1&1 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

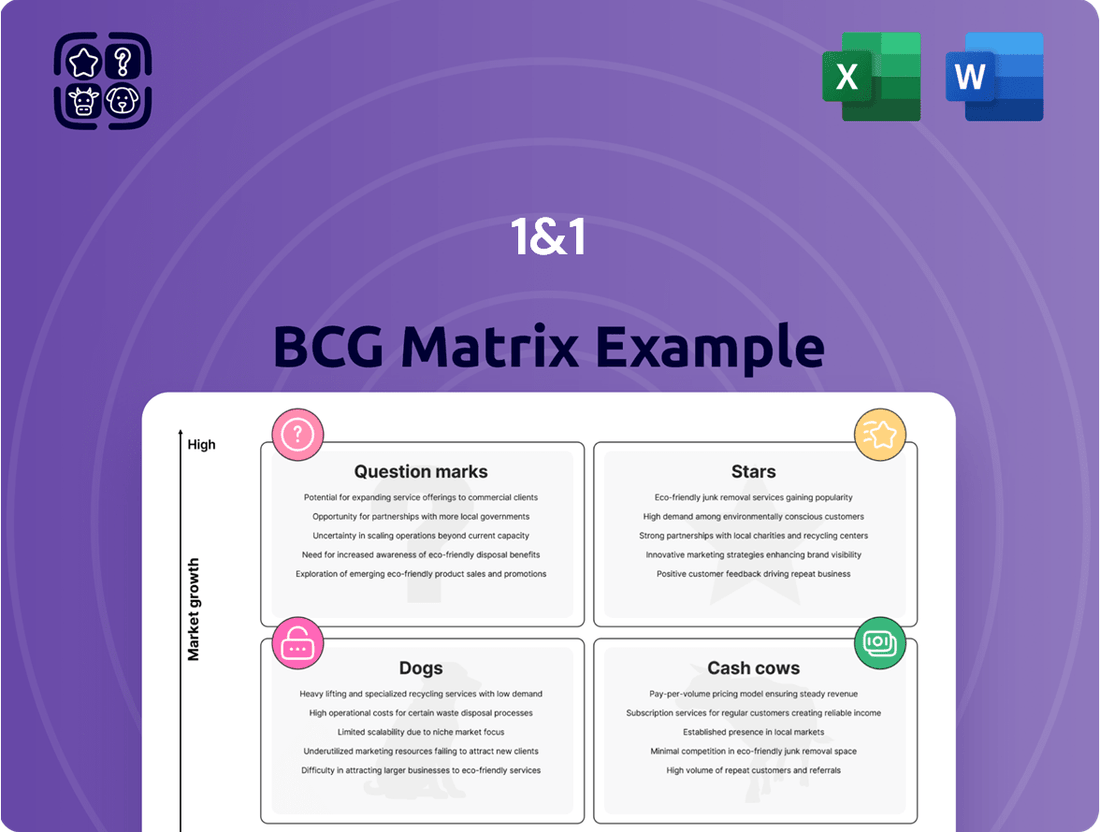

Unlock the strategic potential of a company's product portfolio with a glimpse into its 1&1 BCG Matrix. This powerful framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual representation of their market position and growth prospects. Understanding these placements is crucial for informed decision-making regarding resource allocation and future investments.

This preview highlights key product segments, but to truly grasp the company's competitive landscape and chart a course for sustained growth, you need the full picture. Dive deeper into the detailed analysis and actionable insights that only the complete BCG Matrix can provide.

Purchase the full BCG Matrix today to gain a comprehensive understanding of each product's strategic role, enabling you to optimize your business strategy and maximize profitability.

Stars

1&1's investment in its own 5G mobile network, leveraging Open RAN technology, positions it as a potential market leader in a rapidly expanding sector. This ambitious venture, currently in its deployment phase, is designed to secure a significant portion of the German mobile market by delivering cutting-edge, fully virtualized services.

The company's strategic rollout plan is robust, with targets to reach a quarter of German households by the close of 2025 and to expand coverage to half of all households by 2030. This aggressive expansion signals a strong belief in the high growth potential of its 5G network services.

1&1 is aggressively investing in Germany's gigabit transformation by expanding its fiber optic broadband network. This strategic push, backed by significant capital expenditure, aims to connect millions of German households with high-speed fiber internet. In 2024, 1&1 continued to be a major player in this expansion, leveraging its own infrastructure and strategic partnerships to accelerate deployment.

High-speed mobile data plans represent a significant growth opportunity for 1&1, especially with the ongoing expansion of its proprietary 5G network. The company is strategically positioned to capture market share by offering attractive plans, potentially including unlimited data without speed restrictions, which appeals directly to consumers increasingly reliant on robust mobile connectivity.

The demand for mobile data continues its upward trajectory, with global mobile data traffic expected to reach over 200 exabytes per month by 2024. This surging consumption, driven by video streaming, cloud services, and IoT devices, underpins the high growth potential of this market segment for 1&1.

By leveraging its 5G infrastructure, 1&1 can differentiate itself by providing a superior user experience, a critical factor in attracting and retaining customers in a competitive telecom landscape. This focus on premium connectivity addresses a clear market need for faster and more reliable mobile internet access.

Advanced Cloud-Based Applications for Businesses

1&1's advanced cloud-based applications for businesses, such as virtual servers and online storage solutions, are positioned to become significant Stars within the BCG Matrix. While their current market share isn't explicitly highlighted as dominant, their strategic focus on serving small to medium-sized businesses (SMBs) addresses a rapidly expanding market. The increasing reliance on scalable and flexible IT infrastructure by these businesses creates a strong foundation for growth. For instance, the global cloud computing market size was valued at approximately $610.8 billion in 2023 and is projected to reach $1,300.9 billion by 2027, demonstrating substantial upward momentum. 1&1's comprehensive offerings cater directly to this burgeoning demand.

The potential for these cloud services to evolve into Stars is directly linked to their ability to scale effectively and capture a larger segment of the SMB market. Companies are increasingly migrating their operations to the cloud to enhance efficiency and reduce operational costs. In 2024, it's estimated that over 90% of enterprises are utilizing cloud services in some capacity. 1&1's continued investment in developing and refining these applications, coupled with strategic marketing to highlight their benefits, will be crucial for their ascent.

- Scalable Infrastructure: 1&1's cloud solutions offer businesses the flexibility to adapt their IT resources as their needs change, a critical factor for growth.

- Growing SMB Market: The small and medium-sized business sector represents a vast and largely untapped market for robust cloud services.

- Increased Cloud Adoption: By 2024, the widespread adoption of cloud technologies across industries signifies a favorable market environment.

- Competitive Differentiation: Comprehensive offerings and a focus on user-friendly interfaces can help 1&1 stand out in the competitive cloud market.

Innovative IoT Solutions leveraging 5G

Innovative IoT solutions leveraging 5G, particularly through 1&1's new Open RAN network, are poised for significant growth and represent a strategic opportunity. The global IoT market, projected to reach over $1.3 trillion by 2026, showcases the immense potential for these services. 1&1's investment in a flexible, open 5G infrastructure directly supports the development and deployment of advanced IoT applications, from smart cities to industrial automation. This positions these offerings as strong contenders for future success.

The capabilities of 5G, with its enhanced speed, low latency, and massive connectivity, are crucial enablers for the next generation of IoT. For instance, autonomous vehicles, a key IoT application, rely on 5G for real-time communication and decision-making. While specific market share data for 1&1's IoT solutions isn't publicly available, the inherent demand and the technological advantages provided by their 5G network place these services in a promising position within the BCG matrix, likely in the Star quadrant.

- High Growth Potential: The global IoT market is experiencing exponential growth, with projections indicating continued expansion in the coming years.

- Enabling Technology: 1&1's Open RAN 5G network provides the foundational technology for a wide array of advanced IoT applications.

- Strategic Positioning: By investing in 5G infrastructure, 1&1 is well-positioned to capture market share in the rapidly evolving IoT landscape.

- Future Stars: The combination of market demand and technological enablement suggests that 1&1's innovative IoT solutions are strong candidates for becoming future market stars.

1&1's cloud-based applications for businesses and its innovative IoT solutions leveraging 5G are prime candidates for the Star quadrant in the BCG Matrix. These offerings tap into rapidly expanding markets, with the global cloud computing market projected to exceed $1.3 trillion by 2027 and the IoT market expected to surpass $1.3 trillion by 2026. The company's investment in its own 5G infrastructure, particularly its Open RAN technology, provides a significant competitive advantage, enabling superior performance for these services. With over 90% of enterprises utilizing cloud services by 2024, and the increasing demand for advanced IoT applications, 1&1 is strategically positioned to capture substantial market share and achieve high growth.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Cloud Applications (SMB) | High | Growing | Star |

| IoT Solutions (5G) | High | Growing | Star |

What is included in the product

The 1&1 BCG Matrix provides strategic guidance by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs, highlighting investment priorities.

Visualize your portfolio instantly, turning complex strategic decisions into clear, actionable insights.

Cash Cows

1&1's existing mobile communications portfolio, primarily its MVNO business, functions as a cash cow within its BCG matrix. With over 12 million mobile customers, many locked into stable, high-margin service revenue tariffs, this segment provides consistent financial strength. These established contracts, often relying on national roaming agreements with Telefónica and Vodafone, are a key driver of profitability.

This robust customer base ensures a predictable income stream, even as 1&1 continues its strategic transition to its own network infrastructure. The high margins generated from these existing mobile services allow the company to fund investments in newer, potentially high-growth areas without external financing. For instance, in 2024, the stable revenue from these MVNO customers will significantly support the ongoing build-out and expansion of 1&1's proprietary 5G network.

Traditional DSL/VDSL broadband connections represent a significant cash cow for 1&1, boasting approximately 3.95 million broadband connections in Germany. These established fixed-line services are a cornerstone of the company's revenue, delivering a steady and predictable cash flow. Even with a minor dip in customer numbers, the sheer size of this user base in a mature market ensures consistent financial returns.

1&1's web hosting and domain registration services are firmly positioned as Cash Cows within its portfolio. These offerings, part of the United Internet AG group, are foundational, generating consistent, recurring revenue. Their established market presence and the mature, stable nature of the web services market mean they demand less aggressive marketing spend, allowing them to generate significant free cash flow.

In 2024, the global web hosting market was valued at approximately $241.6 billion and is projected to grow steadily. 1&1 benefits from this stability; its services are essential for businesses and individuals alike, ensuring a predictable demand. The high market share held by these services allows for economies of scale, further contributing to their profitability and cash-generating ability.

Basic Online Storage Solutions

Basic online storage solutions, frequently included with broadband or mobile packages, are a prime example of a Cash Cow for companies like 1&1. These offerings cater to a stable, established user base, consistently generating revenue without demanding substantial new investment or experiencing rapid expansion. The mature nature of this market means that while growth is modest, profitability remains high due to established infrastructure and customer loyalty.

- Revenue Generation: These services provide predictable, ongoing revenue streams, often accounting for a significant portion of a company's earnings.

- Low Investment Needs: Unlike growth-oriented products, Cash Cows require minimal capital expenditure for expansion or marketing.

- Market Maturity: The market for basic online storage is well-established, with most potential users already adopting such services.

- Profitability: High margins are typical due to economies of scale and low operational costs associated with serving an existing customer base.

Value and Premium Segment Mobile Brands

The 1&1 brand, a significant player in the German telecommunications market, operates across both value and premium mobile segments. This dual focus allows 1&1 to capture a broad customer base, leveraging its established brand recognition and customer loyalty.

In 2024, 1&1 continued to solidify its position by focusing on these core segments. The value segment benefits from competitive pricing and bundled offers, attracting price-sensitive consumers. Simultaneously, the premium segment caters to customers seeking advanced features, superior network performance, and enhanced customer service, commanding higher average revenue per user.

These segments are considered cash cows for 1&1 because they generate consistent and substantial revenue streams with relatively stable demand. Their profitability is further enhanced by economies of scale and established operational efficiencies, contributing significantly to the company's overall financial health. For instance, 1&1 reported a notable increase in its customer base in 2023, with a significant portion attributable to its mobile offerings, underscoring the strength of these segments.

The success of these segments is underpinned by several key factors:

- Strong Brand Recognition: 1&1 is a well-known and trusted brand in Germany, fostering customer loyalty.

- Customer Loyalty: Existing customers in both value and premium segments are less likely to switch providers, ensuring recurring revenue.

- Market Presence: A well-established distribution network and marketing efforts in Germany support consistent sales.

- Profitability: These segments contribute significantly to 1&1's overall profitability due to a strong market position and operational efficiencies.

Cash Cows are business units or products that generate more cash than they consume, operating in mature markets with strong competitive positions. For 1&1, its established mobile communications portfolio, particularly its MVNO business with over 12 million customers, exemplifies a cash cow. These services provide a stable, high-margin revenue stream, crucial for funding network expansion.

Similarly, 1&1's traditional DSL/VDSL broadband connections, serving approximately 3.95 million customers, act as significant cash cows. Despite market maturity, the sheer volume of these connections ensures consistent financial returns. Web hosting and domain registration services also fall into this category, benefiting from a stable market and economies of scale, contributing to strong free cash flow for the company.

The value and premium mobile segments of the 1&1 brand are also considered cash cows, generating substantial and consistent revenue. Their profitability is bolstered by strong brand recognition, customer loyalty, and established operational efficiencies, making them key contributors to 1&1's financial health.

Preview = Final Product

1&1 BCG Matrix

The preview you see showcases the complete, unwatermarked 1&1 BCG Matrix report that you will receive immediately after purchase. This document has been meticulously crafted by industry experts to offer actionable insights into portfolio management and strategic decision-making. Rest assured, the file you are currently viewing is the identical, fully formatted, and professionally designed analysis you will download, ready for immediate integration into your business planning processes.

Dogs

Legacy Fixed Wireless Access (FWA) services, while perhaps foundational for 1&1 in the past, are now likely facing significant challenges. These older technologies, often characterized by lower speeds and less robust infrastructure compared to newer options, are typically found in the Dogs quadrant of the BCG matrix. Their market share and growth prospects are generally limited as fiber optic and 5G mobile technologies continue to expand their reach and capabilities.

The continued investment in maintaining and supporting these legacy FWA systems, when their market relevance is waning, can consume resources that could be better allocated to more promising growth areas. For instance, as of early 2024, the global FWA market is increasingly dominated by 5G deployments, with analysts projecting substantial growth in this segment. This trend naturally sidelines older, less efficient wireless technologies.

If 1&1 still offers these legacy FWA services, they might represent a cash trap. This means they continue to require operational expenditure for maintenance and customer support, but generate diminishing returns due to declining customer demand and the availability of superior alternatives. The strategic imperative is often to gradually phase out or divest from such offerings.

The company's launch of 5G FWA in December 2022 signifies a clear strategic shift towards more advanced and competitive technologies. This move further highlights the declining competitive position and diminishing returns associated with their older fixed wireless access solutions, reinforcing their likely placement as Dogs within the 1&1 portfolio.

Certain legacy prepaid mobile tariffs, particularly those from acquired discount brands like Drillisch’s brands in Germany, often fall into the Dogs category of the BCG matrix. These tariffs are characterized by low market share due to a lack of active promotion and declining customer interest in the face of more modern offerings. For instance, by the end of 2023, the prepaid market segment continued to see intense competition, with many older, uncompetitive tariffs struggling to retain or attract subscribers.

These outdated plans typically exhibit minimal growth, as they fail to keep pace with evolving consumer demands for data allowances and network speeds. While some might still break even due to a residual customer base, they represent a drain on resources—both technical and marketing—that could be better allocated to more promising segments of 1&1's portfolio. The operational costs associated with maintaining these legacy systems and customer support can outweigh the meager revenues generated, hindering overall profitability.

Within a B2B cloud provider's portfolio, niche or underperforming offerings often fall into the "dog" category of the BCG matrix. These are specialized cloud solutions that, despite initial investment, have struggled to gain significant market share in the competitive B2B landscape. For example, a provider might have a highly specialized data analytics platform for a very narrow industry that has seen minimal adoption.

These offerings typically generate very low revenue, often not even covering their operational and maintenance costs. In 2024, such a product might only contribute a few hundred thousand dollars in annual recurring revenue, while requiring a dedicated engineering team costing significantly more to maintain and update. The lack of widespread adoption means limited economies of scale, further exacerbating their financial underperformance.

The challenge with these "dogs" is that they tie up valuable resources—both financial and human capital—that could be better allocated to more promising growth areas within the company's cloud strategy. Continuing to support these niche offerings without a clear path to revitalization or divestment represents a drain on overall profitability and strategic focus.

Older, Less Competitive Hardware Sales

The hardware sales segment, often characterized by smartphone bundles tied to service contracts, operates with notably thin profit margins. These sales are also highly susceptible to predictable seasonal demand shifts, making consistent revenue generation a challenge.

When specific smartphone models or older inventory fail to sell at the expected pace, they risk becoming 'dogs' within the BCG matrix framework. This situation ties up valuable company capital in assets that are not generating adequate returns, hindering overall financial flexibility.

For instance, in 2024, the global smartphone market saw increased pressure on pricing, with average selling prices for mid-range devices remaining relatively flat. This environment exacerbates the challenge of clearing older inventory, as new, more competitive models quickly enter the market, diminishing the appeal and value of previous generations.

- Low Margins: The hardware business, especially bundled with contracts, typically yields lower profit margins compared to service-based revenue streams.

- Seasonal Fluctuations: Sales performance can be heavily influenced by holiday seasons and new product launch cycles, leading to unpredictable revenue patterns.

- Inventory Risk: Unsold or slow-moving device models can become obsolete, leading to write-downs and a significant drain on capital.

- Competitive Landscape: Rapid technological advancements and intense competition mean older hardware quickly loses market relevance and value.

Declining Traditional Fixed-Line Telephony (Voice-only)

Stand-alone traditional fixed-line telephony, often referred to as voice-only services, represents a segment within the telecommunications market that is experiencing a significant downturn. This decline is primarily driven by the pervasive adoption of mobile communication technologies and the increasing prevalence of Voice over Internet Protocol (VoIP) services, which offer more flexibility and often lower costs.

These voice-only fixed-line services are typically characterized by a low market share and very limited, if any, growth prospects. As consumers and businesses increasingly rely on mobile devices and internet-based communication solutions, the demand for basic, landline-only telephone services has steadily eroded. For instance, in many developed markets, the penetration of mobile subscriptions far exceeds that of traditional landlines.

The strategic implications for a company like 1&1 are clear when considering this segment within a BCG matrix framework:

- Declining Market Share: Stand-alone voice-only telephony services are likely to hold a shrinking portion of the overall telecommunications market.

- Low Growth Prospects: The segment is characterized by a negative or near-zero growth rate, making it unattractive for substantial investment.

- Reduced Revenue Streams: As customers migrate to bundled packages or alternative communication methods, revenue from these basic services diminishes.

- Strategic Re-evaluation: Companies must evaluate whether to divest, minimize investment, or find niche opportunities within this declining category.

Products classified as Dogs in the BCG matrix exhibit low market share and low market growth. For 1&1, this often translates to legacy services or hardware that are being superseded by newer technologies. These offerings typically consume resources without generating significant returns, acting as a drain on the company's overall performance.

In 2024, segments like older generations of fixed wireless access or specific prepaid mobile plans that haven't been updated are prime examples of potential Dogs. Their limited appeal and declining customer base make them candidates for divestment or minimal investment to manage down. For instance, the decreasing demand for traditional voice-only landlines further solidifies their position as Dogs.

The strategic approach for Dogs is usually to divest, liquidate, or milk them for any remaining cash flow while minimizing further investment. This frees up capital and resources to be redirected towards more promising areas of the business, such as high-growth products or services with strong market positions.

For 1&1, identifying and managing these Dog segments is crucial for optimizing their portfolio. By strategically phasing out or divesting from underperforming legacy offerings, the company can enhance its focus on innovation and growth, ensuring a more robust and competitive future in the telecommunications market.

Question Marks

1&1's new 5G Open RAN network is poised to unlock a suite of advanced enterprise solutions, moving beyond simple connectivity. These include dedicated private networks for enhanced security and control, edge computing for real-time data processing, and ultra-reliable connectivity tailored for demanding sectors like manufacturing and logistics. These represent significant growth opportunities, though 1&1 currently holds a minimal share in these specialized markets.

The potential for these new 5G-enabled enterprise solutions places them squarely in the Question Marks category of the BCG matrix. While the market for private 5G networks and edge computing is experiencing rapid expansion, with global spending on private 5G networks projected to reach over $8 billion by 2026, 1&1's current market penetration in these areas is nascent. This strategic focus aims to capture future market share in these high-potential segments.

1&1's smart home solutions operate within a rapidly expanding market, projected to reach over $100 billion globally by 2025, with the German market alone showing robust growth. While 1&1 offers these solutions, their current market share in this dynamic and competitive sector may be relatively modest. This positions them to potentially be a question mark in the BCG matrix, needing substantial investment in brand building and technological advancement to ascend.

1&1 Versatel's robust fiber optic infrastructure positions it well to expand into specialized B2B connectivity, such as SD-WAN. This market is experiencing significant growth, with the global SD-WAN market projected to reach $26.7 billion by 2027, growing at a CAGR of 27.9%.

While 1&1 has a strong foundation, its penetration in these advanced, higher-margin B2B segments may still be in its nascent stages compared to established competitors.

Leveraging its network, 1&1 could offer tailored SD-WAN solutions, integrating advanced routing, security, and application prioritization for businesses seeking greater network agility and cost-efficiency.

This strategic move could allow 1&1 to capture a larger share of the lucrative enterprise network services market, moving beyond basic connectivity to value-added solutions.

Emerging Digital Services and Value-Added Applications

1&1's investment in emerging digital services like video-on-demand and IPTV positions them in a dynamic growth sector. The global IPTV market, for instance, was valued at approximately USD 120 billion in 2023 and is projected to grow significantly. However, 1&1's current market share in these specific value-added applications might be relatively small, indicating a potential Stars or Question Marks quadrant placement.

To capitalize on these growing markets, 1&1 faces a critical decision: either invest heavily to increase penetration and market share, aiming to transform these services into future Stars, or risk them becoming Dogs if they fail to gain traction against established competitors. This requires careful resource allocation and strategic marketing efforts.

- Market Growth: The global digital services market, including VOD and IPTV, shows robust expansion, driven by increasing internet penetration and consumer demand for personalized content.

- Investment Needs: Capturing significant market share in these competitive segments necessitates substantial investment in content, technology, and marketing.

- Potential for Growth: If successful, these digital services could become significant revenue drivers and key differentiators for 1&1.

- Risk of Stagnation: Failure to gain traction could lead to these services becoming underperforming assets, requiring divestment or restructuring.

Migration of Existing Mobile Customers to Own 5G Network

The migration of 1&1's roughly 12 million existing mobile customers to its self-operated 5G network represents a significant undertaking, currently positioned as a question mark within the BCG matrix.

This transition, while aimed at long-term benefits like reduced operating expenses and greater network autonomy, involves substantial upfront investment and carries considerable execution risk.

The sheer scale of migrating millions of users presents technical and logistical challenges that could impact service quality and customer satisfaction during the transition phase.

As of early 2024, the exact timeline and success rate of this migration remain uncertain, directly affecting the short-to-medium term profitability of this strategic move.

- Projected Cost: The initial investment for building and activating the 5G network is substantial, with analysts estimating tens of billions of Euros across major European operators for network build-out and spectrum acquisition.

- Customer Retention: Maintaining a high customer retention rate during the migration is crucial; a significant churn could negate the projected cost savings.

- Operational Complexity: Managing the transition for 12 million customers simultaneously requires robust IT infrastructure and operational readiness.

- Competitive Landscape: Competitors are also heavily investing in 5G, meaning 1&1 must not only migrate but also offer a compelling 5G experience to retain and attract subscribers.

Question Marks in 1&1's portfolio represent areas of high market growth but currently low market share. These are strategic bets for future growth, requiring significant investment to capture potential. Without adequate funding or successful execution, they risk becoming Dogs.

1&1's new 5G enterprise solutions, smart home offerings, and digital services like VOD/IPTV fall into this category. The migration of its mobile customers to a self-operated 5G network also presents question mark characteristics due to its scale and associated risks.

The success of these Question Marks hinges on 1&1's ability to invest effectively and gain market traction against established players in rapidly expanding sectors.

The BCG matrix helps visualize these strategic positions, highlighting where 1&1 needs to allocate resources for future gains.

| Business Unit | Market Growth | Market Share | BCG Category | Strategic Focus |

| 5G Enterprise Solutions | High | Low | Question Mark | Invest for growth, build share |

| Smart Home Solutions | High | Low/Medium | Question Mark | Increase investment, brand building |

| Digital Services (VOD/IPTV) | High | Low | Question Mark | Strategic investment, competitive differentiation |

| 5G Network Migration | N/A (Internal Project) | N/A | Question Mark | Manage execution risk, optimize for cost savings |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.