3i Infotech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Infotech Bundle

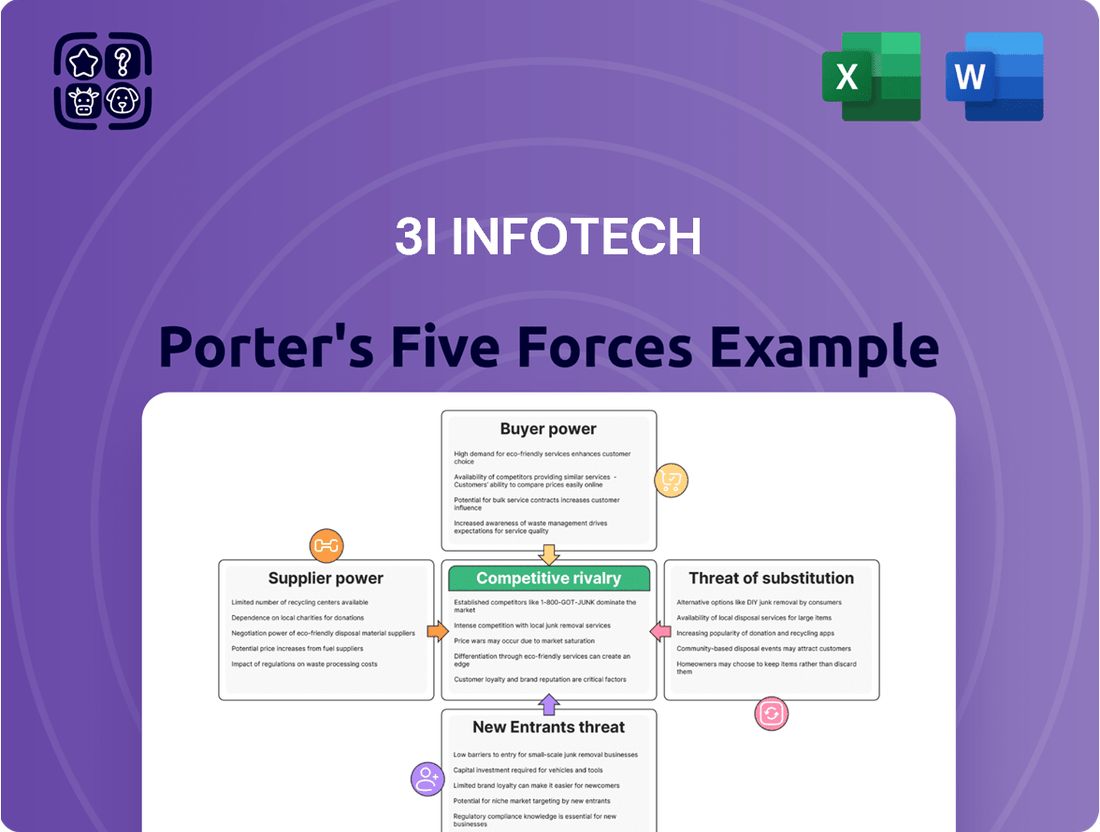

3i Infotech faces moderate bargaining power from buyers due to readily available alternatives in the IT services sector, while the threat of new entrants is significant given the relatively low barriers to entry in certain segments.

The competitive rivalry within the IT services landscape is intense, with established players and emerging firms constantly vying for market share, impacting pricing and innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 3i Infotech’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of a highly skilled workforce, especially in cutting-edge fields like AI, machine learning, and data analytics, directly influences supplier power. A scarcity of this specialized talent can amplify the bargaining leverage of employees and niche contractors, potentially driving up wage expectations and operational expenditures for 3i Infotech.

India's IT sector is grappling with a significant talent deficit. In 2025, a staggering 80% of employers reported challenges in sourcing qualified personnel, with a pronounced shortage observed in critical areas such as artificial intelligence, cybersecurity, and advanced data analytics.

Proprietary software and technology providers can wield significant bargaining power over 3i Infotech, particularly when their solutions are highly specialized or deeply embedded within the company's core offerings like BFSI, ERP, or cloud services. For instance, if 3i Infotech's competitive edge relies on a unique data analytics platform from a single vendor, that vendor could leverage its position to influence pricing and contract terms. This reliance is a key factor in assessing supplier influence.

The bargaining power of hardware and infrastructure providers, such as cloud service giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, is a significant factor for companies like 3i Infotech. This power is generally considered moderate to high.

While 3i Infotech, like many tech firms, relies on these cloud platforms for its operations and service delivery, the cloud infrastructure market is highly concentrated. This concentration means a few dominant players dictate terms, influencing pricing and the specifics of service level agreements (SLAs). The global cloud computing market's robust growth trajectory, projected to reach hundreds of billions of dollars by 2025, underscores the continued high demand and thus the leverage these suppliers hold.

Niche Technology and Consulting Services

For highly specialized niche technologies or consulting expertise that 3i Infotech might need, especially for complex digital transformation projects, suppliers can indeed wield significant bargaining power. This is primarily due to the unique nature of their offerings and the often limited pool of providers possessing such advanced capabilities. Think of areas requiring cutting-edge research or very specific, deep industry knowledge; in these scenarios, suppliers can justify and command higher prices.

This elevated supplier power is particularly evident when 3i Infotech seeks specialized AI development talent or cybersecurity consulting with deep expertise in emerging threats. For instance, the global market for specialized AI consulting services was projected to grow significantly, with some segments experiencing double-digit annual growth rates leading up to 2024, indicating strong demand and limited supply for top-tier expertise.

- Limited Availability of Niche Skills: Suppliers with highly specific, in-demand technical skills, such as quantum computing integration or advanced blockchain development, face fewer competitors, increasing their leverage.

- High Switching Costs: For critical niche technologies, the cost and time involved in finding, vetting, and integrating a new supplier can be substantial, making existing relationships more valuable to 3i Infotech.

- Supplier Concentration: In certain niche technology sectors, a few dominant players might control the market, allowing them to dictate terms and pricing to buyers like 3i Infotech.

Regulatory and Compliance Service Providers

For a company like 3i Infotech, which heavily serves the BFSI sector, the bargaining power of regulatory and compliance service providers is quite substantial. This is because staying compliant with ever-changing financial regulations and data privacy laws is not optional; it's a fundamental requirement for operation. Suppliers offering specialized software for compliance, legal advice, or auditing services are indispensable.

The complexity and critical nature of these services mean that these suppliers can indeed wield significant influence. Consider the impact of new legislation. For instance, the Digital Personal Data Protection Act in India, which came into effect in 2023, places a strong emphasis on data localization. This requirement can directly influence 3i Infotech's choices regarding where and how its data is processed, potentially increasing costs and limiting supplier options, thus boosting supplier bargaining power.

The need for specialized expertise in areas like cybersecurity compliance, anti-money laundering (AML) regulations, and Know Your Customer (KYC) processes further solidifies the position of these service providers. Companies like 3i Infotech must invest in these services to mitigate risks and avoid hefty penalties. The specialized nature of this expertise means there aren't always readily available, low-cost alternatives.

- Critical Dependence: 3i Infotech's BFSI clients demand stringent adherence to regulations, making compliance service providers essential partners rather than mere vendors.

- Specialized Expertise: Providers of regulatory software, legal counsel, and auditing services possess niche knowledge that is difficult and costly for 3i Infotech to replicate internally.

- Evolving Landscape: The constant evolution of financial regulations, such as those related to data privacy and digital transactions, necessitates ongoing engagement with specialized compliance providers, enhancing their leverage.

- Risk Mitigation: Failure to comply can result in severe penalties and reputational damage, compelling 3i Infotech to prioritize reliable and expert compliance solutions, even at a premium.

Suppliers of specialized software and proprietary technologies can exert significant bargaining power over 3i Infotech, especially when their solutions are critical or deeply integrated into the company's offerings. This power is amplified when there are few alternative providers, leading to higher costs and less favorable contract terms for 3i Infotech.

The concentration within cloud infrastructure markets, dominated by a few major players like AWS, Azure, and Google Cloud, grants these providers considerable leverage. Given the essential role of cloud services in modern IT operations and the robust growth of this sector, 3i Infotech faces substantial supplier power in this area, impacting pricing and service agreements.

The bargaining power of suppliers offering niche skills, such as advanced AI or cybersecurity expertise, is substantial due to the scarcity of qualified talent. For instance, in 2025, 80% of IT employers in India reported difficulty finding skilled personnel, particularly in AI and cybersecurity, driving up labor costs and enhancing supplier leverage.

Providers of regulatory and compliance services hold significant sway over 3i Infotech, particularly within the BFSI sector. The critical need for adherence to evolving regulations, like India's 2023 Digital Personal Data Protection Act, makes these specialized services indispensable, increasing supplier influence and potentially costs.

| Supplier Type | Impact on 3i Infotech | Key Factors | Supporting Data (2024-2025) |

|---|---|---|---|

| Proprietary Software/Tech | High Bargaining Power | Specialization, Deep Integration, Limited Alternatives | Reliance on unique data analytics platforms can lead to vendor dictating terms. |

| Cloud Infrastructure Providers | Moderate to High Bargaining Power | Market Concentration, High Demand, Essential Services | Global cloud market projected for significant growth, underscoring supplier leverage. |

| Niche Skills Talent/Consultants | High Bargaining Power | Talent Scarcity, Specialized Expertise | 80% of Indian IT employers faced talent sourcing challenges in 2025, especially in AI/cybersecurity. |

| Regulatory & Compliance Services | Substantial Bargaining Power | Critical Dependence, Evolving Regulations, Risk Mitigation | New data protection laws increase reliance on compliance experts, driving up costs. |

What is included in the product

Uncovers the competitive intensity within the IT services sector for 3i Infotech, detailing the bargaining power of its customers and suppliers, and the threats from new entrants and substitutes.

3i Infotech's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, transforming strategic uncertainty into a manageable roadmap for sustained growth.

Customers Bargaining Power

3i Infotech's diverse customer base across BFSI, manufacturing, government, and healthcare sectors inherently limits the bargaining power of any single customer segment. This broad reach means no single client accounts for an overwhelming portion of revenue, reducing the leverage of individual large clients. For instance, while BFSI clients represent a significant portion of the IT services market, 3i Infotech's presence in other verticals mitigates over-reliance.

The bargaining power of customers for IT service providers like 3i Infotech is typically moderate, largely influenced by the significant switching costs involved. For instance, migrating complex Enterprise Resource Planning (ERP) systems or core Banking, Financial Services, and Insurance (BFSI) solutions to a new vendor is a substantial undertaking.

These migrations are not only expensive but also time-consuming and can lead to considerable operational disruption, making clients hesitant to switch providers frequently. The deep integration of ERP systems into a company's operations, often involving years of investment and customization, further increases client stickiness.

Customers increasingly have a wide array of IT service providers to choose from, ranging from large multinational corporations to specialized niche firms and even their own internal IT departments. This broad availability of options directly strengthens their bargaining position.

The proliferation of cloud-based solutions and accessible off-the-shelf software empowers customers. They can readily compare offerings and negotiate better terms or switch providers if 3i Infotech's solutions aren't competitive, especially as the cloud market continues its robust growth, projected to reach over $1.3 trillion globally by 2025.

Price Sensitivity and Budget Constraints

Clients, especially when the economy is tight, often watch their spending and look for IT solutions that won't break the bank. This makes them more powerful, particularly when the services offered are pretty standard. 3i Infotech needs to clearly show the return on investment and the value they bring to counter this. For instance, global IT spending saw a dip, with some reports indicating a slowdown in enterprise software and services growth in late 2023 and early 2024, directly impacting client budgets.

Their ability to highlight a strong return on investment and a compelling value proposition is key to managing this price sensitivity. This often involves demonstrating how their solutions can lead to cost savings or revenue generation for the client.

- Price Sensitivity: Customers are increasingly focused on cost-effectiveness in IT solutions.

- Budget Constraints: Global tech spending reductions in 2023-2024 have tightened client IT budgets.

- Value Demonstration: 3i Infotech must prove clear ROI to mitigate price pressure.

- Commoditization: Standardized IT services face higher customer bargaining power due to easier comparison.

Demand for Digital Transformation and Emerging Technologies

As clients increasingly prioritize digital transformation, AI, and data analytics, their demand for advanced and specialized solutions can shift bargaining power. Customers seeking cutting-edge capabilities are willing to pay a premium, but they also demand high levels of innovation and proven expertise from providers like 3i Infotech.

The Indian IT services industry, a key market for 3i Infotech, is experiencing robust growth, with projections indicating significant expansion driven by AI investments and ongoing digital transformation initiatives. This heightened demand for specialized digital services strengthens the bargaining power of informed customers who can leverage these trends.

- Digital transformation spending in India was projected to reach $38.1 billion in 2024, an increase from $30.6 billion in 2023.

- AI adoption is a key driver, with many Indian enterprises actively exploring or implementing AI solutions.

- Customers demanding advanced AI and data analytics capabilities can exert greater influence on pricing and service delivery.

The bargaining power of customers for 3i Infotech is generally moderate, influenced by several factors. While switching costs for complex IT solutions remain a deterrent, the increasing availability of numerous IT service providers, coupled with the rise of accessible cloud-based and off-the-shelf software, empowers customers.

Price sensitivity is a significant driver, especially given global IT spending adjustments in late 2023 and early 2024, which have tightened client budgets. To counter this, 3i Infotech must effectively demonstrate a strong return on investment and clear value, particularly for commoditized services where comparison is easier.

Furthermore, as clients increasingly seek advanced digital transformation, AI, and data analytics capabilities, those with specific demands for cutting-edge solutions can exert greater influence. The robust growth in the Indian IT services sector, fueled by AI investments, highlights this trend, with digital transformation spending in India projected to reach $38.1 billion in 2024.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Switching Costs | Moderate (High for complex systems) | Migration of ERP/BFSI solutions is costly and time-consuming. |

| Availability of Alternatives | High | Proliferation of IT service providers and cloud solutions. |

| Price Sensitivity | High | Global IT spending slowdown in 2023-2024; focus on ROI. |

| Demand for Advanced Solutions | Moderate to High (for specific capabilities) | Growth in AI/data analytics; Indian digital transformation spending projected at $38.1B in 2024. |

Same Document Delivered

3i Infotech Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for 3i Infotech, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, offering no surprises or placeholder content. You're looking at the actual, ready-to-use analysis, providing valuable insights into the industry's bargaining power of buyers and suppliers, threat of new entrants, threat of substitutes, and intensity of rivalry faced by 3i Infotech.

Rivalry Among Competitors

The Indian and global IT services landscape is incredibly crowded, featuring a vast array of domestic and international companies. This includes major global players alongside many smaller, niche firms, creating a highly fragmented market for 3i Infotech.

This intense competition often forces companies to engage in price wars, driving down service costs. Consequently, 3i Infotech likely faces increased marketing expenditures and significant pressure on its profit margins as it strives to stand out and secure business in this dynamic environment.

In 2024, the Indian IT sector continues to be defined by its fierce competition, where continuous innovation and the ability to adapt quickly are paramount for survival and growth. Companies like 3i Infotech must constantly evolve their offerings to remain relevant.

The Indian IT services industry is experiencing robust expansion, with exports anticipated to hit $210 billion in FY 2024-25, fueling overall IT spending increases. This dynamic growth, especially in high-demand sectors like AI, cloud computing, and data analytics, naturally draws in new competitors.

As more companies enter the market, the competition for market share intensifies significantly. This heightened rivalry is particularly evident in rapidly expanding segments such as managed infrastructure services and the burgeoning data analytics market.

3i Infotech's ability to differentiate its IT services and product-based solutions, especially in key sectors like BFSI, ERP, cloud computing, and data analytics, is vital for softening direct competition. By offering unique value propositions and specialized expertise, the company aims to build strong client relationships that help lessen competitive pressures.

The company's strategic focus on facilitating digital transformation and driving technology-led business improvements positions it to stand out. For instance, in the BFSI sector, where competition is intense, 3i Infotech's targeted solutions for areas like core banking modernization can provide a distinct advantage.

High Fixed Costs and Exit Barriers

The IT services sector, including companies like 3i Infotech, contends with substantial fixed costs. These stem from ongoing investments in advanced infrastructure, cutting-edge technology, and crucially, attracting and retaining skilled IT professionals. For instance, the global IT services market was valued at approximately $1.3 trillion in 2023, underscoring the significant capital required to operate within it.

High exit barriers further exacerbate competitive rivalry. These barriers, such as specialized assets and long-term customer contracts, can trap companies in the market even when profitability is low. This forces them to continue competing, often aggressively, to recover their investments, intensifying pressure on all players.

- Significant Capital Outlay: IT firms must continually invest in hardware, software, cloud services, and cybersecurity, creating a high fixed cost base.

- Talent is a Key Fixed Cost: Acquiring and retaining top IT talent, essential for service delivery, represents a major and often fixed expenditure.

- Exit Barriers Lock-in: Specialized infrastructure and client relationships make it difficult and costly for companies to leave the market, sustaining competitive intensity.

- Impact on Profitability: High fixed costs mean that revenue dips can quickly erode profits, driving companies to compete fiercely on price and service to maintain volume.

Strategic Realignment and Turnaround Efforts

3i Infotech's strategic shift away from low-margin projects towards high-growth sectors such as healthcare, manufacturing, and telecommunications is a key factor in its competitive rivalry. This realignment is designed to strengthen its market position and foster sustainable growth, though it might temper aggressive expansion plans until fiscal year 2026. The company's recent financial performance, marked by a substantial increase in net profit in the latest quarters, suggests a successful turnaround is underway.

This transformation directly influences how 3i Infotech competes. By focusing on more profitable and expanding markets, it aims to differentiate itself from competitors who may still be engaged in less lucrative segments. This strategic pivot is crucial for re-establishing its competitive edge and securing long-term viability.

- Strategic Focus: Exiting low-margin deals to concentrate on high-growth sectors like healthcare, manufacturing, and telecommunications.

- Market Re-establishment: Rebuilding market presence and seeking sustainable growth post-realignment.

- Growth Horizon: Potential delay in aggressive growth strategies until FY26 due to ongoing transformation.

- Financial Turnaround: Significant improvement in net profit reported in recent quarters, signaling a positive trajectory.

The competitive rivalry in the IT services sector, where 3i Infotech operates, is exceptionally intense. This is driven by a fragmented market with numerous global and domestic players, leading to price pressures and increased marketing costs. For 2024, the Indian IT sector's growth, projected to reach $210 billion in exports for FY 2024-25, attracts new entrants, further intensifying competition, especially in areas like AI and cloud computing.

| Factor | Description | Impact on 3i Infotech |

|---|---|---|

| Market Fragmentation | Numerous global and local IT firms compete. | Requires differentiation and efficient cost management. |

| Price Sensitivity | Intense competition leads to price wars. | Pressures profit margins; necessitates value-added services. |

| Talent Acquisition & Retention | High demand for skilled IT professionals. | Significant fixed cost; impacts service quality and innovation. |

| Innovation Demands | Rapid technological changes require constant investment. | Necessitates agile development and adoption of new technologies. |

SSubstitutes Threaten

For many businesses, especially larger ones, building and maintaining their own IT solutions is a direct substitute for engaging external providers like 3i Infotech. This trend is fueled by the growing accessibility of skilled IT talent, robust open-source software options, and scalable cloud platforms, empowering companies to cultivate internal IT expertise.

While the availability of IT professionals is a global concern, with India facing a notable shortage in certain specialized areas, many organizations still find it feasible to develop in-house capabilities. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, with a significant portion representing internal spending on IT departments and infrastructure.

However, the sheer complexity and substantial cost associated with managing extensive in-house IT teams and infrastructure often make this option less attractive than outsourcing. The ongoing investment in specialized skills, software licenses, and hardware maintenance can quickly become a significant financial burden, limiting the scalability and agility that external providers can offer.

Generic software and off-the-shelf solutions present a significant threat of substitutes for 3i Infotech. Standardized products and readily available cloud services can fulfill the needs of businesses, particularly those with less complex requirements or budget constraints, directly competing with 3i Infotech's more tailored offerings.

The proliferation of Software-as-a-Service (SaaS) platforms for critical functions like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) offers accessible alternatives. For instance, the global cloud ERP market was valued at approximately $51.1 billion in 2023 and is expected to grow substantially, indicating a strong demand for these standardized solutions.

For smaller, specialized IT needs, clients increasingly turn to individual freelancers or niche firms. These alternatives often provide cost savings and faster turnaround times, particularly for projects not requiring 3i Infotech's comprehensive service offerings. This trend is amplified by the IT talent shortage in India, which fuels the growth of these specialized service providers.

Process Automation and AI-driven Tools

The rise of process automation and AI-driven tools presents a significant threat of substitutes for 3i Infotech's traditional IT services. These technologies can perform tasks previously requiring human intervention, directly impacting demand for certain managed IT services.

As AI and machine learning become more deeply embedded within enterprise resource planning (ERP) systems and other core business software, they can automate functions that 3i Infotech currently offers as services. For instance, AI-powered analytics can replace manual data interpretation, and automated workflow tools can streamline business processes, reducing the need for external IT support in these areas.

This trend is already evident, with AI and ML increasingly becoming integral components of modern ERP solutions. For example, by 2024, Gartner predicted that AI would be embedded in over 80% of new enterprise application software, a figure that continues to grow. This means that as clients upgrade or adopt new ERP systems, they are inherently gaining capabilities that could substitute for some of 3i Infotech's service offerings.

The threat is amplified by the continuous improvement in AI's ability to handle complex tasks, potentially encroaching on areas like custom development, testing, and even IT support. This forces companies like 3i Infotech to adapt their service portfolios to focus on higher-value, strategic, or specialized offerings that AI cannot easily replicate.

- AI Integration in ERP: By 2024, over 80% of new enterprise application software incorporated AI, according to Gartner.

- Automation of IT Tasks: AI can automate routine IT support, data analysis, and process management, reducing reliance on human-led services.

- Evolving Service Demand: Clients are increasingly seeking solutions that leverage AI for efficiency, potentially substituting traditional IT service models.

- Competitive Landscape Shift: Companies offering AI-native solutions or AI-enhanced services pose a direct substitute threat to traditional IT service providers.

Shift to Platform-Based Solutions and Ecosystems

Clients are increasingly drawn to integrated platform-based solutions and technology ecosystems, acting as a significant substitute for standalone IT services. These comprehensive offerings, often from major tech players, consolidate various IT requirements into a single vendor relationship.

This shift means companies like 3i Infotech face competition not just from other service providers, but from entire digital ecosystems. For instance, major cloud providers, which dominate the market with over 60% share, offer integrated suites that can fulfill many IT needs previously met by specialized firms.

- Platform Consolidation: Clients prefer one-stop-shop solutions over managing multiple vendors.

- Ecosystem Lock-in: Integrated platforms create stickiness, making it harder for standalone providers to compete.

- Cloud Dominance: Over 60% of the cloud market is controlled by a few major providers, offering bundled services.

Generic software and off-the-shelf solutions present a significant threat of substitutes for 3i Infotech. Standardized products and readily available cloud services can fulfill the needs of businesses, particularly those with less complex requirements or budget constraints, directly competing with 3i Infotech's more tailored offerings.

The proliferation of Software-as-a-Service (SaaS) platforms for critical functions like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) offers accessible alternatives. For instance, the global cloud ERP market was valued at approximately $51.1 billion in 2023 and is expected to grow substantially, indicating a strong demand for these standardized solutions.

For smaller, specialized IT needs, clients increasingly turn to individual freelancers or niche firms. These alternatives often provide cost savings and faster turnaround times, particularly for projects not requiring 3i Infotech's comprehensive service offerings. This trend is amplified by the IT talent shortage in India, which fuels the growth of these specialized service providers.

The rise of process automation and AI-driven tools presents a significant threat of substitutes for 3i Infotech's traditional IT services. These technologies can perform tasks previously requiring human intervention, directly impacting demand for certain managed IT services.

Entrants Threaten

While the IT services sector might seem accessible, building a company akin to 3i Infotech, with its global reach, varied services like BFSI and ERP, and extensive infrastructure, demands substantial financial outlay. This includes setting up advanced technology, data centers, and recruiting a highly skilled workforce.

The sheer scale of investment needed for global operations and specialized services acts as a significant deterrent for potential new players. For instance, the global cloud computing market, a core area for many IT firms, saw investments in infrastructure and development reaching billions in 2024, making it a high-cost entry point.

New entrants into the IT services sector, particularly those aiming to compete with established players like 3i Infotech, face a significant hurdle in assembling a team with the required specialized expertise. Building proficiency in areas like BFSI solutions, intricate ERP systems, and cutting-edge data analytics demands substantial investment in talent acquisition and development. This is compounded by the ongoing IT talent shortage in India, a critical factor impacting the cost and availability of skilled professionals.

The scarcity of specialized IT talent in India presents a considerable barrier for new entrants. For instance, reports from early 2024 highlighted a persistent skill deficit, especially in high-demand fields such as artificial intelligence and other emerging technologies. This makes it both difficult and expensive for newcomers to secure the human capital necessary to deliver complex projects and compete effectively.

Established players like 3i Infotech have cultivated strong brand reputations and deep client relationships over many years, fostering significant trust. New entrants face a substantial hurdle in replicating this, particularly with large enterprise clients in sensitive sectors such as Banking, Financial Services, and Insurance (BFSI), where data security and unwavering reliability are non-negotiable. Gaining this level of confidence is a lengthy process, demanding consistent, proven success.

Regulatory Hurdles and Compliance Requirements

Entering the Banking, Financial Services, and Insurance (BFSI) sector, a key area for 3i Infotech, presents significant challenges due to stringent regulatory hurdles. New players must dedicate substantial resources to comprehend and comply with a complex web of rules, acting as a substantial deterrent.

These regulatory demands, including data protection laws like GDPR and various industry-specific mandates, significantly increase the cost and complexity of market entry. For instance, in 2024, the global FinTech regulatory landscape continued to evolve, with increased scrutiny on data privacy and cybersecurity, requiring new entrants to invest heavily in compliance infrastructure.

The need for specialized legal teams and ongoing compliance monitoring creates a high barrier, favoring established players with existing infrastructure and expertise. This makes it difficult for new, smaller entities to compete effectively against companies like 3i Infotech that have already navigated these complexities.

- High Capital Investment: Significant upfront costs are required to establish compliant IT systems and processes.

- Complex Legal Frameworks: Navigating diverse and evolving regulations across different geographies is a major hurdle.

- Data Security and Privacy Compliance: Adhering to strict data protection acts adds another layer of operational and financial burden.

- Industry-Specific Mandates: Sector-specific regulations within BFSI demand specialized knowledge and ongoing adaptation.

Economies of Scale and Scope

Existing large IT service providers leverage significant economies of scale and scope. This allows them to offer highly competitive pricing and a more comprehensive suite of services than smaller, newer players. For instance, in 2024, the global IT services market was valued at over $1.3 trillion, demonstrating the immense scale of operations that established firms command.

New entrants face a substantial hurdle in matching these cost efficiencies and the breadth of offerings that established companies provide. This is particularly true when bidding for large, complex projects where scale is a critical factor. The IT sector's projected continued growth suggests that the market will remain attractive, but the barriers to entry related to scale will persist.

- Economies of Scale: Large IT firms can spread fixed costs over a greater volume of services, leading to lower per-unit costs.

- Economies of Scope: Diversified service portfolios allow established players to offer bundled solutions, increasing customer value and reducing individual service costs.

- Competitive Pricing: Lower cost structures enable incumbents to undercut new entrants on price, especially for high-volume contracts.

- Market Size: The IT services market's substantial size, projected for continued expansion, underscores the advantage of established players who can capture a larger share due to their operational capacity.

The threat of new entrants for 3i Infotech is moderate, primarily due to high capital requirements and the need for specialized talent. Building global infrastructure and advanced technology stacks demands significant investment, making it difficult for smaller firms to compete. For example, in 2024, the global IT services market continued to see substantial investments in cloud and AI capabilities, with companies spending billions to maintain a competitive edge.

Furthermore, the IT sector's reliance on highly skilled professionals, particularly in areas like BFSI and ERP solutions, creates a talent barrier. The persistent IT talent shortage in India, reported in early 2024, exacerbates this, driving up recruitment costs for newcomers. Established players like 3i Infotech benefit from existing talent pools and robust training programs, giving them an advantage.

Brand reputation and client trust, especially in sensitive sectors like BFSI, are also significant deterrents. New entrants must invest heavily in building credibility and demonstrating unwavering reliability, a process that can take years. The complex regulatory landscape, particularly in financial services, adds another layer of difficulty, requiring substantial resources for compliance and legal expertise.

| Barrier | Description | Impact on New Entrants | 2024 Data Point |

| Capital Requirements | High investment in technology, infrastructure, and talent. | Significant deterrent due to substantial upfront costs. | Global cloud infrastructure investment exceeded $200 billion in 2024. |

| Talent Acquisition | Need for specialized skills in BFSI, ERP, AI, etc. | Challenging and expensive due to talent shortages and competition. | IT talent shortage in India estimated at over 500,000 in early 2024. |

| Brand Reputation & Trust | Cultivating deep client relationships and proven reliability. | Difficult and time-consuming to replicate for new players. | BFSI sector clients prioritize long-term partnerships and proven security. |

| Regulatory Compliance | Navigating complex laws in BFSI and data protection. | Increases cost and complexity of market entry. | Evolving FinTech regulations in 2024 emphasized data privacy and cybersecurity. |

Porter's Five Forces Analysis Data Sources

Our analysis of 3i Infotech's competitive landscape is built upon comprehensive data from annual reports, investor presentations, and industry-specific market research reports. We also leverage insights from financial news outlets and competitor press releases to capture the dynamic nature of the IT services sector.