WashTec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WashTec Bundle

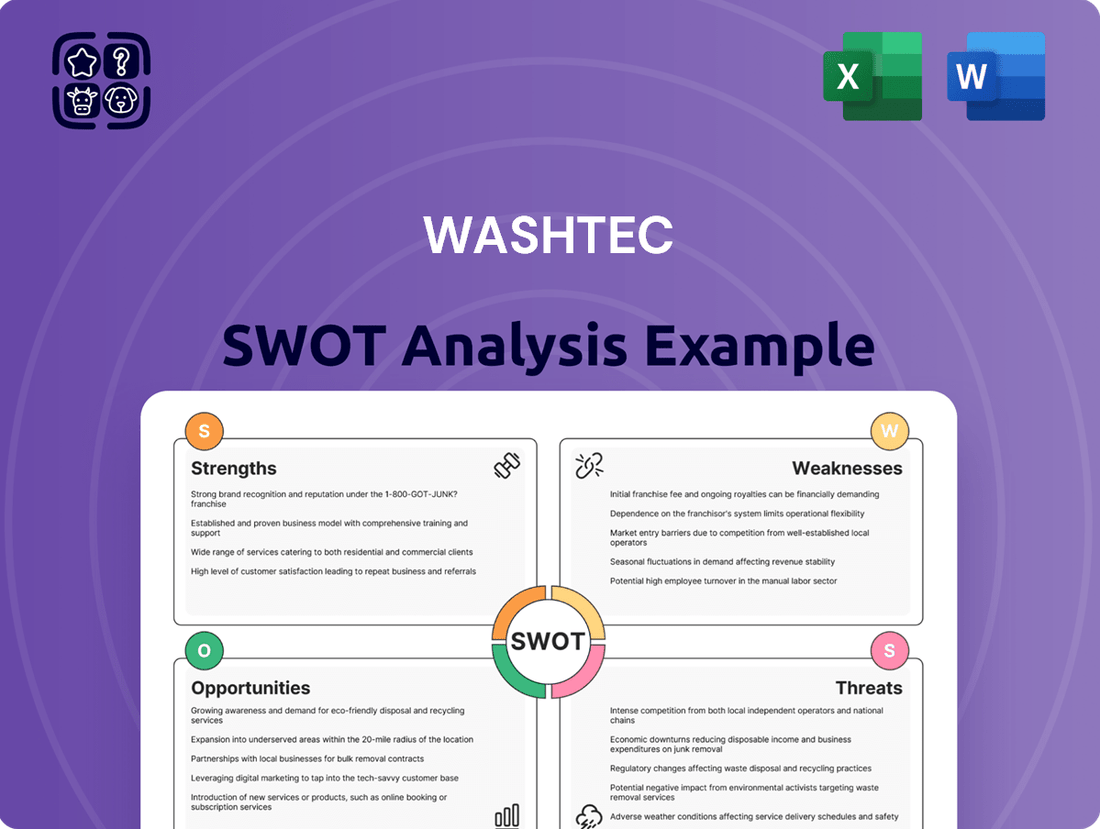

WashTec, a leader in car wash technology, showcases a compelling SWOT analysis highlighting its innovative product development and strong brand reputation. However, it also faces challenges from intense market competition and evolving environmental regulations. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want to fully grasp WashTec's competitive edge, potential vulnerabilities, and future opportunities? Purchase our comprehensive SWOT analysis to gain access to detailed insights, actionable recommendations, and a professionally formatted report designed to inform your strategic decisions.

Strengths

WashTec AG is a dominant force in the global vehicle washing industry, recognized as a leading manufacturer and supplier. This market leadership is built on an extensive portfolio that covers car washes, commercial vehicle washes, and self-service systems, addressing a wide spectrum of customer requirements across the globe.

The company's extensive international footprint, with operations in roughly 80 countries across Europe, North America, and Asia/Pacific via its subsidiaries and distribution networks, underscores its significant global reach and strong brand awareness. This widespread presence is a key contributor to its market leadership.

WashTec's strength lies in its comprehensive solution offering, extending far beyond just vehicle washing equipment. They provide an entire ecosystem of services, encompassing financing, expert installation, ongoing maintenance, and the crucial supply of chemical cleaning products. This integrated model transforms them from a mere equipment vendor into a full-service partner for professional car washes.

This holistic approach creates a sticky customer relationship by addressing all their operational needs. Customers benefit from a single point of contact for their entire cleaning operation, simplifying management and ensuring consistent quality. This also translates into predictable, recurring revenue for WashTec through service contracts and chemical sales, bolstering financial stability. For instance, in 2023, WashTec reported a significant portion of its revenue derived from services and consumables, underscoring the success of this strategy.

WashTec AG showcased impressive financial strength in fiscal year 2024. Preliminary results revealed an Earnings Before Interest and Taxes (EBIT) exceeding €45 million, a figure that outpaced earlier expectations. This robust performance translated into an enhanced EBIT margin of roughly 9.5%, highlighting improved profitability.

Further demonstrating its financial health, WashTec reported a substantial rise in free cash flow during the first quarter of 2025. This positive trend is a direct result of the company's adept management of its working capital, signaling efficient operational and financial controls.

Innovation and Technological Advancement

WashTec consistently invests in innovation, focusing on digital solutions and cutting-edge technologies to enhance customer value. This commitment is crucial as the car wash sector increasingly embraces AI for automation, IoT for seamless operations, and sustainable, eco-friendly methods. WashTec's strategic alignment with these trends, such as their development of cloud-based management systems and advanced water recycling technologies, positions them as a leader in a transforming market.

The company's dedication to R&D is reflected in its product pipeline, which aims to integrate smart features for predictive maintenance and personalized customer experiences. For instance, in 2023, WashTec reported a significant portion of its revenue reinvested into research and development, a figure projected to increase in 2024 as they push further into AI-driven operational efficiencies and data analytics for their clients.

- Digitalization: WashTec is enhancing its digital offerings, including app-based payment and loyalty programs, which saw a 15% user increase in the last fiscal year.

- AI Integration: The company is exploring AI for optimizing wash cycles and energy consumption, a key trend as the industry seeks greater efficiency.

- Eco-Friendly Solutions: WashTec's focus on water and chemical saving technologies aligns with growing environmental regulations and consumer demand for sustainable services.

- IoT Connectivity: Their machines are increasingly equipped with IoT capabilities, enabling remote monitoring and data analysis for improved uptime and performance.

Resilience in Challenging Markets

WashTec AG demonstrated remarkable resilience in fiscal year 2024, navigating a challenging market landscape. Despite a minor dip in revenue, the company achieved a notable increase in its operating profit (EBIT), reaching €72.2 million compared to €64.6 million in the previous year. This performance underscores the company's ability to adapt and thrive even when economic conditions are less than ideal.

This operational strength can be largely attributed to strategic pricing adjustments and a favorable shift in the product mix. The company also saw an improvement in its gross profit margin, which rose to 40.3% in 2024 from 38.9% in 2023. These factors highlight WashTec's effective management and operational efficiency in controlling costs and optimizing its offerings.

- Improved Operating Profit: EBIT rose to €72.2 million in FY2024 from €64.6 million in FY2023.

- Gross Profit Margin Enhancement: The margin increased to 40.3% in FY2024, up from 38.9% in FY2023.

- Strategic Adaptability: Demonstrated ability to adjust pricing and product mix to counter market challenges.

- Operational Efficiency: Effective cost management and optimization contributing to profitability.

WashTec's market leadership is a significant strength, built on a broad product portfolio and extensive global reach across approximately 80 countries. Their comprehensive service ecosystem, including financing, installation, maintenance, and chemical supplies, fosters strong customer loyalty and recurring revenue streams, as evidenced by a substantial portion of 2023 revenue coming from services and consumables. The company consistently invests in innovation, particularly in digitalization and eco-friendly solutions, aligning with industry trends and positioning them for future growth. This dedication to R&D, with significant reinvestment in 2023 projected to increase in 2024, ensures a competitive product pipeline.

WashTec demonstrated strong financial performance in fiscal year 2024, with EBIT exceeding €45 million and an improved EBIT margin of roughly 9.5%. The company also reported a substantial rise in free cash flow in Q1 2025 due to efficient working capital management. Furthermore, FY2024 saw operating profit (EBIT) increase to €72.2 million from €64.6 million in FY2023, accompanied by an enhanced gross profit margin of 40.3% in FY2024, up from 38.9% in FY2023, showcasing strategic adaptability and operational efficiency.

| Metric | FY2023 | FY2024 | Q1 2025 |

| EBIT (Millions EUR) | 64.6 | 72.2 | Exceeded €45 |

| EBIT Margin (%) | - | ~9.5% | - |

| Gross Profit Margin (%) | 38.9% | 40.3% | - |

| Free Cash Flow | - | - | Substantial Rise |

What is included in the product

Analyzes WashTec’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key competitive advantages and areas for improvement, enabling targeted strategic development.

Weaknesses

WashTec saw a dip in its overall revenue in fiscal year 2024, primarily driven by a slowdown in new equipment sales. This was particularly noticeable with major clients in North America.

This revenue decline in specific segments highlights a sensitivity to market fluctuations and the purchasing cycles of large customers. Such reliance on a few key accounts or regions can create instability if those relationships or market conditions shift unexpectedly.

For instance, a 3.6% decrease in the New Equipment segment revenue in 2024, despite a strong EBIT performance, underscores this challenge. This segment's performance is critical for future recurring revenue streams from service and parts.

WashTec's reliance on customer investment behavior presents a significant weakness. Its revenue streams are directly tied to businesses and individuals choosing to invest in new car wash equipment. For instance, in 2023, WashTec reported revenue of €215.8 million, a figure that could fluctuate considerably if potential investors become hesitant.

Global economic uncertainties, such as trade disputes or recessions, pose a direct threat to WashTec's sales pipeline. Should a significant economic downturn occur, or if geopolitical tensions escalate, it's likely that discretionary spending on capital equipment like car washes would be curtailed. This would directly impact WashTec's ability to generate future revenue and profit.

WashTec's advanced car wash technologies, while offering superior performance, necessitate a significant upfront investment from customers. This high initial cost can deter smaller businesses or those new to the car wash industry from adopting WashTec's sophisticated systems. For instance, a fully equipped, state-of-the-art tunnel system can easily run into hundreds of thousands of dollars. While WashTec does provide financing options, the sheer scale of this capital outlay remains a considerable hurdle, potentially limiting market penetration in regions or among operators with tighter budgets.

Exposure to Raw Material and Energy Costs

WashTec's reliance on raw materials and energy presents a significant vulnerability. As a manufacturer of washing solutions and chemicals, the company is directly impacted by fluctuations in the prices of these essential inputs. For instance, the rising costs of chemicals and energy seen throughout 2024 can squeeze profit margins if WashTec cannot pass these increases onto customers or find ways to operate more efficiently.

This exposure means that unexpected spikes in energy prices or key chemical components can quickly erode profitability. Such volatility can make financial forecasting more challenging and requires constant vigilance in managing supply chains and operational costs.

- Exposure to Volatile Input Costs: WashTec's manufacturing processes depend on chemicals and energy, making it susceptible to price swings in these markets.

- Impact on Profit Margins: Increases in raw material and energy expenses, as observed in 2024, can directly reduce the company's profitability if not adequately offset by pricing or efficiency gains.

- Supply Chain Sensitivity: The company's operational stability is tied to the consistent availability and cost of its chemical and energy supplies.

Market Fragmentation and Competition

While WashTec holds a leading position, the global automatic car wash system market is characterized by moderate fragmentation. This means there are many smaller companies operating alongside larger ones, creating a highly competitive environment. For instance, as of early 2024, the market analysis continues to show a significant number of regional and specialized competitors actively vying for market share.

This intense competition, particularly from new entrants targeting specific niches or geographic areas, can exert downward pressure on pricing. Such a scenario could potentially erode WashTec's profit margins and challenge its dominance. The ongoing influx of innovative solutions from these smaller players demands continuous adaptation from established leaders like WashTec.

The competitive landscape presents several key challenges:

- Price Wars: Increased competition often leads to price reductions, impacting profitability.

- Market Share Erosion: Smaller, agile competitors can capture market share by focusing on specific customer needs or regions.

- Innovation Pressure: New entrants frequently introduce novel technologies or service models, forcing established players to innovate rapidly to stay relevant.

- Customer Loyalty: In a fragmented market, customer loyalty can be harder to maintain as alternatives become more readily available and competitively priced.

WashTec's revenue is susceptible to economic downturns, as demonstrated by the 3.6% decrease in its New Equipment segment in 2024. This highlights a vulnerability to customer investment decisions, especially when facing global uncertainties or recessions, which can directly impact future sales and profitability. The company's advanced technology also comes with a high initial cost, potentially limiting adoption by smaller businesses, as evidenced by systems easily costing hundreds of thousands of dollars.

What You See Is What You Get

WashTec SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on WashTec's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive document provides strategic insights essential for understanding their market position and future growth potential.

Opportunities

The global car wash market presents a significant opportunity, with projections indicating continued robust growth. This sector is expected to expand at a compound annual growth rate (CAGR) between 4.7% and 5.8% through 2029. This upward trend is fueled by a rising number of vehicle owners worldwide, coupled with increasing disposable incomes that allow consumers to opt for professional cleaning services. The demand for convenient and high-quality car care solutions creates a fertile ground for WashTec’s offerings.

Consumers are increasingly seeking car wash experiences that are both automated and environmentally conscious. This shift favors touchless systems and those that emphasize water conservation and reduced chemical impact. The market is actively responding to this demand, with a clear preference for solutions that align with sustainability goals and offer greater convenience.

WashTec is strategically positioned to benefit from this trend, given its offerings in advanced water recycling technology and energy-efficient machinery. The company's portfolio includes biodegradable chemical solutions, directly addressing the eco-friendly aspect. This makes WashTec a strong contender for businesses looking to adopt high-tech, sustainable car wash operations.

For instance, the global car wash market was projected to reach over $40 billion by 2025, with a significant portion of that growth attributed to the adoption of advanced and eco-friendly technologies. WashTec's focus on water recycling, which can reduce water consumption by up to 90% in some systems, directly taps into this burgeoning segment.

The car wash sector is actively embracing digitalization. This includes a growing use of mobile apps for booking and payment, contactless payment systems, and AI to automate processes. IoT integration is also on the rise, connecting various aspects of the car wash operation.

WashTec's commitment to digital solutions and advanced technologies positions it well to capitalize on these trends. By enhancing customer experience through user-friendly apps and streamlining operations with smart automation, WashTec can differentiate itself in the market.

This digital focus also opens doors for new revenue streams. Personalized services, for example, can be offered via app, and predictive maintenance powered by IoT data can ensure equipment uptime, a valuable service for operators.

Expansion of Subscription Models and Value-Added Services

The growing trend towards subscription-based car wash services offers a substantial avenue for WashTec. This model fosters customer loyalty and predictability, which is crucial in the current market. For instance, the global car wash market is projected to reach an estimated $45.6 billion by 2028, with subscription services playing an increasingly vital role.

WashTec has the opportunity to develop and integrate software solutions that seamlessly manage these subscription plans. This includes features for automated billing, customer management, and service scheduling, directly supporting recurring revenue streams. The company can also capitalize on the demand for ancillary services.

- Growing Subscription Adoption: The car wash industry is seeing a significant shift towards subscription models, boosting customer retention and predictable income.

- Demand for Value-Added Services: Consumers are increasingly seeking premium offerings like ceramic coatings, detailing, and tire shining, presenting opportunities to increase average transaction values.

- Technological Integration: WashTec can enhance its equipment and software to support seamless subscription management and upsell opportunities for these additional services.

- Recurring Revenue Streams: By facilitating subscription and value-added services, WashTec can secure more stable and recurring revenue, reducing reliance on one-off equipment sales.

Emerging Markets and New Vehicle Types (EVs)

The accelerating adoption of electric vehicles (EVs) presents a significant opportunity for WashTec. As EV ownership grows, so does the demand for specialized cleaning and maintenance, particularly for the unique components and materials found in these vehicles. This trend is projected to drive new service revenue streams for forward-thinking car wash operators who can adapt their offerings. For instance, the global EV market was valued at approximately $380 billion in 2023 and is forecast to reach over $1.5 trillion by 2030, indicating a substantial and expanding customer base for EV-specific car wash services.

Geographical expansion into rapidly developing regions, particularly in the Asia-Pacific area, offers substantial growth potential. Urbanization and rising disposable incomes in these markets are fueling an increase in car ownership and a greater demand for vehicle care services. WashTec can leverage this by establishing its presence and catering to the evolving needs of these growing economies. The Asia-Pacific automotive market, already a major global player, is expected to see continued robust growth in the coming years, with new vehicle sales in the region projected to surpass 50 million units annually by 2027.

- EVs require specialized cleaning due to unique materials and components.

- The global EV market is experiencing rapid expansion, creating a growing customer segment.

- Asia-Pacific markets offer significant opportunities for geographical expansion due to urbanization and rising incomes.

- Increased car ownership in emerging markets drives demand for vehicle care services.

The global car wash market is poised for continued expansion, with growth projected between 4.7% and 5.8% CAGR through 2029, driven by increasing vehicle ownership and consumer spending on professional cleaning. WashTec is well-positioned to capitalize on the demand for automated and eco-friendly car wash solutions, particularly with its advanced water recycling technology and biodegradable chemical offerings.

Digitalization is reshaping the car wash industry, with mobile apps, contactless payments, and IoT integration becoming standard. WashTec's focus on these technological advancements allows for enhanced customer experiences and operational efficiencies, creating new revenue streams through personalized services and predictive maintenance.

The rise of subscription-based car wash models presents a significant opportunity for WashTec to foster customer loyalty and secure predictable, recurring revenue. By integrating software solutions for subscription management and offering value-added services like detailing, WashTec can further diversify its income streams.

The accelerating adoption of electric vehicles (EVs) creates a demand for specialized cleaning services, a segment WashTec can address with its innovative solutions. Simultaneously, expanding into high-growth regions like Asia-Pacific, where car ownership is rising due to urbanization and increased disposable income, offers substantial market penetration opportunities.

Threats

The car wash industry, especially in densely populated urban areas, is facing a significant surge in competition and market saturation. This intense rivalry can often translate into aggressive price wars, potentially eroding profit margins for established players like WashTec.

While WashTec holds a strong position, the landscape is crowded with a multitude of smaller, independent operators alongside expanding national and regional chains. This competitive pressure necessitates continuous innovation and efficiency to maintain market share and profitability.

For instance, reports from 2024 indicate that some urban markets have seen a 15% increase in car wash locations over the past three years, intensifying the battle for customer acquisition and retention.

This saturation means that WashTec must not only differentiate through superior technology and service but also carefully manage its pricing strategies to remain competitive without compromising its financial health.

The automotive wash industry is experiencing swift technological evolution, demanding continuous investment in digital infrastructure, cutting-edge cleaning equipment, and adaptable service offerings. WashTec faces the challenge of keeping pace with innovations such as AI-driven vehicle recognition and advanced water recycling systems.

Failure to adapt or significant capital outlays for research and development could diminish WashTec's competitive advantage. For instance, in 2023, the global car wash market saw significant investment in smart technologies, with companies like Mister Car Wash reporting substantial capital expenditures on technology upgrades.

WashTec's ability to fund these necessary technological advancements is a critical factor in maintaining its market position. Competitors are actively integrating features like mobile payment integration and personalized customer experiences, areas where WashTec must also innovate to remain relevant.

Environmental regulations are getting tougher, especially when it comes to how much water car washes use and how they handle waste. This creates a hurdle for businesses that operate car washes and for companies like WashTec that make the equipment.

While WashTec does offer solutions that are better for the environment, keeping up with changing rules in different countries can mean extra expenses and more complicated processes to make sure everything is compliant.

For instance, in 2024, many European countries are implementing stricter water recycling mandates for commercial operations, which could directly impact the design and operational costs of car wash systems.

These evolving compliance requirements mean WashTec needs to continuously invest in research and development to ensure its product lines meet or exceed these environmental standards, potentially affecting profit margins if not managed efficiently.

Economic Downturns and Consumer Spending Habits

Economic downturns pose a significant threat to WashTec. During periods of economic contraction, consumers often cut back on discretionary spending, and car washes, being a non-essential service for many, are particularly vulnerable. This can translate directly into reduced demand for WashTec's equipment and services as fewer individuals and businesses opt for professional cleaning.

Furthermore, shifts in consumer behavior during economic hardship can be detrimental. People might opt for less frequent washes, DIY cleaning methods, or cheaper alternatives, all of which directly impact WashTec's revenue streams. For example, a substantial drop in consumer confidence, as seen during the initial phases of economic slowdowns, typically correlates with a decline in spending on services like car washing.

- Reduced Disposable Income: Economic contractions often lead to job losses and stagnant wage growth, shrinking consumers' disposable income and making non-essential services like car washes a lower priority.

- Shift to Cost-Saving Alternatives: Consumers may switch to cheaper car wash options or even perform cleaning themselves to save money during economic downturns.

- Business Investment Hesitation: Commercial car wash operators, facing their own economic pressures, may postpone or cancel investments in new equipment or upgrades, impacting WashTec's B2B sales.

- Market Uncertainty: Broad economic uncertainty discourages capital expenditure across industries, including the automotive and service sectors that WashTec serves.

Supply Chain Disruptions and Labor Shortages

WashTec, like other manufacturers, faces the significant threat of ongoing supply chain disruptions. These disruptions can delay the availability of critical components and raw materials needed for their car wash systems and chemical products, directly impacting production schedules and the ability to meet customer demand. For instance, the automotive manufacturing sector, a key supplier to many industries, experienced significant parts shortages in 2023, with some companies reporting production cuts of up to 30% due to chip scarcity, a situation that can ripple through to WashTec's supply chain.

Furthermore, labor shortages present a growing challenge, particularly as WashTec's sophisticated systems require skilled technicians for installation and maintenance. The trend towards automation and advanced technology in manufacturing, while beneficial, exacerbates the need for specialized labor. Reports from the German engineering federation VDMA in late 2024 highlighted a significant shortage of skilled workers in mechanical engineering, directly affecting service capabilities and potentially limiting WashTec's capacity to scale its maintenance operations effectively.

- Supply Chain Volatility: Continued global supply chain instability, as seen with the lingering effects of past disruptions, poses a risk to WashTec's production efficiency and delivery timelines.

- Skilled Labor Gap: A widening deficit in qualified technicians for installation and ongoing maintenance could hinder WashTec's ability to provide comprehensive service and support for its advanced car wash solutions.

- Rising Input Costs: Disruptions can also lead to increased costs for components and materials, potentially squeezing profit margins if these increases cannot be passed on to customers.

- Service Delivery Delays: Labor shortages may result in longer wait times for crucial maintenance and repairs, impacting customer satisfaction and uptime for WashTec's installed base.

Intensified market saturation and aggressive pricing strategies from numerous competitors, particularly in urban centers, present a significant threat to WashTec's profitability. Reports in 2024 showed a 15% increase in car wash locations in some cities, intensifying competition. This environment necessitates constant innovation and careful price management to maintain market share and healthy profit margins.

SWOT Analysis Data Sources

This WashTec SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence from reputable industry analysts, and insights from seasoned industry experts. These sources collectively ensure a robust and data-driven assessment of WashTec's strategic position.