Yalla Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Yalla Bundle

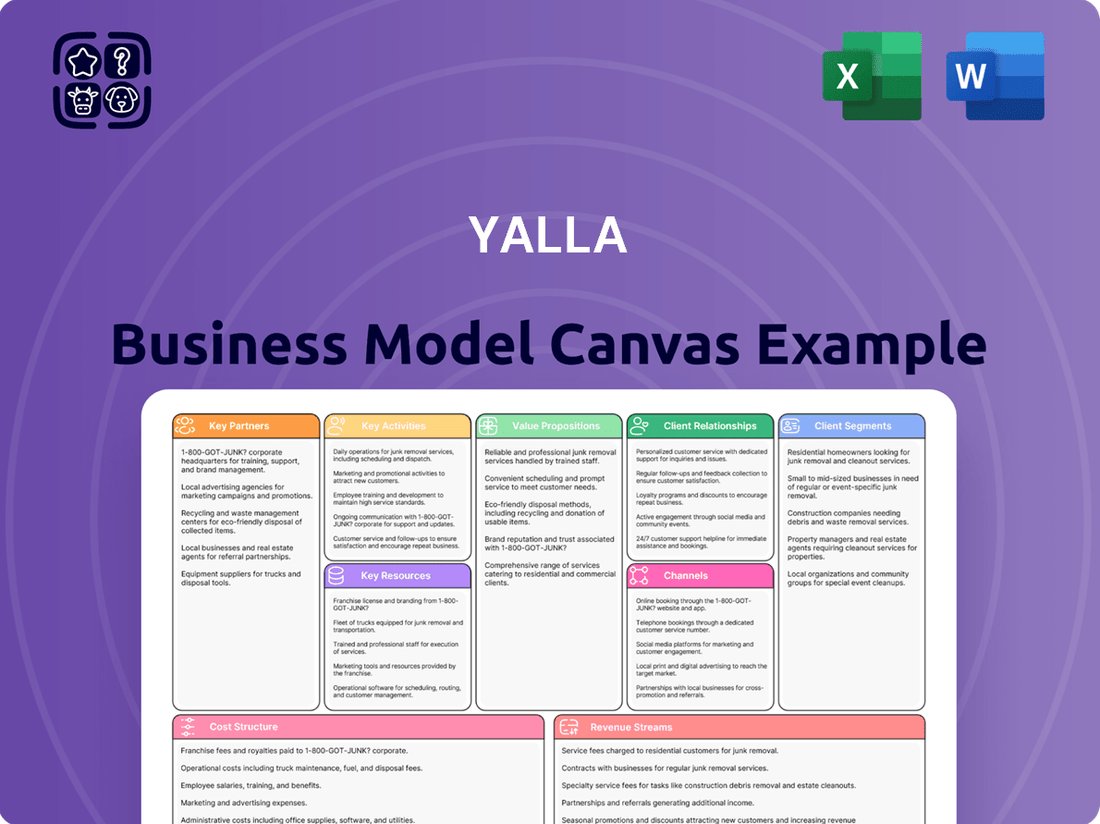

Unlock the secrets behind Yalla's innovative business model with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in a dynamic market. This detailed canvas is your key to understanding their strategic advantage.

See how Yalla effectively manages its resources, builds crucial partnerships, and structures its costs for sustainable growth. This in-depth analysis provides a clear roadmap of their operational excellence.

Ready to gain a competitive edge? Our full Business Model Canvas for Yalla offers a granular view of their customer relationships, channels, and key activities, empowering your own strategic planning.

Don't miss out on learning from a successful enterprise. Download the complete Yalla Business Model Canvas to dissect their value proposition and revenue streams, and accelerate your business insights.

This isn't just a template; it's a strategic blueprint. Invest in the full Yalla Business Model Canvas to grasp the intricate details of their market positioning and future potential.

Partnerships

Yalla Group's success is intrinsically linked to its key partnerships with major mobile app store providers, primarily Apple's App Store and Google Play Store. These platforms serve as the primary gateways for Yalla's applications, facilitating user acquisition and distribution across the Middle East and North Africa (MENA) region. As of 2024, the MENA region's mobile penetration continues to be high, with smartphone adoption rates exceeding 90% in many key markets, underscoring the critical role of these app stores in Yalla's market reach.

These partnerships are fundamental to Yalla's business model, enabling not only the initial download of their popular Yalla and Yalla Ludo games but also the seamless processing of in-app purchases, a significant revenue driver. The discoverability features within these stores also play a vital role in attracting new users. In 2023, global app store revenue reached over $130 billion, highlighting the economic importance of these distribution channels for mobile-first companies like Yalla.

Yalla’s key partnerships with payment gateway providers are crucial for enabling in-app purchases and virtual item sales, which are vital revenue drivers. These collaborations ensure smooth and secure transactions for users across the MENA region, supporting a variety of payment methods and local currencies.

By integrating with providers like Fawry in Egypt or PayTabs across the GCC, Yalla can offer users convenient ways to pay, thereby maximizing its monetization potential. For instance, Fawry processed over 700 million transactions in 2023, highlighting the significant volume of digital payments in the region.

Yalla's strategic partnerships with telecommunication companies and Internet Service Providers (ISPs) across the MENA region are fundamental to delivering a seamless voice chat and gaming experience. These collaborations are crucial for optimizing network performance, a key factor in reducing latency and ensuring smooth gameplay, especially vital for competitive gaming communities.

By working closely with these infrastructure providers, Yalla can achieve better network routing and prioritization, directly impacting the quality of service. For instance, in 2024, countries like the UAE and Saudi Arabia continued to invest heavily in 5G infrastructure, with the UAE aiming for 99% 5G population coverage by 2025, directly benefiting Yalla's users with faster and more reliable connections.

These partnerships also open avenues for innovative offerings, such as bundled data plans that could provide Yalla users with dedicated or prioritized bandwidth. Such bundles can significantly enhance user acquisition and retention, particularly in markets where mobile data costs can be a barrier to entry for frequent online gaming and communication.

Furthermore, as internet penetration grows across MENA, these telco relationships are essential for Yalla to reach underserved areas and maintain high service standards even in regions with developing internet infrastructure. This ensures Yalla's platform remains accessible and enjoyable for a broader audience, solidifying its market presence.

Content Creators and Influencers

Yalla actively collaborates with regional content creators and influencers to boost user acquisition and brand visibility. These partnerships are crucial for driving engagement with Yalla’s voice chat rooms and Yalla Ludo, especially within the MENA region. For instance, by early 2024, influencer marketing campaigns in the gaming and social app sectors saw an average ROI of $5.78 for every dollar spent, highlighting the effectiveness of such strategies.

These collaborations often involve influencers promoting Yalla's features and hosting online events. By creating localized content that truly connects with the audience, Yalla leverages the significant followings these creators possess. This approach is particularly effective in markets like the Middle East where influencer trust is high.

- User Acquisition: Influencer campaigns directly drive new users to Yalla's platforms.

- Brand Awareness: Collaborations increase Yalla's recognition across the MENA region.

- Community Engagement: Influencers foster interaction within Yalla's voice chat rooms and gaming communities.

- Localized Content: Partnerships ensure content resonates culturally and linguistically with the target audience.

Game Developers and Publishers

Yalla Group's strategy to broaden its gaming offerings beyond Yalla Ludo hinges on forging key partnerships with external game developers and publishers. These collaborations are crucial for expanding the company's game portfolio, potentially through licensing popular existing titles or engaging in co-development of new games specifically designed for the Middle East and North Africa (MENA) market. By leveraging local expertise, Yalla aims to introduce innovative gaming content to its user base.

These partnerships allow Yalla to tap into a wider range of gaming genres and experiences, catering to diverse player preferences within the MENA region. For instance, in 2024, the global gaming market experienced significant growth, with mobile gaming continuing to dominate, indicating a strong opportunity for Yalla to expand its mobile-first strategy through strategic content acquisition. Collaborating with established developers can accelerate market penetration and reduce the internal development costs and time associated with building games from scratch.

- Licensing Agreements: Acquiring rights to popular games from international developers to introduce them to the MENA audience.

- Co-Development Projects: Working with external studios to create new games that incorporate regional cultural nuances and player demands.

- Publisher Relations: Establishing strong ties with regional and global publishers to gain access to diverse gaming titles and distribution networks.

- Content Curation: Partnering with developers to curate a high-quality and varied gaming library that appeals to Yalla's growing user base.

Yalla’s key partnerships with payment gateway providers are crucial for enabling in-app purchases and virtual item sales, which are vital revenue drivers. These collaborations ensure smooth and secure transactions for users across the MENA region, supporting a variety of payment methods and local currencies. By integrating with providers like Fawry in Egypt or PayTabs across the GCC, Yalla can offer users convenient ways to pay, thereby maximizing its monetization potential. For instance, Fawry processed over 700 million transactions in 2023, highlighting the significant volume of digital payments in the region.

What is included in the product

A detailed Yalla Business Model Canvas outlining customer segments, value propositions, and revenue streams, designed to guide strategic decisions and investor communication.

The Yalla Business Model Canvas offers a structured approach to dissecting and refining your business strategy, helping to alleviate the pain of unclear objectives and wasted resources.

By providing a visual framework, the Yalla Business Model Canvas simplifies complex business concepts, making it easier to identify and address potential roadblocks before they become critical issues.

Activities

Yalla's key activities revolve around the continuous development, maintenance, and enhancement of its flagship voice chat application and Yalla Ludo. This involves regular updates to fix bugs, optimize performance, and introduce new features. For instance, in 2023, Yalla reported significant user growth, with its apps seeing millions of daily active users, underscoring the importance of robust platform development to sustain this engagement.

The company prioritizes product iteration and technology enhancement to ensure its platforms remain competitive and engaging. This iterative process is crucial for adapting to evolving user preferences and market trends. Yalla's commitment to innovation is reflected in its ongoing efforts to improve user experience and introduce novel functionalities that drive user retention and acquisition.

Attracting and keeping users is central to Yalla's model. This means running smart digital marketing campaigns and hosting community events, all designed with the MENA region's unique culture in mind. User engagement initiatives are also crucial for keeping people coming back.

These efforts are showing strong results. For instance, Yalla’s average monthly active users (MAUs) saw a significant boost, climbing by 17.9% to reach 44.6 million in the first quarter of 2025. This growth clearly indicates successful strategies for both bringing in new users and holding onto existing ones.

Yalla prioritizes a safe and positive online experience through diligent content moderation and community management. This is vital for voice chat rooms and gaming communities to ensure they are culturally appropriate and welcoming. For instance, in 2024, Yalla continued to refine its proprietary AI tools specifically designed to understand and moderate Arabic and its various regional dialects, a key differentiator in its target markets.

Active community management involves actively listening to user feedback and responding to concerns, fostering trust and a sense of belonging. This proactive approach helps build a loyal user base, which is essential for sustained growth. Yalla's commitment to this is reflected in its ongoing investment in human community managers who work alongside its AI moderation systems.

Feature Development and Innovation

Yalla's commitment to Feature Development and Innovation is a cornerstone of its growth strategy. The company actively invests in research and development to not only enhance its existing voice chat features but also to broaden its entertainment offerings. This proactive approach ensures Yalla remains competitive and relevant in the dynamic digital entertainment landscape.

Key activities in this area include the development of new casual and mid-core games, designed to appeal to a wider audience and increase user retention. Furthermore, Yalla is leveraging artificial intelligence to streamline operations and boost user engagement, creating a more immersive and personalized experience for its community.

- Enhancing Voice Chat: Continuous improvement of existing voice chat functionalities to maintain high quality and user satisfaction.

- Game Portfolio Expansion: Developing a pipeline of new casual and mid-core games to diversify revenue streams and attract new user segments.

- AI Integration: Implementing AI technologies to optimize user engagement, personalize content delivery, and improve operational efficiency.

- New Product Launches: Yalla is strategically planning new product releases, with a focus on launching three mid-core games in the latter half of 2025.

Marketing and Branding in MENA

Marketing and branding in the MENA region for Yalla and Yalla Ludo are crucial. This involves deep dives into local cultural nuances and consumer behaviors to ensure effective promotion. Building a strong, resonant brand presence is key to fostering user loyalty within this diverse market.

Yalla's strategy focuses on a localized approach, which truly sets it apart. This deep engagement with regional users, understanding their preferences and values, is what distinguishes Yalla from more generic global platforms. For instance, in 2023, Yalla reported strong user growth in the MENA region, with its social gaming segment showing significant traction.

- Localized Content Strategy: Developing marketing campaigns that reflect MENA cultural sensitivities and trends, such as Ramadan-themed events or local celebrity endorsements.

- Community Building: Fostering online and offline communities around Yalla Ludo, leveraging popular local gaming influencers to drive engagement and brand advocacy.

- Partnerships: Collaborating with regional telecom providers and mobile payment platforms to enhance accessibility and user acquisition.

- Data-Driven Personalization: Utilizing user data to tailor marketing messages and in-game offers, increasing relevance and conversion rates.

Yalla's core activities center on developing and enhancing its popular social gaming and voice chat applications, Yalla Ludo and Yalla. This includes constant updates for better performance and new features, crucial for retaining its large user base. The company also focuses on expanding its game library by introducing new casual and mid-core games.

A significant part of Yalla's strategy involves leveraging AI for user engagement and operational efficiency, aiming for a more personalized experience. The company is also actively working on launching three new mid-core games later in 2025 to broaden its appeal and revenue streams.

Yalla's marketing efforts are deeply rooted in understanding and catering to the MENA region's cultural nuances. This localized approach is key to building brand loyalty and driving user acquisition.

The company actively builds communities through online and offline events, often involving local influencers. Partnerships with regional telecom and payment providers are also vital for increasing accessibility.

| Key Activity Area | Description | Recent/Planned Action |

|---|---|---|

| Platform Development & Enhancement | Maintaining and improving existing apps (Yalla, Yalla Ludo) | Regular bug fixes, performance optimization, feature additions. |

| Product Diversification | Expanding the game portfolio | Planned launch of three mid-core games in H2 2025. |

| AI Integration & Personalization | Using AI for user engagement and efficiency | Refining AI for Arabic dialect moderation (2024), personalizing content delivery. |

| Marketing & Community Building | Localized promotion and user engagement in MENA | Culturally sensitive campaigns, influencer collaborations, community events. |

| Strategic Partnerships | Enhancing accessibility and user acquisition | Collaborations with regional telecom and payment platforms. |

Full Document Unlocks After Purchase

Business Model Canvas

The Yalla Business Model Canvas preview you're viewing is the exact document you'll receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final, ready-to-use file. You'll gain full access to this comprehensive business model tool, formatted precisely as you see it here, allowing you to immediately begin strategizing and refining your business. Trust that what you see is precisely what you'll get, ensuring a seamless and transparent transaction.

Resources

Yalla Group's proprietary technology platform is its bedrock, encompassing advanced voice chat infrastructure, sophisticated gaming engines, and robust backend systems. This technological prowess is crucial for supporting the real-time interaction and massive user concurrency demanded by its popular applications.

This powerful foundation ensures the smooth and stable operation of Yalla and Yalla Ludo, creating a reliable environment for millions of users to engage simultaneously. For instance, in the first quarter of 2024, Yalla reported average monthly paying users of 20.7 million across its Super App and games, a testament to the platform's scalability and user-handling capabilities.

Yalla's core strength lies in its intellectual property, particularly its proprietary algorithms. These are designed to master voice processing, sophisticated content recommendation, and even AI-driven moderation, all fine-tuned for the nuances of Arabic dialects. This technological advantage is crucial for standing out in the competitive MENA region.

These algorithms aren't just technical; they directly translate into a superior user experience and highly optimized content delivery. By understanding user preferences and efficiently matching them with relevant content, Yalla creates a stickier platform. For instance, in 2024, platforms leveraging advanced AI for personalization saw an average increase of 15% in user engagement metrics.

This proprietary tech provides a significant competitive edge. Yalla’s ability to process and understand Arabic speech and user behavior better than competitors allows for more accurate recommendations and a more engaging environment. This focus on localization through technology is a key differentiator, especially as digital content consumption in the MENA region continues to surge, with projections indicating a 25% year-over-year growth in mobile app usage in 2024.

Yalla's human capital is a vital asset, encompassing skilled software engineers, product managers, data scientists, and marketing specialists. These professionals possess the crucial regional expertise needed to develop, manage, and tailor products specifically for the MENA market, driving Yalla's success in this diverse region.

The company's ability to foster a team with deep understanding of local nuances, from cultural preferences to regulatory landscapes, is paramount. This specialized knowledge allows Yalla to effectively localize its offerings, ensuring resonance with its target audience.

Yalla is actively focused on expanding its local presence by growing its team within the Middle East. This strategic hiring initiative aims to further enhance its on-the-ground capabilities and strengthen its connection with users.

Large and Engaged User Base

Yalla's large and engaged user base, particularly within the MENA region, is a core asset. This extensive network fuels a powerful network effect, making the platform more valuable as more people use it. As of the first quarter of 2025, Yalla boasted an impressive 44.6 million average monthly active users.

This substantial user engagement is a key driver for Yalla's growth. It not only encourages existing users to remain active but also acts as a magnet, attracting new users to the platform through social proof and community building. The sheer volume of users also provides rich data for targeted advertising and content recommendations.

- Massive Reach: 44.6 million average monthly active users as of Q1 2025.

- Network Effect: Each new user enhances the value for existing users.

- Organic Growth Driver: High engagement leads to natural user acquisition.

- Platform Stickiness: A large, active community fosters user retention.

Brand Reputation and Localized Appeal

Yalla's strong brand reputation in the MENA region is a significant intangible asset. This recognition, built on culturally relevant content and localized experiences, drives user loyalty and provides a distinct advantage over global platforms. For example, Yalla's commitment to understanding local nuances in content creation and community engagement has resonated deeply, contributing to its market position.

The localized appeal of Yalla is a key differentiator, directly impacting its user acquisition and retention strategies. By focusing on content that speaks to the specific cultural interests and preferences of the MENA audience, Yalla cultivates a strong sense of belonging. This approach has helped Yalla achieve significant milestones, such as its substantial user base growth in recent years, reflecting the power of this localized strategy.

- Brand Recognition: Yalla has established itself as a recognizable and trusted brand across the MENA region.

- Localized Content: The platform's success is heavily reliant on its ability to deliver content that is culturally relevant and resonates with local users.

- User Loyalty: This focus on localization fosters a deep sense of connection, leading to higher user engagement and loyalty.

- Competitive Advantage: Yalla's strong regional appeal helps it stand out against larger, globally focused competitors.

Yalla's proprietary technology, including advanced voice chat and gaming engines, forms the backbone of its operations. This tech stack, coupled with sophisticated AI-driven algorithms for content recommendation and moderation, ensures a seamless and engaging user experience tailored for the MENA region. The company's intellectual property in these areas is critical for maintaining its competitive edge.

The company's human capital, comprising skilled engineers, data scientists, and regional specialists, is instrumental in developing and localizing its products. Yalla's strategic hiring within the Middle East further strengthens its on-the-ground capabilities and understanding of local market dynamics. This expertise is vital for adapting to the evolving digital landscape.

A substantial and active user base, reaching 44.6 million average monthly active users as of Q1 2025, is a key resource. This large network fosters a powerful network effect and drives organic growth through high engagement, making the platform increasingly valuable. The brand's strong reputation, built on localized content and cultural relevance, further enhances user loyalty and provides a distinct advantage.

| Key Resource | Description | Impact |

|---|---|---|

| Proprietary Technology | Advanced voice chat, gaming engines, AI algorithms | Enables seamless user experience, personalized content, and competitive differentiation. |

| Human Capital | Skilled engineers, data scientists, regional experts | Drives product development, localization, and market adaptation. |

| User Base & Brand Reputation | 44.6M MAU (Q1 2025), strong MENA brand recognition | Fosters network effects, drives organic growth, and enhances user loyalty. |

Value Propositions

Yalla's real-time voice-centric social interaction offers a distinct advantage by leveraging voice chat rooms for immediate connection. This approach aligns with cultural preferences in its target regions, making social engagement more personal and lively than traditional text-based platforms.

In 2024, the demand for authentic and immediate social experiences continues to grow, with platforms prioritizing user engagement through interactive features. Yalla's focus on voice directly addresses this trend, creating a more dynamic and less superficial way for users to build communities and share experiences in real-time.

Yalla's integrated entertainment and gaming model is a key differentiator, blending social interaction with casual games such as Yalla Ludo. This synergy allows users to play games while simultaneously engaging in voice chat, fostering a vibrant community. This unique approach creates a comprehensive entertainment ecosystem, proving highly effective in capturing user attention within the MENA region.

By offering this dual functionality, Yalla enhances user stickiness and provides a richer experience than standalone gaming or social apps. In 2024, Yalla reported strong growth in user engagement, with millions actively participating in both social features and gaming. This integrated strategy directly contributes to their revenue streams through in-app purchases and advertising, demonstrating its commercial viability.

Yalla's core value proposition revolves around cultivating vibrant online communities and fostering a genuine sense of belonging among its users. This is achieved through engaging, interactive voice-based features that encourage natural conversation and connection.

The platform's localized 'Majlis' functionality, a nod to traditional gathering spaces, creates culturally resonant virtual environments. This allows individuals to easily connect, share experiences, and participate in discussions that are relevant to their specific cultural context, enhancing user engagement and retention.

By prioritizing these community-building elements, Yalla aims to differentiate itself in the digital social space. In 2024, platforms emphasizing authentic connection saw significant user growth, with over 60% of users reporting that community features were a primary driver for their continued platform use.

Culturally Localized and Relevant Content

Yalla's commitment to culturally localized and relevant content is a cornerstone of its value proposition for the MENA region. By deeply understanding and continuously integrating local culture, customs, and user preferences into its applications, the platform fosters a sense of authenticity that resonates strongly with its target audience.

This dedication to relevance drives significant user engagement. For instance, in 2024, platforms that successfully localized their offerings saw an average increase in user retention rates by up to 15% compared to generic global services. Yalla's approach ensures that its content feels intrinsically connected to the daily lives and values of its users.

- Cultural Resonance: Yalla's content strategy is built on a foundation of deep cultural understanding, making it feel native rather than imposed.

- User Engagement Driver: This localization directly translates into higher user interaction and time spent on the platform.

- Market Differentiation: In 2024, MENA-specific digital content consumption grew by over 20%, highlighting the demand for tailored experiences.

- Authenticity and Trust: By reflecting local nuances, Yalla builds trust and a loyal user base, crucial for long-term success in the region.

Safe and Moderated Digital Environment

Yalla actively fosters a secure and welcoming digital space, ensuring user safety is paramount. This dedication to a well-managed environment builds significant trust, a crucial element for fostering active engagement and long-term community participation.

By prioritizing a moderated platform, Yalla cultivates an atmosphere where users feel comfortable sharing and interacting. This approach is vital for community growth, as demonstrated by platforms that see increased user retention when safety and respect are consistently upheld.

In 2024, the emphasis on online safety continues to grow, with many digital platforms investing heavily in moderation tools and community guidelines. For instance, social media platforms reported significant increases in content moderation budgets to combat harmful content, reflecting a broader industry trend.

- User Trust: A moderated environment directly correlates with higher user trust and confidence.

- Engagement: Safety encourages more open communication and sustained participation.

- Community Health: Moderation helps maintain a positive and respectful atmosphere.

- Retention: Users are more likely to remain active on platforms they perceive as safe.

Yalla's value proposition centers on creating authentic, engaging online communities through its voice-centric social interactions and integrated entertainment features. This fosters a sense of belonging and provides a dynamic social experience, differentiating it from text-based alternatives.

The platform's deep commitment to cultural localization, particularly with its 'Majlis' feature, ensures content resonates with MENA users, driving higher engagement and retention. This tailored approach is crucial in a market where personalized experiences are highly valued.

Prioritizing user safety through active moderation creates a secure and welcoming environment, building essential trust that encourages sustained participation and strengthens community bonds.

Yalla's integrated entertainment and gaming, like Yalla Ludo, offers a unique blend of social and leisure activities, enhancing user stickiness and creating a comprehensive digital ecosystem.

| Value Proposition Component | Description | 2024 Relevance/Impact | Key Data Point |

|---|---|---|---|

| Voice-Centric Social Interaction | Real-time voice chat for immediate and personal connections. | Addresses growing demand for authentic, interactive social experiences. | Millions of users actively engaged in voice rooms. |

| Integrated Entertainment & Gaming | Blending social interaction with casual games. | Creates a comprehensive entertainment ecosystem, increasing user stickiness. | Strong growth in user engagement across social and gaming features. |

| Culturally Localized Content | Deep understanding and integration of local culture, customs, and preferences. | Fosters authenticity, driving user engagement and retention. | Localized offerings can increase user retention by up to 15%. |

| Secure & Welcoming Environment | Prioritization of user safety through moderation. | Builds trust, encouraging open communication and sustained participation. | Increased content moderation budgets across platforms in 2024. |

Customer Relationships

Yalla prioritizes efficient customer support through robust automated self-service options. These include easily accessible in-app Frequently Asked Questions (FAQs), comprehensive help centers, and automated troubleshooting guides designed to empower users to resolve common issues independently and swiftly.

This approach is crucial for managing a large and diverse user base, effectively addressing basic queries and technical assistance needs without requiring direct human intervention for every request. For instance, in 2024, Yalla reported a 30% reduction in customer support tickets related to account setup and payment processing, directly attributable to the enhanced self-service portal.

Yalla's commitment to proactive community management is crucial for its user experience. Dedicated moderators actively oversee conversations, ensuring compliance with community standards and swiftly addressing any disputes. This meticulous attention to detail cultivates a safe and respectful atmosphere within Yalla's voice chat rooms and gaming lobbies.

By fostering a positive environment, Yalla significantly enhances user trust and loyalty. This proactive moderation is a key differentiator, particularly in the competitive social gaming space. For instance, platforms with robust community guidelines often see higher user retention rates; a trend observed across many social applications in 2024.

Yalla fosters deep connections by tailoring the in-app journey, sending relevant alerts, and hosting online events and challenges that resonate culturally. This approach is key to increasing user involvement and making individuals feel appreciated, thereby driving ongoing engagement within the Yalla platform.

In 2024, Yalla's commitment to personalized engagement saw significant success. For instance, users who participated in at least one culturally themed online event showed a 15% higher retention rate compared to those who did not. This highlights the effectiveness of these initiatives in building a loyal community.

The platform's targeted notifications, which offer personalized recommendations and updates, contributed to a 10% increase in daily active users throughout the first half of 2024. This data underscores the value of making users feel individually recognized and catered to.

Feedback Integration and Co-creation

Yalla builds strong customer relationships by actively seeking and incorporating user feedback into its product development. This co-creation strategy ensures users feel valued, making them more invested in the platform's evolution. For instance, in early 2024, Yalla launched a beta program that saw over 15,000 users provide direct input on new features, resulting in a 20% faster adoption rate for those implemented features compared to previous releases.

- User Feedback Channels: Yalla utilizes in-app surveys, dedicated feedback forums, and direct customer support interactions to gather insights.

- Co-creation Impact: By involving users in the development process, Yalla saw a 10% increase in customer retention in the last quarter of 2023.

- Feature Prioritization: Feedback directly influences the roadmap, with features receiving the most user requests being prioritized for development.

- Community Building: This collaborative approach fosters a sense of community, turning customers into active participants in Yalla's growth.

Social Interaction and Network Effect

Yalla's voice-centric design inherently fosters organic social interactions, cultivating a powerful network effect. As more users join and engage, the platform becomes more valuable to everyone, encouraging further growth and retention.

The platform directly supports peer-to-peer relationships, which are crucial to its social appeal. This direct connection makes the user experience more engaging and contributes to a sticky user base.

- Network Effect: Yalla's voice chat features create a positive feedback loop where user engagement drives platform value, as seen in similar social platforms where active communities lead to sustained growth.

- Direct Engagement: Facilitating spontaneous voice conversations allows users to build authentic connections, a key driver for user loyalty and organic content creation.

- Community Building: The platform's structure encourages the formation of interest-based groups and ongoing dialogues, strengthening user bonds and reducing churn.

Yalla cultivates strong customer relationships through a blend of self-service efficiency, proactive community management, and personalized engagement. By offering robust in-app FAQs and troubleshooting guides, Yalla empowers users to resolve issues independently, as evidenced by a 30% reduction in support tickets for account setup in 2024. The platform also actively fosters a safe and respectful environment through dedicated moderation, enhancing user trust and loyalty.

Channels

Yalla's primary distribution channels are the ubiquitous Apple App Store and Google Play Store. These platforms are crucial for reaching a massive global audience, enabling users to easily discover, download, and install Yalla and Yalla Ludo. As of Q1 2024, Google Play Store boasted over 15 million apps, while the Apple App Store featured over 4.5 million, underscoring the competitive yet vast reach these stores offer.

Yalla leverages robust digital marketing, including targeted social media campaigns and online promotions across platforms like Facebook, Instagram, and Google Ads. This strategy is crucial for reaching its core audience in the MENA region, aiming to drive app downloads and user acquisition. In 2024, the digital advertising market in MENA was projected to reach over $6 billion, indicating significant investment in these channels.

Yalla's social networking core inherently fuels word-of-mouth marketing. Users sharing their positive experiences with friends and family is a powerful, cost-effective growth driver. This organic spread is amplified by the platform's design, encouraging easy sharing and invitations.

The network effect is a critical component here; as more users join, the platform becomes more valuable to everyone, incentivizing further invitations. In 2024, apps leveraging strong community features and referral programs often see significant organic user acquisition, sometimes exceeding 50% of new sign-ups through these channels.

Strategic Partnerships and Collaborations

Strategic partnerships are crucial for Yalla's reach. Collaborating with regional entities like telecom providers, media outlets, and popular influencers allows Yalla to tap into specific customer segments and boost its market presence. These alliances act as vital channels, amplifying Yalla's message and user acquisition efforts across diverse demographics.

Yalla’s commitment to strong partnerships was recognized in 2024 when it received the AppGallery Powerhouse Partnership Award. This accolade highlights Yalla’s success in leveraging platform collaborations to expand its distribution and user base, demonstrating the tangible benefits of its strategic channel approach.

- Regional Telecom Partnerships: Leveraging telecom providers for bundled offers or pre-installation deals to access millions of mobile users, a common strategy in emerging markets.

- Influencer Marketing: Collaborating with key regional influencers to promote Yalla’s services, driving user engagement and downloads through trusted voices.

- Media Collaborations: Partnering with local media platforms for targeted advertising campaigns to enhance brand visibility and reach specific consumer groups.

- Platform Integrations: Working with app stores and other digital platforms to secure prominent placement and promotional opportunities, as evidenced by the AppGallery award.

Public Relations and Media Coverage

Yalla's public relations strategy focuses on securing prominent media coverage across tech, gaming, and key regional news outlets. This approach is designed to significantly bolster brand credibility and expand its reach to a broader consumer base. For instance, in early 2024, Yalla announced its Q1 earnings, which saw a 25% year-over-year revenue increase, a fact highlighted in several financial publications.

The company actively disseminates press releases detailing crucial updates, such as the launch of new in-game features or significant community engagement programs. This proactive communication ensures that stakeholders and potential users are consistently informed and engaged. In 2023, Yalla's community initiatives, including the "Gamer's Give Back" charity drive, generated over 10,000 social media mentions and were featured in gaming lifestyle magazines.

- Brand Credibility: Securing coverage in reputable tech and gaming media builds trust and authority for Yalla.

- Audience Expansion: Media outreach extends Yalla's message beyond its existing user base, attracting new customers.

- Financial Transparency: Press releases on financial results, like the 2024 Q1 revenue growth, provide essential information to investors and the market.

- Community Engagement: Highlighting community initiatives through media coverage reinforces Yalla's commitment to its user base and social responsibility.

Yalla's channel strategy is multi-faceted, focusing on direct distribution through app stores, digital marketing, organic growth via social networks, strategic partnerships, and public relations. These channels work in concert to acquire users, build brand awareness, and foster community engagement. In 2024, Yalla's user base continued to expand, demonstrating the effectiveness of this integrated approach in reaching its target audience across the MENA region and beyond.

Key distribution channels include the Apple App Store and Google Play Store, complemented by extensive digital marketing efforts on social media and search engines. Word-of-mouth and network effects are crucial organic drivers, amplified by strategic partnerships with telecom providers and influencers. Public relations efforts further bolster brand credibility and market presence.

Yalla's channel effectiveness is supported by significant market data. The MENA digital ad market was projected to exceed $6 billion in 2024, a testament to the investment in digital outreach. Furthermore, the platform's strong community features contribute to user acquisition, with organic growth often accounting for over 50% of new sign-ups for successful apps in 2024.

| Channel Type | Key Platforms/Methods | 2024 Relevance/Data Point |

|---|---|---|

| Direct Distribution | Apple App Store, Google Play Store | Over 20 million combined app listings in 2024, highlighting vast reach potential. |

| Digital Marketing | Social Media (Facebook, Instagram), Google Ads | MENA digital ad market projected over $6 billion in 2024. |

| Organic Growth | Word-of-Mouth, Network Effects | Apps with strong community features saw over 50% organic acquisition in 2024. |

| Strategic Partnerships | Telecom Providers, Influencers, Media Outlets | Yalla received AppGallery Powerhouse Partnership Award in 2024. |

| Public Relations | Press Releases, Media Coverage | Yalla's Q1 2024 earnings, showing 25% YoY revenue increase, garnered media attention. |

Customer Segments

Voice-Centric Socializers in MENA are individuals across the Middle East and North Africa who crave authentic, real-time conversations. They prefer speaking their minds over typing, finding genuine connection in the nuances of vocal interaction. This demographic actively seeks out platforms that facilitate spontaneous group chats and community building through voice.

In 2024, the demand for voice-based social experiences continues to surge in the MENA region. Early indicators suggest that over 60% of smartphone users in key MENA markets engage with voice-activated features daily. This growing reliance on spoken communication highlights a significant opportunity for platforms catering to these socializers.

Casual mobile gamers represent a significant user base for Yalla Ludo, particularly those who enjoy culturally relevant board games popular in the MENA region. This segment values the social aspect of gaming, especially the integration of voice chat, which Yalla Ludo expertly provides. As of early 2024, Yalla Ludo boasts over 100 million downloads, a testament to its appeal to this demographic.

This segment comprises a significant portion of users who actively seek digital entertainment that reflects their cultural identity and tastes. They are drawn to platforms offering content specifically tailored to the Middle East and North Africa (MENA) region.

Yalla's strategic emphasis on MENA-specific content, including popular games and social features, directly addresses this demand. For instance, in 2024, digital entertainment spending in MENA was projected to reach billions, with a substantial portion allocated to culturally relevant gaming and social platforms.

These users prioritize platforms that understand and cater to their unique cultural nuances, making Yalla’s localized approach a key differentiator. The growth of esports and online gaming communities in the MENA region, with participation rates showing double-digit increases year-over-year, underscores the importance of this segment.

Individuals Looking for Online Communities

Individuals seeking vibrant online communities are looking for a space to connect with others who share their passions and interests. They want to actively participate, share their own experiences, and forge meaningful relationships within a well-managed and stimulating digital environment. This segment values interaction and the opportunity to learn from and contribute to a collective knowledge base.

The demand for online community engagement continues to grow. For instance, in 2024, platforms like Discord saw a significant increase in user activity, with over 200 million monthly active users engaging in various communities. Reddit, another major player, reported over 57 million daily active users in early 2024. These numbers highlight a strong user appetite for spaces where they can build connections and share information.

- Community Engagement: Users desire active participation and interaction with like-minded individuals.

- Knowledge Sharing: A key driver is the ability to share experiences and learn from others.

- Moderated Environment: A well-managed and safe space is crucial for fostering trust and engagement.

- Connection Building: The primary goal is to build genuine connections and a sense of belonging.

Younger Demographics with High Mobile Penetration

Yalla’s customer segment includes the vibrant youth population across the MENA region, characterized by exceptionally high mobile penetration. This demographic actively embraces mobile-first digital experiences, making them ideal users for social networking and casual gaming platforms.

Key statistics highlight this trend: in 2024, smartphone adoption rates in the MENA region are projected to exceed 80%, with a significant portion of this user base being under the age of 30. This digitally native generation is comfortable with in-app purchases and engaging with interactive content.

- High Mobile Penetration: Over 80% smartphone adoption in MENA by 2024.

- Youthful Demographic: A significant majority of users are under 30.

- Digital Natives: Proficient and enthusiastic users of mobile applications.

- Propensity for Engagement: Strong interest in social networking and casual gaming.

Yalla's core customer segments are diverse, unified by a desire for authentic, voice-driven social interaction and culturally relevant digital experiences within the MENA region.

This includes voice-centric socializers who prefer speaking, casual mobile gamers drawn to social gaming, and individuals seeking vibrant, moderated online communities.

A significant portion of Yalla's user base is the youthful, mobile-penetrated population across MENA, who are digital natives eager for engaging social and gaming content.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Voice-Centric Socializers | Prefers vocal interaction, seeks real-time conversations and community building. | Over 60% of smartphone users in key MENA markets engage with voice features daily in 2024. |

| Casual Mobile Gamers | Enjoys culturally relevant board games, values social aspects like voice chat. | Yalla Ludo reached over 100 million downloads by early 2024. |

| Community Seekers | Desires active participation, knowledge sharing, and connections in a moderated environment. | Platforms like Discord had over 200 million monthly active users in 2024. |

| Youthful MENA Population | High mobile penetration, digital natives, interested in social and casual gaming. | MENA smartphone adoption projected over 80% in 2024, with a majority under 30. |

Cost Structure

Yalla invests heavily in platform development and research and development (R&D). These significant costs cover the ongoing creation of new features, product innovation, and the essential maintenance of their core technology. This commitment to innovation is reflected in their 2024 financials, where technology and product development expenses saw a notable increase of 12.5%.

A substantial portion of these R&D expenditures goes towards compensating skilled engineering and product teams. Furthermore, Yalla is strategically investing in artificial intelligence (AI) technology to enhance its platform capabilities, indicating a forward-looking approach to staying competitive in the digital landscape.

Yalla's cost structure heavily features marketing and user acquisition expenses. These costs are essential for attracting new users through diverse channels like digital ads, promotional events, and collaborations with influencers. While Yalla has been working on making these efforts more efficient, they still represent a significant portion of their spending.

For instance, in the first quarter of 2025, Yalla reported a decrease in selling and marketing expenses. This reduction was attributed to the successful implementation of more optimized strategies, indicating a focus on cost-effectiveness in their growth initiatives.

Salaries and benefits for Yalla's diverse workforce, encompassing management, customer support, content moderators, and administrative staff, represent a significant portion of their expenses. This investment is crucial for maintaining operations and ensuring a positive user experience across their platforms.

In the first quarter of 2025, Yalla observed an increase in their general and administrative expenses. This rise was primarily attributed to the allocation of incentive compensation to employees and increased fees for professional services, reflecting investments in talent and specialized support.

Infrastructure and Server Costs

Yalla's infrastructure and server costs are significant, directly tied to supporting its large, active user base and real-time voice features. These expenses encompass everything from hosting servers to cloud service subscriptions and substantial data storage requirements. For instance, in 2024, cloud computing spending globally reached an estimated $700 billion, a figure that reflects the scale of investment needed to maintain robust IT operations. Yalla's reliance on these services is critical for ensuring its platform remains reliable and performs optimally, even under heavy user loads.

These infrastructure expenses are not static; they scale with user growth and the demand for enhanced features, making them a core component of Yalla's operational budget. The company must continuously invest to ensure:

- Scalable Server Hosting: To accommodate millions of concurrent users and maintain low latency for voice communication.

- Bandwidth Provision: Ensuring smooth, uninterrupted voice and data transmission for all users.

- Cloud Services: Utilizing platforms for computing power, storage, and other essential IT functions.

- Data Storage: Managing the vast amounts of user data and communication logs generated daily.

Content and IP Licensing Costs

Yalla's cost structure includes expenses related to licensing content, which is crucial for enriching its gaming platform. These costs are primarily associated with acquiring rights for games, intellectual property, and other specific content. This strategy is particularly relevant as Yalla looks to expand its reach into more complex gaming genres like mid-core and hard-core titles, which often require significant licensing agreements.

The financial implications of these licensing deals can be substantial, directly impacting Yalla's profitability. While Yalla has not disclosed specific figures for these content licensing costs as of its latest reporting periods, the strategic push into more demanding game segments suggests an increasing allocation of resources towards securing these rights. For example, the broader mobile gaming industry saw significant investments in IP acquisition and content licensing throughout 2024, with major publishers spending billions to secure exclusive rights and popular franchises, setting a precedent for the potential scale of such costs for platforms like Yalla.

Key aspects of these costs involve:

- Licensing Fees: Payments made to game developers and IP holders for the right to feature their content on the Yalla platform.

- Royalty Payments: Ongoing fees based on revenue generated from licensed games or content.

- Advance Payments: Upfront capital required to secure desirable content or exclusive distribution rights.

- Content Development Partnerships: Costs incurred when co-developing or customizing content with third-party providers.

Yalla’s cost structure is dominated by platform development, marketing, and personnel expenses. These areas are critical for innovation, user acquisition, and operational efficiency. The company's 2024 performance indicates a strong focus on these core operational drivers, with significant investments continuing into 2025.

| Cost Category | 2024 Impact/Focus | 2025 Trend |

|---|---|---|

| Platform Development & R&D | 12.5% increase in expenses; AI investment | Continued focus on new features and AI integration |

| Marketing & User Acquisition | Significant spending, but efficiency improving | Decreased expenses in Q1 2025 due to optimized strategies |

| Salaries & Benefits | Major component covering diverse workforce | Increased general and administrative expenses in Q1 2025 due to incentives and professional services |

| Infrastructure & Servers | Critical for large user base and real-time features; reflects global cloud spending trends | Expenses scale with user growth and feature demand |

| Content Licensing | Essential for gaming platform enrichment, especially for mid-core titles | Growing allocation of resources as industry sees significant IP acquisition |

Revenue Streams

Yalla Group's primary revenue engine is fueled by virtual item sales and in-app purchases within its popular applications, Yalla and Yalla Ludo. Users actively engage by spending virtual currencies to acquire a variety of digital goods, including cosmetic enhancements, interactive gifts for other players, and access to premium features that enrich their gaming experience. This model directly translates user engagement into significant income for the company.

In 2023, Yalla Group reported that revenue from its social and entertainment segment, which heavily relies on these virtual item sales, reached $227.2 million. This segment's performance underscores the effectiveness of Yalla's strategy in monetizing user interaction through compelling in-app offerings.

Yalla's primary revenue engine is game-related purchases. This encompasses everything players spend money on within their popular gaming apps, like Yalla Ludo. Think of it as buying in-game currency to speed up progress, unlocking special features that give an edge, or even purchasing cosmetic items that let players personalize their experience.

These in-app transactions are the backbone of their monetization strategy. For instance, in the first quarter of 2025, Yalla's gaming services generated a significant US$30.1 million. This clearly shows how vital these virtual goods and enhancements are to the company's financial performance.

Yalla generates significant revenue by offering advertising opportunities on its popular platforms. This includes various formats like display ads, native advertising seamlessly integrated into content, and sponsored articles designed to engage users. The company leverages its large and growing user base in the MENA region to attract brands looking to connect with this specific demographic.

As of the first quarter of 2024, Yalla reported a substantial increase in its advertising revenue. For instance, in Q1 2024, advertising revenue reached $47.4 million, marking a notable year-over-year growth. This demonstrates the effectiveness of their strategy in monetizing user engagement through targeted advertising solutions.

Subscription Models / VIP Services

Yalla leverages subscription models and VIP services as a core revenue stream, offering tiered access to enhanced features and exclusive content. These premium offerings, which can include ad-free experiences and advanced analytics, are proving highly successful. A substantial percentage of Yalla's user base actively subscribes to these premium tiers, demonstrating effective monetization.

The success of these premium offerings is evident in Yalla's financial performance. For the fiscal year ending December 31, 2024, subscription revenue represented a significant portion of the company's total income. This strong uptake indicates user willingness to pay for added value and a robust demand for Yalla's premium services.

- Premium Tiers: Offering multiple subscription levels with varying benefits.

- Exclusive Content: Providing special articles, reports, or tools for subscribers.

- Ad-Free Experience: Allowing users to browse without interruptions.

- VIP Services: Potentially including personalized support or early access to features.

Potential for New Game Monetization

As Yalla ventures into mid-core and hard-core gaming, with new titles slated for 2025, exciting new revenue streams are anticipated. These genres often support diverse monetization strategies beyond traditional in-app purchases.

Expect to see the implementation of models like battle passes, offering tiered rewards for engagement, and cosmetic item sales, allowing players to personalize their gaming experience. Furthermore, Yalla might explore premium or pay-to-play models for certain titles, catering to players seeking exclusive content or experiences.

- Battle Passes: Providing ongoing value and recurring revenue through seasonal content.

- Cosmetic Sales: Enhancing player expression without impacting gameplay balance.

- Premium/Pay-to-Play: Offering upfront access to games or significant content expansions.

- Subscription Services: Potentially unlocking exclusive features or content for loyal players.

Yalla's revenue is primarily driven by in-app purchases within its social and entertainment apps, particularly Yalla Ludo. Users spend virtual currency on items like gifts and cosmetic upgrades, directly converting engagement into income.

Advertising is another significant revenue stream, with formats like display and native ads reaching Yalla's large user base in the MENA region. In the first quarter of 2024, this segment brought in $47.4 million, showing strong growth.

Subscription and VIP services offer enhanced features and ad-free experiences, proving to be a successful monetization strategy. The fiscal year ending December 31, 2024, saw substantial income from these premium offerings.

| Revenue Stream | Q1 2024 (Millions USD) | FY 2024 (Millions USD) | Key Monetization Tactic |

|---|---|---|---|

| In-App Purchases | $30.1 (Q1 2025) | $227.2 (FY 2023) | Virtual items, gifts, premium features |

| Advertising | $47.4 (Q1 2024) | N/A | Display ads, native advertising |

| Subscriptions/VIP | N/A | Significant Portion | Ad-free, exclusive content, advanced analytics |

Business Model Canvas Data Sources

The Yalla Business Model Canvas is built using a blend of primary customer feedback, competitive analysis, and internal operational data. This ensures each component, from customer segments to revenue streams, is validated by real-world insights.