execute projects effectively and drive innovation forward. Reports from late 2023 and early 2024 indicated a persistent talent gap in specialized IT roles, with some surveys showing over 70% of companies struggling to find qualified candidates.

- High demand for AI, cloud, and cybersecurity specialists.

- Increased competition for IT talent globally.

- Potential impact on project delivery and innovation capabilities.

- Industry-wide challenges in retaining experienced IT professionals.

Regulatory and Geopolitical Risks

Operating in diverse global markets means 3i Infotech must navigate a complex web of varying regulations, from data privacy laws like GDPR to local tax structures. These differing compliance demands can increase operational costs and introduce potential legal challenges. For instance, evolving data localization requirements in key markets could necessitate significant infrastructure adjustments.

Geopolitical shifts, such as trade disputes or political instability in regions where 3i Infotech has a presence, pose a direct threat. These events can disrupt supply chains, affect currency exchange rates, and even lead to the suspension of services in affected areas. The ongoing global economic climate, influenced by factors like inflation and interest rate policies in major economies, also adds a layer of uncertainty to international business operations.

- Regulatory Complexity: 3i Infotech faces a patchwork of regulations across its operating geographies, impacting compliance and operational efficiency.

- Data Privacy Scrutiny: Increased focus on data privacy, with evolving legislation globally, requires continuous adaptation and investment in security measures.

- Geopolitical Volatility: International trade relations and political stability in key markets directly influence market access and operational continuity.

- Economic Headwinds: Global economic slowdowns or inflationary pressures can impact client spending and project pipelines for IT service providers.

The IT services market is intensely competitive, with numerous players vying for market share, leading to price wars that can erode profit margins. The global IT services market was valued at approximately $1.3 trillion in 2024, a figure expected to grow, but this also signifies a crowded space where differentiation is crucial for survival and growth.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, drawing from 3i Infotech's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded perspective.