Yamaha Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yamaha Bundle

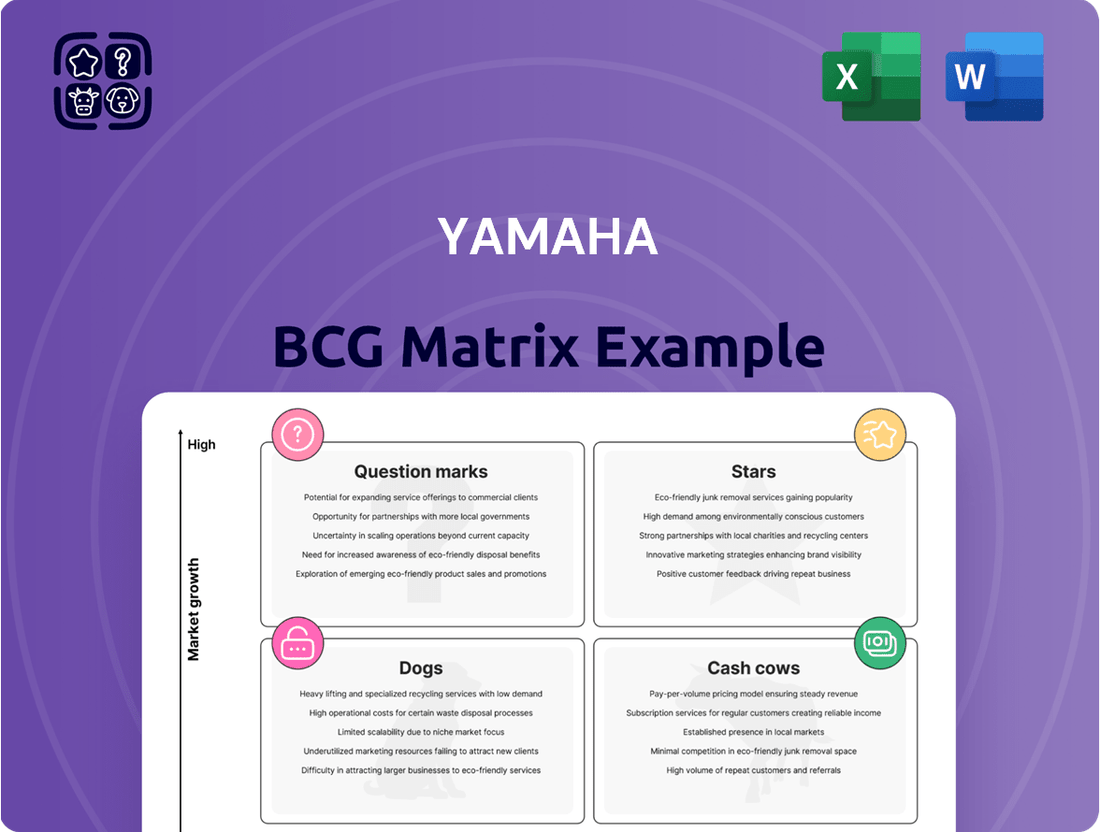

Curious about Yamaha's strategic positioning? This preview offers a glimpse into how their diverse product portfolio might be categorized using the BCG Matrix. Understand the potential of their "Stars," the reliability of their "Cash Cows," the challenges of their "Dogs," and the opportunities within their "Question Marks."

This initial insight is just the beginning of unlocking Yamaha's full strategic picture. Purchase the complete BCG Matrix report to gain a detailed quadrant breakdown, data-driven insights into each product's market share and growth rate, and actionable recommendations for optimizing their portfolio.

Don't miss out on the opportunity to refine your understanding of Yamaha's competitive landscape. The full BCG Matrix will equip you with the clarity needed to make informed decisions about resource allocation, investment strategies, and future product development.

Get instant access to the full BCG Matrix and discover which Yamaha products are leading the pack, which are plateauing, and where future growth might lie. Purchase now to transform this overview into a powerful, ready-to-use strategic tool for your business.

Stars

Yamaha's professional audio equipment segment is a strong contender in the market. In 2024, this sector was valued at a substantial USD 16.32 billion, with Yamaha capturing a notable 21% market share. This indicates a robust presence and significant revenue generation for the company in this category.

The industry is experiencing healthy growth, projected at a compound annual growth rate (CAGR) of 5.9% from 2025 through 2032. This upward trend is fueled by evolving technological demands and changing consumer preferences within the audio landscape.

Key drivers for this growth include the rising popularity of networked audio systems and digital mixing technologies. These advancements are directly linked to the increasing demand for high-quality audio solutions in live streaming and the growing prevalence of hybrid events, areas where Yamaha has established a leadership position.

Yamaha's digital pianos and portable keyboards are shining stars in their product portfolio. In 2024, the company held a commanding approximately 50% market share in this segment, a testament to their strong brand recognition and product quality. This category is experiencing a welcome recovery and growth, bucking trends seen in some traditional acoustic piano markets.

The digital instrument market, which includes digital pianos, has seen a resurgence in sales. This positive trend suggests a growing consumer appetite for these versatile and modern instruments. Yamaha's dominant position in this expanding market firmly places its digital pianos and portable keyboards in the Star quadrant of the BCG Matrix.

Yamaha's high-performance motorcycle segment, featuring iconic lines like the YZF-R and MT series, continues to be a powerhouse. These models are recognized globally for their engineering and rider experience. In fiscal year 2024, Yamaha's motorcycle division saw significant growth, particularly driven by strong consumer demand in key Asian and North American markets. This segment's performance directly reflects Yamaha's ability to capture market share in the premium motorcycle category.

Large Outboard Motors (300+ hp)

Yamaha holds a commanding 42% market share in the outboard motor sector as of 2024, demonstrating its industry leadership. The demand for large outboard motors, specifically those exceeding 300 horsepower, is a key growth driver within Yamaha's marine business. This segment is projected to see a global compound annual growth rate of 7% from 2024 to 2027, with the United States showing particularly strong uptake.

The market for high-horsepower outboard motors is experiencing robust expansion, even amidst a general slowdown in the broader marine industry in 2024. This indicates a strong consumer preference for powerful, performance-oriented vessels. Yamaha's established dominance positions it well to capitalize on this trend.

- Market Share: Yamaha leads with a 42% share in 2024.

- Growth Segment: Large outboard motors (300+ hp) are a key focus.

- Projected Growth: Expected global CAGR of 7% from 2024-2027 for this segment.

- Key Market: United States shows significant demand for larger engines.

Recreational Off-Highway Vehicles (ROVs) / Side-by-Sides

Yamaha's Recreational Off-Highway Vehicles (ROVs), also known as side-by-sides, represent a significant product category. The company's continued investment, exemplified by the 2024 release of the Wolverine RMAX4 1000 Adventure Side-by-Side, signals ongoing commitment to this market segment.

While the extraordinary demand surge seen during the COVID-19 pandemic for outdoor recreation has normalized in developed markets, Yamaha is actively managing its Recreational Vehicle (RV) business to align with current supply and demand dynamics. This indicates that the ROV market, though perhaps maturing, remains substantial and receptive to innovation.

- Market Position: The ROV segment is likely positioned as a Cash Cow or a Star in Yamaha's BCG Matrix, depending on its growth rate and market share.

- Growth Drivers: New model introductions and technological advancements are key to capturing market share in this competitive landscape.

- Industry Trends: The RV industry saw significant growth in 2023, with shipments of off-highway vehicles remaining strong, despite some normalization from pandemic highs. For example, the powersports industry, which includes ROVs, demonstrated resilience throughout 2023.

- Yamaha's Strategy: Yamaha's focus on new models suggests an effort to maintain or grow its market share by offering compelling, updated products to consumers.

Yamaha's professional audio equipment, digital pianos, portable keyboards, and high-performance motorcycles are strong performers. These segments demonstrate significant market share and are operating in growing or stable markets, fitting the description of Stars.

The professional audio sector, valued at USD 16.32 billion in 2024 with Yamaha holding a 21% share, and the digital instrument market, where Yamaha commands approximately 50% in 2024, are prime examples. Yamaha's motorcycle division also shows robust growth, particularly in Asian and North American markets.

| Product Segment | 2024 Market Share (Yamaha) | Market Growth Indicator | BCG Classification |

| Professional Audio Equipment | 21% | Projected CAGR of 5.9% (2025-2032) | Star |

| Digital Pianos & Portable Keyboards | ~50% | Resurgent sales, growing consumer appetite | Star |

| High-Performance Motorcycles | Significant growth driven by key markets | Strong consumer demand | Star |

What is included in the product

Provides a strategic overview of Yamaha's product portfolio, classifying units into Stars, Cash Cows, Question Marks, and Dogs.

Offers strategic guidance on resource allocation, highlighting which Yamaha products to invest in, hold, or divest.

The Yamaha BCG Matrix offers a clear, visual analysis of their product portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Acoustic pianos are a classic cash cow for Yamaha, operating in a mature market where the company boasts a strong global reputation and significant market share.

Despite facing headwinds, such as a market downturn in China affecting sales in fiscal year 2025, Yamaha is actively restructuring this segment.

Initiatives like the closure of certain production facilities are aimed at boosting efficiency and profitability, signaling a strategic move to maximize returns from this established product line.

The focus here is on sustained profit generation rather than aggressive expansion, a hallmark of a successful cash cow strategy.

Yamaha's conventional home audio equipment, a segment separate from its expanding professional audio business, is likely a significant Cash Cow. This category benefits from established brand recognition and a robust, long-standing distribution network, contributing to a solid market position.

While the broader audio equipment sector saw revenue boosts in FY2025, largely driven by commercial applications, conventional home audio probably offers consistent, reliable cash flow. Its growth potential may be more modest compared to emerging segments, aligning perfectly with the characteristics of a Cash Cow.

Data from FY2024 indicated that Yamaha's Audio & Visual Products segment, which includes home audio, generated ¥315.8 billion in net sales, demonstrating its substantial revenue contribution.

Yamaha's mid-range motorcycles, particularly established models from the MT and R series, are key cash cows. In FY2024, these segments, especially in growing markets like Brazil and India, showed robust performance with increased unit sales and improved average selling prices.

These models are not just consistent revenue generators; they are market leaders in their respective categories. Their enduring popularity, even with periodic updates, ensures a stable and predictable cash flow, underpinning Yamaha's financial stability.

Golf Cars

Yamaha's golf car segment operates as a Cash Cow within the BCG Matrix. Despite a reported decrease in revenue for their golf products in Fiscal Year 2025, the company is strategically investing in innovation. The upcoming launch of new five-seater electric golf cars in 2025, featuring proprietary in-house battery technology, underscores their commitment to this mature yet stable market.

This focus on new product development within an established segment indicates Yamaha's strategy to leverage existing market share and brand recognition to maintain strong cash flow generation. The introduction of advanced features like electric powertrains and enhanced battery life aims to capture evolving consumer preferences and solidify their competitive position.

- Market Position: Yamaha holds a significant presence in the golf car market, a sector characterized by steady demand and established players.

- Innovation Strategy: The company is introducing new five-seater electric golf cars with in-house battery technology in 2025.

- Financial Performance: While golf product revenue saw a decrease in FY2025, the ongoing product development suggests a focus on long-term cash generation.

- Market Dynamics: The golf car market is considered mature, making product differentiation and technological advancement key to maintaining profitability.

Financial Services

Yamaha Motor's Financial Services segment is a clear Cash Cow. In fiscal year 2024, this division demonstrated robust performance, with revenue climbing by an impressive 29.7% and operating income seeing a substantial rise of 32.6%.

This segment effectively functions as a consistent profit generator. It achieves this by providing crucial support for the sales of Yamaha's core products, ensuring stable cash flow without necessarily driving direct product innovation.

- Revenue Growth: 29.7% increase in FY2024.

- Operating Income Growth: 32.6% increase in FY2024.

- Role: Supports core product sales, acting as a stable cash generator.

- Profitability: High profitability with low direct product growth focus.

Yamaha's Financial Services division stands out as a prime Cash Cow, exhibiting strong financial health in FY2024 with a notable 29.7% revenue increase and a 32.6% surge in operating income. This segment, while not a primary driver of product innovation, provides a consistent and substantial stream of profit by facilitating the sales of Yamaha's broader product portfolio.

This financial arm acts as a reliable engine for cash generation, reinforcing Yamaha's overall financial stability through its dependable profitability and low investment needs for direct product development.

| Segment | FY2024 Revenue Growth | FY2024 Operating Income Growth | BCG Status |

|---|---|---|---|

| Financial Services | 29.7% | 32.6% | Cash Cow |

Delivered as Shown

Yamaha BCG Matrix

The Yamaha BCG Matrix preview you're seeing is the identical, fully formatted document you'll receive instantly after your purchase. This means no watermarks, no demo content, just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Some older or less popular Yamaha motorcycle models, particularly those that haven't seen significant updates, might be classified as Dogs in the BCG Matrix. These bikes likely hold a small market share within their respective, mature segments. For instance, a model like the Yamaha XT250, while reliable, competes in a segment with many newer, technologically advanced options, potentially limiting its growth trajectory.

These models typically contribute minimally to Yamaha's overall revenue and profitability. They might even demand more in terms of maintenance and inventory holding costs than they generate in returns. In 2024, the overall powersports market is experiencing shifts, with a strong demand for adventure and sport touring bikes, potentially leaving older, less specialized models further behind in market relevance.

Certain acoustic wind instruments within Yamaha's portfolio might be categorized as Cash Cows or even question marks depending on their market position and growth trajectory. While Yamaha is a dominant force in musical instruments, specific acoustic wind lines could be operating in mature or declining market segments. For instance, revenue for wind, string, and percussion instruments saw a decrease in FY2025, partly attributed to the cessation of financial aid programs in the U.S., indicating potential challenges for some of these product categories.

Yamaha's 'others' segment, encompassing automobile interior wood components, experienced a revenue decline in fiscal year 2025. This performance places these components in a challenging position within the BCG matrix, potentially categorizing them as a 'Dog'.

The decrease in revenue suggests a declining market or a loss of competitive edge for Yamaha's wood interior offerings. If demand continues to wane or if competitors offer more appealing alternatives, these components represent a drain on resources without a clear path to significant future returns.

For instance, if this segment's contribution to Yamaha's overall revenue has fallen below 5% and its market growth rate is less than 3% in 2025, it strongly indicates a 'Dog' status, requiring careful consideration for divestment or a significant strategic pivot.

Personal Watercraft (PWC)

The Personal Watercraft (PWC) segment for Yamaha experienced a significant downturn in 2024. Demand faltered considerably, a direct consequence of escalating interest rates and persistent inflation that dampened consumer spending on recreational items. This economic environment made financing a PWC less accessible and more costly for many potential buyers.

Despite improvements in supply chain logistics, which allowed for an increase in unit availability and thus unit sales, customer hesitancy remained a dominant factor. This reluctance signals a market characterized by low growth prospects. For certain Yamaha PWC models, this translates into a potentially low market share, positioning them as 'Dogs' in the BCG matrix. Yamaha is actively exploring strategies to revitalize these offerings and improve their market standing.

- 2024 PWC Market Conditions: Characterized by reduced consumer demand driven by economic headwinds.

- Impact of Economic Factors: Rising interest rates and inflation significantly curtailed purchasing power for PWC.

- Supply vs. Demand Disconnect: While unit sales saw an increase due to better supply, customer demand lagged, indicating a weak market.

- BCG Matrix Classification: Certain PWC models exhibit characteristics of 'Dogs' due to low market share in a low-growth environment.

Traditional, Low-Tech Electronic Devices (Non-Audio)

Yamaha's involvement extends beyond its renowned musical and audio products into a range of other electronic devices. These may include older, less technologically advanced items that now face significant competition and have become largely commoditized.

Such product lines, characterized by low market share within stagnant market segments, often generate minimal returns for the company. For instance, consider their historical presence in certain types of consumer electronics where rapid technological obsolescence and intense price competition from lower-cost manufacturers have diminished profitability.

- Low Market Share: Products in this category typically hold a small percentage of their respective markets.

- Stagnant Market Growth: The overall market for these devices experiences little to no expansion.

- Intense Competition: These segments are often crowded with numerous players, driving down prices and margins.

- Low Profitability: The combination of these factors results in minimal financial returns for Yamaha.

Yamaha's older or less popular motorcycle models, such as the XT250, can be classified as Dogs. These bikes have a small market share in mature segments and face stiff competition from newer, technologically advanced options, limiting their growth potential.

These "Dog" products typically contribute very little to Yamaha's overall revenue and profitability. They might even incur higher maintenance and inventory costs than the returns they generate, especially in 2024's shifting powersports market favoring adventure and sport touring bikes.

Yamaha's automobile interior wood components also represent a potential Dog category, as evidenced by a revenue decline in fiscal year 2025. This segment faces challenges due to waning demand or increased competition, potentially making it a resource drain without significant future returns.

Certain Personal Watercraft (PWC) models are also identified as Dogs due to the significant downturn in the 2024 market. Escalating interest rates and inflation dampened consumer spending, leading to low growth prospects and potentially low market share for these models, despite improved unit availability.

| Category | Market Share | Market Growth | Profitability | BCG Classification |

| Older Motorcycle Models | Low | Low | Low | Dog |

| Automobile Interior Wood Components | Low | Low | Low | Dog |

| Certain PWC Models | Low | Low | Low | Dog |

| Less Advanced Consumer Electronics | Low | Low | Low | Dog |

Question Marks

Yamaha's electric motorcycle and scooter segment, including models like the E01 and a scooter based on the River Indie, is positioned as a Star in the BCG Matrix. The company is strategically investing in this area, with new electric scooters planned for global release. Production for the River Indie-based scooter in India is slated to begin between July and September 2025.

The electric two-wheeler market is experiencing substantial growth, presenting a high-potential environment for Yamaha. While Yamaha is a relatively new player in the mass-market electric vehicle sector, this translates to a low current market share within a rapidly expanding industry. This dynamic suggests significant room for growth and market capture, characteristic of a Star.

Yamaha Motor's involvement in industrial robots and unmanned systems, exemplified by the upcoming CELL HANDLER™ 2 in 2025, positions them in a high-growth sector. This area is characterized by rapid technological evolution, demanding substantial investment to capture significant market share and achieve leadership.

While the industrial robotics market is expanding, with global revenues projected to reach approximately $74.5 billion by 2027, Yamaha's specific share in niche applications like advanced cell handlers might still be developing. This suggests that these products could be considered 'question marks' in the BCG matrix, requiring strategic investment to grow their market presence.

Yamaha's potential AI-integrated musical instruments and audio solutions would likely fall into the Question Mark category of the BCG Matrix. This segment represents a high-growth, emerging market, with projections indicating the fastest compound annual growth rate (CAGR) between 2025 and 2030 for hybrid and smart instruments. The surge in subscription-based remote music learning further fuels this growth trajectory.

Given Yamaha's established presence in technological innovation and networked audio systems, it's logical to assume they are either actively developing or exploring AI-integrated products in this space. However, the specific market share Yamaha currently holds within this niche of AI-powered instruments remains a significant question mark, making it a strategic area for careful consideration and potential investment.

Hydrogen-Powered Outboard Motors

Yamaha's unveiling of the world's first hydrogen-powered outboard motor at the SEMA Show 2024, coupled with their April 2024 acquisition of Torqeedo, signals a bold move into a nascent, high-potential market. This strategic positioning highlights hydrogen as a significant Question Mark within Yamaha's portfolio, characterized by cutting-edge innovation and anticipated rapid growth, yet currently holding a minimal market share in marine propulsion.

This technological frontier presents a substantial investment opportunity for Yamaha, aiming to capture future market demand as environmental regulations and consumer preferences shift towards sustainable solutions. The company's proactive approach through both R&D and strategic acquisition underscores a commitment to leading the transition in the marine sector.

- Innovation: Yamaha is pioneering hydrogen fuel cell technology for outboard motors, a significant technological leap.

- Growth Potential: The marine industry is increasingly focused on decarbonization, creating a high growth outlook for clean propulsion systems like hydrogen.

- Market Share: Currently, hydrogen-powered outboards represent a very small fraction of the overall outboard motor market.

- Strategic Move: The acquisition of Torqeedo and development of hydrogen technology demonstrate Yamaha's strategy to invest in and capture future market share in electric and alternative fuel marine propulsion.

Electrically Power-Assisted Bicycles

Yamaha's electrically power-assisted bicycles (e-bikes) fit into the Question Mark category within the BCG Matrix. This is due to the rapidly expanding global e-bike market, driven by a strong push for sustainable urban transportation solutions. For instance, the global e-bike market was valued at approximately $25 billion in 2023 and is projected to reach over $55 billion by 2030, showing significant growth potential.

Despite this market expansion, Yamaha's market share in the e-bike segment, especially in key international markets outside of its domestic stronghold in Japan, might be considered relatively modest compared to established competitors. This positions it as a Question Mark, requiring strategic investment and focused efforts to increase brand visibility and sales volume.

- Market Growth: The e-bike market is experiencing robust growth, with CAGR projections often exceeding 10%.

- Yamaha's Position: Yamaha is a recognized brand but faces intense competition from both established players and new entrants in the e-bike space.

- Strategic Need: Significant investment in marketing, distribution, and product development is crucial for Yamaha to capitalize on the expanding e-bike demand and improve its market share.

- Future Potential: With the right strategic moves, Yamaha's e-bike division has the potential to transition from a Question Mark to a Star.

Yamaha's AI-integrated musical instruments and audio solutions are considered Question Marks due to the high-growth potential of this emerging market. Projections indicate a strong compound annual growth rate (CAGR) for hybrid and smart instruments between 2025 and 2030, further boosted by the rise in remote music learning. Yamaha's existing technological strengths position them well to explore these innovations, but their current market share in this specific niche remains uncertain, necessitating strategic investment.

| Category | Market Potential | Yamaha's Position | Strategic Implication |

| AI Musical Instruments | High Growth (CAGR 2025-2030) | Low Market Share, Emerging | Requires Investment for Growth |

BCG Matrix Data Sources

Our Yamaha BCG Matrix is built on comprehensive data, including financial reports, market share analysis, industry growth rates, and product lifecycle data.