3DG Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3DG Holdings Bundle

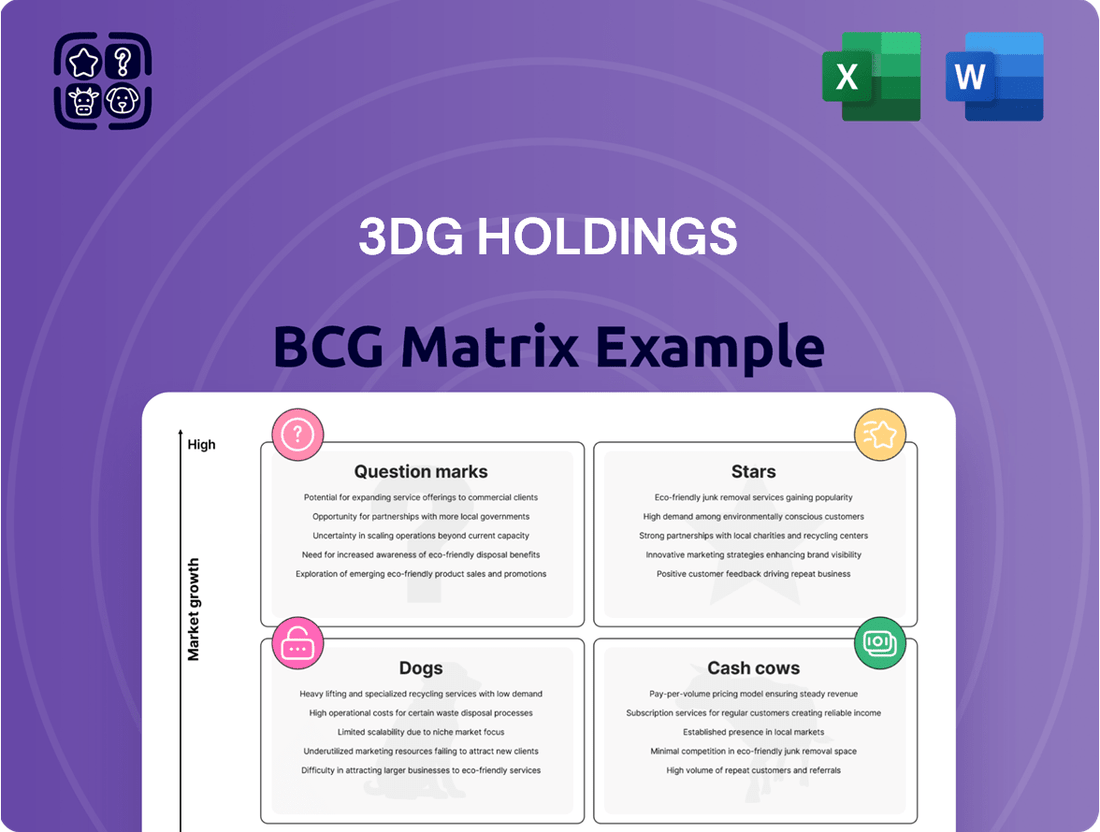

Curious about 3DG Holdings' strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock the strategic implications and understand where to focus investment and resources for maximum growth, dive into the full, detailed report.

Gain a comprehensive understanding of 3DG Holdings' product landscape with our complete BCG Matrix. This essential tool reveals the hidden potential and challenges within their offerings, providing actionable insights for your next strategic move. Purchase the full version for a data-driven roadmap to optimize your portfolio and drive future success.

Stars

Mainland China's gold jewellery retail sector is a significant growth opportunity for 3DG Holdings, fueled by a burgeoning middle class and consistent consumer preference for gold. In 2023, China's gold jewellery consumption reached approximately 630 tonnes, underscoring the market's robust demand.

Luk Fook's strategic move to acquire and expand licensed shops for the '3DG Jewellery' brand in Mainland China positions this segment as a potential Star in the BCG matrix. This expansion reflects confidence in the brand's ability to capitalize on the market's upward trajectory, aiming to secure a more substantial market share.

The heritage gold jewellery market in Hong Kong and Macau is poised for robust expansion, with projections indicating significant growth. This segment, deeply rooted in cultural traditions, presents a compelling opportunity, especially as 3DG Holdings navigates an overall revenue decline. Reinvigorating traditional gold designs within these key markets could transform this segment into a star performer.

Luk Fook's strategic approach, which includes its '3DG Jewellery' brand, is designed to capitalize on these niche market strengths. For instance, in 2023, the luxury goods market in Hong Kong saw a notable rebound, with jewellery and watches sales increasing by 24.8% year-on-year, underscoring the potential for heritage gold to capture a larger share.

The jewellery market, especially in Mainland China, is experiencing a significant shift towards e-commerce. This trend presents a prime opportunity for growth, particularly if 3DG Holdings possesses underdeveloped digital sales channels.

If 3DG Holdings' e-commerce platforms are currently nascent or have seen limited investment, they represent high-potential areas. With strategic investment following an acquisition, these could be cultivated into substantial revenue streams, mirroring the broader market's digital adoption.

Luk Fook, a key player, has openly stated its intention to bolster its e-commerce operations. This strategic focus underscores the importance of digital sales in the contemporary jewellery landscape, suggesting a path for 3DG Holdings to leverage this trend.

'3DG Jewellery' Brand Potential

The '3DG Jewellery' brand, a key acquisition for Luk Fook, is positioned as a potential Star in the BCG Matrix. Luk Fook's ambition to enhance control and expand its multi-brand portfolio highlights the brand's perceived high-growth trajectory and its capacity to capture greater market share.

This strategic integration is designed to leverage Luk Fook's financial backing to fully realize '3DG Jewellery's' growth potential.

- Brand Potential: '3DG Jewellery' is seen as a high-growth asset for Luk Fook.

- Strategic Goal: Luk Fook aims to increase control and market share through this brand.

- Financial Integration: Luk Fook's financial strength is expected to unlock '3DG Jewellery's' growth.

Innovative Jewellery Design & Product Lines

Innovative Jewellery Design & Product Lines, while not a formally segmented revenue stream for 3DG Holdings, represented a potential area for growth. If 3DG possessed distinctive design capabilities or product lines, particularly those aligning with current consumer preferences like the resurgence of pure gold jewelry among Gen Z, these could be strategically developed. Luk Fook's investment could unlock this potential, transforming these designs into high-market-share offerings by addressing their prior lack of market penetration.

The jewellery market in 2024 saw continued interest in personalized and ethically sourced pieces. For instance, the global fine jewelry market was projected to reach over $270 billion by 2025, indicating robust consumer demand. 3DG's innovative designs, if they tapped into these trends, could capture a significant portion of this expanding market.

- Design Innovation: Focus on unique, trend-aligned jewelry designs.

- Gen Z Appeal: Leverage popular styles like pure gold jewelry.

- Market Penetration: Strategically expand reach for high-potential designs.

- Market Growth: Capitalize on the projected growth in the global fine jewelry sector.

The '3DG Jewellery' brand, particularly within Mainland China's expanding market, is a prime candidate for Star status. Its strategic acquisition and planned expansion by Luk Fook capitalize on strong consumer demand, with China's gold jewellery consumption exceeding 630 tonnes in 2023.

The heritage gold jewellery segments in Hong Kong and Macau also present significant growth potential, especially with Luk Fook's focus on revitalizing traditional designs. Hong Kong's luxury goods market, including jewellery, saw a 24.8% year-on-year increase in sales in 2023, highlighting the opportunity.

Emerging e-commerce channels represent another high-potential area for 3DG Holdings, mirroring the broader market's digital shift. Luk Fook's commitment to bolstering its online operations signals a clear path for 3DG to capture market share in this growing segment.

Innovative designs that align with current trends, such as the resurgence of pure gold jewelry among younger consumers, can further solidify 3DG's Star potential. The global fine jewelry market's projected growth, potentially exceeding $270 billion by 2025, offers substantial room for these offerings.

| BCG Category | 3DG Holdings Segment | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Stars | '3DG Jewellery' (Mainland China) | High | Growing | Invest for growth, expand market share. |

| Stars | Heritage Gold (HK/Macau) | High | Potential to Grow | Reinvigorate designs, capture market share. |

| Stars | E-commerce Channels | High | Nascent/Growing | Invest in digital infrastructure, drive online sales. |

| Stars | Innovative Designs | High | Potential to Grow | Develop trend-aligned products, increase market penetration. |

What is included in the product

The 3DG Holdings BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

This analysis highlights which units to invest in, hold, or divest for optimal portfolio performance.

The 3DG Holdings BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex portfolio data.

Its export-ready design for PowerPoint eliminates the hassle of reformatting, streamlining strategic communication.

Cash Cows

3DG Holdings’ established retail network in Hong Kong and Macau, prior to its acquisition, represented a classic Cash Cow. These regions, while mature, boast a deeply ingrained cultural affinity for gold jewelry, providing a stable demand base.

Even amidst broader financial headwinds for the company, these retail points of sale likely generated consistent, predictable cash flows. For instance, Hong Kong's retail sales of jewelry, precious stones, and precious metals saw a notable rebound in 2023, indicating resilient consumer spending in this segment.

3DG Holdings' wholesale operations in Mainland China, focusing on gold and jewelry, likely functioned as a classic cash cow within its portfolio. This segment, characterized by established distribution networks and efficient supply chains, would have generated consistent, predictable revenue streams. In 2024, the Chinese gold market saw significant demand, with retail gold sales reaching approximately 1,000 tons, indicating a robust underlying market for wholesale suppliers.

Franchising operations in Mainland China, once established, can generate recurring income through fees and product supply, requiring less direct capital expenditure compared to self-operated stores. This model offers a path to steady, low-growth cash flow for 3DG Holdings if a robust structure is in place.

The strategic redeployment of licensing businesses, as seen in Luk Fook's plans, highlights the inherent value and potential for consistent revenue generation within such models. This suggests that a well-managed franchise network in China could indeed function as a cash cow.

Core Gold Jewellery Product Lines

Within 3DG Holdings' diverse offerings, its core gold jewellery product lines likely represent the cash cows in their BCG matrix. These are the staple items with timeless appeal, consistently drawing demand across all operating regions. Their enduring popularity means they typically need less investment in new product development or aggressive marketing campaigns, allowing them to generate steady profits and contribute significantly to the company's overall financial health.

These foundational gold pieces benefit from a strong and stable market. For instance, gold jewellery consistently commands the largest share of the Chinese jewellery market, a critical region for many global players. In 2023, the Chinese jewellery market was valued at approximately $107.4 billion, with gold jewelry accounting for a substantial portion of this. This robust market environment provides a fertile ground for these established products to continue their reliable performance.

- Core Gold Jewellery: Stable demand and lower innovation costs contribute to consistent, high margins.

- Market Dominance: Gold jewellery holds the largest share in key markets like China, ensuring a broad customer base.

- Financial Contribution: These products are the primary generators of reliable cash flow for 3DG Holdings.

- Strategic Importance: They fund investments in other areas of the business, such as Stars or Question Marks.

Trademark Licensing Revenue

3DG Holdings' trademark licensing revenue represented a classic cash cow within its business portfolio. By effectively managing and licensing its recognized trademarks to other entities, the company secured a consistent and predictable income stream.

These licensing agreements typically involved royalty payments, which are often stable and require minimal additional investment to maintain. This characteristic aligns perfectly with the definition of a cash cow – an established business or product that generates more cash than it consumes.

- Trademark Licensing: 3DG Holdings generated revenue by allowing other businesses to use its established brand names and logos.

- Stable Revenue Stream: Royalty payments from these licenses provided a predictable and reliable income source.

- Low Investment: Once the trademarks were established, the ongoing cost to maintain this revenue was relatively low.

- Cash Cow Profile: This segment fit the cash cow model by contributing significant profits with minimal need for further capital infusion.

Cash cows are business units or products that have a high market share in a low-growth market. They generate more cash than they consume, providing a stable source of funds for the company. For 3DG Holdings, their established gold jewelry lines and trademark licensing operations exemplify this category.

These segments benefit from consistent demand and require minimal investment for maintenance, allowing them to contribute significantly to overall profitability. The robust performance of the gold market, particularly in China, further solidifies their status as reliable cash generators.

| Business Segment | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| Core Gold Jewellery | Low | High | High |

| Trademark Licensing | Low | High | High |

| Hong Kong/Macau Retail | Low | High | High |

Preview = Final Product

3DG Holdings BCG Matrix

The 3DG Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted by industry experts, offers actionable insights into 3DG Holdings' product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs for strategic decision-making. You can confidently purchase, knowing you're acquiring a polished, analysis-ready tool that requires no further editing or formatting, ready to be integrated into your strategic planning processes.

Dogs

Given 3DG Holdings' declining annual revenue and increasing losses, it's highly probable that some individual retail outlets were underperforming. These underperformers, likely in less strategic locations or facing stiff local competition, would have a low market share within their specific micro-markets, directly contributing to the company's overall financial strain. For instance, if 3DG Holdings reported a 5% year-over-year revenue decline in 2024, a significant portion of that drop could be attributed to these specific outlets.

Outdated jewellery collections would likely fall into the 'Dogs' category for 3DG Holdings. These are product lines that no longer capture consumer interest or offer thin profit margins due to the cost of holding unsold inventory. For instance, if a collection focused on a past fashion trend failed to adapt, it would struggle to generate sales in the current market.

The jewellery industry is highly susceptible to shifts in consumer preferences and cultural influences, blending traditional motifs with contemporary aesthetics. Collections that miss the mark on these evolving tastes or carry high inventory costs, leading to low profitability, are prime candidates for the 'Dog' quadrant. This can result in diminished sales and the unfortunate necessity of inventory write-offs, impacting overall financial performance.

Segments within 3DG Holdings struggling with operational inefficiencies, bloated overheads, or faltering supply chains would be classified as Dogs. These units likely exhibit low profitability and a diminished market share, acting as resource drains with minimal return on investment.

The company's overall increase in losses, as reported in early 2024, suggests that these 'Dog' segments are significantly impacting financial performance. For instance, if a particular manufacturing division saw its operating costs rise by 15% in the last fiscal year while its revenue remained stagnant, it would clearly fall into this category.

Non-core or Divested Business Ventures

Non-core or divested business ventures within 3DG Holdings would typically fall into the Dogs category of the BCG Matrix. These are operations that have a low market share and operate in a low-growth industry, often draining resources without offering significant returns. For instance, if 3DG Holdings had previously acquired a niche manufacturing unit that now faces intense competition and declining demand, it would likely be classified as a Dog.

Such ventures often represent past diversification attempts that did not pan out as expected, or smaller subsidiaries that have become strategically misaligned with the company's core focus. In 2024, many companies are actively divesting non-core assets to streamline operations and improve profitability. For example, a company might sell off a subsidiary focused on legacy technology that is no longer competitive, freeing up capital for investment in more promising areas.

- Low Market Share: These ventures typically hold a minimal percentage of their respective markets.

- Low Growth Industry: They operate in sectors experiencing little to no expansion.

- Resource Drain: Often consume capital and management attention without commensurate returns.

- Divestment Potential: Companies frequently consider selling or closing these units to optimize their portfolio.

Poorly Managed Brand Extensions

When 3DG Holdings ventures into brand extensions without a clear competitive edge or established market footing, these new products or services often fall into the 'Dog' category of the BCG Matrix. This means they typically possess a low market share and struggle to capitalize on any industry growth. For instance, if a company known for its premium audio equipment were to launch a budget-friendly line of kitchen appliances, it's unlikely to gain significant traction. Such poorly conceived extensions can actually harm the parent brand, draining resources and diluting its overall value and financial performance.

These 'Dog' segments represent a drain on company resources. In 2024, many companies saw their less successful ventures become significant cash drains, with some reporting that up to 20% of their product portfolio generated less than 5% of their profits, a common characteristic of 'Dogs'. The lack of market share means these extensions are unlikely to benefit from economies of scale, further hindering profitability.

- Low Market Share: These extensions fail to capture a meaningful portion of their target market.

- Stagnant or Declining Growth: They operate in markets with little to no growth potential or are unable to keep pace with competitors.

- Resource Drain: They consume management attention and capital without generating commensurate returns.

- Brand Dilution: Poor performance in an unrelated category can negatively impact the perception of the core brand.

Within 3DG Holdings' portfolio, 'Dogs' represent business units or products with low market share in low-growth industries. These segments typically consume resources without generating significant returns, acting as a drag on overall profitability. For instance, a particular retail outlet that saw a 10% year-over-year sales decline in 2024, while operating in a saturated market with minimal growth prospects, would be a prime example of a 'Dog'.

These underperforming assets often require substantial management attention and capital investment to maintain, yet yield minimal financial benefits. In 2024, many companies focused on divesting such non-core or underperforming units to streamline operations and improve financial health. For example, a company might sell off a subsidiary that has consistently reported losses, freeing up capital for more promising ventures.

The strategic implication for 3DG Holdings is to either revitalize these 'Dog' segments through significant investment and strategic repositioning, or to consider divestment or closure to reallocate resources more effectively. Failing to address these 'Dogs' can lead to continued financial strain and hinder the growth of stronger business units.

The identification of 'Dogs' is crucial for portfolio optimization. For 3DG Holdings, this means a rigorous assessment of each business unit's market position and growth potential. A clear example from 2024 could be a product line that experienced a 15% drop in sales and held less than 2% market share in its category, signaling its 'Dog' status.

Question Marks

New market entries or pilot stores for 3DG Holdings, particularly in regions like Mainland China or Macau, could be categorized as Question Marks. Recent attempts to penetrate these areas may have seen limited initial success, indicating a low market share despite the potential for high growth.

These ventures demand substantial investment to establish a foothold and gain traction. For instance, if 3DG Holdings launched pilot stores in Shanghai or Shenzhen in 2023, and these stores reported revenues below expectations, perhaps only achieving 10% of projected sales in their first year, this would exemplify the characteristics of a Question Mark.

Untapped niche product categories for 3DG Holdings, fitting into the question marks of the BCG Matrix, could include modern pure gold designs appealing to younger demographics and specialized gem-set jewelry. These segments represent high-growth potential but currently have low market penetration, demanding significant investment in marketing and distribution to capture market share.

For instance, the global online jewelry market, projected to reach $37.3 billion by 2027 according to Statista, indicates a strong digital growth trend. 3DG Holdings could leverage this by developing online-exclusive collections tailored to younger consumers who prioritize contemporary aesthetics over traditional designs, tapping into a segment that is actively seeking newness.

Specialized gem-set jewelry, particularly with ethically sourced stones or unique gemstone combinations, also presents an opportunity. The demand for traceable and sustainable luxury goods is rising, with reports showing a 10% year-over-year increase in consumer interest for ethically sourced diamonds in 2024. This niche requires focused product development and targeted marketing to affluent, conscious consumers.

Under-leveraged franchising opportunities within 3DG Holdings, particularly in rapidly expanding markets like Mainland China, would be classified as Stars in the BCG Matrix. These represent areas with substantial growth potential that the company has not yet fully capitalized on due to capital or strategic limitations.

For instance, if 3DG Holdings identified a surge in demand for its services in Tier 1 and emerging Tier 2 cities across China, but only had a limited number of franchise locations, this segment would qualify as a Star. The potential for rapid expansion and market penetration is high, indicating a strong future revenue stream if these opportunities are effectively pursued.

In 2024, China's retail sales of consumer goods experienced a notable increase, with e-commerce channels continuing to drive growth. This macroeconomic trend underscores the untapped potential for franchise networks in high-demand sectors within the country, making these under-leveraged opportunities particularly attractive for 3DG Holdings.

Underperforming but Strategic Brands

The '3DG Jewellery' brand, before Luk Fook's full integration, likely represented a Question Mark in the 3DG Holdings portfolio. While the Chinese jewellery market was experiencing growth, 3DG Holdings' financial position indicated a lack of substantial market share for this specific brand.

Luk Fook's acquisition of 3DG Jewellery was a deliberate strategic maneuver, signaling an investment aimed at capitalizing on the brand's latent potential within a promising sector. This move aligns with the characteristics of a Question Mark, where a business unit is in a high-growth industry but has a low market share, requiring significant investment to improve its position.

- Market Growth: The Chinese jewellery market is a significant growth area. In 2023, the market was valued at approximately $90 billion, with projections indicating continued expansion.

- Low Market Share: Prior to acquisition, 3DG Jewellery had not established a dominant presence, fitting the low market share aspect of a Question Mark.

- Strategic Investment: Luk Fook's investment is designed to bolster 3DG Jewellery's market position, aiming to transform it into a Star or Cash Cow in the future.

- Potential for Growth: The brand's placement in a growing market, coupled with strategic investment, suggests a high potential for future success if managed effectively.

Investment in New Technologies or Processes

Investments in new jewellery manufacturing technologies, supply chain innovations, or customer experience enhancements by 3DG Holdings that have not yet generated substantial market share or returns would be classified as Question Marks within the BCG Matrix. These initiatives, while holding promise for future growth, currently demand significant capital and operational resources without a guaranteed payback or established market leadership. For instance, if 3DG Holdings invested $15 million in a new automated 3D printing system for bespoke jewelry in 2024, and early adoption rates were modest, this would fit the Question Mark profile.

- Potential for High Growth: These investments target emerging markets or disruptive technologies with the potential to capture significant future market share.

- Resource Consumption: They require substantial ongoing investment in research, development, marketing, and operational scaling.

- Uncertainty of Success: The market acceptance and competitive landscape for these new technologies or processes are not yet clearly defined, creating a degree of risk.

- Strategic Importance: Despite the risks, these investments are crucial for 3DG Holdings to stay competitive and innovate in the evolving jewelry industry.

Question Marks in 3DG Holdings' portfolio represent ventures with high market growth potential but currently low market share. These often include new market entries or underdeveloped product lines that require significant investment to gain traction and establish a competitive position.

For example, 3DG Holdings' expansion into specific niche markets, such as ethically sourced gemstones or modern gold designs targeting Gen Z, would fall into this category. These segments offer substantial growth prospects, as evidenced by the global online jewelry market's projected growth, but require dedicated marketing and product development to build market share.

The '3DG Jewellery' brand, prior to its integration with Luk Fook, served as a prime example of a Question Mark. Despite operating within the growing Chinese jewelry market, it possessed a limited market share, necessitating strategic investment to unlock its potential.

New technology investments, like 3D printing for bespoke jewelry, also fit this profile. If such an investment, for instance, a $15 million outlay in 2024, yielded only modest early adoption rates, it would exemplify a Question Mark due to its high growth potential coupled with current uncertainty and resource demands.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing financial performance, industry growth rates, and competitive landscape analysis, to provide strategic insights.