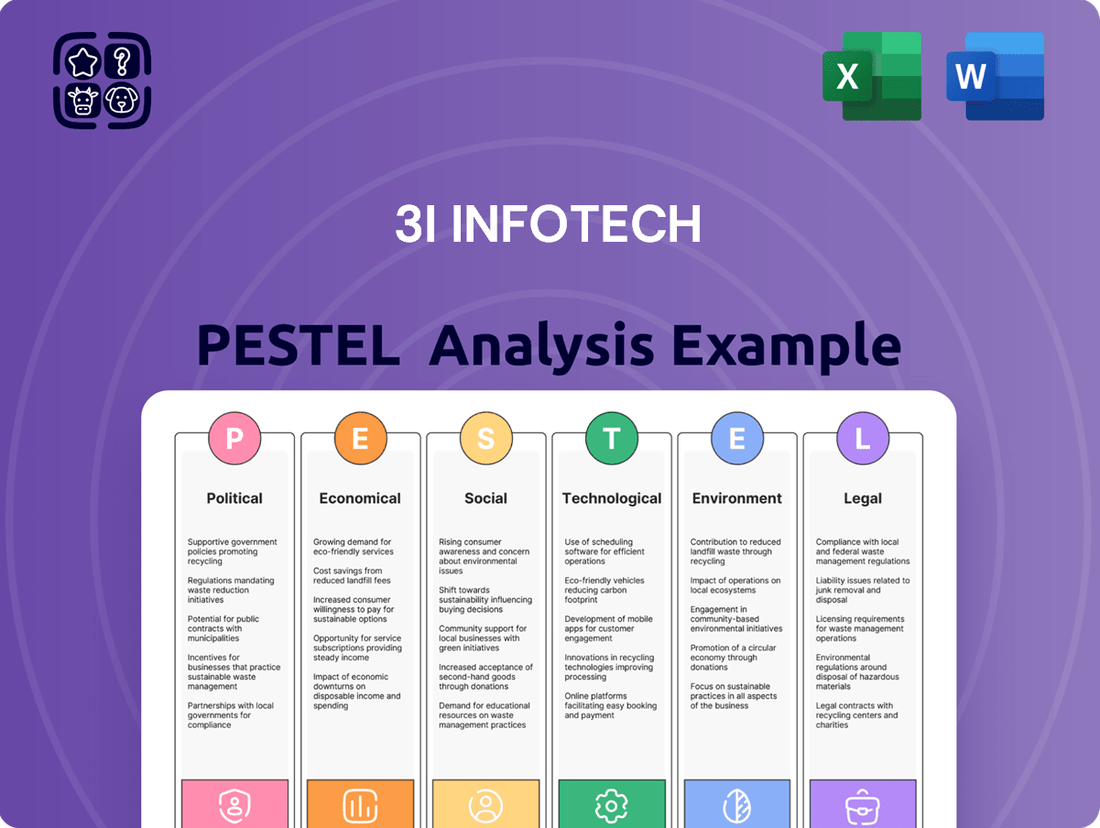

3i Infotech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Infotech Bundle

Navigate the complex external environment shaping 3i Infotech's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Gain a strategic advantage by understanding these critical forces. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies, both domestic and international, significantly influence the IT services landscape for companies like 3i Infotech. For instance, India's National Digital Communications Policy 2018, aiming to boost digital infrastructure and services, directly benefits IT providers. Similarly, international trade agreements and data localization laws, such as the EU's GDPR, shape how 3i Infotech operates globally.

Initiatives promoting digital transformation, like the Indian government's Smart Cities Mission, create substantial business opportunities for IT firms. These projects require extensive IT infrastructure, cloud solutions, and cybersecurity services, areas where 3i Infotech possesses expertise. The projected spending on India's digital economy was estimated to reach $1 trillion by 2025, underscoring the growth potential driven by such policies.

Conversely, protectionist policies or restrictions on cross-border data flow can pose challenges. For example, if a major market implements strict data localization requirements, it could increase operational costs and complexity for 3i Infotech’s service delivery models. Such policies might impact market access and necessitate adjustments to global IT strategies.

The banking, financial services, and insurance (BFSI) sector, a key market for 3i Infotech, operates within a stringent regulatory framework. For instance, in 2024, global financial regulators continued to emphasize robust data protection and cybersecurity measures, impacting how BFSI firms manage their digital infrastructure and the solutions they procure. These evolving compliance norms, including updated anti-money laundering (AML) directives and Know Your Customer (KYC) requirements, directly influence the design and functionality of 3i Infotech's offerings.

Staying ahead of these dynamic regulations is paramount for 3i Infotech’s product roadmap and maintaining client confidence. For example, the implementation of new data privacy laws in major markets during 2024 necessitated significant adjustments in software development lifecycles for companies serving the BFSI sector, requiring proactive adaptation to ensure continued market relevance and client trust.

Global geopolitical stability and India's trade relations significantly influence 3i Infotech's outsourcing contracts and international growth. For instance, the ongoing geopolitical shifts in Eastern Europe and the Middle East, while not directly impacting 3i Infotech's core markets, contribute to a general global economic uncertainty that can affect client spending on IT services.

Bilateral trade relations between India and key markets like North America and Europe are crucial. As of early 2024, trade volumes remain robust, but potential protectionist policies or changes in visa regulations could impact talent mobility, a critical factor for IT service providers like 3i Infotech. The IT sector's contribution to India's exports, which stood at approximately $150 billion in FY23, underscores the importance of stable international trade environments.

Data Sovereignty and Privacy Laws

The global push for data sovereignty and stricter privacy laws significantly shapes 3i Infotech's operations. Companies must now ensure client data is stored and processed within specific geographical boundaries and adheres to evolving privacy standards.

Compliance with regulations such as the European Union's General Data Protection Regulation (GDPR) and India's Digital Personal Data Protection Bill (DPDPB), which came into effect in August 2023, is critical. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial implications of non-compliance.

- GDPR: Affects data processing for EU citizens, with significant penalties for breaches.

- CCPA/CPRA: California's laws grant consumers more control over their personal information.

- India's DPDPB: Establishes rules for processing digital personal data, requiring consent and impacting data transfer mechanisms.

- Data Localization: Many countries are mandating that data generated within their borders must remain within those borders.

Taxation Policies and Incentives

Government taxation policies significantly shape 3i Infotech's financial landscape. Corporate tax rates directly impact profitability, while incentives for IT and research and development (R&D) can encourage investment in innovation and growth. Special Economic Zone (SEZ) benefits, where applicable, offer further advantages for operational costs and expansion.

Favorable tax regimes can boost 3i Infotech's bottom line and encourage strategic investments. For instance, India's corporate tax rate was reduced to 22% for domestic companies not availing exemptions in 2019, with a further option for a lower 15% rate for new manufacturing companies. Such policies can make investing in R&D and expanding operations more attractive.

- Corporate Tax Rates: India's standard corporate tax rate of 22% (effective FY20-21) provides a baseline for 3i Infotech's tax liabilities.

- R&D Incentives: The Indian government offers weighted tax deductions for R&D expenditure under Section 35(1)(iii) of the Income Tax Act, potentially reducing effective tax burdens for innovative companies like 3i Infotech.

- SEZ Benefits: Companies operating within SEZs can benefit from exemptions on customs duties, GST, and income tax for a specified period, enhancing cost competitiveness.

Government regulations and policies are pivotal for 3i Infotech, influencing everything from data handling to market access. The Indian government's focus on digital infrastructure, such as the National Digital Communications Policy, creates a fertile ground for IT service providers. Conversely, international data localization mandates and evolving privacy laws like GDPR and India's DPDPB (Digital Personal Data Protection Bill) necessitate careful compliance, impacting operational strategies and potentially increasing costs.

The BFSI sector, a core market for 3i Infotech, is particularly sensitive to regulatory shifts. In 2024, global financial watchdogs continued to stress robust cybersecurity and data protection. New AML and KYC directives directly shape the features and security protocols of the software solutions 3i Infotech provides to its financial clients, demanding constant adaptation.

Geopolitical stability and international trade agreements are also key political factors. While direct impacts may be minimal, global uncertainties can influence client IT spending. India's trade relations with major markets like North America and Europe are crucial for talent mobility and market access, with IT exports from India reaching approximately $150 billion in FY23, highlighting the sector's reliance on a stable global environment.

| Political Factor | Impact on 3i Infotech | Supporting Data/Example (2023-2025) |

| Digital India Initiatives | Creates demand for IT infrastructure and services. | India's digital economy projected to reach $1 trillion by 2025. |

| Data Privacy Regulations (GDPR, DPDPB) | Requires strict compliance, impacting data handling and operations. | GDPR fines up to 4% of global annual revenue or €20 million. DPDPB effective August 2023. |

| Trade Relations & Geopolitics | Influences market access, talent mobility, and client IT spending. | India's IT exports ~$150 billion in FY23; potential impact from global uncertainties. |

| BFSI Sector Regulations | Drives demand for secure and compliant IT solutions. | Continued emphasis on cybersecurity and data protection in financial services in 2024. |

What is included in the product

This PESTLE analysis examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, impact 3i Infotech's strategic landscape.

It provides actionable insights for identifying emerging threats and opportunities, enabling proactive decision-making and robust business planning.

This PESTLE analysis for 3i Infotech offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for efficient strategic discussions.

Economic factors

Global economic expansion is a significant tailwind for IT services firms like 3i Infotech. As economies grow, businesses tend to increase their technology budgets to drive efficiency and innovation. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a potentially more favorable environment for IT investments.

Conversely, economic slowdowns can dampen IT spending. Companies facing reduced revenues or uncertainty often pare back discretionary expenditures, including technology projects. If global GDP growth falters, 3i Infotech could see a slowdown in new project wins and a potential delay in payments from existing clients.

Industry-specific IT spending forecasts are also crucial. For example, reports from Gartner and IDC in late 2023 and early 2024 indicated continued robust spending in areas like cloud computing and cybersecurity, which are core offerings for many IT companies. However, spending on less critical areas might be more susceptible to economic headwinds.

Currency exchange rate fluctuations present a significant factor for 3i Infotech as a global IT services provider. With operations and client bases spanning multiple countries, the company's financial performance is directly impacted by the relative strength of the Indian Rupee (INR) against major currencies such as the US Dollar (USD) and the Euro (EUR).

For instance, in early 2024, the INR experienced moderate volatility against the USD, with rates fluctuating around 83 INR to the dollar. This volatility means that when 3i Infotech earns revenue in USD, a stronger dollar translates to more INR upon repatriation, boosting reported profits. Conversely, a weaker dollar or a stronger Rupee can reduce the INR value of its foreign earnings, impacting profitability and potentially making its services less competitive in dollar-denominated markets.

Managing this exposure is crucial. Companies like 3i Infotech often employ hedging strategies, such as forward contracts or options, to lock in exchange rates for anticipated transactions. This helps to mitigate the unpredictable impact of currency swings on their financial statements and maintain pricing stability for international clients.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for 3i Infotech. Increased costs for skilled IT professionals and essential infrastructure, such as cloud services and hardware, directly impact operational expenditures. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2024, and while forecasts suggest a moderation, elevated levels are expected to persist, directly affecting 3i Infotech's cost of doing business and potentially its profit margins.

Fluctuations in interest rates, particularly those set by central banks like the US Federal Reserve, have a dual impact. Higher rates increase the cost of capital for 3i Infotech if it needs to borrow for expansion or acquisitions. Concurrently, clients may scale back IT investments or delay projects due to increased borrowing costs for their own operations, affecting 3i Infotech's revenue streams. The expected trajectory of interest rate adjustments in 2024 and 2025 will therefore be a critical factor in the company's financial planning and market demand for its services.

Competition and Pricing Pressures

The IT services sector is fiercely competitive, with established global giants and agile regional players constantly vying for market share. This dynamic environment often translates into significant pricing pressures, forcing companies like 3i Infotech to focus on value-added services and operational efficiency to remain profitable.

In 2024, the global IT services market was valued at an estimated $1.3 trillion, with growth projected to continue. This intense competition necessitates differentiation through specialized solutions, superior service quality, and cost-effectiveness.

- Intense Competition: The IT services market is crowded with numerous global and local vendors.

- Pricing Pressures: Fierce competition often leads to downward pressure on service pricing.

- Differentiation is Key: Companies must stand out through specialized offerings and service quality.

- Cost-Effectiveness: Maintaining profitability requires efficient operations and competitive pricing strategies.

Availability of Capital and Investment Climate

The availability of capital significantly impacts 3i Infotech's ability to fund its growth, including expansion, mergers, and research and development. In 2024, the global IT services market continued to see robust investment, with venture capital funding for technology firms remaining strong, albeit with a more discerning approach compared to earlier periods. This environment allows companies like 3i Infotech to seek capital for strategic initiatives.

A positive investment climate, marked by investor confidence and accessible funding, is vital for 3i Infotech to execute its strategic plans. For instance, the Indian IT sector, where 3i Infotech operates, has benefited from government initiatives promoting digital transformation and innovation. This has led to increased foreign direct investment in the technology sector, creating a more favorable landscape for capital deployment.

- IT Services Market Growth: The global IT services market was projected to reach over $1.3 trillion in 2024, indicating a strong demand for capital to support expansion within this sector.

- Venture Capital Trends: While specific figures for 3i Infotech's capital access aren't public, broader venture capital funding for technology in India saw significant inflows in late 2023 and early 2024, demonstrating investor interest.

- Digital Transformation Investments: Increased spending on digital transformation by enterprises worldwide directly fuels the need for capital in IT service providers like 3i Infotech to scale operations and develop new solutions.

Global economic conditions significantly influence 3i Infotech's performance. The IMF projected global growth at 3.2% for 2024, suggesting a generally supportive environment for IT spending, though economic slowdowns can curb client investments. Inflationary pressures in 2024 and into 2025 are increasing operational costs for IT firms, impacting profit margins. Interest rate hikes also raise capital costs and can deter client spending on technology projects.

| Economic Factor | Impact on 3i Infotech | 2024/2025 Data/Projections |

|---|---|---|

| Global GDP Growth | Drives IT spending; slowdowns reduce it. | IMF projected 3.2% global growth in 2024. |

| Inflation | Increases operational costs (salaries, infrastructure). | Elevated inflation expected to persist into 2025. |

| Interest Rates | Affects cost of capital and client investment capacity. | Central banks maintained higher rates through early 2024. |

| Currency Exchange Rates | Impacts profitability of foreign earnings. | INR volatility against USD observed in early 2024 (approx. 83 INR/USD). |

Same Document Delivered

3i Infotech PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of 3i Infotech delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The surge in digital adoption, evidenced by a projected global internet penetration rate reaching 70% by the end of 2024, directly fuels demand for 3i Infotech's digital transformation services. Evolving customer behaviors, with a significant portion of transactions and interactions moving online, necessitate sophisticated digital platforms and data analytics, areas where 3i Infotech specializes.

The availability of skilled IT professionals, especially in specialized fields like cloud, AI, and cybersecurity, is a significant sociological consideration for 3i Infotech. The intense global competition for talent, coupled with persistent skill shortages, necessitates substantial investment in recruitment, upskilling initiatives, and employee retention to ensure project execution and service excellence.

The global workforce is experiencing significant generational shifts, with millennials and Gen Z now comprising a larger portion of employees. These younger generations often prioritize work-life balance and flexible arrangements, pushing companies like 3i Infotech to adapt their human resource policies. For instance, a 2024 survey indicated that over 70% of Gen Z employees consider flexible work options a key factor when choosing an employer.

Furthermore, the emphasis on diversity, equity, and inclusion (DEI) continues to grow. Companies that actively foster inclusive environments are better positioned to attract and retain top talent. In 2025, it's estimated that businesses with strong DEI initiatives see a 15-20% higher employee retention rate compared to those with weaker programs, directly impacting 3i Infotech's ability to build a skilled and motivated workforce.

Ethical Considerations in AI and Data Usage

Societal awareness around AI ethics and data privacy is significantly increasing, directly influencing how companies like 3i Infotech operate and are perceived. This heightened public scrutiny means that transparent and responsible data handling is no longer optional but a core requirement for maintaining trust. For instance, by mid-2024, over 70% of consumers expressed concerns about how their personal data is used by technology companies, according to a global survey.

3i Infotech must therefore embed ethical considerations into its AI development and deployment. This involves not only complying with existing regulations but also proactively adopting best practices in responsible AI, such as fairness, accountability, and transparency. Failure to do so risks reputational damage and potential loss of business. The company's commitment to ethical AI can be a key differentiator in a crowded market.

- Data Privacy Compliance: Ensuring adherence to regulations like GDPR and CCPA, which saw significant enforcement actions in 2023-2024.

- Algorithmic Bias Mitigation: Actively working to identify and reduce biases in AI algorithms to promote fairness.

- Transparency in AI Usage: Clearly communicating to clients and end-users how AI is being used and what data it relies on.

- Ethical AI Frameworks: Developing and implementing internal guidelines for the responsible creation and deployment of AI technologies.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility (CSR) are increasingly shaping how companies like 3i Infotech operate and are perceived. This means that beyond just financial performance, how a company impacts the environment, its employees, and the wider community is under scrutiny.

Engaging in robust CSR initiatives, such as adopting sustainable IT practices or contributing to local digital literacy programs, can significantly boost 3i Infotech's brand image. For instance, a 2024 survey indicated that over 60% of consumers consider a company's CSR efforts when making purchasing decisions. This trend is expected to grow, making ethical conduct and community involvement crucial for attracting and retaining clients who value responsible partnerships.

- Enhanced Reputation: Strong CSR programs can differentiate 3i Infotech in a competitive market.

- Talent Attraction: Socially conscious employees are drawn to organizations with a clear commitment to CSR, with studies showing a 15% higher retention rate in companies with strong ethical frameworks.

- Stakeholder Relations: Positive CSR engagement builds trust and strengthens relationships with investors, customers, and the public.

The increasing demand for digital services, with global internet penetration projected to hit 70% by the end of 2024, directly benefits 3i Infotech's core business. Evolving consumer behaviors, favoring online interactions, necessitate the sophisticated digital solutions 3i Infotech provides.

Generational shifts in the workforce, where younger employees prioritize work-life balance, compel 3i Infotech to adapt its HR policies, as over 70% of Gen Z consider flexible work a key factor in employment. Similarly, a growing emphasis on diversity, equity, and inclusion (DEI) is crucial, with companies strong in DEI seeing up to 20% higher retention rates in 2025.

Societal awareness regarding AI ethics and data privacy is a significant factor, with over 70% of consumers in a mid-2024 survey expressing concerns about data usage. This necessitates 3i Infotech's commitment to transparent data handling and ethical AI development to maintain trust and avoid reputational damage.

Corporate social responsibility (CSR) is also increasingly influencing purchasing decisions, with over 60% of consumers in a 2024 survey considering a company's CSR efforts. This makes 3i Infotech's engagement in sustainable practices and community programs vital for brand image and client acquisition.

| Sociological Factor | Impact on 3i Infotech | Supporting Data (2024/2025) |

|---|---|---|

| Digital Adoption & Evolving Consumer Behavior | Increased demand for digital transformation services. | Global internet penetration projected at 70% by end of 2024. |

| Generational Workforce Shifts | Need for flexible work policies and focus on work-life balance. | Over 70% of Gen Z consider flexible work a key employment factor. |

| Diversity, Equity, and Inclusion (DEI) | Enhanced talent attraction and retention. | Companies with strong DEI initiatives see 15-20% higher employee retention (2025 estimate). |

| AI Ethics & Data Privacy Awareness | Requirement for transparent data handling and responsible AI. | Over 70% of consumers concerned about personal data usage (mid-2024 survey). |

| Corporate Social Responsibility (CSR) | Importance for brand image and client acquisition. | Over 60% of consumers consider CSR in purchasing decisions (2024 survey). |

Technological factors

Cloud computing's pervasive adoption, encompassing Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), alongside hybrid and multi-cloud strategies, significantly impacts 3i Infotech's core business. The company's reliance on offering cloud-based solutions and migration services means staying abreast of advancements in these areas is paramount for its competitive standing.

As of early 2024, the global cloud computing market was projected to reach over $700 billion, with continued strong growth expected through 2025. For 3i Infotech, this trend underscores the immense opportunity but also the necessity of forging and maintaining robust partnerships with key cloud providers like AWS, Azure, and Google Cloud to enhance service offerings and ensure seamless integration for clients.

The continuous evolution of cloud technologies, including serverless computing and edge computing, presents both challenges and opportunities for 3i Infotech. Successfully navigating these advancements, coupled with a strong focus on cloud security and compliance, is crucial for maintaining a competitive edge and building client trust in an increasingly complex digital landscape.

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) presents a significant technological shift impacting 3i Infotech's market. These advancements are not just opportunities but necessities for staying competitive in sectors like BFSI and ERP.

By embedding AI/ML into its core offerings, 3i Infotech can develop more sophisticated, data-driven analytics for its clients. For instance, AI-powered fraud detection in BFSI solutions could significantly reduce financial losses for institutions, a critical need in the current economic climate.

Furthermore, leveraging AI for internal process automation, such as in customer support or software development lifecycle management, can lead to substantial cost savings and improved efficiency. Reports indicate that companies adopting AI for automation can see operational cost reductions of up to 20% by 2025.

The sheer volume of data generated globally is staggering, creating a critical need for businesses to extract meaningful insights. 3i Infotech's proficiency in data analytics and business intelligence directly addresses this demand, enabling clients to leverage their data for better decision-making and operational efficiency. The company's investment in these areas is paramount to staying competitive.

As of early 2024, the global big data market was projected to reach over $229 billion, highlighting the immense opportunity. 3i Infotech's focus on data warehousing and advanced analytics solutions positions them to capitalize on this trend, offering clients the tools to transform raw data into actionable intelligence and optimize their business strategies.

Cybersecurity Threats and Solutions

The increasing complexity of cyber threats demands that 3i Infotech implement and offer advanced cybersecurity solutions. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial risk. For 3i Infotech, safeguarding its own digital assets and those of its clients is critical for business continuity and reputation.

Maintaining client trust and regulatory compliance, such as GDPR and India's Digital Personal Data Protection Act, hinges on effective data protection. The company must continuously invest in and adapt its cybersecurity strategies to counter evolving threats like ransomware and sophisticated phishing attacks. This includes offering services that ensure data integrity and secure client operations.

- Escalating Threat Landscape: Cyberattacks are becoming more frequent and sophisticated, impacting businesses globally.

- Need for Robust Solutions: 3i Infotech must provide and utilize strong cybersecurity measures to protect itself and its clients.

- Data Protection Imperative: Ensuring the security of sensitive client data is paramount for maintaining trust and adhering to regulations.

- Investment in Security: Continuous investment in advanced cybersecurity technologies and practices is essential for competitive advantage.

Automation and Robotic Process Automation (RPA)

The growing integration of automation and Robotic Process Automation (RPA) is a significant technological trend reshaping industries by driving efficiency. 3i Infotech is positioned to benefit by both adopting RPA internally to optimize its own processes and by providing these solutions to its clientele, helping them automate routine tasks, cut expenses, and boost overall operational effectiveness.

The global RPA market is projected to reach substantial figures, with some estimates suggesting it could exceed $10 billion by 2025, underscoring the immense demand for these technologies. For 3i Infotech, this presents a dual opportunity: to enhance internal productivity through RPA adoption and to capture market share by offering these transformative services to a broad client base seeking cost savings and improved accuracy.

- Market Growth: The worldwide RPA market is expected to see robust growth, with forecasts indicating it will surpass $10 billion by 2025.

- Efficiency Gains: Businesses adopting RPA can achieve significant improvements in operational efficiency, with studies showing reductions in processing times by up to 80%.

- Cost Reduction: RPA implementation can lead to substantial cost savings, often reported in the range of 25% to 50% for automated processes.

- 3i Infotech's Role: The company can leverage RPA to streamline its internal operations and offer these solutions to clients, driving digital transformation and competitive advantage.

The increasing demand for advanced analytics and business intelligence tools is a key technological factor for 3i Infotech. Companies are actively seeking ways to derive actionable insights from their vast data reserves. The global big data market was projected to exceed $229 billion by early 2024, indicating a substantial opportunity for 3i Infotech to provide data warehousing and analytics solutions.

The rapid advancement of Artificial Intelligence (AI) and Machine Learning (ML) is transforming industries, particularly BFSI and ERP sectors, where 3i Infotech operates. By integrating AI/ML into its offerings, the company can deliver more sophisticated analytics, such as AI-powered fraud detection, which is critical for financial institutions. Reports suggest that companies leveraging AI for automation could see operational cost reductions of up to 20% by 2025.

The growing integration of automation and Robotic Process Automation (RPA) offers significant efficiency gains for businesses. 3i Infotech can both adopt RPA internally and offer these solutions to clients, helping them automate routine tasks and reduce expenses. The global RPA market was expected to surpass $10 billion by 2025, highlighting the strong demand for such technologies and the potential for 3i Infotech to capture market share.

The escalating threat landscape necessitates robust cybersecurity solutions, as cybercrime costs were projected to reach $10.5 trillion annually in 2024. 3i Infotech must continuously invest in advanced cybersecurity measures to protect its own assets and those of its clients, ensuring data integrity and regulatory compliance with evolving data protection laws.

Legal factors

Global and regional data privacy laws like GDPR, CCPA, and India's DPDP Bill are crucial for 3i Infotech, given its extensive client data handling. Compliance is non-negotiable, demanding strong data governance, consent management, and secure processing.

Protecting its intellectual property, such as its software and proprietary solutions, is crucial for 3i Infotech to maintain its competitive advantage. This includes safeguarding its unique methodologies and codebases from infringement.

Ensuring compliance with intellectual property laws and licensing agreements for all third-party software and components used in its operations is equally vital. This proactive approach helps 3i Infotech avoid costly legal disputes and maintain its reputation.

Contract law and Service Level Agreements (SLAs) form the bedrock of 3i Infotech's client relationships and project execution. These legal frameworks dictate the terms of service, performance metrics, and responsibilities, ensuring clarity and accountability in all engagements. For instance, a robust SLA might specify uptime guarantees of 99.9% for cloud services, with penalties for non-compliance, directly impacting revenue and client satisfaction.

Effective management of contractual obligations and liabilities is paramount for 3i Infotech's sustained growth and risk mitigation. Clear definitions within contracts, especially regarding intellectual property rights and data security, prevent disputes and safeguard the company's interests. In 2024, the global IT services market, where 3i Infotech operates, saw significant contract value growth, underscoring the importance of well-structured agreements.

Industry-Specific Regulations (e.g., BFSI Compliance)

Beyond general IT laws, 3i Infotech must navigate specific regulatory frameworks pertinent to its target industries, especially BFSI. For instance, in India, the Reserve Bank of India (RBI) mandates strict compliance for financial institutions, impacting how technology providers like 3i Infotech design and implement solutions. The increasing focus on data privacy, as seen with global regulations like GDPR and its local equivalents, also necessitates robust security and compliance features in their software.

Regulations related to financial transactions, anti-money laundering (AML), Know Your Customer (KYC), and regulatory reporting require specialized compliance solutions and expertise within 3i Infotech's offerings. For example, the digital transformation in banking means that platforms must adhere to evolving standards for secure online transactions and customer verification. Failure to comply can lead to significant penalties, impacting revenue and reputation.

Key regulatory areas impacting 3i Infotech's BFSI clients include:

- Data Security and Privacy: Adherence to regulations like India's Digital Personal Data Protection Act, 2023, which mandates secure handling of personal data.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Implementing solutions that facilitate robust identity verification and transaction monitoring to prevent financial crimes.

- Regulatory Reporting: Providing systems that enable accurate and timely submission of financial reports to regulatory bodies, such as those required by SEBI or RBI.

- Cybersecurity Mandates: Ensuring their software meets stringent cybersecurity standards to protect sensitive financial data from breaches.

Labor Laws and Employment Regulations

3i Infotech must navigate a complex web of labor laws across its operating regions, impacting everything from recruitment to employee separation. This includes adhering to regulations on working hours, statutory benefits, and fair dismissal procedures. For instance, in India, the Code on Wages, 2019, aims to consolidate laws related to wages, bonus payments, and employee benefits, setting new benchmarks for compliance.

Ensuring fair labor practices is paramount to mitigating legal risks. This involves strict adherence to hiring protocols, defining clear terms for employee benefits, and managing non-compete agreements effectively. A significant aspect is compliance with termination policies, which vary greatly by jurisdiction and can involve notice periods and severance pay requirements.

The company's commitment to these regulations is vital for maintaining a positive employee relations environment. For example, in the UK, the Employment Rights Act 1996 governs many aspects of the employer-employee relationship, including unfair dismissal claims. Recent data from the UK's Advisory, Conciliation and Arbitration Service (ACAS) indicates a continued focus on fair dispute resolution in workplaces.

- Compliance with Indian Labor Codes: Adherence to the new labor codes, such as the Code on Wages, 2019, which impacts minimum wage and overtime calculations for 3i Infotech's Indian workforce.

- Global Employment Standards: Meeting diverse international labor regulations, including those concerning working hours and employee benefits in countries like the US and UAE, which have distinct legal frameworks.

- Risk Mitigation: Proactive management of HR legal risks by ensuring all hiring, contract, and termination practices align with local labor laws, thereby avoiding penalties and litigation.

3i Infotech's operations are heavily influenced by evolving data privacy regulations, such as India's Digital Personal Data Protection Act, 2023, and global standards like GDPR. Compliance necessitates robust data governance and secure processing, impacting how client data is handled and protected. The company must also ensure its intellectual property, including software solutions, is safeguarded against infringement.

Environmental factors

3i Infotech, like many IT firms, faces scrutiny over its energy consumption and resulting carbon footprint, primarily from its data centers and office operations. The company's commitment to sustainability is increasingly vital as clients and investors demand demonstrable action on environmental impact.

The global push for net-zero emissions is intensifying regulatory pressure, pushing companies like 3i Infotech to adopt energy-efficient technologies and explore renewable energy sources. For instance, the IT sector's global carbon emissions were estimated to be around 2.1% of the total in 2023, a figure that is under constant review and pressure to decrease.

The growing volume of electronic waste (e-waste) presents a significant environmental challenge. Globally, e-waste generation is projected to reach 74.7 million metric tons by 2030, a substantial increase from 53.6 million metric tons in 2019. This trend necessitates responsible management practices for companies like 3i Infotech.

3i Infotech must implement robust e-waste management strategies, focusing on proper disposal and recycling of its own IT hardware. This includes exploring partnerships with certified e-waste recyclers and potentially offering clients guidance on sustainable IT asset lifecycle management, aligning with increasing regulatory pressures and corporate social responsibility expectations.

Clients, especially large corporations, are increasingly seeking 'green IT' solutions to minimize their environmental footprint. This trend presents a significant opportunity for 3i Infotech to align its offerings with sustainability goals.

By providing eco-friendly cloud services, energy-efficient software, and expert consulting on sustainable IT practices, 3i Infotech can tap into this growing market. For instance, the global green IT market was valued at approximately $20.4 billion in 2023 and is projected to reach $50.3 billion by 2028, demonstrating substantial client appetite for such solutions.

Climate Change Impact and Business Continuity

Climate change presents significant environmental challenges, with extreme weather events increasingly disrupting global supply chains and impacting physical infrastructure. For 3i Infotech, this translates to potential risks for business continuity, necessitating a proactive approach to resilience. The company must evaluate these climate-related vulnerabilities and integrate robust disaster recovery plans and geographically diversified infrastructure to mitigate potential operational disruptions.

The increasing frequency and intensity of climate-related events, such as floods and heatwaves, pose a direct threat to operational stability. For instance, a report by Swiss Re in 2023 estimated that global warming of 2°C could lead to a 11-14% reduction in global GDP by 2050 due to physical risks. This underscores the need for businesses like 3i Infotech to fortify their operations against such eventualities.

- Supply Chain Vulnerability: Extreme weather events in 2024, like the widespread flooding in Southeast Asia, impacted critical IT hardware manufacturing hubs, potentially delaying component deliveries for technology firms.

- Infrastructure Risk: Rising sea levels and increased storm surges threaten coastal data centers, a critical asset for cloud-based service providers.

- Operational Resilience: Investing in geographically dispersed data centers and cloud-agnostic strategies can reduce single points of failure.

- Disaster Recovery Planning: Enhancing business continuity plans with specific protocols for climate-induced disruptions is paramount for maintaining service levels.

Environmental Regulations and Reporting

Environmental regulations are becoming more stringent globally, impacting businesses like 3i Infotech. These rules cover areas such as carbon emissions, waste disposal, and the sourcing of materials, requiring companies to adapt their operations and reporting practices. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024, mandates extensive environmental disclosures for a broad range of companies, including those in the tech sector. This means 3i Infotech needs to actively track these evolving legal landscapes to ensure ongoing compliance and to integrate sustainability into its core business strategies.

The increasing focus on environmental, social, and governance (ESG) factors means that companies are under pressure to demonstrate their commitment to sustainability. This often involves detailed reporting on environmental performance. For example, many organizations are now expected to measure and report their Scope 1, 2, and 3 emissions. 3i Infotech must therefore invest in robust systems for data collection and analysis to meet these reporting requirements accurately. Proactive environmental management is not just about compliance; it's also about building trust with stakeholders and enhancing brand reputation in a market increasingly sensitive to ecological impact.

Key areas of environmental focus for 3i Infotech include:

- Emissions Reduction: Implementing strategies to lower greenhouse gas emissions from operations and data centers.

- Waste Management: Developing programs for responsible disposal and recycling of electronic waste and other operational byproducts.

- Sustainable Procurement: Prioritizing vendors and suppliers who adhere to environmental best practices and ethical sourcing.

- Water Usage: Monitoring and optimizing water consumption, particularly in data center operations.

Environmental factors are critical for 3i Infotech, influencing its operational costs, regulatory compliance, and market positioning. The company must navigate increasing pressure to reduce its carbon footprint, manage e-waste responsibly, and adapt to the physical risks posed by climate change.

The global push for sustainability, exemplified by the EU's CSRD in 2024, mandates detailed environmental reporting, requiring 3i Infotech to invest in robust data collection and analysis systems. This focus on ESG factors is also driving client demand for green IT solutions, a market projected to grow significantly, reaching an estimated $50.3 billion by 2028.

Climate change impacts, such as extreme weather events, pose risks to business continuity, necessitating investments in resilient infrastructure and disaster recovery planning. The IT sector's global carbon emissions, estimated at 2.1% in 2023, highlight the sector's environmental responsibility.

| Environmental Factor | Impact on 3i Infotech | Key Data/Trend |

| Carbon Footprint & Energy Consumption | Operational costs, regulatory compliance, client demand for green IT | IT sector emissions ~2.1% of global total (2023) |

| E-waste Management | Resource management, regulatory fines, brand reputation | Global e-waste projected to reach 74.7M metric tons by 2030 |

| Climate Change Risks | Business continuity, infrastructure resilience, supply chain disruption | 2°C warming could reduce global GDP by 11-14% by 2050 (Swiss Re) |

| Green IT Market Growth | Opportunity for new service offerings and revenue | Green IT market valued at ~$20.4B (2023), projected to reach $50.3B by 2028 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for 3i Infotech is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading technology industry research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the IT sector.