1&1 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1&1 Bundle

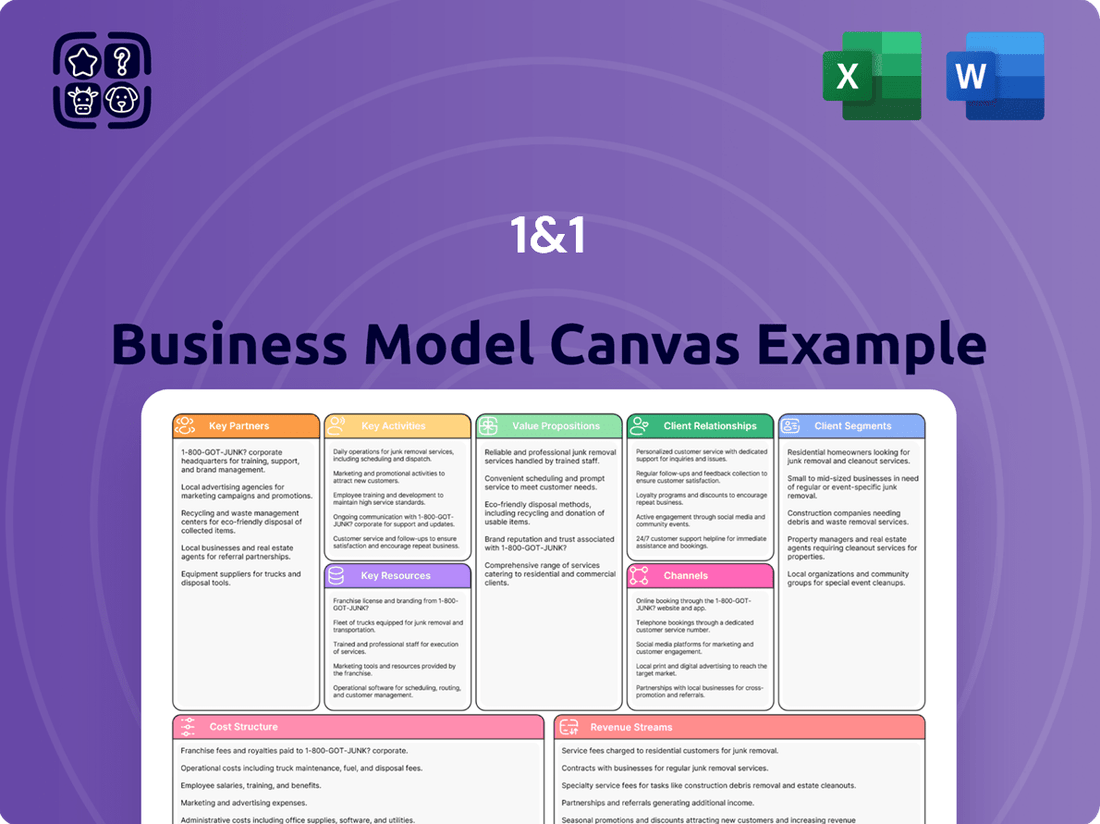

Discover the strategic DNA of 1&1 with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their operational success. Gain invaluable insights into how 1&1 effectively delivers value and maintains its competitive edge. This professionally crafted canvas is essential for anyone looking to understand and replicate strategic excellence.

Partnerships

1&1’s network infrastructure hinges on critical partnerships with established telecommunication giants such as Vodafone and Deutsche Telekom. These collaborations are essential for national roaming capabilities, allowing 1&1 customers to access services even outside their primary network coverage. In 2023, the German telecommunications market saw continued investment, with these providers playing a pivotal role in the underlying infrastructure.

Access to the 'last mile' fiber-optic networks of these partners is a cornerstone of 1&1's broadband strategy. This ensures that 1&1 can offer high-speed internet to a broad customer base across Germany, particularly in areas where their own network deployment is still ongoing. These agreements are vital for delivering a consistent and high-quality service experience.

The strategic importance of these alliances cannot be overstated, as they directly impact 1&1's ability to expand its market reach and offer competitive mobile and broadband solutions. By leveraging existing infrastructure, 1&1 can accelerate its growth and provide seamless connectivity to more customers nationwide.

1&1 heavily relies on technology and hardware suppliers to construct its advanced 5G network. A key partner is Rakuten Symphony, acting as the general contractor, enabling the deployment of a fully virtualized 5G mobile network built on Open RAN principles. This strategic alliance is foundational to 1&1's network build-out.

The company's ecosystem boasts over 100 partners and vendors. These collaborations are crucial for supplying active network equipment, essential software components, and ensuring optimal mobile performance across the network. This broad base of suppliers fuels innovation and network development.

These partnerships are not just about sourcing components; they are vital for the actual construction of the 5G infrastructure. By working with a diverse group of technology providers, 1&1 can leverage specialized expertise and cutting-edge solutions, which is essential for staying competitive in the fast-evolving telecommunications market.

1&1 heavily relies on its subsidiary, 1&1 Versatel, for its extensive nationwide fiber-optic transport network. This internal infrastructure is crucial for delivering high-speed internet services across Germany.

To further enhance its reach, 1&1 partners with numerous regional city carriers. These collaborations are vital for accessing local fiber networks, enabling the company to offer gigabit bandwidths in more areas.

These strategic partnerships are the backbone of 1&1's strategy to drive Germany's gigabit transformation. By combining its own network with those of its city carrier partners, 1&1 can rapidly expand its broadband footprint.

This collaborative approach ensures 1&1 can provide future-proof internet services, meeting the increasing demand for faster and more reliable connectivity. For instance, in 2024, 1&1 continued its aggressive fiber rollout, aiming to connect millions of households to gigabit speeds through these very partnerships.

International Roaming Partners

1&1 cultivates strategic alliances with international mobile network operators to offer robust roaming services. These partnerships, exemplified by agreements with carriers such as Orange, are crucial for extending 1&1's service footprint globally. By collaborating with these established players, 1&1 gains access to extensive network coverage and advanced technologies.

These collaborations ensure that 1&1 customers enjoy uninterrupted connectivity while traveling abroad, supporting critical services like 5G and VoLTE. This access to state-of-the-art roaming infrastructure significantly enhances the customer experience, making international travel more seamless. For instance, by the end of 2023, global mobile data traffic continued its upward trajectory, underscoring the importance of reliable international roaming for business and leisure travelers alike.

Key aspects of these partnerships include:

- Expanded Network Access: Providing 1&1 customers with connectivity in numerous countries worldwide.

- Technology Integration: Enabling support for advanced roaming technologies like 5G and Voice over LTE (VoLTE).

- Service Quality Assurance: Ensuring a consistent and high-quality user experience even when roaming.

- Competitive Offering: Allowing 1&1 to offer competitive international roaming packages to its customer base.

Retail and Distribution Partners

While 1&1 heavily relies on its direct online sales, it strategically partners with retail and distribution channels to broaden its customer reach. These collaborations often involve electronics retailers and other physical sales points, acting as an extension of 1&1's direct sales force. In 2024, for instance, many telecommunications and internet service providers, including those in Europe where 1&1 is prominent, continued to explore in-store promotions and partnerships to capture customers who prefer in-person interactions or bundled deals.

These retail partnerships are crucial for expanding market presence beyond the digital realm. They can offer customers tangible touchpoints to explore services or bundled hardware, like routers or smart home devices, that complement 1&1's offerings. For example, a tie-up with a major electronics chain could see 1&1 internet packages advertised alongside new television or computer sales, increasing visibility. Such alliances aim to capture a segment of the market that may not be as active online or that values the convenience of purchasing multiple services and products from a single, trusted retailer.

- Expanded Reach: Retail partners provide access to customer segments that may not actively seek out online providers.

- Brand Visibility: Physical presence in retail locations enhances brand awareness and credibility.

- Bundled Offerings: Partnerships can facilitate bundled deals with hardware or other services, increasing customer value proposition.

- Complementary Sales: Retail outlets can act as a channel for complementary products or services offered by 1&1.

1&1's Key Partnerships are critical for its operational success and market expansion. The company relies on major telecommunication providers like Vodafone and Deutsche Telekom for national roaming and last-mile fiber-optic access, ensuring broad service coverage. Strategic alliances with technology firms, notably Rakuten Symphony for its Open RAN 5G network, are foundational for its network infrastructure development.

Further strengthening its broadband capabilities, 1&1 collaborates with regional city carriers to access local fiber networks, accelerating its gigabit rollout. International mobile network operators, such as Orange, are vital for providing seamless global roaming services to 1&1 customers. Additionally, partnerships with retail and distribution channels help extend 1&1's market presence beyond online sales.

| Partner Type | Key Role | Example Partners | Impact |

| Infrastructure Providers | Network Access & Roaming | Vodafone, Deutsche Telekom | Broad service coverage, enhanced customer experience |

| Technology Suppliers | 5G Network Deployment | Rakuten Symphony | Enables advanced, virtualized 5G network |

| Regional Networks | Fiber-Optic Expansion | City Carriers | Accelerates gigabit broadband rollout |

| International Operators | Global Roaming Services | Orange | Seamless international connectivity |

| Retail Channels | Customer Reach & Visibility | Electronics Retailers | Expands market presence beyond online |

What is included in the product

A detailed breakdown of 1&1's strategy, outlining their target customer segments, diverse service offerings, and key revenue streams.

This model effectively maps out 1&1's approach to delivering web hosting, cloud services, and domain registration through various channels.

The 1&1 Business Model Canvas streamlines complex strategy by providing a clear, visual framework, alleviating the pain of disorganization and confusion.

Activities

1&1's core activity is the construction and operation of Europe's first fully virtualized 5G mobile network, leveraging Open RAN technology. This undertaking requires substantial capital expenditure for infrastructure, including the rollout of numerous antenna sites and the development of robust data centers. The company is also focused on a seamless transition for its existing customer base to this advanced network.

This strategic focus on building a new mobile network is a cornerstone of 1&1's long-term vision, aiming to establish a strong competitive edge in the European telecommunications market. The company's investments in 2024 are heavily weighted towards this infrastructure build-out, positioning it as a key player in the future of mobile connectivity.

1&1 focuses on providing and expanding high-speed broadband internet services, utilizing VDSL, vectoring, and fiber-optic technologies. This core activity involves building out its own fiber-optic infrastructure and forging strategic partnerships to reach more customers.

A significant part of this is connecting households to its network and consistently offering attractive, competitive pricing plans. This proactive approach is crucial for maintaining its position as a key player in Germany's ongoing gigabit expansion initiatives.

In 2024, 1&1 continued its aggressive fiber-optic rollout, aiming to connect millions of new households to its gigabit network. The company reported in early 2024 that its fiber-optic network already served over 4 million households, with significant expansion plans throughout the year.

1&1 actively pursues customer acquisition through targeted marketing and competitive pricing for its mobile and broadband offerings. In 2024, the company continued its strategy of bundling services to attract new subscribers, aiming to enhance lifetime customer value.

Managing customer contracts and ensuring satisfaction are paramount for retention. This involves efficient service delivery and responsive customer support, vital for minimizing churn in the highly competitive telecommunications market.

The success of these activities directly impacts 1&1's subscriber growth and overall revenue. For instance, the company's strategic focus on acquiring new customers for its 5G mobile network in 2024 was a key driver of its expansion efforts.

Product Development and Innovation

1&1's core activities revolve around the relentless pursuit of product development and innovation. This means they are constantly working on new things, like cloud applications and smart home tech. They also focus on adding extra value to their existing services. This dedication keeps them ahead in the fast-changing telecom world and ensures they're giving customers what they want.

Innovation is crucial for 1&1 to stand out. In the highly competitive telecommunications market, having unique offerings is what makes a difference. By investing in R&D and staying on top of trends, 1&1 can introduce services that competitors don't have, securing their market position. For example, in 2023, 1&1 invested significantly in expanding its fiber-optic network, a strategic move to support future innovative broadband services.

- Continuous development of new products and services: This includes cloud-based applications, smart home solutions, and value-added services.

- Ensuring competitiveness: Innovation helps 1&1 meet evolving customer demands and stay ahead of competitors.

- Market differentiation: Novel offerings help distinguish 1&1 in the dynamic telecommunications landscape.

- Strategic investment in infrastructure: For instance, significant capital expenditure in 2023 was directed towards fiber-optic network expansion, facilitating future service innovation.

Sales, Marketing, and Customer Support

1&1 invests heavily in sales and marketing to reach both individual consumers and businesses with its wide array of services, from web hosting to cloud solutions. This proactive approach is crucial for building brand awareness and driving customer acquisition.

Customer support is a cornerstone of 1&1's strategy, offering accessible hotlines and comprehensive online portals to address user needs and ensure a positive experience. This dedication to service quality fosters loyalty and reduces churn.

- Sales and Marketing Reach: In 2024, 1&1 continued its robust digital marketing campaigns, focusing on search engine optimization and targeted social media advertising to capture market share in the competitive cloud and web services sector.

- Customer Support Infrastructure: By mid-2024, 1&1 reported a significant increase in online self-service portal usage, indicating a successful shift towards digital customer support alongside its traditional phone services.

- Brand Visibility and Service Quality: 1&1's commitment to enhancing service uptime and speed, coupled with proactive marketing, contributed to its sustained visibility in key European markets throughout 2024.

1&1's key activities revolve around building and operating its 5G mobile network using Open RAN technology, which involves significant infrastructure investment, including antenna sites and data centers. They also focus on expanding high-speed broadband internet through fiber-optic rollout, connecting millions of households and offering competitive pricing. Furthermore, 1&1 actively engages in product development for cloud applications and smart home technology, alongside robust sales, marketing, and customer support to acquire and retain subscribers.

| Key Activity | Description | 2024 Focus/Data Points |

|---|---|---|

| 5G Network Build-out | Constructing and operating a virtualized 5G mobile network using Open RAN. | Continued rollout of antenna sites and data center development. |

| Broadband Expansion | Expanding high-speed internet services via VDSL, vectoring, and fiber optics. | Aiming to connect millions of new households to its gigabit network; over 4 million households served by early 2024. |

| Product Innovation | Developing new products like cloud applications and smart home tech. | Investing in R&D to introduce unique services and enhance existing offerings. |

| Customer Acquisition & Support | Targeted marketing, competitive pricing, and efficient customer service. | Robust digital marketing campaigns; increased usage of online self-service portals by mid-2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the file's structure and content. Once your order is processed, you'll gain full access to this professionally formatted and ready-to-use Business Model Canvas, allowing you to immediately begin strategizing.

Resources

1&1's core resources include its proprietary 5G network infrastructure, built using Open RAN principles, and its substantial 5G frequency licenses. This self-developed network is fundamental to its strategy, offering a distinct advantage in a market often reliant on third-party infrastructure.

Access to national roaming agreements with major players like Vodafone and Deutsche Telekom is another critical resource, ensuring widespread coverage for its customers while its own network continues to expand. This provides immediate reach and a competitive service offering.

The fiber-optic transport network owned by 1&1 Versatel is an indispensable asset, providing the high-capacity backbone necessary for efficient data transmission. This integrated network capability is vital for delivering premium broadband and mobile services.

For 2024, 1&1 reported significant progress in its 5G network build-out, aiming for extensive coverage across Germany. The company's investment in spectrum licenses underscores its long-term commitment to owning and controlling its network assets, positioning it for future growth in the mobile sector.

1&1 boasts a robust brand reputation cultivated over three decades in the German telecommunications sector. This long-standing presence signifies trust and reliability for consumers, translating into a significant competitive edge in the market.

With more than 16 million contracts held, 1&1 commands a substantial and loyal customer base. This extensive network of users represents a powerful asset, providing consistent revenue streams and a strong foundation for future growth and market penetration.

1&1 relies heavily on its dedicated team of over 3,000 employees, a diverse group encompassing engineers, IT specialists, sales experts, and customer service professionals. This human capital is fundamental to their operations, driving everything from smooth network functioning to cutting-edge product creation and exceptional customer assistance.

The collective expertise of this workforce is a critical asset, directly impacting the company's ability to innovate and consistently deliver high-quality services. Their skills are the engine behind 1&1's competitive edge in the digital infrastructure and cloud computing sectors.

IT Systems and Software Platforms

1&1's robust IT systems and software platforms are the backbone of its operations, facilitating everything from network management to customer interactions. These digital resources are critical for delivering and scaling its services efficiently. The company's investment in a fully virtualized, cloud-native 5G network architecture underscores the pivotal role of these sophisticated technological assets. For instance, in 2023, 1&1 reported significant capital expenditures, a portion of which was allocated to enhancing its IT infrastructure to support its burgeoning cloud and mobile offerings.

These platforms are instrumental in managing a vast array of functions, including:

- Network Operations: Ensuring the seamless functioning and maintenance of its telecommunications network.

- Customer Data Management: Securely storing and efficiently processing customer information for personalized service and support.

- Billing and Invoicing: Automating and streamlining the complex processes of customer billing and revenue collection.

- Cloud-Based Applications: Providing and managing a suite of cloud services for business customers, requiring integrated software solutions.

Financial Capital and Access to Funding

1&1 requires substantial financial capital for its ambitious network expansion, ongoing technology upgrades, and day-to-day operational costs. This significant investment fuels the company's growth trajectory.

Access to funding is a cornerstone of 1&1's business model. A key resource is the financial backing provided by its parent company, United Internet AG. The company's adept cash flow management further solidifies its financial stability.

In 2023, United Internet AG reported revenues of €6.2 billion, demonstrating the financial strength of the parent group, which can indirectly support 1&1's capital needs.

Financial stability is paramount for 1&1's continuous development and sustained growth in the competitive telecommunications market.

- Network Expansion: Ongoing investment in fiber optic networks and 5G infrastructure necessitates significant capital outlay.

- Technology Investments: Upgrading data centers, cloud services, and customer-facing platforms requires continuous financial commitment.

- Operational Expenses: Covering personnel, marketing, and maintenance costs are essential for smooth operations.

- Access to Funding: Loans from United Internet AG and strategic debt management are critical for securing necessary capital.

- Cash Flow Management: Efficiently managing incoming and outgoing cash ensures liquidity and financial health.

1&1's core resources are its self-built 5G network infrastructure, substantial 5G frequency licenses, and national roaming agreements with major operators like Vodafone. The company also owns a fiber-optic transport network, providing a robust backbone for its services.

Financially, 1&1 benefits from the substantial backing of its parent company, United Internet AG, which reported €6.2 billion in revenue for 2023. This financial strength, coupled with effective cash flow management, underpins the significant capital expenditures required for network expansion and technology upgrades.

| Resource Category | Key Resources | 2023/2024 Data/Context |

|---|---|---|

| Infrastructure | 5G Network Infrastructure (Open RAN) | Continued build-out and expansion across Germany in 2024. |

| Spectrum | 5G Frequency Licenses | Significant investment underscores long-term commitment. |

| Network Access | National Roaming Agreements (Vodafone, Deutsche Telekom) | Ensures broad coverage complementing own network expansion. |

| Backbone Network | Fiber-Optic Transport Network (1&1 Versatel) | Essential for high-capacity data transmission. |

| Financial | Parent Company Support (United Internet AG) | €6.2 billion revenue reported for 2023, providing financial strength. |

| Financial Management | Cash Flow Management | Crucial for liquidity and funding operational costs and investments. |

Value Propositions

1&1's reliable high-speed connectivity is a cornerstone of its value proposition, offering businesses and individuals robust VDSL, fiber-optic, and 5G mobile access. This ensures consistent and seamless online experiences, crucial for productivity and communication in today's digital landscape. For instance, in 2024, 1&1 continued its aggressive fiber optic rollout, aiming to connect millions of households and businesses across Germany, enhancing the overall speed and reliability of its network offerings.

1&1 offers a broad spectrum of mobile and broadband plans, ensuring they are both attractively priced and adaptable to individual requirements. This strategy effectively serves a wide customer base, from those seeking budget-friendly options through their discount brands to customers prioritizing premium services.

The company’s commitment to transparent pricing and a variety of plan structures empowers customers with greater choice and control over their telecommunications spending. For example, in 2024, 1&1 continued to offer competitive entry-level mobile plans starting as low as €4.99 per month, alongside premium fiber optic broadband packages exceeding 1 Gbps.

This competitive and flexible tariff approach is a cornerstone of 1&1's value proposition, allowing them to capture market share across different consumer segments. By consistently reviewing and adjusting their pricing against market leaders, 1&1 aims to maintain a strong appeal in a dynamic telecommunications landscape.

Beyond its foundational telecommunications, 1&1 provides a suite of integrated cloud and digital solutions. This includes cloud-based applications, smart home technologies, and online storage, offering a comprehensive digital ecosystem. For small and medium-sized businesses, this unified offering simplifies the acquisition and management of essential digital tools, enhancing operational efficiency.

Customer-Centric Service and Support

1&1 differentiates itself through exceptional customer service, a cornerstone of its value proposition. This isn't just a claim; the company boasts award-winning support, including a dedicated priority hotline for swift issue resolution. This focus directly addresses customer needs for reliable and accessible assistance, fostering trust and reducing churn.

The 1&1 Service Card exemplifies this commitment, offering tangible benefits like 24-hour device replacement. Such proactive measures ensure minimal disruption for users, a critical factor in maintaining satisfaction, especially for businesses relying on consistent connectivity and IT infrastructure. This tangible support builds strong customer loyalty.

Customer satisfaction is paramount, translating into a superior experience that encourages repeat business and positive word-of-mouth referrals. By prioritizing responsive and high-quality support, 1&1 cultivates enduring relationships, a key driver for long-term growth and market stability. For instance, in 2024, customer satisfaction scores for telecommunications providers often cited responsive support as a primary differentiator.

This customer-centric approach is not just about fixing problems; it's about building relationships and providing peace of mind. 1&1 understands that in the competitive digital landscape, reliable support is as crucial as the product itself, directly contributing to customer retention and brand advocacy.

Pioneering Open RAN 5G Technology

1&1 is pioneering Open RAN 5G technology in Europe, launching the continent's first fully virtualized 5G mobile network built on this innovative architecture. This approach provides enhanced agility and efficiency compared to traditional networks.

By leveraging Open RAN, 1&1 gains significant independence from single-vendor solutions, fostering a more adaptable and cost-effective infrastructure. This strategic move positions 1&1 as a key innovator in Germany's next-generation mobile communication landscape.

- First European operator with a fully virtualized Open RAN 5G network

- Enhanced agility and efficiency through open architecture

- Reduced vendor lock-in and increased flexibility

- Strong market positioning as a next-generation mobile leader in Germany

1&1's value proposition is deeply rooted in its commitment to providing high-speed, reliable connectivity across various platforms, including VDSL, fiber optics, and 5G mobile. This ensures users experience seamless online interactions, vital for both personal and professional activities. In 2024, 1&1 significantly advanced its fiber optic network expansion across Germany, aiming to bring faster and more dependable internet to millions of homes and businesses.

The company offers a diverse range of mobile and broadband plans, emphasizing both affordability and customization to meet varied customer needs. This approach caters to a broad market, from budget-conscious individuals to those seeking premium service tiers. 1&1's 2024 offerings included entry-level mobile plans starting at competitive price points, alongside high-speed fiber optic packages reaching gigabit speeds, demonstrating their commitment to accessible yet powerful telecommunications.

1&1 distinguishes itself through a strong focus on customer service, backed by award-winning support channels. This dedication ensures quick and effective problem resolution, building significant customer trust and loyalty. Features like the 1&1 Service Card, which includes benefits such as 24-hour device replacement, underscore their proactive approach to minimizing customer downtime and enhancing overall satisfaction, a critical factor in the competitive telecommunications market of 2024.

A key differentiator for 1&1 is its pioneering adoption of Open RAN 5G technology, making it the first European operator to launch a fully virtualized 5G mobile network using this architecture. This innovation grants 1&1 greater flexibility and efficiency, reducing reliance on single vendors and solidifying its position as a leader in next-generation mobile infrastructure in Germany.

Customer Relationships

1&1 heavily relies on self-service online portals and mobile applications, giving customers the power to manage their accounts, check usage, switch plans, and find support without needing to contact customer service directly. This digital empowerment offers significant convenience and efficiency, allowing users to handle routine tasks on their own terms.

This self-service model streamlines operations and reduces the workload on support teams, letting them focus on more complex customer needs. In 2024, a significant portion of 1&1's customer service interactions were handled through these digital channels, showcasing their effectiveness in providing prompt and accessible solutions.

1&1 prioritizes customer satisfaction through dedicated support channels. This includes readily available phone hotlines, with a specific priority hotline accessible via the 1&1 Service Card, ensuring swift assistance for urgent matters. In 2024, a significant portion of customer inquiries are expected to be resolved through these direct support lines, reflecting the company's commitment to responsive service.

1&1 actively cultivates customer relationships by delivering personalized offers and exploring loyalty programs. This strategy is built on a foundation of understanding individual customer needs and usage patterns.

By leveraging data analytics, 1&1 can tailor promotions and service upgrades, making existing customers feel valued and encouraging repeat business. For instance, in 2024, many telecommunication providers reported significant increases in customer retention when personalized bundles were introduced.

These tailored initiatives are crucial for boosting customer lifetime value and actively working to reduce churn. A study by Accenture in early 2024 indicated that companies with strong personalization strategies saw up to a 15% increase in customer loyalty compared to those without.

Community Engagement and Feedback Mechanisms

A telecommunications company like 1&1 actively fosters community engagement through various digital channels. This includes dedicated online forums where customers can interact with each other and the company, seeking solutions and sharing experiences. Social media platforms are also utilized for direct communication, customer support, and broadcasting important updates, with companies often responding to thousands of customer queries daily across platforms like Twitter and Facebook.

Feedback mechanisms are crucial for understanding customer sentiment and identifying areas for improvement. 1&1 likely employs customer satisfaction surveys, both periodic and post-interaction, to gauge service quality. For instance, by mid-2024, many tech companies reported Net Promoter Scores (NPS) ranging from 20 to 50, indicating a significant portion of customers are willing to recommend their services, a metric that would be closely monitored.

- Online Communities: Dedicated forums for peer-to-peer support and direct company interaction.

- Social Media Engagement: Real-time customer service and communication on platforms like X (formerly Twitter) and Facebook.

- Feedback Surveys: Gathering customer satisfaction data through post-interaction and periodic surveys.

- Data-Driven Insights: Using feedback to identify common issues and improve service offerings, aiming to boost customer retention rates which in 2024 often hovered around 85-90% for established providers.

Proactive Communication and Service Updates

1&1 prioritizes proactive communication to keep customers informed about crucial service updates, such as network enhancements and upcoming migrations. For instance, during the transition to its new 5G network, customers received timely notifications about progress and any potential impacts on their services.

This transparency extends to managing challenging situations, like network outages. By providing clear and upfront information, even during disruptions, 1&1 aims to manage customer expectations effectively, thereby fostering and maintaining trust. This commitment to open dialogue is a cornerstone of their customer retention strategy.

- Service Updates: Informing customers about network improvements and new technology rollouts, like 5G.

- Migration Processes: Clear communication regarding transitions to new infrastructure or services.

- Expectation Management: Proactively addressing potential issues, such as outages, to maintain customer trust.

- Customer Retention: Recognizing clear communication as vital for keeping customers loyal.

1&1's customer relationships are built on a foundation of digital self-service, direct support, and proactive communication. The company leverages online portals and mobile apps for account management, reducing reliance on human interaction. In 2024, the company saw a significant portion of customer inquiries resolved through these digital channels, highlighting their efficiency.

For more complex needs, 1&1 offers dedicated phone support, including a priority hotline for urgent issues, aiming for swift resolution. Personalization through data analytics fuels tailored offers and loyalty programs, a strategy that in 2024 contributed to increased customer retention for many providers. This focus on individual needs and data-driven engagement is key to fostering long-term loyalty.

Community engagement through forums and social media, alongside robust feedback mechanisms like surveys, allows 1&1 to gather insights and continuously improve. Proactive communication about service updates and potential disruptions, a practice highlighted in 2024 by numerous tech companies, is crucial for maintaining customer trust and managing expectations.

| Customer Relationship Strategy | Key Channels/Methods | 2024 Data/Insights |

| Digital Self-Service | Online portals, mobile apps | Significant portion of inquiries resolved digitally |

| Direct Support | Phone hotlines, priority service | Focus on swift resolution for complex needs |

| Personalization & Loyalty | Data analytics, tailored offers, loyalty programs | Contributed to increased customer retention |

| Community & Feedback | Online forums, social media, surveys | Gathering insights for continuous improvement |

| Proactive Communication | Service updates, outage notifications | Managing expectations and maintaining trust |

Channels

The 1&1 website is a cornerstone of their business, acting as a digital storefront where customers can explore offerings, compare plans, and initiate service subscriptions. This direct-to-consumer approach streamlines the sales process and enhances accessibility for a broad customer base.

In 2024, 1&1's online presence continued to be a critical driver for new customer acquisition. The company reported a significant portion of its new business originates directly through its website, underscoring its effectiveness as a primary sales channel.

This digital platform not only facilitates new sales but also serves as a central hub for existing customers to manage their accounts, upgrade services, and access support, reinforcing customer loyalty and reducing churn.

1&1 likely utilizes a dedicated direct sales force to cultivate relationships within the small to medium-sized business (SMB) sector. This approach is essential for understanding unique client needs and delivering customized IT and cloud solutions, which often involve intricate contract discussions and ongoing support. For instance, in 2024, the B2B cloud services market continued its robust growth, with many SMBs actively seeking reliable partners for digital transformation. Direct engagement allows 1&1 to effectively navigate these complex sales cycles and build lasting partnerships.

1&1 leverages its own branded retail stores and collaborates with partner shops, such as electronics retailers and authorized dealers, to create a tangible touchpoint for customers. This dual-channel approach allows potential clients to interact directly with products and receive personalized guidance, enhancing the overall customer experience.

In 2024, the importance of physical retail continues to be evident, with many consumers still valuing the ability to see and touch products before purchasing, especially for technology services. This strategy complements 1&1's robust online presence by offering an alternative and often more personal sales and support channel.

Telemarketing and Customer Service Inbound/Outbound

Telemarketing and customer service are crucial channels for 1&1, driving both new customer acquisition and retaining existing ones. Outbound telemarketing actively reaches out to potential clients with tailored offers, while inbound customer service lines serve as a vital touchpoint for support, inquiries, and even upselling opportunities. These direct communication channels are essential for building relationships and addressing customer needs promptly.

These channels are instrumental in the customer journey. For instance, a significant portion of cloud service providers see telemarketing as a key driver for lead generation. In 2024, it's estimated that 20% of SMBs reported telemarketing as a primary source for new business leads, highlighting its continued relevance in reaching target audiences. These interactions allow for immediate feedback and personalized engagement, which is critical for customer satisfaction and loyalty.

- Customer Acquisition: Outbound telemarketing campaigns directly target potential customers, presenting 1&1's product and service bundles.

- Customer Retention & Upselling: Inbound service calls offer opportunities to resolve issues, gather feedback, and promote upgrades or additional services to existing clients.

- Direct Communication: These channels facilitate a personal connection, enabling real-time dialogue to understand and meet customer requirements effectively.

- Lead Generation: Telemarketing contributes significantly to filling the sales pipeline, with many businesses relying on it to identify and qualify prospects.

Advertising and Marketing Campaigns

1&1 heavily relies on extensive advertising and marketing campaigns to build brand awareness and attract customers. These efforts span across television, online platforms, and print media, ensuring broad market reach. In 2023, 1&1 reported significant investment in marketing, contributing to its customer acquisition goals.

To further enhance market visibility and connect with target audiences, 1&1 engages in strategic sponsorships and brand ambassador programs. These initiatives are crucial for reinforcing brand messaging and driving engagement across diverse customer segments. This approach aims to cultivate a strong brand presence and encourage customer interaction with their sales channels.

- Brand Awareness: Extensive media coverage aims to make 1&1 a household name in the telecommunications and cloud services sector.

- Customer Acquisition: Marketing campaigns are designed to drive traffic to their sales channels, converting awareness into tangible customer growth.

- Market Reach: Utilizing a mix of traditional and digital advertising ensures that 1&1 can connect with a wide demographic.

- Partnerships: Sponsorships and brand ambassadors leverage existing influence to amplify 1&1's message and credibility.

1&1 leverages a multi-channel approach to reach its diverse customer base. The company's website serves as a primary digital storefront and customer management portal, driving significant new business in 2024. Complementing this, a direct sales force targets the SMB sector for complex cloud solutions, while branded retail stores and partner shops offer physical touchpoints for product interaction and personalized guidance. Telemarketing and customer service channels are crucial for both acquiring new customers and retaining existing ones, with telemarketing noted as a key lead generation source for many businesses in 2024.

| Channel | Primary Function | 2024 Relevance/Data |

|---|---|---|

| Website | Digital storefront, sales, account management | Major driver of new customer acquisition; significant portion of new business originates here. |

| Direct Sales Force | B2B sales, complex solutions, relationship building | Essential for SMB sector, navigating complex sales cycles for IT and cloud solutions. |

| Retail Stores/Partner Shops | Physical touchpoint, product interaction, personalized guidance | Complements online presence, valued by consumers for seeing/touching products. |

| Telemarketing/Customer Service | New customer acquisition, customer retention, support, upselling | Key for lead generation; 20% of SMBs reported telemarketing as a primary source for new business leads in 2024. |

| Advertising & Sponsorships | Brand awareness, market reach, customer engagement | Significant investment in 2023 to meet customer acquisition goals; crucial for reinforcing brand messaging. |

Customer Segments

Private households represent a cornerstone for 1&1, encompassing individuals and families who depend on robust broadband internet and mobile services for their daily lives. This segment is diverse, with many customers prioritizing cost-effectiveness, while others seek top-tier performance and bundled features.

1&1 actively serves both the value and premium tiers within this crucial demographic, providing a spectrum of plans designed to meet varying needs and budgets. In 2024, the demand for reliable connectivity continued to soar, with a significant portion of German households actively seeking upgrades or new providers for their internet and mobile requirements.

Small to medium-sized businesses (SMBs) are a core customer segment for 1&1, seeking reliable telecommunications and cloud solutions to power their operations. These businesses, which often have between 10 and 250 employees, require robust internet connectivity, professional email services, and scalable cloud infrastructure to compete effectively. In 2024, SMBs continue to drive digital transformation, with a significant portion investing in cloud adoption to enhance efficiency and remote work capabilities. 1&1's tailored offerings address the specific needs of this vital B2B market, providing them with the tools to grow and succeed.

1&1 actively courts price-sensitive customers through its specialized discount brands like smartmobil.de. This strategic move allows them to penetrate segments where cost is the primary driver for mobile and internet service selection. By offering highly competitive rates, 1&1 aims to expand its overall market reach, ensuring affordability doesn't exclude potential subscribers.

These value-oriented offerings serve as a crucial complement to the core 1&1 brand, providing a tiered approach to their service portfolio. For instance, smartmobil.de often features plans with generous data allowances at significantly lower monthly costs compared to premium providers. This dual-brand strategy enables 1&1 to cater to a wider demographic, from students to budget-conscious families, who might otherwise opt for smaller, less established providers.

Tech-Savvy Users and Early Adopters (5G)

Tech-savvy users and early adopters are crucial for 1&1's 5G strategy, particularly those eager for high-performance networks and innovative solutions. These customers actively seek out the latest advancements, making them prime targets for 1&1's pioneering 5G services and Open RAN technology. Their interest lies in cutting-edge performance and the future possibilities that advanced network infrastructure unlocks.

1&1's investment in building a new 5G network, including its focus on Open RAN, directly appeals to this segment. By being one of the first European operators to deploy a fully virtualized, cloud-native Open RAN network, 1&1 positions itself as a leader in network innovation. This approach is designed to attract users who prioritize technological leadership and a forward-thinking approach to connectivity.

- Target Audience: Individuals and businesses actively seeking the latest in mobile technology, valuing speed, low latency, and network flexibility.

- Key Motivations: Desire for cutting-edge performance, early access to new features, and engagement with innovative technological solutions.

- 1&1's Appeal: Pioneering 5G deployment and Open RAN adoption offer a distinct advantage for early adopters looking for next-generation network capabilities.

- Market Trend: The growing demand for 5G services, particularly in enterprise applications and enhanced mobile broadband, fuels interest from this tech-forward customer base.

Customers Seeking Bundled Services

A significant portion of 1&1's customer base actively seeks bundled services, valuing the convenience and cost efficiencies of integrating mobile, broadband, and digital applications like cloud storage or smart home solutions into a single package. This preference for consolidated offerings simplifies their digital lives by reducing the number of providers and bills they manage.

These customers are drawn to the idea of a one-stop shop for their telecommunications and digital needs. For instance, in 2024, the German telecommunications market saw continued strong demand for converged offerings, with many consumers actively comparing bundled deals over standalone services. 1&1 leverages this trend by presenting attractive packages that often include:

- Mobile and Fixed-Line Bundles: Combining smartphone plans with home internet access.

- Broadband and Entertainment: Including internet service with streaming or TV options.

- Cloud Services Integration: Adding online storage or productivity tools to existing plans.

The appeal lies not just in simplification but also in potential savings. By consolidating services, customers often benefit from lower overall monthly costs compared to subscribing to each service individually. This strategy positions 1&1 to capture customers prioritizing value and ease of management in their digital consumption.

Existing customers represent a vital segment for 1&1, comprising individuals and businesses who have already adopted their services. Retaining these customers is paramount, focusing on satisfaction and offering value-added services to encourage loyalty and reduce churn. In 2024, the competitive landscape underscored the importance of customer retention strategies, with providers actively investing in loyalty programs and improved service experiences.

Cost Structure

Building and maintaining 1&1's 5G mobile network represents a major cost driver. This involves significant capital expenditure for antenna sites, data centers, and fiber-optic networks, essential for providing reliable service. For example, in 2023, the telecom industry globally saw substantial investments in 5G infrastructure, with many operators allocating billions to network expansion.

Ongoing operational expenses are also considerable. These include the continuous maintenance of existing infrastructure to ensure optimal performance and security, as well as regular upgrades to keep pace with technological advancements and increasing data demands. These recurring costs are critical for maintaining a competitive edge in the telecommunications market.

Even with its own network build-out, 1&1 faces significant expenses for national roaming. These agreements, notably with Vodafone, are crucial for extending coverage. In 2023, the cost of these roaming services represented a substantial portion of their operational expenditure, particularly as they continued network expansion and customer migration.

Accessing the last mile of broadband infrastructure from incumbents like Deutsche Telekom and various city carriers also contributes heavily to 1&1's cost structure. These wholesale fees are a necessary but significant outlay, impacting profitability, especially during periods of rapid customer acquisition and network integration.

1&1 heavily invests in marketing, sales, and customer acquisition to fuel its growth in the competitive telecommunications and cloud services market. These extensive expenditures are vital for attracting new subscribers and maintaining its market share. For instance, in 2024, the company continued its aggressive advertising campaigns across various media channels, alongside significant spending on sales commissions and digital marketing to reach a broad customer base.

The ongoing brand promotion and customer outreach are not just initial investments but continuous efforts to reinforce 1&1's presence and value proposition. These costs are directly linked to acquiring new customers, which is a primary driver for revenue expansion in their subscription-based business model. The company strategically allocates resources to ensure a consistent pipeline of new business.

Personnel and Operational Costs

Personnel and operational costs are a major component of 1&1's expenses. This includes the significant outlay for salaries, comprehensive benefits packages, and ongoing training for a substantial workforce. This workforce spans critical roles from highly skilled engineers to customer service representatives and essential administrative staff.

Beyond personnel, operational expenses are considerable. These encompass the maintenance and advancement of customer service centers, the robust IT infrastructure that underpins its digital services, and the general administrative functions necessary for smooth business operations. Efficient human resource management is absolutely crucial for controlling these costs.

- Salaries and Benefits: For a large tech company like 1&1, personnel costs, including salaries and benefits, can easily represent 50-60% of total operating expenses.

- Training and Development: Investing in employee training, especially in rapidly evolving tech fields, is vital but adds to the cost structure.

- Customer Service Infrastructure: Operating large, multi-channel customer support centers involves significant costs for staffing, technology, and facilities.

- IT System Maintenance: Keeping complex IT systems, servers, and network infrastructure updated and secure is a perpetual operational expense.

Research, Development, and Technology Costs

Investment in research and development is a significant driver of costs for companies like 1&1, particularly as they innovate in areas such as Open RAN technology. These expenditures are crucial for developing new products, enhancing existing services, and upgrading core network infrastructure. For instance, in 2024, telecommunications companies globally continued to pour substantial resources into R&D to maintain a competitive edge.

Key cost components within this category include software licensing fees for essential development tools and platforms, as well as ongoing expenses related to cloud computing services that support development and testing environments. Innovation-driven projects also contribute to this cost base, encompassing everything from initial concept validation to prototype development and field trials. Staying ahead in the rapidly evolving tech landscape necessitates consistent and substantial R&D investment.

- R&D Investment: Companies allocate significant budgets to explore and implement new technologies, such as Open RAN, to enhance their service offerings and network capabilities.

- Software and Cloud Expenses: Costs associated with acquiring software licenses and utilizing cloud platforms form a notable part of technology expenditures for development and operations.

- Innovation Outlays: Direct spending on innovation, including research projects and the development of proprietary technologies, is a critical factor in maintaining market leadership.

- Network Technology Advancement: Continuous investment is required to stay at the forefront of network technologies, ensuring efficient and advanced service delivery.

1&1's cost structure is heavily influenced by its substantial investments in building and maintaining its 5G mobile network. This includes significant capital expenditures for antenna sites, data centers, and fiber-optic infrastructure, crucial for service delivery. For example, the global telecom sector in 2023 saw billions invested in 5G infrastructure expansion by various operators.

Operational expenses are also considerable, covering the continuous maintenance and upgrades of network infrastructure to ensure performance and keep pace with technological advancements. These recurring costs are vital for maintaining a competitive edge in the telecommunications market.

1&1 also incurs significant costs for national roaming agreements, particularly with Vodafone, which are essential for extending network coverage during its expansion phase. These roaming service costs represented a substantial operational expenditure in 2023.

Furthermore, accessing the last mile of broadband infrastructure from incumbent providers like Deutsche Telekom and city carriers results in significant wholesale fees. These fees are a necessary but impactful cost for customer acquisition and network integration.

Aggressive marketing and sales expenditures are key to 1&1's growth strategy, involving substantial spending on advertising campaigns, digital marketing, and sales commissions, especially evident in their 2024 initiatives to attract new subscribers.

Personnel costs, including salaries and benefits for a large workforce of engineers, customer service representatives, and administrative staff, form a major part of 1&1's expenses. Efficient human resource management is crucial for cost control.

Investment in research and development, particularly in areas like Open RAN technology, is a significant cost driver for 1&1. These expenditures support new product development and network infrastructure upgrades, a trend seen across the telecommunications industry in 2024.

Key cost components also include software licensing fees for development tools and cloud computing services, alongside direct spending on innovation projects from concept to field trials.

| Cost Category | Key Components | Estimated Impact (General Telecom Industry) |

| Network Infrastructure | 5G build-out, fiber optics, data centers | Billions in CAPEX for network expansion globally (2023) |

| Operational Expenses | Network maintenance, upgrades, software licenses | Significant recurring costs for service continuity and technological advancement |

| Roaming and Wholesale Access | National roaming agreements, last-mile access fees | Substantial portion of operational expenditure for coverage extension and service delivery |

| Sales & Marketing | Advertising, digital marketing, sales commissions | Aggressive spending to drive customer acquisition and market share (e.g., 1&1's 2024 campaigns) |

| Personnel | Salaries, benefits, training for a large workforce | Can represent 50-60% of total operating expenses for tech companies |

| Research & Development | New technology exploration (e.g., Open RAN), software, cloud services | Continuous investment to maintain competitive edge and innovate services |

Revenue Streams

Mobile service subscription fees are the bedrock of 1&1's revenue, generated from a diverse range of postpaid and prepaid mobile tariffs. This core offering represents a high-margin revenue stream, directly tied to their primary business of providing mobile connectivity. In 2024, the company's continued expansion in the mobile sector, evidenced by steady growth in new mobile contracts, directly fuels the financial health of this crucial revenue pillar.

1&1 generates significant revenue through recurring monthly subscription fees for its broadband internet services. These fees cover a range of technologies, including DSL, VDSL, and the increasingly important fiber-optic connections.

This subscription model provides a stable and predictable income stream, crucial for financial planning and investment. The company serves both private households and business customers, diversifying its customer base for these essential connectivity services.

For example, in the first quarter of 2024, 1&1 reported approximately 4.2 million broadband customers, highlighting the substantial recurring revenue base derived from these subscriptions. Any slowdown in customer acquisition or an increase in churn for these broadband connections could directly impact this primary revenue driver.

1&1 generates substantial income through recurring subscriptions to its diverse cloud-based offerings. These include essential cloud applications, expansive online storage solutions, and innovative smart home technologies. The company also leverages subscriptions for its IPTV services and a range of other value-added services, all designed to enrich the customer experience.

These supplementary services are crucial in boosting the overall customer proposition and significantly increase the average revenue generated per user. For instance, in 2023, the growth in cloud and digital services was a key driver for many telecommunications providers, with subscription revenues forming a predictable and stable income base.

By continuously expanding and refining these service portfolios, 1&1 can unlock new avenues for revenue growth. This strategic focus on enhancing the value delivered to customers through these subscriptions is a cornerstone of its business model, ensuring sustained financial performance and market competitiveness.

Hardware Sales

Revenue streams for 1&1's hardware sales encompass the direct purchase of telecommunication devices and associated accessories. This includes popular items like smartphones, essential home networking equipment such as routers, and a range of other hardware supporting their service packages.

While the profit margins on individual hardware units are generally modest compared to service subscriptions, these sales play a crucial role in enhancing customer convenience and providing a bundled solution. This integrated approach often encourages longer-term customer loyalty.

The hardware sales segment can experience notable volatility, often influenced by seasonal purchasing trends and new product release cycles. For instance, in 2024, the mobile phone market saw continued demand for flagship devices, with many consumers upgrading their handsets to take advantage of new technologies and carrier promotions.

- Device Sales: Revenue from selling mobile phones, tablets, and other personal communication devices.

- Networking Equipment: Income generated from the sale of routers, modems, and Wi-Fi extenders.

- Accessory Revenue: Earnings from selling complementary items like chargers, cases, and cables.

- Seasonal Impact: Sales often peak during holiday seasons and around new device launches, contributing to revenue fluctuations.

Usage-Based Charges and Ancillary Services

Beyond core subscriptions, 1&1 taps into usage-based charges for services like international calls and data overages. For instance, in 2024, many telecommunication providers continued to see a significant portion of their revenue derived from these variable usage fees, especially as global connectivity remains crucial for businesses. These supplementary income streams add a valuable layer to the overall revenue model.

Ancillary services and one-time fees also bolster 1&1's revenue. This can include charges for initial setup, hardware installations, or specific customer-requested configurations. In 2024, the demand for specialized IT support and integration services remained robust, allowing companies like 1&1 to capitalize on these additional service offerings, which are often high-margin.

- Usage-Based Revenue: Generates income from variable consumption of services like international calls and potential data overages, reflecting continued global business communication needs in 2024.

- Ancillary Services: Includes one-time fees for installations, hardware setup, and specialized configurations, catering to the ongoing demand for IT integration in 2024.

- Premium SMS: Offers another avenue for revenue through specialized messaging services, contributing to the diverse income streams for telecommunication and digital service providers.

- Supplementary Income: These additional revenue sources provide financial flexibility and enhance overall profitability beyond standard subscription plans.

1&1's revenue model is a multifaceted approach, blending recurring subscription income with hardware sales and usage-based charges. This diversification creates a resilient financial structure, capable of adapting to market shifts and consumer demands. The company strategically leverages each stream to maximize profitability and customer lifetime value.

| Revenue Stream | Description | 2024 Relevance/Data Example | Impact on Business Model |

|---|---|---|---|

| Mobile Subscriptions | Recurring fees from postpaid and prepaid mobile plans. | Continued growth in new mobile contracts fuels this high-margin revenue. | Core of business, drives customer acquisition and retention. |

| Broadband Subscriptions | Monthly fees for DSL, VDSL, and fiber-optic internet services. | 4.2 million broadband customers in Q1 2024 indicates a substantial recurring base. | Provides stable, predictable income; diversification through business customers. |

| Cloud & Digital Services | Subscriptions for cloud applications, storage, and smart home tech. | Key driver for telecom revenue growth in 2023, offering stable subscription income. | Enhances customer proposition, increases ARPU, fosters loyalty. |

| Hardware Sales | Direct sales of smartphones, routers, and accessories. | Demand for flagship devices continued in 2024, impacting handset upgrade cycles. | Convenience for customers, bundled solutions, can drive longer-term loyalty. |

| Usage-Based Charges | Fees for international calls and data overages. | Significant portion of revenue for many telcos in 2024 due to global connectivity needs. | Adds variable income, caters to specific customer usage patterns. |

| Ancillary Services | One-time fees for setup, installation, and custom configurations. | Robust demand for IT support and integration services in 2024 offered high-margin opportunities. | Provides supplementary, often high-margin, income beyond standard plans. |

Business Model Canvas Data Sources

The Business Model Canvas is informed by extensive market research, competitive analysis, and internal financial data. These diverse sources ensure each component accurately reflects our strategic positioning and operational realities.