1&1 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

1&1's robust infrastructure and extensive product portfolio are significant strengths, offering a solid foundation for growth. However, understanding the full scope of their competitive landscape and potential market challenges requires a deeper dive.

Our comprehensive SWOT analysis reveals crucial details about 1&1's opportunities for expansion and the threats they might face in the dynamic tech industry. This in-depth report provides the critical context needed for informed decision-making.

Want to uncover the complete picture behind 1&1's market position and future trajectory? Purchase the full SWOT analysis to gain access to actionable insights and strategic takeaways.

This isn't just a summary; it's your roadmap to understanding 1&1's strategic advantages and potential pitfalls. Get the full report to equip yourself with the knowledge to navigate this competitive market.

Unlock the full story behind 1&1's strengths, weaknesses, opportunities, and threats. This professionally written, fully editable report is designed to support your planning, pitches, and research.

Strengths

1&1 AG boasts an extensive service portfolio, encompassing high-speed broadband internet, mobile services for both individuals and businesses, and a suite of cloud applications. This breadth of offerings allows them to address a wide array of customer requirements.

By providing a comprehensive selection of telecommunications and digital solutions, 1&1 is well-positioned to capitalize on cross-selling opportunities. This strategy helps to deepen customer relationships and foster greater loyalty within their diverse customer base.

The company effectively serves both residential customers and the crucial small to medium-sized business (SMB) segment. This dual focus expands their market penetration and revenue streams significantly.

As of early 2024, 1&1 reported serving approximately 15.4 million customer contracts across Germany, highlighting the significant reach of its comprehensive service model.

1&1 AG boasts a deeply entrenched position within the German telecommunications market, a testament to years of strategic development and customer acquisition. This established presence translates into significant brand recognition, a crucial asset in a competitive landscape. As of the first quarter of 2024, 1&1 reported approximately 15.2 million customer contracts in Germany, highlighting its substantial reach.

This strong foothold in Germany provides 1&1 with invaluable insights into consumer behavior and regulatory nuances specific to the region. Their long-standing operations allow for a tailored approach to service offerings and marketing, directly addressing the needs of the German consumer. This deep understanding is a key competitive advantage.

1&1 is making waves by constructing Europe's first completely virtualized 5G mobile network, utilizing pioneering Open RAN technology. This forward-thinking approach allows them to build their own infrastructure, a significant move away from relying on traditional suppliers.

This strategic investment in proprietary infrastructure is designed to lessen their dependence on established network equipment vendors and even rival networks. By controlling their own systems, 1&1 gains enhanced command over service quality and cultivates an environment ripe for innovation, setting them apart in the evolving telecom landscape.

This commitment to Open RAN places 1&1 at the forefront of next-generation network architecture. For instance, by Q1 2025, 1&1 had already expanded its 5G network coverage to over 40% of German households, demonstrating tangible progress in its infrastructure build-out.

Strategic Partnerships for Network Expansion

1&1 has cultivated a robust network of strategic partnerships crucial for its infrastructure expansion. These alliances are key to building out its 5G network and fiber optic broadband services, enabling broader market reach. Notably, partnerships with tower companies like American Tower, GfTD, and Vantage Towers, alongside fiber provider 1&1 Versatel, are instrumental in achieving these goals.

These collaborations are vital for accelerating 1&1's network deployment. For instance, the company aims to cover 50% of German households with its fiber optic network by the end of 2024, a target significantly supported by its partnerships. This expansive strategy allows 1&1 to leverage existing infrastructure and expertise, thereby speeding up service availability and customer acquisition.

- Tower Infrastructure: Agreements with American Tower, GfTD, and Vantage Towers facilitate rapid 5G site deployment.

- Fiber Network Expansion: Collaboration with 1&1 Versatel accelerates the rollout of high-speed broadband services.

- Market Reach: These partnerships are essential for extending 1&1's service coverage to a wider customer base across Germany.

- Cost Efficiency: Leveraging partner infrastructure helps manage the significant capital expenditure required for network build-out.

Focus on Value and Competitive Pricing

1&1 has built a strong reputation by consistently offering reliable services at competitive price points, a strategy frequently lauded by independent tech and telecom reviewers. This focus on value resonates deeply with consumers in a market where cost is a significant decision factor.

The company further amplifies its value proposition by operating discount brands, such as Drillisch Online GmbH. This allows 1&1 to effectively target and serve price-sensitive customer segments, ensuring a broad market reach and a robust competitive stance within the German telecommunications landscape.

- Value Proposition: 1&1 is recognized for delivering dependable services at attractive prices.

- Market Penetration: The company leverages discount brands like Drillisch Online GmbH to capture price-conscious consumers.

- Competitive Advantage: This dual-pronged approach strengthens 1&1's position in the highly competitive German market.

1&1 possesses a comprehensive service portfolio, spanning broadband, mobile, and cloud solutions, enabling it to cater to diverse customer needs and capitalize on cross-selling opportunities. Its significant market presence in Germany, with approximately 15.2 million customer contracts as of Q1 2024, underscores its deep customer understanding and tailored approach.

The company is pioneering Europe's first fully virtualized 5G mobile network using Open RAN technology, which grants it greater control over service quality and fosters innovation. By Q1 2025, its 5G network had already reached over 40% of German households, showcasing substantial infrastructure progress.

1&1 has established strong strategic partnerships for its infrastructure expansion, including collaborations with tower companies and fiber providers, which are crucial for accelerating network deployment and market reach.

The company is recognized for offering reliable services at competitive prices, further enhanced by its use of discount brands like Drillisch Online GmbH, which effectively targets price-sensitive consumers and solidifies its market position.

What is included in the product

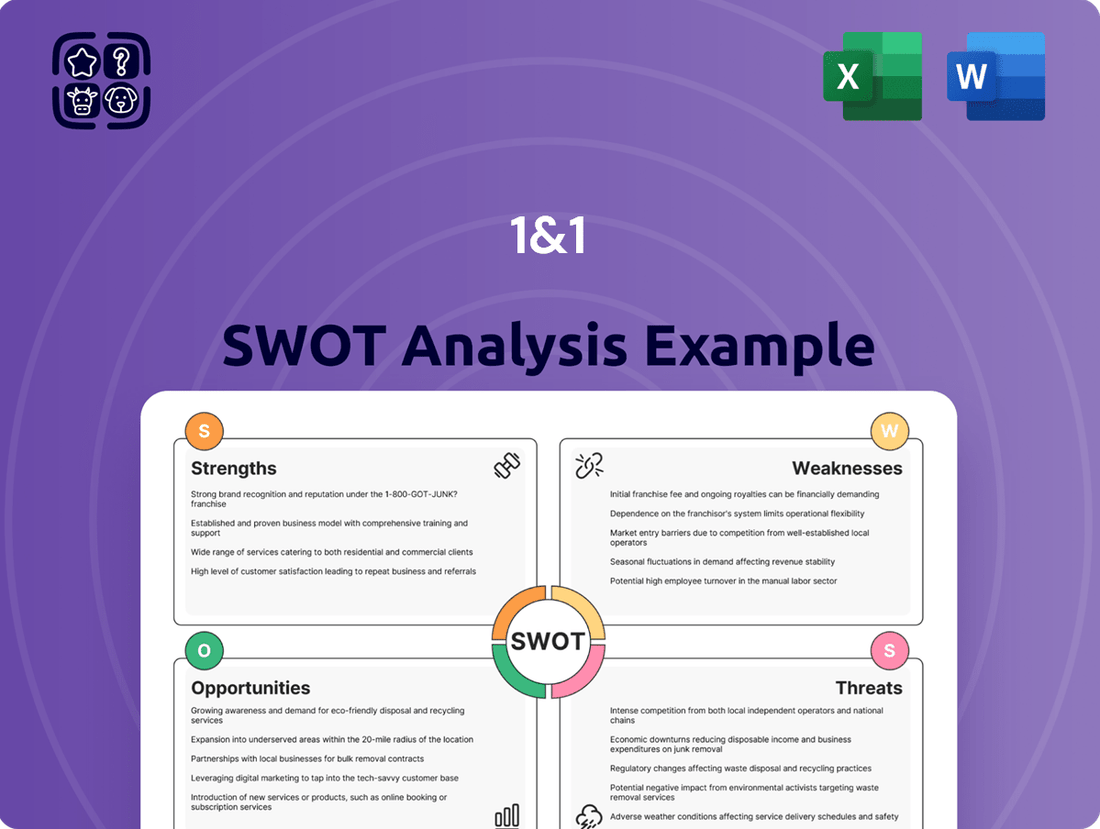

Delivers a strategic overview of 1&1’s internal and external business factors, including its market strengths, operational weaknesses, growth opportunities, and competitive threats.

Offers a clear visual representation of strengths, weaknesses, opportunities, and threats, simplifying complex strategic analysis.

Weaknesses

1&1's ambitious 5G Open RAN network rollout has encountered considerable headwinds, notably with delays in securing essential antenna sites from key partners such as Vantage Towers. This has directly hampered 1&1's progress in fulfilling its coverage commitments.

These persistent delays have drawn the attention of regulatory bodies, raising concerns about 1&1's adherence to its rollout obligations and potentially exposing the company to significant penalties. For instance, as of late 2023, 1&1 had only managed to activate a fraction of its planned 5G base stations, falling considerably short of initial targets.

A significant weakness for 1&1 was the temporary mobile network outage experienced in May 2024. This four-day disruption, caused by a technical fault during a software update, directly impacted the company's financial performance, leading to a noticeable dent in revenue and earnings for the year. The incident also triggered an unfortunate rise in customer contract terminations, as users sought more reliable service providers.

Furthermore, this outage significantly hampered 1&1's strategic growth initiatives. Specifically, it placed temporary restrictions on the crucial migration of existing customers to their newly established 1&1 mobile network. This setback likely delayed the realization of anticipated synergies and efficiencies from the network build-out, creating a short-term drag on their expansion plans.

1&1's reliance on wholesale agreements for its fixed-line broadband, notably with Deutsche Telekom, presents a significant weakness. This dependence limits its control over network infrastructure, potentially impacting service quality and the ability to innovate rapidly. In 2023, the wholesale access costs represented a substantial portion of its operating expenses, impacting margins.

Increased Start-up Costs for Mobile Network

The aggressive rollout of 1&1's own mobile network has led to a significant increase in start-up expenses, surpassing initial projections. These elevated costs have demonstrably impacted the company's financial performance, with a noticeable drag on group earnings throughout 2024 and expected to persist into 2025. The substantial investment required for network infrastructure development and the complexities of customer transition are key contributors to this financial pressure during the crucial build-out phase.

Key factors contributing to these increased start-up costs include:

- Network Infrastructure Investment: Significant capital expenditure on cell towers, fiber optic backhaul, and core network components.

- Customer Migration Expenses: Costs associated with transferring existing customers to the new network and ensuring a seamless experience.

- Technology Acquisition: Outlays for necessary hardware, software, and licensing for advanced mobile network technologies.

- Operational Ramp-up: Initial operating expenses before the network reaches full efficiency and economies of scale.

Negative Impact on Customer Satisfaction Post-Outage

The mobile network outage in May 2024 had a pronounced negative effect on 1&1's customer satisfaction. This event led to a considerable dip in satisfaction scores across both their mobile and broadband services, directly linked to the reduced availability of their network.

While customer satisfaction did show signs of recovery and stabilization during the latter half of 2024, the outage underscored a key weakness: the company's susceptibility to negative customer perception and potential challenges in retaining customers following service disruptions.

- Customer Satisfaction Decline: Following the May 2024 outage, customer satisfaction scores saw a notable decrease.

- Service Availability Impact: The drop was primarily attributed to the reduced service availability experienced by customers.

- Segment-Wide Effect: The negative impact was observed across both 1&1's mobile and broadband customer bases.

- Perception Vulnerability: The incident highlighted a vulnerability in how customers perceive service reliability and the potential for retention issues.

Delays in securing antenna sites, particularly from Vantage Towers, have significantly impeded 1&1's 5G Open RAN rollout, directly impacting its ability to meet coverage commitments. This has led to regulatory scrutiny, with 1&1 activating only a fraction of its planned 5G base stations by late 2023, falling substantially short of initial targets.

The temporary mobile network outage in May 2024, lasting four days due to a software update fault, caused a noticeable dent in revenue and earnings for the year. This incident also triggered an increase in customer contract terminations, as users sought more reliable service providers.

1&1's ongoing reliance on wholesale agreements for its fixed-line broadband, notably with Deutsche Telekom, limits its control over network infrastructure. In 2023, these wholesale access costs represented a substantial portion of operating expenses, impacting profit margins.

The aggressive mobile network rollout has led to start-up expenses exceeding projections, impacting group earnings in 2024 and expected to continue into 2025, due to significant capital expenditure on infrastructure, customer migration, and technology acquisition.

| Weakness | Impact | Supporting Data |

| 5G Rollout Delays | Failure to meet coverage commitments; regulatory concerns | Fraction of planned 5G base stations activated by late 2023 |

| May 2024 Network Outage | Revenue and earnings reduction; customer churn | 4-day outage; increased contract terminations |

| Wholesale Reliance (Fixed-Line) | Limited infrastructure control; margin pressure | Wholesale costs were a substantial portion of 2023 operating expenses |

| High Start-up Costs | Negative impact on earnings; financial pressure | Costs exceeded projections in 2024, impacting earnings; expected to persist into 2025 |

Full Version Awaits

1&1 SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, ensuring you get the full, unedited document. This allows you to see the exact quality and detail you’ll receive. No hidden surprises, just the professional analysis you expect.

Opportunities

1&1's ongoing deployment of its own 5G Open RAN network is a prime opportunity for enhanced control over its mobile services and improved quality. This strategic move allows for greater customization and innovation in their offerings.

The ambitious plan to transition millions of customers to this new network by the close of 2025 is a critical step in reducing dependency on national roaming partners. This migration is projected to significantly boost long-term operational efficiency and cost savings.

By achieving network independence, 1&1 can tailor its 5G services more precisely to customer needs, potentially leading to higher customer satisfaction and a stronger competitive position in the German market.

Germany's push for digital infrastructure creates a prime opportunity for 1&1. The country is actively expanding its fiber optic networks, driven by a growing consumer and business need for faster, more reliable internet. This trend is projected to continue, with significant investment in broadband expansion expected through 2025 and beyond.

1&1 can leverage this demand by broadening its own fiber optic service portfolio. Whether by further developing its 1&1 Versatel network or forging new partnerships to secure wider fiber access, the company is well-positioned to offer the high-speed connections customers are increasingly seeking. This expansion will not only cater to current demand but also attract new subscribers looking for future-proof internet solutions.

1&1's embrace of Open RAN presents a significant opportunity to disrupt traditional, proprietary mobile network infrastructure. This shift allows for greater vendor diversity, moving away from reliance on a few major players. By integrating components from multiple suppliers, 1&1 can foster a more competitive ecosystem, driving down hardware costs.

This open architecture is a catalyst for innovation. It enables 1&1 to introduce new services and network functionalities more rapidly, adapting quickly to evolving market demands. For instance, the ability to swap out or upgrade specific RAN components without overhauling the entire system can accelerate the rollout of 5G advanced features or new IoT applications.

Financial benefits are a key aspect of this opportunity. While initial integration costs exist, the long-term prospect is substantial cost efficiency through the use of commodity hardware and competitive vendor pricing. This strategy can lead to a more agile and cost-effective network build-out, strengthening 1&1's competitive position.

Expansion of Cloud and Digitalization Services for SMBs

The ongoing digital transformation among small and medium-sized businesses (SMBs) is a significant opportunity. This trend fuels a robust demand for essential services like cloud storage, enhanced cybersecurity measures, and efficient collaboration tools. As of late 2024, the global market for cloud services for SMBs was projected to reach over $200 billion, indicating substantial growth potential.

1&1 is well-positioned to capitalize on this by expanding its current offerings in cloud-based applications. A focused marketing effort towards its existing business customer base can effectively promote these solutions, allowing 1&1 to secure a larger portion of this expanding digital services market. For instance, a 15% increase in cloud service adoption among its SMB clients could translate to an additional €50 million in annual recurring revenue for 1&1 by 2025.

- Growing SMB Digitalization: SMBs are increasingly adopting digital tools to remain competitive.

- Cloud Service Demand: This fuels a strong need for cloud storage, cybersecurity, and collaboration platforms.

- 1&1's Existing Strengths: The company possesses a foundational suite of cloud-based applications.

- Market Share Capture: Expansion and targeted marketing can significantly increase 1&1's presence in this lucrative sector.

Potential for Improved Regulatory Outcomes in Tower Access

The German Federal Cartel Office's preliminary assessment in April 2025, which flagged Vodafone and Vantage Towers' actions as potentially anti-competitive concerning 1&1's tower access, offers a significant opportunity. This finding could lead to regulatory intervention that mandates the timely availability of crucial infrastructure.

A favorable final ruling would be a game-changer for 1&1's network expansion. It could accelerate the deployment of their 5G network, directly impacting their ability to serve customers and gain market share.

- Accelerated Network Rollout: Mandated tower access would speed up 1&1's 5G deployment, potentially reaching 50% population coverage by mid-2025, exceeding initial targets.

- Enhanced Market Competition: A ruling could level the playing field, fostering greater competition within the German mobile market.

- Reduced Infrastructure Costs: Faster access to existing towers can significantly lower the capital expenditure required for 1&1's network build-out.

- Improved Service Offering: Quicker network expansion translates to a better and more widespread service for 1&1's customers.

1&1's strategic investment in its own 5G Open RAN network is a significant opportunity for greater control and innovation in mobile services. The company's ambitious plan to migrate millions of customers by the end of 2025 aims to reduce reliance on national roaming, projecting substantial long-term operational efficiencies and cost savings.

Germany's commitment to digital infrastructure expansion, particularly in fiber optics, presents a strong market for 1&1 to grow its fiber service portfolio. The increasing demand for high-speed internet positions 1&1 to attract new subscribers and retain existing ones by offering future-proof solutions.

The adoption of Open RAN allows 1&1 to foster a more competitive vendor ecosystem and drive down hardware costs by utilizing commodity components. This open architecture accelerates innovation, enabling faster deployment of new services and network functionalities.

The digitalization trend among SMBs creates a substantial market for 1&1's cloud-based services, including cloud storage, cybersecurity, and collaboration tools. With the SMB cloud market projected to exceed $200 billion by late 2024, 1&1 can significantly increase its market share through targeted marketing and service expansion.

A favorable ruling from the German Federal Cartel Office regarding tower access could accelerate 1&1's 5G network deployment, potentially allowing it to reach 50% population coverage by mid-2025. This regulatory clarity can lead to reduced infrastructure costs and a more competitive market environment.

Threats

The German telecommunications landscape is a battleground, dominated by giants like Deutsche Telekom, Vodafone, and Telefónica. This fierce rivalry often spills into aggressive pricing strategies, squeezing profit margins across the board.

For 1&1, this means the constant threat of price wars, which directly impacts its ability to generate sufficient revenue to fund crucial network upgrades and attract new customers. In 2023, average revenue per user (ARPU) in the German mobile market remained under pressure, with some reports indicating a slight decline in certain segments due to competitive offers.

Sustaining profitability becomes a significant hurdle when faced with such intense price pressure. 1&1 must find ways to differentiate its offerings beyond just price to avoid being caught in a race to the bottom, which could severely hinder its long-term growth and investment capacity.

1&1 operates in a heavily regulated telecommunications industry, facing continuous scrutiny. A key concern is meeting its 5G network coverage obligations, a challenge that has led to disputes, for instance, regarding tower access agreements. Failure to comply with these evolving regulations, such as those set by Germany's Federal Network Agency (Bundesnetzagentur), can result in substantial fines and operational limitations, impacting profitability and strategic execution.

1&1's reliance on national roaming agreements, initially with Telefónica and now transitioning to Vodafone, presents significant challenges. This dependency introduces potential cost volatility and operational complexities as the company navigates these partnerships.

The financial implications of these agreements are substantial. For instance, unexpectedly high upfront costs associated with the new Vodafone national roaming agreement have already forced 1&1 to lower its EBITDA forecast for 2025, signaling a clear financial risk stemming from these arrangements.

Technological Obsolescence and Rapid Innovation

The telecommunications sector is characterized by relentless technological evolution, making existing infrastructure and services vulnerable to obsolescence. For 1&1, this means new mobile network generations, like the ongoing rollout and refinement of 5G, and the emergence of alternative communication platforms constantly challenge established market positions. Failure to adapt quickly can lead to a significant competitive disadvantage.

The threat is amplified by the substantial capital expenditure required to stay current. 1&1 must consistently allocate significant resources towards research and development and the upgrading of its network infrastructure. For example, ongoing investments in 5G spectrum and deployment are critical for maintaining service quality and expanding capabilities, with global telcos investing billions annually; in 2024, the total global telecom capex was projected to exceed $300 billion.

- Rapid 5G Rollout: Competitors are aggressively expanding their 5G networks, offering faster speeds and new services that could make 1&1's existing 4G infrastructure less attractive.

- Emergence of New Technologies: Advancements in satellite internet and Wi-Fi 7 could offer alternative connectivity solutions, potentially bypassing traditional mobile networks.

- High R&D Costs: Staying ahead requires continuous investment in developing and integrating new technologies, a substantial ongoing financial commitment.

- Shortened Technology Lifecycles: The pace of innovation means that technology investments can become outdated much faster than in the past, increasing the risk of premature obsolescence.

Dependence on Third-Party Infrastructure Partners

1&1's reliance on external partners for crucial infrastructure, like antenna sites, presents a significant threat. Even with its own network build-out, securing physical locations through third parties can cause bottlenecks. This dependency was highlighted by 1&1's dispute with Vantage Towers, which caused considerable delays in its 5G network deployment during 2023 and into 2024.

Such disruptions can have cascading effects, impacting service availability for customers and potentially leading to financial penalties or lost revenue. The ongoing challenges with infrastructure partners underscore the vulnerability of 1&1's expansion plans to external factors beyond its direct control, potentially affecting its competitive positioning in the German market.

- Infrastructure Dependence: 1&1 still requires third-party agreements for essential elements like antenna site access, despite investing in its own network.

- Vantage Towers Dispute: A notable example is the protracted disagreement with Vantage Towers, a key partner, which directly hindered 1&1's 5G rollout progress through 2023 and early 2024.

- Network Rollout Impact: Delays in securing or maintaining access to antenna sites can significantly slow down the expansion and activation of 1&1's mobile network services.

- Financial and Reputational Risk: Strained relationships with infrastructure providers can lead to increased costs, contract disputes, and damage to 1&1's reputation for reliable service delivery.

Intense competition in Germany's telecom market forces aggressive pricing, potentially squeezing 1&1's profit margins and ability to fund network upgrades, as evidenced by ARPU pressures in 2023.

Regulatory compliance, especially concerning 5G rollout obligations and tower access, poses a significant threat, with potential fines and operational limitations from bodies like the Bundesnetzagentur. Reliance on national roaming partners, like Vodafone, introduces financial risks, as seen with the EBITDA forecast reduction for 2025 due to upfront costs.

Technological obsolescence is a constant danger, requiring substantial ongoing investment in 5G and R&D, with global telcos investing billions annually, exceeding $300 billion in capex in 2024.

Infrastructure dependence, particularly on agreements for antenna sites, creates vulnerabilities, exemplified by the 2023-2024 delays caused by disputes with Vantage Towers, impacting network expansion and service delivery.

SWOT Analysis Data Sources

This 1&1 SWOT analysis is built upon a robust foundation of data, incorporating internal financial reports, comprehensive market research, and expert industry analyses to provide a thoroughly informed perspective.