Zhejiang Yinlun Machinery Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Yinlun Machinery Bundle

Zhejiang Yinlun Machinery faces a dynamic competitive landscape, shaped by several critical forces. The bargaining power of buyers, particularly large automotive manufacturers, presents a significant challenge, demanding cost-efficiency and innovation. Intense rivalry among established players and the looming threat of new entrants keen to capture market share underscore the need for robust strategies.

The complete report reveals the real forces shaping Zhejiang Yinlun Machinery’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Zhejiang Yinlun Machinery's suppliers hinges significantly on the concentration of those providing critical inputs. For specialized metals like aluminum and copper, essential for their heat exchanger products, or advanced electronic components used in thermal management systems, a limited supplier base grants those suppliers greater leverage. If only a handful of companies can reliably produce these high-quality materials or components, they can dictate terms, potentially increasing costs for Yinlun.

The bargaining power of suppliers for Zhejiang Yinlun is significantly influenced by switching costs. If Yinlun needs to invest heavily in re-tooling existing manufacturing lines or re-designing its products to accommodate a new supplier's components, the cost and effort involved would be substantial. This complexity directly translates into higher switching costs, strengthening the leverage of current suppliers.

Suppliers offering highly specialized or patented components, particularly in the burgeoning new energy vehicle sector's advanced thermal management systems, significantly bolster their bargaining power. Zhejiang Yinlun's reliance on such unique inputs directly curtails its ability to switch suppliers, thereby increasing its dependence on those providing these critical, often custom-designed, parts. This situation was evident in 2024, where the demand for niche battery cooling components saw lead times extend, giving suppliers of these specific materials greater leverage in price negotiations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the production of heat exchangers or exhaust gas after-treatment systems would significantly bolster their bargaining power over Zhejiang Yinlun Machinery. This strategic move would allow suppliers to capture a larger share of the value chain by directly competing with their existing customers. For instance, a supplier of specialized aluminum alloys, if they possessed the technical capability and market access, could begin manufacturing the core heat exchanger components themselves. This would directly challenge Yinlun's core business and reduce Yinlun's ability to negotiate favorable terms.

The potential for forward integration by suppliers is a critical factor in assessing their leverage. If suppliers possess the necessary technology, capital, and market understanding to produce heat exchangers or exhaust after-treatment products, they can credibly threaten to enter Yinlun's market. This capability forces Yinlun to consider the suppliers not just as providers of raw materials but as potential competitors. In 2024, the automotive supply chain has seen increased consolidation and vertical integration efforts by component manufacturers seeking to diversify revenue streams and capture higher margins, making this threat particularly relevant.

- Supplier Capability: Suppliers must possess the technical expertise and manufacturing infrastructure to produce finished heat exchangers or exhaust gas after-treatment components.

- Market Access: Suppliers would need established relationships with original equipment manufacturers (OEMs) or the ability to develop them to sell their integrated products.

- Cost Advantage: For forward integration to be a credible threat, suppliers would need to demonstrate they can produce these components at a cost comparable to or lower than Yinlun.

- Strategic Motivation: Suppliers might be motivated to integrate forward if they see declining margins in their current product lines or significant growth opportunities in Yinlun's market.

Importance of Yinlun to Supplier's Business

The relative importance of Zhejiang Yinlun Machinery as a customer significantly influences its bargaining power with suppliers. If Yinlun constitutes a minor segment of a supplier's overall sales, that supplier is likely to possess greater leverage in negotiating terms, pricing, and delivery timelines. This dynamic can lead to less favorable conditions for Yinlun if it’s not a primary client.

Suppliers who view Yinlun as a less critical account may be less inclined to accommodate specific requests or offer preferential pricing. This is particularly true for suppliers with a diverse customer base where Yinlun’s contribution is not substantial enough to warrant special attention or concessions. Consequently, Yinlun must assess its purchasing volume and its impact on supplier revenue to gauge this aspect of supplier power.

- Customer Dependency: If Yinlun represents a small percentage of a supplier's total revenue, the supplier has more autonomy to set terms, potentially increasing costs or reducing flexibility for Yinlun.

- Supplier Market Share: For suppliers with a dominant position in their respective markets, Yinlun's importance might be diminished, granting them greater pricing power.

- Contractual Agreements: The nature of existing contracts can mitigate or exacerbate this power imbalance, with long-term, high-volume agreements typically favoring the buyer.

- Alternative Suppliers: The availability of numerous alternative suppliers willing to meet Yinlun’s needs reduces the bargaining power of any single supplier, especially if Yinlun is a significant customer to them.

Suppliers of specialized materials, like high-performance aluminum alloys or advanced electronic components for thermal management systems, possess significant bargaining power if they are few in number. This concentration means Yinlun has limited options, allowing these suppliers to dictate terms and potentially increase prices, especially for critical inputs like those needed for new energy vehicle components. In 2024, the tight supply of certain rare earth elements used in advanced automotive cooling systems exemplifies this leverage, with lead times and prices increasing due to limited global production capacity.

The bargaining power of Zhejiang Yinlun Machinery's suppliers is amplified by high switching costs, which arise when changing suppliers requires substantial investment in re-tooling or product redesign. This was a notable factor in 2024 for components in the electric vehicle sector, where the integration of new battery cooling technologies often involved complex engineering changes, making it difficult and costly for manufacturers like Yinlun to switch suppliers mid-production, thus strengthening existing supplier positions.

Suppliers who can credibly threaten to integrate forward into Yinlun's business, such as by producing finished heat exchangers themselves, hold considerable power. This threat is more potent if suppliers have the technical capability, market access, and a cost advantage. In 2024, the trend of vertical integration within the automotive supply chain, driven by companies seeking to control more of the value chain and capture higher margins, made this a relevant concern, potentially forcing Yinlun to negotiate more cautiously.

| Factor | Impact on Yinlun's Supplier Bargaining Power | 2024 Relevance/Example |

|---|---|---|

| Supplier Concentration | High if few suppliers for critical inputs (e.g., specialized alloys) | Limited supply of rare earth elements for EV cooling systems increased supplier leverage. |

| Switching Costs | High when re-tooling or redesign is needed for new components | Complex integration of new EV battery cooling tech made switching difficult and costly. |

| Forward Integration Threat | Significant if suppliers can produce finished goods | Vertical integration trends in auto supply chain increased potential for competition from suppliers. |

| Yinlun's Customer Importance | Low if Yinlun is a small part of supplier's revenue | Suppliers with dominant market share may have less incentive to offer favorable terms to smaller clients. |

What is included in the product

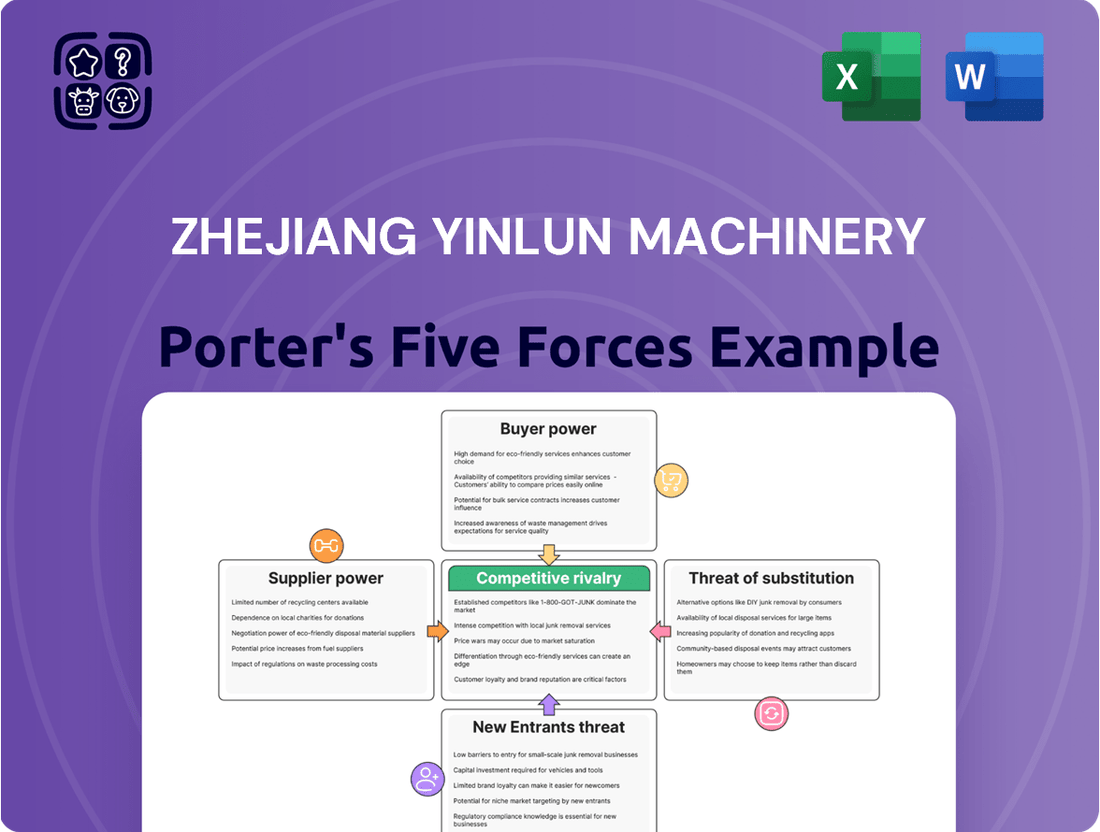

This Porter's Five Forces analysis for Zhejiang Yinlun Machinery dissects the competitive landscape, focusing on supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive components industry.

Instantly visualize the competitive landscape for Zhejiang Yinlun Machinery, revealing key pressures from suppliers, buyers, new entrants, substitutes, and existing rivals.

Navigate competitive threats with clarity, allowing Zhejiang Yinlun Machinery to proactively address supplier power and buyer bargaining to maintain profitability.

Customers Bargaining Power

Zhejiang Yinlun Machinery's customer concentration is a key factor influencing the bargaining power of its customers. The company primarily serves large automotive original equipment manufacturers (OEMs), construction machinery producers, and commercial vehicle manufacturers.

If a substantial portion of Yinlun's revenue comes from a small number of these major clients, those customers wield significant leverage. This leverage stems from the sheer volume of their orders, giving them the ability to negotiate favorable terms, pricing, and delivery schedules.

For instance, in 2023, Yinlun's top five customers accounted for approximately 60% of its total revenue, highlighting the considerable bargaining power held by these key accounts. This concentration means that losing even one major customer could have a material impact on Yinlun's financial performance.

The bargaining power of customers for Zhejiang Yinlun Machinery is significantly influenced by product standardization. When Yinlun offers highly standardized products, like basic heat exchangers, customers can more readily switch to competitors if pricing or terms are unfavorable. This increases customer leverage.

Conversely, Yinlun's focus on customized thermal management solutions for emerging sectors, such as new energy vehicles (NEVs), can diminish customer bargaining power. These specialized solutions often involve unique engineering, proprietary technology, and integration challenges, making it harder for customers to find readily available alternatives. This specialization can lock in customers and reduce their ability to switch.

In 2023, Yinlun reported that its revenue from NEV components continued to grow, indicating an increasing proportion of customized solutions in its product mix. This shift towards customization likely strengthens Yinlun's position against customers, as switching costs become higher for buyers of these tailored products.

Zhejiang Yinlun Machinery benefits from reduced customer bargaining power when switching costs are high. For instance, if automakers have deeply integrated Yinlun's thermal management systems into their vehicle architectures, the effort and expense to retool and adapt to a competitor's offerings can be substantial.

This integration, especially for complex solutions, creates a significant barrier. Consider the automotive industry's trend towards more sophisticated cooling systems for electric vehicles, where a supplier's solution becomes a critical component of the overall vehicle design.

Long-term supply contracts, often in place for established vehicle models, further lock in customers and diminish their ability to switch freely. This contractual commitment effectively raises the switching cost, thereby curtailing their bargaining leverage over Yinlun.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large automotive original equipment manufacturers (OEMs), poses a significant challenge to Zhejiang Yinlun Machinery. These major players could decide to produce heat exchangers or other thermal management components internally, especially for their high-volume or strategically vital parts. This capability directly enhances their bargaining power.

A strong potential for OEMs to bring production in-house escalates their leverage over suppliers like Yinlun. For instance, if a major automotive client, representing a substantial portion of Yinlun's revenue, were to signal intent to develop its own thermal management solutions, it would significantly strengthen its negotiating position on pricing and terms. This is a constant consideration for companies in the automotive supply chain.

- OEMs' Capacity: Many large automotive manufacturers possess the engineering expertise and capital to develop and manufacture components like heat exchangers.

- Cost Savings Potential: In-house production can sometimes offer cost advantages for OEMs, especially on high-volume, standardized parts.

- Supply Chain Control: Backward integration allows OEMs greater control over the quality, innovation, and supply continuity of critical components.

- Market Dynamics: Shifts in the automotive industry, such as increased demand for electric vehicle thermal management systems, could incentivize OEMs to explore vertical integration to secure specialized technology.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Zhejiang Yinlun Machinery, particularly within the automotive and heavy machinery industries. Companies in these sectors often face intense competition themselves, leading them to scrutinize costs and push for lower prices on components like those supplied by Yinlun. This dynamic directly translates into increased bargaining power for Yinlun’s customers.

For instance, when Yinlun supplies more standardized or commodity-like parts, this price sensitivity becomes even more pronounced. Customers can more readily switch suppliers if price becomes the primary differentiator, giving them leverage to negotiate more favorable terms. This puts downward pressure on Yinlun's profit margins for those product lines.

- Automotive Sector Pressure: The automotive industry, a key market for Yinlun, experienced fluctuating demand and supply chain challenges in 2023 and early 2024, intensifying cost-consciousness among automakers.

- Heavy Machinery Dynamics: Similarly, the global heavy machinery sector faced varying economic conditions in 2023, with some segments reporting slower growth, making price a critical factor in purchasing decisions.

- Component Commoditization: Yinlun's offerings in standardized engine components, for example, are more susceptible to price-based competition, amplifying customer bargaining power.

Zhejiang Yinlun Machinery's customers, particularly large automotive OEMs and heavy machinery manufacturers, possess considerable bargaining power due to factors like customer concentration and price sensitivity. In 2023, the top five customers represented approximately 60% of Yinlun's revenue, underscoring the leverage these major clients wield in negotiations. This concentration means that even a small shift in demand from a key customer can significantly impact Yinlun's financial performance, driving them to offer competitive pricing and favorable terms.

The company's efforts to develop specialized thermal management solutions for the burgeoning new energy vehicle (NEV) sector are strategically aimed at mitigating this customer power. By offering customized, technologically advanced components, Yinlun increases switching costs for NEV manufacturers, thereby reducing their ability to negotiate aggressively on price or terms. This specialization is crucial as the NEV market continues its rapid expansion, with Yinlun reporting continued revenue growth in this segment throughout 2023.

However, the threat of backward integration by powerful OEMs remains a significant concern, potentially enhancing customer bargaining power. If major clients, especially those representing a large share of Yinlun's business, were to develop in-house capabilities for critical thermal management components, their leverage would increase substantially. This possibility necessitates continuous innovation and value-added services from Yinlun to maintain its competitive edge and customer loyalty.

| Factor | Impact on Yinlun | 2023/Early 2024 Relevance |

|---|---|---|

| Customer Concentration | High leverage for top clients | Top 5 customers accounted for ~60% of revenue |

| Product Standardization | Increases switching ease, thus bargaining power | Standardized components remain a significant part of the product mix |

| Customization (NEVs) | Reduces switching ease, thus bargaining power | Growing revenue from NEV components |

| Switching Costs | High integration increases costs for customers | Complex thermal systems for EVs have high integration costs |

| Backward Integration Threat | Potential for OEMs to produce in-house | Constant consideration in the automotive supply chain |

| Price Sensitivity | Customers push for lower prices, especially on standardized parts | Automotive and heavy machinery sectors experienced cost pressures |

What You See Is What You Get

Zhejiang Yinlun Machinery Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Zhejiang Yinlun Machinery provides an in-depth examination of industry competition, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitute products, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

Zhejiang Yinlun Machinery operates in a highly competitive landscape for both heat exchangers and exhaust gas after-treatment systems. This market is populated by a significant number of domestic Chinese manufacturers as well as established international players, creating a diverse competitive environment.

The company contends with a broad spectrum of competitors. These range from large, established automotive component suppliers who have diversified into thermal management solutions to smaller, specialized firms focusing solely on niche areas like exhaust gas recirculation (EGR) coolers or selective catalytic reduction (SCR) systems.

As of 2024, the global automotive thermal management market, where Yinlun is a key player, is estimated to be worth billions of dollars, with numerous companies vying for market share. For instance, in the exhaust after-treatment segment alone, companies like Tenneco, Bosch, and Cummins are significant rivals, alongside many Chinese domestic brands.

This intensity of competition means that companies like Zhejiang Yinlun must constantly innovate and maintain cost-effectiveness to secure and grow their market position. The presence of both global giants and agile domestic competitors necessitates a dynamic strategy to navigate pricing pressures and technological advancements.

The automotive industry's growth rate presents a mixed picture, with traditional internal combustion engine segments experiencing moderate expansion. However, the new energy vehicle (NEV) thermal management market is a different story. This sector is projected for robust growth, with estimates suggesting it will reach substantial market value by 2030, driven by a high compound annual growth rate (CAGR). For instance, some analyses point to NEV thermal management systems potentially growing at a CAGR exceeding 15% in the coming years.

This rapid NEV expansion, while potentially easing competitive intensity in some areas by expanding the overall market pie, also acts as a magnet for new entrants. Established players and startups alike are vying for market share in this burgeoning segment. The high growth rate, therefore, fuels competitive rivalry as companies invest heavily in research and development and production capacity to capture a piece of this expanding market.

Zhejiang Yinlun Machinery's product differentiation strategy, particularly its investment in advanced technology and quality for new energy vehicle components, serves as a crucial shield against intense competitive rivalry. This focus allows them to command premium pricing and build customer loyalty, especially in burgeoning markets where innovation is highly valued.

For instance, in 2023, Yinlun reported a significant increase in revenue from its new energy vehicle thermal management systems, indicating successful differentiation in this high-growth segment. This contrasts with their more traditional product lines where differentiation is less pronounced, leading to heightened price-based competition among numerous players.

Exit Barriers

Zhejiang Yinlun Machinery faces intense competition, partly due to high exit barriers within the automotive parts manufacturing sector. These barriers, such as significant investments in specialized machinery and R&D for engine cooling systems, make it difficult and costly for firms to leave the market. For instance, the automotive industry often involves long-term contracts with major car manufacturers, creating a commitment that’s hard to break. This situation can lead to prolonged periods of intense rivalry, even for less profitable players, as they are compelled to remain operational and continue competing for market share.

The substantial sunk costs associated with developing and maintaining advanced manufacturing facilities and proprietary technologies are a prime example of these exit barriers. Companies like Yinlun have invested heavily in state-of-the-art production lines and research capabilities. In 2023, for example, the global automotive supplier market saw significant capital expenditures, reflecting the ongoing need for technological advancement and capacity. This high capital intensity means that exiting the market would result in a substantial loss on these specialized assets, encouraging existing firms to persevere through challenging economic conditions rather than abandon their investments.

The strategic importance of maintaining market presence, even in downturns, further contributes to the difficulty of exiting. Competitors might be locked into long-term supply agreements with original equipment manufacturers (OEMs), obligating them to continue production. This can keep capacity in the market, suppressing prices and intensifying the competitive struggle for all participants. The persistence of such firms, despite potential unprofitability, directly fuels the competitive rivalry that Zhejiang Yinlun Machinery must navigate.

- Specialized Assets: High investment in dedicated machinery for producing complex automotive components.

- Long-Term Contracts: Commitments with OEMs that extend for several years, preventing easy withdrawal.

- R&D and Technology: Significant sunk costs in research, development, and intellectual property for advanced cooling solutions.

- Manufacturing Facilities: Extensive capital invested in factories and production lines that are not easily repurposed.

Strategic Stakes

The automotive and new energy vehicle (NEV) thermal management sectors are critical battlegrounds due to stringent global emission regulations and the accelerating shift towards electrification. Companies in this space face immense pressure to innovate and secure market share, resulting in intense rivalry.

Zhejiang Yinlun Machinery, as a significant player, operates within an environment where strategic importance translates directly into aggressive competition. This means companies are heavily investing in research and development to stay ahead, impacting profitability and market dynamics.

- High Strategic Stakes: The global push for reduced emissions and the rapid growth of the NEV market elevate the importance of thermal management solutions. Companies view leadership in this area as crucial for long-term survival and profitability.

- Aggressive Competition: The strategic value of these sectors attracts numerous players, leading to price wars, rapid product development cycles, and significant marketing expenditures as companies fight for dominance.

- Innovation Investment: To gain a competitive edge, companies are channeling substantial resources into developing advanced thermal management technologies, including sophisticated heat pumps and battery cooling systems, essential for the performance and efficiency of electric vehicles.

- Market Penetration Efforts: Companies are actively seeking to expand their customer base by securing contracts with major automakers, often through competitive pricing and technological superiority, as evidenced by the increasing number of global partnerships being announced.

Competitive rivalry is fierce for Zhejiang Yinlun Machinery, with numerous domestic Chinese and international players vying for market share in both thermal management and exhaust after-treatment systems. The automotive sector's shift towards new energy vehicles (NEVs) amplifies this rivalry, as companies like Yinlun invest heavily in R&D to secure leadership in this high-growth area.

Companies are compelled to innovate and maintain cost-effectiveness due to intense competition. For instance, in 2023, Yinlun saw strong revenue growth in its NEV thermal management systems, demonstrating successful differentiation in a market where advanced technology is key to commanding premium pricing and customer loyalty.

The strategic importance of emissions regulations and electrification drives aggressive competition, leading to significant investments in advanced thermal management technologies. This intense focus on market penetration and technological superiority ensures a dynamic and demanding competitive landscape for all participants.

High exit barriers, such as substantial investments in specialized machinery and long-term contracts with OEMs, further contribute to persistent rivalry. These factors make it challenging and costly for firms to leave the market, ensuring that existing players continue to compete for market share, even during economic downturns.

SSubstitutes Threaten

The threat of substitutes for Zhejiang Yinlun Machinery's thermal management solutions is a significant consideration. Alternative technologies that bypass traditional heat exchangers, such as advanced passive cooling systems or direct liquid cooling, could emerge and gain traction. For instance, in the electric vehicle sector, where Yinlun is a key player, innovative thermal management approaches are constantly being developed to improve efficiency and reduce component size. Companies are exploring phase change materials and advanced heat pipes that offer comparable or superior heat dissipation without relying on the complex, often bulky, heat exchangers Yinlun typically produces. The increasing focus on miniaturization and energy efficiency across various industries fuels this innovation, potentially diverting demand away from conventional solutions.

The threat of substitutes for Zhejiang Yinlun Machinery is elevated when alternative technologies provide comparable or better performance at a reduced price. This dynamic is particularly potent in the fast-paced automotive sector, where advancements can quickly render existing solutions less competitive. For instance, if a new cooling system technology emerges that is 15% cheaper and offers equivalent or slightly improved heat dissipation, Yinlun's market position could be challenged.

Customer willingness to switch to substitute solutions for Zhejiang Yinlun Machinery's products, primarily exhaust systems, hinges on several key factors. Perceived reliability of alternatives is paramount; customers need assurance that a substitute will perform as consistently as Yinlun's offerings. Ease of integration into existing vehicle platforms is also critical. If a substitute requires significant modifications or complex retrofitting, adoption rates will naturally be lower.

Regulatory acceptance plays a crucial role, especially in emissions control. As environmental regulations evolve, new technologies might emerge that offer compliance with stricter standards, potentially creating substitutes. For instance, advancements in alternative exhaust treatment methods, such as novel catalytic converters or exhaust gas recirculation (EGR) systems, could present viable alternatives to traditional exhaust pipes and mufflers.

In 2024, the automotive industry continues to push for lighter, more efficient, and cleaner exhaust solutions. While Yinlun Machinery holds a strong position, the ongoing development of electric vehicles (EVs) represents a significant long-term substitute, as EVs inherently do not require traditional exhaust systems. This shift could impact the demand for Yinlun's core products over time, though the transition is gradual.

Technological Advancements

Technological advancements, especially in the new energy vehicle sector, pose a significant threat of substitutes. Rapid progress in battery technology and vehicle design is paving the way for entirely new thermal management systems that might render some traditional heat exchanger components obsolete. For instance, integrated thermal management solutions that directly cool batteries and power electronics could reduce the reliance on separate heat exchangers. By mid-2024, the global electric vehicle market was projected to reach over 15 million units, highlighting the accelerating shift towards technologies that could displace conventional components.

These innovations could fundamentally alter the demand for Zhejiang Yinlun Machinery's core products. Consider the potential for direct liquid cooling of battery packs, a technology gaining traction in high-performance EVs. This approach bypasses the need for traditional radiator and fan assemblies in some configurations. As of early 2025, several major automakers are integrating such advanced thermal systems into their upcoming EV platforms, signaling a potential decline in demand for certain legacy heat exchanger designs.

- Emerging Thermal Management Architectures: New EV designs may incorporate consolidated cooling loops that manage heat for batteries, motors, and cabin climate control, potentially reducing the number of individual heat exchanger units required.

- Direct Cooling Technologies: Advances in direct liquid cooling for battery cells and power electronics offer more efficient heat dissipation, potentially negating the need for air-cooled radiators in certain applications.

- Software-Defined Thermal Control: Sophisticated control algorithms are enabling more dynamic and integrated thermal management, reducing reliance on passive or simpler active heat exchanger designs.

- Material Science Innovations: Development of advanced materials could lead to lighter, more efficient, and potentially integrated cooling solutions that challenge existing heat exchanger technologies.

Regulatory Influence

Changes in environmental regulations or vehicle design mandates can significantly impact the threat of substitutes for Zhejiang Yinlun Machinery. For example, by mid-2024, many regions are tightening emission standards, which could accelerate the adoption of alternative powertrain technologies or advanced exhaust after-treatment systems that are not currently core to Yinlun's product line. This regulatory pressure may force customers to consider substitutes that offer greater compliance or efficiency.

These evolving standards present a dual-edged sword. Stricter emission norms, such as those being implemented globally in 2024 and beyond, might necessitate new types of catalytic converters or particulate filters, potentially creating opportunities for Yinlun if they can adapt their product development. However, if these regulations favor entirely different technologies, such as hydrogen fuel cells or advanced electric vehicle thermal management systems, then existing internal combustion engine (ICE) exhaust after-treatment solutions, Yinlun's current focus, could face a greater threat from these emerging substitutes.

The automotive industry's trajectory towards electrification and alternative fuels, driven by regulatory push and consumer demand, directly influences the viability of traditional exhaust components. For instance, a faster-than-expected transition to electric vehicles (EVs) in key markets like China and Europe, which saw EV sales grow significantly in 2023, would reduce the overall market for ICE exhaust systems. This shift means that substitutes for Yinlun's current offerings, such as specialized thermal management components for EVs, could become more prominent.

- Regulatory Shifts: Evolving emission standards (e.g., Euro 7) in 2024 and beyond can either boost demand for advanced after-treatment technologies or accelerate the shift to non-ICE substitutes.

- Technological Advancements: Mandates for cleaner air can drive innovation in alternative powertrain solutions and exhaust after-treatment, presenting new competitive threats if Yinlun's core business is not aligned.

- Market Penetration of Substitutes: The speed at which electric vehicles and other alternative fuel vehicles gain market share, influenced by regulations, directly impacts the threat of substitutes for Yinlun's traditional products. For example, by the end of 2023, EVs represented over 30% of new car sales in China, a significant market for Yinlun.

The threat of substitutes for Zhejiang Yinlun Machinery's thermal management solutions is amplified by the rapid evolution of the automotive industry, particularly the shift towards electric vehicles. New cooling architectures and direct cooling technologies for batteries and power electronics are emerging as viable alternatives to traditional heat exchangers. For instance, integrated thermal management systems that consolidate cooling functions are gaining traction. By mid-2024, the global EV market was projected to surpass 15 million units, indicating a growing segment that may not require Yinlun's conventional exhaust-related components.

These technological shifts, driven by the push for efficiency and miniaturization, could reduce reliance on existing heat exchanger designs. As of early 2025, several automakers are incorporating advanced thermal systems into new EV platforms, signaling a potential decline in demand for some legacy components. Furthermore, evolving environmental regulations, such as tighter emission standards in 2024, can accelerate the adoption of alternative powertrain technologies, further impacting the market for traditional exhaust systems.

The increasing market penetration of electric vehicles, especially in key regions, directly affects the demand for Yinlun's core products. By the end of 2023, EVs accounted for over 30% of new car sales in China, a crucial market. This trend suggests a growing demand for specialized thermal management components for EVs, which could serve as substitutes for Yinlun's current offerings.

| Key Substitute Threat Factors | Description | Impact on Yinlun | 2024 Data Point |

| Electric Vehicle (EV) Adoption | Shift from Internal Combustion Engine (ICE) vehicles to EVs | Reduces demand for traditional exhaust systems; increases demand for EV-specific thermal management. | EVs represented over 30% of new car sales in China by end of 2023. |

| Advanced Thermal Management Systems | Integrated cooling, direct liquid cooling for batteries/electronics | Potentially bypasses the need for conventional heat exchangers. | Several automakers integrating advanced thermal systems into EV platforms by early 2025. |

| Regulatory Changes | Stricter emission standards and push for cleaner technologies | Accelerates adoption of alternative powertrains and potentially new thermal solutions. | Global tightening of emission standards throughout 2024. |

Entrants Threaten

Entering the specialized manufacturing of automotive heat exchangers and exhaust gas after-treatment systems demands substantial upfront capital. Companies need to invest heavily in advanced research and development to innovate efficient and compliant products. For instance, in 2024, setting up a state-of-the-art manufacturing plant capable of producing these complex components can easily run into tens of millions of dollars, covering machinery, automation, and quality control systems.

Beyond initial production, building a robust and reliable supply chain for specialized materials and components is crucial, adding another layer of significant investment. Furthermore, securing patents and intellectual property for proprietary technologies requires considerable financial outlay. These high capital requirements act as a substantial barrier, deterring smaller or less capitalized players from entering the market and challenging established firms like Zhejiang Yinlun Machinery.

Established players like Zhejiang Yinlun Machinery benefit significantly from economies of scale across production, procurement, and research and development. This means they can produce more units at a lower cost per unit. For instance, in 2024, Yinlun's substantial production volume allowed it to negotiate better raw material prices compared to a smaller, new entrant. This cost advantage makes it challenging for newcomers to compete effectively on price.

Zhejiang Yinlun Machinery benefits from its deep-rooted experience and established reputation as a key player in setting industry standards in China. This long-standing presence, coupled with its status as a leading manufacturer, fosters a strong brand identity that new competitors find challenging to match. Their proprietary knowledge and the trust built over years create significant barriers to entry.

Access to Distribution Channels

New entrants face a significant hurdle in gaining access to established distribution channels within the automotive and industrial sectors. Building trust and securing partnerships with major Original Equipment Manufacturers (OEMs) and other large industrial clients is a lengthy and rigorous process. This typically involves extensive product testing, stringent qualification procedures, and demonstrating a consistent history of reliability and quality. For instance, a new supplier might need to undergo several years of validation before being approved for mass production, a timeline that deters many potential new competitors.

The capital investment required to meet the exacting standards of major automotive players is also substantial. This includes not only advanced manufacturing capabilities but also sophisticated quality control systems and the ability to scale production rapidly.

- Customer Loyalty: Existing suppliers often benefit from long-standing relationships with OEMs, making it difficult for new entrants to displace them.

- Supplier Qualification Processes: The multi-stage, often multi-year, qualification process for automotive suppliers acts as a significant barrier.

- Technical Expertise and R&D: OEMs demand high levels of technical expertise and continuous innovation, which new companies may struggle to match initially.

- Supply Chain Integration: New entrants must prove their ability to seamlessly integrate into complex, just-in-time automotive supply chains.

Government Policy and Regulations

Government policy and regulations represent a significant barrier to entry for new players in the automotive parts manufacturing sector, particularly for companies like Zhejiang Yinlun Machinery. Strict automotive emission standards and safety regulations, such as China VI emission standards and Euro 7 regulations, demand substantial investment in research, development, and advanced manufacturing processes to ensure compliance. For instance, the push towards electrification and stricter emissions means new entrants must possess advanced technological capabilities in areas like thermal management systems for EVs, which requires considerable capital outlay and specialized knowledge. This regulatory landscape, especially in major markets like China and Europe, deters those lacking the financial muscle and technical expertise to meet these evolving requirements.

The compliance burden can be immense. Companies must navigate complex certification processes and continuously adapt their product lines to meet evolving standards.

- Stringent Emission Standards: Compliance with evolving standards like China VI and Euro 7 requires significant R&D and capital investment.

- Safety Regulations: Adherence to global safety mandates necessitates robust quality control and potentially costly design modifications.

- Certification Costs: The expense and time involved in obtaining necessary certifications can be a substantial hurdle for new entrants.

- Technological Adaptation: Keeping pace with regulatory-driven technological shifts, such as electrification, demands advanced capabilities and resources.

The threat of new entrants in the automotive heat exchanger and exhaust gas after-treatment systems market, where Zhejiang Yinlun Machinery operates, is moderately low. Significant capital investment is required for advanced manufacturing and R&D. For example, establishing a compliant production facility in 2024 could cost tens of millions of dollars. Additionally, the need for specialized materials and intellectual property further increases these upfront costs, acting as a substantial barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zhejiang Yinlun Machinery leverages data from official company filings, reputable industry research reports, and financial news outlets to provide a comprehensive view of the competitive landscape.