3DG Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3DG Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping 3DG Holdings's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate evolving market dynamics and identify strategic opportunities. Gain the competitive edge by understanding the external forces impacting 3DG Holdings's future. Download the full report now for in-depth insights and a robust strategic advantage.

Political factors

Government policies in Hong Kong, Macau, and Mainland China profoundly shape the retail and luxury landscape. For instance, China's ongoing efforts to boost domestic consumption, including targeted stimulus measures announced in late 2023 and early 2024, directly influence consumer spending on items like jewelry, impacting market sentiment and sales volumes.

Policies governing cross-border travel between Mainland China, Hong Kong, and Macau are pivotal for the luxury retail sector, particularly for businesses like 3DG Holdings. Changes in travel restrictions, visa requirements, and duty-free allowances directly influence the volume of tourists, a primary customer base for high-end goods. For example, in early 2023, Hong Kong eased many of its COVID-19 travel restrictions, leading to a notable increase in mainland Chinese visitor numbers, which in turn supported a recovery in retail sales.

Ongoing geopolitical tensions, such as the persistent US-China trade frictions, continue to cast a shadow of economic uncertainty, potentially dampening consumer confidence. These trade disputes can disrupt global supply chains, impacting the availability and cost of raw materials used in luxury goods.

Such geopolitical instability can also influence international investment flows and overall economic stability, which in turn affects discretionary spending. For instance, in 2024, the IMF projected global growth to be 3.2%, a slight slowdown from previous years, partly attributable to these ongoing geopolitical risks.

Gold, often perceived as a safe-haven asset, typically sees its price influenced by periods of geopolitical unrest. This increased demand during uncertain times can affect its affordability and, consequently, consumer purchasing behavior for gold and jewellery, particularly impacting segments of the market sensitive to price fluctuations.

Political Stability and Business Environment

Political stability in Hong Kong and Mainland China is a crucial factor influencing the business environment for companies like 3DG Holdings, now integrated with Luk Fook. A predictable political landscape boosts investor confidence and reduces operational risks, which is vital for retail expansion strategies.

Conversely, political uncertainty can significantly dampen investment appetite and introduce market volatility, impacting growth prospects. For instance, the Hong Kong Special Administrative Region (HKSAR) government's focus on economic recovery and integration with the Greater Bay Area aims to foster a more stable business climate. In 2024, Hong Kong's GDP growth was projected to be around 2.5-3.5%, indicating a recovering but sensitive economic environment influenced by geopolitical factors.

- Geopolitical Stability: Continued stability in Hong Kong is essential for maintaining its status as a global financial hub, directly benefiting retail businesses reliant on international trade and investment.

- Regulatory Environment: Changes in regulations or trade policies stemming from political shifts can impact supply chains, import/export costs, and market access for companies like Luk Fook (which now includes 3DG Holdings).

- Consumer Confidence: Political stability directly correlates with consumer confidence, influencing discretionary spending on retail goods. For example, periods of unrest have historically led to temporary dips in retail sales in Hong Kong.

- Government Policies: Pro-business government policies and a stable legal framework are critical for encouraging long-term investment in retail infrastructure and expansion.

Franchising Regulations in China and Hong Kong

Navigating franchising regulations in China and Hong Kong presents distinct challenges and opportunities for companies like 3DG Holdings. Mainland China's legal framework is more prescriptive, requiring franchisors to demonstrate a track record of at least two directly operated stores for over a year and to have registered trademarks before they can offer franchises. This stringent approach aims to protect local consumers and ensure the stability of franchise operations.

In contrast, Hong Kong operates under a less regulated environment for franchising, primarily relying on common law principles and general contract law. This absence of specific franchise legislation offers greater flexibility but also places a higher onus on franchisors to establish clear contractual terms and manage potential disputes through established legal channels. Understanding these differences is crucial for developing effective market entry and brand management strategies across both regions.

- China's Franchise Regulations: Minimum of two directly operated stores for over one year, trademark registration required.

- Hong Kong's Franchise Approach: Relies on common law and general contract law, no specific franchise legislation.

- Strategic Implications: Divergent legal landscapes necessitate tailored approaches for market penetration, compliance, and brand protection for 3DG Holdings.

Government policies in China and Hong Kong significantly influence retail and luxury markets, directly impacting companies like 3DG Holdings. China's focus on boosting domestic consumption, evidenced by stimulus measures in late 2023 and early 2024, affects spending on luxury goods. Furthermore, the regulatory environment for franchising differs markedly between Mainland China and Hong Kong, requiring tailored strategies for market entry and brand management.

Geopolitical stability is a cornerstone for investor confidence and operational risk reduction in Hong Kong and Mainland China. While Hong Kong's GDP growth was projected between 2.5-3.5% in 2024, indicating a recovering economy, it remains sensitive to global geopolitical tensions. These tensions, such as US-China trade frictions, can disrupt supply chains and dampen consumer confidence, impacting discretionary spending on luxury items.

Changes in travel policies between Mainland China, Hong Kong, and Macau directly impact the luxury retail sector, a key customer base for high-end goods. The easing of COVID-19 restrictions in Hong Kong in early 2023, for example, led to an increase in mainland Chinese visitors, supporting retail sales recovery. The price of gold, a safe-haven asset, is also influenced by geopolitical unrest, affecting purchasing behavior for gold and jewelry.

What is included in the product

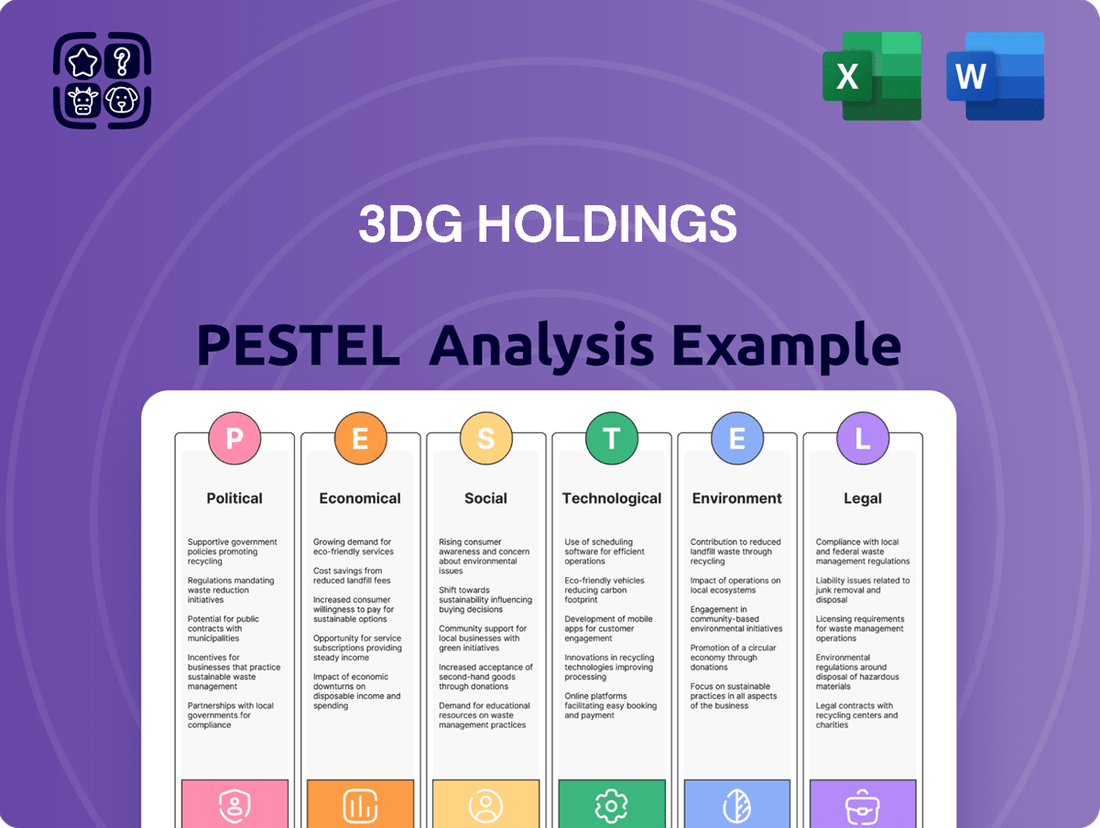

This PESTLE analysis meticulously examines the external macro-environmental factors impacting 3DG Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for the company's future growth and risk mitigation.

A PESTLE analysis for 3DG Holdings provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during meetings and presentations.

Economic factors

Consumer confidence and disposable income are key economic indicators that significantly influence the gold and jewellery market. In 2024, Mainland China's luxury sector saw a notable dip, with domestic spending in this segment reportedly falling by 18-20% due to subdued consumer confidence and a trend of consumers opting for overseas purchases.

Hong Kong's retail environment also faced difficulties during the first half of 2024, experiencing a general downturn that would impact discretionary spending on items like jewelry.

Gold price volatility directly affects the jewelry retail industry. For instance, the average price of gold fluctuated significantly in 2024, with prices reaching highs of over $2,400 per ounce in May before settling lower later in the year, impacting consumer purchasing power.

When gold prices surge due to factors like increased central bank buying, geopolitical instability, or inflation fears, demand for gold jewelry often softens. Consumers may respond by choosing lighter pieces, simpler designs, or delaying purchases altogether, shifting their focus from discretionary spending to gold as a potential investment.

Economic growth in Hong Kong, Macau, and Mainland China is a key driver for consumer spending. China's GDP expanded by 5.2% in 2023, indicating a strengthening economy. Hong Kong, meanwhile, saw its GDP grow by 3.2% during the same year. These figures directly impact the purchasing power available for goods and services.

A healthy economic climate typically boosts consumer confidence and spending, particularly in luxury markets. However, recent observations suggest a shift towards a more prudent consumer attitude across these regions. This cautiousness could temper the direct correlation between GDP performance and immediate luxury consumption increases.

Inflation and Interest Rate Environment

High inflation rates and shifts in interest rates significantly influence consumer spending and business operating costs. For instance, persistent inflation can lead investors to seek safe havens like gold, potentially driving up its market price.

Conversely, a decrease in interest rates, such as the anticipated easing in Hong Kong by November 2024, is expected to boost consumer demand and invigorate retail sectors. This environment creates both challenges and opportunities for businesses like 3DG Holdings.

- Inflationary pressures: Global inflation remained elevated in early 2024, impacting purchasing power and increasing input costs for many industries.

- Interest rate trajectory: Central banks are navigating a complex path, with potential rate cuts anticipated in late 2024 and early 2025, which could alter borrowing costs and investment attractiveness.

- Consumer confidence: Fluctuations in inflation and interest rates directly affect consumer sentiment, influencing discretionary spending on goods and services.

Competition from Investment Gold Products

The increasing allure of gold as an investment, especially in the form of bars and coins, directly competes with the demand for gold jewelry. As gold prices climbed, reaching highs like $2,300 per ounce in early 2024, some consumers shifted their focus from adornment to pure investment, seeking gold as a stable store of value during economic uncertainty.

This dynamic necessitates that jewelry retailers highlight the unique aesthetic and fashion-forward qualities of their offerings. For instance, in 2024, the global jewelry market was valued at approximately $270 billion, with gold jewelry being a significant segment, yet the investment demand, particularly from central banks and retail investors, saw robust growth, adding pressure on the discretionary spending for jewelry.

- Investment Demand Surge: Global central bank gold purchases in 2023 reached 1,037 tonnes, the second-highest annual total on record, indicating a strong preference for gold as a reserve asset.

- Price Sensitivity: Retail consumers may reallocate discretionary income from jewelry to investment gold if they perceive a greater short-term return or safety in bullion.

- Retailer Strategy: Jewelry businesses must differentiate by emphasizing craftsmanship, unique design, and brand storytelling to maintain market share against the investment appeal of gold.

Economic growth in key markets like Mainland China and Hong Kong directly impacts consumer spending on discretionary items such as gold jewelry. While China's GDP grew 5.2% in 2023 and Hong Kong saw 3.2% growth, consumer sentiment has shown caution, potentially tempering luxury spending. Gold price volatility, with highs over $2,400 per ounce in May 2024, influences purchasing decisions, sometimes shifting focus from adornment to investment.

Inflationary pressures and interest rate changes are critical economic factors. Elevated global inflation in early 2024 affected purchasing power and input costs. Anticipated interest rate easing in Hong Kong by late 2024 could stimulate retail demand, presenting both opportunities and challenges for businesses like 3DG Holdings.

The dual role of gold as both a luxury good and an investment asset creates a dynamic market. In 2024, robust investment demand, including significant central bank purchases (1,037 tonnes in 2023), competed with jewelry consumption. Retailers must emphasize design and brand value to attract consumers amidst this trend.

| Economic Factor | 2023 Data | 2024 Outlook/Trend | Impact on 3DG Holdings |

|---|---|---|---|

| China GDP Growth | 5.2% | Continued growth, but consumer caution noted | Potential for increased demand, but sensitive to consumer sentiment |

| Hong Kong GDP Growth | 3.2% | Anticipated interest rate cuts may boost retail | Improved retail environment, increased purchasing power |

| Gold Price (Average High) | N/A | Exceeded $2,400/oz in May 2024 | Can deter jewelry purchases, boost investment demand for gold |

| Global Inflation | Elevated | Persisted in early 2024 | Increased input costs, impacted consumer disposable income |

Preview the Actual Deliverable

3DG Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of 3DG Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. Understanding these external forces is crucial for informed decision-making and sustained growth.

Sociological factors

Chinese luxury consumers are shifting their focus from tangible goods to memorable experiences. For instance, a 2024 report indicated that over 60% of affluent Chinese consumers are willing to spend more on travel and unique activities than on physical luxury items. This trend is particularly pronounced across generations, with Millennials prioritizing indulgent moments and Gen Z increasingly valuing wellness-focused experiences.

The demand for personalization in the luxury sector is also on the rise, especially within the jewelry market. Data from early 2025 suggests that customized jewelry orders have seen a 15% year-over-year increase as consumers seek to express their individuality and creativity through unique pieces.

A powerful sociological shift is underway in Mainland China, with a marked increase in consumers favoring domestic luxury brands. This rise is deeply intertwined with growing national pride, creating a fertile ground for local companies to expand their market presence.

This trend is particularly evident in the jewellery sector, where national identity plays a significant role in purchasing decisions. Projections for 2025 indicate a strong commitment from consumers, with a substantial 56% of Mainland Chinese consumers expressing their intention to increase their spending on Chinese luxury brands.

Younger generations, particularly Gen Z and Millennials, are significantly altering the jewellery market. Their purchasing power and habits are shifting towards online platforms and social commerce, influenced by digital trends.

Gen Z females are a primary driver of jewellery sales, while a notable trend shows Gen Z males in Tier 2 and 3 cities increasingly engaging with jewellery purchases, defying traditional patterns.

Cultural Significance of Gold and Jewellery

In China, gold is more than just a commodity; it's deeply woven into the cultural fabric, symbolizing prosperity and good fortune. This intrinsic value makes it a preferred gift for significant events like Chinese New Year and weddings, ensuring a consistent baseline demand for gold jewellery.

Even when gold prices are elevated, this cultural imperative often leads consumers to adjust their purchasing habits rather than forgo the tradition. They might opt for lighter designs or smaller quantities, demonstrating the resilience of gold's appeal. For instance, reports from early 2024 indicated strong consumer interest in gold jewellery during the Lunar New Year period, with sales volumes remaining robust despite price fluctuations.

- Cultural Symbolism: Gold represents prosperity and good luck in Chinese culture.

- Gift Occasions: It is a traditional gift for major celebrations like Chinese New Year and weddings.

- Demand Resilience: Cultural significance sustains demand even with high gold prices.

- Consumer Adaptation: Buyers may choose lighter or smaller gold items to maintain tradition.

Increasing Demand for Sustainable and Ethical Products

Consumer awareness of environmental and ethical concerns is significantly reshaping the jewellery market, driving a strong demand for sustainable and ethically sourced products. This isn't just a niche interest anymore; it's becoming a mainstream expectation.

Customers are actively looking for jewellery crafted from recycled precious metals, featuring lab-grown gemstones, and sourced from suppliers who demonstrate a commitment to fair labor practices and supply chain transparency. For instance, by late 2024, reports indicated that over 60% of Gen Z consumers considered a brand's ethical and environmental impact when making purchasing decisions, a figure that continues to climb.

- Growing Consumer Preference: Studies in early 2025 show a 25% year-over-year increase in searches for "ethical jewellery" and "recycled gold jewellery".

- Impact on Brand Reputation: Brands that fail to address these concerns risk alienating a growing segment of their customer base, potentially impacting sales by as much as 15-20% in the coming years.

- Supply Chain Scrutiny: Transparency in sourcing, particularly for diamonds and precious metals, is becoming a key differentiator, with consumers demanding proof of origin and ethical mining practices.

- Market Growth: The global market for ethically sourced jewellery is projected to grow at a compound annual growth rate (CAGR) of 8.5% through 2027, reaching an estimated $30 billion.

Societal values are increasingly emphasizing experiences over material possessions, with Chinese consumers, particularly younger demographics, prioritizing travel and unique activities. This shift is also fueling a strong preference for domestic luxury brands, driven by rising national pride. For example, a 2024 survey revealed that over 60% of affluent Chinese consumers favored spending on experiences, while early 2025 data showed a 15% rise in customized jewelry orders as consumers seek personal expression.

Technological factors

The digital revolution has profoundly reshaped the jewelry sector, with e-commerce emerging as a critical sales channel. Online platforms provide consumers with unparalleled convenience, a wider selection of products, and often more competitive pricing, driving a significant increase in online purchases.

Evidence of this shift is stark: in 2023, e-commerce represented over 40% of all jewelry sales in China, demonstrating robust year-over-year expansion. This trend underscores the growing consumer preference for digital shopping experiences in the luxury goods market.

Augmented Reality (AR) is transforming how customers interact with jewelry. Companies like 3DG Holdings can leverage this by letting shoppers virtually try on pieces using their smartphones, a trend that saw significant growth in 2024. This technology boosts customer confidence in online purchases, effectively bridging the gap between the digital and physical shopping experience.

3D printing and advanced design software are revolutionizing jewelry creation, allowing for intricate, custom pieces with remarkable accuracy and speed. This technology enables rapid prototyping, significantly cuts down on material waste, and opens doors for highly personalized designs that cater to modern consumer demand for uniqueness.

AI in Personalization and Design

Artificial intelligence is revolutionizing how jewelry brands connect with customers. By analyzing purchasing history and browsing behavior, AI algorithms provide highly personalized product recommendations, making the industry more attuned to evolving tastes. This personalized approach is particularly impactful in the luxury sector.

The influence of AI on luxury consumption is significant, especially in key markets. For instance, a substantial portion of Chinese luxury consumers are eager to embrace AI-driven innovations. Reports indicate that a high percentage of these consumers are willing to pay a premium for unique features and tailored experiences facilitated by AI, signaling a strong market demand for such technological integration.

- Personalized Recommendations: AI analyzes consumer data to offer tailored jewelry suggestions, increasing engagement and sales.

- Market Responsiveness: AI helps brands quickly adapt to and anticipate shifts in consumer preferences and market trends.

- Luxury Consumption Shifts: A significant percentage of Chinese luxury consumers are willing to pay more for AI-enhanced personalization and innovative features.

Blockchain for Authenticity and Transparency

Blockchain technology is fundamentally changing how the jewelry industry operates, particularly concerning authenticity and transparency. It offers a way to create unchangeable records of a diamond's journey, from its initial source to its final sale, including ownership history. This digital ledger provides a verifiable trail, which is crucial for consumers who increasingly demand assurance about the ethical sourcing and genuine nature of their purchases, especially for luxury goods.

The integration of blockchain directly addresses the growing consumer desire for verifiable provenance and ethical sourcing in the luxury goods market. For instance, by mid-2024, reports indicated that over 60% of luxury consumers considered sustainability and ethical practices as key purchasing drivers. Blockchain provides the technological backbone to meet this demand, offering irrefutable proof of a product's origin and journey.

- Immutable Record: Blockchain creates a tamper-proof ledger for a diamond's lifecycle, ensuring data integrity.

- Enhanced Consumer Trust: Verifiable authenticity and ethical sourcing information build significant consumer confidence.

- Market Demand Alignment: Meets the rising consumer preference for ethically sourced and transparently produced luxury items.

- Reduced Counterfeiting: The technology makes it significantly harder to introduce counterfeit or conflict diamonds into the supply chain.

Technological advancements are significantly reshaping the jewelry sector, with e-commerce sales in China alone exceeding 40% in 2023. Augmented Reality (AR) is enhancing the online shopping experience by allowing virtual try-ons, a trend that saw notable growth in 2024, boosting consumer confidence. Furthermore, AI is personalizing customer interactions and product recommendations, with a high percentage of Chinese luxury consumers willing to pay a premium for AI-driven innovations.

Legal factors

Consumer protection laws across Hong Kong, Macau, and Mainland China are designed to shield individuals in retail transactions. These regulations mandate product quality standards, clear pricing disclosures, and ethical business conduct, all vital for fostering consumer confidence, particularly in the sensitive jewellery market. For instance, China's Consumer Rights Protection Law, updated in 2023, reinforces these principles with stricter penalties for non-compliance, impacting how companies like 3DG Holdings must operate.

For jewelry companies like 3DG Holdings, especially those with franchise models, safeguarding intellectual property (IP) and trademarks is paramount. This includes protecting unique designs, brand names, and logos that differentiate them in a competitive market.

In Mainland China, a crucial market for many global brands, foreign franchisors must register their trademarks before operating. The E-Commerce Law of the People's Republic of China, implemented in January 2019, further emphasizes the importance of IP protection, particularly in the digital realm, aiming to curb online infringement and ensure fair competition.

Operating a franchise in Mainland China involves navigating specific legal hurdles, notably the '2+1' rule which mandates two directly operated stores for over a year before franchising can commence. Furthermore, mandatory record-filing with the Ministry of Commerce is essential for compliance. As of early 2024, the Ministry of Commerce reported over 1.2 million franchise outlets across China, highlighting the sector's scale and regulatory importance.

In contrast, Hong Kong's legal framework, rooted in common law, generally provides greater flexibility for franchising agreements. However, businesses must still strictly adhere to overarching contract and commercial laws, ensuring all transactions are legally sound and transparent. Hong Kong's franchise market, while smaller than the mainland, saw a steady growth in new entrants in 2023, with an estimated 5% increase in franchise registrations.

Acquisition and Corporate Governance Frameworks

The acquisition of 3DG Holdings by Luk Fook Holdings in January 2024 was governed by specific legal frameworks for mergers and acquisitions. These included the finalization of share purchase agreements and the execution of mandatory cash offers, ensuring compliance with established legal procedures. This transaction underscores the critical role of robust corporate governance and adherence to stock exchange regulations during significant ownership changes.

The legal landscape surrounding such acquisitions is complex, often involving:

- Share Purchase Agreements: These legally binding contracts detail the terms and conditions of the sale and purchase of shares, including pricing, payment methods, and closing conditions.

- Mandatory Cash Offers: In certain jurisdictions, when an acquirer gains a significant stake in a publicly listed company, they are legally obligated to make a cash offer to all remaining shareholders.

- Corporate Governance Compliance: Acquired companies and their new owners must ensure ongoing adherence to the rules set by relevant stock exchanges and corporate governance codes, which can impact reporting, board structure, and shareholder rights.

- Regulatory Approvals: Depending on the size and nature of the deal, various regulatory bodies may need to approve the acquisition, ensuring it does not violate antitrust or other competition laws.

Ethical Sourcing and Due Diligence

The jewellery industry faces increasing pressure for ethical sourcing, which, while not always a direct legal mandate, can translate into stricter industry standards and potential regulatory oversight. Companies like 3DG Holdings are expected to implement robust due diligence processes. This ensures that materials, particularly diamonds, are conflict-free and responsibly sourced, mirroring international frameworks such as the Kimberley Process. For instance, in 2023, the Responsible Jewellery Council (RJC) reported a significant increase in member audits focused on supply chain transparency and ethical practices.

This heightened focus on ethical sourcing is driving a shift in consumer expectations and, consequently, business practices. Companies are increasingly evaluated not just on product quality but also on the integrity of their supply chains. Failure to demonstrate responsible sourcing can lead to reputational damage and loss of market share. By 2024, many major jewellery retailers had publicly committed to sourcing 100% of their diamonds from conflict-free origins, a trend that is expected to solidify further into 2025.

The legal and regulatory landscape is evolving to reflect these ethical considerations. While direct legislation might lag, industry self-regulation and the threat of future legal frameworks encourage proactive compliance. This includes:

- Enhanced supply chain mapping to identify origins of raw materials.

- Implementation of stricter supplier codes of conduct.

- Increased investment in blockchain technology for transparent tracking of gemstones.

- Adherence to evolving international standards for responsible mining and trading.

Navigating consumer protection laws in Hong Kong, Macau, and Mainland China is crucial for 3DG Holdings, with China's 2023 Consumer Rights Protection Law imposing stricter penalties. Intellectual property protection is also vital, especially in China where foreign franchisors must register trademarks before operating, a process reinforced by the 2019 E-Commerce Law.

Franchising in Mainland China requires adherence to the '2+1' rule and mandatory Ministry of Commerce record-filing, a sector that had over 1.2 million outlets by early 2024. Hong Kong offers more franchise flexibility under common law, with its market seeing a 5% increase in registrations in 2023.

The acquisition of 3DG Holdings by Luk Fook Holdings in January 2024 highlighted the legal complexities of M&A, involving share purchase agreements, mandatory cash offers, corporate governance compliance, and potential regulatory approvals.

Ethical sourcing is increasingly important, with the Responsible Jewellery Council noting more audits in 2023 focused on supply chain transparency; by 2024, many retailers committed to 100% conflict-free diamond sourcing.

Environmental factors

Consumers are increasingly prioritizing sustainability and ethical sourcing in their jewelry purchases, a trend that significantly impacts the industry. This growing awareness means companies like 3DG Holdings must demonstrate responsible practices, from mining to manufacturing. For instance, in 2024, reports indicated that over 70% of consumers surveyed would pay a premium for jewelry made with recycled metals or ethically sourced gemstones, highlighting a clear market preference.

The extraction of precious metals and gemstones, crucial for many industries including jewelry and technology, carries a significant environmental footprint. Mining operations often lead to deforestation, habitat destruction, and substantial water pollution. For instance, gold mining frequently involves the use of mercury and cyanide, chemicals that can contaminate water sources and harm ecosystems, posing risks to both wildlife and human health.

Sustainable jewelry and responsible sourcing initiatives are gaining traction to mitigate these impacts. These practices emphasize ethical mining techniques, aiming to reduce ecological damage and promote fair labor conditions. By 2024, the global ethical jewelry market is projected to reach over $25 billion, demonstrating a growing consumer demand for transparency and environmental consciousness in material sourcing.

Jewellery brands are prioritizing recycled metals and lab-grown gems to reduce their environmental impact and cater to growing consumer demand for sustainable products. These alternatives present significant environmental and ethical benefits over conventionally mined resources.

The market for lab-grown diamonds is experiencing rapid growth. For instance, sales of lab-grown diamonds in the US alone were projected to reach $5 billion in 2024, indicating a strong consumer preference for these ethically sourced and environmentally conscious options.

Supply Chain Transparency and Traceability

Supply chain transparency is increasingly crucial in the jewelry sector, with consumers and businesses demanding to know the origin and journey of materials from mine to market. This push for traceability is driven by a desire to ensure ethical sourcing and environmental responsibility, holding companies accountable and mitigating the risk of unethical practices.

By 2025, industry reports indicate that over 60% of consumers will prioritize brands demonstrating clear ethical sourcing practices. For 3DG Holdings, this means investing in technologies that can track precious metals and gemstones, providing verifiable proof of origin and responsible mining. This not only builds consumer trust but also strengthens relationships with ethical suppliers and reduces the potential for reputational damage.

- Consumer Demand: A significant majority of consumers, projected to exceed 60% by 2025, actively seek out brands with transparent and ethical supply chains.

- Ethical Sourcing: The ability to trace materials from their source ensures compliance with labor laws and environmental regulations, minimizing the risk of association with conflict minerals or exploitative practices.

- Brand Reputation: Enhanced transparency directly contributes to a stronger brand image and customer loyalty, as demonstrated by brands that have successfully implemented robust traceability systems.

- Risk Mitigation: Proactive supply chain mapping and verification helps 3DG Holdings avoid potential disruptions and negative publicity associated with non-compliance or unethical sourcing discovered by regulators or watchdog groups.

Corporate Social Responsibility (CSR) Initiatives

3DG Holdings, like many in the jewelry sector, is navigating a landscape where corporate social responsibility (CSR) is no longer optional. Companies are increasingly focusing on environmental protection and fair labor. For instance, a significant portion of luxury jewelry brands are now committed to sourcing conflict-free diamonds and ethically mined gold, reflecting growing consumer demand for transparency and responsible practices.

This shift translates into tangible actions within the supply chain. Jewelry firms are actively advocating for fair working conditions, ensuring living wages, and maintaining safe environments for all workers involved, from mining to manufacturing. This commitment is crucial for building brand reputation and mitigating risks associated with unethical sourcing, which can lead to significant financial and reputational damage.

Key CSR initiatives often include:

- Ethical Sourcing: Ensuring all precious metals and gemstones are sourced responsibly, avoiding conflict zones and exploitative labor.

- Supply Chain Transparency: Mapping and auditing the entire supply chain to guarantee fair labor practices and safe working conditions.

- Environmental Sustainability: Implementing practices to reduce carbon footprint, minimize waste, and promote eco-friendly production methods.

- Community Engagement: Investing in local communities where raw materials are sourced and where manufacturing facilities are located.

Environmental factors significantly shape the jewelry industry, with consumer demand for sustainability driving change. By 2025, over 60% of consumers will favor brands with transparent, ethical supply chains, pushing companies like 3DG Holdings to invest in traceability technologies. This focus on responsible sourcing, including recycled metals and lab-grown gems, is crucial for mitigating risks and enhancing brand reputation in a market increasingly valuing environmental consciousness.

PESTLE Analysis Data Sources

Our PESTLE Analysis for 3DG Holdings is meticulously crafted using data from reputable sources such as government publications, international economic organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.