Zhejiang Yinlun Machinery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Yinlun Machinery Bundle

Navigate the complex external forces shaping Zhejiang Yinlun Machinery's future with our comprehensive PESTLE analysis. Uncover how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting this key player in the automotive industry. Our expertly crafted report provides actionable intelligence, allowing you to anticipate challenges and capitalize on emerging opportunities. Gain a strategic advantage by understanding the complete external landscape. Download the full PESTLE analysis now and empower your decision-making.

Political factors

The Chinese government's robust backing for the new energy vehicle (NEV) sector remains a significant political driver. Policies such as tax exemptions on NEV purchases and active trade-in programs, which were notably extended into 2025, continue to stimulate demand. These measures are designed to fast-track the transition to electric mobility, directly benefiting manufacturers like Zhejiang Yinlun that specialize in essential NEV components.

Ongoing trade tensions, particularly between the US and China, present a notable political risk for Zhejiang Yinlun Machinery. The imposition of tariffs, such as those seen on Chinese goods entering the US market, directly impacts import costs for essential components and raw materials. For instance, in 2024, the US continued to review and adjust tariffs on various Chinese imports, creating an unpredictable cost structure for businesses relying on global supply chains.

Rising protectionist policies globally can disrupt established supply chains and increase operational expenses. Zhejiang Yinlun, as a significant player in the automotive parts industry, may face higher costs for imported materials or components due to these trade barriers. This can directly affect their manufacturing efficiency and the competitiveness of their exports in international markets, as evidenced by the persistent trade disputes that characterized the global economic landscape in late 2024 and early 2025.

Zhejiang province, the home of Zhejiang Yinlun Machinery, actively pursues industrial policies designed to boost advanced manufacturing and support key local enterprises. These initiatives, often targeting 'eagle enterprises' and 'single champions,' aim to create a more competitive and innovative industrial ecosystem.

Specific local government programs, such as Zhejiang's '8 plus 4' economic policy system projected for 2025, are crucial. These policies can translate into tangible benefits for companies like Yinlun, including financial aid, specialized talent development, and preferential treatment that accelerates growth and technological advancement.

The objective of these government-driven strategies is to modernize the province's industrial base and fortify its economic resilience against global challenges. For Zhejiang Yinlun, this translates to a supportive environment that can enhance its capacity for innovation and market expansion.

Supply Chain Resilience and Geopolitical Instability

Geopolitical tensions and the drive for supply chain resilience are reshaping global manufacturing strategies. Many companies are actively reducing their dependence on single-country production hubs, a shift that could impact Zhejiang Yinlun's international collaborations and how it sources components. This diversification trend is a significant consideration for maintaining stable operations and market access.

The global reliance on China for critical materials, such as rare earth metals, poses a notable risk. China's dominance in this sector, with an estimated 60% of global rare earth mining and 85% of processing in 2023 according to the US Geological Survey, directly affects industries that depend on these elements for their products, including advanced manufacturing and electronics.

- Diversification Efforts: Businesses are exploring nearshoring and friend-shoring options to mitigate risks associated with geopolitical instability.

- Rare Earth Metal Dependence: China's significant control over rare earth supply chains presents a vulnerability for industries reliant on these materials.

- Strategic Sourcing: Zhejiang Yinlun may need to adapt its sourcing strategies to accommodate these global shifts towards more distributed supply networks.

Regulatory Environment for Automotive Industry

China's regulatory environment significantly shapes the automotive sector, directly impacting companies like Zhejiang Yinlun. The government's commitment to electric vehicle (EV) adoption, for instance, is a major driver. Mandates for new energy vehicle sales and increasingly stringent fuel consumption requirements are key policies influencing demand for Yinlun's thermal management systems.

For example, the draft legislation concerning 'Requirements for the Management of Passenger Car Enterprise Average Fuel Consumption and New Energy Vehicle Credits in 2026-2027' underscores this trend. This signals a continued regulatory push toward EVs, which is generally a positive signal for Zhejiang Yinlun's core business as it produces components crucial for efficient vehicle operation, including those for new energy vehicles.

- Continued Push for EV Adoption: China's dual-credit system, which incentivizes the production of new energy vehicles and penalizes high fuel consumption, is expected to remain a cornerstone of automotive policy.

- Stricter Fuel Economy Standards: The average fuel consumption targets for passenger vehicles are progressively tightened, encouraging manufacturers to adopt more efficient technologies.

- Support for Green Technologies: Government subsidies and tax incentives for electric vehicles and related components continue to foster market growth.

- Impact on Component Suppliers: These regulations directly influence the types of components automakers need, creating opportunities for suppliers specializing in thermal management for EVs and fuel-efficient internal combustion engines.

China's strong support for the new energy vehicle (NEV) sector, including tax exemptions and trade-in programs extended into 2025, directly benefits Zhejiang Yinlun's component business. However, global trade tensions and rising protectionism in 2024-2025 create import cost unpredictability and can hinder international competitiveness. Furthermore, China's evolving regulatory landscape, with mandates for NEV sales and tightening fuel economy standards, continues to shape demand for Yinlun's thermal management systems, signaling a positive trend for EV-related products.

What is included in the product

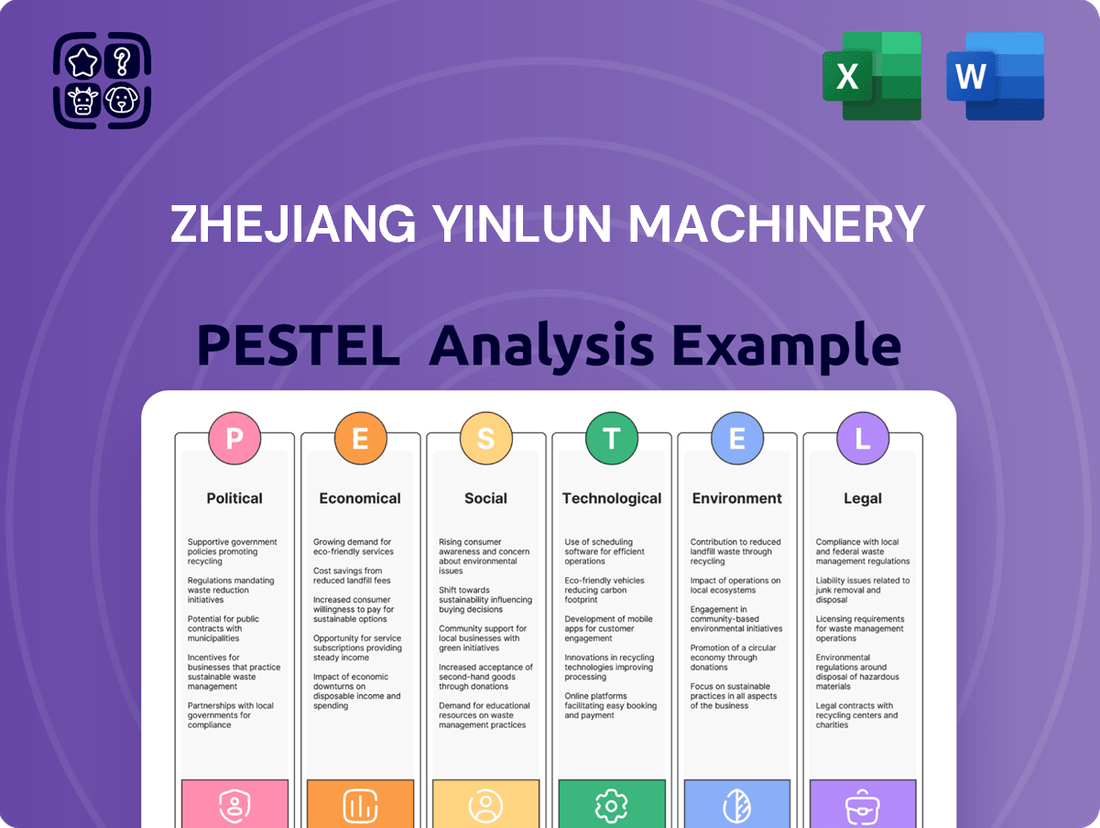

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Zhejiang Yinlun Machinery, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market trends and regulatory landscapes.

A PESTLE analysis of Zhejiang Yinlun Machinery provides a clear, summarized version of external factors, acting as a pain point reliever by enabling quick identification of opportunities and threats for strategic planning.

Economic factors

China's new energy vehicle (NEV) market is on a strong upward trajectory. In the first half of 2025, NEV sales saw substantial increases, with NEVs representing a significant share of all new vehicle sales. This robust domestic demand, fueled by government incentives and growing consumer preference, directly benefits companies like Zhejiang Yinlun that provide thermal management systems for these vehicles.

The penetration rate for new electric vehicles (EVs) in China surpassed 50% for multiple months throughout 2024. This trend highlights a rapidly expanding core market for NEVs. For Zhejiang Yinlun Machinery, this continued expansion signifies a growing customer base and increased demand for its specialized components, positioning the company for future growth within this dynamic sector.

The global economic landscape in 2025 and 2026 anticipates a gentle deceleration in growth, largely due to ongoing geopolitical friction and a rise in protectionist trade measures. This prevailing uncertainty could dampen demand across key sectors like automotive and heavy industry on a worldwide scale, directly influencing Zhejiang Yinlun Machinery's overseas sales and its overall revenue trajectory. For instance, the IMF's April 2025 World Economic Outlook projects global growth at 3.2% for 2025, a slight dip from previous years.

While China's economic expansion is expected to moderate, it is still forecast to remain a significant contributor to global growth. Projections suggest China's GDP growth could settle around 5% in 2025, providing a relatively stable domestic market. However, the interplay between domestic policies and international trade dynamics will remain critical for companies like Zhejiang Yinlun, affecting their ability to leverage the Chinese market effectively amidst global shifts.

China's manufacturing sector is experiencing significant headwinds, with labor costs in manufacturing provinces like Zhejiang seeing consistent annual increases, averaging around 5-7% in recent years. These rising expenses, coupled with the impact of tariffs on imported components, directly translate to higher operational costs for companies like Zhejiang Yinlun Machinery. The ongoing global supply chain disruptions, exemplified by port congestion and shipping container shortages, further exacerbate these challenges, potentially delaying production and increasing freight expenses.

These mounting cost pressures and supply chain vulnerabilities compel businesses to rethink their operational strategies. Diversifying sourcing away from single regions, a trend gaining momentum throughout 2024 and projected to continue into 2025, is becoming a critical risk mitigation tactic. For Zhejiang Yinlun, this could mean exploring new supplier relationships or even regionalizing certain production steps, impacting overall cost structures and competitive positioning in the global market.

Investment in Infrastructure and Industrial Modernization

The Chinese government, including significant efforts within Zhejiang province, is channeling substantial funds into infrastructure development and industrial upgrades. This push is designed to boost economic growth and enhance global competitiveness. A prime example is the ongoing focus on advanced manufacturing sectors, which directly aligns with the modernization of industrial capabilities.

These large-scale investments, often referred to by initiatives like the 'Thousand Projects, Trillion-Yuan Investments' program, are creating a more robust environment for industrial expansion. By the end of 2023, China's total infrastructure investment had seen a notable increase, signaling the government's commitment to this strategy. This trend is expected to continue through 2024 and into 2025.

For Zhejiang Yinlun Machinery, this translates into a potentially stronger market for its products. Increased industrial activity and modernization projects will likely drive demand for machinery and equipment. Specifically, the focus on advanced manufacturing suggests opportunities in sectors requiring sophisticated machinery solutions.

- Government investment in infrastructure and industrial modernization is a key economic driver.

- Initiatives like 'Thousand Projects, Trillion-Yuan Investments' underscore this commitment.

- Focus on advanced manufacturing is expanding opportunities for industrial equipment suppliers.

- China's infrastructure investment saw significant growth in 2023, a trend projected to persist.

Competition in the Automotive and Component Market

The burgeoning New Energy Vehicle (NEV) market in China, a key growth area for Zhejiang Yinlun, is characterized by intense competition. This dynamic environment sees both established international automakers and a rapidly expanding field of domestic players vying for market share, escalating the pressure on component suppliers like Yinlun to innovate and remain cost-competitive.

Zhejiang Yinlun's position in the heat exchanger and thermal management solutions sector is particularly sensitive to this competitive pressure. To sustain and grow its market presence, the company must continuously invest in research and development for advanced thermal technologies while simultaneously optimizing its production processes to offer competitive pricing.

The fierce rivalry among Chinese EV manufacturers, such as BYD, NIO, and XPeng, further intensifies the demand for differentiated and high-performance components. This necessitates that Yinlun not only supply reliable parts but also offer solutions that contribute to the unique selling propositions of its automotive clients, emphasizing the need for strong market positioning and technological leadership.

- China's NEV sales reached approximately 9.5 million units in 2023, a significant increase from previous years, highlighting the market's growth and competitive intensity.

- The average selling price for NEVs in China has seen a downward trend, putting pressure on component suppliers to reduce costs without compromising quality.

- Many Chinese EV startups are heavily focused on proprietary technology and integrated solutions, demanding advanced thermal management systems that Yinlun must be capable of delivering.

The global economic outlook for 2025 and 2026 indicates a slowdown, with growth projected at 3.2% for 2025 according to the IMF. This deceleration, driven by geopolitical tensions and trade protectionism, could negatively impact Zhejiang Yinlun's international sales by reducing demand in key automotive and industrial sectors.

Despite global headwinds, China's economy is expected to maintain robust growth, with forecasts around 5% for 2025. This sustained domestic expansion offers a stable market for Yinlun, though its success will be influenced by the balance between internal policies and international trade conditions.

Full Version Awaits

Zhejiang Yinlun Machinery PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Zhejiang Yinlun Machinery covers political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. Gain valuable insights into market dynamics, regulatory landscapes, and future growth opportunities by examining this detailed report.

Sociological factors

Consumer preferences in China are significantly leaning towards new energy vehicles (NEVs). This shift is fueled by a combination of government incentives, growing environmental consciousness, and the increasing practicality of owning an electric car. Surveys from 2024 indicate that a substantial portion of Chinese consumers are now seriously considering an NEV for their next vehicle purchase, reflecting a deep societal transformation that directly boosts demand for companies like Zhejiang Yinlun Machinery that provide crucial thermal management systems.

This evolving market dynamic, moving from a 'regulatory push' to a 'consumer pull' scenario, highlights the increasing maturity of China's NEV sector. For instance, by the end of 2024, NEV sales in China were projected to exceed 9 million units, a testament to this growing consumer acceptance and a strong indicator of sustained demand for advanced automotive components.

Public awareness of environmental protection and air quality is significantly increasing, directly influencing consumer choices and regulatory pressures. This growing concern fuels demand for technologies that mitigate pollution, creating a robust market for companies like Zhejiang Yinlun that specialize in exhaust gas after-treatment systems.

Zhejiang Yinlun's product portfolio, focused on reducing harmful emissions from vehicles and industrial machinery, aligns perfectly with these societal shifts. For instance, the increasing adoption of New Energy Vehicles (NEVs) in China, which has seen substantial carbon emission reductions, underscores the market's move towards cleaner alternatives, benefiting companies providing essential emission control components.

China's manufacturing sector, particularly advanced areas like automotive components where Zhejiang Yinlun operates, is experiencing a significant shift in its workforce. The demand is increasingly for higher-level competencies, encompassing advanced technical manufacturing skills, digital literacy, and crucial soft skills essential for navigating industrial modernization.

This evolving landscape necessitates that Zhejiang Yinlun proactively revises its workforce strategies. Adapting talent attraction and retention practices will be key to securing the necessary skilled personnel for a future-focused, technologically sophisticated manufacturing environment.

Urbanization and Infrastructure Development

China's ongoing urbanization continues to fuel demand for vehicles, directly benefiting Zhejiang Yinlun Machinery. This trend is particularly strong in sectors like commercial transport and construction, both significant markets for the company's heat exchange solutions. By 2025, it's projected that over 70% of China's population will reside in urban areas, a substantial increase that translates to greater vehicle needs.

The expansion of urban infrastructure, including the critical development of electric vehicle (EV) charging networks, creates a favorable environment for Yinlun's presence in the new energy vehicle market. China's commitment to green transportation is evident in its charging infrastructure build-out; by the end of 2024, the nation had already deployed over 9 million charging piles, a number poised for further growth and supporting widespread EV adoption.

- Urban Population Growth: China's urbanization rate is expected to exceed 70% by 2025, increasing vehicle demand.

- EV Charging Infrastructure: Over 9 million charging piles were operational across China by the close of 2024, facilitating EV adoption.

- Commercial & Construction Sectors: These key industries, driven by urbanization, represent significant demand for Yinlun's heat exchangers.

Brand Reputation and Corporate Social Responsibility (CSR)

Societal expectations are placing greater emphasis on a company's brand reputation and its commitment to Corporate Social Responsibility (CSR). This is particularly true concerning environmental impact. Zhejiang Yinlun's strategic direction, evidenced by its development of exhaust gas after-treatment systems and thermal management solutions for New Energy Vehicles (NEVs), directly addresses these growing concerns. By aligning its product portfolio with sustainability, Yinlun enhances its attractiveness to environmentally conscious consumers and investors alike.

The company's dedication to environmental regulations and ethical business practices significantly shapes its public image. For instance, in 2023, Zhejiang Yinlun reported a substantial increase in its revenue from new energy vehicle components, indicating market acceptance of its green initiatives. This positive public perception is crucial for maintaining stakeholder trust and fostering long-term brand loyalty.

- Brand Reputation: Strong CSR initiatives, especially in environmental protection, bolster brand image.

- Societal Scrutiny: Consumers and stakeholders are increasingly evaluating companies based on their environmental and social impact.

- Product Alignment: Yinlun's focus on NEV thermal management and emissions control resonates with these societal trends.

- Public Perception: Adherence to environmental standards and ethical conduct positively influences public opinion and stakeholder relations.

Chinese consumer preferences are rapidly shifting towards New Energy Vehicles (NEVs), driven by environmental awareness and government support. This trend significantly boosts demand for companies like Zhejiang Yinlun Machinery, which supplies critical thermal management and emissions control systems. By 2024, NEV sales in China were projected to surpass 9 million units, demonstrating strong consumer adoption.

| Sociological Factor | Impact on Zhejiang Yinlun Machinery | Supporting Data (2024-2025 Projections/Trends) |

|---|---|---|

| Consumer Preference for NEVs | Increased demand for thermal management and emission control systems. | China NEV sales projected to exceed 9 million units in 2024. |

| Environmental Consciousness | Drives demand for cleaner technologies and positively impacts brand image. | Growing public concern about air quality and pollution. |

| Urbanization | Increases overall vehicle demand, particularly in commercial and construction sectors. | Urbanization rate projected to exceed 70% by 2025. |

| Brand Reputation & CSR | Enhances market attractiveness and stakeholder trust for companies with strong sustainability focus. | Increased focus on environmental impact and ethical business practices. |

Technological factors

The swift progress in new energy vehicles (NEVs) demands constant upgrades in thermal management systems to boost battery performance, safety, longevity, and overall efficiency. For instance, advancements in liquid cooling, phase change materials, and integrated heat pump systems are crucial for maintaining optimal battery operating temperatures, which directly impacts range and charging speed. The global electric vehicle thermal management system market was valued at approximately $12.1 billion in 2023 and is anticipated to grow significantly, with some forecasts suggesting it could reach over $30 billion by 2030.

Zhejiang Yinlun Machinery, as a key supplier of comprehensive thermal management solutions for NEVs, is well-positioned to benefit from these technological leaps. Innovations in areas like advanced cooling technologies, the integration of novel materials such as graphene for enhanced heat dissipation, and the development of AI-driven predictive systems for proactive thermal control represent significant market opportunities. These advancements are critical for extending battery life and ensuring reliable operation across diverse environmental conditions, a key selling point for NEV manufacturers.

Increasingly tough emission rules worldwide are pushing advancements in exhaust gas after-treatment technologies for both diesel and gasoline engines. Zhejiang Yinlun, a key player in this sector, needs to keep investing in research and development to create better, more efficient, and smaller systems. This includes improving catalyst materials, sensors, and the electronic control units that manage the whole process.

The global market for these after-treatment systems is projected for substantial growth, driven primarily by these tightening regulations. For instance, the market for Selective Catalytic Reduction (SCR) systems, a key component in diesel exhaust after-treatment, was valued at over $12 billion in 2023 and is expected to see a compound annual growth rate of around 6% through 2030, according to industry reports.

The integration of AI and digital simulation is transforming product development. For Zhejiang Yinlun, this means advanced embedded predictive thermal management, allowing for real-time temperature monitoring and automated system optimization. This convergence enhances product design and creates more efficient, adaptable solutions.

Companies are investing heavily in these technologies. For instance, the global AI market was valued at over $200 billion in 2023 and is projected to grow significantly, with simulation software also seeing robust expansion. Zhejiang Yinlun can tap into this trend to refine its manufacturing processes and improve product performance.

Furthermore, AI's application in areas like humanoid robots, including their thermal management, opens new avenues for innovation. Zhejiang Yinlun could explore these emerging applications to diversify its offerings and stay ahead in a rapidly evolving technological landscape.

Material Science Innovations

Innovations in material science are significantly shaping the future of heat exchangers and thermal management systems, directly benefiting companies like Zhejiang Yinlun Machinery. Advances in areas like nanomaterials and advanced composites are key to creating lighter, more efficient, and robust components. For instance, research into graphene and carbon nanotubes promises enhanced heat transfer capabilities. A 2024 report highlighted that materials incorporating graphene could improve thermal conductivity by up to 200% compared to traditional materials. This translates to tangible performance gains for Yinlun's product lines.

The pursuit of superior thermal barrier coatings also relies heavily on breakthroughs in material science. Ceramic nanomaterials, for example, are being explored for their potential to withstand higher temperatures and reduce heat loss, a critical factor in engine efficiency and longevity. The global market for advanced ceramics, including those used in high-temperature applications, was projected to reach over $12 billion in 2024, indicating substantial ongoing investment and development in this area. These developments offer Zhejiang Yinlun opportunities to integrate cutting-edge materials into their offerings.

Furthermore, the increasing emphasis on sustainability is driving a focus on developing recyclable and environmentally friendly materials for heat exchangers. This trend aligns with global efforts to reduce waste and carbon footprints across industries. By 2025, it's anticipated that a significant portion of new material development in automotive components will prioritize recyclability. Zhejiang Yinlun's strategic adoption of such materials could provide a competitive edge and meet evolving regulatory and consumer demands.

Key material science advancements impacting Zhejiang Yinlun include:

- Nanomaterial Integration: Utilizing materials like graphene and carbon nanotubes for improved heat transfer efficiency.

- Advanced Composites: Developing lighter and stronger components for enhanced durability and performance.

- Ceramic Nanomaterials: Enhancing thermal barrier coatings for higher temperature resistance and reduced heat loss.

- Sustainable Materials: Focusing on recyclable and eco-friendly options to meet environmental regulations and market preferences.

Automation and Smart Manufacturing

The push towards automation and smart manufacturing in China is a significant technological driver. This trend, marked by increasing adoption of industrial robotics, directly boosts production efficiency, elevates product quality, and sharpens responsiveness to fluctuating market demands. For Zhejiang Yinlun, integrating advanced automation into its facilities offers a clear path to optimizing production lines and enhancing overall operational capabilities.

China's leading position in the industrial robotics sector, with investments reaching billions, underpins its advanced manufacturing ambitions. By leveraging these advancements, companies like Zhejiang Yinlun can expect to see improved precision and reduced labor costs.

- Production Efficiency: Automation can reduce cycle times and increase output volume.

- Quality Control: Robotic systems offer consistent precision, minimizing defects.

- Cost Reduction: Lower labor costs and reduced material waste contribute to profitability.

- Market Responsiveness: Flexible automation allows for quicker adaptation to new product designs and demand shifts.

The rapid evolution of electric vehicle (EV) technology necessitates advanced thermal management solutions. Zhejiang Yinlun Machinery is at the forefront, integrating innovations like AI-driven predictive thermal management and novel materials such as graphene for enhanced cooling. The global EV thermal management market, valued at approximately $12.1 billion in 2023, is projected for substantial growth, highlighting the critical role of technological advancement.

Furthermore, tightening global emission standards are driving significant progress in exhaust gas after-treatment systems. Yinlun's investment in research and development for more efficient and compact systems, including improved catalyst materials and sensors, is essential. The market for Selective Catalytic Reduction (SCR) systems alone was over $12 billion in 2023, demonstrating the demand for such technological upgrades.

Material science breakthroughs, particularly in nanomaterials and advanced composites, are key to developing lighter, more efficient heat exchangers. For instance, materials incorporating graphene can improve thermal conductivity by up to 200%. Zhejiang Yinlun's adoption of these materials, alongside advancements in ceramic nanomaterials for thermal barrier coatings, positions it to capitalize on this trend, with the advanced ceramics market projected to exceed $12 billion in 2024.

The increasing adoption of automation and smart manufacturing, especially in China, is enhancing production efficiency and quality control. Zhejiang Yinlun's integration of industrial robotics, supported by billions invested in China's robotics sector, allows for optimized production and improved product precision, leading to reduced costs and enhanced market responsiveness.

| Technological Factor | Impact on Zhejiang Yinlun | Market Data/Opportunity | Key Innovations |

| EV Thermal Management | Demand for advanced cooling solutions | Global market ~ $12.1B (2023), growing rapidly | AI-driven predictive systems, liquid cooling, phase change materials |

| Emission Control Technologies | Need for improved after-treatment systems | SCR market ~ $12B (2023), ~6% CAGR | Advanced catalyst materials, sensors, ECU integration |

| Material Science | Development of lighter, more efficient components | Graphene-enhanced materials ~200% conductivity increase | Nanomaterials (graphene, carbon nanotubes), advanced composites, ceramic nanomaterials |

| Automation & Smart Manufacturing | Increased production efficiency and quality | Significant investment in industrial robotics in China | Robotic integration, AI in manufacturing processes |

Legal factors

China's commitment to environmental protection is evident in its evolving legal landscape, with increasingly stringent regulations like the China VI emission standards for vehicles and the ongoing expansion of its national carbon trading plan. These policies directly impact industries reliant on emissions control. For Zhejiang Yinlun Machinery, a key player in exhaust gas after-treatment products, these mandates create a market opportunity, as demand for their solutions is legally driven.

However, the company also faces rigorous compliance obligations for its own manufacturing operations. Failure to adhere to these environmental laws can result in significant financial penalties, potentially leading to operational disruptions or even temporary shutdowns, underscoring the critical importance of robust environmental management systems for sustained business operations and market positioning.

As the automotive sector, particularly electric vehicles, increasingly depends on cutting-edge tech, safeguarding intellectual property is paramount for companies like Zhejiang Yinlun. China has been actively enhancing its IP enforcement, with stricter penalties for infringement and dedicated forums for automotive IP discussions, signaling a more protective environment.

Zhejiang Yinlun must implement strong IP strategies to shield its innovative designs and proprietary technologies from unauthorized use. This involves proactive measures to register patents and defend its innovations in a rapidly evolving and competitive automotive landscape.

Navigating potential IP disputes, especially concerning patents and licensing agreements, is a critical legal consideration. The company needs to stay abreast of evolving IP laws and vigorously protect its market position through sound legal practices and strategic patent management.

Zhejiang Yinlun Machinery must navigate strict product safety and quality standards, especially concerning automotive and new energy vehicle components where defects can lead to serious repercussions. For instance, the automotive industry is increasingly focused on safety, with regulations tightening around components like those in thermal management systems, critical for both traditional and electric vehicles.

Regulatory bodies are intensifying their oversight, particularly concerning marketing claims for advanced driver-assistance systems (ADAS). Following reported incidents, there's a heightened demand for absolute transparency and strict adherence to safety protocols across all automotive parts, including those Yinlun produces.

Compliance with both international and domestic quality benchmarks is not merely a suggestion but a prerequisite for market entry and maintaining a strong corporate reputation. In 2024, the global automotive market saw significant recalls related to component failures, underscoring the financial and reputational risks of non-compliance.

Labor Laws and Employment Regulations

As a major manufacturer in China, Zhejiang Yinlun Machinery is bound by the nation's comprehensive labor laws and employment regulations. These laws dictate critical aspects of its operations, including minimum wage requirements, standards for working conditions, and overall employment practices. Staying compliant is paramount for smooth business operations and avoiding legal repercussions.

The evolving labor market presents both challenges and opportunities for Yinlun. Potential talent shortages, particularly for skilled manufacturing roles, necessitate proactive and competitive employment strategies. The company must focus on attracting and retaining qualified workers by offering compelling compensation, benefits, and a positive work environment. Recent data from 2024 indicate a continued demand for skilled labor within China's manufacturing sector, with some regions experiencing wage increases of up to 8% for specialized roles.

Zhejiang province itself is actively promoting the development of its manufacturing workforce. This provincial focus can be leveraged by Yinlun through partnerships with vocational schools and training programs. Such initiatives can create a pipeline of skilled talent aligned with the company's needs. For instance, government-backed training programs in Zhejiang saw a 15% increase in enrollment for advanced manufacturing skills in 2024, highlighting a growing pool of potential employees.

Key legal factors impacting Zhejiang Yinlun Machinery's employment strategies include:

- Compliance with National Labor Laws: Adherence to regulations concerning wages, working hours, social insurance contributions, and workplace safety is non-negotiable.

- Talent Acquisition and Retention: The need to develop competitive compensation packages and career development paths to attract and keep skilled employees in a tight labor market.

- Provincial Workforce Development Initiatives: Leveraging local government support for vocational training and skill enhancement to build a robust talent pool.

- Evolving Employment Protections: Staying abreast of changes in labor protection measures, such as those related to gig economy workers or new safety standards, to ensure ongoing compliance.

Trade and Tariff Regulations

Changes in international trade regulations, particularly tariffs, pose a significant challenge for Zhejiang Yinlun Machinery. For instance, the US imposition of tariffs on Chinese goods directly affects the company's export revenue and competitiveness in key markets. Navigating these complex trade barriers requires meticulous attention to customs regulations and trade agreements to maintain smooth international operations.

The ongoing trade war dynamics necessitate strategic adjustments. For example, in 2023, the US maintained tariffs on a wide range of Chinese imports, impacting sectors like automotive parts. This environment forces companies like Yinlun to re-evaluate pricing strategies and explore alternative markets or supply chain adjustments to mitigate the impact of potential future tariff increases, which could further influence global trade flows.

- Tariff Impact: US tariffs on Chinese goods can increase the cost of Zhejiang Yinlun's exported products, potentially reducing demand.

- Compliance Burden: Adhering to varying customs regulations across different export markets adds operational complexity and costs.

- Market Volatility: Fluctuations in trade policies, such as the prospect of further tariffs, create uncertainty and require agile business planning.

- Strategic Response: Companies may need to diversify export destinations or adjust their product mix to counter the effects of trade protectionism.

Zhejiang Yinlun Machinery operates within a legal framework that mandates strict adherence to environmental protection laws, including emission standards for vehicles. Compliance is crucial, as demonstrated by the significant penalties associated with violations. The company also benefits from evolving intellectual property laws in China, which are increasingly focused on protecting innovations in the automotive sector. By securing patents and actively defending its technological advancements, Yinlun can maintain a competitive edge.

Environmental factors

China's ambitious goals to reach peak carbon emissions by 2030 and achieve carbon neutrality by 2060, as detailed in its 14th Five-Year Plan and specific 2024-2025 energy reduction action plans, create a powerful tailwind for companies like Zhejiang Yinlun. This governmental drive directly fuels demand for Yinlun's thermal management systems for new energy vehicles (NEVs) and exhaust gas after-treatment solutions for conventional vehicles, both critical for emission reduction.

The ongoing expansion of China's Emissions Trading System (ETS) to encompass more industrial sectors underscores the seriousness of these environmental mandates. This policy framework incentivizes businesses to invest in cleaner technologies, a trend that directly benefits Yinlun's product portfolio focused on efficiency and emissions control.

The global market is seeing a significant surge in demand for products and solutions that are kind to the environment. This isn't just a niche trend; it's a widespread shift affecting many industries, including the automotive and industrial sectors where Zhejiang Yinlun Machinery operates.

Zhejiang Yinlun's core business, focusing on thermal management systems for electric vehicles and exhaust gas treatment for traditional vehicles, is perfectly positioned to capitalize on this growing preference for sustainability. For instance, by 2025, the global market for automotive thermal management systems is projected to reach over $40 billion, with a substantial portion driven by new energy vehicles.

This alignment with green technologies gives Zhejiang Yinlun a distinct edge. As consumers and businesses increasingly prioritize lower environmental impact, companies offering eco-friendly solutions gain a competitive advantage. This trend is expected to continue, driving innovation and market share for companies like Yinlun that are already invested in these areas.

The global push for sustainability is highlighting potential shortages of key resources, like rare earth metals, which are vital for advanced manufacturing. For Zhejiang Yinlun, this means a growing need to secure reliable, eco-friendly material sources and investigate new materials or recycling methods to counter supply chain disruptions and align with environmental goals.

China's significant role in the global supply of critical minerals, including rare earths, directly impacts international markets and presents a strategic consideration for companies like Zhejiang Yinlun. This dominance means fluctuations in Chinese policy or production can ripple through global supply chains, affecting availability and price for manufacturers worldwide.

In 2024, global demand for critical minerals is projected to surge, with the International Energy Agency forecasting a fourfold increase by 2040 for minerals essential to clean energy technologies. This increasing demand, coupled with supply chain concentration, underscores the importance of Zhejiang Yinlun's proactive approach to resource management and diversification.

Waste Management and Recycling Regulations

Stricter environmental regulations concerning industrial waste management and the push towards a circular economy are increasingly shaping the automotive sector. For Zhejiang Yinlun Machinery, this means adapting its production processes and product lifecycle strategies, especially regarding vehicle parts and batteries. The company must anticipate increased investments in advanced recycling technologies and ensure strict adherence to waste disposal and material recovery mandates.

China's commitment to a circular economy is evident in its ambitious targets. For instance, the nation aims to double the recycling rate of scrapped vehicles by 2027, a significant move that will directly influence the supply chain and material sourcing for companies like Yinlun. This policy shift necessitates a proactive approach to waste reduction and resource efficiency.

- Circular Economy Focus: Government initiatives are prioritizing resource reuse and waste minimization, impacting how vehicle components are designed, manufactured, and eventually disposed of.

- Recycling Targets: The forecast to double scrapped vehicle recycling by 2027 underscores the growing importance of end-of-life vehicle management and material recovery.

- Investment in Technology: Zhejiang Yinlun will likely need to allocate capital towards innovative recycling solutions and processes to meet evolving environmental standards.

- Compliance Costs: Adhering to new waste disposal and material recovery regulations may introduce additional operational costs for the company.

Climate Change Impact and Extreme Weather Events

Climate change is increasingly disrupting global supply chains and manufacturing. By 2025, the frequency of extreme weather events like floods and droughts is expected to significantly impact raw material availability and logistics for companies like Zhejiang Yinlun Machinery.

These environmental shifts can lead to unexpected production delays and increased operational costs. For instance, a severe drought in a key agricultural region could impact the supply of certain materials used in manufacturing, forcing adjustments to production schedules and sourcing strategies.

To mitigate these risks, Yinlun Machinery must prioritize robust contingency planning and build greater resilience into its supply chain. This involves diversifying suppliers and exploring alternative logistics routes to ensure operational continuity.

- Supply Chain Disruption: Extreme weather events in 2025 are projected to cause widespread disruptions, affecting the timely delivery of components.

- Raw Material Volatility: Climate-induced impacts on agriculture and resource extraction can lead to unpredictable price fluctuations and shortages of essential materials.

- Logistics Challenges: Damaged infrastructure due to extreme weather can impede transportation networks, increasing shipping times and costs.

- Operational Interruptions: Direct impacts of severe weather can halt factory operations, leading to lost production days and revenue.

China's commitment to carbon neutrality by 2060, with interim goals for 2030, directly benefits Yinlun's focus on thermal management for new energy vehicles (NEVs) and emissions control for traditional vehicles. The expanding Emissions Trading System further incentivizes cleaner technologies, aligning perfectly with Yinlun's product offerings.

The global demand for sustainable solutions is a significant market driver, with the automotive thermal management system market projected to exceed $40 billion by 2025, largely fueled by NEVs. This trend positions Yinlun favorably as it caters to this growing eco-conscious market preference.

Growing concerns over critical mineral supply chains, exacerbated by China's dominance in rare earth metals, highlight the need for Yinlun to secure reliable, eco-friendly material sources and explore recycling. The projected fourfold increase in demand for clean energy minerals by 2040 underscores this strategic imperative.

Increasingly stringent environmental regulations around waste management and the circular economy necessitate that Yinlun adapt its production processes and product lifecycles, especially concerning vehicle parts and batteries. China's aim to double scrapped vehicle recycling rates by 2027 emphasizes the importance of end-of-life management and resource efficiency.

PESTLE Analysis Data Sources

Our Zhejiang Yinlun Machinery PESTLE Analysis draws from a robust blend of official government publications, international economic reports, and leading automotive industry analyses. This ensures comprehensive coverage of relevant political, economic, social, technological, legal, and environmental factors impacting the company.