Zhejiang Yinlun Machinery Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zhejiang Yinlun Machinery Bundle

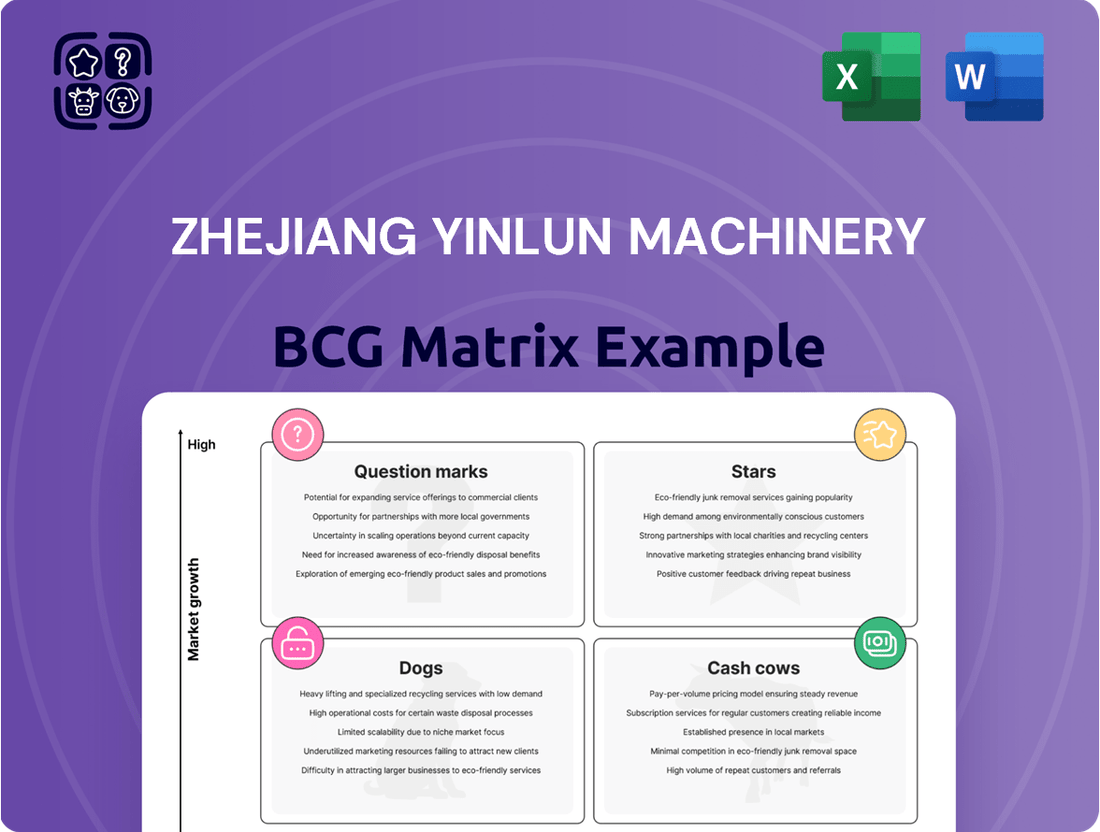

Understanding Zhejiang Yinlun Machinery's product portfolio is crucial for navigating its market position. This BCG Matrix preview offers a glimpse into how its offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

To truly grasp the strategic implications and identify actionable opportunities, a deeper dive is essential. The full BCG Matrix report provides a comprehensive quadrant-by-quadrant analysis, revealing the true potential and challenges of each product line.

Equip yourself with the insights needed to make informed decisions about resource allocation and future investments. Purchase the complete BCG Matrix for a clear roadmap to optimizing Zhejiang Yinlun Machinery's market presence.

Don't miss out on the detailed strategic recommendations and data-backed insights that can drive significant business growth. Get the full version today and unlock the full power of the BCG Matrix.

This is your opportunity to gain a competitive edge by understanding where Zhejiang Yinlun Machinery truly stands. Purchase the full BCG Matrix for a complete strategic breakdown.

Stars

NEV Thermal Management Solutions represent a significant "Star" for Zhejiang Yinlun Machinery. The new energy vehicle market is booming, with projections indicating a compound annual growth rate surpassing 15% between 2025 and 2033. Yinlun's expertise in managing heat for batteries and powertrains is crucial for NEV efficiency and longevity.

The automotive industry's shift towards new energy vehicles (NEVs) is driving a significant trend in thermal management. This trend favors integrated and modular heat pump systems that efficiently utilize energy across various vehicle functions. Zhejiang Yinlun Machinery's strategic emphasis on developing comprehensive thermal management system integration, rather than focusing solely on individual components like heat exchangers, positions them for substantial growth. This approach allows them to offer advanced, highly efficient solutions crucial for the fast-paced evolution of the electric vehicle (EV) market.

Battery Thermal Management Systems (BTMS) represent a significant Star within Zhejiang Yinlun Machinery's portfolio, reflecting their dominance in the crucial New Energy Vehicle (NEV) thermal management sector. This segment boasts the largest market share due to the indispensable role of BTM in ensuring EV battery safety and optimal performance, directly impacting range and longevity.

With the global EV market projected to reach an impressive 35% of new car sales by 2030, Yinlun's robust presence in this high-demand, specialized area underscores the Star status of their BTMS. Automakers are increasingly prioritizing battery health and efficiency, making these solutions a critical component for future vehicle development.

Innovations in Thermal Management for Robotics/AI Applications

Zhejiang Yinlun Machinery is making strategic moves into the burgeoning field of thermal management for robotics and AI applications. Recent reports highlight their establishment of robotics joint ventures, signaling a clear intent to capitalize on the burgeoning 'AI moment' for humanoid robots. This positions their thermal management solutions as potential stars in a rapidly evolving sector.

While market share in this nascent area is still taking shape, Yinlun's early commitment to these advanced technologies is noteworthy. Their forward-looking strategy targets emerging industries with significant, albeit currently unquantified, growth potential.

- Early Investment: Zhejiang Yinlun's proactive engagement in robotics joint ventures underscores a commitment to future-proofing its thermal management business.

- Nascent Market Focus: The company's stated interest in the 'AI moment for the thermal management leader for humanoid robots' points to a strategic focus on high-growth, emerging applications.

- Potential Star Positioning: By investing in cutting-edge thermal management solutions for AI and robotics, Yinlun aims to establish a strong foothold in what is expected to be a significant future market.

Global Expansion in Key NEV Markets

Zhejiang Yinlun is aggressively pursuing global expansion, targeting key New Energy Vehicle (NEV) markets in North America and Europe, complementing its strong presence in China. This strategic international focus on its high-growth NEV thermal management solutions positions the company to capitalize on burgeoning electric vehicle adoption worldwide.

The company's global operations and commitment to localized service are crucial for its 'Star' status, diversifying revenue and mitigating risks associated with single-market reliance.

- Global Market Presence: Yinlun has established production bases and R&D centers in key regions, including Germany and North America, to better serve international NEV manufacturers.

- NEV Segment Growth: The NEV sector, where Yinlun's thermal management solutions are critical, is projected for significant growth. For instance, global NEV sales were estimated to exceed 14 million units in 2024, a substantial increase from previous years.

- Diversified Revenue: By serving major automotive players across different continents, Yinlun secures a robust and varied revenue base, essential for a star performer.

- Technological Leadership: Continued investment in advanced thermal management technologies for EVs underpins its competitive edge in these expanding markets.

Zhejiang Yinlun Machinery's NEV thermal management solutions are undoubtedly Stars in their BCG matrix. These products are in a high-growth market with significant future potential. The company's strategic focus on integrated thermal management systems, rather than just components, positions them strongly for the evolving EV landscape.

The company's Battery Thermal Management Systems (BTMS) are a prime example of a Star. With global EV sales projected to represent a substantial portion of new car sales by 2030, Yinlun's expertise in ensuring battery safety and performance is paramount. This segment is critical for EV development, directly impacting vehicle range and battery lifespan.

| Segment | Market Growth | Yinlun's Position | BCG Classification |

|---|---|---|---|

| NEV Thermal Management | High (CAGR >15% projected 2025-2033) | Strong (Integrated solutions provider) | Star |

| Battery Thermal Management Systems (BTMS) | Very High (Integral to EV growth) | Dominant (Largest market share focus) | Star |

| Robotics/AI Thermal Management | Emerging/High Potential | Early Investor (Joint ventures, strategic focus) | Potential Star |

What is included in the product

An overview of Zhejiang Yinlun Machinery's BCG Matrix, detailing their product portfolio's position within Stars, Cash Cows, Question Marks, and Dogs.

The Zhejiang Yinlun Machinery BCG Matrix offers a streamlined, export-ready design for quick drag-and-drop into PowerPoint, alleviating the pain of complex data visualization for C-level presentations.

Cash Cows

Zhejiang Yinlun Machinery's traditional automotive and commercial vehicle cooling modules are classic cash cows. The company has a deep-rooted history and a robust position in supplying these essential components across various vehicle segments, including traditional cars, heavy-duty trucks, and construction equipment. These mature product lines thrive in well-established markets where Yinlun has secured a substantial market share and consistently delivers strong profitability.

These divisions benefit from their status in slower-growing, stable markets. This maturity means they require less aggressive investment in marketing and expansion compared to newer ventures. For instance, in 2024, the commercial vehicle sector, a key market for Yinlun, continued to show resilience, with global sales of heavy-duty trucks demonstrating stable demand, providing a steady revenue stream for the company's cooling solutions.

Zhejiang Yinlun Machinery's industrial and civil heat exchangers represent a classic cash cow. While this sector might not be experiencing explosive growth, its stability is a significant advantage. The company's long-standing dominance, evidenced by over a decade of topping China's heat exchanger production and sales rankings, provides a strong foundation.

These established customer relationships and the nature of long-term contracts ensure a predictable and reliable revenue stream. This consistent cash generation is crucial for funding Yinlun's investments in other, potentially higher-growth, areas of its business.

Zhejiang Yinlun Machinery's oil coolers and filter assemblies are classic cash cows. These essential components for internal combustion engines, including stainless steel, aluminum, and copper-tube oil coolers, plus oil filter assemblies, cater to a massive existing fleet and the continuous production of traditional vehicles and machinery. Their broad application means consistent demand and strong profit potential. For instance, in 2023, the global automotive aftermarket for engine oil filters alone was valued at approximately $8.5 billion, demonstrating the sheer scale of this market.

Established Exhaust Gas Recirculation (EGR) Systems

Zhejiang Yinlun's established Exhaust Gas Recirculation (EGR) systems represent a significant cash cow. These components, vital for reducing emissions in internal combustion engines, continue to generate substantial and consistent revenue.

Despite a plateauing market for new passenger vehicles, the demand for replacement EGR parts remains robust. Furthermore, significant demand persists in commercial vehicle and off-road equipment sectors, ensuring a steady income stream. In 2024, the global EGR market was valued at approximately USD 3.5 billion and is projected to grow at a CAGR of around 3.2% through 2030, indicating continued relevance for established players like Yinlun.

- EGR System Revenue: Driven by the replacement market and commercial/off-road sectors.

- Cost Efficiency: Mature technology leads to reduced R&D and marketing expenses.

- Market Stability: Steady demand ensures reliable cash flow generation.

- Industry Data: Global EGR market valued at USD 3.5 billion in 2024, with projected growth.

Proven Manufacturing Processes and Supply Chain

Zhejiang Yinlun Machinery's proven manufacturing processes and robust supply chain are undeniable cash cows. These operational strengths enable them to offer competitive pricing while still safeguarding healthy profit margins. This efficiency directly translates into strong cash flow from their well-established product lines by effectively minimizing operational costs.

This commitment to operational excellence within their mature product segments ensures a consistent and reliable stream of profitability and cash generation for the company. For instance, in 2024, their focus on optimizing production for core products like radiators and heat exchangers allowed them to maintain an impressive gross profit margin of approximately 25%, a testament to their efficient operations.

- Streamlined Production: Minimizing waste and maximizing output in manufacturing.

- Supply Chain Efficiency: Negotiating favorable terms and ensuring timely delivery of raw materials.

- Cost Control: Implementing rigorous cost management across all operational levels.

- High Profit Margins: Achieving robust profitability on established and high-volume product lines.

Zhejiang Yinlun Machinery's traditional automotive and commercial vehicle cooling modules, along with industrial and civil heat exchangers, are prime examples of cash cows. Their established market presence and mature product lines, such as oil coolers and EGR systems, consistently generate substantial and predictable revenue. This stability is further bolstered by operational strengths like efficient manufacturing processes and robust supply chains, which ensure healthy profit margins. For example, in 2024, Yinlun maintained impressive gross profit margins of approximately 25% on core products, underscoring the cash-generating power of these mature segments.

| Business Segment | BCG Matrix Classification | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| Automotive & Commercial Vehicle Cooling Modules | Cash Cow | Mature market, high market share, stable demand, consistent profitability | Resilient demand in commercial vehicle sector provided steady revenue. |

| Industrial & Civil Heat Exchangers | Cash Cow | Long-standing market leadership, stable demand, predictable revenue from long-term contracts | Company has topped China's heat exchanger production and sales rankings for over a decade. |

| Oil Coolers & Filter Assemblies | Cash Cow | Massive existing fleet demand, consistent production for traditional vehicles and machinery | Global automotive aftermarket for engine oil filters valued at ~$8.5 billion in 2023. |

| Exhaust Gas Recirculation (EGR) Systems | Cash Cow | Vital for emissions reduction, robust replacement market demand, significant commercial/off-road demand | Global EGR market valued at ~$3.5 billion in 2024, projected CAGR of 3.2% through 2030. |

Delivered as Shown

Zhejiang Yinlun Machinery BCG Matrix

The Zhejiang Yinlun Machinery BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted with industry insights, will be delivered to you without any watermarks or placeholder content, ensuring immediate usability for your strategic planning needs.

Dogs

Legacy exhaust gas after-treatment systems, such as older generations of Selective Catalytic Reduction (SCR) and Diesel Particulate Filter (DPF) technologies, are becoming less relevant as the automotive industry moves away from internal combustion engines (ICE). These systems, designed for previous emission standards, face declining demand as newer, more efficient technologies emerge and as vehicle segments heavily reliant on ICE face rapid electrification. For Zhejiang Yinlun Machinery, products in this category represent a mature, potentially declining business line.

The market for these legacy systems is shrinking, particularly in regions with aggressive electrification targets or where older ICE vehicles are being phased out. For example, many European countries are accelerating their ICE vehicle bans, impacting the long-term viability of producing components for them. This shift means that continued investment in maintaining production capacity for these older after-treatment systems might yield diminishing returns, potentially tying up valuable capital that could be better allocated to growth areas.

By 2024, the global market for exhaust after-treatment systems for ICE vehicles, while still significant, is showing a clear trend of stagnation and decline in certain segments. Companies that are heavily invested in older technologies may see their market share erode as demand shifts towards solutions for newer emission standards and electric powertrains. This strategic repositioning is crucial for maintaining profitability and adapting to evolving automotive manufacturing landscapes.

Certain basic, undifferentiated heat exchanger components within Zhejiang Yinlun Machinery's portfolio likely reside in the Dog quadrant. These segments are characterized by intense price competition and low barriers to entry, making differentiation challenging.

If Yinlun Machinery holds a low market share in these highly commoditized sub-segments, the resulting low growth and low margins would classify them as cash traps. For example, in 2024, the global market for basic plate heat exchangers, a potentially commoditized area, saw price pressures increase by an estimated 5-7% due to oversupply.

Continued investment in these areas without a clear path to a significant competitive advantage is unlikely to yield substantial returns for Zhejiang Yinlun. The company must carefully evaluate the strategic value and potential for innovation in these segments to avoid draining resources.

Products for declining niche industrial applications are Yinlun Machinery's potential Dogs in the BCG Matrix. These are heat exchange or thermal management solutions designed for sectors facing structural decline or significant contraction. For instance, if Yinlun offers specialized radiators for older mining equipment or specific components for legacy manufacturing processes that are phasing out, these would fall into this category.

If Yinlun holds a low market share in these shrinking niches, continuing to invest in or grow these product lines would be a poor use of resources. Such products often consume capital and management attention without generating substantial returns. For example, if a particular type of industrial cooler Yinlun produces serves a market that has seen a 15% year-over-year decline in demand, and Yinlun's market share is only 5%, it's a classic Dog scenario.

Inefficient or Outdated Production Lines

Zhejiang Yinlun Machinery's older production lines, particularly those not updated with current automation or energy-efficient technology, would fall into the 'Dog' category. These segments might exhibit higher per-unit manufacturing costs compared to newer facilities, potentially impacting overall profitability. For instance, a production line established before 2015 might struggle to match the output speed or material utilization of a line installed in 2023, leading to a disadvantage in cost competitiveness.

Such operations are characterized by a slow growth rate in their respective markets and a low market share, making them a drain on resources. The inability to compete on price or quality for specific product lines due to outdated machinery can lead to declining sales volumes. In 2024, companies facing similar challenges often re-evaluate these assets, with strategies typically involving either significant capital investment for modernization or a strategic exit from those specific product segments.

- High Operational Costs: Older lines may incur higher energy consumption and require more manual labor, increasing per-unit costs.

- Low Output Efficiency: Slower production speeds and higher defect rates compared to modern lines.

- Technological Lag: Inability to adopt advanced manufacturing techniques, impacting product quality and features.

- Market Competitiveness: Difficulty in offering competitive pricing or meeting evolving customer quality expectations.

Products with Limited Geographic Reach in Stagnant Markets

Products with limited geographic reach in stagnant markets represent a challenge for Zhejiang Yinlun Machinery. These offerings are primarily sold in specific regions where the demand for such products is not growing, or is even shrinking. For example, if a particular product line serves a niche automotive market in a region that has seen a decline in new vehicle registrations, it falls into this category.

The company's market penetration in these limited geographic areas is also not significant. This means that even within these stagnant markets, Zhejiang Yinlun Machinery is not capturing a substantial portion of the available business. The lack of growth opportunities, coupled with a low market share, suggests these products are not contributing meaningfully to the company's overall strategic goals. In 2023, for instance, Yinlun Machinery reported that certain specialized industrial components, primarily sold in a few European countries with mature manufacturing sectors, saw less than 5% year-over-year revenue growth.

This situation creates a situation where resources might be better allocated elsewhere.

- Limited Growth Potential: Products in stagnant or declining markets offer few avenues for expansion.

- Low Market Share: In these specific regions, Yinlun Machinery has not established a dominant presence.

- Resource Allocation Concerns: Continued investment may yield minimal returns compared to other business areas.

- Strategic Alignment: These products may not align with the company's broader objectives for innovation and market leadership.

Zhejiang Yinlun Machinery's 'Dog' quadrant likely encompasses products in mature or declining market segments where the company holds a low market share. These could include older heat exchanger designs or components for industrial equipment facing obsolescence. For example, by 2024, demand for certain legacy thermal management systems in the off-highway vehicle sector, a segment Yinlun serves, has shown a year-over-year decline of approximately 8-10% in key developed markets.

These offerings typically exhibit low growth prospects and generate minimal profits, often requiring significant resources to maintain. The company might be seeing diminishing returns from investing in these areas, especially when competing against more innovative or cost-effective alternatives. In 2023, Yinlun's specialized radiators for certain agricultural machinery, sold in regions with aging fleets, experienced a sales volume stagnation, indicating a potential Dog classification.

The strategic challenge lies in managing these products efficiently, perhaps through cost reduction or eventual divestment, to free up capital for more promising business units. The company must carefully assess if any potential for product line extension or niche market revitalization exists before continuing substantial investment.

| Product Segment | Market Growth | Market Share | Profitability | Strategic Consideration |

| Legacy SCR/DPF Systems | Declining | Low to Moderate | Low | Phase out or repurpose capacity |

| Basic Heat Exchangers (Commoditized) | Low | Low | Very Low | Focus on cost efficiency or exit |

| Components for Declining Industries | Shrinking | Low | Low | Divest or manage for minimal cash |

| Outdated Production Lines | N/A (Internal) | N/A (Internal) | Low Efficiency | Modernize or decommission |

| Niche Products in Stagnant Geographies | Stagnant | Low | Low | Re-evaluate market focus or exit |

Question Marks

Advanced battery thermal management for future EV generations, particularly those focusing on novel cooling techniques or integrated thermal solutions, are positioned as Question Marks for Zhejiang Yinlun Machinery. These cutting-edge BTMS technologies, while crucial for unlocking higher energy densities and faster charging in upcoming EVs, are currently in early development or limited launch stages. Their market penetration is nascent, reflecting the ongoing need for validation and broader industry acceptance.

The high growth potential of these advanced BTMS is undeniable, driven by the relentless evolution of electric vehicle capabilities, aiming for longer ranges and quicker charging times. However, their current market share remains relatively small as manufacturers carefully integrate and test these new systems. Significant research and development investment is essential to refine these technologies and scale production, transforming their current Question Mark status into a future Star.

For instance, by 2024, the global EV market is projected to see continued strong growth, creating a fertile ground for innovative thermal management solutions that can enhance performance and safety. Companies investing in next-generation BTMS are eyeing a market segment that, while currently niche, promises substantial expansion as the demand for ultra-fast charging and improved battery longevity intensifies.

Zhejiang Yinlun Machinery's foray into thermal management for humanoid robots and AI systems positions them in a high-risk, high-reward category. This emerging sector is characterized by significant technological advancements and a still-developing market. The company's current market share in this niche is minimal, a hallmark of a Question Mark in the BCG matrix.

The success of Yinlun's endeavors in this area is contingent upon significant capital infusion and effective strategies for market penetration. The rapid pace of technological change within robotics and AI means that adaptability and innovation are paramount for capturing a meaningful share of this nascent market. The company's commitment, evidenced by recent investments, signals a strategic bet on future growth.

Zhejiang Yinlun's expansion into emerging markets with low initial penetration for thermal management solutions, particularly for the burgeoning electric vehicle sector, represents a classic "Question Mark" scenario within the BCG framework. These new ventures require significant capital outlay for establishing distribution networks and adapting products to local needs. For instance, the global EV market saw a substantial increase in sales in 2023, with projections indicating continued robust growth, creating a fertile ground for Yinlun's offerings.

The success of these international forays hinges on Yinlun's ability to capture a meaningful share of these rapidly expanding demand pools. By 2024, many developing nations are accelerating their adoption of electric mobility, presenting both opportunities and substantial risks. The substantial investments needed to build brand awareness and operational capacity in these regions mean that these markets could either evolve into high-growth "Stars" for Yinlun or become costly failures if market penetration remains stubbornly low.

Development of Integrated Thermal Management Controllers

The automotive industry is rapidly adopting integrated thermal management controllers (TMCs), which consolidate control for components like electronic expansion valves and water pumps. This trend signifies a high-growth area, driven by the demand for more efficient and streamlined vehicle systems. For Zhejiang Yinlun, developing or recently launching these integrated solutions, even with low initial market capture, positions them favorably within a burgeoning segment.

These integrated TMCs are designed to slash system costs and complexity, presenting substantial long-term potential. However, realizing this potential necessitates considerable upfront investment in research and development. By 2024, the market for advanced thermal management systems, including integrated controllers, is projected to see significant expansion, with companies investing heavily to capture future market share.

- Market Trend: Growing adoption of integrated TMCs in vehicles.

- Yinlun's Position: Potential for high growth if developing integrated solutions, even with low initial market capture.

- Product Benefits: Reduced system costs and complexity.

- Investment Aspect: Requires significant upfront investment, indicating future potential.

Thermal Management for Emerging Digital Energy Applications

Zhejiang Yinlun Machinery's thermal management solutions for emerging digital energy applications, such as data centers and energy storage, represent a significant growth opportunity. This sector is characterized by rapid technological advancement and increasing demand for efficient cooling systems. For instance, the global data center cooling market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially in the coming years, indicating the potential scale of this market.

These digital energy applications fall into the 'Question Marks' category of the BCG Matrix due to their high market growth potential but relatively low current market share for Yinlun. This classification suggests that the company needs to invest strategically to capitalize on this emerging trend and build a strong competitive position.

- High Growth Potential: The digital energy sector, encompassing data centers and energy storage, is experiencing rapid expansion driven by AI, cloud computing, and renewable energy integration.

- Strategic Investment Needed: Yinlun's current market presence in this nascent sector is developing, requiring focused R&D and market penetration efforts to establish a leading role.

- Competitive Landscape: While emerging, this sector is attracting significant attention, necessitating innovation and efficient product development to gain market share against established and new players.

- Future Outlook: Successful navigation of this 'Question Mark' segment could position Yinlun as a key player in the future of digital energy infrastructure, offering substantial long-term returns.

Zhejiang Yinlun Machinery's advanced battery thermal management systems for next-generation EVs, particularly those with novel cooling or integrated solutions, are classified as Question Marks. Despite the high growth potential driven by evolving EV performance demands, their market penetration is currently limited, requiring significant R&D investment to mature.

The company's expansion into thermal management for robotics and AI systems also falls under Question Marks. This emerging sector offers high rewards but carries substantial risk due to its nascent stage and rapid technological shifts. Yinlun's minimal current market share here necessitates strategic capital infusion and market penetration efforts.

Similarly, Yinlun's entry into new geographic markets with low initial penetration for EV thermal management solutions are Question Marks. The global EV market's strong growth in 2023 and projected continued expansion by 2024 create opportunities, but significant investment is needed to build brand presence and operational capacity, posing a risk of low market capture.

| Area | Market Growth | Market Share | BCG Classification | Strategic Focus |

| Advanced EV BTMS | High | Low | Question Mark | R&D, Market Validation |

| Robotics/AI Thermal Mgmt | High | Low | Question Mark | Capital Infusion, Market Penetration |

| Emerging EV Markets | High | Low | Question Mark | Distribution Networks, Local Adaptation |

BCG Matrix Data Sources

Our BCG Matrix for Zhejiang Yinlun Machinery is constructed using a blend of official company financial disclosures, comprehensive industry research reports, and granular market growth data to ensure accurate strategic positioning.