Zenvia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zenvia Bundle

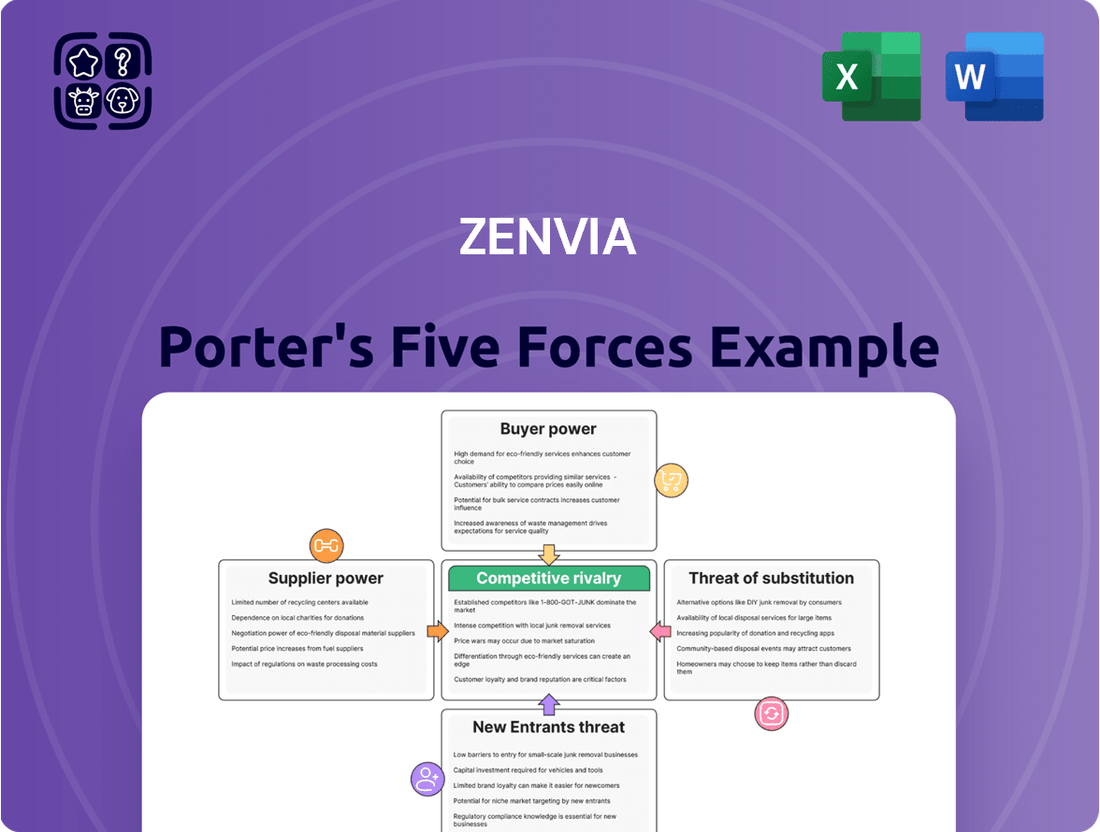

Zenvia operates in a dynamic market where understanding competitive forces is paramount. Our Porter's Five Forces Analysis reveals how intense rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the pressure from substitutes all shape Zenvia's strategic landscape. This brief overview highlights the critical factors influencing profitability and market share within Zenvia's industry.

The complete report reveals the real forces shaping Zenvia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Zenvia, operating as a cloud-based platform, is significantly dependent on a small pool of critical infrastructure providers. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are dominant forces in this space, meaning they hold substantial sway.

This concentration of power among a few key players translates to considerable bargaining leverage for these suppliers. For Zenvia, the prospect of switching providers involves substantial costs and complexities, including the intricate processes of data migration and system re-integration.

In 2023, cloud infrastructure spending globally reached an estimated $266 billion, highlighting the immense scale and importance of these providers in the digital economy. This vast market size further solidifies their position and bargaining strength.

The inability of Zenvia to easily switch suppliers means these infrastructure providers can potentially dictate terms, affecting Zenvia's operational costs and strategic flexibility.

Zenvia's reliance on telecommunication carriers for its core communication services, such as SMS and WhatsApp, grants these carriers significant bargaining power. This dependence is a key factor influencing Zenvia's operational costs and profitability.

The impact of this supplier power was evident in Zenvia's financial performance. Despite robust revenue growth in its CPaaS segment, the company experienced a squeeze on its margins. Specifically, increased SMS costs in Q4 2024 directly affected Zenvia's profitability, highlighting the carriers' ability to dictate pricing.

Zenvia's reliance on specialized software components, particularly for its AI-driven customer experience solutions, means suppliers of unique AI/ML tools and advanced analytics can wield significant influence. If these components are critical for Zenvia's competitive edge and difficult to replicate, their suppliers gain leverage. For instance, a supplier of a proprietary natural language processing engine that significantly enhances Zenvia's chatbot capabilities could command better terms.

High Switching Costs for Zenvia

Zenvia faces a considerable challenge from the bargaining power of its suppliers, particularly concerning its core technology infrastructure. Switching major cloud providers or key communication API (Application Programming Interface) suppliers would incur substantial technical migration expenses and significant time investment for Zenvia. This creates high switching costs, effectively cementing the leverage of existing suppliers.

These elevated switching costs mean Zenvia cannot easily or affordably transition to alternative providers without disrupting its operations. Consequently, the suppliers of these critical technologies are in a strong position. For instance, a major cloud provider might have pricing power, knowing that Zenvia's investment in their platform makes a move costly. This dynamic directly impacts Zenvia's operational costs and strategic flexibility.

- High Switching Costs: Zenvia's reliance on specialized cloud and communication API providers means migrating to new platforms would involve extensive re-engineering and integration efforts.

- Supplier Leverage: Existing suppliers can leverage these high switching costs to maintain favorable terms, potentially impacting Zenvia's profitability.

- Technical Dependency: The intricate nature of integrating communication technologies means that any change requires deep technical expertise and a lengthy implementation period.

- Operational Disruption Risk: A poorly managed migration process could lead to significant downtime and service interruptions, impacting Zenvia's customer base.

Proprietary Technology and Data Providers

Proprietary technology and unique data providers can significantly impact Zenvia's bargaining power with its suppliers. If a supplier offers specialized AI models or unique data insights that are critical for Zenvia's personalized customer journey strategies, this distinctiveness limits Zenvia's options for finding substitutes. This scarcity of alternatives naturally enhances the supplier's leverage in negotiations.

For instance, a supplier providing a highly specialized natural language processing (NLP) model that Zenvia relies on for sentiment analysis in its customer service platform would hold considerable power. Without this specific technology, Zenvia might face substantial costs and delays in developing an in-house alternative or integrating a less effective third-party solution. This dependence empowers the supplier to command higher prices or more favorable contract terms.

- Unique Data Sets: Suppliers possessing exclusive or proprietary datasets, such as detailed consumer behavior analytics or specialized market trend information, can exert strong bargaining power if these are integral to Zenvia's service offerings.

- Specialized AI/ML Models: Providers of advanced, proprietary AI or machine learning models, especially those tailored for customer communication or engagement, can hold significant leverage if Zenvia’s core functionalities depend on them.

- Proprietary Communication Protocols: In the realm of communication platforms, suppliers offering unique or industry-standard proprietary protocols that are essential for Zenvia's interoperability and service delivery can wield considerable influence.

- Limited Substitutability: The key driver of supplier power here is the difficulty or high cost for Zenvia to switch to an alternative provider without compromising service quality or incurring substantial integration expenses.

Zenvia faces significant supplier power due to its reliance on a few major cloud infrastructure providers and specialized communication API suppliers. These suppliers, like AWS and major telecom carriers, benefit from high switching costs for Zenvia, which involve complex data migration and system re-integration, limiting Zenvia's ability to negotiate favorable terms.

The bargaining power of suppliers is amplified by Zenvia's dependence on proprietary technologies, such as specialized AI models for customer experience solutions. The difficulty in finding comparable substitutes for these unique offerings allows suppliers to dictate pricing and terms, directly impacting Zenvia's operational costs and profit margins. For instance, increased SMS costs in Q4 2024 demonstrably squeezed Zenvia's profitability.

The global cloud infrastructure market, valued at $266 billion in 2023, underscores the dominance of providers like AWS, Azure, and Google Cloud. This market concentration, coupled with Zenvia's technical dependency on these platforms and essential communication APIs, grants suppliers considerable leverage. This situation limits Zenvia's strategic flexibility and can lead to higher operational expenses.

| Supplier Type | Key Dependencies for Zenvia | Supplier Bargaining Power Factor | Impact on Zenvia |

|---|---|---|---|

| Cloud Infrastructure Providers (e.g., AWS, Azure) | Hosting, computing power, data storage | High concentration, high switching costs | Potential for price increases, limited negotiation leverage |

| Communication API Suppliers (e.g., SMS, WhatsApp) | Core communication services delivery | High reliance, essential for platform functionality | Pricing power, margin pressure (e.g., Q4 2024 SMS cost impact) |

| Proprietary AI/ML & Data Providers | Advanced analytics, NLP, customer insights | Lack of substitutes, critical for competitive edge | Ability to command higher prices, influence on service development |

What is included in the product

This analysis dissects the competitive forces shaping Zenvia's market, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Eliminate the frustration of manual data aggregation and analysis for each force, allowing for faster, more accurate strategic insights.

Customers Bargaining Power

Customer switching costs are a critical factor influencing Zenvia’s bargaining power of customers. If a business has heavily integrated Zenvia’s communications and customer experience solutions into its core operations, the expense and complexity of migrating to an alternative provider can be substantial. This deep integration, encompassing data migration, retraining staff, and reconfiguring workflows, directly limits a customer’s ability or willingness to switch, thereby diminishing their leverage.

For instance, a large enterprise that relies on Zenvia for its entire customer engagement strategy, from SMS notifications to chatbot integration, would face significant disruption and cost if they decided to switch. This could involve months of planning, considerable IT resources, and potential downtime, making Zenvia’s offerings stickier. In 2024, businesses are increasingly focused on seamless customer journeys, which often means deeper platform integration, amplifying these switching costs.

The customer experience (CX) and Communications Platform as a Service (CPaaS) sectors are brimming with options. Think of major global players like Twilio and Infobip, alongside a host of regional providers and even marketing automation platforms that offer similar functionalities. This sheer volume of choices significantly amplifies the customer's leverage.

For instance, in 2024, the CPaaS market was projected to reach over $20 billion, indicating a highly fragmented landscape with numerous vendors vying for market share. This intense competition means customers can easily switch providers if they aren't satisfied with pricing, features, or service quality, directly impacting Zenvia's ability to dictate terms.

Customer price sensitivity is a key factor in the CPaaS market, particularly for high-volume messaging services. Market volatility often amplifies this, making price a decisive element in customer acquisition and retention.

Zenvia's financial performance reflects this dynamic. The company's Q4 2024 earnings report highlighted that competitive pressures within its SaaS segment led to a reduction in profitability, directly indicating that customers are highly attuned to pricing, especially when choosing core communication solutions.

Importance of Zenvia's Service to Customer Operations

Zenvia's platform is deeply embedded in customer operations, acting as a central hub for service, sales, and marketing. Its ability to craft unique customer journeys makes it a vital component for businesses seeking to personalize interactions. For many companies, Zenvia's role in automating communication and enhancing customer engagement is not just beneficial, it's mission-critical, directly impacting their ability to retain and grow their customer base.

When a business relies heavily on Zenvia for essential functions, the switching costs can become significant. This dependency, driven by the platform's effectiveness in delivering value, can therefore diminish the immediate bargaining power of these customers. They are less likely to exert pressure on pricing or terms if replacing Zenvia would disrupt critical customer-facing processes.

- Mission-critical reliance: Businesses using Zenvia for core customer service automation face significant operational disruption if they switch providers.

- High switching costs: Integrating Zenvia into sales and marketing workflows creates technical and operational hurdles for customers looking to change platforms.

- Value proposition strength: The effectiveness of Zenvia in creating personalized customer journeys directly impacts its stickiness with clients, reducing their incentive to negotiate aggressively.

Customer Segmentation and Volume

Zenvia's customer base spans a wide spectrum, from small and medium-sized businesses to large enterprises. This diversity in client size influences their collective bargaining power.

Larger enterprise clients, often requiring significant volumes of Zenvia's communication and customer experience solutions, can leverage their substantial spending potential. Their capacity to negotiate for customized features or preferential pricing is generally higher than that of smaller clients.

Conversely, smaller businesses, particularly those engaging with Zenvia through product-led growth (PLG) models, typically have less individual bargaining power. Their reliance on standardized offerings means their ability to influence pricing or product development is more limited.

- Customer Segmentation: Zenvia serves both SMEs and large corporations.

- Volume Impact: Larger clients with higher usage volumes possess greater bargaining leverage.

- Customization Needs: Enterprise clients' demand for tailored solutions can increase their negotiating power.

- PLG vs. Enterprise: Clients acquired through product-led growth typically have less individual bargaining power than large enterprise accounts.

Zenvia's bargaining power of customers is influenced by market fragmentation and customer price sensitivity. The competitive CPaaS market, with an estimated value exceeding $20 billion in 2024, offers numerous alternatives, empowering customers to switch easily if unsatisfied with pricing or service. This dynamic is reflected in Zenvia's Q4 2024 performance, where competitive pricing pressures impacted profitability, indicating customers are highly price-aware.

Preview Before You Purchase

Zenvia Porter's Five Forces Analysis

This preview shows the exact Zenvia Porter's Five Forces analysis you'll receive immediately after purchase—no surprises, no placeholders. The document details the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, all crucial for understanding Zenvia's industry landscape. You'll gain a comprehensive understanding of the external forces shaping Zenvia's strategic environment. This professionally formatted analysis is ready for your immediate use.

Rivalry Among Competitors

The customer experience (CX) and Communications Platform as a Service (CPaaS) sectors where Zenvia competes are exceptionally crowded. This means there are many companies, both large international ones and smaller local providers, all vying for the same customers. This intense competition is a defining characteristic of Zenvia's operating environment.

This market fragmentation directly translates into aggressive competition for market share. Companies are constantly innovating and adjusting pricing to attract and retain clients. For instance, the CPaaS market was projected to reach $257 billion by 2027, indicating significant growth but also a highly contested space.

Zenvia contends with formidable global competitors such as Twilio and Infobip. These established players offer comprehensive communication API suites and boast substantial market penetration, providing them with significant advantages.

These industry giants leverage their considerable resources for accelerated innovation, aggressive marketing campaigns, and extensive global expansion efforts, intensifying the competitive landscape for Zenvia.

Zenvia differentiates itself with its Zenvia Customer Cloud, an AI-driven platform designed to unify customer interactions across multiple channels. This focus on an integrated, intelligent solution aims to provide a superior customer experience compared to competitors offering more siloed approaches.

The company's commitment to continuous innovation in Artificial Intelligence and Machine Learning is paramount. For instance, Zenvia's investment in AI capabilities allows for advanced personalization and automation, directly addressing the evolving demands of customer engagement. This is critical as the market sees significant R&D spending by rivals on similar AI-powered customer experience (CX) solutions, making ongoing feature development a key battleground.

Market Growth and Attractiveness

The Communications Platform as a Service (CPaaS) market is witnessing robust expansion, with projections suggesting a compound annual growth rate (CAGR) surpassing 25% in the near future, highlighting its considerable market attractiveness. This substantial growth trajectory naturally draws in new entrants and encourages existing players to invest more aggressively, thereby amplifying the competitive landscape.

The increasing size of the CPaaS market, which was valued at approximately $10.9 billion in 2023 and is expected to reach $36.2 billion by 2028 according to some industry analyses, fuels intense competition. Companies are actively competing for market share by innovating their service offerings, refining their pricing strategies, and expanding their global reach. This dynamic means that even as the pie gets bigger, the fight for each slice becomes fiercer.

- Market Growth: CPaaS market CAGR projected to exceed 25%.

- Market Valuation: Estimated at $10.9 billion in 2023, with forecasts suggesting growth to $36.2 billion by 2028.

- Competitive Intensification: Strong growth attracts new players and encourages aggressive investment from incumbents.

- Strategic Focus: Companies are competing on innovation, pricing, and global expansion to capture market share.

Regional vs. Global Focus

Zenvia's competitive landscape is shaped by its strategic choice between regional dominance and global expansion. Its deep roots in Latin America, evidenced by its strong market share and tailored offerings, provide a significant localized advantage. This regional strength allows Zenvia to better understand and cater to specific market needs, a key differentiator against less adaptable global competitors.

However, Zenvia's ambition for international growth inevitably pits it against established global players. As it enters new markets, it faces intense rivalry from companies with established brand recognition, extensive infrastructure, and significant financial resources. This global push intensifies competition, requiring Zenvia to constantly innovate and adapt to diverse market dynamics.

For instance, in 2024, the digital communications market, where Zenvia operates, saw continued consolidation and aggressive expansion by major global tech firms. Zenvia’s strategy involves leveraging its Latin American expertise to gain a foothold in other emerging markets, but direct competition with giants like Twilio or Sinch, who have a much broader international presence, remains a significant challenge.

- Regional Strength: Zenvia's localized approach in Latin America, understanding local nuances and regulations, is a core competitive asset.

- Global Ambitions: Expansion into new territories brings Zenvia into direct competition with larger, globally entrenched players.

- Competitive Intensity: The presence of global competitors with vast resources and market reach heightens the rivalry Zenvia faces outside its home region.

- Market Dynamics: The digital communications sector in 2024 is characterized by rapid technological advancements and aggressive market share grabs by major international corporations.

Zenvia operates in a highly competitive Communications Platform as a Service (CPaaS) market, characterized by numerous global and local players. This intense rivalry is fueled by the market's rapid growth, with projections indicating a substantial increase in valuation. Companies actively compete through innovation, pricing strategies, and global expansion to secure market share.

| Competitor | Key Offerings | Market Presence |

|---|---|---|

| Twilio | Comprehensive Communication APIs, Cloud Communications | Global |

| Infobip | Omnichannel Communication Platform, Messaging Solutions | Global |

| Sinch | Cloud Communications for Mobile Customer Engagement | Global |

SSubstitutes Threaten

Traditional communication methods like direct email, phone calls, or manual SMS pose a threat by offering businesses an alternative to integrated customer experience (CX) platforms. While these methods are less efficient, they serve as a basic substitute for automated communication, especially for smaller businesses or specific use cases. For instance, many small to medium-sized businesses (SMBs) continue to rely heavily on email and direct phone contact for customer interactions, bypassing the need for complex platform integration.

Large enterprises with substantial IT budgets, like major banks or telecommunications firms, often possess the capability and inclination to develop proprietary communication and customer engagement platforms. For instance, a global financial institution might invest millions in building a secure, integrated system for customer service and internal communication, bypassing the need for external SaaS providers.

These in-house solutions can be meticulously crafted to align with a company's unique workflows, data security protocols, and existing IT infrastructure. This offers a significant advantage over off-the-shelf products, as they are built from the ground up to meet very specific operational demands.

While the upfront investment can be considerable, the long-term operational control and customization potential make this a compelling alternative for some organizations. Consider the extensive investments made by companies like Salesforce in developing their own integrated CRM and cloud solutions, demonstrating the strategic value of in-house development.

The threat of substitutes from in-house solutions is particularly potent when these custom-built platforms offer superior integration, data ownership, or cost efficiencies compared to third-party offerings over the long haul.

Many general Customer Relationship Management (CRM) systems, like Salesforce Essentials or HubSpot CRM, offer basic communication and engagement tools that can serve as substitutes. While these platforms may not possess the specialized, integrated customer experience (CX) features of Zenvia, they cater to businesses needing foundational capabilities without a deep investment. For instance, in 2024, the global CRM market was valued at approximately $65 billion, indicating a vast landscape where businesses can opt for simpler, more generalized solutions.

Stand-alone Point Solutions

Businesses might opt for individual, specialized software instead of a comprehensive platform. This means using separate tools for tasks like live chat, email campaigns, or social media engagement. This strategy can serve as a substitute for a unified customer experience management system.

This approach allows companies to select best-in-class solutions for specific needs, potentially offering more tailored functionality than an all-in-one platform. For instance, a company might integrate a highly-rated live chat tool with a separate, robust email marketing service.

- Cost-Effectiveness: Businesses can acquire only the specific functionalities they require, potentially leading to lower upfront costs compared to a full platform subscription.

- Flexibility and Customization: Allows for greater tailoring of the customer experience technology stack to unique business processes and workflows.

- Vendor Lock-in Avoidance: Reduces reliance on a single provider, offering more freedom to switch individual components if performance or pricing becomes unfavorable.

- Integration Challenges: A significant drawback is the potential for integration complexities and added costs when trying to make disparate systems work together seamlessly.

Manual Customer Service and Sales Processes

For businesses, especially smaller ones or those not heavily invested in digital tools, manual customer service and sales processes represent a significant substitute. These methods often rely on direct human interaction, like phone calls or in-person meetings, and can be less scalable than automated solutions. However, they bypass the subscription or platform fees associated with digital engagement, making them a cost-effective alternative for some.

While these manual approaches might avoid immediate technology investment, their limitations become apparent as a business grows. The cost of labor for a large volume of customer interactions can quickly outweigh the savings from not using a digital platform. For instance, a company relying solely on phone support for customer inquiries in 2024 might find its operational costs escalating rapidly compared to a competitor using a chatbot or self-service portal, which can handle a much larger volume of queries at a lower per-interaction cost.

- Cost Advantage: Manual processes avoid recurring software or platform fees.

- Accessibility: Human interaction can be more accessible for certain customer demographics.

- Scalability Issues: Direct human involvement limits the volume of transactions that can be handled efficiently.

- Potential for Higher Per-Unit Cost: As volume increases, the labor cost per interaction can become prohibitive.

Businesses can opt for specialized software for individual customer engagement tasks instead of a comprehensive platform. This fragmented approach, using separate tools for live chat, email marketing, or social media, acts as a substitute for unified customer experience management systems. Such a strategy allows for selecting best-in-class solutions for specific needs, potentially offering more tailored functionality.

The threat of substitutes is amplified by the availability of more basic, generalized CRM systems. For example, in 2024, the global CRM market was valued around $65 billion, highlighting a vast sector where companies can choose simpler, less integrated solutions over specialized CX platforms. These alternatives cater to businesses requiring foundational capabilities without deep platform investment.

These substitutes, whether specialized tools or simpler CRMs, offer cost-effectiveness and flexibility, allowing companies to acquire only needed functionalities and avoid vendor lock-in. However, they often introduce integration challenges and added costs to connect disparate systems effectively.

Entrants Threaten

Entering the cloud-based customer experience (CX) platform market, like the one Zenvia operates in, demands substantial upfront capital. Companies need to invest heavily in robust cloud infrastructure, cutting-edge technology development, particularly in areas like artificial intelligence and machine learning, and aggressive marketing to gain traction. For instance, building a comprehensive platform comparable to Zenvia Customer Cloud requires millions in R&D and operational setup.

Developing and maintaining advanced, AI-powered customer experience (CX) platforms requires deep expertise in cloud infrastructure, artificial intelligence, and data science. New companies struggle to match the established technological prowess of incumbents like Zenvia, which continually invests in R&D.

The fierce competition for specialized talent, particularly AI engineers and cloud architects, presents a substantial hurdle for emerging players. For instance, in 2024, the demand for AI specialists significantly outstripped supply, driving up compensation and making recruitment a costly endeavor for startups aiming to compete with established tech firms.

Established players like Zenvia have cultivated significant brand recognition over two decades, serving more than 10,000 clients. This deep-rooted presence, especially in Latin America, makes it challenging for new entrants to gain traction. Building trust and displacing existing, loyal customer bases requires substantial investment and a compelling value proposition.

Regulatory Hurdles and Compliance

The customer communication and data management sector is heavily influenced by stringent regulatory frameworks, acting as a significant barrier for newcomers. Navigating complex data privacy laws like Brazil's LGPD or Europe's GDPR requires substantial investment in compliance infrastructure and expertise, making market entry costly. For instance, companies must allocate resources to data security, consent management, and breach notification protocols, all of which add to operational expenses.

These compliance costs can deter smaller or less capitalized entrants. Zenvia, operating in this space, must continuously adapt its systems to meet evolving data protection standards. In 2024, the ongoing scrutiny of data handling practices by regulatory bodies worldwide means that any new player would face immediate and substantial compliance overheads, potentially hindering their ability to compete on price or innovation from the outset.

- LGPD Compliance Costs: New entrants in Brazil must invest in data protection officers and secure data processing systems, adding significant upfront and ongoing expenses.

- GDPR Impact: Companies targeting European markets face similar mandatory investments, impacting scalability and operational flexibility.

- Increased Scrutiny: Regulatory bodies worldwide are increasing enforcement actions, raising the stakes for non-compliance and deterring potential market entrants.

- Data Security Investments: Essential for compliance, these investments in encryption, access controls, and regular audits are a considerable hurdle for new companies.

Access to Distribution Channels and Ecosystems

Zenvia actively cultivates its market presence through a multi-pronged approach. This includes a dedicated direct sales force, a carefully nurtured network of partners, and the recent introduction of a franchising model, all designed to broaden its customer reach.

For new companies entering the customer engagement platform market, replicating Zenvia's established distribution channels and intricate partner ecosystems presents a significant hurdle. This process is not only time-intensive but also demands substantial capital investment to develop comparable reach and credibility.

- Zenvia's Distribution Strategy: Direct sales, partner network expansion, and franchising.

- Barrier to Entry: The cost and time required for new entrants to build equivalent distribution and partner networks.

- Ecosystem Development: The challenge for newcomers in establishing a robust and supportive partner ecosystem comparable to Zenvia's.

The threat of new entrants into the cloud-based customer experience (CX) platform market is moderate, largely due to significant capital requirements and the need for specialized expertise. Building a platform comparable to Zenvia's requires substantial investment in R&D and infrastructure, estimated in the millions. Furthermore, the intense competition for skilled talent, particularly in AI, makes it difficult for newcomers to match established players' technological capabilities, a challenge amplified in 2024 by a significant talent shortage.

Brand loyalty and established distribution networks also act as considerable barriers. Zenvia's two-decade presence and extensive client base, serving over 10,000 customers, create a strong competitive advantage. New entrants must overcome the high cost and time associated with building comparable brand recognition and distribution channels, including direct sales forces and partner networks.

Regulatory compliance further elevates the barriers to entry. Navigating complex data privacy laws like Brazil's LGPD and Europe's GDPR demands significant investment in legal expertise, data security infrastructure, and ongoing compliance efforts. In 2024, increased regulatory scrutiny globally means new entrants face immediate and substantial compliance overheads, potentially hindering their ability to compete on price or innovation.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | High upfront investment in technology, infrastructure, and marketing. | Significant financial hurdle for startups. | Millions required for R&D and operational setup to match established platforms. |

| Technological Expertise | Need for deep knowledge in cloud, AI, and data science. | Difficulty in matching incumbent innovation and platform sophistication. | AI talent demand in 2024 significantly outstripped supply, driving up recruitment costs. |

| Brand Recognition & Loyalty | Established trust and customer relationships of incumbents. | Challenge in acquiring customers and displacing existing providers. | Zenvia serves over 10,000 clients, indicating a strong existing market presence. |

| Distribution Channels | Need to build extensive sales forces and partner networks. | Time-consuming and capital-intensive process to achieve market reach. | Zenvia's multi-pronged approach includes direct sales, partners, and franchising. |

| Regulatory Compliance | Adherence to data privacy laws (e.g., LGPD, GDPR). | Adds substantial operational costs and complexity. | LGPD compliance requires investment in data protection officers and secure systems. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zenvia leverages a robust mix of data, including company financial statements, investor presentations, and publicly available market research reports. We also incorporate insights from industry news, regulatory filings, and competitive landscape analyses to provide a comprehensive view.