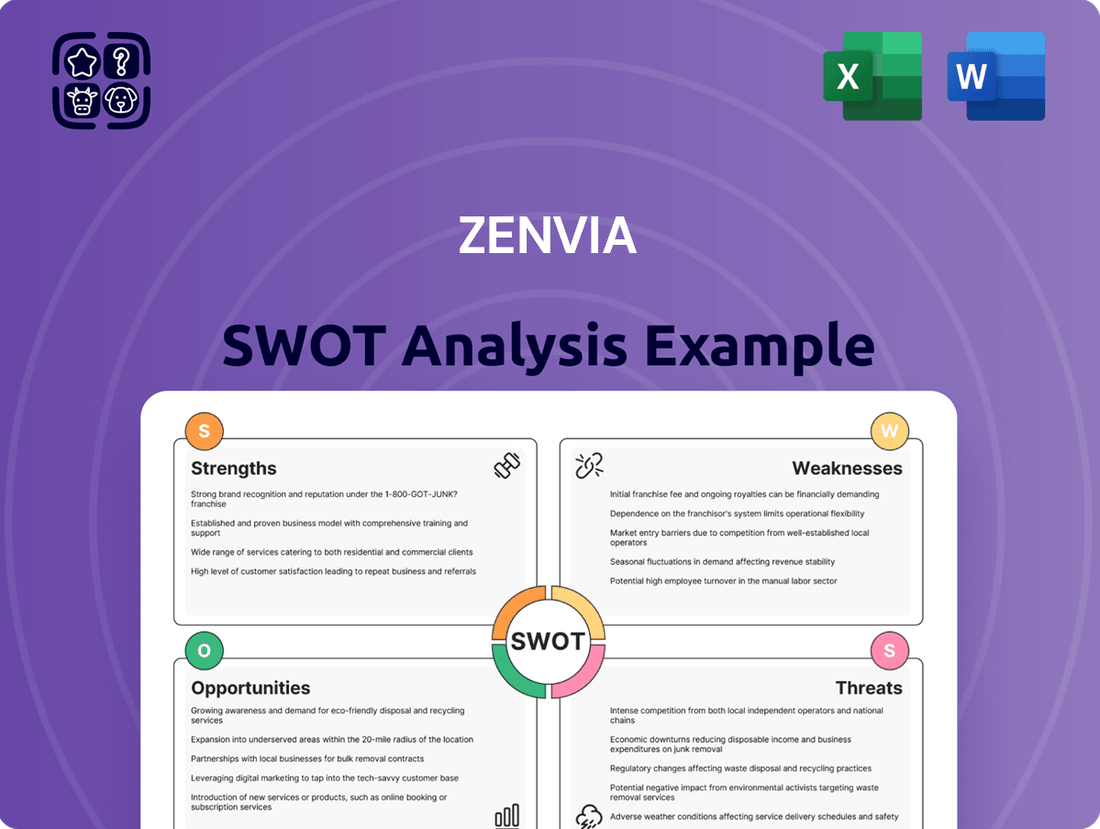

Zenvia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zenvia Bundle

Zenvia's strengths lie in its robust customer engagement platform and expanding market reach, while its opportunities include capitalizing on digital transformation trends. However, potential weaknesses such as intense competition and threats from evolving regulations require careful navigation.

Want to dive deeper into Zenvia's strategic positioning and unlock actionable insights? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research. Don't miss out on understanding the full picture!

Strengths

Zenvia's strength lies in its comprehensive, cloud-based platform designed to manage the entire customer journey. This unified approach, exemplified by the Zenvia Customer Cloud launched in 2024, consolidates various engagement tools, including SMS and WhatsApp, into a single, efficient solution.

By centralizing customer interactions across multiple channels, Zenvia simplifies complex operations for businesses. This holistic platform streamlines communication and customer service, from initial outreach through to post-sales support, enhancing overall customer experience management.

Zenvia's Customer Cloud is a powerful platform, with artificial intelligence and automation built right in. This means they're using things like generative AI chatbots to make customer conversations better and help businesses save money by automating tasks. Their focus on AI allows for customized experiences for customers, even when dealing with a lot of people at once, and it means faster, more accurate answers.

This strong AI foundation translates directly into real business benefits. Companies using Zenvia can expect higher productivity and happier customers because the AI handles routine queries and provides personalized support. Zenvia is doubling down on this, with a strategic plan starting in January 2025 specifically designed to speed up the development and adoption of these AI-powered solutions.

Zenvia stands out as a premier cloud-based customer experience (CX) solution provider throughout Latin America, holding a significant position within the Communications Platform as a Service (CPaaS) market. This dominant presence is a core strength, allowing them to deeply understand and cater to the unique needs of regional customers.

Their localized strategy, coupled with an intricate grasp of Latin American consumer behavior, grants Zenvia a substantial competitive edge. This understanding is crucial in a diverse market, enabling them to tailor their offerings effectively.

The company boasts a broad customer portfolio, encompassing both small and medium-sized enterprises (SMEs) and large corporations. This diverse clientele spans multiple industries across key Latin American economies such as Brazil, Argentina, and Mexico, showcasing Zenvia's wide-reaching impact.

In 2023, Zenvia reported substantial revenue growth, with their CPaaS segment driving significant contributions, underscoring their leadership in the region. The company's strategic acquisitions in 2024 further bolstered its market share and service capabilities within Latin America.

Strategic Focus on High-Margin SaaS Growth

Zenvia is strategically prioritizing its Zenvia Customer Cloud, a move designed to boost its higher-margin Software as a Service (SaaS) offerings. This focus involves looking at selling off non-essential parts of the business and simplifying operations to concentrate on dependable customer experience SaaS income. The company is forecasting substantial expansion in this area, with expected gross margins to be in the 68% to 70% range for 2025. This strategic realignment is key to Zenvia's future growth trajectory.

Key aspects of this strength include:

- Focus on High-Margin SaaS: Zenvia is concentrating on its Zenvia Customer Cloud, which offers better profit margins compared to other business segments.

- Divestment of Non-Core Assets: The company is considering selling off assets that are not central to its core SaaS strategy to free up resources and streamline operations.

- Streamlined Operations: Efforts are underway to simplify the business structure, allowing for a more efficient focus on recurring SaaS revenue streams.

- Projected Strong Gross Margins: Management anticipates gross margins for the Zenvia Customer Cloud segment to reach between 68% and 70% by 2025, indicating strong profitability potential.

Improved Cost Management and Financial Health

Zenvia exhibits strong capabilities in cost management, a key driver for its improved financial health. This is clearly seen in their Q1 2025 performance, where General and Administrative (G&A) expenses were reduced by a significant 24% compared to the previous year. Even with the impact of severance costs related to a 15% workforce reduction, this operational efficiency is a notable strength.

The company's focus on streamlining operations has translated into tangible financial benefits. Zenvia achieved a positive Normalized EBITDA, indicating profitability from core operations. Furthermore, their balance sheet has strengthened, evidenced by an increase in cash reserves and the generation of positive operating cash flow, showcasing a more robust financial foundation.

- Reduced G&A Expenses: A 24% year-over-year decrease in Q1 2025 highlights effective cost control.

- Positive Normalized EBITDA: Demonstrates improved operational profitability.

- Strengthened Balance Sheet: An increased cash balance and positive operating cash flow indicate better financial stability.

- Operational Efficiency: Successful implementation of cost-saving measures despite workforce adjustments.

Zenvia's strength is its integrated, cloud-based platform, the Zenvia Customer Cloud, launched in 2024. This consolidates various engagement tools like SMS and WhatsApp, simplifying customer journey management. The platform leverages AI and automation, including generative AI chatbots, to enhance customer interactions and operational efficiency.

The company has a strong presence in Latin America's CPaaS market, benefiting from a localized strategy and deep understanding of regional consumer behavior. This regional expertise, combined with a diverse customer base spanning SMEs and large corporations across key Latin American economies, provides a significant competitive advantage.

Zenvia is strategically shifting its focus to its higher-margin Zenvia Customer Cloud SaaS offerings, aiming to divest non-core assets and streamline operations. This strategic realignment is projected to yield strong gross margins, with an estimated 68% to 70% for the SaaS segment in 2025, indicating a clear path to enhanced profitability.

Significant cost management improvements are evident, with a 24% reduction in G&A expenses in Q1 2025. This, along with a positive Normalized EBITDA and a strengthened balance sheet featuring increased cash reserves and positive operating cash flow, underscores Zenvia's improved financial health and operational efficiency.

| Key Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Integrated CX Platform | Unified cloud-based solution for customer journey management. | Zenvia Customer Cloud launched in 2024, consolidating tools like SMS and WhatsApp. |

| AI and Automation | Leverages AI for enhanced customer interactions and operational efficiency. | Incorporates generative AI chatbots for improved customer conversations. |

| Latin American Market Leadership | Strong presence in CPaaS market with localized strategy. | Deep understanding of regional consumer behavior provides competitive edge. |

| Strategic SaaS Focus | Prioritizing high-margin SaaS offerings for growth. | Projected gross margins of 68-70% for Zenvia Customer Cloud in 2025. |

| Cost Management & Financial Health | Improved operational efficiency and financial stability. | 24% reduction in G&A expenses (Q1 2025), positive Normalized EBITDA, increased cash reserves. |

What is included in the product

Delivers a strategic overview of Zenvia’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic planning by offering a clear, actionable SWOT framework.

Weaknesses

Zenvia has encountered persistent profitability hurdles, especially within its Communications Platform as a Service (CPaaS) sector, despite robust revenue expansion. This segment, a significant contributor to the company's top line, has seen its gross margins erode.

A primary driver of this margin compression is the increasing cost of SMS services from telecommunication carriers. These higher expenses have not been entirely transferred to Zenvia's clientele, creating a direct impact on profitability. For instance, in the first half of 2024, while revenue grew by 21% year-over-year to R$1.2 billion, the company reported a net loss of R$110 million, highlighting the pressure on its bottom line from these cost increases.

Zenvia experienced a significant 21.1% year-over-year drop in active customers during the first quarter of 2025. While leadership indicated stabilization compared to the previous quarter, this decline in the total customer count, even with revenue increases, points to potential issues with attracting or keeping customers across its services.

Zenvia's growth strategy heavily relies on acquisitions, but integrating these new entities has proven difficult. These integration efforts have sometimes hurt the cost of services and operational efficiency, leading to reduced margins in specific quarters.

For instance, in Q3 2023, Zenvia reported a gross margin of 61.4%, a slight dip from 62.2% in Q3 2022, partly attributed to the ongoing integration of recent acquisitions and the associated costs.

The company acknowledges these challenges and is actively working on streamlining processes and systems post-acquisition to mitigate these impacts on profitability and operational smoothness.

Market Valuation and Investor Skepticism

Zenvia's market valuation faces headwinds, trading at a lower multiple than many of its industry peers. As of late 2024, its trailing Price-to-Sales (P/S) ratio was notably below that of leading SaaS companies, indicating a degree of investor caution.

This undervaluation appears closely tied to investor skepticism, fueled by a history of earnings per share (EPS) misses. Furthermore, the company's ongoing strategic transition and the associated margin pressures are likely contributing to this cautious market sentiment.

- Lower Valuation Multiples: Zenvia's P/S ratio lags behind key competitors in the Software-as-a-Service (SaaS) sector.

- Investor Skepticism: Recurring EPS misses have eroded investor confidence.

- Transition and Margin Pressures: The company's ongoing strategic shifts and the impact on profitability are a concern.

- Impact on Capital Raising: A lower valuation can make it more challenging and costly to raise capital through equity offerings.

Reliance on Third-Party Communication Channels

Zenvia's dependence on third-party messaging platforms like WhatsApp and SMS, while crucial for broad customer outreach, creates a significant vulnerability. Changes in these external providers' pricing structures, such as adjusted SMS rates or WhatsApp business API fees, can directly squeeze Zenvia's profitability if these cost increases cannot be swiftly passed on to its clientele. For instance, a hypothetical 5% increase in SMS carrier costs could potentially reduce Zenvia's gross margin on SMS-based services if not immediately re-priced.

This reliance also exposes Zenvia to the risk of sudden policy shifts from these platform providers. Alterations to API access, usage limitations, or even outright service suspensions by a dominant platform could disrupt Zenvia's operations and impact its service delivery capabilities. Such policy changes, if implemented without adequate notice, could force Zenvia into costly and time-consuming adjustments to its infrastructure or client communication strategies.

- Dependency on WhatsApp and SMS: Core communication relies on external providers.

- Carrier Cost Fluctuations: Unpredictable changes in SMS and messaging fees impact margins.

- Policy Changes: Potential for disruptions due to platform provider policy shifts.

- Pass-Through Challenges: Difficulty in immediately passing increased costs to clients.

Zenvia faces significant challenges in translating revenue growth into profitability, particularly within its CPaaS segment. Rising SMS costs from carriers are directly impacting gross margins, as seen in the first half of 2024 where a net loss of R$110 million was reported despite a 21% revenue increase. Furthermore, a substantial 21.1% year-over-year decline in active customers in Q1 2025 suggests potential issues with customer acquisition and retention, even as overall revenue trends upward.

The company's acquisition-led growth strategy has also presented integration difficulties, which have negatively affected operational efficiency and margins. For example, Q3 2023 saw a slight gross margin dip to 61.4% from 62.2% in the prior year, partly due to these integration costs. Zenvia's market valuation is also a concern, trading at lower multiples than peers due to investor skepticism stemming from past EPS misses and ongoing margin pressures during its strategic transition.

Preview Before You Purchase

Zenvia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Zenvia SWOT analysis, offering a clear snapshot of its strategic positioning. Upon purchase, you'll gain access to the complete, in-depth report, detailing all aspects of Zenvia's Strengths, Weaknesses, Opportunities, and Threats. This ensures you get the full professional quality analysis you expect.

Opportunities

The global customer experience management market is booming, expected to reach $32.1 billion by 2029, a significant jump from $12.1 billion in 2023, fueled by businesses prioritizing digital engagement. This robust growth trajectory presents a prime opportunity for Zenvia, whose integrated platform and AI capabilities are well-positioned to capture a larger share of this expanding market. Latin America's SaaS market is also a key growth area, with projections indicating substantial expansion in the coming years, offering Zenvia a geographically advantageous position.

Zenvia's ongoing commitment to developing advanced AI capabilities, particularly in areas like real-time sentiment analysis and continuously learning generative AI chatbots, presents a significant opportunity for market expansion and product differentiation. These enhancements are designed to offer clients tangible benefits, such as increased operational efficiency and a deeper understanding of customer interactions.

By leveraging these sophisticated AI tools, Zenvia can solidify its competitive edge, attracting new clients seeking cutting-edge customer engagement solutions. For instance, the global AI market in customer service was projected to reach $32.2 billion by 2029, indicating substantial room for growth in this segment.

Zenvia can pursue geographic expansion beyond its core Latin American markets, eyeing other emerging economies with burgeoning digital adoption rates and less entrenched competition. For instance, Southeast Asian nations or select African markets present significant growth potential. This strategic move could tap into a wider customer base and diversify revenue streams.

The company also has a clear opportunity to deepen its penetration within existing vertical markets or enter new ones by customizing its communication and customer engagement solutions. For example, tailoring offerings for the rapidly growing e-commerce sector or the healthcare industry, which increasingly relies on digital communication, could be highly beneficial. Zenvia’s platform flexibility allows for such specialized adaptations.

Strategic Partnerships and Ecosystem Development

Zenvia's opportunity lies in strategically expanding its partner ecosystem. This can significantly boost its organic growth and allow for a wider array of services. By forging collaborations with complementary technology providers, Zenvia can develop more robust, integrated solutions that appeal to a broader customer base. This approach is central to Zenvia's new strategic cycle, aiming to enhance market reach and operational efficiency.

These partnerships can unlock new revenue streams and create a more comprehensive value proposition for customers. For instance, integrating with leading Customer Relationship Management (CRM) platforms or payment gateways could streamline customer journeys. Such alliances are crucial for staying competitive in the dynamic customer experience market. In 2024, Zenvia has been actively pursuing these avenues, recognizing their potential to drive future success.

- Accelerated Growth: Partnerships can provide access to new customer segments and distribution channels, speeding up market penetration.

- Enhanced Offerings: Collaborations allow for the creation of bundled or integrated solutions, increasing the value proposition for clients.

- Increased Efficiency: Working with partners can lead to shared resources, technology integration, and streamlined processes, improving overall operational efficiency.

- Market Reach Expansion: Aligning with established players in related industries can significantly broaden Zenvia's geographical and sectoral reach.

Monetization of Zenvia Customer Cloud

The Zenvia Customer Cloud, introduced in 2024, is Zenvia's new central focus, projected for substantial growth and healthy profit margins. This unified SaaS platform offers a prime avenue for generating consistent, scalable revenue by migrating current customers and attracting new ones. The company anticipates this cloud offering to become a significant revenue driver, aiming for a substantial portion of its income to originate from this segment in the coming years, building on its 2023 revenue of R$469.4 million.

Leveraging Product-Led Growth (PLG) strategies for the Zenvia Customer Cloud is a key opportunity to drive adoption and create predictable, recurring revenue streams. This approach allows customers to experience the platform's value firsthand, fostering organic growth. Zenvia's investment in this area is expected to yield strong customer retention and expand its market reach efficiently, contributing to its goal of achieving positive EBITDA by 2025.

Monetizing the Zenvia Customer Cloud presents a clear path to unlocking new revenue streams and enhancing overall profitability. The company is strategically focused on demonstrating the platform's value proposition to a wider audience.

- Scalable Recurring Revenue: The SaaS model inherently supports predictable income.

- High Growth Potential: The Customer Cloud is identified as a core growth engine.

- Attractive Gross Margins: SaaS platforms typically offer better profitability than traditional software.

- Product-Led Growth (PLG): This strategy can accelerate customer acquisition and reduce sales costs.

Zenvia is well-positioned to capitalize on the expanding global customer experience management market, projected to reach $32.1 billion by 2029. Its AI-driven platform offers significant opportunities for differentiation and market share growth, especially as businesses increasingly prioritize digital engagement. The company can further leverage its advanced AI capabilities, such as real-time sentiment analysis, to provide clients with enhanced operational efficiency and deeper customer insights, thereby strengthening its competitive edge in a market where AI in customer service is expected to reach $32.2 billion by 2029.

Threats

Zenvia faces fierce competition from global giants like Twilio and Infobip in the Customer Experience (CX) and Communications Platform as a Service (CPaaS) sectors. This crowded market also includes numerous regional CPaaS providers and marketing automation platforms, all vying for market share.

The intense rivalry puts significant pressure on pricing, particularly when dealing with large enterprise clients in the Software as a Service (SaaS) model. This could potentially erode Zenvia's market share if it cannot effectively differentiate its offerings or maintain competitive pricing strategies.

For instance, Twilio reported revenue of $4.5 billion for the fiscal year 2023, showcasing the scale of established players. Zenvia must navigate these competitive dynamics to secure and grow its customer base in this rapidly evolving industry.

Zenvia faces a significant threat from fluctuating carrier costs, particularly within its Communications Platform as a Service (CPaaS) segment. Increases in SMS rates from telecom providers directly impact gross profit margins if Zenvia cannot promptly pass these higher expenses onto its clients, potentially eroding profitability.

Furthermore, the dynamic landscape of data privacy regulations and evolving communication channel policies presents another considerable risk. These changes can necessitate substantial investment in compliance measures and may even alter the operational effectiveness of Zenvia's services, impacting its ability to deliver solutions efficiently.

Economic volatility across Latin America presents a significant threat. For instance, in 2023, several key economies like Argentina and Brazil experienced high inflation rates, impacting consumer purchasing power and business investment decisions. This economic instability, coupled with potential currency fluctuations, could dampen demand for Zenvia's customer experience (CX) platforms as companies tighten their belts.

Budget constraints are a direct consequence of economic downturns. As businesses face reduced revenues or increased operating costs due to inflation, they are likely to scrutinize technology expenditures. This could lead to delayed adoption of new CX solutions or scaled-back investments in existing platforms, directly impacting Zenvia's revenue streams and growth projections in the region.

Technological Disruption and Rapid Innovation

The customer experience and communications sectors are moving at lightning speed, driven by constant upgrades in AI and the emergence of new ways for businesses to connect with customers. For Zenvia, this means staying ahead of the curve is not just an option, but a necessity. Failure to keep pace with these innovations, particularly in AI and communication platform development, could quickly make its current solutions feel outdated. For instance, a recent report from Gartner in late 2024 indicated that companies prioritizing AI integration in customer service saw an average improvement of 15% in customer satisfaction scores. Zenvia’s ability to adapt and incorporate these advancements directly impacts its market position.

The threat of technological disruption is significant. If Zenvia doesn't continuously invest in and integrate the latest advancements, its products could become less appealing compared to competitors who are quicker to adopt new technologies. This rapid innovation cycle means that what is cutting-edge today might be standard or even obsolete tomorrow. For example, the market for conversational AI platforms is projected to grow substantially, with some analysts predicting a compound annual growth rate (CAGR) of over 20% through 2028, according to IDC data from early 2025. Zenvia must ensure its technological roadmap aligns with these growth trajectories to maintain its competitive edge.

- AI Evolution: The rapid advancement of AI, including generative AI and natural language processing, demands constant platform updates to remain competitive.

- New Communication Channels: The emergence of new customer engagement channels requires Zenvia to integrate support for these platforms to avoid client churn.

- Competitive Lag: Falling behind in technological integration can lead to Zenvia's offerings becoming less attractive and potentially obsolete in a fast-paced market.

- Market Share Erosion: Competitors who embrace and effectively deploy new technologies can capture market share from companies that are slower to adapt.

Execution Risks in Strategic Transformation

Zenvia's strategic shift to its Customer Cloud, alongside the sale of non-essential business units, presents significant execution hurdles. Successfully migrating clients to the new platform without disruption is a key challenge. For instance, in Q1 2024, Zenvia reported that its cloud-based solutions revenue grew by 20% year-over-year, highlighting the importance of this transition, but any delays could hamper this momentum.

Potential client resistance to increased pricing for its Communications Platform as a Service (CPaaS) offerings also poses a threat. If Zenvia cannot effectively communicate the value proposition of these price adjustments, it could lead to customer churn, impacting the financial turnaround plan. The company's ability to secure favorable terms and timely closings for its asset divestitures is another critical factor that could influence its path to profitability.

Zenvia faces intense competition from established global players like Twilio and Infobip, alongside numerous regional providers in the CPaaS and Customer Experience (CX) markets. This crowded landscape, characterized by aggressive pricing, particularly for large SaaS clients, pressures Zenvia's market share and profitability, especially considering Twilio's $4.5 billion revenue in 2023.

SWOT Analysis Data Sources

This Zenvia SWOT analysis is built upon a foundation of robust data, incorporating Zenvia's official financial statements, comprehensive market research reports, and insights from industry analysts to provide a well-rounded perspective.