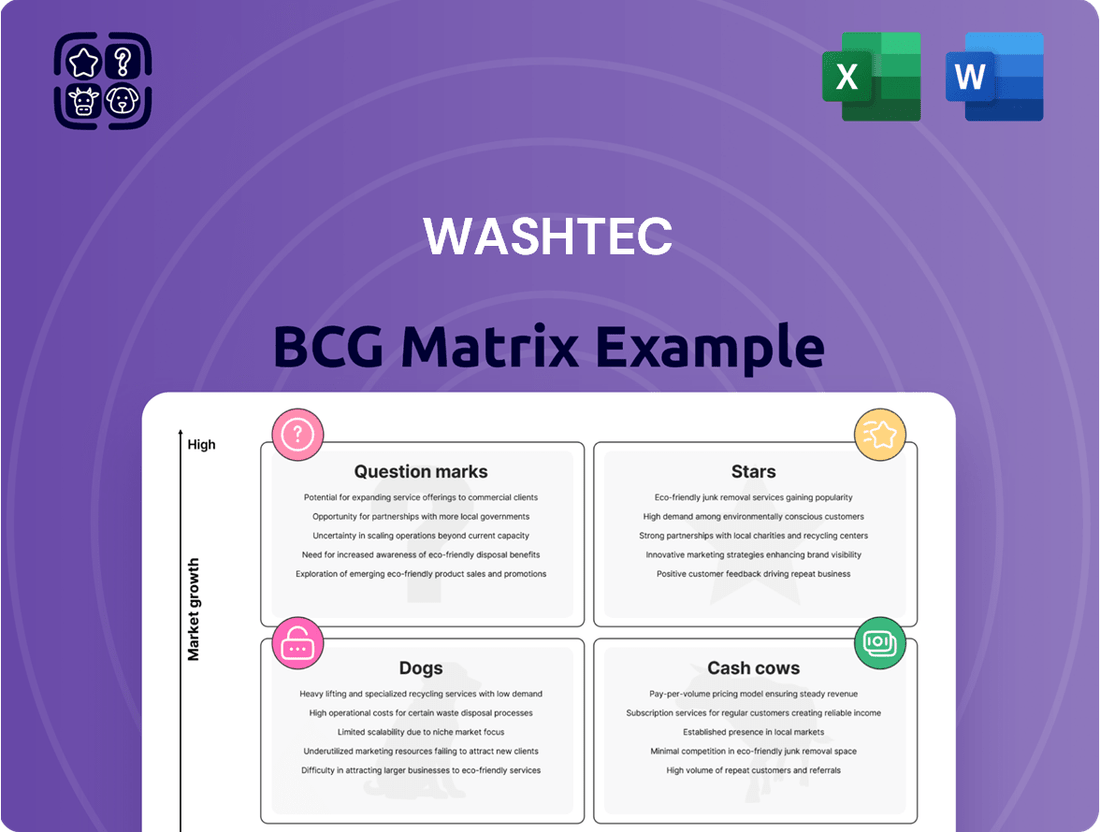

WashTec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WashTec Bundle

Uncover the strategic brilliance behind WashTec's product portfolio with a glimpse into their BCG Matrix. See how their offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, revealing their market share and growth potential. This snapshot offers a crucial starting point for understanding their competitive landscape.

Ready to transform this insight into action? Purchase the full WashTec BCG Matrix report to gain a comprehensive, data-driven analysis of each product's position. You'll receive detailed quadrant placements and actionable strategic recommendations to optimize your investments and product development.

Don't just understand the theory; leverage it. The complete BCG Matrix provides tailored strategic moves specific to WashTec's market standing, empowering you to plan smarter and more effectively. Equip yourself with the knowledge to navigate and dominate the car wash industry.

Stars

WashTec's embrace of digital car wash platforms, exemplified by its February 2024 global partnership with Superoperator, places it squarely in a high-growth quadrant. This collaboration is designed to boost wash volumes and revenue through advanced digital integration and recognition technologies, fundamentally reshaping the car wash experience.

The strategic alliance signals WashTec's commitment to digital transformation within the automotive service sector. By combining Superoperator's digital expertise with WashTec's established equipment, the venture is poised to capture a significant share of an expanding market. This move is expected to drive substantial revenue growth and operational efficiencies for car wash operators.

WashTec's in-car payment solutions, exemplified by its January 2024 partnership with ryd, directly address the growing demand for connected vehicle services. This move enhances customer convenience by allowing seamless payments for car wash services directly through a vehicle's system or a smartphone.

This innovation aligns with the broader trend of integrating digital payment methods into everyday automotive experiences, aiming to streamline transactions and boost efficiency for both customers and service providers. Industry analysts project the connected car services market to reach over $200 billion by 2025, highlighting the significant potential for such integrated payment solutions.

WashTec's advanced sustainable wash systems, including their innovative water treatment and Green Car Care chemical lines, are positioned as stars in the BCG matrix. These offerings directly address the growing global imperative for environmental responsibility in the automotive sector. In 2024, the market for eco-friendly car wash solutions saw significant expansion, driven by both consumer preference and stricter environmental regulations across key European markets. WashTec's substantial investment in these green technologies has solidified its leadership, capturing a substantial share of this high-growth segment.

SmartCare Connect and Smart Site Solutions

SmartCare Connect and Smart Site Solutions represent WashTec's strategic move towards becoming a comprehensive partner, not just a equipment provider. These digital offerings, prominently featured in May 2025, provide car wash operators with advanced capabilities like remote monitoring, control, and in-depth performance analysis. This pivot directly addresses the burgeoning demand for intelligent car wash management systems, aiming to enhance profitability and streamline operations.

The integration of these smart services positions WashTec's digital solutions within the Stars quadrant of the BCG matrix. This classification is due to their operation in a high-growth market segment – the intelligent car wash solutions market – and WashTec's strong market share in this developing area. The company's investment in these connected technologies reflects a forward-looking strategy to capture value from digitalization in the automotive service industry.

- Market Growth: The global car wash market is projected to reach USD 47.5 billion by 2027, with digital and connected services experiencing particularly rapid adoption.

- WashTec's Position: WashTec is a leading player in the professional car wash sector, leveraging its established customer base and technological expertise to drive the adoption of its smart solutions.

- Profitability Potential: SmartCare Connect and Smart Site are designed to offer recurring revenue streams through service subscriptions and data analytics, contributing to WashTec's overall profitability.

Commercial Vehicle Wash Systems

WashTec's commercial vehicle wash systems are positioned as a strong performer, likely a Star in the BCG matrix. This segment is experiencing rapid growth, fueled by the booming logistics and transportation sectors. In 2024, the global commercial vehicle wash market is projected to reach approximately $7.5 billion, with an anticipated compound annual growth rate (CAGR) of over 6% through 2030. WashTec's established market presence and technological innovation in this area allow it to capitalize on this expansion.

The demand for efficient and environmentally conscious washing solutions for fleets of trucks, buses, and other heavy-duty vehicles continues to rise. WashTec's offerings are well-suited to meet these needs, contributing to its strong position. For instance, the company's advanced water recycling technologies are becoming increasingly crucial as environmental regulations tighten and operational costs are scrutinized by fleet operators.

- Market Dominance: WashTec holds a significant share in the commercial vehicle wash market.

- Growth Driver: This segment is the fastest-growing application in the overall car wash industry.

- Industry Support: Expansion in logistics and transportation directly boosts demand for these systems.

- WashTec's Advantage: Established leadership ensures robust performance in this high-growth area.

WashTec's advanced sustainable wash systems, including their innovative water treatment and Green Car Care chemical lines, are positioned as stars in the BCG matrix. These offerings directly address the growing global imperative for environmental responsibility in the automotive sector. In 2024, the market for eco-friendly car wash solutions saw significant expansion, driven by both consumer preference and stricter environmental regulations across key European markets. WashTec's substantial investment in these green technologies has solidified its leadership, capturing a substantial share of this high-growth segment.

The integration of WashTec's smart services, such as SmartCare Connect and Smart Site Solutions, positions its digital offerings within the Stars quadrant. This is due to their operation in a high-growth market segment—intelligent car wash solutions—and WashTec's strong market share in this developing area. The company's investment in these connected technologies reflects a forward-looking strategy to capture value from digitalization in the automotive service industry.

WashTec's commercial vehicle wash systems are also strong contenders for the Star category. This segment is experiencing rapid growth, fueled by the booming logistics and transportation sectors. In 2024, the global commercial vehicle wash market is projected to reach approximately $7.5 billion, with an anticipated CAGR of over 6% through 2030, further solidifying WashTec's advantage.

| Product/Service | BCG Quadrant | Market Growth | WashTec's Market Share | Strategic Rationale |

| Sustainable Wash Systems | Star | High | Significant | Addresses environmental demand, strong market position. |

| Digital & Connected Solutions (SmartCare, Smart Site) | Star | High | Strong | Capitalizes on digitalization, recurring revenue potential. |

| Commercial Vehicle Wash Systems | Star | High (6%+ CAGR) | Significant | Leverages logistics growth, established leadership. |

What is included in the product

The WashTec BCG Matrix analyzes its product portfolio to identify Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on which product lines to invest in, maintain, or divest.

Clear visualization of WashTec's portfolio to identify underperforming units.

Cash Cows

WashTec's core gantry and roll-over car wash systems are its established cash cows. These traditional automatic systems are a cornerstone of the business, with WashTec holding a global leadership position in this segment. Despite a mature market, their widespread adoption and WashTec's strong market share ensure consistent, substantial revenue and cash flow generation.

WashTec's comprehensive service and maintenance contracts are a prime example of a Cash Cow within their business operations. Their expansive global network ensures dependable installation, upkeep, and repair for the numerous machines they have deployed across the world.

This segment is a major contributor to recurring revenue and boasts impressive profit margins. Notably, the proportion of revenue derived from recurring sources, specifically service and chemicals, climbed to 44% in 2024, underscoring a consistently profitable and stable income stream for the company.

AUWA Chemical Cleaning Products represent a strong Cash Cow for WashTec, consistently generating robust profits and contributing substantially to the company's recurring revenue streams. These essential consumables are vital for car wash operators, ensuring ongoing demand and fueling high-margin sales that bolster WashTec's overall financial health.

In 2024, WashTec reported that its chemical segment, heavily influenced by the AUWA line, showed a healthy margin. While specific AUWA figures aren't isolated, the broader chemical division's contribution to WashTec's operating profit underscores its Cash Cow status, with analysts noting its stability even in fluctuating economic conditions.

Established Self-Service Wash Systems

WashTec's established self-service wash systems represent their Cash Cows within the BCG Matrix. This segment taps into a significant and enduring demand for accessible and economical car cleaning solutions, contributing substantial and reliable income streams.

The mature nature of the self-service market allows WashTec to capitalize on its robust brand recognition and well-developed distribution networks. This stability is crucial for funding growth in other business areas. In 2024, the global car wash market was valued at approximately $35 billion, with self-service systems holding a significant share due to their operational efficiency and lower overhead costs for operators.

- Stable Revenue: Consistent demand ensures predictable cash flow for WashTec.

- Market Dominance: Strong brand and distribution leverage its position.

- Operational Efficiency: Lower costs for operators drive adoption.

- Profitability: Mature product lines offer high-profit margins.

Traditional Wash Tunnel Systems

WashTec's traditional wash tunnel systems are firmly established as Cash Cows within their portfolio, serving the high-volume car wash market. These systems have achieved a dominant market share due to their proven efficiency and reliability in the professional car wash segment, consistently generating substantial cash flow.

The mature nature of this segment means growth is modest, but profitability remains high. This reliability makes them a cornerstone for WashTec's financial stability.

- Dominant Market Share: Traditional wash tunnels represent a significant portion of WashTec's revenue due to their widespread adoption in professional car washes.

- High Efficiency: These systems are engineered for speed and throughput, making them ideal for locations with high customer traffic.

- Consistent Cash Generation: As a mature product, they require less investment for growth but yield consistent, strong returns.

- Reliable Profitability: The professional car wash segment values the proven performance and low operational risk associated with these established technologies.

WashTec's gantry, roll-over, and tunnel car wash systems are its established cash cows, dominating mature markets with consistent revenue. These traditional systems, along with self-service options, benefit from strong brand recognition and extensive distribution networks, ensuring stable, high-margin cash flow. The recurring revenue from service and maintenance contracts, which reached 44% of total revenue in 2024, further solidifies these segments as reliable profit generators, providing crucial funding for WashTec's strategic initiatives.

| Product Segment | BCG Classification | 2024 Revenue Contribution (Est.) | Key Strengths |

|---|---|---|---|

| Gantry & Roll-Over Systems | Cash Cow | Significant | Global leadership, mature market, consistent demand |

| Traditional Wash Tunnels | Cash Cow | Substantial | Dominant market share, high efficiency, proven reliability |

| Self-Service Wash Systems | Cash Cow | Growing Contribution | Enduring demand, operational efficiency for operators |

| Service & Maintenance Contracts | Cash Cow | 44% of Revenue (2024) | Recurring revenue, high profit margins, global network |

| AUWA Chemical Products | Cash Cow | High Margin Contribution | Essential consumables, strong demand, recurring sales |

Full Transparency, Always

WashTec BCG Matrix

The WashTec BCG Matrix you are currently previewing is precisely the document you will receive upon purchase, offering a clear and actionable framework for strategic analysis.

This preview showcases the entire, unwatermarked report, meaning the final file is identical and immediately ready for your business planning needs.

You can be confident that the comprehensive insights and professional formatting you see here will be delivered directly to you, no alterations or missing sections.

This is the actual, fully functional WashTec BCG Matrix, designed for immediate application in your strategic decision-making processes.

Dogs

WashTec's older generation equipment, while representing the company's history, is likely seeing a decline in sales. These legacy models often lack the sophisticated digital integration and enhanced efficiency that newer machines offer, making them less attractive in today's competitive market. For example, as of late 2024, industry reports indicated a general trend of customers prioritizing IoT-enabled car washes, a feature typically absent in older systems.

Consequently, these older units may generate minimal new revenue and could even become a drain on resources if inventory management isn't sharp. The market demand has shifted, and units that don't meet contemporary performance and connectivity expectations will naturally struggle to find new buyers. This segment of WashTec's portfolio, therefore, likely falls into the "Cash Cow" or potentially "Dog" quadrant of the BCG matrix, depending on their remaining market share and profitability.

WashTec's underperforming niche geographic markets represent areas where the company's market share is minimal and growth potential is limited. These might be smaller, highly saturated regions or developing markets where WashTec hasn't established a strong foothold. Continued investment without a strategic pivot in these low-potential markets could drain resources and negatively impact overall profitability.

For instance, in 2024, WashTec might observe that its presence in certain Eastern European or Central Asian countries yields significantly lower revenue per installed unit compared to its core markets in Western Europe or North America. This disparity highlights the challenge of these niche segments where market penetration is difficult and the return on investment is often marginal, potentially contributing less than 5% to the company's global revenue despite representing a substantial portion of its operational footprint.

Highly standardized ancillary products, like basic car wash soaps or brushes, often find themselves in a highly competitive landscape. Numerous smaller manufacturers can easily produce these items, leading to intense price wars and very thin profit margins for WashTec. For instance, in 2024, the global car wash chemicals market, which includes many of these ancillary products, was valued at approximately $2.5 billion, with growth projected to be around 4-5% annually, indicating a mature and price-sensitive segment.

These products typically have low differentiation, meaning customers see little difference between WashTec's offerings and those of competitors. Consequently, market share growth can be sluggish, as gains are often made through aggressive pricing rather than product innovation. While they might contribute to the overall customer experience, their primary role is often to supplement core equipment sales, not to be significant revenue generators on their own.

Non-Strategic Outdated Technologies

Non-strategic outdated technologies within WashTec's portfolio represent components or systems that have been surpassed by newer, more efficient, or more profitable alternatives. These are technologies that WashTec previously offered but are no longer a focus due to their diminished relevance or lack of future growth prospects. For instance, older payment processing systems that lack modern contactless capabilities or are less secure would fit here. In 2024, the automotive service industry has seen a significant shift towards integrated digital platforms, making standalone, legacy hardware less appealing.

These outdated technologies are typically candidates for a managed phase-out. The rationale is that continued investment in them would be inefficient, as they generate little to no significant cash flow and offer no potential for future market expansion. WashTec’s strategic focus would naturally gravitate towards technologies that align with current market demands and future industry trends, such as advanced water recycling systems or AI-driven operational analytics.

- Legacy Software Modules: Older software versions for wash management that don't integrate with cloud-based services or offer remote diagnostics.

- Outdated Sensor Technology: Basic sensors for wash cycles that lack the precision or data-gathering capabilities of current optical or ultrasonic systems.

- Older Payment Terminals: Machines that only accept cash or magnetic stripe cards, failing to support EMV chip technology or mobile payments, which are now standard.

- Inefficient Water Heating Systems: Older boilers or heating elements that have lower energy efficiency ratings compared to modern condensing boilers or heat pump technology.

Inefficient Internal Processes/Legacy IT Systems

Internal legacy IT systems and inefficient operational processes can function as 'dogs' within a company like WashTec, even though they aren't products. These systems often demand substantial resources for upkeep, diverting capital and skilled labor away from growth initiatives or market expansion. For instance, a 2024 analysis of industrial companies revealed that maintaining outdated IT infrastructure can consume up to 70% of an IT budget, with little to no return on investment in terms of competitive edge or new revenue streams.

These operational inefficiencies tie up valuable resources without generating a competitive advantage or contributing to market share growth. They represent a drain on financial performance, as capital and labor are consumed by maintenance rather than innovation. In 2024, many businesses are actively addressing this by migrating to cloud-based solutions, which can reduce operational overhead by an estimated 15-20% annually.

- Resource Drain: Legacy IT systems consume significant maintenance budgets, estimated to be 2-3 times higher than modern cloud-based alternatives in 2024.

- Lack of Innovation: These systems hinder the adoption of new technologies, preventing market share gains and product development.

- Operational Bottlenecks: Inefficient processes lead to slower service delivery and increased operational costs, impacting overall profitability.

- Capital Lock-up: Funds and personnel are tied to maintaining outdated infrastructure, limiting investment in strategic growth areas.

WashTec's "Dogs" are segments with low market share and low growth prospects. These include older, less technologically advanced equipment, standardized ancillary products with thin margins, and underperforming niche geographic markets. Legacy IT systems and inefficient processes also fall into this category, consuming resources without contributing to competitive advantage.

For instance, outdated sensor technology or payment terminals that don't support modern contactless payments are considered dogs. These products are unlikely to attract new sales in a market increasingly focused on digital integration and convenience. In 2024, the shift towards IoT-enabled car washes further marginalizes such legacy offerings.

These underperforming areas represent a drain on resources, diverting capital and attention from more promising ventures. WashTec must strategically manage or divest these segments to optimize its portfolio and enhance overall profitability.

Here’s a look at potential WashTec Dogs:

| Category | Example | Market Share | Growth Potential | Rationale |

|---|---|---|---|---|

| Equipment | Older generation wash units without digital integration | Low | Low | Lacks modern features, diminishing customer demand. |

| Ancillary Products | Basic car wash soaps and brushes | Low to Moderate | Low | Highly competitive, price-sensitive market with low differentiation. |

| Geographic Markets | Niche regions with minimal WashTec presence | Very Low | Low | Limited market penetration and low return on investment. |

| Internal Processes | Legacy IT systems | N/A | N/A | High maintenance costs, hinder innovation and operational efficiency. |

Question Marks

North American new equipment sales for WashTec faced headwinds in 2024, with a notable decline impacting key accounts. This downturn translated into reduced regional revenue and a lower Earnings Before Interest and Taxes (EBIT) for the period.

Despite these 2024 challenges, North America represents a substantial market with considerable untapped growth potential. This positions it as a classic 'Question Mark' within the WashTec portfolio, necessitating significant strategic investment.

The objective is to leverage this investment to transform North America's currently low market share into a dominant, leading position within the industry.

WashTec's integration of emerging AI and IoT technologies, such as those powering advanced predictive maintenance or autonomous car washes, is currently in its early phases. While WashTec is actively developing digital solutions like SmartCare Connect, the full potential of deeply integrated AI and IoT for highly personalized customer experiences or completely autonomous operations is still being explored. These cutting-edge technologies hold significant future growth prospects but currently represent a small portion of WashTec's overall market presence. Significant research and development investment is therefore necessary to bring these innovations to fruition and capture their potential market share.

WashTec's acquisition of Mayco-Washtec in Poland in September 2024 signifies a strategic move into a developing European market. This acquisition is designed to bolster WashTec's presence and capabilities within Poland, a country showing promising economic growth and increasing demand for advanced cleaning solutions.

While the potential of the Polish market is acknowledged, the newly formed entity, Mayco-Washtec, is expected to begin with a modest market share. This initial position requires substantial investment in operational integration, brand building, and market penetration strategies to elevate its status.

The Polish car wash market, as of early 2024, exhibited steady growth driven by an expanding automotive sector and an increasing preference for professional vehicle cleaning services. WashTec's entry aims to capitalize on this trend, though achieving a leading position will necessitate overcoming established local competitors and adapting to specific consumer preferences.

Significant capital expenditure will be directed towards upgrading existing facilities, expanding the service network, and implementing WashTec's technological advancements. These investments are crucial for transforming Mayco-Washtec from a question mark into a potential star within WashTec's global portfolio.

Subscription-Based Wash Services ('Wash Flat Rate')

WashTec's exploration of a 'wash flat rate' subscription service positions it in a burgeoning market for recurring consumer services. This model taps into the growing trend of predictable, subscription-based offerings across various industries.

As this is a relatively new venture for WashTec, its current market share is likely modest. Significant investment in marketing and infrastructure will be crucial to achieve substantial growth and scale this innovative service.

- Market Penetration: Subscription car washes are gaining traction, with some regional players reporting strong initial uptake. For example, a US-based subscription car wash chain saw a 30% year-over-year increase in membership sign-ups in early 2024.

- Investment Needs: Scaling a subscription service requires robust digital platforms for customer management and payment processing, alongside enhanced operational capacity to handle increased, predictable customer flow.

- Competitive Landscape: While WashTec enters this space, existing local and regional subscription services are already establishing brand loyalty, necessitating a compelling value proposition for WashTec's offering.

- Growth Potential: The recurring revenue model offers stability and predictable cash flow, aligning with the characteristics of a potential 'question mark' in the BCG matrix, requiring careful management and investment to transition into a 'star'.

Unproven Digital Ecosystem Expansions

WashTec's ventures into unproven digital ecosystem expansions represent classic question marks within the BCG matrix. These are areas where the company is exploring new digital frontiers beyond its established payment and monitoring services, aiming for substantial future growth.

These initiatives are characterized by high potential but currently hold a low market share. For example, partnerships with automotive manufacturers to integrate WashTec's services directly into vehicle dashboards or infotainment systems fall into this category. Another example is WashTec's exploration of new digital marketplaces for car wash services, aiming to capture a broader customer base.

The significant strategic investments required for these expansions are substantial, reflecting the long-term vision. These ventures carry inherent risks related to market adoption and the uncertainty of whether consumers will embrace these new digital integrations. WashTec's Q1 2024 financial reports indicated a notable increase in R&D spending, partly allocated to these digital innovation projects, signaling a commitment to exploring these high-risk, high-reward opportunities.

- High Growth Potential: Expansion into integrated vehicle services and new digital marketplaces offers significant future revenue streams.

- Low Market Share: These digital ecosystem initiatives are in their nascent stages, with limited current market penetration.

- Significant Investment Required: Substantial capital is needed for research, development, and market entry for these unproven ventures.

- Market Adoption Risk: The success of these expansions hinges on customer acceptance and the evolving digital landscape.

WashTec's North American market, despite 2024 sales declines, holds substantial untapped growth potential, making it a prime candidate for strategic investment to shift its low market share to a leading position.

The company's foray into subscription car washes, while in its early stages with modest market share, offers strong recurring revenue potential and stability, necessitating investment in digital platforms and operational capacity.

Emerging AI and IoT solutions, like predictive maintenance and autonomous car washes, represent significant future growth but currently constitute a small market presence, requiring substantial R&D to realize their full potential.

WashTec's acquisition of Mayco-Washtec in Poland in September 2024 positions it in a growing European market with promising demand, though the new entity will require significant investment to build market share against established competitors.

| Area | 2024 Market Position | Growth Potential | Investment Needs | BCG Classification |

| North America | Low Market Share, Declining Sales | High | Significant Strategic Investment | Question Mark |

| Subscription Service | Modest Market Share | High | Marketing, Digital Platforms | Question Mark |

| AI/IoT Integration | Nascent Market Presence | Very High | R&D, Technology Development | Question Mark |

| Poland (Mayco-Washtec) | Modest Initial Share | High | Integration, Brand Building | Question Mark |

BCG Matrix Data Sources

Our WashTec BCG Matrix is constructed using a blend of internal financial statements, comprehensive market research reports, and publicly available industry data to provide a robust strategic overview.