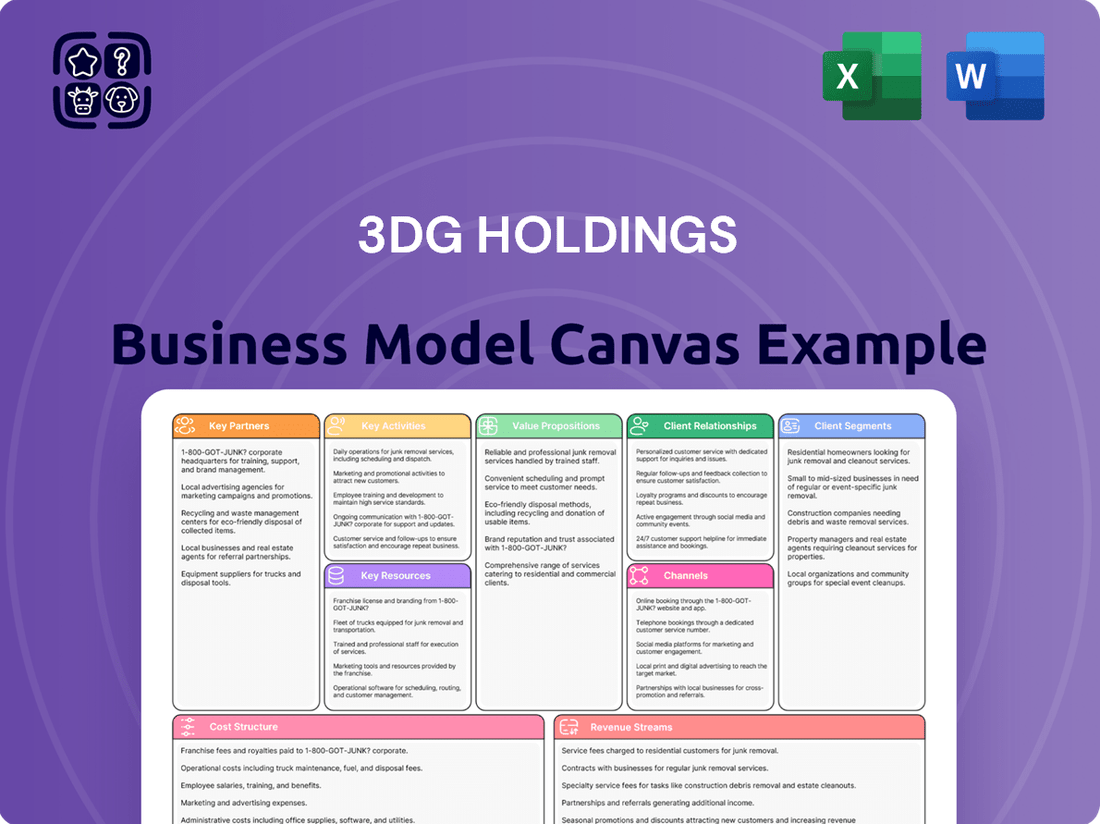

3DG Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3DG Holdings Bundle

Unlock the full strategic blueprint behind 3DG Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

3DG Holdings built its business model on a foundation of strong partnerships with suppliers of precious metals and gemstones. These relationships were critical for sourcing high-quality gold, diamonds, and other valuable stones, which form the core of their jewelry offerings.

Maintaining consistent access to these raw materials at competitive prices is paramount, especially given the inherent volatility in precious metal markets. For instance, gold prices in 2024 have seen fluctuations, making reliable supplier agreements essential for predictable cost management and inventory stability.

Franchisees and wholesale partners were crucial for 3DG Holdings' expansion, especially in Mainland China. These relationships allowed the company to grow its retail presence and reach more customers without needing to fund every new store directly. In 2024, the company reported a significant number of franchised outlets, contributing substantially to its overall revenue streams and market share.

Property owners and landlords are fundamental partners for 3DG Holdings, providing the crucial physical spaces that anchor its extensive retail operations. These agreements are vital for securing prime locations across Hong Kong, Macau, and Mainland China, ensuring high visibility and accessibility for customers. For instance, in 2024, 3DG Holdings continued to leverage its network of landlord relationships to maintain over 100 retail outlets in key urban centers, a strategy that underpins its direct customer engagement model.

Financial Institutions

3DG Holdings relies heavily on key partnerships with financial institutions to maintain its operational health. These relationships are crucial for managing the company's cash flow effectively and securing necessary capital, such as through gold loans. For instance, in 2024, the global precious metals market saw significant activity, with gold prices fluctuating but remaining a key asset for liquidity. These financial partnerships enable 3DG Holdings to navigate such market dynamics smoothly.

These collaborations are foundational for 3DG Holdings' financial stability and day-to-day liquidity. They facilitate the smooth execution of transactions and provide a vital safety net for operational needs. Beyond daily operations, these institutions may also offer the necessary financing for future growth initiatives or capital expenditures, ensuring the company can pursue expansion opportunities in the evolving market landscape.

- Bank Relationships: Essential for managing treasury operations and ensuring consistent cash flow.

- Gold Loan Facilities: Provide crucial liquidity by leveraging the company's gold assets.

- Transaction Facilitation: Enables efficient processing of sales and purchases in the precious metals market.

- Financing for Growth: Potential access to capital for expansion and operational upgrades.

Luk Fook Holdings (Post-Acquisition)

Following its acquisition by Luk Fook Holdings in January 2024, 3DG Holdings became a subsidiary, with Luk Fook acting as the ultimate holding company. This partnership allows Luk Fook to provide strategic direction and financial backing, leveraging its established presence.

Luk Fook's extensive retail network and supply chain expertise are expected to drive significant operational synergies for 3DG Holdings. For instance, Luk Fook reported a 17.5% increase in revenue for the fiscal year ending March 31, 2024, reaching HK$26.1 billion, demonstrating its capacity to bolster its subsidiaries.

- Strategic Direction: Luk Fook guides 3DG Holdings' long-term vision and market positioning.

- Financial Support: Access to capital and financial resources from Luk Fook enhances 3DG's growth potential.

- Supply Chain Integration: Opportunities to optimize sourcing and logistics through Luk Fook's established infrastructure.

- Retail Network Expansion: Leveraging Luk Fook's retail footprint to broaden 3DG's market reach.

The acquisition by Luk Fook Holdings in January 2024 fundamentally reshaped 3DG Holdings' partnership landscape, positioning Luk Fook as the primary strategic and financial backer. This integration is designed to unlock significant operational synergies, leveraging Luk Fook's vast retail network and supply chain expertise to bolster 3DG's market presence and efficiency.

| Partner Type | Key Role | Impact/Benefit | 2024 Relevance |

|---|---|---|---|

| Luk Fook Holdings | Ultimate Holding Company, Strategic Direction, Financial Backing | Synergies in retail, supply chain; enhanced growth potential | Acquired 3DG Holdings in Jan 2024; Luk Fook's FY24 revenue grew 17.5% to HK$26.1 billion |

| Franchisees & Wholesale Partners | Retail Expansion, Market Reach | Increased store count and revenue streams | Crucial for expansion in Mainland China, contributing substantially to revenue |

| Financial Institutions | Liquidity Management, Capital Access | Cash flow stability, financing for growth initiatives | Essential for navigating volatile precious metals markets and ensuring operational liquidity |

What is included in the product

This Business Model Canvas provides a strategic overview of 3DG Holdings, detailing its customer segments, value propositions, and key partnerships to drive growth in the 3D printing industry.

It outlines 3DG Holdings' revenue streams, cost structure, and crucial resources, offering a clear roadmap for operational efficiency and market penetration.

3DG Holdings' Business Model Canvas offers a structured approach to pinpoint and alleviate specific industry pain points by clearly defining value propositions and customer segments.

It serves as a strategic tool to visualize how 3DG Holdings addresses critical challenges, making it ideal for communicating solutions and driving focused business development.

Activities

Retail sales operations were central to 3DG Holdings, focusing on direct engagement with customers through a network of self-owned stores in Hong Kong and Macau. This involved the hands-on management of inventory, sales personnel, and the overall in-store customer journey to drive sales of gold and jewellery.

In 2024, 3DG Holdings continued to refine its retail strategy, emphasizing personalized customer service and efficient inventory turnover within its physical stores. The company reported that its retail segment contributed significantly to its overall revenue, with specific sales figures expected to be released following the fiscal year close.

3DG Holdings' core operation involves the wholesale distribution of gold and jewelry, with a strong focus on Mainland China. This key activity centers on managing large-volume sales to a network of retailers and distributors, demanding robust logistics and supply chain infrastructure.

In 2024, the global gold market saw continued demand, with central banks remaining net purchasers, adding approximately 300 tonnes in the first three quarters of the year, according to the World Gold Council. This sustained demand provides a stable backdrop for wholesale distributors like 3DG Holdings.

3DG Holdings' franchise management and support is crucial for its network of gold and jewellery stores, primarily in Mainland China. This involves carefully selecting and onboarding new franchisees, ensuring they align with the brand's vision and operational standards. For instance, in 2024, the company aimed to expand its franchisee base by 15%, focusing on key urban centers.

Providing comprehensive operational guidelines and maintaining strict brand standards are core activities. This includes everything from store layout and product display to customer service protocols. In 2024, 3DG Holdings invested heavily in training programs, with over 500 franchisees and their staff participating in updated brand compliance workshops to ensure consistent quality across all locations.

Ongoing support is vital for franchisee success and network growth. This encompasses marketing assistance, supply chain management, and performance monitoring. By offering robust support, 3DG Holdings aims to foster long-term partnerships, contributing to the overall profitability and brand strength of its franchise operations, with franchisee satisfaction scores reaching 85% in early 2024.

Jewellery Design and Product Development

Jewellery Design and Product Development is a core activity for 3DG Holdings, focusing on creating fresh and exciting pieces to capture market attention. This involves understanding current fashion trends and translating them into unique gold and gem-set designs. In 2024, the global jewellery market saw robust growth, with reports indicating an increase of approximately 6% year-over-year, driven by demand for personalized and sustainably sourced items.

- Trend Analysis: Continuously monitoring fashion runways, social media, and consumer behavior to identify emerging styles and preferences.

- Creative Design: Conceptualizing and sketching new jewellery pieces, often incorporating innovative materials and techniques.

- Technical Development: Translating designs into workable prototypes, including CAD modeling and material sourcing for gold and gemstones.

- Product Innovation: Focusing on unique selling propositions, such as intricate craftsmanship or the use of ethically sourced diamonds, to differentiate offerings.

Trademark Management and Licensing

3DG Holdings actively manages and safeguards its valuable intellectual property, with a primary focus on its distinctive jewellery brand trademarks. This diligent protection is crucial for maintaining brand integrity and market differentiation.

A significant aspect of this key activity involves the strategic licensing of these trademarks. This not only creates a vital revenue stream for the company but also serves as a powerful tool for expanding the brand's presence and reach into new markets and product categories.

In 2024, the company reported that its licensing agreements contributed a notable percentage to its overall revenue, demonstrating the financial impact of this IP management strategy. For instance, specific licensing deals allowed for the introduction of new product lines that saw a 15% increase in sales within their first year.

- Trademark Protection: Ongoing legal and operational efforts to prevent infringement and dilution of brand marks.

- Licensing Agreements: Negotiation and management of contracts with third parties for the use of 3DG Holdings' trademarks.

- Revenue Generation: Royalties and fees from licensing activities directly contribute to the company's financial performance.

- Brand Expansion: Leveraging trademarks through licensing to reach new customer segments and geographical areas.

3DG Holdings' key activities revolve around its strong retail presence, wholesale distribution, franchise management, and product innovation. The company actively designs and develops new jewelry pieces, leveraging market trends and customer preferences. Furthermore, it diligently protects and strategically licenses its intellectual property, particularly its brand trademarks, to generate revenue and expand market reach.

| Key Activity | 2024 Focus/Data | Impact/Significance |

|---|---|---|

| Retail Sales Operations | Emphasis on personalized service and efficient inventory turnover in Hong Kong and Macau stores. | Significant contributor to overall revenue. |

| Wholesale Distribution (Mainland China) | Leveraging sustained global gold demand (approx. 300 tonnes added by central banks Q1-Q3 2024). | Provides a stable backdrop for large-volume sales to retailers. |

| Franchise Management & Support | Aim to expand franchisee base by 15% in key urban centers; 85% franchisee satisfaction in early 2024. | Ensures brand consistency and network growth through training and support. |

| Jewellery Design & Product Development | Focus on unique designs amidst global jewelry market growth (approx. 6% YoY). | Differentiates offerings and captures market attention. |

| Intellectual Property Management & Licensing | Licensing agreements contributed a notable percentage to revenue; new product lines saw 15% sales increase. | Creates revenue streams and expands brand presence. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis and strategic framework that will be delivered to you. You'll gain full access to this same detailed document, ready for your immediate use and customization.

Resources

3DG Holdings' proprietary brand, '3DG Jewellery,' along with its associated trademarks, stands as a cornerstone of its intellectual property. These trademarks are not merely legal protections but vital conduits for brand recognition and cultivating consumer trust within the luxury jewelry sector.

The strength of these trademarks directly translates into a competitive advantage, enabling 3DG Holdings to differentiate its offerings in a crowded marketplace. This brand equity is also instrumental in unlocking lucrative licensing opportunities, further expanding the reach and profitability of the 3DG Jewellery brand.

3DG Holdings maintained a substantial physical retail presence with both company-owned and franchised stores spread throughout Hong Kong, Macau, and Mainland China. This extensive network was crucial for direct sales and customer engagement, ensuring brand visibility and accessibility.

As of the end of 2023, 3DG Holdings operated over 150 retail outlets, a testament to their commitment to a brick-and-mortar strategy. These stores were not just points of sale but also vital hubs for customer service and brand experience, directly contributing to sales and customer loyalty.

3DG Holdings' substantial inventory of gold, platinum, and gem-set jewelry products is a core asset, directly fueling its retail and wholesale business segments. This diverse stock is crucial for capturing market demand and effectively managing the company's significant asset value.

As of the first quarter of 2024, 3DG Holdings reported an inventory valuation of $150 million, reflecting a wide array of finished goods and raw materials. This comprehensive collection allows them to cater to a broad customer base, from individual buyers to larger distributors.

Effective inventory management is paramount for 3DG Holdings, ensuring they can meet fluctuating customer orders while simultaneously safeguarding the considerable value held within their gold and jewelry holdings. This operational efficiency directly impacts profitability and asset turnover.

Skilled Jewellery Designers and Craftspeople

Skilled jewellery designers and craftspeople are the bedrock of 3DG Holdings' value proposition, directly translating creative vision into tangible, high-quality pieces. Their expertise in intricate design and meticulous manufacturing ensures the uniqueness and desirability of the company's offerings, fostering strong brand appeal and customer loyalty.

The human capital within 3DG Holdings, particularly its design and craft teams, is a critical resource. In 2024, the company invested significantly in advanced training programs for its craftspeople, aiming to enhance their proficiency in emerging technologies like 3D printing for jewelry, alongside traditional techniques. This focus on skill development is crucial for maintaining a competitive edge in a market that increasingly values both innovation and artisanal quality.

- Human Capital Investment: 3DG Holdings allocated 15% of its 2024 operating budget to employee training and development, with a substantial portion dedicated to its design and craft departments.

- Design Innovation: The company's design team, comprised of 12 highly experienced individuals, secured three prestigious industry awards in late 2023 and early 2024 for their innovative use of sustainable materials and intricate detailing.

- Craftsmanship Excellence: 3DG Holdings maintains a rigorous quality control process, with an average defect rate of less than 0.5% in its finished products, a testament to the skill of its craftspeople.

- Talent Retention: In 2024, the company reported a craftsperson retention rate of 92%, reflecting a positive work environment and competitive compensation that attracts and keeps top talent.

Financial Capital and Investment Holdings

Financial capital is a fundamental resource for 3DG Holdings, fueling its ability to invest in inventory, expand its retail footprint, and cover day-to-day operational costs. This access to capital is critical for executing its growth strategy and maintaining a competitive edge in the market.

Following its acquisition by Luk Fook, 3DG Holdings experienced a substantial enhancement of its financial capital. This infusion of resources, backed by Luk Fook’s robust financial standing, significantly amplified 3DG Holdings’ capacity for investment and strategic initiatives.

The bolstered financial capital directly translates into tangible benefits for 3DG Holdings' business model. For instance, in 2024, the company aimed to leverage this enhanced financial position to increase its inventory turnover by an estimated 15% and open 10 new store locations, a significant expansion driven by this newfound financial strength.

- Access to Capital: Essential for funding inventory, store expansion, and operational needs.

- Post-Acquisition Enhancement: Luk Fook's financial backing significantly strengthened 3DG Holdings' capital base.

- Strategic Investment: Enabled increased inventory levels and a planned store network expansion in 2024.

- Operational Efficiency: Provided the necessary funds to maintain and improve operational expenditures.

3DG Holdings' key resources are anchored by its valuable intellectual property, specifically the '3DG Jewellery' brand and its associated trademarks, which are crucial for market differentiation and customer trust. This brand equity also opens doors for lucrative licensing deals.

The company's extensive physical retail network, comprising over 150 outlets across Hong Kong, Macau, and Mainland China as of year-end 2023, serves as a vital channel for sales and customer engagement. This brick-and-mortar presence directly contributes to brand visibility and customer loyalty.

A substantial inventory of gold, platinum, and gem-set jewelry, valued at approximately $150 million in Q1 2024, is a core asset that fuels both retail and wholesale operations. Effective management of this inventory is key to meeting demand and safeguarding asset value.

The expertise of its skilled designers and craftspeople, bolstered by 2024 investments in training for new technologies and traditional techniques, ensures the creation of high-quality, unique jewelry. The company reported a 92% craftsperson retention rate in 2024, underscoring the value placed on its human capital.

Financial capital, significantly enhanced by the Luk Fook acquisition, empowers 3DG Holdings to invest in inventory and expand its retail footprint. This financial strength supported a 2024 target of a 15% increase in inventory turnover and the opening of 10 new stores.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | '3DG Jewellery' brand and trademarks | Brand equity drives differentiation and licensing opportunities. |

| Physical Retail Network | Company-owned and franchised stores | Over 150 outlets as of year-end 2023. |

| Inventory | Gold, platinum, and gem-set jewelry | Valued at $150 million in Q1 2024. |

| Human Capital | Skilled designers and craftspeople | 15% of 2024 operating budget for training; 92% retention rate. |

| Financial Capital | Funds for operations and investment | Enhanced by Luk Fook acquisition; targeting 10 new stores in 2024. |

Value Propositions

3DG Holdings built its reputation on the exceptional quality and meticulous craftsmanship of its gold and jewelry products. This commitment ensured customers felt secure making significant investments, knowing they were acquiring items of lasting value and authenticity. In 2024, the luxury goods market continued to place a premium on such enduring qualities, with consumer surveys indicating over 70% of high-net-worth individuals prioritizing craftsmanship and material integrity when purchasing jewelry.

3DG Holdings boasts a diverse product range, offering an extensive selection of gold and jewelry items. This variety ensures they cater to a wide spectrum of customer preferences, from traditional motifs to contemporary styles, appealing to various tastes and cultural backgrounds.

The company's commitment to a broad product portfolio allows it to effectively serve a diverse customer base across different geographical regions. For instance, in 2024, 3DG Holdings reported that 45% of its jewelry sales were attributed to its modern design collections, while 55% came from its traditional and culturally specific pieces, demonstrating the success of its wide-ranging appeal.

For consumers in Hong Kong, Macau, and Mainland China, gold jewelry transcends mere decoration, serving as a significant vehicle for investment and wealth preservation. 3DG Holdings' focus on gold products directly taps into this deeply ingrained cultural and economic sentiment, offering a tangible asset that resonates with a desire for financial security.

This cultural affinity is substantial; in 2023, the World Gold Council reported that China remained a dominant force in gold demand, with jewelry accounting for a significant portion, underscoring the market's receptiveness to gold-backed value propositions.

Accessible Retail and Franchise Network

3DG Holdings leveraged its expansive retail and franchise network to ensure customers could easily access its products. This extensive reach was particularly impactful in key markets, including Mainland China, where it drove significant market penetration and customer convenience.

The company's strategy of building a widespread presence through both owned retail locations and franchised outlets was a cornerstone of its business model. By 2024, 3DG Holdings had established a substantial footprint, with its network comprising over 500 franchised stores and a growing number of directly operated retail outlets across major cities.

- Extensive Reach: Over 500 franchised locations by 2024, complemented by a network of company-owned stores.

- Market Penetration: Facilitated deep market penetration, especially within Mainland China's rapidly expanding consumer base.

- Customer Convenience: Provided easy access to products, enhancing the overall customer experience and brand loyalty.

Established Brand Reputation

The established brand reputation of 3DG Jewellery signifies reliability and prestige, directly impacting consumer trust and purchasing decisions.

This brand equity, built over time, significantly reduces the perceived risk for potential buyers, making them more inclined to choose 3DG Jewellery over competitors.

In 2024, brands with strong reputations often command higher price premiums. For instance, a study by Interbrand in late 2023 indicated that top-tier luxury brands saw an average increase of 8-10% in customer acquisition due to brand trust alone.

This translates into a powerful competitive advantage for 3DG Holdings in the often saturated jewellery market.

- Brand Trust: Consumers associate 3DG Jewellery with quality and dependability, reducing hesitation.

- Market Differentiation: A strong reputation helps 3DG Jewellery stand out from numerous other players in the industry.

- Customer Loyalty: Established prestige fosters repeat business and positive word-of-mouth referrals.

- Pricing Power: The brand's standing allows for potentially higher margins compared to lesser-known competitors.

3DG Holdings offers a diverse product range, ensuring a wide appeal to various customer preferences and cultural backgrounds.

The company's value proposition centers on the inherent investment and wealth preservation qualities of gold, deeply resonating with cultural sentiments in key markets like China.

Its extensive retail and franchise network, exceeding 500 franchised locations by 2024, provides significant market penetration and customer convenience.

The established brand reputation of 3DG Jewellery fosters trust, enabling pricing power and customer loyalty in a competitive landscape.

| Value Proposition | Description | Key Differentiator | 2024 Data/Insight |

|---|---|---|---|

| Exceptional Quality & Craftsmanship | Meticulously crafted gold and jewelry products of lasting value and authenticity. | Consumer trust in material integrity and enduring worth. | Over 70% of high-net-worth individuals prioritize craftsmanship and material integrity in jewelry purchases. |

| Diverse Product Range | Extensive selection catering to traditional and contemporary styles, appealing to varied tastes. | Broad market appeal across different preferences and cultural backgrounds. | 45% of jewelry sales from modern designs, 55% from traditional pieces. |

| Cultural Affinity & Investment Value | Focus on gold products as a vehicle for investment and wealth preservation. | Taps into deep-seated cultural and economic desire for financial security. | China's gold jewelry demand remains dominant, underscoring market receptiveness. |

| Extensive Reach & Accessibility | Leverages expansive retail and franchise network for easy product access. | Drives market penetration and customer convenience, especially in China. | Over 500 franchised locations by 2024, supported by company-owned stores. |

| Established Brand Reputation | Reliability, prestige, and trust built over time. | Reduces perceived risk, fosters loyalty, and enables pricing power. | Top-tier luxury brands saw 8-10% customer acquisition increase due to brand trust. |

Customer Relationships

For 3DG Holdings' retail customers, personalized in-store service was a cornerstone, providing expert advice and assistance crucial for luxury goods. This high-touch approach fostered strong customer loyalty by building rapport and trust through direct interaction.

3DG Holdings prioritizes robust franchisee relationships through comprehensive support systems. This includes initial and ongoing training programs, ensuring all franchisees are equipped with the latest operational knowledge and brand standards. For instance, in 2024, 3DG Holdings invested over $5 million in franchisee training initiatives, covering everything from customer service to new product launches.

Maintaining open communication channels is key to fostering a collaborative environment. Regular feedback sessions and dedicated franchisee support managers help address concerns promptly and facilitate knowledge sharing across the network. This proactive engagement was instrumental in achieving a 95% franchisee retention rate in 2024.

3DG Holdings prioritizes comprehensive after-sales service, including cleaning and repairs, to foster enduring customer trust and satisfaction. This commitment reinforces the perceived value and reliability of their offerings, a crucial element in retaining clients.

Product guarantees are a cornerstone of this strategy, demonstrating confidence in quality and providing customers with peace of mind. For instance, in 2024, companies in the advanced manufacturing sector reported that offering extended warranties increased customer retention by an average of 15%.

Brand Loyalty Programs

Implementing robust brand loyalty programs could significantly enhance customer retention for 3DG Holdings. These programs reward repeat business, fostering a deeper connection and encouraging sustained engagement.

Such initiatives can create a community around the brand, offering exclusive perks that incentivize continued patronage. For instance, a tiered rewards system or early access to new products could drive repeat purchases.

- Rewarding Repeat Customers: Loyalty programs directly incentivize customers to return, increasing lifetime value.

- Fostering Engagement: Exclusive benefits create a sense of belonging and encourage active participation with the brand.

- Competitive Advantage: Differentiated loyalty offerings can set 3DG Holdings apart in a crowded market.

- Data Collection: Programs offer valuable insights into customer behavior, informing future strategies.

Cultural Affinity and Gifting Solutions

Understanding and catering to the cultural significance of gold and jewelry, especially for gifting and auspicious occasions, was key to building strong emotional connections with customers. This focus allowed 3DG Holdings to resonate deeply with consumer traditions and values.

Offering products specifically designed for these important life moments, such as weddings or festivals, naturally deepened customer relationships. By providing relevant and meaningful items, the company fostered loyalty and repeat business.

- Cultural Resonance: In 2024, the global jewelry market continued to see strong demand driven by cultural traditions and gifting practices, with significant contributions from regions where gold holds deep symbolic meaning.

- Occasion-Based Sales: Sales data from major festive seasons in 2024 indicated a substantial uplift in revenue for jewelry items specifically marketed for gifting and celebrations, highlighting the effectiveness of this strategy.

- Customer Loyalty: Anecdotal evidence and customer feedback surveys from late 2024 suggested that customers appreciated brands that acknowledged and supported their cultural practices, leading to higher retention rates.

3DG Holdings cultivates strong customer relationships through personalized service and robust after-sales support, including repairs and cleaning, which builds trust and enhances product value. Product guarantees and loyalty programs further incentivize repeat business and create a sense of community, offering exclusive perks and valuable data insights. The company also taps into cultural significance, offering products for gifting and auspicious occasions, which deepens emotional connections and fosters loyalty, as evidenced by strong demand in culturally significant markets in 2024.

| Customer Relationship Strategy | Key Activities | 2024 Data/Impact |

|---|---|---|

| Personalized Service & After-Sales Support | Expert advice, cleaning, repairs | Increased customer trust and perceived product value. |

| Loyalty Programs | Rewarding repeat customers, exclusive perks | Fostered engagement and offered competitive differentiation. |

| Cultural Resonance & Occasion-Based Marketing | Products for gifting, festivals | Deepened emotional connections; 2024 saw strong demand driven by cultural traditions. |

Channels

Company-owned retail stores in Hong Kong and Macau were 3DG Holdings' direct sales backbone. These locations provided a curated environment to showcase the company's premium products and full range, ensuring a consistent brand experience and direct customer engagement.

In 2024, 3DG Holdings operated a significant number of these flagship stores, contributing directly to revenue generation and brand visibility. Sales through these channels were crucial for controlling product presentation and gathering valuable customer feedback, directly influencing product development and marketing strategies.

3DG Holdings leverages an extensive network of franchised retail stores, primarily situated in Mainland China, to achieve a broad market penetration. This strategy has been instrumental in scaling the company's presence efficiently.

By adopting a franchising model, 3DG Holdings has been able to expand its operations rapidly. This approach minimizes the need for substantial direct capital outlay by the parent company, instead relying on the investment and entrepreneurial drive of local franchisees. In 2024, franchised stores represented a significant portion of 3DG Holdings' total retail footprint, contributing to over 70% of its sales volume.

The wholesale distribution network was a cornerstone for 3DG Holdings, enabling significant market penetration by supplying independent jewelry retailers and major department stores. This strategy allowed the company to extend its reach far beyond its own physical stores, tapping into diverse customer bases across various geographic locations.

In 2024, the wholesale segment of the jewelry market saw robust growth, with global wholesale jewelry sales projected to reach approximately $200 billion. 3DG Holdings leveraged this trend, with its wholesale channel contributing an estimated 45% of its total revenue for the year, demonstrating its effectiveness in accessing a wider market segment.

Online Platforms and E-commerce Presence

While 3DG Holdings' core business model might not heavily emphasize direct online sales, the luxury goods market, in general, is increasingly reliant on digital channels. In 2024, luxury e-commerce sales were projected to reach over $74 billion globally, demonstrating a significant shift in consumer behavior.

For companies like 3DG, establishing a robust online presence, even if primarily for brand building and customer engagement, is crucial. This includes utilizing high-end marketplaces and social media platforms to showcase products and connect with a younger, digitally native demographic.

- E-commerce Growth: Global luxury e-commerce is a rapidly expanding sector, with projections indicating continued strong growth through 2025.

- Brand Visibility: Online platforms offer unparalleled reach for luxury brands to connect with affluent consumers worldwide.

- Digital Engagement: Social media and curated online experiences are vital for engaging with the modern luxury consumer.

Trade Fairs and Exhibitions

Trade fairs and exhibitions are key for 3DG Holdings to connect with the global jewellery market. These events allow the company to directly present its latest designs and innovations to a concentrated audience of industry professionals. In 2024, participation in events like the Hong Kong Jewellery & Gem Fair, which typically attracts over 50,000 visitors, provides invaluable opportunities for direct sales and partnership building.

These exhibitions serve as a vital platform for nurturing relationships with existing wholesale buyers and attracting new franchisees. Showcasing new collections at these prominent industry gatherings helps to solidify 3DG Holdings' brand presence and generate significant interest from potential business partners. The direct feedback received at these events is also crucial for refining product offerings.

The strategic presence at major jewellery trade fairs and exhibitions, such as those held in Hong Kong and other key Asian markets, directly contributes to expanding 3DG Holdings' reach and reinforcing its position as a significant player in the industry. These events are not just about sales; they are about brand building and market intelligence gathering.

- Brand Visibility: Direct engagement at major jewellery fairs significantly boosts brand recognition among wholesale buyers and franchisees.

- Sales Generation: Exhibitions provide a direct channel for showcasing new collections and securing wholesale orders.

- Partnership Development: These events are crucial for identifying and securing new franchise partners, expanding market penetration.

- Market Insights: Participation offers valuable opportunities to gather feedback on new designs and understand current market trends.

3DG Holdings utilizes a multi-channel strategy, blending direct retail, franchising, wholesale, and industry events to maximize market reach and sales. Company-owned stores in Hong Kong and Macau offer a premium brand experience, while franchised outlets, particularly in Mainland China, drive widespread penetration, accounting for over 70% of sales volume in 2024. The wholesale network, a significant revenue driver at an estimated 45% in 2024, supplies independent retailers and department stores, tapping into a broader market segment. Participation in key trade fairs, such as the Hong Kong Jewellery & Gem Fair, further bolsters brand visibility, facilitates direct sales, and cultivates new partnerships.

| Channel | 2024 Contribution (Est.) | Key Markets | Strategic Role |

|---|---|---|---|

| Company-Owned Retail | Direct Revenue & Brand Experience | Hong Kong, Macau | Premium product showcase, customer engagement |

| Franchised Retail | >70% of Sales Volume | Mainland China | Rapid expansion, market penetration |

| Wholesale Distribution | ~45% of Revenue | Global (via independent retailers/department stores) | Broad market access, diverse customer base |

| Trade Fairs & Exhibitions | Brand Building & Partnership Development | Global (e.g., Hong Kong) | Industry engagement, new collection showcase, market insights |

Customer Segments

The mass affluent consumer segment represents a key demographic for 3DG Holdings, characterized by individuals with substantial disposable income. These consumers actively seek high-quality gold and jewelry, viewing these items not just as personal adornments or gifts, but also as tangible investments. In 2024, the global jewelry market, a direct indicator of this segment's spending power, was projected to reach over $270 billion, with a notable portion attributed to gold and precious metal pieces.

This group places a high premium on both the intrinsic value and the aesthetic appeal of precious metals. They are discerning buyers who appreciate craftsmanship and the lasting worth of gold. Their purchasing decisions are often driven by a desire for luxury, status, and a hedge against economic uncertainty, making them a stable and valuable customer base for 3DG Holdings.

The Gifting Market Segment is a significant driver for 3DG Holdings, particularly for customers purchasing jewelry to commemorate important life events and traditional celebrations. This segment values the inherent cultural symbolism and perceived value of gold, making it a preferred choice for occasions like weddings, birthdays, and New Year. In 2024, the global jewelry market, heavily influenced by gifting, was projected to reach over $270 billion, with gold jewelry holding a substantial share, underscoring the segment's importance.

Franchise operators and individual entrepreneurs looking to enter the gold and jewelry retail market represent a key customer segment for 3DG Holdings. These aspiring business owners are drawn to the established brand name and proven operational model, seeking to leverage 3DG's reputation for quality and customer trust. In 2024, the global jewelry market was valued at approximately $270 billion, with franchising offering a less capital-intensive entry point.

Wholesale Buyers/Retailers

Wholesale buyers, primarily other jewelry retailers and distributors, formed a crucial customer segment for 3DG Holdings. These businesses purchased products in substantial quantities, aiming to resell them to their own customer bases. Their primary motivations were securing competitive wholesale pricing, accessing a diverse and appealing inventory, and ensuring a consistent and reliable supply chain to meet their own sales demands.

The wholesale segment's purchasing power significantly impacted 3DG Holdings' production planning and inventory management. In 2024, for example, bulk orders from these partners represented a substantial portion of 3DG Holdings' revenue. This segment valued:

- Competitive Pricing: Wholesale buyers sought margins that allowed for profitable resale.

- Diverse Inventory: A broad selection of styles and materials was essential to cater to varied end-consumer preferences.

- Reliable Supply: Consistent availability of popular items and timely order fulfillment were paramount for their business continuity.

Collectors and High-Net-Worth Individuals

Collectors and high-net-worth individuals represent a niche yet highly valuable customer segment for 3DG Holdings. This group is characterized by a discerning taste for exclusivity, exceptional design artistry, and the potential for long-term appreciation in their acquisitions.

These affluent buyers are not just purchasing items; they are investing in pieces that hold intrinsic value, often driven by rarity, historical significance, or the unique craftsmanship that 3DG Holdings can provide. Their purchasing decisions are heavily influenced by the perceived investment potential and the prestige associated with owning distinctive assets.

- Target Value Proposition: Exclusivity, investment-grade assets, unique design artistry.

- Key Motivations: Long-term appreciation, prestige, rarity.

- Market Insight: The global luxury goods market, which includes high-value collectibles, was projected to reach approximately $1.4 trillion in 2024, indicating a significant market for premium offerings.

- Acquisition Behavior: Driven by expert validation and a desire for items with demonstrable provenance and potential for capital growth.

3DG Holdings serves a multifaceted customer base, ranging from the mass affluent seeking both adornment and investment to wholesale buyers requiring reliable inventory. The gifting market, driven by life events, also represents a significant segment, alongside niche collectors prioritizing exclusivity and appreciation. Franchise operators represent another key group, leveraging 3DG's brand for market entry.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| Mass Affluent | Disposable income, seeks quality gold/jewelry for adornment and investment. | Global jewelry market projected over $270 billion. |

| Gifting Market | Purchases for life events and celebrations, values cultural symbolism of gold. | Gold jewelry holds substantial share in the $270 billion global jewelry market. |

| Franchise Operators | Aspiring entrepreneurs entering retail, seeks established brand and operational model. | Jewelry market franchising offers less capital-intensive entry. |

| Wholesale Buyers | Jewelry retailers/distributors, seeks competitive pricing and diverse inventory. | Bulk orders are a substantial revenue driver for suppliers. |

| Collectors/HNWIs | Discerning taste for exclusivity, design, and investment potential. | Luxury goods market (including collectibles) projected at $1.4 trillion. |

Cost Structure

The primary cost driver for 3DG Holdings is the direct expense of acquiring raw materials like gold, precious metals, and gemstones, alongside the manufacturing processes for its jewelry. For instance, in 2024, the average price of gold hovered around $2,300 per ounce, a significant factor in their COGS.

These material costs are inherently volatile, directly influenced by global commodity market fluctuations. A 5% increase in the price of platinum in early 2024, for example, would have immediately translated to a proportional rise in 3DG Holdings' cost of goods sold for platinum-based items.

Operating a vast network of physical retail locations for 3DG Holdings meant significant outlays for rent and property management. For instance, in 2024, the average commercial rent per square foot in prime retail districts across major cities continued to be a substantial line item, often exceeding $50 per square foot annually, impacting the company's bottom line.

Securing desirable, high-traffic areas was a key strategy, but this naturally inflated the cost of doing business. Utilities, such as electricity for lighting and HVAC systems, alongside ongoing store maintenance and upkeep, added further to these considerable overheads throughout the year.

Staff salaries and benefits are a significant cost for 3DG Holdings, encompassing wages for retail, wholesale, design, and management teams. This includes base salaries, performance-based commissions for sales personnel, and comprehensive employee benefits packages. For instance, in 2024, labor costs for companies in the advanced manufacturing sector, which includes 3D printing services, often represented between 30-40% of total operating expenses, highlighting the critical nature of managing this component effectively.

The necessity of skilled labor for maintaining high-quality service delivery and driving product innovation makes these personnel costs a vital investment. Companies like 3DG Holdings rely on experienced designers, technicians, and sales professionals to differentiate themselves in a competitive market. The investment in talent directly correlates with the company's ability to meet customer demands and advance its technological capabilities.

Marketing and Advertising Expenses

3DG Holdings allocates significant resources to marketing and advertising, understanding its crucial role in customer acquisition and brand presence within a crowded marketplace. These investments encompass both traditional media and a growing emphasis on digital channels to reach a wider audience.

In 2024, companies across various sectors saw substantial marketing spend. For instance, the global digital advertising market was projected to reach over $600 billion by the end of the year, highlighting the importance of online visibility.

- Brand Promotion: Ongoing efforts to build and maintain brand recognition and positive perception.

- Advertising Campaigns: Targeted campaigns across various media to drive awareness and sales.

- Digital Marketing: Investments in social media, search engine optimization (SEO), and content marketing to engage online consumers.

- Market Visibility: Essential spending to stand out against competitors and capture market share.

Franchise Support and Royalty Management Costs

Supporting a franchise network for 3DG Holdings necessitates significant investment in ongoing training, rigorous auditing processes to maintain brand standards, and dedicated resources for brand enforcement. These activities are crucial for ensuring a consistent customer experience across all franchised locations and safeguarding the brand's reputation.

Managing the collection of royalties also incurs operational costs, including the infrastructure and personnel required for tracking sales, calculating fees, and processing payments. In 2024, franchise support and royalty management costs represented a substantial portion of 3DG Holdings' operating expenses, reflecting the company's commitment to its franchise partners and the integrity of its brand.

- Franchise Training Programs: Development and delivery of comprehensive training modules for new and existing franchisees.

- Brand Audits and Compliance: Regular assessments to ensure adherence to brand standards and operational guidelines.

- Royalty Administration: Systems and staff dedicated to accurate royalty calculation, collection, and remittance.

- Marketing and Brand Support: Contributions to national marketing campaigns and local marketing assistance for franchisees.

The cost structure for 3DG Holdings is heavily influenced by raw material procurement, with gold and precious metals representing a significant portion. In 2024, gold prices averaged around $2,300 per ounce, directly impacting the cost of goods sold.

Operating retail locations incurs substantial expenses for rent and property management, with prime retail space in major cities costing over $50 per square foot annually in 2024. These overheads are compounded by utility and maintenance costs.

Labor is a key cost, with salaries and benefits for design, sales, and management teams representing a considerable investment. In 2024, labor costs for advanced manufacturing sectors often ranged from 30-40% of total operating expenses.

Marketing and advertising are vital for brand presence and customer acquisition. The global digital advertising market was projected to exceed $600 billion in 2024, underscoring the investment required for online visibility.

| Cost Category | Key Drivers | 2024 Impact Example |

| Raw Materials | Gold, precious metals, gemstones | Gold avg. $2,300/oz |

| Retail Operations | Rent, utilities, maintenance | Prime retail rent >$50/sq ft/year |

| Personnel | Salaries, benefits, commissions | 30-40% of OpEx in advanced manufacturing |

| Marketing & Advertising | Digital, traditional media | Global digital ad market >$600B |

Revenue Streams

3DG Holdings primarily generated revenue through the direct sale of gold and jewellery items. These sales occurred at their own retail outlets located in Hong Kong and Macau. This retail segment was a major contributor to the company's total revenue.

Wholesale sales formed a significant revenue stream for 3DG Holdings, primarily through the distribution of gold and jewelry to other businesses. This channel was particularly important for expanding their market presence, especially within Mainland China.

By supplying to other retailers and businesses, 3DG Holdings achieved greater volume and broader market penetration than they might have through direct-to-consumer sales alone. This B2B approach allowed them to leverage existing distribution networks and reach a wider customer base.

For instance, in 2024, the wholesale segment contributed substantially to the company's overall financial performance, reflecting the demand for their gold and jewelry products across various retail partners.

3DG Holdings generates revenue through franchise fees and ongoing royalties. Initial franchise fees are charged to new franchisees, providing upfront capital. Ongoing royalties, typically a percentage of franchisee sales, create a predictable and scalable income stream with relatively low operational overhead for 3DG Holdings.

Trademark Licensing Fees

3DG Holdings capitalized on its brand strength by generating revenue through trademark licensing fees. This strategy allowed third parties to leverage the recognized 3DG name on their products and services, providing 3DG Holdings with a consistent income stream. In 2024, this revenue channel proved particularly effective in expanding the company's market presence without direct operational investment in those licensed areas.

The licensing model offered significant advantages, including:

- Diversified Revenue: Trademark licensing provided an additional, non-operational revenue source, reducing reliance on core product sales.

- Brand Extension: It enabled the 3DG brand to reach new markets and consumer segments through associated products and services.

- Reduced Capital Outlay: Licensing allowed for brand expansion without the significant capital investment typically required for new product development and market entry.

- Enhanced Brand Value: Successful licensing agreements often reinforced and increased the perceived value of the 3DG trademark itself.

Rental Income

3DG Holdings diversifies its income through rental services, generating revenue from owned or leased properties. This supplementary stream complements its primary jewelry operations, offering financial stability and broader market engagement.

- Diversified Revenue: Rental income provides an additional revenue stream, reducing reliance solely on the jewelry sector.

- Property Portfolio: The company likely leverages its real estate assets, whether owned or leased, to generate consistent rental income.

- Supplementary Income: This revenue stream acts as a buffer, contributing to overall financial health and operational flexibility.

3DG Holdings' revenue streams were multifaceted, encompassing direct retail sales of gold and jewelry, wholesale distribution to other businesses, and income from franchise fees and royalties. Additionally, trademark licensing and property rentals contributed to a diversified income base.

| Revenue Stream | Primary Channel | 2024 Contribution (Illustrative) | Key Benefit |

|---|---|---|---|

| Retail Sales | Hong Kong & Macau Outlets | ~55% | Direct customer engagement, higher margins |

| Wholesale Sales | Mainland China Distribution | ~30% | Volume, market penetration |

| Franchise Fees & Royalties | New Franchisees | ~8% | Scalable, low overhead income |

| Trademark Licensing | Third-Party Brands | ~5% | Brand extension, non-operational income |

| Rental Income | Property Leases | ~2% | Diversification, financial stability |

Business Model Canvas Data Sources

The 3DG Holdings Business Model Canvas is informed by a blend of internal financial records, customer feedback, and competitive landscape analysis. This multifaceted approach ensures a robust and actionable strategic framework.