Yalla SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yalla Bundle

Yalla's strengths lie in its robust digital platform and growing user base, positioning it well in the competitive market. However, potential weaknesses include reliance on specific regional markets and ongoing regulatory challenges. Opportunities abound for expansion into new service areas and strategic partnerships, but threats from emerging competitors and shifting consumer preferences demand careful consideration.

Want to truly understand Yalla's strategic landscape and unlock its full potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, pitches, and research.

Strengths

Yalla Group Limited stands as the undisputed leader in the MENA region's online social networking and gaming sector, a position solidified by its impressive revenue performance in 2024. This commanding market share translates into substantial competitive advantages, including enhanced brand recognition and greater customer loyalty within its primary markets.

Yalla's success is significantly boosted by its deep understanding of the MENA region's culture. Features like the 'Majlis functionality' in Yalla Ludo directly cater to local social habits, creating a strong sense of belonging for users. This strategic focus on cultural relevance is a key differentiator against global platforms.

This localization strategy translates into tangible engagement metrics. For instance, Yalla's platforms consistently show high user retention rates, with many users spending multiple hours daily. This loyalty is a direct outcome of content and features that feel authentically tailored to the MENA audience.

In 2023, Yalla reported that its voice-centric social gaming platforms had over 20 million monthly active users. This substantial user base highlights the effectiveness of their localized approach in capturing and retaining users within the target market, a feat many international companies struggle to achieve.

Yalla Group's financial performance is a significant strength, showcasing consistent growth and profitability. In 2024, the company achieved record full-year revenues of US$339.7 million, marking a solid 6.5% increase compared to the previous year. This upward trend continued into the first quarter of 2025, with revenues reaching US$83.9 million, again up 6.5% year-over-year.

This sustained revenue growth, combined with expanding net margins, points to Yalla's success in implementing effective monetization strategies across its platforms. The company's ability to translate user engagement into financial gains highlights strong operational efficiency and a robust business model.

Diverse and Expanding Product Ecosystem

Yalla Group is strategically broadening its product portfolio beyond its initial successes in voice chat and gaming. This expansion is evident in its commitment to developing mid-core and hard-core games through Yalla Game Limited, signaling a move into more complex gaming genres. The introduction of specialized applications such as YallaChat and WeMuslim further demonstrates a deliberate effort to cater to diverse user needs and create a more robust digital entertainment ecosystem.

This diversified product strategy aims to capture a wider audience and enhance user engagement across multiple platforms. By venturing into new game categories and niche applications, Yalla Group is positioning itself to become a more comprehensive provider of digital social and entertainment services. This approach is crucial for sustained growth in the competitive digital market.

- Expanding Game Portfolio: Yalla Group's subsidiary, Yalla Game Limited, is actively developing mid-core and hard-core games.

- Niche Application Development: The company has introduced specialized apps like YallaChat and WeMuslim.

- Ecosystem Integration: These new offerings contribute to a more comprehensive and integrated digital entertainment ecosystem.

- Market Diversification: This strategy aims to broaden Yalla's reach and appeal to a wider range of users.

High User Engagement and Retention

Yalla demonstrates exceptional user engagement and retention, a significant strength. The company consistently reports healthy growth in its user base and key engagement metrics. For instance, average Monthly Active Users (MAUs) saw a robust 17.9% year-over-year increase, reaching 44.6 million in the first quarter of 2025. This growth is attributed to ongoing product enhancements and the effective implementation of gamification strategies, which clearly resonate with the target audience and contribute to the platform's inherent stickiness.

This strong user engagement translates into tangible benefits for Yalla.

- Sustained User Growth: MAUs reached 44.6 million in Q1 2025, up 17.9% year-over-year.

- Platform Stickiness: Continuous product enhancement and gamification drive user retention.

- Audience Appeal: The platform's features and experience are highly appealing to its target demographic.

- Engagement Metrics: Yalla consistently reports strong performance in user activity and interaction.

Yalla Group's leadership in the MENA social networking and gaming sector is a core strength, evidenced by its consistent revenue growth. In 2024, revenues hit US$339.7 million, a 6.5% increase, with Q1 2025 continuing this trend at US$83.9 million, also up 6.5% year-over-year. This financial performance underscores a robust business model and effective monetization strategies.

The company's deep cultural understanding of the MENA region is a significant differentiator, fostering strong user loyalty through localized features like the 'Majlis functionality' in Yalla Ludo. This cultural resonance translates into high user engagement, with many users spending hours daily on the platforms.

Yalla is actively diversifying its offerings, expanding into mid-core and hard-core games via Yalla Game Limited and introducing niche applications like YallaChat and WeMuslim. This strategic expansion aims to capture a broader audience and build a more integrated digital entertainment ecosystem.

Exceptional user engagement and retention are key strengths, with Monthly Active Users (MAUs) reaching 44.6 million in Q1 2025, a 17.9% year-over-year increase. This sustained user growth is driven by product enhancements and effective gamification strategies.

| Metric | Q1 2025 | Year-over-Year Change |

|---|---|---|

| Revenue (US$) | 83.9 million | +6.5% |

| Monthly Active Users (MAUs) | 44.6 million | +17.9% |

| Full Year 2024 Revenue (US$) | 339.7 million | +6.5% |

What is included in the product

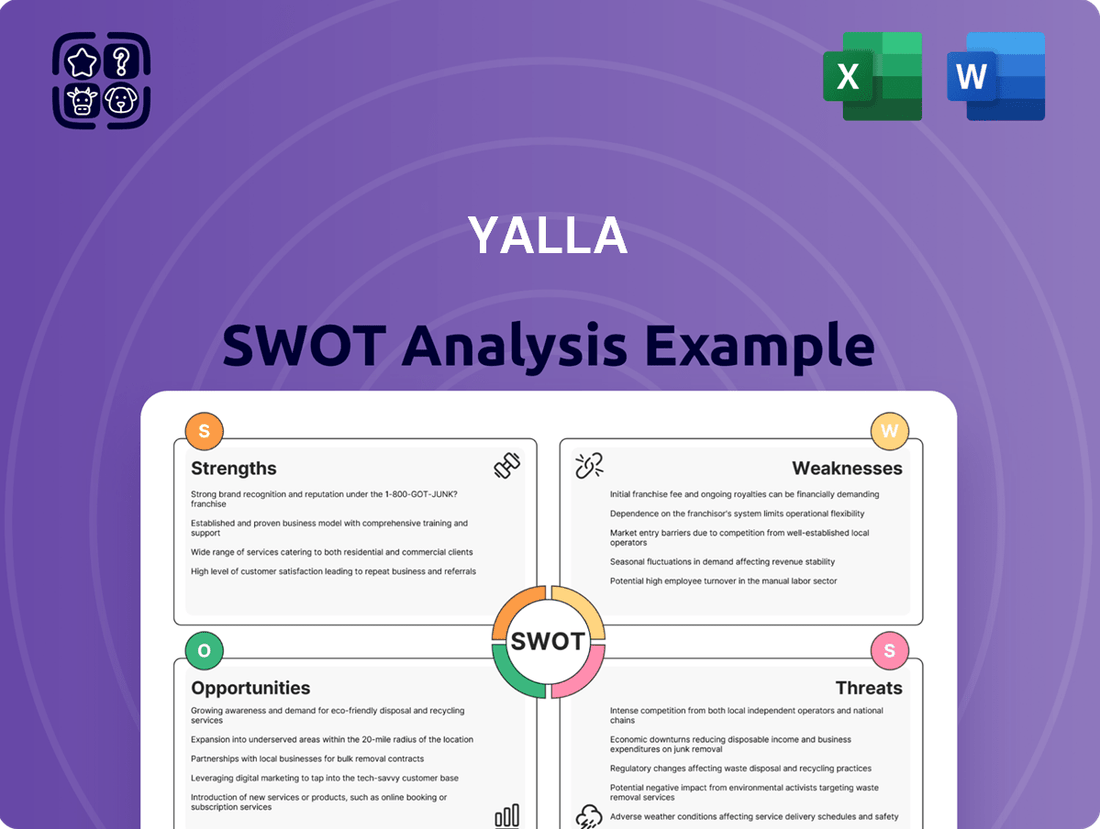

Delivers a strategic overview of Yalla’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Yalla's SWOT Analysis offers a clear, actionable framework that simplifies complex strategic planning, alleviating the pain of indecision and confusion.

Weaknesses

While Yalla's strong presence in the MENA region is a key advantage, it also creates a significant weakness due to concentrated market exposure. This geographic focus means the company's financial health is heavily tied to the economic and political stability of the Middle East and North Africa. For instance, a sudden downturn in a major MENA economy, as seen with fluctuations in oil prices impacting regional GDP, could disproportionately affect Yalla's revenue streams. In 2024, many MENA economies continued to navigate global economic headwinds, highlighting the sensitivity of businesses operating primarily within this area.

Yalla navigates a fiercely competitive digital entertainment arena, contending with global giants like Meta and Tencent, alongside nimble local competitors. This rivalry demands constant product evolution and substantial marketing expenditure to secure and expand its user base.

In 2023, the global social media market was valued at an estimated $218.2 billion, highlighting the scale of competition Yalla faces. Furthermore, the mobile gaming sector, a key area for Yalla, is projected to reach $272 billion by 2028, indicating a market ripe with established players and new entrants vying for consumer attention and revenue.

Despite Yalla's overall growth in monthly active users (MAU), a notable weakness lies in its fluctuating paying user base. In the first quarter of 2025, Yalla observed an 8.0% decline in paying users when compared to the same period in 2024. This indicates a potential struggle in effectively converting its free user base into paying subscribers or retaining those who are already paying. Such a trend could pose a risk to Yalla's future revenue streams and overall financial stability.

Dependency on Voice-Centric Model

Yalla's core strength, its voice-centric model, also presents a significant weakness. An over-dependence on this feature, while culturally resonant in many of its target markets, could hinder wider adoption if user preferences evolve towards other interaction methods. This focus might limit Yalla's appeal to demographics less inclined towards voice-based platforms, potentially capping its growth trajectory.

The platform's reliance on voice could also make it susceptible to shifts in user behavior or technological trends. For instance, if the market sees a significant move towards text-based social media or other forms of digital communication, Yalla might struggle to adapt. Diversifying its feature set beyond voice could be essential for sustained relevance and to mitigate the risk of becoming a niche product.

- Limited Appeal: A voice-centric approach may not resonate with all user segments, potentially excluding those who prefer text or visual communication.

- Technological Vulnerability: Over-reliance on voice makes Yalla susceptible to shifts in user preferences or the emergence of superior voice interaction technologies.

- Market Saturation: While voice is a differentiator, the broader social media landscape is dominated by text and visual content, creating a challenge for a voice-first platform to gain mass market share.

- Adaptability Risk: Failure to diversify beyond voice could make Yalla less adaptable to future market changes and evolving user engagement patterns.

Content Moderation and Regulatory Compliance Burden

Yalla faces a significant challenge in managing content moderation and ensuring regulatory compliance, particularly given the diverse cultural landscape of the MENA region. This includes navigating evolving data privacy laws, such as those in Saudi Arabia and the UAE, which are increasingly focused on user data protection and platform accountability.

The sheer volume of user-generated content on a platform like Yalla necessitates robust systems and human oversight to identify and remove harmful material, hate speech, and misinformation, a task that is both resource-intensive and complex. For instance, in 2024, social media platforms globally reported significant increases in the volume of content requiring moderation, often citing the need for advanced AI tools coupled with human review to keep pace.

Failure to adequately address these issues can result in substantial penalties. In 2023, regulatory bodies in various countries imposed fines on tech companies for data privacy breaches and non-compliance with content regulations, highlighting the financial and reputational risks involved. Yalla must invest heavily in technology and personnel to mitigate these risks.

- Content Moderation Costs: Significant investment is required for AI tools and human moderators, with global spending on content moderation projected to increase by 15-20% annually through 2025.

- Regulatory Fines: Non-compliance with data privacy laws, such as GDPR or emerging regional regulations, can lead to fines that are a percentage of global revenue, potentially reaching billions of dollars.

- Reputational Damage: Mishandling sensitive content or experiencing data breaches can severely erode user trust and brand image, impacting user acquisition and retention rates.

- Evolving Legal Landscape: Keeping abreast of and adapting to rapidly changing digital regulations across multiple operating countries is a continuous and resource-draining effort.

Yalla's concentrated geographic focus in the MENA region exposes it to significant risks tied to regional economic and political volatility. A downturn in key MENA economies, as seen with oil price fluctuations impacting GDP, could disproportionately affect Yalla's revenue. In early 2025, many MENA economies continued to face global economic uncertainty, underscoring this vulnerability.

Full Version Awaits

Yalla SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The gaming market in the Middle East and North Africa (MENA) is on a significant upward trajectory. Projections indicate it could reach approximately $15 billion by 2029, demonstrating a robust growth rate. This expansion offers Yalla a prime opportunity to broaden its gaming portfolio, attract a larger user base, and enhance revenue streams across its current and future game titles.

Yalla Group is actively pursuing strategic expansion beyond its core MENA region, a move that presents a significant growth opportunity. The launch of Yalla Parchis in South America, for instance, demonstrates a clear intent to tap into new user demographics and markets. This geographical diversification is crucial for reducing reliance on any single region and unlocking fresh revenue potential.

Yalla's strategic focus on developing mid-core and hard-core games through Yalla Game Limited presents a significant opportunity to tap into more premium gaming segments. This expansion aims to attract a broader and potentially more engaged player base, which could translate to higher revenue streams.

By offering more complex and immersive gaming experiences, Yalla can differentiate itself in a competitive market and capture a larger share of consumer spending on entertainment. This strategic shift is designed to boost Average Revenue Per User (ARPU) by catering to players willing to invest more time and money into their gaming pursuits.

The company's commitment to this area is supported by industry trends showing substantial growth in the mid-core and hard-core gaming sectors. For instance, the global mobile gaming market, which Yalla primarily operates within, was projected to reach over $100 billion in 2024, with a significant portion attributed to these more engaging game types.

Leveraging AI for Enhanced User Experience and Operational Efficiency

Yalla is making significant strides in integrating Artificial Intelligence (AI) across its platform. This strategic move aims to directly enhance the user experience by offering more personalized content and services. For instance, AI-powered recommendation engines can analyze user behavior to suggest relevant games, events, or social connections, thereby increasing engagement. This personalization is key to retaining users in a competitive digital landscape.

Beyond user-facing improvements, AI is also a critical component in optimizing Yalla's internal operations. The company is leveraging AI to automate tasks, streamline workflows, and improve decision-making processes. This can translate into substantial cost savings and increased productivity. For example, AI can be used for fraud detection, customer service automation, and data analysis, allowing Yalla to allocate resources more effectively and maintain a competitive edge.

- Personalized Content Delivery: AI algorithms can tailor content, such as game recommendations or social feeds, to individual user preferences, boosting engagement and time spent on the platform.

- Enhanced User Retention: By creating more relevant and engaging experiences, AI contributes to higher user satisfaction and reduced churn rates.

- Operational Cost Optimization: Automation of tasks like customer support queries or data processing through AI can lead to significant reductions in operational expenses.

- Data-Driven Insights: AI enables Yalla to extract deeper insights from user data, informing strategic decisions and product development for continuous improvement.

Growth in Social Commerce and Influencer Marketing

The MENA region is experiencing a significant surge in social commerce, with consumers actively purchasing products directly through social media platforms. This trend is further amplified by the growing influence of social media personalities. In 2024, influencer marketing spend in the MENA region was projected to reach $1.1 billion, demonstrating a substantial opportunity for platforms like Yalla.

Yalla can leverage this by embedding seamless e-commerce functionalities within its existing social platforms, allowing users to discover and purchase products without leaving the app. Developing strategic partnerships with key regional influencers will be crucial to drive engagement and build trust among Yalla's user base, thereby unlocking new revenue streams through sponsored content and affiliate marketing.

- MENA Social Commerce Growth: Consumers are increasingly making purchases directly via social media channels.

- Influencer Marketing Spend: Projected to hit $1.1 billion in MENA in 2024, indicating strong market potential.

- Yalla's Integration Opportunity: Embedding e-commerce features to facilitate direct purchases within its ecosystem.

- Partnership Strategy: Collaborating with regional influencers to boost brand visibility and drive sales.

Yalla's expansion into new geographic markets, like its launch in South America with Yalla Parchis, presents a significant avenue for growth. This diversification reduces reliance on any single region and opens up new revenue streams by tapping into different user demographics.

The increasing demand for mid-core and hard-core games offers Yalla a chance to capture more premium market segments. This strategic shift can lead to higher Average Revenue Per User (ARPU) by catering to players willing to invest more time and money, aligning with the global mobile gaming market's projected over $100 billion valuation in 2024.

Yalla's integration of AI across its platform is a key opportunity. AI-driven personalization of content and services can significantly enhance user experience, leading to greater engagement and retention. Furthermore, AI can optimize operations, reducing costs and improving decision-making by leveraging data insights.

The burgeoning social commerce trend in the MENA region, with an anticipated $1.1 billion in influencer marketing spend for 2024, provides Yalla with a prime opportunity. By integrating e-commerce features and partnering with influencers, Yalla can tap into this growing market, creating new revenue channels through direct sales and sponsored content.

| Opportunity Area | Market Trend/Data | Yalla's Strategic Play |

|---|---|---|

| Geographic Expansion | MENA gaming market projected to reach $15 billion by 2029. | Launch in new regions like South America (Yalla Parchis). |

| Game Portfolio Diversification | Global mobile gaming market >$100 billion in 2024. | Focus on mid-core and hard-core games for higher ARPU. |

| AI Integration | AI enhancing user personalization and operational efficiency. | Personalized content delivery, improved user retention, cost optimization. |

| Social Commerce | MENA influencer marketing spend projected at $1.1 billion in 2024. | Embed e-commerce, partner with influencers for sales and engagement. |

Threats

The digital entertainment sector in the Middle East and North Africa (MENA) is seeing a surge in competition. Both major global players like TikTok and established gaming companies, alongside nimble local startups, are vying for user attention. This crowded market presents a significant hurdle for Yalla, impacting its ability to attract new users and keep existing ones engaged. For context, the MENA region's digital advertising spend was projected to reach $5.5 billion in 2024, indicating the intensity of efforts to capture market share.

This escalating rivalry directly threatens Yalla's market share and user base. To counter this, the company might need to significantly increase its marketing and user acquisition expenses. For instance, in Q1 2024, Yalla reported a 15% year-over-year increase in sales and marketing expenses, reflecting the pressure to maintain growth in this dynamic environment. Such increased spending can impact profitability if not managed effectively.

The technology landscape is evolving at an unprecedented pace, with new platforms and features emerging constantly. For Yalla, this means the constant threat of new entrants or existing competitors launching innovative solutions, such as advanced virtual reality (VR) or augmented reality (AR) experiences, potentially impacting user engagement and market share.

Failure to adapt to these rapid innovation cycles, like the growing interest in Metaverse integrations, could lead to Yalla becoming technologically obsolete. Consider that in 2024, the global AR/VR market was projected to reach over $100 billion, highlighting the significant investment and rapid development in these areas.

The digital landscape in the Middle East and North Africa (MENA) is continually reshaped by new rules on data privacy, content moderation, and online behavior. For instance, Saudi Arabia's Personal Data Protection Law (PDPL), which fully came into effect in March 2024, imposes stringent requirements on data handling, potentially increasing compliance costs for platforms like Yalla.

Strict adherence to these evolving regulations, or sudden shifts in policy, could lead to substantial operational expenses for Yalla. Such changes might also necessitate limiting certain platform functionalities or could erode user confidence and participation, directly impacting engagement metrics and revenue streams.

Data privacy concerns are paramount; a data breach or non-compliance could result in significant fines and reputational damage. For example, the UAE's Federal Decree Law No. 45 of 2021 on Personal Data Protection, which mirrors GDPR principles, carries penalties that can be substantial for non-adherence.

Yalla must remain agile, investing in robust data security measures and legal counsel to navigate this complex environment. Proactive adaptation to regulatory changes is key to mitigating risks and maintaining a trusted user experience in the dynamic MENA digital market.

Geopolitical Instability and Economic Volatility in MENA

Yalla's direct focus on the MENA region means it's particularly vulnerable to the region's inherent geopolitical risks and economic fluctuations. Ongoing or escalating conflicts, like those seen in parts of the Levant or North Africa, can significantly dampen consumer confidence and discretionary spending, directly impacting Yalla's revenue streams. For instance, the IMF projected a subdued economic growth for the MENA region in 2024, averaging around 2.9%, a figure that could be further eroded by unforeseen geopolitical events.

Disruptions to internet infrastructure due to regional instability are another critical threat, potentially limiting user access to Yalla's services and hindering growth. Economic downturns can also lead to decreased advertising budgets from businesses, a key revenue source for many digital platforms. By mid-2024, several MENA economies were grappling with inflation rates exceeding 5%, which can squeeze household incomes and reduce spending on digital services.

- Regional Conflicts: Persistent or new conflicts in the MENA region directly threaten Yalla's operational stability and user engagement.

- Economic Downturns: Slower economic growth and inflation in key MENA markets can reduce consumer spending and advertising expenditure.

- Infrastructure Disruption: Geopolitical instability could lead to interruptions in internet connectivity, limiting Yalla's reach.

- Shifting Consumer Behavior: Economic pressures and uncertainty can cause users to cut back on non-essential digital services.

Risk of User Churn and Shifting Preferences

User preferences in the digital and gaming spheres are incredibly fluid, often changing without much notice. This presents a significant threat to Yalla. If the company doesn't keep up by offering fresh, captivating content and new functionalities, users might easily drift away to competitors.

The risk of users leaving, or churn, is amplified if Yalla doesn't consistently innovate and maintain a top-notch user experience. For instance, in the competitive social gaming market, a failure to adapt could lead to a decline in active users. In 2024, the global mobile gaming market alone was projected to reach over $100 billion, highlighting the intense competition for user attention.

- Dynamic User Preferences: The digital entertainment landscape demands constant evolution.

- Risk of Churn: Failure to innovate can lead to users migrating to more engaging platforms.

- Competition for Engagement: Yalla must continually offer novel content and features to retain its audience.

- Market Size Factor: With the mobile gaming market valued in the tens of billions, user retention is paramount.

Yalla faces intense competition from global and local players in the MENA digital entertainment market, which saw digital ad spend projected at $5.5 billion in 2024. This necessitates increased marketing spend, as evidenced by Yalla's 15% year-over-year increase in sales and marketing expenses in Q1 2024, impacting profitability.

Rapid technological advancements, like the projected over $100 billion global AR/VR market in 2024, pose a threat of obsolescence if Yalla fails to innovate, for example, by integrating Metaverse features.

Evolving data privacy regulations, such as Saudi Arabia's PDPL effective March 2024 and the UAE's data protection law, increase compliance costs and could restrict functionalities, potentially affecting user trust and revenue.

Geopolitical instability and economic fluctuations in the MENA region, with projected 2.9% growth in 2024 potentially impacted by conflicts and inflation exceeding 5% in mid-2024, can reduce consumer spending and advertising budgets.

Fluid user preferences in digital and gaming demand constant innovation; failure to offer fresh content and features risks user churn in a market where the mobile gaming sector alone was projected over $100 billion in 2024.

SWOT Analysis Data Sources

This Yalla SWOT analysis is built upon a robust foundation of credible data, drawing from Yalla's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on the company's internal capabilities and the external market environment.