Yalla Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yalla Bundle

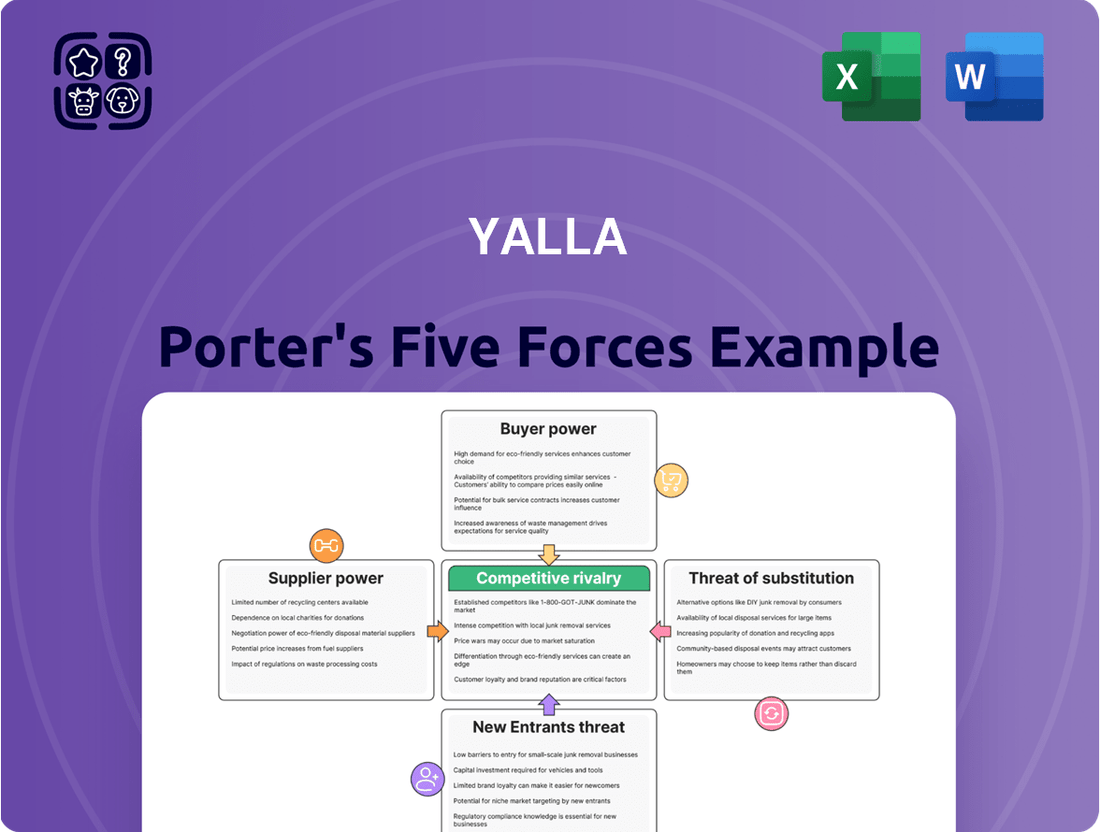

Yalla Porter's Five Forces Analysis illuminates the competitive landscape, revealing the intense rivalry and the significant bargaining power of buyers in its market. The threat of new entrants is moderate, while the threat of substitutes presents a growing challenge. Understanding these dynamics is crucial for Yalla's strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Yalla’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Yalla Group's reliance on essential technology providers, such as cloud infrastructure and payment gateways, can significantly impact its operational costs and flexibility. The concentration of key technology providers in the MENA region is a critical factor. If only a few dominant players control essential services, their bargaining power escalates, potentially resulting in higher fees or less favorable contract terms for Yalla.

For instance, cloud computing is fundamental to Yalla's operations. Major global providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer extensive infrastructure. While these global giants provide scale and advanced services, their dominance, coupled with any significant regional players, can create a scenario where Yalla has limited alternatives. This concentration means suppliers can dictate terms, affecting Yalla's profitability and competitive edge.

In 2024, the cloud computing market continued to see significant investment, with global spending projected to reach hundreds of billions of dollars. Providers like AWS, Azure, and Google Cloud hold substantial market share, often exceeding 60% collectively. This consolidation of market power among a few large entities directly translates to increased bargaining leverage for them when negotiating with companies like Yalla, potentially leading to higher infrastructure costs if Yalla cannot secure competitive pricing through long-term commitments or alternative solutions.

The cost and complexity of switching core technology suppliers, such as cloud hosting providers, represent a significant hurdle for Yalla. Migrating its extensive platform and user data to a new provider would likely involve substantial expenses and operational disruptions. For instance, a major cloud migration can take months, with costs potentially running into millions of dollars for a platform of Yalla's scale, encompassing data transfer, re-architecting applications, and retraining staff.

While fundamental cloud services are becoming increasingly standardized, the bargaining power of suppliers can significantly shift when they offer unique or highly specialized capabilities. For instance, providers excelling in advanced AI/ML model deployment or offering sophisticated, integrated cybersecurity solutions tailored to specific industry needs can command greater leverage.

If Yalla Porter's operations depend on such specialized offerings, like hyper-personalized customer service AI or unique data analytics tools, the suppliers providing these distinct advantages would possess a stronger negotiating position. This is because Yalla would have fewer readily available alternatives that can match the same level of specialized functionality.

For example, a cloud provider offering proprietary, highly secure payment gateway integration that is essential for Yalla's regional expansion in markets with stringent regulations, like certain Southeast Asian countries, would have considerable bargaining power. By mid-2024, the demand for specialized cloud services, particularly in AI and cybersecurity, continued to outpace supply, with reports indicating significant price increases for niche cloud computing resources.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers is influenced by their ability to forward integrate, meaning they could potentially become direct competitors. For Yalla, this threat might materialize if suppliers of its core services, like social networking or gaming platforms, decided to develop their own competing offerings. This would allow them to capture more of the value chain and potentially disintermediate Yalla.

While infrastructure providers might seem less inclined to forward integrate into Yalla’s specific business, large technology conglomerates with broad service portfolios present a more nuanced threat. For instance, companies like Tencent, a major player in cloud services, also possess significant operations in gaming and social media. This dual presence means that while Tencent Cloud might be a Yalla supplier, Tencent's broader ecosystem could indirectly compete if Yalla's platform relies heavily on integrated social or gaming features.

- Threat of Forward Integration: Suppliers developing their own competing platforms directly challenges Yalla's market position.

- Indirect Competition from Tech Giants: Companies like Tencent, with vast gaming and social media arms, pose a potential indirect threat if Yalla leverages their broader ecosystems.

- Example: Tencent reported over $32 billion in gaming revenue in 2023, highlighting the scale of companies that could potentially integrate forward.

Importance of Yalla to Supplier's Revenue

The extent to which Yalla constitutes a significant portion of a supplier's overall revenue directly influences the supplier's bargaining power. If Yalla is a major client, suppliers are more likely to be accommodating to maintain the business relationship, thereby reducing their leverage. For instance, if a particular content provider derives 20% of its income from Yalla's platform, they would likely be hesitant to make demands that could jeopardize this substantial revenue stream.

Conversely, for large, diversified technology suppliers, Yalla's contribution might represent a relatively small percentage of their total sales. In such scenarios, Yalla would have less influence over the supplier's terms and conditions because the supplier is not heavily reliant on Yalla's business. Consider a major cloud service provider that serves thousands of clients; Yalla's account, even if substantial in absolute terms, may be a minor factor in their overall revenue, limiting Yalla's ability to negotiate favorable terms.

- Supplier Dependence: If a supplier's revenue is heavily dependent on Yalla, their bargaining power is weakened.

- Yalla's Contribution: Yalla's share of a supplier's revenue is a key metric; a larger share means less supplier power.

- Supplier Diversification: Highly diversified suppliers have less incentive to concede to Yalla's demands.

- Relationship Management: Suppliers with a significant revenue stake from Yalla are motivated to maintain a positive business relationship.

Yalla's bargaining power with suppliers is significantly influenced by the availability of alternatives and the ease of switching providers. High switching costs, often involving substantial financial investment and operational disruption, tip the scales in favor of powerful suppliers. This is particularly true for essential services like cloud infrastructure, where migrating complex platforms can cost millions and take months.

Suppliers offering unique or highly specialized capabilities, such as advanced AI/ML solutions or tailored cybersecurity, also gain considerable leverage. Yalla's dependence on these distinct functionalities limits its ability to find comparable replacements, strengthening the supplier's negotiating position. For example, reliance on proprietary, secure payment gateway integrations for regulated markets enhances supplier power.

The threat of forward integration by suppliers, where they might launch competing services, also plays a role. Large tech conglomerates with diverse portfolios, like those in gaming and social media, present an indirect competitive risk. Yalla's reliance on their broader ecosystems could lead to potential disintermediation if these giants decide to develop similar offerings.

Supplier dependence on Yalla's business is a critical factor; if Yalla represents a significant revenue stream for a supplier, their bargaining power diminishes. Conversely, if Yalla is a small client for a highly diversified supplier, Yalla has less leverage. In 2024, the trend of consolidation in key technology sectors continued, with major cloud providers maintaining substantial market share, reinforcing their negotiating strength with clients like Yalla.

| Factor | Impact on Yalla | 2024 Context |

|---|---|---|

| Availability of Alternatives | Low alternatives increase supplier power. | Cloud market remains concentrated; few dominant players. |

| Switching Costs | High costs favor incumbent suppliers. | Migrating complex platforms can cost millions. |

| Supplier Specialization | Unique offerings grant suppliers leverage. | Demand for niche AI/cybersecurity services outpaced supply. |

| Forward Integration Threat | Potential for suppliers to become competitors. | Tech giants' diverse portfolios pose indirect risks. |

| Supplier Revenue Dependence | Yalla's significance to supplier revenue. | Diversified suppliers have less incentive to concede. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive evaluation of Yalla's competitive environment, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Effortlessly pinpoint strategic vulnerabilities and identify areas of competitive advantage to proactively address market pressures.

Customers Bargaining Power

Users of social networking and entertainment platforms generally experience very low costs when deciding to switch to a competitor. This ease of transition is a significant factor in the bargaining power of customers. For instance, in 2024, the average user spent just under 2 hours daily on social media, and many apps offer free basic services, meaning there's no financial penalty for trying out a new platform.

Customers can readily download and experiment with different applications without any upfront financial investment. If Yalla’s offerings, whether its features, the content available, or its pricing structure, fall short of expectations, users can seamlessly move to an alternative. This lack of financial friction empowers users to demand better value and service from Yalla.

The MENA region boasts a rich ecosystem of digital applications, including numerous social networking, communication, and gaming platforms. This abundance of alternatives significantly amplifies the bargaining power of customers. For Yalla, this means users have readily available substitutes, compelling the company to continuously innovate and offer superior features and an engaging user experience to retain its user base.

Yalla's freemium model relies on in-app purchases, but users in the MENA region, especially for casual gaming and voice chat, can be quite price-sensitive. If the cost of virtual goods or premium features feels too steep, players might cut back on spending. For instance, in 2024, the global mobile gaming market saw a significant portion of its revenue coming from in-app purchases, highlighting the importance of perceived value. If Yalla's pricing isn't competitive or doesn't clearly demonstrate added benefit, users could easily switch to alternatives offering better value.

User-Generated Content and Network Effects

Yalla's reliance on user-generated content and strong network effects significantly amplifies customer bargaining power. When a large number of users contribute content and engage within communities, the platform's value increases for everyone. However, this also means that if a substantial segment of users decides to leave, the platform's attractiveness for remaining and potential new users can rapidly decline, triggering a negative feedback loop.

This dynamic is particularly evident in platforms where community engagement is a core offering. For instance, in 2024, social media platforms that saw significant user churn often experienced a corresponding drop in engagement metrics and advertising revenue due to the weakened network effect. Yalla, by its nature, is susceptible to this; a mass exodus of users, perhaps driven by dissatisfaction with features or the emergence of a superior competitor, could severely erode its value proposition.

- User-Generated Content as a Double-Edged Sword: While essential for platform growth, user-generated content makes the platform's appeal directly dependent on active participation, giving users collective leverage.

- Network Effects and Churn Impact: The strength of Yalla's network effects means that a significant loss of users can disproportionately diminish the platform's utility for those who remain.

- Potential for Cascading Decline: A substantial user departure can create a cascading effect, making the platform less appealing and potentially accelerating further churn.

Information Availability and Transparency

Customers today have an unprecedented amount of information at their fingertips. They can easily research app functionalities, read detailed user reviews, and compare pricing and features across numerous platforms. This widespread availability of data significantly boosts their ability to make informed choices.

This transparency directly translates into increased bargaining power for customers. For instance, in the ride-sharing market, users can readily compare pricing between services like Uber and Lyft, and even explore local alternatives. In 2024, studies showed that over 70% of consumers regularly consult online reviews before making purchasing decisions, a clear indicator of how information empowers them.

- Informed Decision-Making: Access to detailed app reviews and feature comparisons allows users to select the most suitable and cost-effective platform.

- Price Sensitivity: Customers can easily compare pricing models, driving down prices as platforms compete for their business.

- Feature Expectations: Transparency in features sets benchmarks, pressuring platforms to offer competitive functionalities or risk losing users.

- Switching Costs: While not always zero, the ease of accessing information about alternatives can lower perceived switching costs for customers.

The bargaining power of customers is substantial for Yalla, primarily due to the low switching costs and the abundance of alternatives available in the digital space. Users can easily move between platforms, especially in the social networking and entertainment sectors, without incurring significant financial penalties. This ease of transition means Yalla must continuously offer compelling value to retain its user base.

In 2024, the average daily time spent on social media platforms by users was just under 2 hours, with many services offering free basic access. This low barrier to entry and engagement means customers can readily experiment with new applications. If Yalla's features, content, or pricing do not meet user expectations, they can swiftly migrate to a competitor, highlighting the need for Yalla to maintain competitive offerings and a superior user experience.

| Factor | Impact on Yalla | Customer Action |

|---|---|---|

| Low Switching Costs | High customer leverage | Easily move to competitors |

| Abundant Alternatives | Intensified competition | Shop for best features/price |

| Price Sensitivity (Freemium) | Pressure on in-app purchase revenue | Reduce spending if perceived value is low |

| Information Transparency | Empowers informed decisions | Compare reviews, features, and pricing |

What You See Is What You Get

Yalla Porter's Five Forces Analysis

This preview showcases the complete Yalla Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the industry. What you see here is the exact, professionally formatted document you will receive instantly upon purchase, ensuring no surprises or missing sections. You'll gain immediate access to this comprehensive analysis, ready for your strategic planning and business development needs. This detailed report empowers you with the insights to understand Yalla's competitive landscape and make informed decisions.

Rivalry Among Competitors

The MENA region's social networking and gaming landscape is teeming with activity, drawing in a wide array of both local and global competitors. Yalla, a prominent player in voice-based social networking and gaming, navigates this competitive environment. It contends with established international powerhouses like Meta and Tencent, alongside nimble regional startups focusing on niche social media or gaming experiences.

The digital economy across the Middle East and North Africa (MENA) region, encompassing social networking and gaming, is on a substantial growth trajectory, with forecasts suggesting it will hit $200 billion by 2025. This rapid expansion can, in some instances, temper direct competitive rivalry as companies find ample room to grow by capturing new demand rather than solely by poaching existing customers.

However, this very growth also acts as a magnet for new entrants eager to tap into the burgeoning market. Simultaneously, existing players are often incentivized to pursue aggressive expansion strategies to solidify their positions, which can, in turn, intensify competitive pressures despite the overall market expansion.

Yalla's niche in voice-centric social networking and localized board games like Yalla Ludo offers a degree of product differentiation. This focus allows them to capture a specific user base seeking interactive social experiences.

However, the core features of voice chat and casual gaming are readily replicable across the social networking and mobile gaming landscape. Competitors can quickly adopt similar functionalities, diminishing Yalla's unique appeal over time.

This constant threat of feature replication necessitates ongoing innovation to maintain a distinct value proposition. For instance, while Yalla Ludo saw significant growth, new social gaming platforms emerge regularly, offering fresh mechanics and social integration.

The competitive rivalry is therefore characterized by a persistent need for Yalla to differentiate not just through features, but also through community building and unique content. The market for social and casual gaming is highly dynamic, with new entrants frequently challenging established players.

Exit Barriers for Competitors

High exit barriers are a significant factor that can keep competitors entrenched in the market, even when facing declining profitability. These barriers can manifest in various forms, including substantial investments in fixed assets, the need for highly specialized employee skill sets, or considerable expenditure on building brand equity. For instance, companies heavily invested in proprietary technology or extensive physical infrastructure may find it prohibitively expensive to divest, thus prolonging their presence and intensifying competitive pressures. In 2024, industries with high capital intensity, such as manufacturing or heavy infrastructure, often exhibit these characteristics, forcing players to continue operations despite suboptimal returns.

In the digital realm, the nature of exit barriers shifts from tangible assets to intangible ones, yet their impact on competitive rivalry remains potent. While physical brick-and-mortar facilities are less of a concern for many online businesses, the accumulated user base and established brand recognition represent significant, often unrecoverable, investments. Companies like Meta, with its vast social media user networks, face substantial challenges in exiting or significantly altering their core offerings without incurring immense losses in perceived value and market position. The sheer inertia of a large, engaged user base acts as a powerful anchor, compelling continued engagement and competition within the existing digital landscape.

- High fixed asset investment: Companies with substantial sunk costs in specialized machinery or real estate find it difficult to exit without significant financial loss.

- Specialized talent and expertise: A workforce trained in niche skills or proprietary technologies creates a barrier to departure, as these skills may not be easily transferable.

- Brand loyalty and recognition: Significant investment in marketing and customer relationship building creates a valuable intangible asset that companies are reluctant to abandon.

- Contractual obligations: Long-term supply agreements, leases, or service contracts can lock companies into a market, even if it becomes unprofitable.

Strategic Stakes of Competitors

The MENA region is a significant growth frontier for many logistics and delivery companies. This strategic importance fuels substantial investment in tailoring services to local needs, enhancing brand presence, and innovating product offerings. For instance, by the end of 2023, major players reported double-digit year-over-year growth in the MENA market, indicating a strong competitive drive.

Consequently, competitors are highly motivated to capture and retain market share, leading to intensified battles for customer acquisition and loyalty. This aggressive competition often translates into price wars and increased promotional activities, especially in key markets like the UAE and Saudi Arabia, where market penetration is high.

The strategic stakes are further amplified by the potential for first-mover advantage and long-term market leadership. Companies are therefore willing to absorb higher operational costs in the short term to establish a dominant presence. This includes substantial outlays on technology, such as AI-powered route optimization and advanced tracking systems, which were a major focus for investment in 2024.

Key competitive dynamics include:

- Aggressive Investment in Localization: Companies are heavily investing in understanding and catering to diverse consumer preferences and regulatory landscapes across different MENA countries.

- Intense Marketing and User Acquisition: Significant marketing budgets are allocated to gain visibility and attract new users, often through competitive pricing and loyalty programs.

- Product Development and Service Innovation: Rivals are continuously enhancing their service portfolios, introducing features like faster delivery times, specialized handling, and expanded service areas to differentiate themselves.

- Focus on Technological Advancement: Adoption of cutting-edge technology is a critical battleground, aimed at improving operational efficiency and customer experience.

Competitive rivalry in the MENA social networking and gaming sector is fierce, driven by rapid market growth and the potential for significant returns. Yalla faces established global giants and emerging regional players, necessitating continuous innovation and differentiation in its voice-centric social and gaming offerings.

The high demand in the MENA digital economy, projected to reach $200 billion by 2025, attracts new entrants and encourages aggressive expansion by existing companies. This dynamic intensifies competition, even as the market expands, as players vie for new users and market share.

Yalla's differentiation through localized board games and voice chat provides a temporary edge, but feature replication by competitors is a constant threat. Maintaining a competitive advantage requires ongoing investment in unique content and community building, highlighting the need for constant adaptation in this fast-paced industry.

SSubstitutes Threaten

While digital platforms are front and center, traditional communication methods still offer a viable alternative for certain needs, acting as a substitute threat. Direct phone calls, SMS messages, and even face-to-face conversations fulfill the fundamental requirement of conveying information, albeit with less scalability for large-scale community engagement. For example, in 2024, mobile voice traffic still represented a significant portion of global telecommunications revenue, highlighting its continued relevance.

The threat of substitutes from other digital social platforms is significant for Yalla Porter. Users have a vast array of options for connecting and entertainment, from text-based messaging apps like WhatsApp and Telegram, which facilitate direct communication, to video-centric platforms such as TikTok and YouTube, offering diverse content consumption. General social networks like Facebook and Instagram also provide broad social interaction features.

These platforms compete by offering different user experiences and content formats. For instance, TikTok's short-form video focus attracts a different user base than Facebook's community-building features. In 2024, global social media usage continued to climb, with estimates suggesting over 5 billion active users, highlighting the sheer scale of the competitive landscape Yalla Porter operates within. Each platform siphons potential user attention and engagement away from dedicated logistics or community-building apps.

Yalla's entertainment offerings, particularly through games like Yalla Ludo, face significant competition from a broad spectrum of substitutes. These alternatives directly vie for users' leisure time and engagement. For instance, the mobile gaming market itself is vast, with millions of games available, many offering similar social and competitive experiences. In 2023, the global mobile gaming revenue was projected to reach over $90 billion, highlighting the sheer scale of this substitute market.

Beyond mobile games, Yalla must also contend with established platforms in console and PC gaming, which offer more immersive and graphically advanced experiences. Furthermore, video streaming services like Netflix and YouTube, along with music streaming platforms such as Spotify, consume significant amounts of user attention. These services, which generated billions in revenue in 2023, represent a strong alternative for users seeking passive entertainment, directly pulling attention away from interactive social gaming.

The threat is amplified by readily available offline entertainment options, ranging from board games and social gatherings to reading and other hobbies. These offline activities, while not directly measurable in digital revenue figures, represent a fundamental diversion of user time. The ease of access and variety of these substitutes mean that Yalla's social gaming features must continuously innovate and offer compelling value to retain users.

Emerging Technologies (e.g., AI Voice, Metaverse)

Advances in AI voice technology and the growth of metaverse platforms present a significant threat of substitutes for Yalla Porter's current services. These technologies offer increasingly immersive and interactive experiences that could draw users away from traditional online social and gaming platforms. For instance, the metaverse promises a persistent, shared virtual space where users can socialize, play games, and even conduct business, potentially replacing engagement on platforms like Yalla.

The appeal lies in the novel and engaging nature of these emerging technologies. By 2024, the global metaverse market size was projected to reach hundreds of billions of dollars, with significant investment flowing into its development. This rapid growth indicates a strong user interest and a potential shift in online behavior, making these substitutes more potent.

- Immersive Experiences: AI voice and metaverse platforms offer richer, more engaging interactions than many current online services.

- Shifting User Behavior: As these technologies mature, they could fundamentally alter how people socialize and entertain themselves online.

- Market Growth: The substantial investment and projected market growth in areas like the metaverse signal a powerful competitive force.

- Potential Disruption: Yalla Porter must consider how these substitutes could capture market share by offering fundamentally different, yet compelling, user experiences.

Offline Social and Recreational Activities

Offline social and recreational activities represent a fundamental substitute threat to online platforms. Real-world interactions, hobbies, and sports directly compete for users' time and attention, pulling them away from digital engagement. This is a constant, underlying pressure that digital services must contend with, especially as people seek balance.

The appeal of offline experiences can grow significantly, particularly when digital fatigue sets in. For instance, in 2024, there's a noticeable trend of individuals prioritizing in-person connections and activities. Participation in community sports leagues and local clubs saw a resurgence, indicating a desire for tangible social interaction.

Consider the impact on platforms like Yalla Porter. If users find more fulfilling or engaging experiences through:

- Attending live music events or festivals

- Participating in outdoor recreational activities like hiking or cycling

- Engaging in local community events or volunteer work

- Pursuing physical hobbies such as pottery or woodworking

These offline pursuits offer a direct alternative to the social networking and entertainment provided by digital services. The threat is amplified when these real-world activities offer unique benefits not easily replicated online, such as genuine physical connection or a break from screens.

The threat of substitutes for Yalla Porter is multifaceted, encompassing both digital and offline alternatives that vie for users' time and engagement. From direct communication apps to immersive metaverse experiences and traditional offline activities, Yalla faces competition across a broad spectrum.

These substitutes capture user attention by offering different forms of entertainment, social interaction, or even perceived value. For instance, while Yalla Ludo competes with other mobile games, it also competes with video streaming services and console gaming, which offer more developed experiences. In 2023, the global mobile gaming revenue exceeded $90 billion, a clear indicator of the vast substitute market.

Emerging technologies like AI voice and the metaverse present a growing threat, with projected market sizes in the hundreds of billions by 2024, signaling a potential shift in user behavior towards more immersive digital environments.

Furthermore, offline social activities, such as attending live events or participating in community sports, directly compete for leisure time, especially as users seek a break from screen-based interactions. This highlights the ongoing need for Yalla to continuously innovate and provide compelling value to retain its user base.

Entrants Threaten

Launching a social networking and gaming platform akin to Yalla Porter demands substantial financial backing. While a rudimentary app might seem accessible, creating a sophisticated, scalable, and secure experience, especially for the MENA region, necessitates significant investment. This includes building out robust server infrastructure, attracting top-tier engineering and design talent, and executing aggressive marketing campaigns for user acquisition.

For instance, major social media platforms often spend billions annually on R&D, infrastructure, and marketing. In 2023, Meta, the parent company of Facebook and Instagram, reported operating expenses of over $85 billion, a significant portion of which fuels platform development and user engagement initiatives. This highlights the immense capital required to compete and establish a significant market presence, acting as a considerable barrier for potential new entrants.

Yalla's significant brand loyalty, especially in the MENA region, presents a formidable barrier to new entrants. This loyalty is reinforced by strong network effects, particularly evident in its popular voice chat features and engaging games, which encourage users to stay within the Yalla ecosystem. For instance, Yalla's user base reached over 20 million monthly active users in 2023, demonstrating the depth of its established community. New competitors would need to invest heavily and dedicate considerable time to build comparable user engagement and overcome the inertia of existing user preferences.

New entrants in the MENA region face significant hurdles due to diverse regulatory landscapes and the need to adapt to local cultural nuances. For instance, varying data privacy laws across countries like the UAE and Saudi Arabia require substantial legal and compliance investment. A new player without this deep regional understanding might struggle with slower market penetration and increased operational costs compared to established entities.

Access to Distribution Channels

For new entrants looking to compete with Yalla, securing access to crucial distribution channels presents a significant hurdle. Gaining visibility and driving user downloads hinges on effective placement within major app stores like Google Play and the Apple App Store, alongside robust marketing efforts.

Established companies, including Yalla, benefit from well-developed marketing infrastructure and proven user acquisition strategies. This existing ecosystem makes it considerably more difficult for newcomers to capture attention and build a user base. For instance, in 2023, the average cost to acquire a user across mobile apps globally continued to climb, with some categories exceeding $5 per install, a cost that can be prohibitive for startups lacking established marketing budgets.

- App Store Dominance: New entrants must navigate the competitive landscape of app stores, where prominent placement is often influenced by existing popularity and marketing spend.

- Marketing Channel Costs: Acquiring users through digital marketing channels can be expensive, with user acquisition costs remaining a significant barrier for emerging platforms. In early 2024, mobile advertising spend was projected to reach over $360 billion globally, highlighting the scale of investment required to gain traction.

- Brand Recognition: Yalla's established brand recognition and existing user community provide a distinct advantage, making it harder for new entrants to attract initial downloads and build trust.

Technological Expertise and Talent Acquisition

The development and upkeep of advanced voice chat and gaming platforms require deep technical knowledge in areas like low-latency audio streaming and robust backend systems. New companies entering this space face a significant hurdle in acquiring the necessary skills. In 2024, the global tech talent shortage continued, with specialized roles in areas like AI and cloud computing seeing demand outstrip supply by as much as 30% in some regions, impacting the ability of new entrants to build competitive platforms.

Attracting and keeping top-tier talent is a major challenge for newcomers. Established players often offer more competitive compensation packages and a clearer career path, making it difficult for startups to poach skilled engineers and developers. For instance, the average salary for a senior game developer in major tech hubs can exceed $150,000 annually, a substantial investment for a nascent business.

- High Demand for Specialized Skills: Expertise in real-time communication protocols, game engine development, and cloud infrastructure management is critical.

- Talent Acquisition Costs: The competitive market for tech talent drives up recruitment and retention expenses, posing a barrier to entry.

- Retention Challenges: New entrants struggle to match the benefits and career progression offered by established technology firms.

- Impact of AI in Development: While AI tools can assist, they don't replace the need for skilled human developers, particularly in areas requiring nuanced problem-solving.

The threat of new entrants into Yalla's market is significantly mitigated by the substantial capital requirements for building and scaling a platform of its kind. Developing a sophisticated, secure, and engaging social networking and gaming experience, particularly tailored for the MENA region, demands immense financial backing. This includes the costs associated with robust infrastructure, attracting top engineering and design talent, and executing aggressive user acquisition campaigns. For example, in 2023, major tech companies like Meta invested heavily in platform development and user engagement, with operating expenses exceeding $85 billion, underscoring the financial barriers for newcomers.

Porter's Five Forces Analysis Data Sources

Our Yalla Porter's Five Forces analysis utilizes a comprehensive data strategy, integrating information from company financial reports, industry-specific market research, and competitor press releases to provide a robust understanding of the competitive landscape.