3i Infotech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3i Infotech Bundle

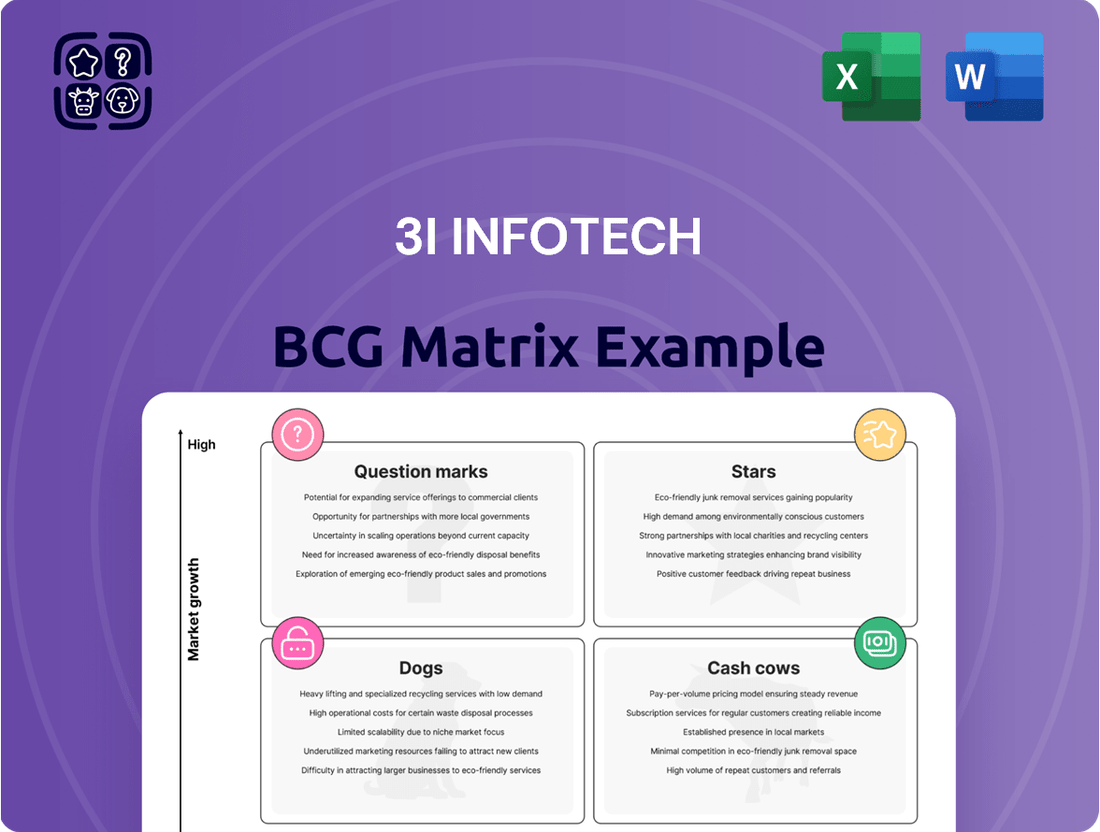

Curious about 3i Infotech's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, categorizing them as potential Stars, Cash Cows, Dogs, or Question Marks. Understand where their strengths lie and where challenges may exist.

Ready to unlock the full strategic potential? Purchase the complete 3i Infotech BCG Matrix report for a detailed breakdown of each product's quadrant placement, accompanied by actionable insights and data-driven recommendations to guide your investment and product development decisions.

Stars

3i Infotech's BFSI solutions are a clear Star in their portfolio, generating close to 40% of overall revenue. This strong performance is driven by the BFSI sector's significant need for digital transformation, a space where 3i Infotech excels, particularly with its cloud offerings. The cloud computing market within BFSI is projected for substantial growth, expected to reach $46.8 billion by 2025, underscoring the strategic importance of these solutions.

Cloud Computing Services, under the NuRe brand, represent a significant growth opportunity for 3i Infotech. The Indian IT services market is booming, with cloud adoption being a primary driver. Indian enterprises are projected to spend USD 13 billion on public cloud services by 2026, highlighting the immense potential in this sector.

3i Infotech's strategic investment in cloud-first and edge-ready products under its NuRe umbrella is a key differentiator. By focusing on reducing cloud costs and ensuring secure cloud technology, they are directly addressing critical market needs. This commitment to innovation within a high-growth segment firmly places their cloud services as a Star in the BCG matrix.

Digital Transformation Consulting at 3i Infotech is positioned as a Star in the BCG Matrix. The Indian IT services market is booming, largely due to digital transformation, with an anticipated CAGR of 7.30% between 2025 and 2033. 3i Infotech is actively participating in this high-growth sector.

3i Infotech acts as a digital transformation orchestrator, assisting clients across various industries. Their strategy emphasizes helping businesses improve through technology, developing new capabilities to speed up market penetration. This approach directly targets the expanding digital transformation market, where they aim to capture substantial share.

AI and Machine Learning Solutions

AI and Machine Learning Solutions are indeed a shining Star for 3i Infotech within the BCG Matrix. These technologies are revolutionizing the Indian IT landscape, with a significant 75% of Indian enterprises projected to integrate AI into their operations by 2025. 3i Infotech is strategically embedding AI and ML capabilities into its product suite, thereby boosting customer value and competitive advantage.

This proactive investment in cutting-edge technologies, aligned with the robust growth trajectory of AI/ML adoption across various sectors, firmly positions these solutions as Stars. This classification underscores the need for sustained research and development alongside aggressive market penetration strategies to capitalize on their high growth and market share potential.

- AI/ML Integration: 75% of Indian enterprises expected to integrate AI by 2025.

- 3i Infotech's Strategy: Incorporating AI/ML features to enhance customer value.

- Market Position: Considered a Star due to high growth prospects and market penetration efforts.

- Investment Focus: Continued R&D is crucial for maintaining leadership in this segment.

Cybersecurity Services

Cybersecurity services are a critical component for businesses navigating an increasingly digital landscape. The sophistication of cyber threats continues to escalate, making robust data protection a paramount concern worldwide. 3i Infotech addresses this by offering comprehensive, proactive cybersecurity solutions, including Secure Access Service Edge (SASE), a segment experiencing significant expansion.

The growing demand for advanced security measures, combined with 3i Infotech's extensive portfolio, strongly suggests that cybersecurity services represent a high-growth, high-potential area for the company. For instance, the global cybersecurity market was valued at an estimated $217.9 billion in 2024 and is projected to reach $437.1 billion by 2029, growing at a CAGR of 14.9%.

- Growing Cyber Threats: Increasing complexity of cyberattacks necessitates advanced security solutions.

- 3i Infotech's Offerings: Proactive, end-to-end cybersecurity services, including the rapidly expanding SASE market.

- Market Potential: The critical need for cybersecurity positions these services as a key growth driver for 3i Infotech.

- Market Growth: The global cybersecurity market is projected for substantial growth, indicating strong demand.

3i Infotech's BFSI solutions, particularly its cloud offerings, are a significant Star, contributing nearly 40% of total revenue. This segment is bolstered by the BFSI sector's strong demand for digital transformation, with cloud adoption being a key driver. The Indian IT services market's growth, fueled by digital initiatives, further solidifies this position.

Cloud Computing Services, under the NuRe brand, are a clear Star, capitalizing on the booming Indian IT services market where cloud adoption is paramount. Indian enterprises are expected to invest USD 13 billion in public cloud services by 2026, highlighting the immense growth potential for 3i Infotech's cloud-first and edge-ready products.

AI and Machine Learning Solutions are positioned as Stars for 3i Infotech, with 75% of Indian enterprises projected to integrate AI by 2025. By embedding AI/ML capabilities into its product suite, 3i Infotech enhances customer value and competitive advantage in this high-growth area.

Cybersecurity services are a Star for 3i Infotech, addressing the escalating sophistication of cyber threats. The global cybersecurity market, valued at $217.9 billion in 2024 and projected to reach $437.1 billion by 2029, underscores the critical demand for 3i Infotech's comprehensive security solutions, including SASE.

| Solution Area | BCG Matrix Position | Key Growth Drivers | 3i Infotech's Strategy | Market Data Point |

|---|---|---|---|---|

| BFSI Solutions | Star | Digital transformation in BFSI | Cloud-first offerings | BFSI sector contributes ~40% of revenue |

| Cloud Computing Services (NuRe) | Star | Indian IT services market growth, cloud adoption | Edge-ready products, cost reduction focus | Indian enterprises to spend USD 13B on public cloud by 2026 |

| AI and Machine Learning Solutions | Star | AI integration across enterprises | Embedding AI/ML in product suite | 75% of Indian enterprises to integrate AI by 2025 |

| Cybersecurity Services | Star | Increasing cyber threats, demand for data protection | Comprehensive, proactive solutions (e.g., SASE) | Global cybersecurity market to reach $437.1B by 2029 (CAGR 14.9%) |

What is included in the product

The 3i Infotech BCG Matrix offers a strategic breakdown of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides decisions on investment, divestment, and resource allocation for each unit.

The 3i Infotech BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Traditional ERP systems represent a solid cash cow for 3i Infotech. Despite market maturation, the company's deep-rooted presence and loyal clientele in this segment ensure a steady revenue stream. These established solutions continue to be vital for businesses, even as newer technologies emerge, allowing 3i Infotech to capitalize on consistent demand with minimal incremental investment.

3i Infotech's Digital Infrastructure Management Services (DIMS) represent a classic Cash Cow within its business portfolio. These services focus on managing clients' on-premise digital assets, a critical function for many organizations.

While the market for managing existing infrastructure might be considered mature, DIMS provides a stable and recurring revenue stream. This consistency is a hallmark of a Cash Cow, offering dependable income despite potentially slower growth compared to other business segments.

The emphasis on efficiency improvements and the support of established infrastructure allow DIMS to achieve high profit margins. This operational efficiency translates directly into consistent cash flow, reinforcing its position as a strong Cash Cow for 3i Infotech. For example, in the fiscal year ending March 31, 2024, 3i Infotech reported a significant portion of its revenue from its managed services, underscoring the steady contribution of its infrastructure management offerings.

Many businesses depend on their existing applications, which need continuous upkeep and assistance. 3i Infotech's expertise in developing, modernizing, and supporting these established applications likely forms a dependable source of income.

These services, while not experiencing rapid growth, can produce substantial cash flow. This is often due to existing long-term contracts and the reduced investment needed compared to creating entirely new products.

For instance, in the fiscal year ending March 2024, 3i Infotech reported that its managed services segment, which includes application maintenance and support, contributed significantly to its overall revenue, demonstrating the stability of this business area.

Specific Industry-focused Solutions (e.g., Government, Education)

Beyond its strong presence in the BFSI sector, 3i Infotech has carved out significant niches in industries like Government and Education. If these specialized solutions have secured a dominant market share within mature, stable markets characterized by consistent demand, they would qualify as Cash Cows within the BCG framework.

These established offerings, backed by deep industry expertise and strong client relationships, are capable of generating reliable and predictable revenue streams. This allows 3i Infotech to leverage these segments for steady income without the need for substantial reinvestment in aggressive expansion efforts.

- Government Solutions: 3i Infotech's offerings in the government sector, such as citizen services portals and e-governance platforms, often operate in markets with high adoption rates and predictable, recurring revenue from maintenance and support contracts.

- Education Technology: In education, platforms for learning management systems (LMS) and administrative solutions for universities and schools, once established, tend to become stable revenue generators due to long-term contracts and ongoing user needs.

- Market Maturity: The demand in these sectors, while not explosive, is often stable and predictable, fitting the profile of mature markets where 3i Infotech has already achieved a strong competitive position.

- Revenue Stability: The predictable nature of government and education sector contracts, often involving multi-year agreements, ensures a consistent and reliable cash flow for the company.

Business Process Services (BPS)

3i Infotech's Business Process Services (BPS) segment functions as a potential cash cow. These services focus on streamlining and managing essential, often repetitive, business operations for their clients, leading to predictable revenue streams.

If 3i Infotech has established a robust competitive edge and secured a significant market share within particular BPS niches, these operations can transform into consistent profit generators. The recurring nature of BPS contracts, coupled with opportunities to enhance profitability through operational efficiencies, underpins their cash-generating capacity.

For example, in the fiscal year 2024, 3i Infotech reported significant growth in its BPS segment, contributing substantially to its overall revenue. This growth is often driven by long-term contracts in areas like finance and accounting outsourcing, and IT support services, which provide stable income.

- Key BPS Offerings: Finance & Accounting Outsourcing, Human Resources Outsourcing, Customer Support, and IT Infrastructure Management.

- Market Position: 3i Infotech aims for leadership in specific BPS verticals by leveraging technology and process automation.

- Revenue Contribution: The BPS segment consistently forms a significant portion of 3i Infotech's total revenue, demonstrating its role as a stable income source.

Traditional ERP systems remain a significant cash cow for 3i Infotech. The company's established presence and loyal customer base in this mature market ensure a consistent revenue stream, capitalizing on ongoing demand with minimal new investment. This segment continues to be a reliable income generator despite market maturation.

Digital Infrastructure Management Services (DIMS) are a prime example of a cash cow for 3i Infotech. These services, focused on managing clients' existing on-premise digital assets, provide a stable and recurring revenue. For the fiscal year ending March 31, 2024, 3i Infotech's managed services, including infrastructure management, contributed substantially to its overall revenue, highlighting the dependable income from this segment.

3i Infotech’s expertise in maintaining and supporting established applications for various businesses also acts as a cash cow. These services, while not experiencing rapid growth, generate substantial cash flow through long-term contracts and lower investment needs compared to new product development. The fiscal year 2024 financial results showed managed services, encompassing application maintenance, as a key revenue contributor, reinforcing its stable cash-generating capability.

Specialized solutions in sectors like Government and Education, where 3i Infotech holds strong positions in mature markets, also function as cash cows. These established offerings, supported by deep industry knowledge and client relationships, provide predictable revenue streams. For instance, government e-governance platforms and educational learning management systems often secure multi-year maintenance and support contracts, ensuring consistent income for 3i Infotech.

Preview = Final Product

3i Infotech BCG Matrix

The preview of the 3i Infotech BCG Matrix you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently use this preview as a true representation of the valuable insights within the complete 3i Infotech BCG Matrix report you will download.

Dogs

Outdated proprietary software products at 3i Infotech would likely fall into the Dogs category of the BCG Matrix. These are products with low market share in slow-growing markets, often struggling against newer competitors. For instance, if 3i Infotech still supports legacy ERP systems that are no longer the preferred choice for businesses seeking cloud-based, scalable solutions, these would fit the description.

In highly commoditized IT service sectors, where 3i Infotech might not possess a distinct competitive edge or substantial operational scale, these offerings can be categorized as Dogs. Such services face considerable challenges, operating within intensely competitive and slow-growing markets, which naturally limits their ability to capture significant market share and contribute meaningfully to the company's profitability.

Geographical markets where 3i Infotech has a limited presence and minimal growth prospects can be categorized as Dogs within the BCG matrix. These regions might represent legacy operations or niche markets that are no longer aligned with the company's strategic growth objectives.

Continued investment in these low-growth, low-market-share areas would likely result in suboptimal returns on capital. For instance, if 3i Infotech's presence in a particular developing market shows negligible revenue growth, perhaps only 1-2% annually, and its market share remains below 3%, it would be a prime candidate for a Dog.

Such segments often drain resources that could be better allocated to Stars or Question Marks with higher potential. Therefore, a strategic review might lead to decisions regarding divestiture or a significant restructuring to minimize ongoing costs and focus on more promising opportunities.

Non-core, Underperforming Acquired Assets

Non-core, underperforming acquired assets are those past acquisitions that have struggled with integration or whose offerings haven't resonated with the market. These can become drains on resources, yielding minimal returns and negatively affecting the company's financial standing. For example, if a company acquired a niche software product in 2023 that only captured 0.5% of its target market by mid-2024, it would likely fall into this category.

These assets typically reside in segments characterized by slow growth and possess a low market share. Their disposition is often considered to unlock capital and streamline operations. In 2024, many technology firms reassessed their portfolios, with some divesting non-essential software units that failed to meet growth projections.

- Definition: Acquired assets that have not integrated successfully or whose products/services have failed to gain market acceptance.

- Impact: Consume resources without generating proportionate returns, potentially harming overall financial health.

- Strategic Consideration: Low market share in low-growth markets makes them candidates for divestiture to improve efficiency and focus.

- Example Scenario: A 2023 acquisition of a complementary business unit that reported only a 2% year-over-year revenue increase by Q2 2024, significantly below internal targets.

Services Dependent on Obsolete Technologies

Services reliant on legacy technologies, such as older programming languages or outdated hardware infrastructure, are increasingly becoming a challenge. These offerings face declining demand as the market shifts towards more modern and efficient solutions. For instance, companies still heavily invested in mainframe maintenance or COBOL development might find their market share shrinking, as newer platforms offer greater scalability and cost-effectiveness.

The continuous need for expensive updates to keep these obsolete services functional, without a clear path to substantial revenue growth, places them in a weak market position. In 2024, the Indian IT sector's rapid embrace of generative AI and cloud-native architectures further accelerates the obsolescence of services tied to older tech stacks.

Consider these points regarding services dependent on obsolete technologies:

- Diminishing Market Demand: Services built on technologies like legacy ERP systems or older versions of operating systems are experiencing a significant drop in demand as businesses migrate to cloud-based, updated solutions.

- High Maintenance Costs: Keeping outdated systems operational often incurs disproportionately high maintenance and support costs, diverting resources from innovation and growth areas.

- Limited Future Growth Potential: Without a clear strategy for modernization or transition, these services offer little to no potential for future revenue expansion, making them candidates for divestment or strategic phasing out.

Products or services with a very small market share in industries experiencing minimal to no growth are classified as Dogs within the BCG Matrix. These offerings typically generate low revenue and often require significant investment for maintenance rather than expansion. For 3i Infotech, this could include niche software solutions that have been superseded by newer technologies or services catering to industries in sharp decline.

In 2024, the IT landscape continued its rapid evolution, making legacy offerings particularly vulnerable. For example, a company might have a service for maintaining on-premise servers for a specific industry that is rapidly adopting cloud infrastructure. This service would likely have a low market share and operate in a shrinking market, fitting the Dog profile.

These segments often drain resources that could be better allocated to Stars or Question Marks with higher potential. For instance, if 3i Infotech's presence in a particular developing market shows negligible revenue growth, perhaps only 1-2% annually, and its market share remains below 3%, it would be a prime candidate for a Dog.

The strategic implication for such Dogs is often divestiture, discontinuation, or a significant restructuring to minimize ongoing costs and focus on more promising opportunities. This approach helps unlock capital and streamline operations for more profitable ventures.

| Category | Market Growth | Market Share | 3i Infotech Example |

| Dogs | Low | Low | Legacy software maintenance for declining industries |

| Dogs | Low | Low | Niche IT services with no competitive differentiation |

| Dogs | Low | Low | Outdated proprietary software products |

Question Marks

Generative AI (GenAI) is a significant disruptor in the Indian IT services landscape, prompting many enterprises to re-evaluate their digital strategies. 3i Infotech is actively engaging with this trend, likely investing in GenAI capabilities to tap into this high-potential, emerging market.

While the potential is substantial, GenAI solutions are still in their early stages of market penetration. This means that despite their future promise, their current market share for companies like 3i Infotech is expected to be relatively low. Significant investment will be necessary to scale these offerings and elevate them to Star status within the BCG framework.

3i Infotech's NuRe Bharat Network, in collaboration with RailTel, is poised to tap into the burgeoning digital connectivity market in rural India. This project is designed to leverage advertising revenue streams by targeting prepaid mobile users and offering a platform for SMEs to gain visibility. The initiative is positioned within a high-growth sector, but its current market penetration and profitability remain to be fully established.

As a Question Mark in the BCG matrix, the NuRe Bharat Network requires substantial investment and strategic focus to achieve market leadership. While the potential for connecting underserved rural populations is immense, the project's success hinges on securing widespread adoption and demonstrating a clear path to profitability. For instance, as of early 2024, the Indian government's BharatNet project aims to connect over 250,000 Gram Panchayats, indicating the scale of the opportunity and the competitive landscape 3i Infotech is entering.

3i Infotech is strategically investing in edge-ready products, aiming to capitalize on the burgeoning edge computing market, particularly by leveraging 5G technology. This focus positions them within a rapidly evolving, high-growth sector.

While the overall market for edge computing is substantial, with projections indicating significant expansion, 3i Infotech's current penetration in this niche area is likely modest. This necessitates considerable investment to scale its offerings and gain a more prominent market share in the coming years. The global edge computing market was valued at approximately $20.2 billion in 2023 and is expected to reach over $100 billion by 2028, demonstrating the immense growth potential.

New Product Lines Launched in 2025

3i Infotech is strategically introducing new product lines in 2025, signaling a commitment to innovation and capturing emerging market opportunities. These ventures are positioned in sectors with substantial growth prospects, though their market penetration and competitive standing are still developing.

These new offerings represent significant capital outlays with outcomes that are not yet guaranteed, aligning them with the characteristics of Stars in the BCG matrix. This necessitates robust marketing campaigns and focused efforts to drive customer adoption and market share growth.

For instance, the company’s recent foray into AI-driven analytics platforms, launched in early 2025, exemplifies this strategy. While early indicators show promising engagement, achieving a dominant market share remains a key objective for the next 18-24 months. The success of these new lines will heavily influence 3i Infotech's overall portfolio balance.

- New Product Lines: 3i Infotech launched several new technology solutions in 2025, targeting high-growth market segments.

- Market Position: These products are in nascent stages, with market acceptance and share still to be solidified.

- Strategic Investment: The new lines require substantial investment for development and market penetration, carrying inherent risk and potential for high returns.

- BCG Matrix Classification: They are classified as Stars, demanding aggressive strategies to build market leadership and eventually transition into Cash Cows.

Solutions for Emerging Verticals (e.g., Healthcare, TME - mid-tier)

While 3i Infotech has a strong foothold in the BFSI sector, their expansion into emerging verticals like Healthcare and Telecom Media Entertainment (TME) for mid-tier companies represents a strategic move towards future growth. These sectors are experiencing significant digital transformation, offering substantial revenue potential.

These new ventures can be viewed as potential 'Question Marks' in a BCG Matrix context. 3i Infotech is investing in these areas to build market share, acknowledging that their current presence might be smaller compared to their established BFSI business. For instance, the global healthcare IT market was projected to reach $279.5 billion in 2024, and the TME sector also shows robust growth trajectories.

- Healthcare IT Growth: The global healthcare IT market is expected to grow at a CAGR of 13.9% from 2024 to 2030, presenting a significant opportunity for 3i Infotech to capture market share.

- TME Digitalization: The TME industry's increasing reliance on digital platforms and services creates a fertile ground for 3i Infotech's offerings.

- Strategic Investment Needed: To convert these 'Question Marks' into 'Stars,' 3i Infotech will need to strategically allocate resources for product development, sales, and marketing in these new verticals.

- Market Penetration Focus: Success will depend on effectively penetrating these markets and demonstrating value to mid-tier clients who may be more price-sensitive and require tailored solutions.

Question Marks represent business units or products with low market share in high-growth industries. These ventures require significant investment to increase market share and move towards becoming Stars. Without sufficient investment or strategic focus, they risk becoming Dogs.

3i Infotech's NuRe Bharat Network and its investments in edge-ready products are prime examples of Question Marks. While operating in high-growth sectors, their current market penetration is modest, necessitating substantial capital and strategic planning to achieve market leadership and future profitability.

The company's expansion into Healthcare IT and the Telecom Media Entertainment (TME) sectors for mid-tier companies also falls into this category. These areas offer considerable growth potential, but 3i Infotech's current market share is still developing, requiring focused investment to transform them into successful Stars.

| Business Unit/Product | Industry Growth | Current Market Share | Investment Required | Potential Outcome |

| NuRe Bharat Network | High (Rural Digitalization) | Low | High | Star or Dog |

| Edge-Ready Products | High (Edge Computing, 5G) | Low | High | Star or Dog |

| Healthcare IT (Mid-tier) | High | Low | High | Star or Dog |

| TME (Mid-tier) | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth rates, and competitive analysis, to accurately position each business unit.