WashTec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

WashTec Bundle

WashTec operates within a dynamic car wash industry, influenced by several key competitive forces. Understanding these pressures is crucial for strategic planning.

The threat of new entrants, while moderate due to capital requirements, could disrupt existing market share. Buyer power, particularly from large fleet operators, can impact pricing and service demands.

The bargaining power of suppliers, especially for specialized equipment and chemicals, presents another critical factor for WashTec. Intense rivalry among existing car wash operators also shapes the competitive landscape.

Furthermore, the availability of substitute services, such as self-service bays or mobile detailing, necessitates continuous innovation and value proposition refinement for WashTec.

The complete report reveals the real forces shaping WashTec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

WashTec's reliance on specialized component suppliers for critical parts such as high-pressure pumps, advanced sensors, and automation software gives these suppliers a moderate to high bargaining power. This leverage is amplified when components are proprietary or necessitate specific certifications, making it difficult for WashTec to switch providers easily. For instance, in 2024, the semiconductor shortage continued to impact the availability and pricing of advanced sensors, demonstrating supplier power.

WashTec's reliance on chemical cleaning products positions its suppliers with a degree of bargaining power. While general chemical suppliers are plentiful, those offering specialized, eco-friendly, or high-performance cleaning agents can command greater influence. This is particularly relevant as the car wash industry, and by extension WashTec's customer base, increasingly prioritizes sustainability.

The demand for environmentally conscious cleaning solutions is a growing trend. For instance, the global green cleaning products market was valued at over USD 55 billion in 2023 and is projected to grow significantly. Suppliers who can meet these stringent environmental standards and provide certified eco-friendly formulations may find themselves in a stronger negotiating position with WashTec.

Furthermore, if WashTec's proprietary wash systems are designed to work optimally with specific chemical formulations, suppliers of these niche products gain increased leverage. The cost and complexity of reformulating or finding alternative chemical suppliers for such specialized applications can be substantial, thereby enhancing the bargaining power of existing providers.

Suppliers of basic raw materials like metals and plastics typically hold less sway over WashTec. This is because these materials are widely available from numerous sources, making them commodities. For instance, the global steel market in 2024 saw significant price volatility, with benchmarks like the TSI European Hot-Rolled Coil index experiencing shifts due to supply chain adjustments and demand patterns, impacting potential input costs for manufacturers like WashTec.

Despite this general weakness, significant swings in global commodity prices can still affect WashTec's manufacturing expenses and profitability. For example, a sharp rise in aluminum prices, which are crucial for many machinery components, could squeeze margins if not passed on to customers.

To mitigate this, WashTec can leverage long-term supply agreements or build strategic alliances. These arrangements can lock in more predictable pricing, offering a buffer against market volatility and ensuring a more stable cost base for production.

Technology and Software Providers

WashTec's increasing dependence on technology and software providers for critical digital solutions, such as advanced recognition systems and connectivity hardware, empowers these suppliers. As the car wash sector digitizes, partnerships like the one with Superoperator highlight WashTec's need for specialized tech expertise. This reliance could grant these tech partners significant leverage, particularly if there are few alternative suppliers offering comparable innovative solutions.

The bargaining power of technology and software providers is amplified by the specialized nature of their offerings and the increasing demand for integrated digital experiences in the car wash industry. For instance, the global market for automotive telematics, which includes connectivity solutions, was projected to reach over $150 billion by 2025, indicating a robust and growing sector where specialized knowledge commands higher value. WashTec's strategic integration of such technologies means that key software and hardware vendors can exert considerable influence over pricing and terms.

- High Switching Costs: For WashTec, the cost and complexity of replacing integrated software and connectivity systems can be substantial, making it difficult to switch providers.

- Proprietary Technology: Many technology suppliers possess unique, patented software or hardware that is essential for WashTec's advanced functionalities, limiting alternative options.

- Concentration of Suppliers: In niche areas of car wash technology, the number of competent suppliers might be limited, concentrating power in fewer hands.

- Importance of Innovation: Suppliers driving innovation in areas like AI-powered recognition or advanced data analytics hold strong leverage as WashTec seeks to maintain a competitive edge.

Installation and Maintenance Service Providers

WashTec's reliance on installation and maintenance service providers, including its own technicians and third-party networks, presents a dynamic where these entities can exert some bargaining power. The scarcity of qualified personnel and specialized equipment for complex installations and repairs, especially in certain geographic areas, can amplify this leverage. For instance, in 2024, the global shortage of skilled technicians across various industrial sectors has been a persistent challenge, impacting service delivery timelines and costs.

WashTec actively works to counter this potential power imbalance through its expansive service network, ensuring consistent service availability across its operations. By maintaining a broad reach and investing in training and technology, the company aims to reduce dependency on any single external service provider or region with limited skilled labor. This strategy is crucial for maintaining customer satisfaction and operational efficiency.

The bargaining power of these service providers is influenced by several factors:

- Availability of Skilled Labor: Regions facing a deficit in qualified technicians can see higher bargaining power for those available.

- Specialized Equipment Needs: The requirement for proprietary or highly specialized tools for WashTec's machinery can consolidate power among providers who possess them.

- Service Contract Terms: Long-term maintenance contracts can offer providers a degree of stability, potentially influencing negotiation leverage.

- WashTec's Network Size: A larger, more diversified service network for WashTec inherently dilutes the power of individual providers.

Suppliers of specialized components and proprietary chemicals hold moderate to high bargaining power due to high switching costs and the need for specific certifications, as seen with the continued impact of semiconductor shortages on sensor availability in 2024. Conversely, providers of basic raw materials like metals and plastics have low leverage because these are commodity items, though significant price volatility in 2024, like in the European steel market, can still impact WashTec's costs.

Technology and software providers wield significant influence, especially as the car wash sector digitizes, due to the specialized nature of their offerings and WashTec's increasing dependence on integrated digital solutions. Installation and maintenance service providers can also exert some power, particularly where skilled labor is scarce, a challenge noted across industrial sectors in 2024.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | 2024/Recent Data Points |

|---|---|---|---|

| Specialized Component Providers | Moderate to High | Proprietary technology, high switching costs, specific certifications | Semiconductor shortages impacting sensor availability and pricing |

| Chemical Product Suppliers | Moderate | Demand for specialized/eco-friendly formulations, system compatibility | Global green cleaning products market valued at over USD 55 billion in 2023 |

| Basic Raw Material Suppliers | Low | Availability of commodity materials, numerous sources | European steel market volatility impacting raw material costs |

| Technology & Software Providers | High | Specialized digital solutions, increasing industry digitization, integration complexity | Global automotive telematics market projected over $150 billion by 2025 |

| Installation & Maintenance Services | Moderate | Scarcity of skilled labor, specialized equipment needs, service network size | Persistent shortage of skilled technicians across industrial sectors in 2024 |

What is included in the product

This analysis meticulously dissects the competitive forces impacting WashTec, offering insights into supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the car wash industry.

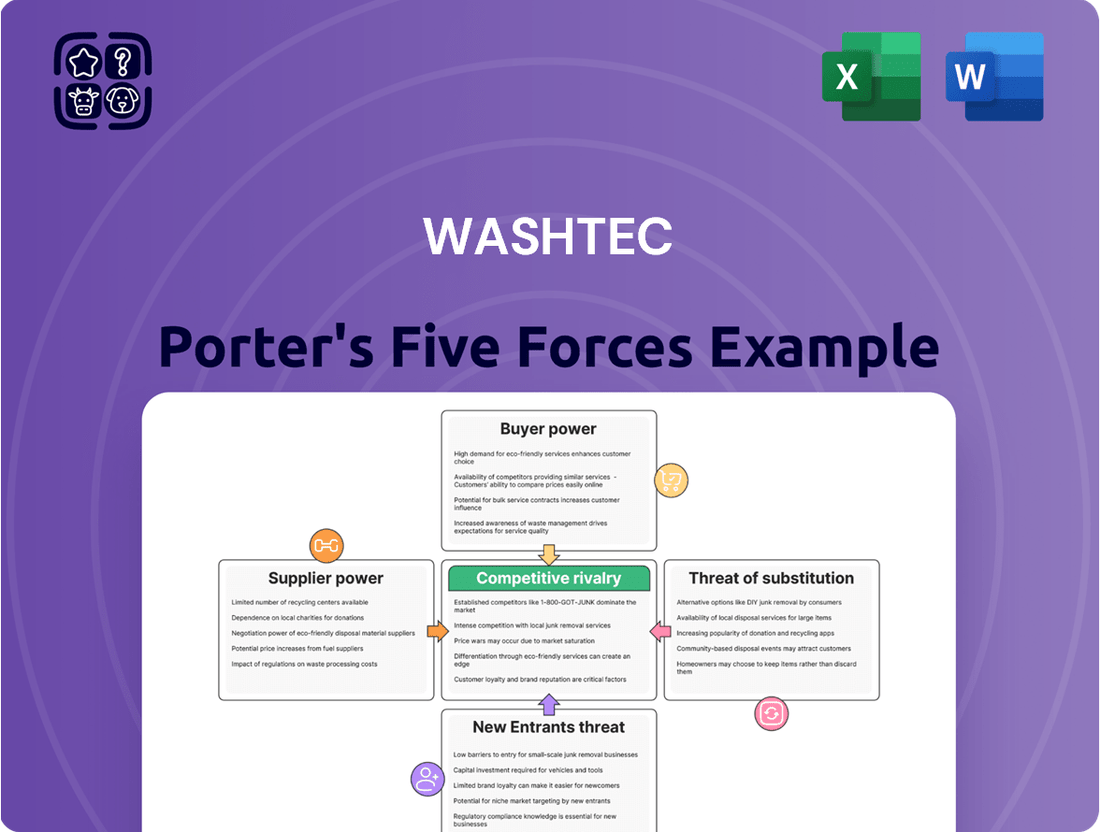

Visualize competitive pressures with a dynamic spider chart, offering immediate insights into WashTec's market positioning.

Customers Bargaining Power

Large car wash chains and major key accounts, like prominent petroleum companies or supermarket giants, represent substantial purchasing volumes for WashTec. These significant clients wield considerable bargaining power, primarily stemming from the sheer scale of their orders, allowing them to negotiate more favorable terms, pricing structures, and service level agreements. For example, WashTec's sales to these key accounts in North America saw a decline in the first quarter of 2025, underscoring their impactful influence on WashTec's performance.

Independent car wash operators, often small business owners with one or a few locations, represent a significant customer base for WashTec. Their individual purchasing power is typically limited due to smaller order sizes, meaning they can't exert as much pressure on pricing as larger entities. However, their collective demand is substantial, making them a vital segment for WashTec to cater to. In 2024, the independent car wash sector continued to be a key driver of market volume for equipment manufacturers.

To attract and retain these operators, WashTec needs to offer compelling value propositions. This includes competitive pricing on their equipment, flexible financing options to ease upfront investment, and robust after-sales support, such as maintenance and spare parts availability. The ability of independent operators to switch suppliers, though potentially costly, means WashTec must consistently demonstrate superior product quality and reliable service to maintain their loyalty.

Commercial vehicle fleet operators, including bus and truck companies, represent a key customer segment for WashTec, requiring specialized, heavy-duty wash systems. Their need for robust and reliable equipment, often with integrated maintenance and service packages, gives them a degree of influence.

While this is a specialized market, the potential for long-term service contracts and the demand for customized solutions means these operators can exert moderate bargaining power. For example, a large logistics company operating hundreds of trucks might negotiate favorable terms due to the volume and ongoing service needs.

WashTec's strength lies in its ability to offer comprehensive, tailored solutions that address the unique operational demands of commercial fleets, thereby mitigating some of the customers' direct bargaining leverage.

Dealerships and Auto Service Centers

Dealerships and auto service centers, as key customers for car wash equipment manufacturers like WashTec, possess moderate bargaining power. Their decisions to purchase professional wash systems are often driven by the need to enhance customer experience or create new revenue streams. For instance, many dealerships offer car washes as part of their service packages, directly impacting their demand for such equipment. In 2024, the automotive service industry saw continued growth, with revenue from vehicle maintenance and repair expected to remain robust, underscoring the importance of efficient wash systems for these businesses.

These businesses evaluate suppliers based on factors like brand reputation, equipment reliability, and the ease of integration into their existing operations. They often look for comprehensive solutions that include installation, maintenance, and support. This can lead them to seek bundled offerings or negotiate pricing based on the total value proposition. Their ability to switch between suppliers, while requiring some effort due to integration, is a significant leverage point.

- Brand Reputation: Dealerships often prefer established brands known for durability and performance.

- Reliability and Service: Downtime is costly, so reliable equipment and responsive service are critical purchasing factors.

- Integration Capabilities: The ability of wash systems to integrate with existing dealership management software can influence purchasing.

- Bundled Solutions: Customers may negotiate for packages that include equipment, chemicals, and maintenance.

Customers Seeking Comprehensive Service Packages

WashTec's strategy of bundling services like financing, installation, and ongoing maintenance significantly influences customer bargaining power. When customers prioritize a complete, hassle-free solution over just the initial equipment purchase, their focus shifts from pure price negotiation to the overall value and convenience offered. This integrated approach can lead to reduced price sensitivity among these customers.

For example, a car wash operator looking for minimal operational disruption might be willing to pay a premium for WashTec's all-inclusive packages. This reliance on comprehensive service offerings allows WashTec to build stronger customer relationships, potentially mitigating the impact of price-based bargaining. In 2023, WashTec reported a strong aftermarket business, indicating a significant portion of revenue comes from services beyond initial equipment sales, underscoring the importance of these bundled solutions.

- Integrated Service Offerings: WashTec's comprehensive packages, including financing, installation, and maintenance, cater to customers seeking convenience and a single point of contact.

- Reduced Price Sensitivity: Customers valuing these full-service solutions may exhibit lower price sensitivity, prioritizing reliability and ease of use.

- Customer Loyalty: The integrated approach fosters stronger customer relationships and can increase loyalty, thereby reducing the customer's ability to bargain on price alone.

- Market Differentiation: This strategy helps WashTec differentiate itself in the market, moving beyond being a mere equipment supplier to a solutions provider.

The bargaining power of customers for WashTec is influenced by several factors, including the size of the customer, their purchasing volume, and the availability of alternative suppliers. Large chains and key accounts can negotiate better terms due to their significant order volumes, impacting pricing and service agreements.

Independent operators, while individually having less power, collectively represent a substantial market. For them, WashTec must focus on value, offering competitive pricing, flexible financing, and reliable after-sales support to retain their business.

Commercial fleet operators and dealerships also exert moderate influence, often seeking customized solutions and comprehensive service packages. Their ability to switch suppliers, though involving some integration costs, provides leverage, making WashTec's bundled offerings crucial for customer retention.

| Customer Segment | Bargaining Power Influence | Key Factors for WashTec |

|---|---|---|

| Large Car Wash Chains/Key Accounts | High | Volume purchasing, negotiation of pricing and service agreements. Decline in Q1 2025 North America sales highlights impact. |

| Independent Car Wash Operators | Low (individually), Moderate (collectively) | Competitive pricing, financing options, after-sales support. 2024 saw continued volume growth from this sector. |

| Commercial Vehicle Fleet Operators | Moderate | Need for specialized, robust equipment, long-term service contracts, customized solutions. |

| Dealerships & Auto Service Centers | Moderate | Brand reputation, equipment reliability, integration ease, bundled solutions. 2024 automotive service industry revenue remained robust. |

Preview the Actual Deliverable

WashTec Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for WashTec delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the car wash industry. Understand how these forces shape WashTec's strategic positioning and profitability.

Rivalry Among Competitors

The global vehicle wash systems market is characterized by robust competitive rivalry among several key players. Companies like Otto Christ and Istobal are significant competitors, often vying for market share through technological advancements and expanded service networks. This intense competition pushes manufacturers to constantly innovate, focusing on areas such as water reclamation, energy efficiency, and automated payment systems.

In 2024, WashTec, a prominent global manufacturer, faces this dynamic landscape where differentiation is crucial. The market's growth is further fueled by increasing demand for automated and eco-friendly car wash solutions. WashTec's strategy to maintain its leadership involves substantial investment in research and development, alongside forging strategic alliances to enhance its product portfolio and geographical presence.

Beyond the major global players, WashTec faces competition from a significant number of regional and local manufacturers and service providers. This is particularly evident in markets like the United States, which can be quite fragmented. These smaller competitors often compete by offering more tailored local service or more cost-effective solutions for standard equipment and basic maintenance needs, putting pressure on WashTec's market share.

WashTec's strategic approach of establishing subsidiaries and working with independent distributors across numerous countries is a key tactic to counter this localized competition. This presence allows them to better understand and respond to the specific needs and pricing dynamics within different regional markets, ensuring they can offer competitive solutions against smaller, more agile rivals.

The car wash sector is seeing a surge in tech-driven competition. Companies are vying to offer advanced digital solutions, sophisticated water recycling, and environmentally conscious operations. This means a race to integrate smart features, convenient mobile payment systems, and highly energy-efficient machinery, pushing innovation to the forefront.

WashTec’s strategic alliance with Superoperator exemplifies this trend, highlighting how digital transformation is a key battleground. In 2024, the market for car wash technology solutions is expanding, with investments in automation and data analytics becoming crucial for competitive advantage. For instance, the global car wash equipment market is projected to reach over $6 billion by 2027, with technological upgrades being a significant growth driver.

Competition on Service and Maintenance Networks

Competitive rivalry in the car wash industry extends well beyond the initial sale of equipment, heavily focusing on after-sales service, maintenance, and the consistent supply of consumables. Companies that can offer robust and dependable service networks, coupled with rapid response times and all-encompassing maintenance agreements, often secure a substantial competitive edge.

WashTec, for instance, actively highlights its comprehensive full-service offerings and readily available call-out services. This emphasis on support and immediate assistance is a critical differentiating factor that can attract and retain customers in a competitive market. The availability and quality of these services directly impact customer loyalty and operational uptime.

- Extensive Service Networks: Companies with a widespread presence and a high density of service technicians can address customer needs more efficiently, reducing downtime for car wash operators.

- Maintenance Packages: Offering tiered maintenance plans, from basic checks to comprehensive overhauls, allows for predictable revenue streams and enhances customer retention by ensuring equipment longevity.

- Consumables Supply Chain: Reliable and cost-effective access to chemicals, brushes, and other consumables is crucial for daily operations, and suppliers who manage this efficiently gain an advantage.

- Response Time Metrics: For instance, some service providers aim for guaranteed response times, such as within 24 hours for non-critical issues, to minimize business interruption for their clients.

Price Competition in Mature Markets

In mature markets, price competition intensifies as growth slows, making customers more cost-conscious regarding both initial outlay and ongoing operational expenses. This environment pressures companies like WashTec to maintain profitability through efficient cost management, even if revenue sees minor dips. For example, in 2023, WashTec demonstrated resilience by focusing on operational efficiencies.

- WashTec's EBIT margin remained robust, showcasing effective cost control despite a challenging market.

- Customers in mature segments often prioritize total cost of ownership, leading to price sensitivity.

- The company's ability to manage gross profit underscores its strategic approach to pricing and cost optimization.

- In 2023, WashTec achieved an EBIT margin of approximately 4.5%, a testament to its operational discipline.

Competitive rivalry is a significant force for WashTec, with numerous global and regional players vying for market share through innovation and service. The market is driven by demand for automated and eco-friendly solutions, pushing companies to invest heavily in R&D. In 2024, WashTec's strategic alliances, like the one with Superoperator for digital transformation, are crucial for staying ahead. The fragmented nature of some markets, particularly the US, means WashTec must also contend with smaller, localized competitors offering tailored or cost-effective alternatives.

SSubstitutes Threaten

Manual car washing, whether done by owners themselves (DIY) or through traditional hand-wash services, represents a fundamental substitute. While automated car washes like those from WashTec offer speed and consistent results, manual washing provides a low-cost option. Many consumers still opt for manual washing for a more detailed clean or when budget is a primary concern.

Despite the appeal of manual washing for some, the market is increasingly shifting towards automated systems. This trend is driven by the demand for greater convenience and efficiency, especially in urban areas where time is a premium. For instance, the global car wash market, which includes both automated and manual services, was valued at approximately USD 30 billion in 2023 and is projected to grow, with automation playing a significant role in this expansion.

Mobile car detailing services present a significant threat of substitutes for traditional car wash operations like WashTec. These mobile providers bring convenience directly to the customer's doorstep, offering a high degree of personalized attention that can be particularly appealing for owners of luxury or high-value vehicles, or for those with demanding schedules. While they don't replicate the extensive infrastructure of a fixed car wash, they effectively address the core customer need: a clean vehicle.

The market for mobile detailing is growing. For instance, in 2024, the U.S. car wash and detailing industry is projected to generate over $11.5 billion in revenue, with mobile services capturing an increasing share due to their flexibility. This convenience factor allows them to attract customers who might otherwise opt for a traditional car wash, especially when the perceived value of personalized service outweighs the cost difference.

Emerging waterless car wash solutions, leveraging advanced spray-on formulas and microfiber technology, present a growing threat to traditional car wash services. These alternatives are particularly attractive in drought-prone areas and for consumers seeking convenience. For instance, the global waterless car wash market was valued at approximately $2.5 billion in 2023 and is projected to reach $4.8 billion by 2030, indicating a significant shift in consumer preference towards more sustainable and time-saving options.

Alternative Cleaning Technologies

Future or niche cleaning technologies, such as advanced steam cleaning or specialized coatings that reduce the need for frequent washes, could emerge as substitutes for traditional car washes. While currently not widespread, continuous innovation in car care products and methods presents a long-term threat by offering alternative ways to maintain vehicle cleanliness. For instance, the market for hydrophobic and ceramic coatings, which repel dirt and water, has seen significant growth, with some estimates suggesting the global automotive coatings market could reach over $90 billion by 2025. This indicates a growing consumer interest in solutions that extend the time between washes.

These emerging technologies, though nascent, could disrupt the car wash industry by offering convenience and potentially lower long-term costs to consumers.

- Emerging Technologies: Advanced steam cleaning and self-cleaning coatings are potential substitutes.

- Market Trends: The automotive coatings market shows strong growth, indicating demand for solutions reducing wash frequency.

- Consumer Preference: Convenience and long-term cost savings drive adoption of alternative cleaning methods.

- Long-Term Impact: These substitutes could significantly alter demand for traditional car wash services.

Less Frequent Professional Washes

Economic shifts can significantly impact the frequency of professional car washes. For instance, during economic downturns, consumers often cut back on discretionary spending, leading to fewer visits to premium car wash services. This trend was observed in early 2023, with some regions reporting a slight decrease in car wash frequency as inflation pressures mounted.

This reduction in professional wash frequency acts as a substitute threat because it directly reduces demand for WashTec’s core offerings. Customers might instead opt for less frequent premium washes, or even more basic, lower-cost alternatives. This behavioral change, driven by the need to save money, indirectly replaces the revenue that would have come from regular, high-frequency professional services.

The rise of more affordable car wash options also intensifies this threat. Consider the growing popularity of:

- Self-service wash bays: These offer a much lower price point, appealing to budget-conscious consumers.

- Basic automatic washes: These are often priced attractively compared to full-service detailing.

- DIY car washing at home: While time-consuming, it remains a zero-cost alternative for many.

The threat of substitutes for WashTec remains significant, encompassing both traditional and evolving methods of vehicle cleaning. While automated car washes offer efficiency, consumers can still opt for manual washing, which is generally cheaper and allows for more detailed attention. The increasing popularity of mobile car detailing also directly competes by bringing convenience to the customer's location, particularly appealing to those with busy schedules or owners of premium vehicles.

Furthermore, the market is seeing a rise in waterless car wash solutions and advanced cleaning technologies like steam cleaning and protective coatings that reduce the need for frequent washing. These alternatives cater to a growing consumer demand for convenience, environmental consciousness, and long-term cost savings. For instance, the U.S. car wash and detailing industry generated over $11.5 billion in revenue in 2024, with mobile services gaining traction.

Economic pressures also influence substitute choices, as consumers may reduce spending on premium washes, favoring cheaper alternatives like self-service bays or DIY washing. This dynamic underscores the importance for WashTec to adapt to diverse consumer needs and preferences in the car cleaning market.

Entrants Threaten

The vehicle wash system sector demands significant upfront capital. Companies need substantial investments in research and development to create innovative technologies, alongside setting up advanced manufacturing facilities. Establishing a worldwide distribution network and a robust service infrastructure further escalates these initial costs. For instance, a new entrant might need hundreds of millions of dollars to even begin operations on a competitive scale.

These immense capital requirements act as a formidable barrier, effectively shielding established players like WashTec. It becomes exceedingly challenging for newcomers to match the economies of scale and the breadth of product and service offerings that incumbents have cultivated over years. This financial hurdle significantly limits the threat of new entrants, as only well-funded organizations can realistically consider entering the market and challenging established leaders.

WashTec's strong position is underpinned by its deep technological expertise and a portfolio of patents, particularly in advanced wash systems, water reclamation, and digital customer solutions. This innovation focus means new competitors must either invest heavily in their own research and development to match WashTec's offerings or face the challenge of acquiring existing, protected intellectual property.

For instance, WashTec’s commitment to R&D is reflected in its consistent product development cycles. While specific patent numbers are proprietary, the company’s market presence suggests a robust patent strategy protecting its core technologies. In 2023, WashTec reported substantial investments in research and development, indicating a continued drive to maintain its technological edge.

This high barrier to entry, stemming from the need for comparable technological capabilities and the legal protection afforded by patents, significantly deters potential new entrants from challenging WashTec's established market share.

WashTec’s formidable global reach, supported by subsidiaries and independent distributors across many nations, is a significant barrier. This network facilitates not just sales but also vital installation and after-sales services, a crucial aspect in the car wash industry. For instance, by the end of 2023, WashTec reported a presence in over 70 countries, underscoring the breadth of its established infrastructure.

The sheer scale and reliability of this distribution and service network represent a substantial capital investment and a considerable time commitment to replicate. New entrants would face immense challenges in achieving comparable market penetration and customer support coverage, making it economically unfeasible for many to compete effectively.

Brand Reputation and Customer Loyalty

WashTec benefits significantly from its established brand reputation and deeply ingrained customer loyalty within the professional vehicle cleaning sector. This is a formidable barrier for any newcomer looking to break into the market.

New entrants face the challenge of building trust and recognition, which WashTec has cultivated over decades. Their commitment to product quality, unwavering reliability, and extensive service offerings have fostered a loyal customer base that is less likely to switch to an unknown brand.

- Strong Brand Equity: WashTec is recognized globally for its innovation and quality in car wash technology, often commanding premium pricing.

- Customer Retention: High switching costs, tied to integrated service and parts, contribute to WashTec’s strong customer retention rates, estimated to be over 90% for existing clients in core markets.

- Established Network: The company boasts an extensive network of service technicians and parts distribution, a critical factor for operational uptime that new entrants struggle to replicate quickly.

- Reputational Capital: Years of successful installations and positive customer experiences translate into a powerful reputational capital that new competitors find difficult to match.

Regulatory Hurdles and Safety Standards

The manufacturing and operation of vehicle wash systems face stringent environmental regulations concerning water usage and waste disposal, alongside critical safety standards. For WashTec and its competitors, navigating these complex compliance requirements, which often necessitate substantial investment in technology and processes, acts as a significant barrier to entry. For instance, in 2024, the European Union's Water Framework Directive continued to impose strict limits on wastewater discharge, requiring advanced filtration and recycling systems that add considerable upfront costs for any new player.

New entrants must also contend with the escalating costs and time associated with obtaining necessary approvals and certifications across diverse international markets. This regulatory fragmentation means a newcomer might need to re-engineer products or invest in separate compliance strategies for each region, a considerable challenge. For example, obtaining CE marking for machinery in Europe, a crucial step for market access, involves rigorous testing and documentation.

- Environmental Compliance Costs: New entrants may face millions of dollars in upfront investment to meet stringent water recycling and chemical disposal regulations, such as those enforced by the EPA in the United States.

- Safety Certifications: Obtaining certifications like UL or TÜV for electrical safety and machine operation can be a lengthy and expensive process, delaying market entry.

- International Regulatory Diversity: Adapting to varying national standards for emissions, noise pollution, and chemical usage adds significant complexity and cost, potentially requiring country-specific product designs.

- Ongoing Compliance Burden: Beyond initial approvals, continuous monitoring, reporting, and potential upgrades to meet evolving regulations represent an ongoing operational expense that deters new entrants.

The threat of new entrants in the vehicle wash system market, particularly concerning WashTec, is significantly mitigated by substantial barriers. These include the immense capital required for R&D, manufacturing, and global distribution networks, often running into hundreds of millions of dollars for a single entrant. Furthermore, WashTec’s deep technological expertise, protected by a robust patent portfolio, necessitates either equivalent innovation investment or costly IP acquisition by newcomers.

WashTec's established global presence, spanning over 70 countries by the end of 2023, provides a critical advantage through its extensive sales, installation, and after-sales service infrastructure. Replicating this scale and reliability is a daunting and expensive undertaking for any potential competitor. Combined with strong brand equity and customer loyalty, cultivated over decades of reliable service and quality, these factors create a formidable deterrent for new market participants.

Stringent environmental and safety regulations, such as the EU's Water Framework Directive and the need for certifications like CE marking, add further complexity and cost. New entrants must invest heavily in compliance technology and navigate diverse international standards, a process that can delay market entry and increase operational expenses. These regulatory hurdles, alongside the high initial capital demands, effectively limit the threat of new entrants to well-capitalized and strategically prepared organizations.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for WashTec is built upon a robust foundation of publicly available information, including the company's annual reports, investor presentations, and SEC filings. We also incorporate industry-specific data from reputable market research firms and trade publications to gain a comprehensive understanding of the competitive landscape.