3DG Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3DG Holdings Bundle

3DG Holdings is poised for growth, leveraging its innovative technology and strong market presence. However, understanding the full scope of its competitive landscape and potential challenges is crucial for informed decision-making.

Want the full story behind 3DG Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

3DG Holdings enjoys considerable financial strength thanks to its ultimate holding company, Luk Fook Holdings, a position solidified in January 2024. This backing is substantial, with Luk Fook providing various forms of funding, including interest-free and interest-bearing loans, as well as gold loans. This strategic infusion of capital has enabled 3DG Holdings to completely clear all its outstanding bank borrowings.

3DG Holdings benefits significantly from its integration into Luk Fook's expansive retail network, which covers Hong Kong, Macau, and Mainland China. This provides immediate access to a vast customer base and established market presence.

Luk Fook's strategic retail network expansion plans further bolster 3DG's reach. The company aims to open 50 new shops in Mainland China and 20 international locations in fiscal year 2026, enhancing 3DG's visibility and market penetration.

The acquisition by Luk Fook, a prominent jewelry retailer, has significantly boosted 3DG Jewellery's brand recognition and consumer trust. Luk Fook's leading position in the 2023 Gold Jewellery Retail Industry Brand Value and Brand Strength in China directly benefits 3DG.

Optimized Business Structure and Synergies

The acquisition by Luk Fook was strategically designed to streamline 3DG Holdings' business framework and reinforce Luk Fook's command over the 3DG Jewellery brand. This integration is anticipated to unlock significant operational synergies, boost overall efficiency, and enable cost reductions throughout the merged operations.

This consolidation is expected to yield substantial benefits, with Luk Fook's established strengths in the jewelry supply chain, from sourcing and design to wholesale and retail, being directly applied to enhance 3DG's performance. For instance, in 2023, Luk Fook reported a 24.8% increase in revenue, reaching HKD 10.8 billion, demonstrating their robust operational capabilities which can now be leveraged by 3DG.

- Enhanced Operational Efficiency: Luk Fook's established supply chain and retail network are expected to improve 3DG's speed to market and reduce lead times.

- Synergistic Cost Savings: Consolidation of operations, marketing, and administrative functions can lead to significant cost rationalization, potentially boosting profit margins.

- Leveraged Expertise: 3DG can benefit from Luk Fook's decades of experience in jewelry design, manufacturing quality control, and sophisticated retail management.

- Improved Market Reach: Integration into Luk Fook's extensive retail footprint, which includes over 2,200 stores as of 2023, provides 3DG with immediate access to a broader customer base.

Diversified Product Portfolio and Expertise

3DG Holdings benefits significantly from a diversified product portfolio, encompassing existing retail, wholesale, and franchising of gold and jewellery. This is further bolstered by Luk Fook's deep expertise in sourcing, designing, and retailing a wide array of gold, platinum, and gem-set jewellery.

This synergy creates a more robust and comprehensive offering, catering to a broader and more varied customer base. For instance, Luk Fook reported a 20.5% year-on-year increase in revenue for the fiscal year ending March 31, 2024, driven by strong sales across its diverse product lines, highlighting the market's appetite for such a comprehensive approach.

- Expanded Product Range: Combines 3DG's core offerings with Luk Fook's specialized gem-set and platinum jewellery.

- Enhanced Design Capabilities: Leverages Luk Fook's established design and sourcing expertise to introduce innovative products.

- Broader Market Appeal: Addresses a wider spectrum of consumer preferences and price points within the jewellery market.

3DG Holdings' financial stability is significantly enhanced by its parent company, Luk Fook Holdings, a relationship solidified in January 2024. This backing provides crucial funding, including interest-free and interest-bearing loans, enabling 3DG to eliminate all outstanding bank borrowings. Furthermore, 3DG benefits from Luk Fook's extensive retail network across Hong Kong, Macau, and Mainland China, offering immediate access to a vast customer base.

Luk Fook's strategic expansion plans, targeting 50 new shops in Mainland China and 20 international locations in fiscal year 2026, will further amplify 3DG's market reach and visibility. The acquisition has also boosted 3DG Jewellery's brand recognition, leveraging Luk Fook's leading position in the 2023 Gold Jewellery Retail Industry Brand Value and Strength in China. This integration promises operational synergies, improved efficiency, and cost reductions by applying Luk Fook's robust supply chain expertise, evident in their 24.8% revenue increase to HKD 10.8 billion in 2023.

3DG Holdings boasts a diversified product portfolio, encompassing retail, wholesale, and franchising of gold and jewelry, complemented by Luk Fook's specialized gem-set and platinum offerings. This synergy caters to a broader customer base, as demonstrated by Luk Fook's 20.5% year-on-year revenue growth for the fiscal year ending March 31, 2024, driven by diverse product sales.

| Strength | Description | Supporting Data |

| Financial Backing | Substantial financial support from Luk Fook Holdings. | Luk Fook provided interest-free and interest-bearing loans; 3DG cleared all bank borrowings. |

| Retail Network Access | Immediate access to Luk Fook's extensive retail presence. | Covers Hong Kong, Macau, and Mainland China; Luk Fook had over 2,200 stores as of 2023. |

| Brand Recognition | Enhanced brand equity through Luk Fook's established reputation. | Luk Fook ranked leading in 2023 Gold Jewellery Retail Industry Brand Value and Strength in China. |

| Operational Synergies | Leveraging Luk Fook's supply chain and retail expertise. | Luk Fook's 2023 revenue increased by 24.8% to HKD 10.8 billion. |

What is included in the product

Delivers a strategic overview of 3DG Holdings’s internal and external business factors, highlighting its competitive position and market challenges.

Provides a clear, actionable roadmap for leveraging 3DG Holdings' strengths and addressing weaknesses, thereby relieving the pain of strategic uncertainty.

Weaknesses

3DG Holdings experienced a substantial increase in its financial losses for the year ending June 30, 2024. Losses attributable to equity holders surged by 51%, reaching HK$135 million. This widening deficit was largely a consequence of significant hedging losses, directly linked to the sharp rise in gold prices.

This performance highlights a notable vulnerability to market volatility, particularly within its hedging strategies. The company's susceptibility to fluctuations in commodity prices, such as gold, suggests a potential weakness in its risk management framework.

While financial backing from Luk Fook is a significant advantage, it simultaneously underscores a weakness in 3DG Holdings' independent financial health. This reliance on its parent company for funding raises questions about its ability to operate and grow without consistent external capital injections.

As of June 30, 2024, Luk Fook's subsidiaries had extended substantial financing to 3DG through various loan agreements, indicating a deep financial interdependence. Luk Fook's confirmed irrevocable commitment to continue providing financial assistance further emphasizes this dependency.

This ongoing reliance suggests that 3DG Holdings may not yet possess robust self-sustaining financial capabilities. Its operational and strategic decisions could be heavily influenced by the parent company's financial priorities and capacity.

Integrating 3DG Holdings' operations, trademarks, and management into Luk Fook's broader corporate framework presents a significant hurdle. This process is inherently complex, touching upon disparate systems, distinct corporate cultures, and varied operational processes.

Such integrations frequently lead to temporary operational disruptions as the entities harmonize. For instance, in 2023, the average integration time for acquisitions exceeding $500 million in the retail sector was reported to be 18-24 months, often requiring dedicated teams and substantial financial investment, estimated at 5-10% of the deal value.

This complexity demands considerable management focus and resource allocation, potentially diverting attention from core business growth initiatives. The success of the integration hinges on meticulous planning and execution to mitigate these inherent weaknesses.

Previous Revenue Decline

3DG Holdings faced a revenue downturn, with a 5% drop to HK$587 million for the fiscal year ending June 30, 2024. This decline indicates potential pre-existing issues within the company's operations or market positioning prior to its acquisition. Such a trend raises concerns about the sustainability of its business model and its ability to generate consistent growth.

The previous revenue decline highlights several key weaknesses:

- Financial Performance: A 5% year-over-year revenue decrease to HK$587 million for the year ended June 30, 2024, signals a period of financial struggle.

- Market Challenges: The revenue dip suggests that 3DG Holdings was likely contending with unfavorable market conditions or competitive pressures.

- Operational Issues: The decline could also point to internal operational inefficiencies or a failure to adapt to evolving customer demands.

- Acquisition Risk: This historical financial performance may impact the perceived value and integration success of the acquisition.

Vulnerability to Gold Price Fluctuations

3DG Holdings' significant exposure to gold and jewellery products makes it inherently vulnerable to shifts in gold prices. For instance, in early 2024, gold prices saw considerable volatility, reaching record highs in March before experiencing some pullback. This volatility directly impacts 3DG Holdings, as a sharp increase in gold prices can lead to hedging losses if not managed effectively.

Furthermore, elevated gold prices tend to curb consumer spending on jewellery. When gold becomes more expensive, consumers may postpone purchases or opt for less costly alternatives, thereby dampening sales volumes for 3DG Holdings. This market risk poses a direct threat to the company's revenue streams and overall profitability.

- Gold Price Sensitivity: The company's core business relies heavily on gold, making it susceptible to price swings.

- Hedging Challenges: Surges in gold prices can result in financial losses from hedging strategies.

- Demand Dampening: Higher gold prices often reduce consumer demand for jewellery, impacting sales.

- Profitability Impact: These market risks can directly affect 3DG Holdings' bottom line.

3DG Holdings' financial performance shows a clear vulnerability to market volatility, particularly concerning gold prices. The company reported a 51% increase in financial losses for the year ending June 30, 2024, reaching HK$135 million, largely due to hedging losses stemming from rising gold prices. This reliance on hedging strategies, coupled with a 5% revenue decline to HK$587 million in the same period, highlights significant weaknesses in risk management and market adaptation.

The company's deep financial dependence on its parent, Luk Fook, also presents a weakness, indicating a potential lack of self-sustaining financial capabilities and susceptibility to the parent's strategic priorities. Furthermore, the complex process of integrating 3DG Holdings' operations and trademarks into Luk Fook's framework poses a risk of operational disruption and resource diversion, a common challenge in acquisitions where integration can take 18-24 months and cost 5-10% of the deal value.

| Metric | 2023 (HK$) | 2024 (HK$) | Change |

|---|---|---|---|

| Revenue | 617.9 million | 587 million | -5.0% |

| Net Loss Attributable to Equity Holders | 89.4 million | 135 million | +51.0% |

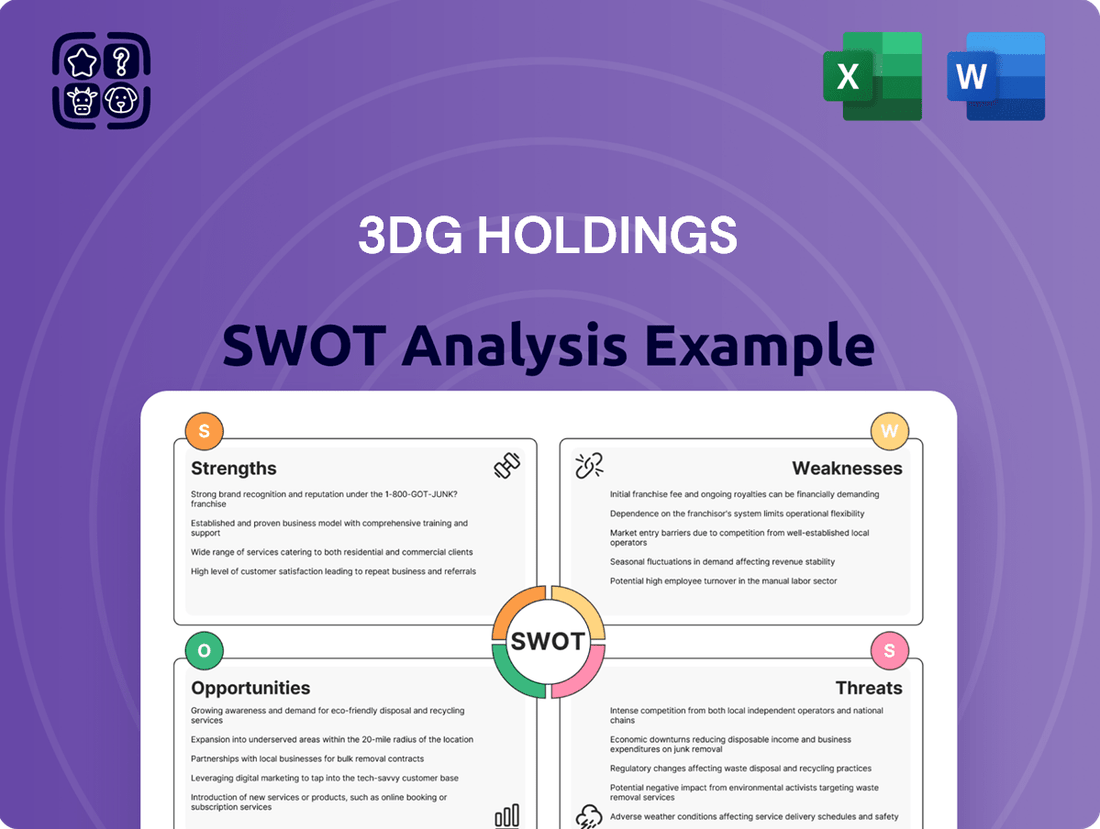

Preview Before You Purchase

3DG Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details 3DG Holdings' Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into 3DG Holdings' competitive landscape and internal capabilities.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the 3DG Holdings SWOT analysis, empowering you with detailed strategic intelligence.

Opportunities

Luk Fook Holdings' strategic expansion, with plans for a net addition of 50 shops in Mainland China and around 20 overseas in fiscal year 2026, presents a significant opportunity for 3DG Holdings. This aggressive growth trajectory allows 3DG to leverage Luk Fook's increasing footprint to expand its own physical presence and tap into previously unreached customer bases.

By aligning with Luk Fook's expansion into new territories, including approximately 2 new shops in Macau for Luk Fook, 3DG Holdings can gain access to burgeoning markets. This strategic alignment can accelerate 3DG's market penetration and customer acquisition efforts, capitalizing on the established brand recognition and retail infrastructure of Luk Fook.

Despite a somewhat challenging economic climate in 2024, Mainland China's luxury market is poised for a significant rebound, presenting substantial long-term growth opportunities for companies like 3DG Holdings. This growth is anticipated to be particularly robust in Tier 2 and Tier 3 cities, where rising disposable incomes and an expanding middle class are fueling demand for premium goods and experiences.

Analysts project a cautiously optimistic outlook for the latter half of 2025. A notable segment of Chinese consumers, estimated to be around 60% according to recent surveys, plan to increase their spending on luxury items. This increased spending is largely attributed to growing confidence in the domestic economy and a desire for aspirational purchases.

Chinese consumers are showing a strong and persistent appetite for gold jewelry, even with elevated prices. In the first quarter of 2025, spending reached RMB84 billion, marking the third-highest quarter on record for gold jewelry consumption value in China. This trend highlights a significant opportunity for 3DG Holdings to capitalize on this robust consumer demand.

This sustained willingness to purchase gold jewelry, despite cost, suggests that consumers are prioritizing gold as a valuable asset and a desirable luxury item. 3DG Holdings can leverage this by developing and marketing premium product lines and collections that appeal to this segment of the market, potentially focusing on unique designs or enhanced perceived value.

Optimization of Product Mix towards Fixed-Price Jewellery

Luk Fook, a key player in the jewelry market and representative of 3DG Holdings' strategy, is focusing on fixed-price jewelry to counter the effects of fluctuating gold costs. This approach aims to attract consumers who prefer predictable pricing, thereby stabilizing revenue streams.

This strategy is particularly relevant given the volatility of gold prices. For instance, gold prices saw significant increases throughout 2024, reaching record highs. By offering fixed-price items, 3DG can insulate itself from these market swings.

The optimization extends to diamond-set pure gold products, broadening the appeal of fixed-price offerings. This diversification helps maintain sales momentum and supports profit margins even when raw material costs are elevated.

The effectiveness of this strategy is underscored by market trends observed in late 2024 and early 2025, where consumers showed increased interest in value-driven purchases. This shift in consumer preference directly benefits 3DG's fixed-price product line.

- Focus on Fixed-Price Gold Products: A direct response to high gold prices, aiming for stable sales.

- Inclusion of Diamond-Set Pure Gold: Expands the fixed-price category to cater to a wider audience.

- Mitigation of Gold Price Volatility: Protects profit margins by decoupling pricing from raw material cost fluctuations.

- Alignment with Consumer Preferences: Addresses the growing demand for predictable pricing in jewelry purchases.

Expanding E-commerce and Digital Footprint

Luk Fook is strategically enhancing its e-commerce presence, aiming to offer affordable luxury jewelry. This move directly targets the substantial online spending power of younger consumers, presenting a prime opportunity for 3DG Holdings to broaden its market reach. By prioritizing digital channels, the company can foster deeper engagement with this key demographic and unlock significant online sales growth.

The global e-commerce market is projected to reach $8.1 trillion by 2024, underscoring the immense potential for brands that effectively leverage online platforms. For 3DG Holdings, this translates into a clear path to tap into new customer segments and diversify revenue streams beyond traditional brick-and-mortar retail.

- Increased Online Sales: Targeting young consumers with affordable luxury jewelry online can significantly boost sales figures.

- Broader Market Reach: Digital platforms allow 3DG Holdings to connect with customers beyond its physical store locations.

- Enhanced Customer Engagement: E-commerce facilitates interactive marketing and personalized experiences, building stronger customer relationships.

- Data-Driven Insights: Online sales provide valuable data on consumer preferences, enabling more effective product development and marketing strategies.

The strategic expansion of key partners like Luk Fook Holdings, with plans to open approximately 70 new stores in fiscal year 2026, offers 3DG Holdings a significant opportunity to grow its physical presence and access new customer bases. This expansion into new territories, including Macau, allows 3DG to accelerate market penetration by leveraging established brand recognition and retail infrastructure.

Mainland China's luxury market is expected to see a strong rebound, particularly in Tier 2 and Tier 3 cities, driven by rising disposable incomes. Analysts project that by the latter half of 2025, around 60% of Chinese consumers plan to increase their spending on luxury items, presenting a substantial growth opportunity for 3DG Holdings.

The persistent demand for gold jewelry in China, evidenced by RMB84 billion in spending in Q1 2025, highlights a key opportunity. 3DG can capitalize on this by developing premium product lines that appeal to consumers prioritizing gold as a valuable asset and luxury item.

Luk Fook's focus on fixed-price jewelry, including diamond-set pure gold products, is a strategic move to counter gold price volatility and align with consumer preferences for predictable pricing. This strategy helps stabilize revenue and protect profit margins, especially given the record highs gold prices reached in 2024.

Enhancing e-commerce presence to offer affordable luxury jewelry directly targets the significant online spending power of younger consumers. This digital push allows 3DG Holdings to expand its market reach, foster customer engagement, and gather valuable data to refine its strategies, tapping into the global e-commerce market projected to reach $8.1 trillion by 2024.

Threats

Weak consumer confidence, especially in Mainland China, is a major threat. Economic uncertainty and falling real estate values are making people hesitant to spend on luxury goods, which directly impacts 3DG Holdings.

The luxury market experienced a sharp slowdown in 2024, and forecasts suggest a flat performance for 2025. This economic climate means reduced demand for high-end jewelry, a key segment for the company.

Record-high gold prices, reaching over $2,400 per ounce in early 2024, are significantly impacting the jewelry sector by dampening consumer demand. This trend is particularly evident in key markets like China, where jewelry consumption has seen substantial year-on-year declines, a direct consequence of the precious metal's elevated cost.

Consumers are increasingly opting to postpone jewelry purchases or redirect their spending towards alternative assets or experiences that offer perceived value preservation. This shift in consumer behavior directly translates to reduced sales volumes for companies like 3DG Holdings, posing a considerable threat to their revenue streams in the current economic climate.

3DG Holdings faces a significant threat from shifting consumer spending patterns, particularly among Chinese and Hong Kong consumers. As international travel rebounds, many are choosing to spend their disposable income abroad, favoring destinations like Europe and Japan over domestic purchases. This trend directly impacts luxury goods sectors, including jewelry.

Furthermore, there's a discernible move towards experiential luxury, where consumers value unique experiences and services more than tangible products. This preference for memories over material possessions presents a challenge to traditional retail models, potentially reducing demand for items like fine jewelry, which 3DG Holdings offers.

Intense Competition in the Jewellery Retail Market

The gold and jewellery retail landscape across Hong Kong, Macau, and Mainland China is characterized by fierce competition. Established brands and numerous smaller retailers vie for consumer attention, creating a challenging environment for 3DG Holdings.

This intense rivalry means 3DG Holdings, even as part of the Luk Fook Group, must continually adapt. Evolving consumer preferences, particularly a growing demand for personalized and unique designs, necessitate ongoing innovation and differentiation to secure and grow market share.

- Market Saturation: The Greater China region boasts a high density of jewellery retailers, leading to price sensitivity and reduced margins.

- Brand Loyalty Challenges: Consumers frequently switch between brands based on promotions and new collections, making sustained loyalty difficult to cultivate.

- Emergence of Online Retailers: Digital platforms are increasingly capturing market share, forcing traditional brick-and-mortar players like 3DG Holdings to invest heavily in omnichannel strategies.

- Economic Sensitivity: Jewellery sales are often discretionary, making them vulnerable to economic downturns that can dampen consumer spending power.

Supply Chain Disruptions and Rising Operating Costs

Macroeconomic and geopolitical instability continue to pose significant risks to 3DG Holdings' operations. These factors can create supply chain bottlenecks, directly impacting the sourcing of raw materials and the production of jewellery. For instance, ongoing global conflicts and trade tensions have led to increased shipping costs and lead times, as seen in the 2024 shipping industry reports indicating a 15-20% rise in freight rates for certain routes.

The anticipated growth in jewellery demand, projected by industry analysts to reach a global market size of $300 billion by 2025, is tempered by rising operating expenses. Exhibitors at major industry trade shows in late 2024 frequently cited concerns about escalating costs for precious metals, gemstones, and labor. This suggests potential pressure on 3DG Holdings' profit margins if these increased expenses cannot be fully absorbed or passed on to consumers in the form of higher prices.

- Increased sourcing costs: Geopolitical events in 2024 have driven up the price of key precious metals by an average of 8-12%.

- Production cost inflation: Labor and energy costs have seen a general increase of 5-7% year-over-year.

- Supply chain fragility: Delays in material delivery can disrupt production schedules and increase inventory holding costs.

- Margin compression risk: Difficulty in passing on all cost increases to consumers could erode profitability.

Intensifying competition within the Greater China region presents a significant threat, with market saturation leading to price sensitivity and potentially reduced profit margins for 3DG Holdings. Furthermore, cultivating sustained brand loyalty is challenging as consumers frequently switch brands based on promotions and new collections.

The rise of online retailers is capturing market share, compelling traditional players like 3DG Holdings to invest heavily in omnichannel strategies to remain competitive. Economic sensitivity also plays a crucial role, as discretionary spending on jewelry makes sales vulnerable to economic downturns that can dampen consumer spending power.

| Threat Factor | Impact | Supporting Data (2024-2025) |

|---|---|---|

| Intense Competition & Market Saturation | Price sensitivity, reduced margins | High density of retailers in Greater China; consumers switch brands based on promotions. |

| Rise of Online Retailers | Need for omnichannel investment | Digital platforms capturing market share from traditional brick-and-mortar. |

| Economic Sensitivity | Vulnerability to spending downturns | Jewelry sales are discretionary; consumer confidence impacts demand. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including 3DG Holdings' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.