1&1 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

1&1 operates in a dynamic digital services landscape, facing moderate threats from new entrants eager to capture market share with innovative solutions. The bargaining power of buyers is significant, as customers can readily switch between hosting and cloud providers, demanding competitive pricing and superior service. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 1&1’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for critical network infrastructure, such as fiber optic cables and 5G equipment, is a significant factor for companies like 1&1. Key providers like Ericsson and Nokia offer highly specialized and essential technologies, giving them substantial leverage. The ongoing global demand for 5G deployment and continued fiber optic expansion, especially in Germany, further strengthens the position of these suppliers.

The extensive R&D investment required for advanced telecommunications equipment means fewer companies can compete, concentrating power among a handful of major players. For instance, the global 5G infrastructure market, valued at approximately $35 billion in 2023, is dominated by a few key vendors, indicating their strong supplier power. This reliance on a limited number of specialized providers means 1&1 must navigate these relationships carefully to secure necessary components and services at competitive terms, especially given the high switching costs associated with changing major infrastructure suppliers.

Regulatory bodies like Germany's Bundesnetzagentur wield considerable influence over 1&1 by allocating scarce spectrum licenses. These licenses are the lifeblood of mobile network operators, making their availability and cost critical determinants of 1&1's competitive position and ability to expand services.

The price of spectrum directly affects 1&1's capital expenditure and operational costs. For instance, significant spectrum auctions in 2019 saw substantial investment from German operators, highlighting the financial commitment required to secure essential frequencies for future growth.

Wholesale network access providers, such as major mobile network operators, wield considerable bargaining power over new entrants like 1&1. Even as 1&1 invests in its own infrastructure, it remains dependent on these established players for national roaming during its network build-out. This reliance was highlighted in 2023 when 1&1 transitioned its primary roaming partner from Telefónica to Vodafone, demonstrating the leverage these wholesale providers possess in negotiating terms.

IT and Software Vendors

Suppliers of specialized IT systems, cloud computing infrastructure, and software for billing, customer relationship management, and network management hold moderate bargaining power over companies like 1&1. These critical solutions are often highly customized, leading to potentially significant switching costs for businesses that rely on them for efficient operations. For instance, in 2024, the average cost for a business to migrate its core IT infrastructure to a new cloud provider can range from tens of thousands to hundreds of thousands of dollars, depending on complexity.

The ability of these vendors to exert influence is further amplified by the criticality of their offerings. Downtime or integration issues with essential software, such as customer relationship management (CRM) systems that manage subscriber interactions, can directly impact revenue and customer satisfaction. This reliance means that companies like 1&1 must carefully consider vendor relationships and contract terms.

- Specialized Solutions: Vendors providing tailored IT and software are key to operational efficiency.

- High Switching Costs: Migrating critical systems can be expensive and time-consuming.

- 2024 Data: Cloud migration costs can range from $10,000s to $100,000s, impacting vendor leverage.

- Operational Dependency: Reliance on software like CRM makes vendor relationships crucial.

Content and Application Providers

Content and application providers can hold significant bargaining power, especially when offering exclusive or highly sought-after bundles like IPTV or cloud services. For 1&1, this means that if a particular piece of content or a critical application is unique to a provider, their negotiation leverage diminishes. This situation can force 1&1 to accept less favorable terms, impacting profitability.

In 2024, the demand for premium streaming content and specialized cloud applications continues to grow, strengthening the position of key providers. Major content studios and software developers often have the ability to dictate terms due to the high customer acquisition and retention value of their offerings. This can manifest in higher licensing fees or revenue-sharing agreements that are less advantageous for service providers like 1&1.

- Exclusive Content Power: Providers of exclusive sports rights or popular movie libraries can command higher wholesale prices.

- Platform Dependence: If 1&1's service relies heavily on specific applications for its core functionality, the application provider gains leverage.

- Bundling Strategies: Providers can bundle desirable content, making it difficult for 1&1 to source comparable alternatives independently.

- Market Concentration: In segments with few dominant content or application suppliers, their bargaining power is amplified.

Suppliers of critical network infrastructure, like specialized 5G equipment, hold significant bargaining power due to high R&D costs and limited competition. For 1&1, this means reliance on a few key vendors, such as Ericsson and Nokia, who are essential for network build-out. The global 5G infrastructure market, projected to reach over $50 billion by 2025, is dominated by these few players, giving them considerable leverage over purchasing companies.

Wholesale network access providers, including major mobile network operators, also exert considerable influence. 1&1's continued dependence on national roaming, even as it builds its own network, underscores this power. The negotiated terms with these providers directly impact 1&1's operational costs and service availability during its expansion phase.

Content and application providers can wield substantial power, particularly those offering exclusive or highly popular services like premium streaming or specialized cloud applications. In 2024, the increasing demand for such content strengthens their ability to dictate terms, potentially leading to less favorable agreements for 1&1.

| Supplier Type | Example Companies | Impact on 1&1 | Leverage Factor | 2023-2024 Data/Trend |

|---|---|---|---|---|

| Network Infrastructure | Ericsson, Nokia | High dependency for 5G build-out | Limited suppliers, high R&D | Global 5G infra market > $35B (2023), growing demand |

| Wholesale Network Access | Telefónica, Vodafone | Reliance on roaming during network build | Essential for national coverage | 1&1 switched primary roaming partner in 2023 |

| Content/Applications | Major streaming services, Cloud providers | Need for exclusive/popular offerings | Customer acquisition/retention value | Growing demand for premium content and cloud apps in 2024 |

What is included in the product

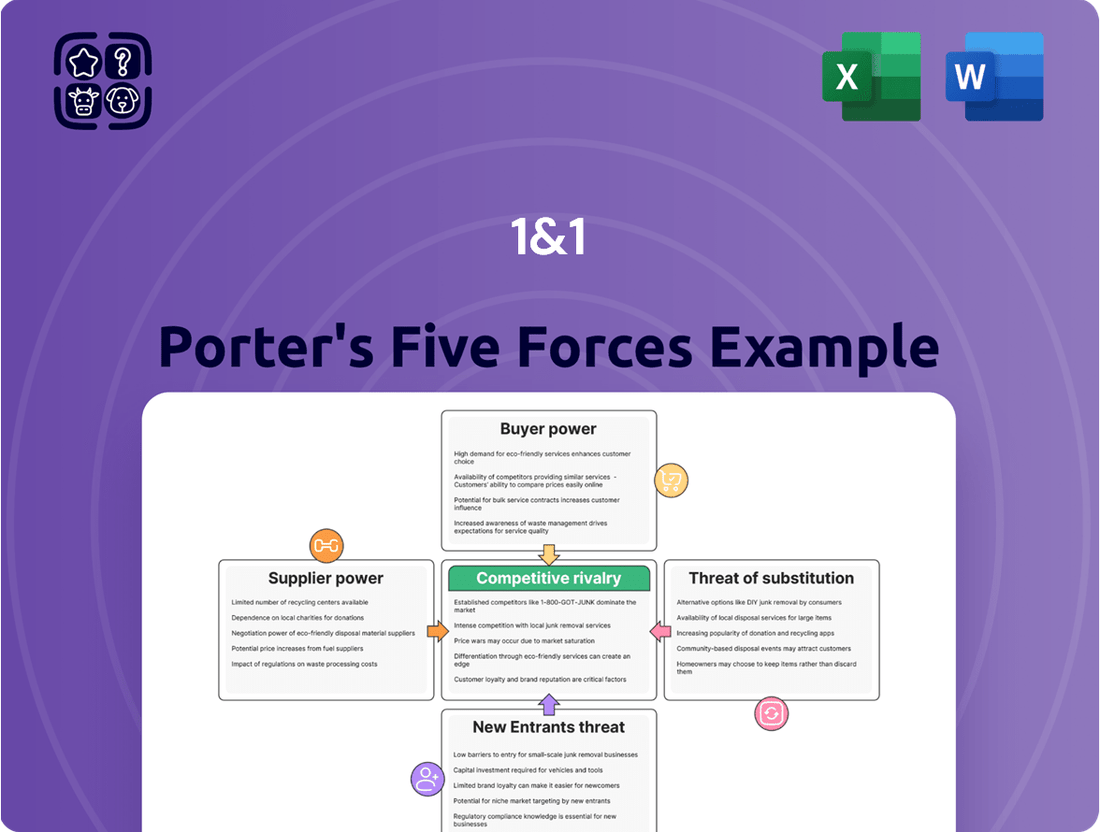

Analyzes the competitive intensity and profitability of the hosting and cloud services market for 1&1, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Instantly identify and alleviate competitive pressures with a visually intuitive framework, enabling proactive strategic adjustments.

Customers Bargaining Power

In the German telecom market, especially for mobile and broadband services, consumers are highly attuned to pricing. This means providers often find themselves in a competitive race to offer the most attractive deals.

Customers in Germany are not hesitant to switch providers if they can find a better offer or more tailored services. This willingness to change fuels a fierce price war among telecom companies.

For instance, in 2024, many German consumers actively sought out promotions and bundled offers, making price a primary decision-making factor. This trend puts significant pressure on companies like 1&1 to maintain competitive pricing structures.

The bargaining power of customers is amplified by the ease of switching and the availability of transparent price comparison tools online. This empowers consumers to demand more value for their money, impacting 1&1's pricing strategies.

For 1&1's mobile services, customer switching costs are generally quite low. While setting up fixed broadband might involve some effort, changing mobile providers is usually a straightforward process, particularly with number portability widely available. This ease of transition significantly amplifies the bargaining power of customers.

This low barrier to switching compels 1&1 to remain highly competitive in its pricing and the attractiveness of its service packages. In 2024, the telecommunications market continued to see intense price competition, with providers frequently offering promotional deals to attract and retain subscribers. For instance, many providers offered unlimited data plans for under €20 per month, highlighting the pressure on incumbents to match or beat competitor offers.

Customers today wield significant power due to readily available information and increased market transparency. Comparison websites, online forums, and social media platforms provide a wealth of data, allowing consumers to easily evaluate prices, product features, and service quality across various providers. For instance, in the German internet and mobile market, where 1&1 operates, a 2024 study revealed that over 70% of consumers consult at least two online sources before making a purchasing decision for telecommunication services. This easy access to comparative data directly empowers customers, intensifying competition and pressuring providers like 1&1 to maintain competitive offerings and transparent pricing structures.

Diverse Customer Segments

1&1 caters to a broad customer base, encompassing both individual consumers and businesses of varying sizes. This diversity means the bargaining power of customers isn't uniform. For instance, while large enterprise clients might negotiate better terms due to their significant purchase volumes, the sheer number of individual residential users means that, on their own, each has limited leverage. However, the potential for widespread customer churn or coordinated action within the residential segment can amplify their collective bargaining power.

In 2024, the telecommunications market, where 1&1 operates, saw intense competition, often leading to price wars. This environment inherently strengthens customer bargaining power as providers vie for market share. For 1&1, this translates to potential pressure on pricing for both its residential and business offerings.

Key aspects influencing customer bargaining power for 1&1 include:

- Customer Segmentation: The distinction between individual households and businesses means different negotiation dynamics are at play.

- Switching Costs: The ease or difficulty for customers to switch providers directly impacts their leverage; lower switching costs empower customers.

- Price Sensitivity: The degree to which customers prioritize price over other factors like service quality or brand loyalty.

- Information Availability: Increased access to comparative pricing and service information online gives customers more power.

Impact of Network Outages

The bargaining power of customers for 1&1 is significantly influenced by the reliability of its network services. Recent disruptions, such as the 1&1 mobile network outage in May 2024, have directly illustrated this. During this incident, customers experienced service interruptions, leading to a noticeable increase in contract terminations.

This event underscores a crucial point: when service quality falters, customers are empowered to seek alternatives. The ability for customers to easily switch providers due to network instability directly erodes 1&1's customer base and, consequently, its revenue streams. The cost of switching for consumers in the telecommunications sector is often low, further amplifying this customer power.

- Increased Contract Terminations: The May 2024 outage resulted in a tangible rise in customers leaving 1&1.

- Low Switching Costs: The ease with which customers can move to competing providers amplifies their bargaining power.

- Reputational Damage: Network outages can damage 1&1's brand reputation, making customers more sensitive to service quality.

- Price Sensitivity: Unreliable service can make customers more price-sensitive and actively seek better deals elsewhere.

The bargaining power of customers for 1&1 is substantial due to the highly competitive German telecom market. Consumers are informed, price-sensitive, and readily switch providers for better deals, especially given low switching costs for mobile services. This forces 1&1 to focus on competitive pricing and service quality to retain its customer base.

In 2024, the German telecommunications sector experienced intense price competition, with many providers offering unlimited data plans below €20 per month. This environment directly empowers customers, compelling companies like 1&1 to offer attractive promotions and bundles to secure and maintain market share.

The ease of switching providers, coupled with the availability of online comparison tools, significantly amplifies customer leverage. For instance, a 2024 German consumer survey indicated that over 70% of individuals consult multiple online sources before committing to a telecom service, highlighting the informed nature of today's consumers.

Network reliability is a critical factor; the 1&1 mobile network outage in May 2024 led to increased contract terminations, demonstrating how service disruptions empower customers to seek alternatives and exert greater bargaining power.

| Factor | Impact on 1&1 | Supporting Data (2024) |

|---|---|---|

| Price Sensitivity | High pressure on pricing strategies | Average monthly mobile spend in Germany remained competitive, with many plans under €20. |

| Switching Costs (Mobile) | Low, increasing customer leverage | Number portability is standard, facilitating easy provider changes. |

| Information Availability | Empowers customers with comparison data | >70% of German consumers consult multiple online sources before purchase. |

| Network Reliability | Directly impacts retention and bargaining power | May 2024 outage led to observable increases in customer churn. |

Full Version Awaits

1&1 Porter's Five Forces Analysis

This preview showcases the identical, professionally crafted Porter's Five Forces analysis for 1&1 that you will receive immediately upon purchase. Rest assured, there are no placeholder sections or altered content; what you see is precisely what you'll download. This comprehensive analysis is ready for immediate application, providing you with actionable insights without any further editing required. You're getting the complete, uncompromised document that details the competitive landscape of 1&1.

Rivalry Among Competitors

The German telecommunications sector is characterized by a high degree of competitive rivalry, primarily driven by the presence of major incumbents. Companies like Deutsche Telekom, Vodafone, and Telefónica (O2) are deeply entrenched, leveraging their vast network infrastructure and substantial financial backing to compete fiercely with newer entrants like 1&1.

These established players command large customer bases built over many years, giving them significant market share and pricing power. In 2023, Deutsche Telekom reported a revenue of €112 billion globally, with its German operations forming a substantial portion, highlighting its immense scale.

The incumbents' extensive physical infrastructure, including extensive fiber optic networks and mobile towers, creates a substantial barrier to entry and intensifies competition. Vodafone Germany, for instance, invested heavily in its 5G network rollout, further solidifying its competitive position.

This intense competition among these well-resourced giants often translates into aggressive pricing strategies and continuous investment in technological advancements, directly impacting the profitability and market strategy of all players, including 1&1.

Competitive rivalry in the telecommunications sector, including for companies like 1&1, is exceptionally fierce. This intensity is fueled by aggressive pricing strategies where providers frequently undercut each other on broadband, mobile, and TV packages. For instance, in early 2024, many providers continued to offer significant discounts for new customers, sometimes cutting prices by 50% for the first year.

Innovation in bundled offerings is another key battleground. Companies are constantly trying to differentiate themselves by packaging services like high-speed internet, mobile plans, television content, and cloud storage into attractive, all-in-one deals. This creates a complex environment where customer loyalty is hard-won and easily lost if a competitor presents a more compelling or cost-effective bundle.

Furthermore, continuous investment in network infrastructure, such as expanding 5G coverage and upgrading to fiber optic networks, is crucial for maintaining a competitive edge. In 2024, significant capital expenditures were still being directed towards 5G rollout, with many operators aiming for nationwide coverage by 2025. This arms race for network superiority can put substantial pressure on profit margins as companies balance the need for investment with price competition.

The constant drive for market share means providers are always looking for ways to attract and retain subscribers, often leading to promotional wars and a relentless focus on customer acquisition costs. This dynamic can erode profitability across the industry as providers fight for every percentage point of market share.

The telecommunications sector is characterized by fierce competition, with major players like Deutsche Telekom, Vodafone, and Telefónica, alongside 1&1, pouring billions into expanding their 5G and fiber optic networks. This capital-intensive race is about more than just infrastructure; it's a strategic battle for technological superiority and market share. For instance, in 2023, German network operators collectively invested over €7 billion in broadband expansion, a trend expected to continue strongly into 2024. This relentless investment cycle means companies are constantly trying to outpace rivals in offering faster speeds and wider coverage, directly intensifying the rivalry.

Product Differentiation Challenges

The telecommunications sector, including providers like 1&1, faces significant hurdles in product differentiation. While companies offer diverse bundles and feature sets, the fundamental services like internet access and mobile communication are increasingly viewed as commodities. This commoditization pushes competition heavily towards price and perceived service reliability, making it difficult to establish a truly unique market position.

This challenge is evident in how providers market their offerings. Many highlight speed tiers, data caps, or bundled entertainment, but the core utility remains similar across competitors. For instance, in 2024, the average monthly mobile data usage in Germany, a key market for 1&1, continued to rise, putting pressure on providers to offer competitive data allowances at attractive price points rather than solely relying on service uniqueness.

- Commoditization of Core Services: Internet and mobile plans are often seen as interchangeable, shifting focus to price.

- Price-Sensitive Market: Competition frequently devolves into price wars, impacting profit margins.

- Perceived Reliability as a Differentiator: Companies emphasize network stability and customer service to stand out.

- Bundling Strategies: Providers use bundled services, such as TV or smart home features, to create perceived value beyond basic connectivity.

Market Share Dynamics

Competitive rivalry within the German telecommunications sector remains intense, significantly impacting 1&1's market position. Despite 1&1's reported growth in mobile contracts, the overall landscape is characterized by dynamic shifts in customer bases. For instance, in 2023, Deutsche Telekom also experienced growth in its mobile and fiber segments, intensifying the competition for subscribers.

This constant flux necessitates that 1&1 continuously adapts its strategies to maintain and grow its market share. The presence of major players like Deutsche Telekom and Vodafone, each with substantial infrastructure and customer loyalty programs, creates a challenging environment. As of early 2024, the German broadband market, for example, continues to see significant investment and aggressive customer acquisition campaigns from all major providers.

- Intense Competition: The German telecom market features strong established players like Deutsche Telekom and Vodafone.

- Market Share Volatility: Customer contract bases are fluid, with providers like 1&1 and Deutsche Telekom both reporting growth in key areas.

- Strategic Imperative: Continuous adaptation of strategies is crucial for 1&1 to navigate this competitive landscape.

- Subscriber Acquisition: Aggressive customer acquisition strategies are prevalent across the industry, particularly in broadband and mobile services.

Competitive rivalry in the German telecommunications market, where 1&1 operates, is exceptionally high. Major players like Deutsche Telekom and Vodafone possess extensive infrastructure and significant financial resources, leading to aggressive pricing and continuous innovation in bundled services. This intense competition, marked by frequent promotional campaigns and substantial investments in network upgrades like 5G and fiber optics, puts constant pressure on all operators to attract and retain customers. For example, in 2023, German telecom companies invested billions in network expansion, a trend that continued into 2024, as they vie for market share in a landscape where core services are increasingly commoditized.

| Key Competitor | 2023 Revenue (Approximate Global) | Key Strategic Focus |

|---|---|---|

| Deutsche Telekom | €112 billion | Network expansion (5G/Fiber), bundled services |

| Vodafone | £21.7 billion (FY23 ended March 2023) | 5G rollout, convergence (mobile/fixed) |

| Telefónica (O2 Germany) | €7.5 billion (Germany FY23) | Digitalization, 5G network development |

| 1&1 | €2.26 billion (FY23) | Own 5G network build-out, fiber expansion, customer growth |

SSubstitutes Threaten

The rise of Over-the-Top (OTT) services presents a significant threat of substitution for telecommunications companies like 1&1. Consumers increasingly opt for communication platforms such as WhatsApp and Zoom, and entertainment streaming services like Netflix and YouTube, over traditional voice calls and SMS. This shift is driven by the convenience and often lower cost associated with these digital alternatives, directly impacting the revenue streams derived from legacy services.

For instance, the global OTT market for video streaming alone was valued at over $200 billion in 2023 and is projected to grow substantially. This widespread adoption means a decreasing reliance on traditional mobile operator services for communication and entertainment, forcing companies to adapt their business models to remain competitive in this evolving landscape.

The rise of accessible public Wi-Fi and community mesh networks presents a growing threat of substitution for mobile network operators like 1&1. In 2024, urban centers continue to see an expansion of free Wi-Fi zones in cafes, libraries, and public transport, directly competing with paid mobile data plans. This trend can lead to reduced data usage on cellular networks for less demanding tasks, impacting revenue per user.

Satellite internet solutions, like Starlink, represent an increasing threat of substitutes for traditional broadband providers, especially in rural or underserved regions. As of early 2024, Starlink has deployed over 5,000 satellites, significantly improving its service reach and speed, making it a more competitive option where fiber or DSL infrastructure is absent or unreliable. The ongoing advancements in satellite technology promise lower latency and higher bandwidth, directly challenging the market share of established terrestrial internet providers by offering an alternative for connectivity.

Private Networks and Enterprise Solutions

The increasing availability of private 5G networks and tailored enterprise connectivity solutions presents a notable threat to 1&1's business. As companies increasingly invest in their own dedicated networks, they may decrease their dependence on public telecommunications providers like 1&1 for critical operations. This shift could directly impact 1&1's B2B revenue streams, particularly within its enterprise services segment.

For instance, the growing trend of businesses implementing private networks for enhanced security, lower latency, and greater control over their data traffic means fewer corporations will rely solely on public mobile network operators. This strategic move towards self-sufficiency in connectivity could erode market share for companies like 1&1 that cater to enterprise clients.

Consider the impact on 1&1's German market presence. While specific figures for 1&1's B2B segment's exposure to private network adoption are not publicly detailed, the broader trend suggests a potential challenge. Globally, the private wireless market is projected for significant growth. For example, analysts predicted the global private LTE and 5G market to reach tens of billions of dollars by the early 2030s, indicating a substantial shift in enterprise spending on connectivity solutions.

- Reduced Reliance: Businesses adopting private 5G networks may reduce their reliance on public telecom services for specific applications, impacting 1&1's B2B segment.

- Enterprise Solutions: Dedicated enterprise connectivity solutions offer alternatives to public networks, potentially diverting business from 1&1.

- Market Share Erosion: The trend towards self-managed or specialized private networks could lead to a decline in 1&1's market share within the enterprise sector.

- Growing Market: The expanding global private wireless market indicates a significant potential threat as more businesses opt for private network solutions.

Voice over IP (VoIP) and Cloud-based Communication

Voice over IP (VoIP) and cloud-based communication platforms present a significant threat to traditional telecommunication services, including those offered by 1&1. These technologies enable voice and video communication over the internet, offering a more cost-effective and feature-rich alternative to traditional fixed-line telephony, especially for businesses. For instance, by 2024, the global cloud communication market was projected to reach over $150 billion, indicating a strong shift away from legacy systems.

The appeal of VoIP and cloud solutions lies in their flexibility, scalability, and advanced functionalities like unified communications, video conferencing, and presence management. These integrated platforms can consolidate multiple communication channels, often at a lower price point than separate traditional services. This competitive pricing and enhanced functionality can directly impact 1&1's revenue from traditional voice services, as customers increasingly opt for these more modern and integrated solutions.

- Increased Adoption: Businesses are rapidly migrating to cloud-based communication systems for improved efficiency and cost savings.

- Feature Richness: VoIP and cloud platforms offer advanced features that traditional telephony often lacks, such as integrated video conferencing and CRM connectivity.

- Cost Competitiveness: The pricing models for VoIP and cloud services are frequently more attractive than traditional fixed-line plans, especially when considering bundled features.

- Market Growth: The global market for Unified Communications as a Service (UCaaS), which includes VoIP, is experiencing substantial growth, with projections indicating continued expansion through 2025.

The availability of alternative internet access methods directly challenges 1&1's core business. As public Wi-Fi becomes more ubiquitous and satellite internet services like Starlink expand their reach, consumers and businesses have more options beyond traditional broadband and mobile data. This diversification of connectivity choices means 1&1 must continually innovate to retain its customer base and revenue streams.

For example, the global public Wi-Fi hotspot market continues to grow, offering free or low-cost internet access in numerous public spaces. Furthermore, satellite internet providers are enhancing their offerings, with reports in early 2024 indicating significant improvements in download speeds and reductions in latency, making them increasingly viable substitutes for fixed-line broadband, especially in areas with limited infrastructure.

| Substitute Technology | 2024 Market Trend Impact | Potential Impact on 1&1 |

| Over-the-Top (OTT) Services | Continued strong growth in video streaming and communication apps. | Reduced demand for traditional voice and data services. |

| Public Wi-Fi & Mesh Networks | Expansion in urban and public areas. | Decreased mobile data usage on cellular networks. |

| Satellite Internet | Increased satellite deployment and performance improvements. | Competition for broadband services, particularly in underserved regions. |

| Private 5G Networks | Growing enterprise investment in dedicated connectivity. | Potential erosion of B2B revenue from public network reliance. |

| VoIP & Cloud Communication | Rapid adoption by businesses for cost and feature benefits. | Shift away from traditional voice service revenue. |

Entrants Threaten

The telecommunications industry, particularly with the aggressive build-out of 5G and fiber optic networks, demands staggering upfront investments. New companies must secure expensive spectrum licenses from governments, purchase advanced network hardware, and undertake extensive civil engineering projects to lay fiber optic cables and erect cell towers. For instance, in the US, the FCC's 5G spectrum auctions have generated billions of dollars, with the C-band auction alone in 2021 grossing over $81 billion. This immense capital requirement acts as a formidable barrier, effectively deterring most potential new entrants from even attempting to establish a competitive national network.

The telecommunications industry presents substantial barriers to entry, particularly in the form of rigorous regulatory requirements. Companies aspiring to enter this market must obtain various licenses, including those for spectrum usage and network operation, a process often characterized by significant costs and lengthy timelines. For instance, in 2024, the average cost of acquiring mobile spectrum licenses in major European markets continued to be in the billions of euros, effectively limiting the pool of potential new entrants.

Compliance with a complex web of consumer protection and data privacy laws, such as GDPR in Europe, adds another layer of difficulty. New entrants must invest heavily in systems and processes to ensure adherence to these regulations, which can be daunting for smaller or less capitalized companies. The ongoing evolution of these regulations, driven by technological advancements and societal concerns, necessitates continuous adaptation and investment.

Established brand loyalty is a significant barrier for new entrants in the telecommunications sector. Incumbent operators such as Deutsche Telekom, Vodafone, and Telefónica have cultivated strong brand recognition and deeply entrenched customer bases over many years of operation. For instance, in 2023, Deutsche Telekom reported over 24 million mobile customers in Germany alone, illustrating the sheer scale of loyalty established providers command.

New players entering the market face the daunting task of overcoming this loyalty. They would need to commit substantial resources to marketing campaigns and introduce truly disruptive service offerings or aggressive pricing strategies to even begin luring customers away from trusted, long-standing providers. This investment hurdle significantly dampens the threat of new entrants by making customer acquisition a costly and uncertain endeavor.

Access to Existing Infrastructure

While regulations often mandate wholesale access to existing networks for new players, securing this access in an effective and truly cost-efficient manner remains a significant hurdle. Incumbents may impose terms that are disadvantageous, or the process itself can be complex and drawn out.

The sheer cost and time involved in constructing an entirely new, nationwide telecommunications infrastructure from the ground up are immense. This reality is clearly illustrated by 1&1's own substantial investment and ongoing efforts in building its fiber optic network, a process that underscores the capital-intensive nature of the industry.

- High Capital Outlay: Building a new fiber optic network can cost tens of billions of euros. For instance, 1&1 reported significant capital expenditures in its 2023 financial year, reflecting the ongoing network build.

- Regulatory Hurdles: Even with mandated access, navigating regulatory frameworks and ensuring fair pricing can be challenging for new entrants.

- Economies of Scale: Established players benefit from existing infrastructure and customer bases, creating significant economies of scale that are difficult for newcomers to match.

- Technological Obsolescence: Rapid advancements in technology mean that any new infrastructure investment must consider future-proofing, adding to the upfront cost and risk.

Intense Competition and Price Pressure

The threat of new entrants in the German telecom sector is considerably low due to the existing intense competition and significant margin pressure. Established players like Deutsche Telekom, Vodafone, and O2 Germany already engage in aggressive pricing strategies and offer comprehensive bundled services. This makes it exceedingly difficult for newcomers to carve out market share and achieve profitability swiftly, especially without substantial capital investment and established brand recognition.

For instance, in 2023, the German broadband market saw continued price wars, with average monthly prices for high-speed internet plans remaining highly competitive. New entrants would need to overcome substantial barriers, including high infrastructure costs, regulatory hurdles, and the need to match the extensive network coverage and customer service of incumbents.

- High Capital Requirements: Building out a competitive network infrastructure demands billions of euros, a prohibitive cost for most potential new entrants.

- Incumbent Dominance: The established market share and brand loyalty of current operators create a significant hurdle for new players.

- Price Sensitivity: The German market is highly price-sensitive, meaning new entrants must offer compelling value propositions to attract customers away from established providers.

- Bundled Services: Incumbents frequently offer attractive bundles of mobile, fixed-line, and entertainment services, which are difficult for new, specialized entrants to replicate.

The threat of new entrants in the telecommunications industry is significantly mitigated by the substantial capital investment required for network infrastructure. Building out a competitive fiber optic or 5G network demands billions of euros, a prohibitive cost for most potential new players. For example, 1&1's own reported capital expenditures in 2023 highlight the immense financial commitment involved in network construction.

Regulatory hurdles, including the acquisition of expensive spectrum licenses and compliance with intricate legal frameworks, further deter new entrants. These requirements often involve lengthy approval processes and significant upfront costs. Furthermore, established operators benefit from economies of scale and strong brand loyalty, making it difficult for newcomers to compete on price or service quality. In 2023, major German telecom providers like Deutsche Telekom maintained large customer bases, with Deutsche Telekom alone serving over 24 million mobile customers in Germany, illustrating the entrenched market position of incumbents.

| Barrier Type | Description | Example/Impact |

| Capital Requirements | Building a new national network requires billions of euros. | 1&1's substantial capital expenditures in 2023 for network build-out. |

| Regulatory Hurdles | Spectrum licenses and operational permits are costly and complex. | 2021 US C-band spectrum auction grossed over $81 billion. |

| Economies of Scale | Incumbents leverage existing infrastructure and customer bases. | Established providers offer bundled services that are hard to replicate. |

| Brand Loyalty | Long-standing providers have deeply entrenched customer relationships. | Deutsche Telekom's over 24 million German mobile customers in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from industry-specific market research reports, official company filings like 10-Ks, and reputable financial news outlets to provide a comprehensive view of competitive dynamics.