Zenvia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zenvia Bundle

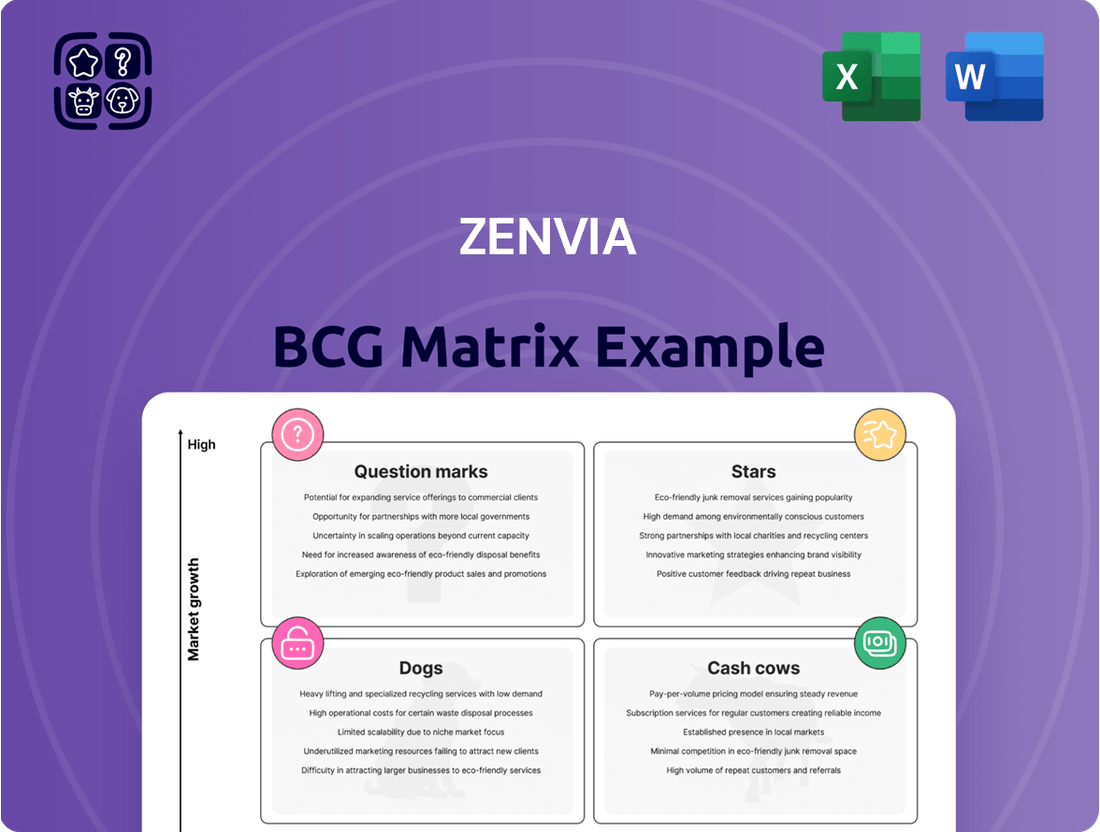

Unlock the strategic potential of Zenvia's product portfolio with this insightful BCG Matrix preview. See at a glance which offerings are poised for growth and which require careful consideration. This glimpse into Zenvia's market position is just the beginning of understanding their competitive landscape. To truly grasp their strategic direction and make informed decisions, you need the full picture. Purchase the complete Zenvia BCG Matrix report to receive a detailed quadrant-by-quadrant analysis, actionable recommendations, and a clear roadmap for optimizing your investments and product strategy.

Stars

Zenvia Customer Cloud with AI, launched in October 2024, represents Zenvia's strategic shift towards a unified customer experience, powered by artificial intelligence. This platform is expected to be a significant revenue generator, with 2024 revenues estimated between BRL 180-200 million.

The company anticipates robust growth for Zenvia Customer Cloud, projecting a 25-30% increase in revenue for 2025, accompanied by impressive gross margins of 68-70%. This growth trajectory underscores the platform's importance as a new core business for Zenvia.

By the end of 2024, Zenvia Customer Cloud had secured nearly 6,000 clients, demonstrating strong market adoption, with 20% of these clients being international. The platform's AI-driven personalization and automation capabilities are key drivers behind this rapid client acquisition and its potential for future expansion.

WhatsApp Business API Solutions are a key component of Zenvia's strategy, positioning them within the high-growth CPaaS market, especially in Latin America. This sector saw significant expansion in 2024 as businesses intensified their digital customer engagement efforts. Zenvia's ability to consolidate A2P SMS and WhatsApp Business API into a single platform provides a distinct advantage, streamlining omnichannel communications for their clients. This integrated approach is crucial for companies aiming to leverage the massive user base of WhatsApp, estimated to have over two billion monthly active users globally.

Zenvia's AI-Powered Conversational Tools, like its generative AI chatbot integrated into the Zenvia Customer Cloud, are designed to automate customer interactions and slash operational expenses for businesses. This technology is central to Zenvia's objective of implementing intelligence across its operations, particularly for handling high volumes of customer engagements. Early indicators suggest robust market acceptance, as evidenced by SMB clients utilizing the platform demonstrating notably higher upsell rates, pointing to significant growth potential and demand.

International Expansion in Latin America (Mexico & Argentina)

Zenvia is strategically targeting Latin America, with Mexico and Argentina identified as key growth markets. This expansion is driven by the increasing demand from international clients for Zenvia's Customer Cloud solutions in these regions. By concentrating on these specific markets, Zenvia leverages a deep understanding of local customer needs, which translates into a significant competitive edge.

To fuel this expansion, Zenvia is actively developing its partner ecosystem. A significant development is the introduction of a new franchise sales model, designed to accelerate market penetration and revenue generation in these burgeoning Latin American territories. This approach aims to replicate Zenvia's success in other markets by building a network of local partners.

- Market Focus: Mexico and Argentina are prioritized for international growth.

- Customer Segment: International clients are a key driver for Zenvia Customer Cloud in these regions.

- Competitive Advantage: Localized understanding of customer needs differentiates Zenvia.

- Growth Strategy: Scaling the partner ecosystem, including a new franchise sales model, is crucial for acceleration.

Product-Led Growth (PLG) Strategy for Zenvia Customer Cloud

Zenvia's adoption of a Product-Led Growth (PLG) strategy for its Customer Cloud is a deliberate move to democratize access to its solutions. This means customers can explore and utilize Zenvia's offerings with minimal friction, fostering organic adoption and significantly lowering the expenses associated with acquiring new users. This self-service model is crucial for scaling efficiently.

The PLG approach allows Zenvia's customers to begin with smaller commitments and gradually expand their usage as their needs evolve. This incremental adoption builds confidence and strengthens the customer relationship over time. For instance, Zenvia's focus on user experience in its Customer Cloud aims to make onboarding and initial usage so intuitive that customers are naturally drawn to explore more advanced features.

This strategy is central to Zenvia's broader objective of accelerating the growth of its core Software-as-a-Service (SaaS) platform. By enabling users to experience the value proposition firsthand, Zenvia cultivates a loyal user base that is more likely to upgrade and advocate for the product. This is particularly evident as SaaS markets continue to see growth, with the global SaaS market projected to reach over $300 billion in 2024.

- PLG enables self-service access to Zenvia Customer Cloud solutions.

- This reduces customer acquisition costs and promotes organic adoption.

- Customers can scale their usage incrementally, fostering long-term relationships.

- PLG is a core driver for Zenvia's SaaS platform growth strategy.

Stars in the Zenvia BCG Matrix represent Zenvia Customer Cloud with AI and WhatsApp Business API Solutions. These are high-growth, high-market-share offerings that require significant investment to maintain their leadership position. Their strong performance in 2024, with Zenvia Customer Cloud projecting 25-30% revenue growth in 2025 and WhatsApp solutions tapping into the expanding CPaaS market, solidifies their Star status.

What is included in the product

The Zenvia BCG Matrix offers tailored analysis for the company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

The Zenvia BCG Matrix offers a one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Zenvia's core Communications Platform as a Service (CPaaS) offerings are a significant revenue driver, bolstering the company's top line. This segment's impressive growth is underscored by a remarkable 58.5% year-over-year revenue increase in Q1 2025.

While this segment sees substantial volume growth, especially from large enterprise clients, it typically operates with lower gross margins when contrasted with Software as a Service (SaaS) products. The consistent high volume of SMS and other messaging services, however, solidifies its position as a stable and substantial cash generator for Zenvia.

Zenvia's established SMS and basic messaging infrastructure, built over two decades, is a prime example of a cash cow. This foundational service enabled millions of businesses in Brazil to connect via SMS, becoming the country's leading messaging infrastructure early on. The widespread adoption and essential nature of this service continue to ensure consistent revenue generation, even as the market matures.

Despite facing challenges like rising carrier costs and pricing pressures, the core SMS business remains a reliable income stream for Zenvia. In 2024, the demand for basic messaging for transactional purposes, such as notifications and confirmations, continues to be robust across various sectors. This steady revenue supports Zenvia's investments in newer, high-growth areas of its business.

Zenvia's traditional marketing automation tools represent a classic cash cow within its comprehensive Customer Experience (CX) platform. These established offerings have consistently generated stable recurring revenue for the company.

These tools are crucial for businesses seeking to automate customer acquisition and engagement through sophisticated campaigns. Their mature market position means Zenvia can rely on these for predictable income streams, a hallmark of a cash cow.

Investment in these mature segments is typically minimal, focusing on essential maintenance and minor enhancements to ensure continued performance. This low investment, high return profile is characteristic of Zenvia's cash cow assets.

For instance, as of 2024, the marketing automation software market is projected to reach over $10 billion globally, demonstrating the continued demand for these services. Zenvia's established presence in this segment allows it to capitalize on this ongoing market need.

Legacy Customer Service and Engagement Solutions

Zenvia's legacy customer service and engagement solutions form a strong cash cow within its portfolio. These offerings cater to a broad range of businesses, from small and medium enterprises to large corporations, particularly within the Latin American market. This segment is characterized by its maturity and Zenvia's established presence, ensuring a consistent revenue stream with minimal need for substantial new investment. For instance, in 2023, Zenvia reported that its traditional communication solutions continued to be a primary revenue driver, contributing a significant portion to its overall financial performance.

- Established Market Position: Zenvia leverages its deep roots in Latin America to maintain a dominant position in traditional customer service channels.

- Steady Revenue Generation: These mature solutions provide predictable and stable cash flow, supporting ongoing operations and investment in other growth areas.

- Diverse Customer Base: Serving both SMEs and large enterprises ensures a resilient revenue base, less susceptible to fluctuations in specific market segments.

- Lower Investment Needs: Compared to nascent technologies, these cash cows require less aggressive capital allocation, optimizing resource deployment.

SMB Customer Base for Core Offerings

Zenvia's robust SMB customer base is a significant driver for its core, mature offerings. This segment, encompassing small and medium-sized enterprises across diverse industries, provides a stable foundation for the company's revenue streams.

In 2024, Zenvia saw its SaaS revenues from SMB customers grow by 8%. This growth is instrumental in building the necessary scale for Zenvia Customer Cloud.

- Diversified SMB clientele across multiple sectors.

- 8% increase in SaaS revenue from SMBs in 2024.

- Established base using mature, core Zenvia offerings.

- Reliable cash flow generation from this customer segment.

While these SMBs are also migrating to Zenvia's newer platform, their continued engagement with existing, well-established products ensures a consistent and dependable contribution to Zenvia's overall cash flow, solidifying its Cash Cow status.

Zenvia's established SMS and legacy customer service solutions are prime examples of its cash cows. These mature offerings benefit from a dominant market position in Latin America, ensuring steady, predictable revenue streams with minimal new investment requirements. This stability allows Zenvia to fund growth initiatives in emerging areas of its business.

The company's traditional marketing automation tools also function as cash cows. They cater to a broad customer base, including a significant SMB segment, which saw an 8% increase in SaaS revenue in 2024. This consistent income supports Zenvia's strategic expansion and platform development.

These cash cow segments, while not experiencing hyper-growth, provide the essential financial backbone for Zenvia. Their consistent performance, exemplified by the continued demand for transactional SMS services and the robust SMB customer base, underpins the company's overall financial health and investment capacity.

| Segment | Key Characteristics | 2024/2025 Data/Insights |

| SMS & Messaging Infrastructure | Mature, high-volume, essential service | 58.5% YoY revenue increase (Q1 2025) for CPaaS; robust demand for transactional SMS in 2024 |

| Marketing Automation | Established, stable recurring revenue | Market projected over $10 billion globally in 2024; 8% SaaS revenue growth from SMBs in 2024 |

| Legacy Customer Service Solutions | Dominant position, diverse customer base | Continued to be a primary revenue driver in 2023; reliable cash flow generation from SMBs |

Preview = Final Product

Zenvia BCG Matrix

The Zenvia BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you'll get the complete strategic analysis, ready for your immediate use without any watermarks or demo limitations. You can confidently use this preview as an accurate representation of the professional, actionable insights contained within the final Zenvia BCG Matrix report.

Dogs

Zenvia announced in January 2025 its intention to divest non-core assets, a strategic move to sharpen its focus on the Zenvia Customer Cloud. These divested assets likely represent areas with limited market growth and low competitive standing, hindering overall company performance.

This proactive divestiture signals Zenvia's commitment to optimizing its portfolio, shedding underperforming segments that drain resources without generating substantial returns. The company aims to streamline operations and strengthen its financial position by shedding these non-core elements.

By concentrating on its core Customer Cloud offering, Zenvia expects to improve capital allocation and drive growth in its most promising business areas. This strategic realignment is designed to enhance profitability and shareholder value in the long run.

As Zenvia pivots towards its integrated AI-powered Customer Cloud, legacy communication channels that remain siloed and lack deep integration are being evaluated. These might include older SMS gateways or basic chatbot functionalities that don't seamlessly connect with the broader platform. Consider their market relevance and alignment with Zenvia's strategic push for a unified customer experience.

These less integrated channels often represent a declining market share or are being superseded by more advanced, connected solutions. For instance, a standalone IVR system that doesn't feed into a central customer data platform offers limited value compared to AI-driven conversational interfaces. Their continued maintenance could divert resources from developing and promoting the core Customer Cloud offering.

In 2024, companies that haven't updated their communication infrastructure may face challenges. Reports indicate that customer satisfaction can drop significantly when interactions are fragmented across multiple, unlinked channels. Zenvia's strategy likely involves phasing out or deprioritizing these standalone tools to focus on the synergistic benefits of its unified platform.

Certain enterprise SaaS contracts within Zenvia's portfolio presented challenges in 2024, notably contributing to lower overall margins. These specific agreements, characterized by sluggish growth and minimal profit generation, could be categorized as Dogs within a BCG Matrix framework. Zenvia's strategic focus on enhancing SaaS profitability indicates an effort to address these underperforming segments. For instance, if these contracts represent a significant portion of the SaaS revenue but yield disproportionately low profits, their impact on overall financial health becomes more pronounced.

Niche Acquired Products Not Integrated into Zenvia Customer Cloud

Zenvia's growth strategy has heavily relied on acquisitions to bolster its tech and messaging capabilities. However, products that haven't been integrated into the Zenvia Customer Cloud or don't fit the AI-first, unified CX vision risk becoming question marks. These are essentially acquired assets that, post-acquisition, haven't demonstrated substantial market traction or growth within Zenvia's ecosystem.

These unintegrated products can become a drain on resources, acting as cash traps if they fail to generate sufficient revenue or user adoption. Without a clear path to integration or strategic alignment, their future within Zenvia's portfolio becomes uncertain, potentially hindering overall company performance.

- Unintegrated Acquired Products: These are offerings that have not yet been successfully merged into the Zenvia Customer Cloud platform.

- Strategic Misalignment: Products that do not align with Zenvia's AI-first, unified Customer Experience (CX) strategy.

- Market Traction Challenges: Acquired products that have struggled to gain significant market share or growth post-acquisition.

- Potential Cash Traps: These unintegrated or underperforming assets may consume resources without delivering proportional returns.

Basic API Services with Commoditized Pricing

While Zenvia's Communication Platform as a Service (CPaaS) segment is generally a strong performer, certain basic API services within it face significant commoditization. This leads to thin profit margins and intense price wars. In 2024, Zenvia specifically highlighted margin pressures within its CPaaS operations, partly attributed to increasing carrier expenses and prevailing market pricing.

These highly standardized, low-differentiation API services, if not strategically bundled with more sophisticated offerings, can be categorized as Question Marks in the broader Zenvia portfolio. Their reliance on basic functionality makes them vulnerable to price erosion, especially when competitors offer similar features at lower costs.

- Low Margins: Basic SMS and voice APIs, for instance, often operate on razor-thin margins due to high competition.

- Pricing Pressure: Zenvia's 2024 reports indicated that competitive pricing in the CPaaS market is a constant challenge.

- Carrier Cost Increases: Rising costs from telecommunication carriers directly impact the profitability of these basic services.

- Lack of Differentiation: Services lacking unique features struggle to command premium pricing.

Zenvia's legacy communication channels, such as standalone SMS gateways or basic IVR systems that are not integrated into the Zenvia Customer Cloud, represent the Dogs in their BCG Matrix. These offerings often have low market growth and a weak competitive position, consuming resources without generating significant returns.

In 2024, Zenvia's strategic divestiture of non-core assets targeted these underperforming segments. The company recognized that these legacy systems divert valuable resources from its core AI-powered Customer Cloud. For instance, maintaining outdated communication infrastructure that fails to provide a unified customer experience can lead to customer dissatisfaction and hinder overall growth.

The focus on divesting these Dogs demonstrates Zenvia's commitment to portfolio optimization. By shedding these low-return assets, Zenvia aims to improve capital allocation, streamline operations, and strengthen its financial position, ultimately driving growth in its more promising business areas.

These legacy channels are often characterized by declining market share and are being superseded by more advanced, integrated solutions. Their continued operation, without a clear path to integration or strategic alignment with the Zenvia Customer Cloud, makes them prime candidates for divestment or deprioritization.

Question Marks

Zenvia Customer Cloud's foray into new international markets outside its Latin American stronghold would classify it as a Question Mark in the BCG matrix. These markets, characterized by high growth potential for AI-driven customer experience solutions, currently see Zenvia with a relatively low market share.

Significant capital infusion will be necessary to penetrate these nascent territories. This investment is crucial for tailoring the Customer Cloud offering through localization efforts and establishing brand recognition, aiming to shift its position from a Question Mark to a Star.

Consider the competitive landscape: while Zenvia's AI capabilities are strong, new markets require overcoming established players and adapting to diverse regulatory environments. For instance, entering a market like Southeast Asia in 2024, with a projected CX software market growth of over 15%, necessitates substantial upfront costs for market entry.

Zenvia is enhancing its Zenvia Customer Cloud with sophisticated AI-driven predictive analytics. This integration aims to unlock deeper customer insights through AI-enabled automation, offering a competitive edge. As of early 2024, the demand for AI in customer experience is soaring, with companies increasingly investing in predictive capabilities to personalize interactions and anticipate needs.

While AI is fundamental to Zenvia's platform, some highly advanced predictive analytics features are in their nascent stages of adoption or cater to niche, emerging applications. These cutting-edge functionalities represent a high-growth technological frontier, though their widespread market penetration for Zenvia may still be developing. For instance, real-time sentiment analysis predicting churn with over 85% accuracy in pilot programs is a prime example of such advanced features.

Zenvia is strategically developing vertical-specific Customer Experience (CX) solutions to cater to diverse industries like Education, Finance, Health, Insurance, and Retail. This proactive approach allows Zenvia Customer Cloud to be highly adaptable and meet the unique needs of businesses within these sectors.

By creating specialized CX solutions for new, specific industry verticals where Zenvia currently has a limited presence, the company is aiming for significant growth. These tailored offerings target high-potential niche markets, even though Zenvia's current market share in these areas might be low.

For instance, by 2024, the global CX market was projected to reach over $10 billion, with specific industry solutions driving substantial adoption. Zenvia's move into these new verticals is a calculated step to capture a share of this expanding market, leveraging specialized technology to address unmet needs.

Franchising Business Model for Zenvia Customer Cloud

Zenvia's adoption of a franchising model for its Customer Cloud solutions positions it as a Question Mark within the BCG Matrix. This strategy, initiated as part of their 2025 strategic cycle, targets accelerated expansion across Brazil, with future ambitions for Mexico and Argentina. While the model promises high growth potential by leveraging franchisees to broaden Zenvia's market presence, it is currently in its nascent phase, with only eight initial units operational.

The franchising approach represents Zenvia's effort to achieve a wider client base and faster market penetration than a solely direct-sales approach might allow. However, its relative newness means Zenvia has limited direct control over these franchised units and its scalability is yet to be definitively proven in real-world operations. This uncertainty, coupled with the significant growth aspirations, firmly places the franchising business model in the Question Mark quadrant, requiring careful management and investment to determine if it will become a Star or a Dog.

- Strategic Shift: Zenvia's franchising model is a key component of its 2025 strategic cycle.

- Geographic Focus: Initial expansion is concentrated in Brazil, with potential follow-on in Mexico and Argentina.

- Growth Ambition: The model aims for accelerated growth and client base expansion.

- Current Status: It's an early-stage initiative with eight initial units, indicating low direct market share control and unproven scalability, characteristic of a Question Mark.

Strategic Partnerships for Broader Ecosystem Integration

Zenvia is actively cultivating its partner ecosystem to drive integrated solutions and bolster organic growth. This strategic focus on partnerships is crucial for expanding market reach and enhancing its product offerings.

The company is actively seeking new, large-scale collaborations with other technology providers and platforms. These alliances are particularly valuable when they unlock access to new customer segments or introduce novel functionalities, thereby expanding Zenvia's addressable market and service capabilities.

These strategic partnerships represent significant growth opportunities for Zenvia, aligning with the "Question Marks" in a BCG matrix due to their high potential but unproven market impact. For example, Zenvia's 2023 expansion into new Latin American markets through channel partnerships demonstrates this strategy in action, aiming to capture new user bases.

- Ecosystem Strengthening: Zenvia prioritizes partnerships to build integrated solutions, aiming for accelerated organic growth.

- New Market Access: Collaborations with tech providers and platforms are key to reaching new customer segments and functionalities.

- High Growth Potential: These partnerships are positioned as significant growth drivers, mirroring "Question Mark" characteristics in strategic analysis.

- Unrealized Impact: While promising, the full market share contribution and success of these strategic alliances are still being evaluated and developed.

Zenvia's expansion into new international markets, coupled with its nascent franchising model and developing strategic partnerships, all represent classic Question Marks. These initiatives are characterized by high growth potential but currently hold a low market share for Zenvia. Significant investment is required to nurture these ventures, with the ultimate success of becoming a market leader still uncertain.

The company's strategic focus on AI-driven CX solutions and vertical-specific offerings also falls into this category. While these areas show promise, their widespread adoption and Zenvia's market penetration are still in early stages, demanding careful cultivation to transition them into Stars.

For instance, Zenvia's foray into the Indonesian market in 2024, aiming to capture a share of its burgeoning digital CX sector, exemplifies a Question Mark. The market is growing rapidly, but Zenvia’s presence is minimal, requiring substantial investment in localization and sales infrastructure. By 2025, the projected growth for CX solutions in Southeast Asia is expected to exceed 18%, highlighting the opportunity but also the competitive intensity.

| Initiative | Market Potential | Current Market Share (Zenvia) | Investment Needs | Projected Success |

|---|---|---|---|---|

| International Market Expansion | High | Low | High | Uncertain (Potential Star) |

| Franchising Model | High | Low (Initial Units) | Moderate | Uncertain (Potential Star/Dog) |

| Strategic Partnerships | High | Low (New Segments) | Low to Moderate | Uncertain (Potential Star) |

| AI-Enhanced CX Features | High | Developing | High | Potential Star |

| Vertical-Specific CX Solutions | High | Low | Moderate | Potential Star |

BCG Matrix Data Sources

Our Zenvia BCG Matrix is constructed from a blend of internal sales data, customer feedback, and competitive market analysis to offer a comprehensive view of product performance.