Yamaha PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yamaha Bundle

Uncover the critical external factors shaping Yamaha's future with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces that could impact their market position and innovation. This expertly crafted report provides actionable intelligence for strategic planning and investment decisions. Gain a competitive edge by downloading the full PESTLE analysis today and equip yourself with the insights needed to navigate the dynamic global environment.

Political factors

Yamaha navigates a landscape shaped by stringent government regulations, especially regarding emissions for its diverse product range, from motorcycles to marine engines.

The European Union, Japan, and the United States are progressively tightening emissions standards, pushing manufacturers like Yamaha to invest heavily in research and development for cleaner technologies.

For instance, upcoming CAFE standards in the U.S. are expected to further influence vehicle design and engine efficiency by 2025, requiring significant adaptation.

Non-compliance with these evolving environmental mandates can result in substantial financial penalties and damage Yamaha's brand reputation, underscoring the critical importance of proactive regulatory adherence.

Changes in trade policies and tariffs can significantly affect Yamaha's global operations. For example, the renegotiation or introduction of new trade agreements, especially those involving major markets like the United States, could alter import duties on components or finished goods. This directly impacts production costs for everything from marine engines to musical instruments.

Potential new U.S. tariffs, particularly in the wake of a presidential election in late 2024, could raise costs for Yamaha's marine products and other imported items. This might necessitate adjustments to pricing strategies to maintain competitiveness or even a re-evaluation of manufacturing and sourcing locations to mitigate the financial impact.

Persistent geopolitical risks, including ongoing conflicts in the Middle East and Ukraine, create a volatile global landscape for Yamaha. These tensions directly impact supply chains, as seen with disruptions affecting component availability and shipping routes throughout 2024. For instance, shipping costs saw significant increases in early 2025 due to re-routed vessels avoiding conflict zones, directly increasing Yamaha's operational expenses.

The economic slowdown in China also presents a considerable challenge, affecting demand for Yamaha's diverse product range, from motorcycles to musical instruments. China's GDP growth, projected to be around 4.5% in 2025, is slower than in previous years, signaling reduced consumer spending power in a key market for Yamaha.

These intertwined factors contribute to an uncertain operating environment, potentially leading to increased raw material prices and fluctuating demand in crucial international markets. For example, the price of key metals used in motorcycle production experienced a 7% surge in the first half of 2025 due to supply chain pressures exacerbated by geopolitical instability.

Political Stability in Key Markets

Political stability in Yamaha's key production and sales markets, such as Thailand and Brazil, is a significant factor. For instance, Thailand, a major manufacturing hub for Yamaha's motorcycles and musical instruments, experienced relative political stability throughout much of 2023 and into early 2024, which supported consistent production. Brazil, a significant market for motorcycles, has seen its political landscape evolve, with the government focusing on economic recovery measures that could influence consumer spending on discretionary items like Yamaha products. Any significant political unrest or abrupt policy changes in these regions could disrupt supply chains, impact manufacturing output, and alter consumer demand, directly affecting Yamaha's financial performance.

The impact of political stability can be seen in economic indicators. In 2023, Thailand's GDP growth was projected to be around 2.7%, a figure that benefits from a stable operating environment. Conversely, Brazil's economic outlook, while showing signs of recovery, remains sensitive to political decisions regarding fiscal policy and trade agreements, which can directly influence the affordability and demand for imported goods and manufactured products. Political stability fosters predictable business conditions, which are essential for Yamaha's long-term investment in manufacturing facilities and market expansion.

- Thailand's political stability in 2023-2024 has supported Yamaha's manufacturing operations.

- Brazil's political environment and economic policies directly influence consumer purchasing power for Yamaha products.

- Disruptions from political instability can lead to increased operational costs and reduced sales volumes for Yamaha.

- Government policies on trade, investment, and consumer protection in key markets are critical for Yamaha's strategic planning.

Government Support and Regulations for Musical Instruments

Governments, particularly in emerging markets like China and India, are increasingly focused on nurturing their domestic musical instrument industries. This often translates into supportive policies aimed at boosting local manufacturing and exports. For instance, China’s Made in China 2025 initiative, while broad, has implications for advanced manufacturing sectors, including musical instruments, by encouraging technological upgrades and quality improvements. Similarly, India has seen initiatives under the 'Make in India' program that can benefit manufacturers, potentially leading to greater domestic production capacity and export opportunities.

Yamaha, as a global leader, must remain agile in adapting to these shifting political landscapes. Navigating country-specific regulations, such as those pertaining to import duties, product safety certifications, and environmental standards, is crucial for maintaining competitive pricing and market access. For example, adherence to stringent EU toy safety directives or specific wood sourcing regulations in different countries directly impacts production costs and supply chain management.

- China's "Made in China 2025" strategy aims to upgrade its manufacturing base, potentially benefiting high-quality musical instrument production.

- India's "Make in India" initiative encourages domestic manufacturing, which could lead to increased competition or collaboration for global players like Yamaha.

- Compliance with diverse international product safety and quality standards is a significant factor influencing market entry and operational costs.

- Government incentives for R&D and export promotion can create opportunities but also require careful strategic alignment.

Political stability in key markets like Thailand and Brazil directly impacts Yamaha's manufacturing and sales. For example, Thailand's stable political climate in 2023-2024 supported consistent production of motorcycles and musical instruments.

Conversely, government economic policies in Brazil can influence consumer spending on discretionary items, affecting demand for Yamaha products. Political shifts can lead to unpredictable business conditions, impacting Yamaha's investments in facilities and market expansion.

Government initiatives in emerging markets, such as China's Made in China 2025 and India's Make in India, aim to boost domestic industries, potentially creating new competitive or collaborative landscapes for Yamaha's musical instrument division.

Navigating diverse international regulations, from emissions standards to product safety certifications, remains critical for market access and cost management, with non-compliance posing significant financial and reputational risks.

| Country/Initiative | Political Factor Impacting Yamaha | Data/Observation (2023-2025) |

|---|---|---|

| Thailand | Political Stability | Supported consistent manufacturing operations in 2023-2024. |

| Brazil | Economic Policies & Political Landscape | Government focus on economic recovery influences consumer spending on Yamaha products. |

| China | "Made in China 2025" | Encourages technological upgrades in manufacturing sectors, including musical instruments. |

| India | "Make in India" Initiative | Promotes domestic manufacturing, potentially impacting global players like Yamaha. |

| Global Markets | Regulatory Changes (Emissions, Safety) | Tightening standards (e.g., EU emissions) necessitate R&D investment; compliance costs are significant. |

What is included in the product

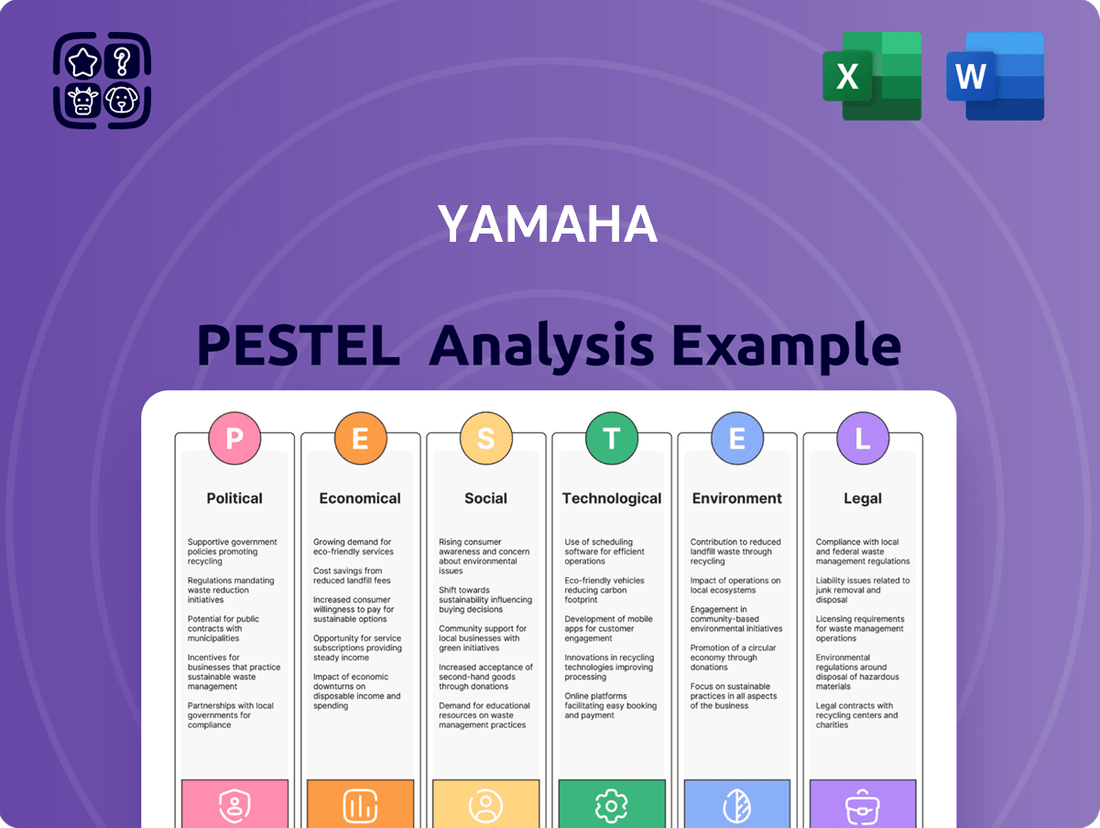

This Yamaha PESTLE analysis delves into the critical external forces shaping its business landscape, offering a comprehensive view of how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and avenues for growth.

Provides a structured framework to proactively identify and mitigate potential threats and capitalize on opportunities, thereby reducing strategic uncertainty and fostering more confident decision-making.

Economic factors

Yamaha is navigating a global economic landscape marked by uncertainty and persistent inflation. The cost of essential raw materials, from metals for musical instruments to components for motorcycles, has seen significant increases, directly impacting Yamaha's production expenses. This inflationary pressure extends to labor, with rising wages in many of its manufacturing hubs adding to overall operational costs.

Furthermore, a projected slowdown in global economic growth, particularly in major markets like China, poses a direct threat to demand. A weaker economy typically leads consumers to cut back on non-essential purchases, which includes Yamaha's core product categories like high-end audio equipment and recreational vehicles. For instance, many analysts projected global GDP growth to moderate in 2024 and 2025 compared to earlier post-pandemic recovery phases, a trend that could dampen sales volumes.

Elevated interest rates, notably in key economies like the US, are making significant purchases, such as Yamaha's marine products, less affordable for consumers. This trend has demonstrably softened demand for items like outboard motors and personal watercraft, directly impacting Yamaha's marine division sales volumes and requiring a more circumspect approach to market engagement.

The Federal Reserve's benchmark interest rate, for example, remained in the 5.25%-5.50% range through the first half of 2024, a significant increase from previous years. This environment directly squeezes discretionary spending, as borrowing costs for recreational vehicles and boats rise, leading consumers to postpone or cancel purchases.

This economic headwind means Yamaha must carefully calibrate its inventory and marketing strategies. Focusing on value propositions and potentially offering more flexible financing options could become critical to maintaining sales momentum in a market where higher borrowing costs are a significant deterrent.

Currency exchange rate fluctuations, particularly involving the Japanese Yen against currencies like the US Dollar and Euro, directly influence Yamaha's financial results. For instance, a weaker Yen can inflate the translated value of overseas earnings for Japanese companies, potentially boosting reported revenue. However, this also presents a mixed bag, as it can simultaneously increase the cost of imported components essential for manufacturing.

In early 2024, the Yen experienced considerable volatility, trading around 150 Yen to the US Dollar, a level that had previously been a point of concern for Japanese policymakers. This weakness, while potentially beneficial for export-oriented companies like Yamaha by making their products cheaper abroad, also raises the cost of raw materials and parts sourced internationally, impacting Yamaha's cost of goods sold and overall profit margins.

Competitive Market Environment

Yamaha operates in intensely competitive markets, particularly in motorcycles where it contends with giants like Honda and a growing number of Chinese manufacturers. This rivalry extends across its audio, musical instruments, and robotics divisions, demanding constant innovation and efficient operations to maintain market share. The pressure is amplified by fluctuating demand and supply chain dynamics, forcing strategic cost management.

In 2024, the global motorcycle market, a key segment for Yamaha, is projected to grow, but competition remains fierce, particularly in emerging economies where Chinese OEMs are rapidly gaining traction with cost-effective models. Yamaha's strategy often involves balancing its premium offerings with competitive pricing in certain segments to counter these threats. For instance, while specific market share figures fluctuate, the presence of over 200 motorcycle manufacturers globally underscores the intense competitive environment Yamaha navigates.

The company must continuously invest in research and development to differentiate its products, whether it's through advanced engine technology, new mobility solutions, or cutting-edge audio equipment. This competitive landscape necessitates agile responses to market shifts, including potential oversupply in some product categories and softening demand in others, driving a focus on operational efficiency and lean manufacturing principles.

Supply Chain Resilience and Cost Management

Yamaha is still navigating the complexities of supply chain disruptions, though the severe semiconductor shortages that plagued the industry in prior years have shown signs of easing. This improved availability is a positive development, but the company must remain vigilant.

The economic landscape continues to present challenges, particularly with rising ocean freight rates and the cost of essential raw materials. These increasing expenses directly impact Yamaha's bottom line, demanding proactive strategies to mitigate their effects. Effective cost management is therefore paramount.

To counter these pressures, Yamaha is implementing several key initiatives. These include rigorous cost control measures across its operations, strategic adjustments to production schedules to align with material availability and demand, and a dedicated effort to diversify its supply chain. This diversification aims to reduce reliance on single sources and build greater resilience against future shocks.

For instance, global shipping costs saw significant fluctuations. While some routes may have stabilized by late 2024 or early 2025, overall freight expenses remained elevated compared to pre-pandemic levels, impacting the landed cost of components and finished goods for companies like Yamaha. Similarly, the prices of key materials, such as aluminum and certain plastics, continued to be a point of focus for cost management efforts throughout 2024 and into 2025.

- Semiconductor availability has improved but remains a monitoring point.

- Rising ocean freight rates and raw material costs are key economic headwinds.

- Cost control measures are critical for maintaining profitability.

- Production adjustments and supply chain diversification are strategic priorities.

The global economic climate presents significant challenges for Yamaha, characterized by persistent inflation and moderating growth forecasts. Rising raw material and labor costs directly impact production expenses, while elevated interest rates in key markets like the US are dampening consumer demand for discretionary items such as recreational vehicles and marine products.

Currency fluctuations, particularly the volatility of the Japanese Yen against major currencies, also play a crucial role. While a weaker Yen can benefit exporters by making products cheaper abroad, it simultaneously increases the cost of imported components, affecting profit margins. This economic environment necessitates careful inventory management and strategic pricing.

Yamaha faces intense competition across its diverse product lines, from motorcycles to audio equipment, with rivals, including emerging Chinese manufacturers, intensifying pressure. Continuous investment in R&D is vital for product differentiation and maintaining market share. The company is focusing on cost control, production adjustments, and supply chain diversification to navigate these economic headwinds effectively.

The company's financial performance is directly influenced by global economic trends. For example, while semiconductor availability improved through 2024, rising ocean freight rates and raw material costs continued to exert pressure on Yamaha's cost of goods sold. These factors underscore the importance of Yamaha's ongoing cost control measures and strategic supply chain adjustments.

| Economic Factor | Impact on Yamaha | Data Point/Trend (2024-2025 Projections) |

|---|---|---|

| Global GDP Growth | Moderating growth can dampen demand for discretionary products. | Projected to slow compared to post-pandemic recovery phases. |

| Inflation | Increases production costs (raw materials, labor). | Persistent inflation impacting input costs throughout 2024-2025. |

| Interest Rates (e.g., US Federal Reserve) | Makes financing for large purchases (boats, motorcycles) more expensive, reducing demand. | Benchmark rates remained elevated in the 5.25%-5.50% range through early 2024. |

| Currency Exchange Rates (JPY/USD) | Affects export competitiveness and import costs. | Yen traded around 150 to the US Dollar in early 2024, showing volatility. |

| Shipping Costs | Increases the landed cost of components and finished goods. | Ocean freight rates remained elevated compared to pre-pandemic levels. |

Preview the Actual Deliverable

Yamaha PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Yamaha PESTLE analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand market dynamics and strategic opportunities with this detailed report.

Sociological factors

The post-pandemic landscape has reshaped consumer behavior, with a notable slowdown in the surge of outdoor recreational activities that previously boosted power sports equipment demand. Yamaha must now navigate this recalibration, understanding that the fervent interest in activities like off-roading and water sports may not sustain its peak levels.

Adapting to new consumer expectations is paramount. This includes a heightened awareness of environmental impact and a growing preference for sustainable options. Yamaha's product development must reflect these evolving lifestyle trends, moving beyond traditional gasoline-powered engines.

A significant trend is the increasing embrace of electric propulsion across various sectors, including personal mobility and recreation. Yamaha's research and development, particularly in areas like electric motorcycles and personal watercraft, will be crucial in capturing this segment of the market. For instance, sales of electric motorcycles in the US saw a significant uptick in 2023, indicating a growing consumer appetite for electrified alternatives.

Demographic shifts in emerging economies are a significant driver for Yamaha's growth. For instance, a burgeoning young population in countries like India, where the median age is around 28 years, represents a massive potential customer base for two-wheelers. This youthful demographic is increasingly mobile and aspirational, seeking affordable and efficient transportation solutions.

Brazil also presents a similar picture, with a growing middle class that has more disposable income to spend on personal mobility. Understanding the evolving consumer behaviors, such as a preference for fuel-efficient and feature-rich motorcycles, is paramount for Yamaha to effectively tailor its product offerings and marketing campaigns in these dynamic markets.

The increasing urbanization in these regions further amplifies the demand for motorcycles as a practical mode of transport. In India, for example, over 35% of the population now lives in urban areas, a figure projected to climb higher, creating concentrated markets for Yamaha's products.

Generation Z, born roughly between 1997 and 2012, wields significant influence with their diverse consumer behaviors and reliance on online channels. Their preference for authenticity and social responsibility shapes how brands like Yamaha must communicate and operate, with digital engagement being paramount. By 2024, an estimated 40% of the global workforce is projected to be Gen Z, highlighting their growing economic power and impact on market trends.

The digital acceleration driven by this generation means that online experiences are critical for product discovery, engagement, and ultimately, sales for Yamaha. Their comfort with e-commerce and social media platforms requires Yamaha to invest heavily in its digital presence, from interactive websites to influencer marketing campaigns. For instance, by Q3 2024, digital sales channels are expected to account for over 30% of total retail sales across many industries, a trend strongly propelled by Gen Z.

Increased Awareness of Health and Well-being

The escalating global focus on health and well-being is significantly shaping consumer preferences. This societal shift directly impacts demand for products that support active lifestyles and mental wellness. For instance, the market for electric bicycles, including Yamaha's power-assisted models, has seen robust growth, aligning with a desire for sustainable and health-conscious transportation. In 2024, the global e-bike market was valued at approximately USD 35.7 billion and is projected to expand further, demonstrating this strong trend.

Yamaha can capitalize on this trend by highlighting the health and mental benefits embedded within its diverse product portfolio. Promoting its musical instruments, for example, as tools for stress reduction and cognitive enhancement resonates with consumers prioritizing mental well-being. Similarly, its fitness equipment and power-assisted bicycles directly cater to the active lifestyle segment. This strategic positioning allows Yamaha to connect with a growing consumer base actively seeking products that contribute positively to their overall health and quality of life.

- Increased Demand for Fitness-Related Products: The global e-bike market, a key area for Yamaha, was valued at around USD 35.7 billion in 2024, indicating strong consumer interest in health-conscious mobility.

- Mental Well-being as a Driver: Consumers are increasingly recognizing the therapeutic benefits of music, creating opportunities for Yamaha's musical instrument division.

- Lifestyle Integration: Yamaha can position its products not just as recreational items but as integral components of a healthy and balanced lifestyle.

- Marketing Opportunities: Emphasizing the health benefits in marketing campaigns can attract a wider audience segment concerned with personal wellness.

Cultural Significance of Music and Arts Education

The enduring cultural importance of music and a growing focus on arts education globally translates into a consistent demand for Yamaha's diverse range of musical instruments. This trend is particularly evident in markets where cultural heritage heavily influences consumer preferences, ensuring a baseline of sales for the company.

Government-led initiatives aimed at boosting music education are actively shaping market dynamics. For instance, China's commitment to integrating music into its compulsory education system, with plans to expand music teacher training and instrument access, directly fuels the market for educational musical tools. This strategic push is projected to increase the number of students engaging with music, thereby expanding Yamaha's potential customer base in the region.

The emphasis on holistic child development, which includes artistic expression, further underpins the demand for musical instruments. In 2024, surveys indicated that over 60% of parents in developed nations believe music education is crucial for cognitive development, a sentiment that directly benefits instrument manufacturers like Yamaha. This societal value placed on arts education creates a fertile ground for sustained market growth.

- Cultural Value: Music's deep-rooted cultural significance across many societies ensures consistent demand for instruments.

- Educational Mandates: Government policies, like those in China, prioritizing music in schools directly increase the market for educational instruments.

- Cognitive Benefits: Growing recognition of music's role in cognitive development, supported by parental sentiment, drives instrument sales.

Societal shifts towards health and well-being are boosting demand for fitness-related products, with the global e-bike market valued at approximately USD 35.7 billion in 2024. Consumers increasingly view music as a therapeutic tool, creating opportunities for Yamaha's musical instrument division. This focus on mental wellness and active lifestyles positions Yamaha's diverse product range as contributors to a balanced life.

The ongoing cultural importance of music and expanding arts education globally sustains demand for Yamaha's instruments. Government initiatives, such as China's integration of music into compulsory education, directly fuel the market for educational musical tools. Furthermore, the recognized cognitive benefits of music education, supported by strong parental sentiment—over 60% of parents in developed nations deeming it crucial in 2024—bolster instrument sales.

Technological factors

Yamaha is heavily investing in electric and hybrid propulsion technologies, a key technological factor shaping its future. This commitment is clearly demonstrated by their acquisition of Torqeedo GmbH, a leading company in electric boat motors, and their ongoing development of electric motorcycle prototypes.

The company has set an ambitious target to increase the share of electric models within its product lineup to 20% by the year 2025. This strategic pivot reflects a broader industry trend towards electrification and Yamaha's proactive approach to capturing market share in this growing segment.

Yamaha is actively embracing digitalization and the adoption of smart factory concepts, a trend sweeping the manufacturing sector. This involves integrating advanced technologies to streamline operations. For instance, the company is enhancing its information systems to better manage data and leverage business intelligence tools.

These technological advancements are crucial for data analysis and optimizing business processes. By doing so, Yamaha aims to achieve significant improvements in operational efficiency and bolster its decision-making capabilities. In 2023, global investment in smart factory solutions was projected to exceed $200 billion, highlighting the significant market shift towards these technologies.

The increasing integration of Artificial Intelligence (AI), particularly generative AI, is reshaping product development and manufacturing. This technology offers significant opportunities for Yamaha, such as accelerating the design cycle and creating novel musical instruments or components. For instance, AI can optimize material usage in manufacturing, potentially reducing costs and environmental impact.

Yamaha's robotics division is already capitalizing on AI's influence, experiencing robust demand for its semiconductor manufacturing post-processing equipment. This surge reflects the broader industry's need for advanced automation driven by AI advancements. This trend highlights Yamaha's strategic alignment with technological shifts, positioning them to benefit from the growing AI-driven manufacturing sector.

New Materials and Sustainable Manufacturing Processes

Technological advancements in new materials and sustainable manufacturing are paramount for Yamaha's future, influencing everything from product design to operational efficiency.

Yamaha is actively integrating these innovations, with a specific target to boost its recycled aluminum usage by 30% by the year 2025. This initiative underscores a broader commitment to incorporating sustainable materials across its production lines and achieving ambitious recycling rates.

The company's strategic focus on these areas is not just about environmental responsibility but also about future-proofing its operations and supply chain. By embracing new materials and greener manufacturing, Yamaha aims to reduce its environmental footprint while potentially gaining a competitive edge through cost savings and enhanced brand reputation.

- Recycled Aluminum Target: Increase use of recycled aluminum by 30% by 2025.

- Material Innovation: Focus on utilizing sustainable materials throughout production.

- Circular Economy: Aim for high recycling rates in manufacturing processes.

- Environmental Impact: Reduce carbon emissions and waste through advanced manufacturing.

Innovation in Audio Equipment and Digital Musical Instruments

Yamaha's technological edge is significantly boosted by continuous innovation in audio equipment, especially within the professional audio sector. This segment, crucial for B2B clients, sees constant advancement, directly impacting Yamaha's market position. The company's strategy involves blending cutting-edge technology with established principles to cater to diverse and changing customer demands.

Digital musical instruments are another vital technological frontier for Yamaha. The company is heavily invested in developing instruments that offer new creative possibilities for musicians. This focus on digital innovation ensures Yamaha remains competitive and relevant in a rapidly evolving music technology landscape. For instance, Yamaha's 2024 product releases have seen a notable integration of AI in sound design and performance assistance, a trend expected to accelerate.

Yamaha's commitment to R&D is evident in its product pipeline, which consistently introduces features that enhance user experience and sound quality. This technological prowess is a core strength, allowing them to adapt to market shifts and maintain a leadership role. The global market for professional audio equipment was valued at over $12 billion in 2023 and is projected to grow by a CAGR of 7% through 2028, a market Yamaha actively participates in and influences through its technological advancements.

Key technological drivers influencing Yamaha include:

- Advancements in digital signal processing (DSP) for clearer, more versatile audio output in professional gear.

- Integration of AI and machine learning in digital instruments for enhanced sound creation and interactive performance features.

- Development of connected audio ecosystems allowing seamless integration between various Yamaha audio products and third-party devices.

- Focus on sustainable manufacturing technologies for audio equipment, aligning with environmental consciousness and regulatory trends.

Technological factors are driving significant shifts for Yamaha, particularly in electrification and digitalization. Their investment in electric propulsion, evidenced by the Torqeedo acquisition, aims for 20% electric models by 2025, reflecting a broader industry trend. Smart factory initiatives and AI integration are also key, with global smart factory investment projected to exceed $200 billion in 2023, enhancing operational efficiency and product development.

Yamaha is also focusing on new materials and sustainable manufacturing, targeting a 30% increase in recycled aluminum usage by 2025. In audio, advancements in DSP, AI-driven instruments, and connected ecosystems are critical, with the professional audio market valued over $12 billion in 2023 and expected to grow. These technological pursuits are vital for Yamaha's competitive edge and future growth.

| Technological Factor | Yamaha's Action/Target | Industry Context/Data |

| Electrification | Acquisition of Torqeedo; Target: 20% electric models by 2025 | Growing demand for electric mobility solutions |

| Digitalization & Smart Factories | Embracing smart factory concepts; Enhancing information systems | Global smart factory investment > $200 billion (2023 est.) |

| AI Integration | Capitalizing on AI in product development and robotics division | AI adoption accelerating across manufacturing and design sectors |

| Sustainable Materials | Target: 30% increase in recycled aluminum usage by 2025 | Increasing focus on circular economy principles in manufacturing |

| Audio Technology | Advancements in DSP, AI in instruments, connected ecosystems | Professional audio market valued > $12 billion (2023); projected 7% CAGR through 2028 |

Legal factors

Yamaha faces rigorous product safety and quality regulations globally for everything from its motorcycles to its pianos. For instance, in 2024, the EU's General Product Safety Regulation (GPSR) continues to emphasize manufacturer responsibility for product safety throughout the supply chain, impacting Yamaha's market access and product design.

Adherence to these standards, such as those set by the Consumer Product Safety Commission (CPSC) in the US for recreational vehicles or international standards for musical instruments, is crucial. Failure to comply can lead to recalls, fines, and significant damage to brand reputation, as seen in past automotive industry recalls impacting millions of dollars in sales.

Yamaha's commitment to quality, often highlighted in its financial reports through investments in research and development and quality control processes, directly influences its ability to meet these legal mandates. For example, continuous improvement in manufacturing processes aims to reduce defects, thereby minimizing the risk of non-compliance with safety standards like ISO 9001.

Yamaha heavily relies on its intellectual property, encompassing patents for musical instruments, engines, and cutting-edge technologies, to safeguard its market position. For instance, in 2024, Yamaha continued to invest significantly in R&D, with a notable portion allocated to patent filings across its diverse product lines, aiming to secure its innovations in areas like electric vehicle powertrains and advanced audio processing.

The legal frameworks surrounding intellectual property rights are paramount for Yamaha to maintain its competitive edge and deter unauthorized use of its technologies. In 2024, global IP enforcement efforts remained a key focus, with companies like Yamaha actively monitoring for potential infringements on their patents, which are critical assets in the highly competitive global markets for musical instruments and motorized products.

Yamaha, operating globally, must navigate a complex web of anti-trust and competition laws across numerous countries. These regulations are designed to prevent monopolies and ensure fair market practices, impacting everything from pricing strategies to mergers and acquisitions.

A notable example of the strict enforcement of these laws occurred in Germany, where Yamaha faced fines for resale price maintenance. This case underscores the critical need for Yamaha to maintain rigorous compliance procedures to avoid penalties and uphold fair competition.

These legal frameworks influence Yamaha's distribution agreements and pricing policies. For instance, the European Union's competition authorities actively scrutinize market behavior, with significant financial penalties for violations, as seen in various sectors impacting consumer electronics and musical instruments.

In 2023, the OECD reported that competition authorities worldwide imposed over €10 billion in fines for cartel activities and other anti-competitive practices, a figure that underscores the substantial financial and reputational risks associated with non-compliance for global entities like Yamaha.

Environmental Regulations and Compliance

Yamaha navigates a complex web of environmental regulations that directly influence its manufacturing and product development. Stricter rules concerning emissions, waste disposal, and the incorporation of hazardous materials necessitate ongoing adjustments to production methods and vehicle designs. For instance, adherence to initiatives like Japan's Low-Emission Vehicle (LEV) program is critical for market access and brand reputation.

These legal requirements often translate into significant operational costs for Yamaha. In 2023, global spending on environmental compliance for automotive manufacturers was estimated to be in the billions, with a projected increase for 2024 and 2025 as standards tighten further, particularly around CO2 emissions and the circular economy principles for product lifecycle management. Yamaha's ability to meet these evolving standards, such as those being implemented by the European Union with its Green Deal, will be paramount.

- Emissions Standards: Yamaha must comply with varying international and national emissions regulations, such as Euro 7 standards being phased in across Europe, which significantly impact engine development for motorcycles and marine products.

- Waste Management and Recycling: Regulations mandate responsible handling and disposal of manufacturing waste, as well as increasing requirements for product recyclability, impacting material sourcing and end-of-life product strategies.

- Hazardous Substances: The use of chemicals in batteries, paints, and other components is governed by regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, requiring careful material selection and supply chain oversight.

- Energy Efficiency: Legal frameworks increasingly promote energy efficiency in manufacturing processes and product usage, driving investment in renewable energy sources for factories and more fuel-efficient engine technologies.

International Trade Laws and Tariffs

Yamaha's extensive global manufacturing and sales network means international trade laws are a critical factor. These laws, covering everything from tariffs to import quotas, directly impact the cost of goods and market access. For instance, changes in trade agreements can significantly alter Yamaha's supply chain costs and pricing strategies.

The global trade landscape in 2024 and 2025 is marked by evolving protectionist sentiments. Major economies are reconsidering trade policies, which could lead to increased tariffs on imported goods, including motorcycles and musical instruments. Navigating these shifts requires Yamaha to maintain robust legal and compliance teams to adapt strategies effectively.

- Tariff Impact: A 10% tariff increase on a key component could raise production costs by millions, affecting pricing and competitiveness.

- Trade Agreements: Changes to agreements like the USMCA or EU trade pacts can alter import duties and market access for Yamaha products.

- Regulatory Compliance: Adherence to evolving import/export regulations in over 100 countries is essential to avoid penalties and supply chain disruptions.

- Protectionism Trends: The rise of nationalistic economic policies necessitates proactive legal and strategic planning to mitigate potential trade barriers.

Yamaha's operations are significantly shaped by legal frameworks governing product safety, intellectual property, competition, environmental impact, and international trade. These regulations, which vary by region, necessitate continuous adaptation in product design, manufacturing processes, and market strategies to ensure compliance and mitigate risks. The company's ability to navigate this complex legal landscape is critical for maintaining its market position and achieving sustainable growth.

Environmental factors

Yamaha is keenly aware of the growing impact of climate change regulations and is actively working to reduce its carbon footprint. The company has set ambitious goals to lower CO2 emissions across its operations and product lifecycles. For instance, Yamaha's 2024 sustainability report highlights a continued focus on developing more fuel-efficient engines and exploring electric powertrain solutions for its motorcycle and marine divisions. These efforts are directly influenced by evolving global standards and consumer demand for environmentally responsible products.

Yamaha is increasingly prioritizing resource sustainability, especially for key materials like timber essential for musical instruments and aluminum used in its diverse vehicle production. This focus directly addresses environmental concerns and ensures long-term operational viability.

The company has ambitious recycling goals, aiming for high recycling rates across its manufacturing operations by 2025. This commitment extends to boosting the incorporation of recycled materials into its product lines, a move that aligns with global sustainability trends and consumer preferences.

Yamaha's operations, particularly its manufacturing and distribution, face significant risks from the escalating frequency and intensity of natural disasters. Events like severe hurricanes, prolonged droughts, and widespread forest fires, which have seen notable increases in recent years, can disrupt critical supply chains for components and finished goods. For instance, the 2023 hurricane season, while varied by region, continued a trend of powerful storms impacting coastal areas vital for logistics.

The company's business continuity and disaster preparedness strategies are therefore paramount. In 2024, many industries, including automotive and recreation, are investing heavily in diversifying supplier bases and creating more resilient logistics networks to mitigate the impact of such extreme weather. This proactive approach is crucial for maintaining production schedules and meeting customer demand amidst unpredictable environmental challenges.

Eco-friendly Product Development and Demand

Consumer preference is increasingly shifting towards environmentally friendly products, prompting Yamaha to invest more heavily in green technologies. This includes their push into electric vehicles and the development of sustainable solutions for marine propulsion systems. For instance, Yamaha announced in early 2024 its continued commitment to electrification, aiming for a significant portion of its product lineup to be electric or hybrid by 2030, reflecting this growing market demand.

Developing and actively marketing products that demonstrate environmental consciousness is crucial for Yamaha. This strategy not only resonates with consumers who prioritize sustainability but also aligns with evolving global regulatory landscapes. Yamaha's 2023 sustainability report highlighted a 15% increase in customer inquiries regarding eco-friendly features across their motorcycle and marine divisions.

Yamaha's focus on eco-friendly development is evident in several key areas:

- Electric Outboard Motors: Continued investment in battery-powered and hybrid marine propulsion systems, aiming to reduce emissions in the boating industry.

- EV Motorcycle Development: Expansion of their electric motorcycle range, with new models expected to launch in 2024-2025, targeting urban mobility and emission-free riding.

- Sustainable Materials: Research and implementation of recycled and bio-based materials in product manufacturing, aiming to lower the environmental footprint of their components.

- Energy Efficiency: Enhancing the energy efficiency of their internal combustion engines and exploring alternative fuel compatibility to meet stricter emissions standards.

Supply Chain Environmental Impact and Due Diligence

Yamaha is actively strengthening its timber due diligence processes to guarantee that its raw materials are sourced sustainably, aligning with strict international regulations. This includes adherence to the Lacey Act and CITES, which are critical for managing the trade of plant and animal products, ensuring compliance and responsible sourcing. The company recognizes the significant environmental footprint across its vast global supply chain.

The focus on managing these environmental impacts is crucial for Yamaha's operational integrity and brand reputation. By implementing robust due diligence, Yamaha aims to mitigate risks associated with illegal logging and unsustainable forestry practices.

- Sustainable Sourcing: Yamaha is enhancing timber due diligence to ensure materials are sustainably sourced, meeting global environmental standards.

- Regulatory Compliance: Adherence to regulations like the Lacey Act and CITES is a priority, governing the use of plant and animal products.

- Supply Chain Management: A key objective is managing the environmental impact across Yamaha's extensive and complex global supply chain.

- Risk Mitigation: Proactive due diligence helps mitigate risks tied to deforestation and the use of endangered species in production.

Yamaha is navigating an increasingly stringent environmental regulatory landscape, pushing for reduced emissions and greater fuel efficiency across its product lines, particularly in motorcycles and marine engines. The company is also investing in electric and hybrid technologies, aiming for a significant portion of its offerings to be electrified by 2030, responding to both regulatory pressures and growing consumer demand for eco-friendly options.

Resource sustainability is a key focus, with enhanced timber due diligence to ensure compliance with regulations like the Lacey Act and CITES, critical for managing raw material sourcing in musical instruments and other product lines. Yamaha's commitment to recycling and incorporating recycled materials by 2025 underscores its efforts to minimize its environmental footprint. Furthermore, the company is actively managing supply chain risks associated with climate change impacts, such as increased frequency of natural disasters, by diversifying suppliers and building more resilient logistics.

| Environmental Focus Area | Yamaha's Action/Goal | Year/Target |

|---|---|---|

| Emissions Reduction | Lower CO2 emissions across operations and product lifecycles | Ongoing, with focus on fuel efficiency and electric powertrains |

| Electric Mobility | Expand electric motorcycle range and develop electric/hybrid marine propulsion | New EV motorcycle models in 2024-2025; 2030 electrification target |

| Sustainable Materials | Increase use of recycled and bio-based materials | High recycling rates by 2025 |

| Supply Chain Resilience | Mitigate impact of natural disasters on logistics and production | Diversifying suppliers, enhancing preparedness strategies (2024 focus) |

| Responsible Sourcing | Strengthen timber due diligence for sustainable sourcing | Adherence to Lacey Act and CITES |

PESTLE Analysis Data Sources

Our Yamaha PESTLE Analysis draws from official government reports, reputable economic databases like the World Bank and IMF, and leading industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Yamaha.